Commercial High-Speed Hybrid Ovens Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441937 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Commercial High-Speed Hybrid Ovens Market Size

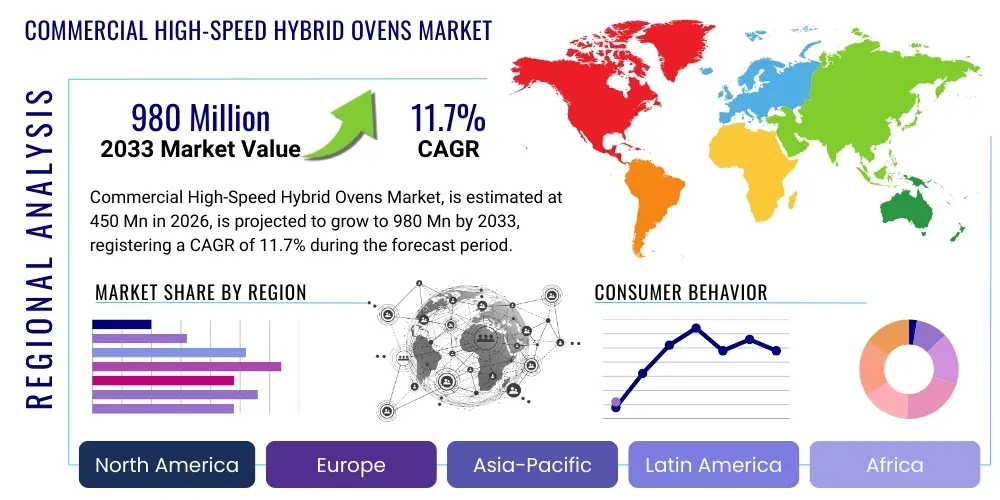

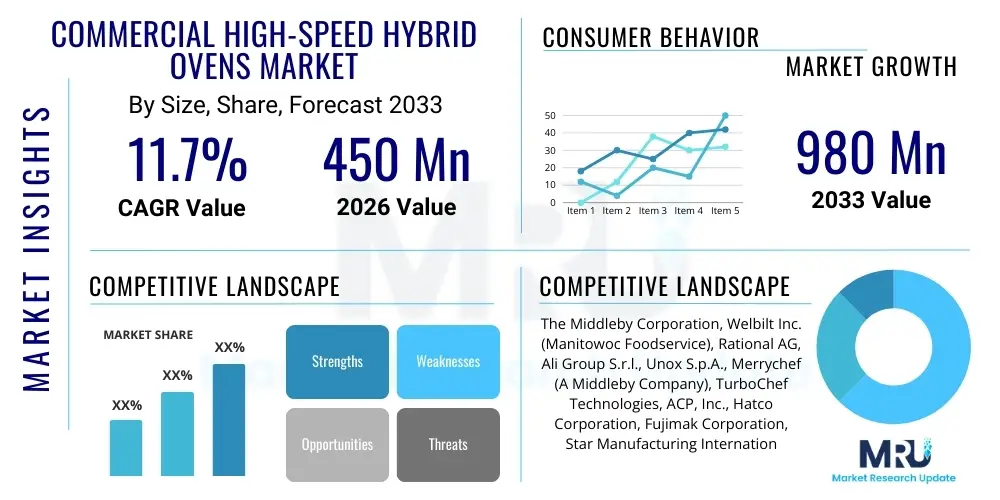

The Commercial High-Speed Hybrid Ovens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.7% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $980 Million USD by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the accelerating global demand for speed and consistency in food service operations, coupled with rising labor costs that incentivize automation and highly efficient cooking equipment. Hybrid ovens, which typically integrate convection, microwave, and impingement technologies, allow establishments to significantly reduce cooking times without compromising food quality, making them indispensable in high-throughput environments like Quick-Service Restaurants (QSRs) and convenience stores.

Market penetration is being driven by continuous technological advancements that improve oven efficiency and ease of use, particularly the integration of Internet of Things (IoT) sensors and digital recipe programming. These features enable centralized management of cooking profiles across multiple locations, ensuring brand consistency, which is a critical success factor for large multinational chains. Furthermore, the growing trend of "ventless" technology, utilizing internal catalytic converters to manage exhaust and odors, allows these sophisticated ovens to be installed in non-traditional commercial spaces, such as kiosks, food trucks, and small urban retail outlets, further broadening the serviceable market.

Commercial High-Speed Hybrid Ovens Market introduction

The Commercial High-Speed Hybrid Ovens Market encompasses specialized kitchen appliances designed for professional food service environments that combine multiple heating technologies—most commonly forced convection, microwave energy, and/or focused infrared or impingement—to drastically reduce cooking and heating times. These sophisticated units are essential for rapid food preparation in sectors where time is a critical operational parameter, such as Quick Service Restaurants (QSR), fast-casual dining, institutional catering, and convenience retail. The primary product description centers on equipment capable of cooking, toasting, baking, or heating complex food items in minutes, or even seconds, while maintaining optimal textural and taste quality.

Major applications of these hybrid ovens include rapid preparation of sandwiches, paninis, pizzas, appetizers, baked goods, and specialized grab-and-go items. The core benefit derived by end-users is enhanced operational efficiency, achieved through faster turnaround times, reduced labor dependency, and consistent output quality across various staff members and locations. Key driving factors propelling market growth include the intensifying competitive landscape in the food service industry requiring operational optimization, the proliferation of ghost kitchens and delivery services demanding ultra-fast cooking solutions, and the critical need for energy efficiency within stringent commercial building standards. These combined pressures establish high-speed hybrid ovens as a foundational technology for modern commercial kitchens striving for profitability and scalability.

Commercial High-Speed Hybrid Ovens Market Executive Summary

The Commercial High-Speed Hybrid Ovens Market is characterized by robust growth, propelled by macro-level business trends emphasizing operational agility and labor optimization across the global food service industry. Key business trends include the shift towards smaller, highly functional kitchen footprints, particularly within urban centers and delivery-only models (ghost kitchens), where space efficiency and speed are paramount. Manufacturers are focusing on developing compact, ventless models that offer maximum flexibility in placement, positioning the equipment as a cornerstone for diversified revenue streams like catering and third-party delivery. Furthermore, significant investment in connectivity and software integration is transforming these ovens from mere cooking tools into data-generating assets that support predictive maintenance and centralized operational control.

Regionally, North America maintains the largest market share, driven by high labor costs and the established dominance of major QSR chains which are early and rapid adopters of efficiency-enhancing technologies. Europe follows, with growth underpinned by a strong regulatory focus on energy efficiency (driving demand for high-efficiency models) and the increasing popularity of premium fast-casual dining formats. Asia Pacific is emerging as the fastest-growing region, fueled by rapid urbanization, expanding middle-class consumption, and the large-scale rollout of international and local quick-service chains, particularly in countries like China and India, where speed of service is rapidly becoming a consumer expectation. Segment trends indicate a strong preference for medium-capacity, internet-enabled ovens, demonstrating a market pivot toward smart kitchen solutions that prioritize network integration over sheer cooking volume.

Segmentation analysis highlights the increasing importance of the 'Ventless' category, driven by regulatory easing and spatial limitations in urban environments, allowing for broader market access outside traditional restaurant spaces. The largest end-user segment remains Quick Service Restaurants (QSRs), which rely on these ovens for core menu items and rapid lunchtime service. However, significant growth is also observed in the convenience store and institutional catering sectors, where the hybrid oven’s ability to quickly refresh or cook pre-portioned meals provides a crucial logistical advantage. Pricing models are evolving, with manufacturers offering subscription services or lease agreements for software and maintenance, helping to mitigate the high initial capital expenditure associated with these advanced appliances and broadening accessibility to smaller, independent operators.

AI Impact Analysis on Commercial High-Speed Hybrid Ovens Market

Analysis of common user questions related to AI's impact on high-speed hybrid ovens reveals central themes focused on optimization, automation, and predictive capabilities. Users frequently inquire: "Can AI automatically adjust cooking parameters based on ingredients or ambient temperature?", "How does machine learning improve energy efficiency?", and "Will AI integration reduce the need for highly skilled kitchen staff?". The collective expectation is that AI will move the oven beyond simple programming toward genuine intelligent processing, managing variables such as load size, ingredient moisture content, and internal component health to ensure perfect, consistent results every time while minimizing utility costs. Concerns often center around data security, the cost of implementing AI-enabled hardware, and the complexity of integrating these smart systems into existing legacy kitchen infrastructure.

AI’s influence is shifting the value proposition of these ovens from speed alone to intelligent speed coupled with unprecedented consistency and operational data insights. By leveraging machine learning algorithms applied to thermal data and user input, AI can dynamically optimize the heating profiles—balancing microwave power, fan speed, and impingement duration—to reduce cooking variability, regardless of external factors or operator skill level. This capability is paramount for global food chains seeking absolute product uniformity. Furthermore, AI-driven predictive maintenance systems can monitor vibration, temperature fluctuations, and component cycling patterns, alerting operators to potential failures before catastrophic downtime occurs, thereby significantly improving the total cost of ownership (TCO) for these expensive assets.

The development of sophisticated AI interfaces also directly addresses the acute labor shortage faced by the food service industry. AI-enabled ovens can utilize visual recognition (via internal cameras) to identify the product placed inside and automatically select the correct, optimized cooking cycle without manual input, simplifying staff training and reducing human error. This level of automation ensures that complex, multi-step recipes are executed flawlessly, allowing even junior staff to produce high-quality menu items consistently. This confluence of operational optimization, error reduction, and labor dependency mitigation solidifies AI as a transformative force in the high-speed hybrid oven sector, defining the competitive edge for next-generation equipment.

- AI-driven Predictive Maintenance: Minimizes unexpected downtime by analyzing component health data.

- Automated Recipe Execution: Utilizes visual or weight sensors to identify products and trigger optimized cooking cycles.

- Dynamic Thermal Optimization (DTO): Adjusts convection and microwave power in real-time based on food load and temperature.

- Energy Efficiency Management: Machine learning algorithms optimize power draw based on historical usage and current demand.

- Remote Diagnostic Capabilities: Allows manufacturers to troubleshoot issues via cloud connectivity and AI-processed data streams.

- Enhanced Consistency: Eliminates variability in cooking outcomes caused by differences in staff handling or ingredient changes.

DRO & Impact Forces Of Commercial High-Speed Hybrid Ovens Market

The market for Commercial High-Speed Hybrid Ovens is powerfully shaped by a convergence of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. A primary driver is the pervasive need for rapid service in the global QSR landscape, where customer expectations for instantaneous order fulfillment directly correlate with hybrid oven adoption. This is compounded by the severe and persistent upward pressure on commercial labor wages globally, making investment in technology that reduces cooking time and simplifies complex processes an immediate economic imperative for operators. The proven ability of these ovens to maintain food quality while achieving dramatic speed increases is the fundamental value proposition fueling their market expansion.

However, significant restraints temper the market’s growth potential. The most critical is the high initial capital expenditure (CapEx) associated with purchasing and installing these advanced, multi-technology appliances compared to traditional commercial ovens. This high entry cost often presents a barrier for smaller, independent food service operators. Furthermore, the operational complexity and required specialized maintenance, particularly related to microwave and catalytic components, necessitate specific technical training, which can be challenging to scale across large organizations. There are also ongoing concerns regarding the complexity of integrating diverse connectivity and software standards among various kitchen equipment vendors, creating friction in implementing fully digitized kitchen ecosystems.

The opportunities within this market are substantial and largely center on emerging food service trends. The explosive growth of the ghost kitchen and virtual restaurant model presents a greenfield opportunity, as these operations rely almost exclusively on efficient, small-footprint, high-speed equipment to manage fluctuating delivery demand without customer-facing dining rooms. Technological advancements, particularly in ventless and compact designs, unlock new markets such as fuel stations, corporate break rooms, and non-traditional retail spaces previously constrained by ventilation requirements. Finally, the shift toward customized and healthier menu items, which often require precise and versatile cooking methods, perfectly aligns with the capabilities of hybrid oven technology, allowing operators to expand their culinary offerings without sacrificing service speed.

- Drivers: Demand for rapid service and efficiency; high operational labor costs; focus on food consistency across multi-unit chains; technological advancements in ventless operation.

- Restraints: High initial purchase price (CapEx); complexity of maintenance and required specialized training; limited integration standards between equipment suppliers.

- Opportunity: Expansion into ghost kitchens and delivery-focused models; penetration into non-traditional retail spaces (convenience stores, kiosks); development of subscription models for maintenance and software.

- Impact Forces: Strong positive impact from operational efficiency and labor savings outweighing the negative impact of high initial investment for large chains; moderate impact from technological integration challenges.

Segmentation Analysis

The Commercial High-Speed Hybrid Ovens Market is comprehensively segmented based on technology type, capacity, and end-user application, allowing manufacturers and analysts to precisely target operational needs across the diverse food service industry. The segmentation by technology is crucial as it determines the oven's operational profile, distinguishing between units that primarily use a combination of microwave and convection (best for reheating and browning) versus those incorporating impingement (best for fast baking and crusting). Capacity segmentation, ranging from small countertop models to large floor-standing units, dictates suitability for specific environments, from single-site cafés to large institutional kitchens requiring high volume throughput during peak hours.

End-user application forms the most critical commercial segmentation, differentiating product needs across Quick Service Restaurants (QSR), Fast Casual dining, Full-Service Restaurants (FSR), and institutional/catering segments. QSRs prioritize maximum speed and repeatability for standardized products, often opting for dedicated, high-power models. Conversely, FSRs might require greater cooking versatility for a broader menu selection, utilizing hybrid models that offer precise control over multiple cooking stages. Understanding these segmentation nuances is key for market stakeholders, enabling the development of tailored products and marketing strategies that address the specific performance, size, and connectivity requirements of each operational environment, thereby maximizing market penetration and adoption rates globally.

The increasing prevalence of smart kitchen technology also introduces a segmentation layer based on connectivity and intelligence, dividing the market into connected (IoT enabled) and non-connected devices. Connected ovens, which offer remote diagnostics, software updates, and centralized recipe management, command a premium and are increasingly favored by large chain operators looking for enterprise-level management solutions. This trend underscores a deeper segmentation by solution sophistication, moving beyond mere hardware capabilities to encompass digital service integration, which is projected to become a dominant purchasing criterion in the forecast period.

- By Technology Type:

- Microwave & Convection

- Impingement & Convection

- Triple Hybrid (Microwave, Convection, Impingement/Infrared)

- By Capacity:

- Small Capacity (Countertop Models)

- Medium Capacity

- Large Capacity (Floor Models)

- By End-User:

- Quick Service Restaurants (QSR)

- Fast Casual Restaurants

- Full-Service Restaurants (FSR)

- Institutional Food Service (Hospitals, Schools, Corporate Catering)

- Convenience Stores & Retail

- By Operation:

- Ventless

- Vented

Value Chain Analysis For Commercial High-Speed Hybrid Ovens Market

The value chain for the Commercial High-Speed Hybrid Ovens Market begins with upstream activities involving the sourcing and manufacturing of highly specialized components, which dictate the ultimate performance of the unit. Key upstream suppliers provide advanced heating elements, high-power magnetrons (for microwave capabilities), precision fans, sophisticated thermal insulation materials, and increasingly, specialized catalytic converters necessary for ventless operation. The complexity of integrating these disparate technologies requires highly specialized Original Equipment Manufacturers (OEMs) who possess deep expertise in electrical engineering, airflow dynamics, and thermal management. The capital intensity of the manufacturing process, coupled with stringent quality control standards required for commercial kitchen reliability, concentrates manufacturing power among a few global players.

The distribution channel plays a critical intermediate role, bridging the gap between sophisticated manufacturing and diverse end-user requirements. Direct distribution, often managed by the top-tier OEMs, is common for large national and international chains where volume purchasing, centralized training, and complex integration services are required. However, the majority of sales rely on indirect channels, comprising specialized food service equipment dealers, regional distributors, and third-party kitchen design consultants. These intermediaries offer crucial services such as kitchen planning, installation, local compliance verification, and post-sale technical support, which are essential given the complexity of the hybrid oven technology.

Downstream activities are dominated by installation, user training, and ongoing maintenance. As these ovens are often crucial to daily peak-hour operations, the aftermarket service—including parts supply, diagnostic services, and rapid repair—is a significant component of the overall value proposition and revenue stream for manufacturers and distributors alike. The increasing adoption of IoT and AI features means the downstream service model is evolving towards proactive, subscription-based maintenance (SaaS), where software and remote diagnostics allow for anticipatory repairs, maximizing equipment uptime. This transition strengthens the link between the OEM and the end-user, creating opportunities for recurring revenue and enhancing customer lifetime value.

Commercial High-Speed Hybrid Ovens Market Potential Customers

The primary cohort of potential customers for Commercial High-Speed Hybrid Ovens centers around commercial establishments facing intense pressure to deliver consistent, high-quality food rapidly and efficiently, often while managing high labor turnover. Quick Service Restaurants (QSRs), which rely on standardized, repeatable menus and peak-hour efficiency, represent the largest and most frequent buyers, using hybrid ovens for everything from cooking proteins to rapid heating of prepared components. Fast Casual dining establishments are also crucial buyers, utilizing the versatility of hybrid technology to handle a slightly broader, more complex menu while maintaining the speed advantage over traditional sit-down restaurants. These customers prioritize operational consistency and minimal training requirements for new staff.

Beyond traditional dining, the emerging segment of convenience stores and specialized retail outlets (like gourmet coffee shops or gas station food service) constitutes a rapidly expanding customer base. These non-traditional food service environments have limited kitchen space and often lack specialized ventilation infrastructure, making compact, ventless high-speed hybrid ovens an ideal solution for expanding their grab-and-go and hot-food offerings. Similarly, institutional food service providers—such as those operating in hospitals, universities, and corporate cafeterias—are significant end-users. Their needs revolve around high-volume batch cooking and precise reheating capabilities to serve thousands of meals within strict time windows, often requiring large-capacity floor models integrated into complex kitchen workflows.

A burgeoning and highly strategic customer segment includes ghost kitchens, virtual brands, and third-party commissary kitchens dedicated solely to fulfilling online delivery orders. These operators are defined by their absolute reliance on speed, small operational footprints, and the need to scale production rapidly during demand spikes. For these entities, the labor-saving and speed advantages of hybrid ovens translate directly into profitability and scalability. Manufacturers are increasingly tailoring sales and marketing efforts specifically toward these delivery-focused businesses, offering integrated software solutions that connect the oven directly to order management systems, further solidifying their position as essential tools for the future of off-premise dining.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $980 Million USD |

| Growth Rate | 11.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Middleby Corporation, Welbilt Inc. (Manitowoc Foodservice), Rational AG, Ali Group S.r.l., Unox S.p.A., Merrychef (A Middleby Company), TurboChef Technologies, ACP, Inc., Hatco Corporation, Fujimak Corporation, Star Manufacturing International, Fagor Industrial, Electrolux Professional, Midea Group, Panasonic Corporation, Atollspeed. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial High-Speed Hybrid Ovens Market Key Technology Landscape

The technology landscape for Commercial High-Speed Hybrid Ovens is defined by the sophisticated integration and control of multiple heat transfer methodologies within a single, optimized chamber. Core technologies include high-velocity forced convection, which uses powerful fans to circulate superheated air, ensuring rapid surface heating and even cooking. This is synergistically combined with high-power microwave energy, which dramatically accelerates the internal temperature rise of the food product by exciting water molecules. The precise electronic management of these two forces is crucial to achieve speed without compromising the textural integrity or succulence of the food, preventing the drying or rubbery texture often associated with older microwave-only commercial units.

A crucial differentiator in high-end hybrid ovens is the incorporation of impingement technology, which directs focused, high-speed jets of hot air onto the food surface, rapidly transferring heat and creating desirable browning or crisping effects, crucial for items like pizzas or toasted sandwiches. Furthermore, the rising demand for flexible kitchen layouts has pushed the widespread integration of catalytic converters, enabling "ventless" operation. These converters chemically neutralize grease and smoke particles, allowing the ovens to meet strict air quality standards without needing expensive, complex exhaust hoods, thereby making them viable for installations in shopping malls, airports, and convenience kiosks.

The current technological frontier is dominated by digitalization and connectivity. Modern hybrid ovens are increasingly equipped with IoT sensors, cloud connectivity, and sophisticated onboard processing power, transforming them into smart kitchen appliances. These features enable critical functionalities such as remote recipe management (allowing corporate chefs to update cooking profiles instantly across thousands of locations), real-time diagnostics, and detailed operational data logging. This shift toward "Oven as a Service" (OaaS) leverages data analytics to optimize energy consumption and schedule predictive maintenance, significantly enhancing the overall return on investment (ROI) for the end-user. The convergence of precise heating control, environmental management (ventless), and intelligent connectivity represents the foundation for next-generation equipment development.

Regional Highlights

Regional dynamics play a significant role in shaping the adoption rates and specific product preferences within the Commercial High-Speed Hybrid Ovens Market, driven by local economic conditions, consumer habits, and regulatory environments. North America, particularly the United States, represents the largest market share holder. This dominance is attributable to the high concentration of global Quick Service Restaurant (QSR) and Fast Casual chains, coupled with persistently high labor costs, which create a compelling economic justification for investing in high-efficiency, labor-saving equipment. The market here is mature, focusing heavily on connected, AI-enabled ovens for enterprise-wide consistency and centralized management. The demand for ventless technology is also high due to flexible leasing and installation needs in densely populated urban areas.

Europe demonstrates substantial growth, marked by a strong focus on energy efficiency and sustainable operation, driven by strict EU regulations regarding commercial energy usage. European operators, especially in Western Europe, often prioritize ovens with superior insulation and advanced energy management systems. The diversity of food service cultures means there is a high demand for versatile hybrid units capable of handling a wide range of menu items, from artisanal baked goods to rapidly prepared lunch items in corporate environments. Germany, France, and the UK are key markets, with increasing penetration into the convenience food sector and smaller, independent coffee shop chains looking to expand their hot food offerings quickly.

The Asia Pacific (APAC) region is projected to be the fastest-growing market throughout the forecast period. This rapid expansion is spurred by explosive urbanization, the burgeoning middle class, and the massive expansion of organized food retail and international QSR chains, particularly in China, India, and Southeast Asia. While initial investment sensitivity remains higher than in Western markets, the sheer volume of new restaurant openings and the increasing pressure for faster service in high-density areas are fueling demand for speed-focused hybrid solutions. Furthermore, the relative lack of standardized ventilation infrastructure in many new commercial spaces makes compact, ventless models exceptionally attractive for fast rollout strategies across the region.

- North America: Market leader; driven by high labor costs and large QSR presence; focus on IoT integration, centralized control, and mature ventless technology adoption.

- Europe: High growth driven by regulatory focus on energy efficiency and sustainability; strong demand from fast-casual chains and specialized food service; emphasis on versatile cooking capabilities.

- Asia Pacific (APAC): Fastest-growing region; fueled by rapid QSR chain expansion, urbanization, and reliance on high-speed efficiency in high-volume, low-margin operations; strong demand for compact and cost-effective ventless solutions.

- Latin America & MEA: Emerging markets with potential, driven by modernization of food service infrastructure and increasing foreign investment in organized retail, though growth is generally constrained by initial capital cost barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial High-Speed Hybrid Ovens Market.- The Middleby Corporation

- Welbilt Inc. (Manitowoc Foodservice)

- Rational AG

- Ali Group S.r.l.

- Unox S.p.A.

- Merrychef (A Middleby Company)

- TurboChef Technologies (A Middleby Company)

- ACP, Inc.

- Hatco Corporation

- Fujimak Corporation

- Star Manufacturing International

- Fagor Industrial

- Electrolux Professional

- Midea Group

- Panasonic Corporation

- Atollspeed (A division of Wiesheu GmbH)

- Lincoln Foodservice Products (Welbilt)

- Smeg S.p.A.

- Duke Manufacturing Co.

- Vollrath Company

Frequently Asked Questions

Analyze common user questions about the Commercial High-Speed Hybrid Ovens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Commercial High-Speed Hybrid Oven and why is it essential for QSRs?

A commercial high-speed hybrid oven combines multiple heating technologies (typically microwave, convection, and impingement) in a single unit. It is essential for Quick Service Restaurants (QSRs) because it reduces cooking times from minutes to seconds, ensuring rapid service, maximizing throughput during peak hours, and maintaining absolute consistency across all menu items and staff members.

Are high-speed hybrid ovens difficult to maintain due to their technological complexity?

While the internal mechanisms (magnetrons, catalytic converters) are complex, modern high-speed ovens are increasingly equipped with IoT and AI features that enable predictive maintenance and remote diagnostics. This allows technicians to identify and address issues proactively, simplifying long-term maintenance and significantly reducing unexpected downtime in busy commercial kitchens.

What are the primary operational benefits of choosing a ventless hybrid oven model?

Ventless hybrid ovens, utilizing internal catalytic technology, eliminate the need for expensive, traditional ventilation hoods and ductwork. This provides significant operational benefits by lowering installation costs, allowing ovens to be placed in non-traditional locations (kiosks, food trucks), and offering greater flexibility in kitchen layout and design.

How does the high initial cost (CapEx) of hybrid ovens justify the investment for small businesses?

The high initial capital expenditure (CapEx) is justified by the substantial long-term operational savings. Hybrid ovens drastically reduce labor time per item, decrease energy consumption compared to multiple separate appliances, and ensure product quality consistency, which collectively increase profitability and accelerate the return on investment (ROI), even for small fast-casual operations.

How will AI integration change the staffing requirements for operating these advanced ovens?

AI integration is designed to simplify operation. Features such as automatic product recognition and dynamic cooking parameter adjustment minimize the need for highly skilled chefs or extensive staff training. This enables junior staff to execute complex recipes flawlessly, directly mitigating the impact of labor shortages and high staff turnover prevalent in the food service sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager