Commercial Hot Dog Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442793 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Commercial Hot Dog Equipment Market Size

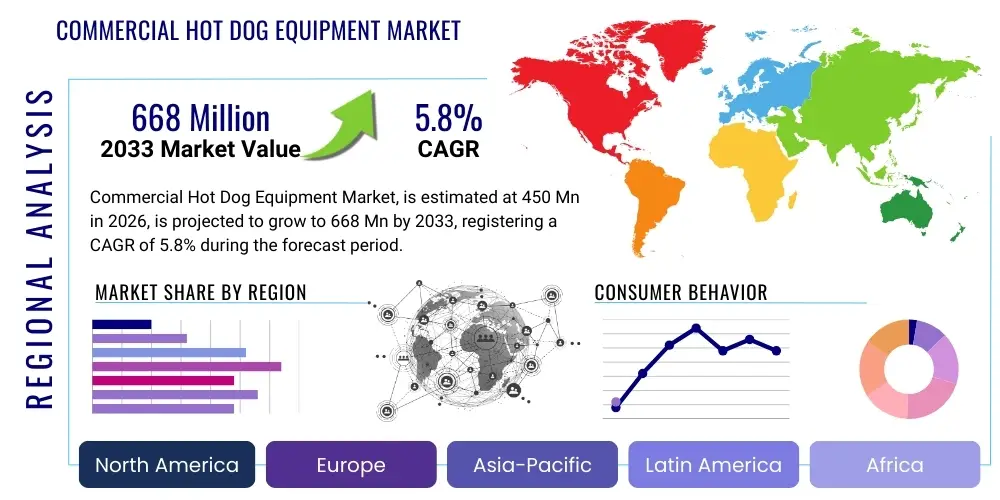

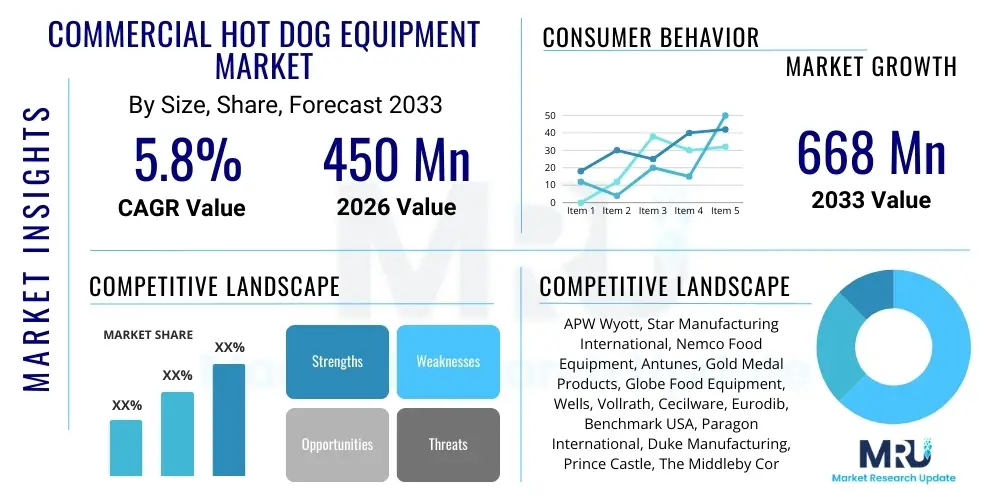

The Commercial Hot Dog Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Commercial Hot Dog Equipment Market introduction

The Commercial Hot Dog Equipment Market encompasses a specialized range of machinery designed for the professional preparation, cooking, holding, and display of hot dogs in high-volume settings. This equipment is critical for quick-service restaurants (QSRs), convenience stores, street vendors, stadiums, cinemas, and institutional cafeterias that rely on efficient and consistent food service operations. The primary product categories include roller grills, steamer units, bun warmers, broilers, and specialized dispensing systems. These machines are engineered to meet stringent commercial requirements concerning durability, ease of cleaning, speed of service, and capacity, ensuring operators can manage peak demand while maintaining food safety standards and product quality. The design innovations in modern commercial hot dog equipment focus heavily on energy efficiency and operational simplicity, allowing minimal training requirements for staff and lowering long-term operating costs for businesses.

Product descriptions vary significantly based on operational needs. Roller grills are arguably the most ubiquitous, utilizing heated rollers to simultaneously cook and display hot dogs, providing a visually appealing presentation that drives impulse purchases. Steamers, conversely, offer a gentler cooking method that maintains moisture, suitable for high-volume batch cooking, particularly in environments where speed is paramount, such as large sporting venues. Bun warmers are almost always paired with the primary cooking unit, ensuring that the entire hot dog preparation process delivers a ready-to-eat product at optimal temperature and texture. Major applications of this equipment span the entire food service industry, but they are particularly vital in sectors characterized by high consumer throughput and limited preparation space. The equipment must be robust enough to handle continuous operation for several hours daily without performance degradation.

The market's growth is fundamentally driven by the expanding global quick-service food sector and the increasing consumer preference for convenient, affordable snack options. Benefits of adopting high-quality commercial equipment include enhanced food safety through precise temperature control, improved speed of service during rush hours, and standardization of the final product, which is crucial for brand consistency across multiple locations. Furthermore, the rising proliferation of mobile food services, such as food trucks and pop-up stands, significantly boosts demand for compact, portable, and reliable commercial hot dog units. Driving factors also include technological advancements leading to digital controls, programmable settings, and automated cleaning features, which optimize labor use and improve overall kitchen efficiency. The ease of incorporating these systems into existing kitchen layouts, coupled with their relatively low capital expenditure compared to full kitchen remodels, makes them an attractive investment for entrepreneurs entering the snack food market.

Commercial Hot Dog Equipment Market Executive Summary

The Commercial Hot Dog Equipment Market is experiencing steady growth, propelled by robust expansion in the global quick-service restaurant (QSR) sector, heightened consumer demand for convenient snack foods, and continuous innovations in food preparation technology. A significant business trend observed is the increasing polarization of equipment demand: high-end, digitally controlled, multi-function units are sought after by major QSR chains for consistency and data logging, while highly durable, low-maintenance, and cost-effective roller grills and steamers remain popular among independent vendors and convenience stores. Consolidation within the manufacturing sector is leading to strategic mergers and acquisitions focused on expanding geographic reach and integrating complementary technologies, such as advanced energy management systems and sanitation features. Furthermore, the shift towards sustainable operations is driving manufacturers to produce equipment using environmentally friendly materials and optimized power consumption mechanisms, appealing to corporate buyers focused on ESG (Environmental, Social, and Governance) compliance.

Regional trends indicate North America currently holds a dominant market share, primarily due to the deeply entrenched hot dog culture, high density of convenience stores, and the expansive network of professional sports and entertainment venues that rely on high-capacity dispensing units. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is attributed to rising disposable incomes, urbanization, and the Westernization of dietary habits, leading to a burgeoning QSR industry in countries like China, India, and Southeast Asian nations. European markets show stable growth, driven by tourism and the development of street food culture, with a specific preference for aesthetically pleasing and highly efficient display equipment. Investment in robust distribution networks and localized service support is a crucial strategic imperative for manufacturers targeting successful penetration into emerging economies in APAC and Latin America.

In terms of segment trends, the Roller Grill segment continues to lead the market by equipment type due to its dual functionality of cooking and visual merchandising, maximizing impulse buying potential. However, the Steamer/Warmer segment is gaining traction, particularly in locations requiring rapid throughput of pre-cooked products or specific regional preferences for moist cooking methods. By end-user, the Quick-Service Restaurants (QSRs) and Convenience Stores (C-Stores) segments remain the bedrock of demand, though the Institutional Food Service segment (schools, hospitals, corporate cafeterias) is showing significant, albeit steady, expansion driven by outsourced catering services. The focus on modularity and portability in equipment design is a notable trend within the Mobile Food Vending segment, responding to the dynamic nature and spatial constraints of food trucks and temporary stalls. Pricing sensitivity remains high in the C-Store segment, driving competition among manufacturers to offer robust equipment at competitive price points without compromising essential quality or safety features.

AI Impact Analysis on Commercial Hot Dog Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Commercial Hot Dog Equipment Market often center on automation potential, predictive maintenance capabilities, and optimization of operational efficiency. Key themes frequently addressed by end-users include whether AI can automate the loading and rotation of hot dogs on grills, how machine learning might predict equipment failure to minimize downtime, and the feasibility of integrating AI-driven demand forecasting with preparation schedules to reduce food waste. Users are generally concerned with the practical application of these technologies, questioning the return on investment (ROI) for relatively low-cost kitchen equipment, and the complexity associated with implementing software solutions in traditional food service environments. The expectation is that AI will initially focus on data aggregation from smart equipment, translating temperature logs, usage patterns, and energy consumption into actionable insights for facility managers, rather than full-scale robotics.

- Predictive Maintenance: AI algorithms analyze sensor data (temperature fluctuations, motor vibration) to anticipate mechanical failures in roller grills or steamers, triggering maintenance alerts before complete operational failure occurs, maximizing equipment uptime.

- Automated Temperature Calibration: Machine learning optimizes heating cycles and holding temperatures based on real-time ambient conditions and usage patterns, ensuring consistent cooking results and adherence to critical food safety regulations (HACCP).

- Demand Forecasting Integration: AI systems integrate POS data with local factors (weather, events) to predict peak demand, automatically adjusting batch cooking instructions for commercial steamers or warmers, reducing overproduction and food waste.

- Operational Efficiency Optimization: AI-driven analysis of equipment usage helps QSR chains identify energy inefficiencies and suboptimal operational workflows across multiple units, leading to significant utility cost reductions.

- Quality Control Assistance: Advanced vision systems, supported by AI, could potentially monitor the color and rotation uniformity of hot dogs on rollers, alerting staff to inconsistencies or prolonged holding times that affect product quality.

DRO & Impact Forces Of Commercial Hot Dog Equipment Market

The dynamics of the Commercial Hot Dog Equipment Market are profoundly shaped by specific Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary driver stems from the relentless growth of the global fast-food industry and the pervasive culture of convenience food consumption, necessitating high-performance, durable equipment capable of sustained operation in demanding environments. This market is further bolstered by increasingly strict food safety regulations globally, which compel older establishments to upgrade to modern equipment featuring precise digital temperature controls and certified sanitation standards. The standardization required by large multinational QSR franchises also acts as a powerful driver, as they require reliable, replicable equipment configurations across thousands of outlets, favoring manufacturers capable of delivering global scale and consistent quality. The rapid expansion of emerging markets and the associated urbanization trends provide fertile ground for new equipment installations, particularly in high-traffic commercial zones.

Key restraints include the relatively high initial capital investment required for top-tier commercial equipment, which can deter smaller independent vendors or startups with limited financial liquidity. Furthermore, the market faces saturation in highly developed economies, where replacement cycles become the primary source of revenue rather than new installations, potentially slowing overall unit volume growth. Another significant restraint is the operational complexity and maintenance requirements of sophisticated, digitally controlled equipment; while offering enhanced features, these units demand specialized technical support and skilled staff, which may be scarce in certain developing regions. The competitive landscape is also intense, with numerous established manufacturers and regional players vying for market share, often leading to price wars that compress profit margins, especially in the low-end and mid-range equipment segments.

Opportunities for market expansion are abundant, particularly in leveraging technological convergence. The development of 'smart' kitchen equipment, featuring IoT connectivity for remote diagnostics, inventory monitoring, and performance tracking, represents a major avenue for growth and differentiation. Furthermore, the growing consumer focus on healthy eating and specialized diets creates an opportunity for versatile, multi-functional equipment that can handle non-traditional items alongside hot dogs, such as plant-based sausages or specialized ethnic sausages. Addressing the niche but expanding market of mobile food vending by offering lightweight, compact, and energy-efficient battery-powered or propane-fueled units provides another critical opportunity. Impact forces resulting from these dynamics include the acceleration of innovation cycles (Impact Force: High R&D Spend), a heightened focus on global supply chain resilience following recent disruptions (Impact Force: Diversified Manufacturing), and aggressive pricing strategies in mature markets (Impact Force: Margin Pressure). These forces collectively shape the competitive strategy of manufacturers, pushing them towards product differentiation through sustainability and advanced functionality.

Segmentation Analysis

The Commercial Hot Dog Equipment Market is comprehensively segmented based on equipment type, operational mechanism, capacity, and end-user application, providing granular insights into demand patterns across the food service ecosystem. Understanding these segments is crucial for manufacturers tailoring their product portfolios and for suppliers optimizing distribution channels. The market structure reveals distinct preferences across different end-user groups; for instance, Quick-Service Restaurants prioritize speed and reliability, leading them to invest heavily in integrated roller grill and bun warmer systems, while institutional settings often favor large-capacity steamers optimized for batch cooking and prolonged holding times. Technological advancement is driving sub-segmentation within operational mechanisms, moving from basic manual controls towards advanced digital, programmable, and networked units, catering to modern kitchen management systems that emphasize data collection and remote monitoring for quality assurance and operational compliance.

The differentiation by equipment capacity is particularly important, ranging from small, countertop units suitable for convenience stores or low-volume mobile vendors, to heavy-duty, floor-standing models designed for stadiums and large event venues. This segmentation reflects the varied spatial constraints and throughput requirements across the market. Furthermore, segmentation by sales channel—direct sales versus indirect distribution through kitchen equipment dealers—highlights the strategic importance of dealer networks, particularly for penetrating fragmented markets of independent operators who rely on local suppliers for equipment advice, installation, and after-sales support. Overall, the increasing specialization of food service operations necessitates equally specialized equipment, reinforcing the importance of a detailed segmentation analysis to capture niche opportunities and mitigate risks associated with generalized product offerings.

- By Equipment Type:

- Roller Grills (Traditional, Angled, Infrared)

- Steamer and Warmer Units (Countertop Steamers, Large Capacity Batch Steamers)

- Broilers (Charbroilers, Infrared Broilers)

- Holding and Merchandising Cabinets (Heated Displays, Bun Warmers)

- Specialized Dispensers and Accessories (Condiment Dispensers, Tongs, Prep Stations)

- By Operational Mechanism:

- Manual/Analog Controlled Equipment

- Digital/Programmable Controlled Equipment

- IoT-Enabled/Smart Equipment

- By Capacity:

- Low Capacity (10-30 hot dogs)

- Medium Capacity (31-70 hot dogs)

- High Capacity (71+ hot dogs)

- By End-User:

- Quick-Service Restaurants (QSRs)

- Convenience Stores and Gas Stations (C-Stores)

- Institutional Food Services (Schools, Hospitals, Corporate)

- Mobile Food Vending (Food Trucks, Carts, Temporary Stalls)

- Entertainment and Leisure Venues (Cinemas, Stadiums, Amusement Parks)

Value Chain Analysis For Commercial Hot Dog Equipment Market

The value chain for the Commercial Hot Dog Equipment Market begins with upstream activities involving the sourcing and processing of essential raw materials, primarily stainless steel, specialized heating elements, high-grade polymers for non-stick surfaces, and electronic components for control panels and IoT functionality. Manufacturers rely heavily on consistent, high-quality steel alloys to ensure durability and sanitation compliance, crucial aspects of commercial-grade machinery. The upstream segment is characterized by global procurement strategies, where manufacturers often leverage economies of scale by purchasing components from specialized suppliers in Asia, particularly for microprocessors and complex heating coil assemblies. Efficient logistics and robust supplier relationship management are paramount at this stage to mitigate risks associated with fluctuating material costs and supply chain disruptions, directly impacting the final manufacturing cost and equipment quality.

The midstream phase, centered on manufacturing and assembly, involves design, fabrication, final assembly, rigorous quality control testing, and certification (e.g., ETL, NSF compliance). Equipment design must balance aesthetic appeal for merchandising with strict functional requirements for energy efficiency and ease of cleaning. Advanced manufacturing techniques, including robotic welding and precision machining, are employed to ensure the longevity and reliability expected in commercial kitchens. Once manufactured, the equipment flows through sophisticated distribution channels. The distribution network is bifurcated into direct sales channels, typically utilized for large, strategic accounts (major QSR chains, national distributors), and indirect channels, which involve specialized food service equipment dealers, regional wholesalers, and online B2B marketplaces. Dealers play a critical role, providing crucial localized sales support, installation services, and technical training to the end-users, especially small and medium-sized enterprises (SMEs).

The downstream segment focuses on the end-user application and post-sale services. End-users, ranging from small local food carts to multinational restaurant groups, purchase equipment based on factors like capacity, footprint, reliability, and warranty duration. Post-purchase activities, including maintenance, repairs, and the provision of spare parts, are vital components of the value chain, representing a recurring revenue stream for both the original equipment manufacturers (OEMs) and certified service providers. The relationship between the manufacturer and the service network directly influences customer satisfaction and brand loyalty. Integration of IoT capabilities into modern equipment is further extending the downstream value, allowing manufacturers to offer subscription-based remote monitoring and predictive maintenance services, enhancing the overall lifecycle management of the equipment and strengthening long-term customer engagement in a highly competitive service environment.

Commercial Hot Dog Equipment Market Potential Customers

Potential customers for commercial hot dog equipment span the breadth of the food service and convenience retail sectors, categorized primarily by their volume requirements, operational structure, and investment capacity. The most significant segment of end-users consists of Quick-Service Restaurants (QSRs) and national/regional convenience store chains. These entities require high-capacity, durable, and standardized equipment that can operate continuously, ensuring product consistency across geographically dispersed locations. QSRs, especially those focused on snack menus or late-night service, rely on roller grills for visual appeal and rapid turnover, viewing the equipment not just as a cooking tool but as a merchandising platform that promotes impulse purchases right at the point of sale. For these large buyers, technical specifications related to energy consumption, ease of HACCP compliance, and network connectivity are decisive purchasing factors.

Another major buying group includes institutional food service providers, encompassing catering companies serving schools, hospitals, corporate campuses, and military installations. While the emphasis here is less on aesthetic merchandising and more on large-batch preparation and holding safety, these customers demand robust, easy-to-clean steamers and warmers that maintain quality over extended holding periods. The purchasing decisions in this segment are often driven by institutional procurement rules, focusing on longevity, warranty coverage, and adherence to strict public health standards. Furthermore, the burgeoning segment of Mobile Food Vending—including food trucks, temporary kiosks, and event-based caterers—constitutes a highly dynamic customer base. These operators prioritize portability, compact design, and versatile power options (propane or battery efficiency), often favoring smaller, multi-functional units that maximize space utilization in confined settings.

Beyond these primary categories, secondary potential customers include various entertainment and leisure venues such as stadiums, cinemas, bowling alleys, and theme parks, which experience high demand peaks and require equipment capable of extremely high throughput during short windows. Moreover, independent small businesses, including family-owned diners, independent delis, and small corner stores, represent a persistent customer base, albeit one highly sensitive to initial equipment cost. Manufacturers must offer tiered product lines, ensuring robust entry-level models are available alongside premium, feature-rich units, allowing them to capture demand across the entire spectrum of purchasing power within the food service industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | APW Wyott, Star Manufacturing International, Nemco Food Equipment, Antunes, Gold Medal Products, Globe Food Equipment, Wells, Vollrath, Cecilware, Eurodib, Benchmark USA, Paragon International, Duke Manufacturing, Prince Castle, The Middleby Corporation, Hatco Corporation, Equipex, BKI, Cookshack, AJ Antunes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Hot Dog Equipment Market Key Technology Landscape

The technological landscape of the Commercial Hot Dog Equipment Market is evolving steadily, driven by the dual needs for enhanced efficiency and stricter food safety compliance. Traditional equipment relied on basic thermostat controls, but modern units increasingly incorporate advanced heating technologies, such as infrared heating elements in roller grills, which provide more uniform heat distribution and reduce energy waste compared to conventional coil heating. Precision temperature management, often achieved through PID (Proportional-Integral-Derivative) controllers, is becoming standard. This technology minimizes temperature overshoot and maintains precise holding temperatures, crucial for HACCP compliance and preventing product spoilage or overcooking. Furthermore, manufacturers are focusing heavily on material science, utilizing non-stick, durable coatings that are easier to clean and maintain, significantly reducing the labor hours dedicated to sanitation tasks and extending the equipment's operational lifespan. The integration of LED lighting systems is also prominent, enhancing the visual appeal of the product in merchandising cabinets and consuming significantly less energy than traditional incandescent lighting.

The most transformative technology currently being adopted is the Internet of Things (IoT) connectivity. Smart hot dog equipment is now being outfitted with embedded sensors and Wi-Fi modules, enabling remote monitoring of performance metrics such as cooking cycles, operational hours, and energy consumption. This connectivity allows large chain operators to centrally manage their fleet of equipment, ensuring standardized settings across all locations and facilitating proactive maintenance scheduling. For example, if a roller grill’s motor consistently registers high torque, the system can automatically flag it for inspection before a critical failure occurs. Data collected through IoT platforms also provides invaluable insights into peak operating times and product turnover rates, informing management decisions related to inventory and staffing. This shift towards data-driven kitchen operations is moving the equipment from being a simple tool to a strategic asset for operational intelligence.

In addition to connectivity, automation and ergonomics are key focus areas. Manufacturers are developing equipment with features designed to reduce manual intervention and improve worker safety. Examples include automatic shut-off features, specialized mechanisms for easier loading and unloading of hot dogs without direct contact, and modular designs that simplify maintenance access. The advancement in control panels—transitioning from analog knobs to intuitive, touch-screen digital interfaces—allows staff to quickly set complex cooking programs and access diagnostic information. The future trajectory involves greater integration with broader kitchen management systems (KMS) and Point of Sale (POS) terminals, allowing the hot dog equipment to respond dynamically to real-time sales data, further reducing food waste and optimizing the speed of service, thus delivering quantifiable return on investment for the end-user.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, technology adoption, and competitive landscape of the Commercial Hot Dog Equipment Market, reflecting variations in consumer preferences, regulatory environments, and the maturity of the quick-service infrastructure. North America, particularly the United States, represents the largest and most established market. The high volume of convenience stores (C-Stores), widespread adoption of professional sporting events necessitating high-throughput equipment, and the deeply ingrained culture of hot dog consumption contribute to its market dominance. North American demand is characterized by a strong preference for high-quality, NSF-certified roller grills and sophisticated holding cabinets, driven by stringent food safety standards and the large operational scale of major QSR chains. Manufacturers here compete aggressively on reliability, ease of service, and adherence to state-specific energy efficiency mandates.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapid economic development, escalating urbanization, and the corresponding expansion of the middle class with greater disposable income. Countries like China, India, and Australia are witnessing a substantial influx of Western QSR formats, creating immense demand for imported or locally manufactured equipment that meets international quality standards. While initial investment might be lower in certain sub-regions of APAC, the sheer population density and increasing demand for prepared foods make this region a critical growth engine. Market penetration requires manufacturers to adapt to diverse local consumption habits and regulatory frameworks, often involving the development of more compact, versatile equipment suitable for small retail footprints and diverse street food applications.

Europe represents a mature yet stable market, characterized by demand for visually appealing, high-design equipment that integrates seamlessly into aesthetically focused retail environments, such as cafes and specialized street food markets. Germany, the UK, and France are key contributors, with strict regulations pushing demand towards technologically advanced units offering precise control and low environmental impact. Latin America and the Middle East & Africa (MEA) are emerging markets showing significant potential. Growth in these regions is closely tied to the expansion of organized retail and tourism infrastructure. In MEA, for example, the hospitality sector’s growth drives demand for durable equipment, while in Latin America, a growing street food culture creates a robust need for portable and rugged equipment solutions. Success in these emerging markets hinges on manufacturers establishing reliable distribution and service networks capable of handling logistical complexities and providing localized technical support.

- North America (Dominant Market): Characterized by high penetration rates, large-scale QSR operations, stringent NSF/ETL certification requirements, and high demand for advanced, connected roller grills.

- Asia Pacific (Fastest Growth): Driven by urbanization, rising disposable income, rapid QSR expansion in China and India, and increasing demand for cost-effective, high-volume steamers and grills.

- Europe (Stable and Quality-Focused): Demand centers on energy efficiency, aesthetically pleasing designs, adherence to strict EU food safety directives, and sophisticated digital controls for precise preparation.

- Latin America: Growth linked to tourism and street food vendor culture, favoring portable, robust, and cost-competitive equipment solutions.

- Middle East & Africa (MEA): Growth bolstered by investment in the hospitality sector and organized retail, requiring durable equipment suitable for high ambient temperatures and demanding usage patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Hot Dog Equipment Market.- APW Wyott

- Star Manufacturing International

- Nemco Food Equipment

- Antunes

- Gold Medal Products

- Globe Food Equipment

- Wells

- Vollrath

- Cecilware

- Eurodib

- Benchmark USA

- Paragon International

- Duke Manufacturing

- Prince Castle

- The Middleby Corporation

- Hatco Corporation

- Equipex

- BKI

- Cookshack

- AJ Antunes

- Server Products

- Cadco, Ltd.

- Adcraft

- Omcan

Frequently Asked Questions

Analyze common user questions about the Commercial Hot Dog Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected market growth rate (CAGR) for commercial hot dog equipment?

The Commercial Hot Dog Equipment Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This growth is primarily attributed to the expansion of the quick-service restaurant industry and global convenience food trends, driving the need for reliable, high-capacity food preparation systems.

Which type of commercial hot dog equipment holds the largest market share?

Roller Grills currently dominate the market share by equipment type. This is due to their operational efficiency, ability to cook and hold products simultaneously, and their strong merchandising capability, which encourages impulse purchasing in high-traffic environments like convenience stores and stadiums.

How is IoT technology impacting modern hot dog preparation equipment?

IoT integration is transforming commercial equipment by enabling remote diagnostics, predictive maintenance, and centralized temperature monitoring. This connectivity ensures consistent food quality across multiple locations, improves regulatory compliance through automated logging, and minimizes equipment downtime, leading to optimized operational efficiency for large chains.

Which region offers the most significant growth opportunities for new equipment installations?

The Asia Pacific (APAC) region is expected to demonstrate the fastest market growth during the forecast period. Factors driving this expansion include rapid urbanization, increasing disposable incomes, and the widespread adoption of Western fast-food models in countries like China and India, necessitating new commercial kitchen equipment installations.

What are the key food safety considerations for commercial hot dog equipment?

Key food safety considerations involve maintaining precise holding temperatures to prevent bacterial growth, adherence to NSF International standards for sanitation, and utilizing non-toxic, easily cleanable materials. Modern equipment must feature accurate digital controls to comply with HACCP guidelines, ensuring hot dogs are held above critical temperature danger zones.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager