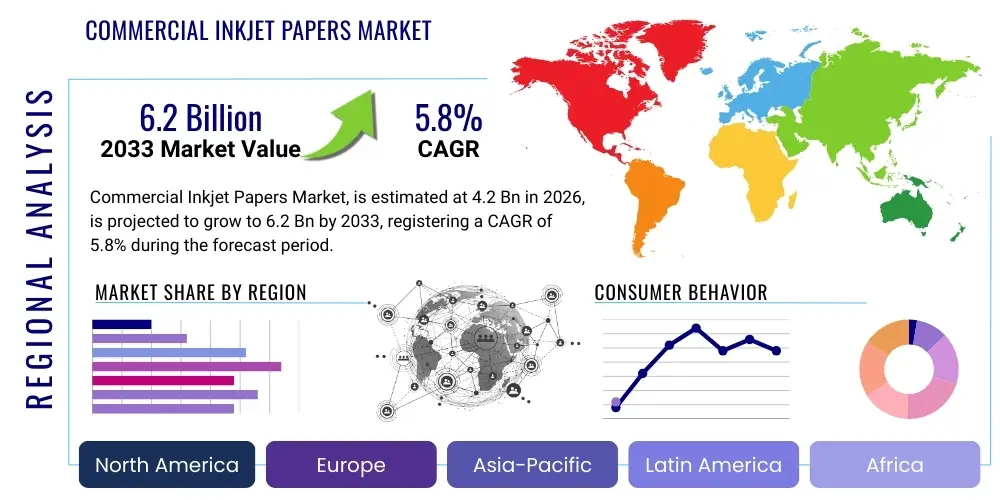

Commercial Inkjet Papers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440914 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Inkjet Papers Market Size

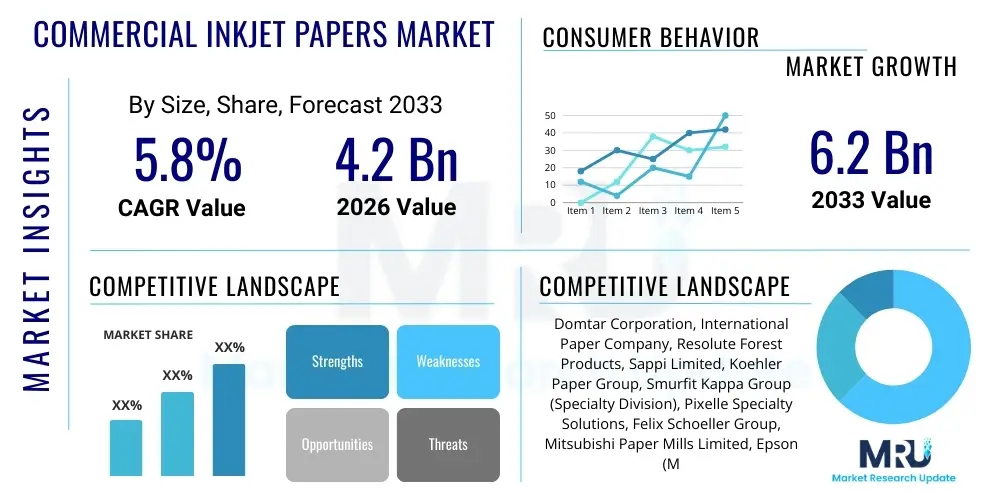

The Commercial Inkjet Papers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Commercial Inkjet Papers Market introduction

The Commercial Inkjet Papers Market comprises an advanced segment of the broader paper industry, focusing exclusively on highly engineered paper substrates optimized for industrial and commercial digital inkjet printing technologies. These papers are distinguished by proprietary surface treatments and multilayered coatings, designed to manage the precise fluid dynamics of aqueous inks, whether dye-based or pigment-based, at extremely high throughput speeds characteristic of continuous-feed presses. The core function of these specialized media is to ensure exceptional dot gain control, high optical density, and instantaneous drying, minimizing inter-color bleed and maximizing color gamut reproduction fidelity crucial for professional applications like personalized direct mail, high-volume book manufacturing (Book-on-Demand), and complex transactional printing. The foundational growth driver for this market is the widespread replacement of legacy analog printing infrastructure (such as conventional offset and electrophotography) with faster, more versatile, and cost-effective digital inkjet systems, making the specialized paper an indispensable chemical and mechanical component of the overall digital printing solution, rather than just a commodity input.

Product complexity within the commercial inkjet domain is dictated by the chemical composition of the ink being used and the required end-use application. For pigment-based inks, which dominate high-speed commercial applications due to superior lightfastness and water resistance, papers often utilize highly porous, inorganic coatings—such as surface-modified precipitated calcium carbonate (PCC) or fine silicas—that rapidly draw the aqueous carrier fluid away from the pigments, fixing the colorants precisely on the surface layer. Conversely, dye-based inks, which offer broader color richness but less durability, typically require swellable polymer coatings that encapsulate the dye particles. Major applications span critical sectors globally: the Financial Services and Insurance (FSI) sector demands papers for secure, high-volume statements and transactional documents; the publishing sector utilizes continuous-feed optimized matte and lightweight coated papers for book production; and the robust marketing sector drives demand for high-gloss, color-critical media for individualized collateral. The rigorous technical specifications required for stability and runnability at speeds exceeding 1,000 feet per minute define the technological sophistication of the leading suppliers in this niche market.

The benefits associated with the adoption of specialized commercial inkjet papers are multifaceted, extending beyond mere print quality to encompass significant operational efficiencies and commercial advantages. Utilizing the correct substrate ensures enhanced print head longevity, reduced maintenance costs associated with ink residue, and minimized paper dust generation, thereby maximizing printing uptime, which is paramount in 24/7 commercial operations. Furthermore, the quick-drying nature of these papers eliminates the need for expensive and energy-intensive post-print drying processes, streamlining the finishing stages (cutting, folding, binding). Driving factors underpinning sustained market expansion include the accelerating trend of variable data printing (VDP), fueled by marketing needs for hyper-personalization, the increasing feasibility of economically viable short-run publications, and strong governmental and corporate compliance towards utilizing sustainably sourced and recycled paper options. This convergence of efficiency, technical performance, and sustainability mandates solidifies the specialized commercial inkjet paper market as a vital and growing component of the global commercial communication landscape, demonstrating resilience despite general digitalization trends by focusing on high-value, necessary print output.

Commercial Inkjet Papers Market Executive Summary

The Commercial Inkjet Papers Market is undergoing dynamic transformation characterized by significant technological convergence between paper chemistry and digital print hardware, resulting in substantial market growth predominantly anchored in specialized, high-performance substrates. Business trends highlight intense competitive differentiation based on paper compatibility with advanced high-density pigment inks, water resistance, and environmental certifications, compelling manufacturers to invest heavily in proprietary coating technologies that optimize surface energy and porosity. A key business focus involves strategic alliances between major paper manufacturers and Original Equipment Manufacturers (OEMs) of continuous feed presses to ensure early validation and optimized paper profiles for new machine generations. Furthermore, the shift toward lightweighting papers without sacrificing opacity or stiffness—essential for reducing postal costs and material consumption—is a primary innovation vector driving competitive strategy across all major global players, while pricing pressure remains acute in the uncoated transactional segment due to high fiber cost volatility.

Regional trends distinctly showcase the Asia Pacific (APAC) region as the epicenter of future growth, capitalizing on massive investments in new printing technologies spurred by flourishing local e-commerce and a rising consumer base demanding localized content and individualized products. North America and Europe, while representing technologically mature markets, sustain demand through continuous innovation in high-end specialty applications, particularly high-quality packaging prototypes and high-impact direct marketing, where print quality justifies premium pricing. In these established markets, regulatory compliance, specifically related to sustainable forest management and chemical safety (e.g., REACH regulations in Europe), dictates market entry and product formulation strategies. Segment trends underscore the rapid expansion of the Coated Matte segment, driven by the explosive growth of digital book manufacturing, offering an ideal balance between superior image resolution and reduced glare, making it highly preferred for text and graphic combined content. Meanwhile, the Uncoated segment remains critical for high-volume transactional documents, where speed and cost-efficiency outweigh aesthetic considerations, emphasizing a clear market bifurcation based on value proposition and application complexity.

In essence, the market's executive outlook is optimistic yet nuanced: growth is inextricably linked to the continued rollout of high-speed inkjet presses globally, transforming print from a high-inventory, static process into a responsive, on-demand service. The primary challenge is mitigating the constant threat of overall volume decline from digitalization by focusing intensively on the high-value, variable data segments that cannot be easily replaced by electronic communication. Successful market players are those that can effectively manage complex global supply chains, buffer against raw material price volatility, and demonstrate verifiable sustainability credentials alongside delivering technically superior paper media capable of reliably performing within the demanding mechanical and thermal constraints of modern industrial digital printers. The market trajectory is therefore defined by precision engineering, technical integration, and alignment with stringent corporate responsibility targets.

AI Impact Analysis on Commercial Inkjet Papers Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Commercial Inkjet Papers Market frequently address potential volume disruption, asking if AI-driven content generation and distribution will accelerate the "paperless" trend, or if AI will enhance the efficiency of print production, thus maximizing the utility of specialized paper. Key user concerns revolve around AI's ability to automate print job preparation, optimize material selection based on real-time ink and press data, and predict equipment maintenance, all of which directly affect paper consumption rates and waste. Users also anticipate AI being utilized in advanced color profiling and consistency checks across different paper batches, ensuring brand integrity regardless of substrate variation.

Based on this analysis, the pervasive theme is that AI acts as an efficiency amplifier and personalization enabler, rather than a direct volume disruptor. While AI algorithms might optimize corporate communications to favor digital channels for non-critical information, they simultaneously enhance the efficacy of printed materials by improving targeting, tailoring content variability, and generating highly complex, personalized designs suitable only for high-quality inkjet output. This refinement increases the value per sheet printed, shifting demand away from generic, high-volume commodity papers toward premium, technically specialized inkjet substrates. Furthermore, AI integration in manufacturing and logistics (e.g., predictive maintenance for coating machines, optimized inventory positioning) ensures higher quality consistency and reliable supply, supporting the core commercial requirement for uninterrupted production, thereby indirectly stabilizing demand for certified, high-performance media.

- AI-driven optimization of print runs reduces material waste and inventory holdings of specialized paper by accurately forecasting job volume and material requirements.

- Predictive analytics integrated into printing presses enhance quality control, identifying and rectifying machine issues early, minimizing spoilage of expensive coated papers during high-speed runs.

- AI accelerates variable data implementation and complex personalization engines, significantly increasing the demand for high-quality, specialized papers necessary for impactful, individualized marketing campaigns.

- Automation in supply chain management (SCM) optimizes paper sourcing, logistics, and regional stock levels, ensuring the timely delivery of specialized media and reducing operational friction for Print Service Providers (PSPs).

- Advanced AI image processing and color management systems require superior, highly consistent paper coatings to accurately maintain digital color fidelity and brand consistency in high-volume print output.

- AI tools assist in identifying optimal substrate pairings (paper type versus specific ink chemistry) for new printer models and complex job requirements, speeding up market adoption of innovative substrates.

- Machine learning algorithms analyze press performance data to recommend necessary paper properties (e.g., surface roughness, porosity) to maximize throughput and minimize drying time under specific environmental conditions.

DRO & Impact Forces Of Commercial Inkjet Papers Market

The Commercial Inkjet Papers Market is fundamentally propelled by technological drivers and market shifts, primarily the extensive investment in and adoption of continuous feed digital inkjet presses globally, which require highly specialized and validated paper media for optimal operation. This rapid conversion from legacy printing technologies to digital inkjet is fueled by the escalating demand for highly customized, short-run print jobs and variable data content across publishing, direct mail, and transactional sectors. Furthermore, continuous innovation in ink formulations (specifically high-density pigment inks) necessitates ongoing paper development to maintain chemical compatibility and surface integrity, creating a symbiotic technological relationship that pushes market boundaries. These driving forces ensure that the demand for technical expertise in paper manufacturing, focused on micro-porous and polymer-coated surfaces, remains high, directly supporting premium pricing and R&D investment for specialized products.

Conversely, significant restraints challenge market expansion, most notably the pervasive global trend toward digitalization and paperless initiatives across governmental, corporate, and household sectors, which exerts constant volumetric pressure on traditional print output. Additionally, the market is highly vulnerable to raw material price volatility, particularly for wood pulp, specialty coating chemicals (like highly refined silica and titanium dioxide), and energy costs necessary for large-scale drying and manufacturing processes. This cost instability compresses profit margins, especially in the highly competitive, price-sensitive uncoated transactional segment. Furthermore, stringent environmental regulations, while providing opportunity, also act as a restraint by increasing the complexity and cost of manufacturing, demanding heavy investment in closed-loop systems, chemical substitution, and rigorous certification processes like FSC and PEFC, restricting the operational flexibility of manufacturers.

Opportunities for high growth lie predominantly in the development and proliferation of environmentally sustainable paper options—specifically those incorporating certified recycled content and achieving chemical safety standards—as end-users actively seek verifiable eco-friendly supply chains, providing a significant competitive advantage. The expansion of continuous-feed inkjet technology into adjacent high-growth markets, such as industrial packaging (e.g., folding cartons, specialty labels) and specialized commercial signage, represents substantial new revenue streams requiring specialized, durable, and unique substrates optimized for non-traditional printing surfaces. The interplay of these drivers, restraints, and opportunities creates critical impact forces: the technological requirement for superior runnability and quality intensifies market consolidation and partnership formation between paper mills and equipment OEMs. Concurrently, environmental mandates are fundamentally reshaping raw material sourcing and product design, establishing sustainability as a non-negotiable prerequisite for large commercial contracts, structurally altering the competitive landscape and raising entry barriers for non-compliant producers.

Segmentation Analysis

Segmentation within the Commercial Inkjet Papers Market provides a granular view of demand based on technical requirements, ink compatibility, and end-user application, highlighting divergent growth trajectories across sub-markets. The core differentiation lies in the coating type: Coated Inkjet Papers, which represent the premium, performance-driven segment, are engineered for maximum image quality and color vibrancy necessary for marketing collateral and high-end publishing. Uncoated Inkjet Papers, conversely, cater to the volume-centric transactional market where speed, low cost, and bulk efficiency are prioritized over aesthetic quality. The functional differences in these segments demand entirely distinct manufacturing processes and chemical formulations. Further segment analysis by application reveals that Book-on-Demand (BoD) printing is a volume powerhouse for coated matte papers, driven by the efficiency of short-run publishing, while direct mail and marketing collateral continue to drive innovation in high-gloss and specialty coated surfaces necessary for visual impact and personalized engagement. Understanding these specific application requirements is critical for manufacturers to tailor their R&D investments effectively.

- By Coating Type:

- Coated Inkjet Papers: These papers feature advanced chemical coatings (e.g., porous inorganic pigments, swellable polymers) designed for high resolution, color fidelity, and rapid drying. They are sub-segmented into Glossy (premium photography, high-impact marketing), Matte (book publishing, textual documents), and Semi-Gloss.

- Uncoated Inkjet Papers: Treated only minimally or not at all, these papers are optimized for absorption, speed, and cost, dominating high-volume transactional print (e.g., utility bills, bank statements) where image quality is secondary to throughput and durability.

- Cast Coated Papers: Offering the highest gloss level and smoothness through a specialized manufacturing process (casting against a heated drum), these are used for the most premium, high-impact photo and graphic art applications.

- By Ink Type Compatibility:

- Dye-Based Ink Papers: Designed with polymer coatings that swell to capture dye particles, providing high color saturation but typically lower water resistance.

- Pigment-Based Ink Papers: Utilizing porous coatings to allow rapid absorption of the ink carrier while keeping the durable pigment particles fixed on the surface, essential for permanence and water resistance in commercial continuous-feed applications.

- Hybrid/Universal Papers: Engineered to provide acceptable performance across multiple ink chemistries and printhead technologies, maximizing flexibility for multi-platform print shops.

- By Application:

- Publishing & Book Manufacturing (Book-on-Demand): High volume use of lightweight matte coated paper optimized for readability and bulk.

- Transactional Printing (Statements, Invoices): Relies heavily on high-speed, cost-effective uncoated papers.

- Direct Mail & Marketing Collateral: Requires high-value glossy or specialty papers for maximum visual impact and personalization.

- Commercial Signage & Graphics: Uses durable, wider-format papers and specialty films needing high water and UV resistance.

- Specialty & Packaging: Emerging segment requiring substrates optimized for folding, scoring, and food safety standards.

- By End-Use Industry:

- Print Service Providers (PSPs): The largest consumers, demanding high-volume, reliable, and technically supported paper supply across all formats.

- Corporate In-Plant Print Shops: Focus on internal communication and specific document requirements, often utilizing universal media.

- Government & Public Sector: High volume, secure document requirements, often favoring suppliers meeting environmental and local procurement mandates.

- Financial Services & Insurance (FSI): Critical users of transactional papers requiring archival quality and security features.

- By Paper Format:

- Continuous Roll/Web Fed: Dominates the high-volume, continuous-feed commercial press segment, prioritizing stiffness and dimensional stability.

- Sheet Fed: Used for lower volume, high-value, or specialized sheet-fed inkjet presses, offering flexibility in size and heavier weight stocks.

Value Chain Analysis For Commercial Inkjet Papers Market

The value chain for commercial inkjet papers is characterized by intensive upstream material science and specialized manufacturing processes that ensure end-product performance aligns precisely with demanding print hardware requirements. Upstream analysis focuses on securing high-quality, sustainably sourced fiber, typically chemical pulp (BKP) for strength and purity, alongside essential chemical inputs like specialized clay, synthetic silicas, and advanced polymer binders that form the sophisticated coatings. The shift toward sustainable sourcing has intensified upstream risks and costs, requiring manufacturers to maintain stringent control over their supply lines and secure certifications (FSC, PEFC). Chemical suppliers play a critical role, constantly innovating in nanoparticle size and distribution within the coating slurry to optimize ink receptor layers, dictating the ultimate speed and quality performance of the finished paper. The efficient management of these specialized inputs is crucial, as slight variations in raw material quality can severely impact the runnability and print quality in a high-speed press environment, leading to costly waste and downtime.

The manufacturing stage represents the primary point of value addition, involving complex paper making, high-precision surface sizing, and multi-layer coating application via specialized equipment like blade coaters or jet coaters, followed by controlled drying and supercalendering to achieve the desired surface finish, thickness, and stiffness. Downstream analysis centers on the distribution and consumption patterns dominated by large Print Service Providers (PSPs). Paper mills often engage in direct sales with major PSPs or Original Equipment Manufacturers (OEMs) for large-volume, customized product runs, ensuring tight technical alignment. This direct distribution model facilitates rapid feedback and co-development of new substrates. Indirect channels, primarily large international paper merchants and distributors, manage inventory and logistics for smaller commercial print shops and specialized media needs, providing crucial regional inventory buffer and rapid delivery services, often focusing on high-value specialty papers that require climate-controlled storage to maintain optimal performance characteristics before use.

A critical technical element within the value chain is the formal validation process. Commercial inkjet papers must often undergo rigorous testing and certification by major equipment OEMs (such as HP, Canon/Océ, Kodak, Screen, Ricoh) to ensure seamless performance, reliability, and printhead compatibility. This validation acts as a significant entry barrier and a key differentiator, linking paper manufacturers closely with hardware providers and dictating purchasing decisions in the downstream market. Therefore, the long-term competitive advantage in this sector stems not just from cost control, but from seamless vertical integration or robust technical collaboration throughout the chain, ensuring the physical substrate remains the perfect chemical and mechanical counterpart to rapidly evolving digital printing technology, ultimately delivering the performance guarantees demanded by commercial print clients.

Commercial Inkjet Papers Market Potential Customers

The core customers for commercial inkjet papers are institutional entities with high-volume, mission-critical printing requirements, prioritizing reliability, speed, and cost-efficiency. Primary buyers include major Print Service Providers (PSPs) and commercial trade printers who operate massive continuous-feed inkjet installations. These customers are highly sensitive to paper specifications related to runnability, coefficient of friction (COF), and dimensional stability, as operational failures translate directly into significant financial losses due to press downtime. They require high-bulk papers for publishing, specialized coated papers for high-impact marketing, and durable uncoated stock for transactional purposes, often managing multiple paper types simultaneously to serve a diverse client base. Their purchasing decisions are heavily influenced by long-term supply agreements and technical support from suppliers that can guarantee compatibility with specific press models and ink sets, making them the largest volume segment within the market.

A second critical segment comprises corporate entities with large in-plant print operations, particularly within the Financial Services and Insurance (FSI) sector, utility companies, and major governmental agencies. These end-users utilize specialized inkjet papers for producing secure, auditable, and high-volume transactional documents such as bank statements, invoices, and policy documents. For these buyers, paper selection is heavily weighted toward security features, archival permanence, and compliance with data privacy regulations, often demanding specific uncoated or lightly coated substrates optimized for high-speed variable data insertion while maintaining low glare for ease of reading. The growth in digital book manufacturing has also cemented publishing houses, both traditional and self-publishing platforms, as major end-users, requiring lightweight, high-opacity matte papers that provide the look and feel of traditional offset printing while leveraging the flexibility of digital Book-on-Demand production models.

Finally, the high-value segment is driven by creative agencies and corporate marketing departments purchasing specialty inkjet media for premium applications. This includes high-gloss photo papers, unique textured stocks, and pre-scored media for customized packaging and luxury brochures. While these customers purchase smaller volumes than PSPs, they are willing to pay a substantial premium for substrates that enhance brand image and tactile appeal. Across all potential customer groups, the overarching demand is for a technically superior paper product that minimizes waste, maximizes uptime, and ensures that the final printed output accurately reflects the quality and consistency expected of modern digital production capabilities, necessitating continuous quality control and product innovation from paper manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domtar Corporation, International Paper Company, Resolute Forest Products, Sappi Limited, Koehler Paper Group, Smurfit Kappa Group (Specialty Division), Pixelle Specialty Solutions, Felix Schoeller Group, Mitsubishi Paper Mills Limited, Epson (Media Division), Canon (Media Division), HP (Media Division), Ricoh (Media Division), Ahlstrom-Munksjö Specialty Papers, Twin Rivers Paper Company, Asia Pulp & Paper (APP), Stora Enso, Sylvamo Corporation, ND Paper LLC, Lecta Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Inkjet Papers Market Key Technology Landscape

The technological sophistication inherent in the Commercial Inkjet Papers Market is centered on advanced coating chemistry and structural paper engineering required to meet the unprecedented demands of modern high-speed digital presses. The primary technological challenge is achieving instant ink immobilization and rapid drying without compromising image resolution or color fidelity. This is predominantly addressed through the application of micro-porous inorganic coatings, typically composed of optimized blends of structured silica, engineered clays, or treated precipitated calcium carbonate (PCC), held together by polymer binders. The engineering precision required for these coatings is exceptionally high: the pore size distribution must be strictly controlled to allow the rapid capillary action needed to absorb the aqueous ink vehicle immediately, thereby preventing coalescence, bleed, and cockle, while simultaneously ensuring the pigment particles remain anchored near the surface for maximum optical density and vibrancy. Manufacturers are utilizing sophisticated computational fluid dynamics and surface chemistry modeling to predict and optimize ink-paper interaction at the nanometer scale, distinguishing high-performance commercial media from generic printing papers.

A secondary, but equally critical, area of technological focus involves enhancing the runnability and structural integrity of the base paper substrate, particularly as the market demands lighter weight papers to reduce shipping and postage costs. New technological processes include specialized fiber fractionation, high-precision calendering, and chemical surface sizing agents designed to increase paper bulk and stiffness (essential for reliable feeding through high-speed continuous web transport systems) while minimizing dimensional instability issues such as curl, which can cause significant production halts. Furthermore, the development of papers specifically tailored for thermal inkjet versus piezo electric printhead technologies—each requiring slightly different thermal stability and surface treatments—drives ongoing R&D specialization. The successful integration of paper chemistry with machine mechanics requires continuous collaboration between paper technologists and press engineers to ensure that the substrate performs flawlessly under the high heat, tension, and speed present in modern commercial printing environments, making materials science innovation a continuous competitive necessity.

The latest advancements are heavily concentrated on multi-functional coatings and sustainability integration. Technologically, this involves formulating coatings that provide essential features like water resistance (crucial for outdoor or durable documents) and scratch resistance, often through bio-based or highly refined polymer chemistries that do not compromise the paper’s recyclability. Advanced techniques are also being applied to incorporate recycled fibers into high-performance papers without introducing contaminants that could damage printheads or degrade coating integrity. This sustainability drive is shifting the technological landscape by demanding new coating formulas that minimize chemical oxygen demand (COD) in wastewater and reduce reliance on non-renewable materials. Overall, the technological barrier to entry is continuously rising, driven by the need for capital-intensive machinery, proprietary chemical knowledge, and complex intellectual property surrounding nanoparticle dispersion and fixation, ensuring that the market remains dominated by a few global specialty manufacturers capable of delivering consistent, high-specification products.

Regional Highlights

Global demand for Commercial Inkjet Papers is geographically diverse, influenced by regional economic maturity, digital adoption rates, and specific regulatory environments concerning print sustainability.

- North America (NA): Represents a highly mature and innovation-focused market segment, characterized by the highest per-capita utilization of specialized coated inkjet media. Demand is primarily driven by large Print Service Providers (PSPs) serving the high-value direct mail and personalized marketing sectors, where investment in the latest high-speed continuous feed presses is extensive. The market demands robust supply chain transparency, leading to strong preference for papers with extensive sustainability certifications (FSC, SFI) and a significant focus on developing papers compatible with water-based pigment inks for permanence.

- Europe: This region is defined by stringent environmental and chemical regulations (e.g., REACH compliance), significantly influencing product formulation and sourcing. Western European countries, particularly Germany, France, and the UK, are strong adopters of Book-on-Demand and transactional printing, generating high demand for high-bulk matte coated and uncoated papers. Fragmentation across multiple national markets also necessitates paper versatility to support diverse language and regional print requirements, fostering innovation in universal compatibility media.

- Asia Pacific (APAC): Positioned as the primary global growth engine for commercial inkjet papers. The rapid expansion of industrial capacity, increasing literacy rates driving demand for book printing, and robust financial sector growth necessitate massive investment in digital printing infrastructure in countries like China, India, and Southeast Asia. While cost-sensitivity is prevalent, the sheer volume potential and the accelerated rate of continuous feed press installations ensure APAC will command the largest share of market growth through the forecast period, with increasing focus on establishing domestic, high-quality manufacturing bases.

- Latin America (LATAM): This region exhibits steady, moderate growth, largely concentrated in high-volume transactional and educational printing. Market adoption is often slower than in NA or Europe due to economic volatility and infrastructure challenges, leading to a strong demand for cost-effective, reliable uncoated papers. Market expansion is dependent on stable regional economic performance and increasing governmental investment in modernizing public sector document processing infrastructure.

- Middle East and Africa (MEA): Currently an emerging market heavily reliant on imports of specialized media. Growth is concentrated in centralized economic hubs (e.g., UAE, Saudi Arabia) driven by government modernization initiatives and corporate expansion. Demand is steadily increasing for durable, high-quality papers suitable for financial and educational applications, with future growth closely tied to successful regional diversification efforts away from resource extraction industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Inkjet Papers Market.- Domtar Corporation

- International Paper Company

- Resolute Forest Products

- Sappi Limited

- Koehler Paper Group

- Smurfit Kappa Group (Specialty Division)

- Pixelle Specialty Solutions

- Felix Schoeller Group

- Mitsubishi Paper Mills Limited

- Epson (Media Division)

- Canon (Media Division)

- HP (Media Division)

- Ricoh (Media Division)

- Ahlstrom-Munksjö Specialty Papers

- Twin Rivers Paper Company

- Asia Pulp & Paper (APP)

- Stora Enso

- Sylvamo Corporation

- ND Paper LLC

Frequently Asked Questions

Analyze common user questions about the Commercial Inkjet Papers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Commercial Inkjet Papers Market?

The central driver is the global transition from traditional offset printing to high-speed digital continuous-feed inkjet printing, which requires highly specialized, coated media to achieve optimal print quality, speed, and cost efficiency for personalized and variable data applications.

How do coated and uncoated inkjet papers differ in commercial use?

Coated inkjet papers feature specialized chemical layers that absorb the ink vehicle rapidly while keeping pigment on the surface, crucial for vibrant colors, high resolution, and photographic quality (e.g., direct mail). Uncoated papers are generally more economical and are preferred for text-heavy, high-volume transactional documents requiring speed and readability and often less sensitive to cost variation.

What impact does sustainability have on sourcing commercial inkjet media?

Sustainability is a mandatory factor; major commercial buyers increasingly prioritize papers with certified sustainable sourcing (FSC, SFI) and high levels of post-consumer recycled (PCR) content. Manufacturers are focusing R&D on developing environmentally friendly, recyclable coatings that maintain required high-speed performance metrics without compromising material integrity.

Which geographical region exhibits the fastest growth rate for commercial inkjet papers?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial investments in digital printing infrastructure, rapid industrial expansion, and surging demand for localized publishing and financial communication services across key economies like China and India, rapidly modernizing their print sectors.

How critical is ink compatibility when selecting commercial inkjet paper?

Ink compatibility is paramount. Improper paper selection leads to poor quality outputs (e.g., bleed, smearing, low density) and operational issues (e.g., machine downtime). Commercial papers must be precisely formulated to match specific ink chemistries, particularly the difference between pigment-based and dye-based aqueous inks, ensuring optimal printhead health and maximum throughput speeds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager