Commercial Milkshake Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441045 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Commercial Milkshake Machines Market Size

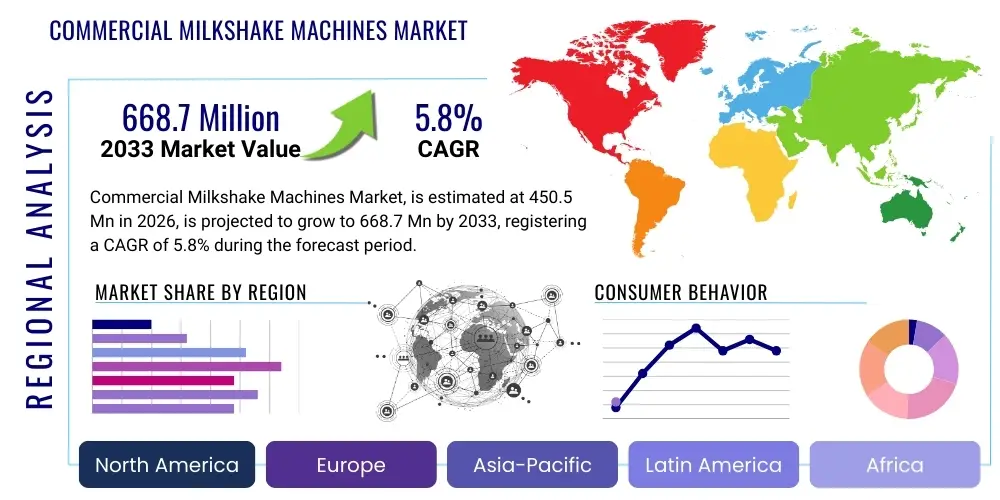

The Commercial Milkshake Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.7 Million by the end of the forecast period in 2033.

Commercial Milkshake Machines Market introduction

The Commercial Milkshake Machines Market encompasses a specialized range of high-performance blending and dispensing equipment engineered exclusively for rigorous use within commercial food service environments. This market is defined by the necessity for equipment capable of handling rapid production cycles, maintaining exceptional product consistency, and adhering to strict public health and safety regulations, particularly those concerning dairy and frozen consumables. The core product category includes traditional multi-spindle mixers, favored for their versatility in creating customized, manually-prepared milkshakes; high-capacity soft-serve/dispensing machines, which hold and continuously freeze a pre-mix, optimizing them for high-volume, standardized operations; and heavy-duty, industrial-grade blenders designed for processing ice, whole fruits, and complex ingredients into thick, specialty beverages. Market growth is structurally linked to the global proliferation of Quick Service Restaurants (QSRs) and fast-casual dining concepts, which rely heavily on efficient beverage programs to drive profitability. Furthermore, the persistent consumer trend favoring indulgent, customized frozen drinks, often featuring high-fat dairy bases, complex flavorings, and various mix-ins, necessitates machines with robust motor power, advanced cooling technologies, and precise control systems capable of managing varied viscosities effectively. The transition toward programmable, digital interface machines represents a significant technological leap, offering operators greater control over consistency and labor efficiencies across multiple operational outlets. These technological improvements are crucial competitive differentiators, especially when addressing the need for rapid service during high-peak consumer demand periods, such as summer months or meal rushes, where equipment failure or product inconsistency can result in substantial revenue loss and reputational damage. The integration of durable, corrosion-resistant materials, particularly food-grade stainless steel components, is also non-negotiable, supporting the longevity required in demanding commercial settings and ensuring compliance with sanitation certification bodies like NSF International and CE standards for European deployment.

The primary applications of these machines extend beyond traditional fast-food outlets into specialized segments such as gourmet coffee houses that integrate blended frozen drinks into their offerings, dedicated ice cream and dessert parlors focusing exclusively on customized creations, and institutional settings like large corporate canteens or military dining facilities where capacity and ease of maintenance are paramount. Key benefits realized by adopting modern commercial units include dramatic improvements in throughput speed compared to consumer-grade equipment, guaranteeing standardized quality regardless of the operator, minimizing ingredient waste through precision dispensing, and lowering the overall energy footprint via high-efficiency compressors and improved insulation techniques. Driving factors underpinning current market acceleration include the necessity for operational robustness—machines must handle consecutive batch production without thermal failure—and the imperative to meet increasing regulatory scrutiny regarding hygiene protocols. This regulatory pressure directly stimulates the replacement market, compelling owners of older, mechanically complex machines to upgrade to models featuring advanced automated cleaning cycles, such as automated heat treatment or self-pasteurization, which significantly simplify compliance and reduce staff labor required for deep cleaning. The globalized nature of QSR franchise expansion further mandates that equipment manufacturers offer globally standardized models that meet diverse regional electrical and safety standards, pushing R&D towards versatile, universally compliant designs. Therefore, the market’s trajectory is heavily influenced by the interplay between consumer indulgence, global food service expansion logistics, and continuous engineering efforts focused on hygiene and operational resilience.

Commercial Milkshake Machines Market Executive Summary

The Commercial Milkshake Machines Market is navigating a phase of sustained moderate-to-high growth, largely catalyzed by the structural shifts occurring within global consumer dining habits and the corresponding technological advancements in food preparation equipment. Current business trends are heavily emphasizing machine flexibility, moving away from single-purpose units toward multi-functional dispensers capable of producing milkshakes, frozen yogurt, or highly viscous smoothie bases from a single platform, thereby maximizing kitchen real estate utility and expanding menu possibilities for operators. This drive for flexibility is closely tied to the competitive environment, where differentiation is sought through unique beverage offerings that require precise temperature and blending control. Furthermore, the increasing capital allocated towards digital integration, specifically IoT functionality for remote monitoring and centralized quality control, is dictating procurement strategies for large chain operators who require uniform performance across geographically dispersed outlets. Investment in modular designs that simplify repair and component replacement is also a noticeable trend, targeting reduction in Total Cost of Ownership (TCO) over the machine’s lifespan, responding directly to the high cost of specialized maintenance labor.

Regional dynamics exhibit significant divergence based on market maturity. North America and Western Europe command the largest installed base, positioning them as primary markets for advanced replacement units that offer superior energy efficiency (meeting Energy Star standards) and comprehensive self-diagnostics. Demand here is less about initial market penetration and more about upgrading for sustainability and labor efficiency gains. Conversely, the Asia Pacific (APAC) region, particularly East and Southeast Asia, presents the most robust growth opportunity, driven by large-scale commercial kitchen infrastructure development and aggressive franchising activities by both Western and indigenous fast-food brands. This region demands equipment that balances high-volume capability with competitive pricing and robustness against potentially harsh operating conditions, such as high humidity and inconsistent power supply. Segment trends reveal that the high-capacity, floor-standing soft-serve style dispenser category is experiencing the fastest growth in volume, directly correlating with QSR expansion, while the niche for high-end, dedicated spindle mixers remains stable, serving artisanal and specialized coffee/dessert shops that prioritize customization and ingredient incorporation. The synthesis of these trends points toward a market where investment in digital infrastructure and sustainable, labor-saving features will be the decisive factors defining competitive advantage and market share gain over the next decade.

AI Impact Analysis on Commercial Milkshake Machines Market

Analysis of public discourse and industry inquiries surrounding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Commercial Milkshake Machines Market reveals a central focus on predictive operational excellence and ingredient consistency management. End-users, particularly large food service chains, frequently query how AI can transcend basic diagnostic alerts to offer truly predictive insights—moving beyond simply notifying of a motor failure to proactively signaling when a specific component, like a refrigeration valve or a scraper blade seal, is approaching its critical wear threshold based on accumulated usage cycles, ambient operating temperature, and historical failure data patterns. This high level of predictive maintenance, facilitated by continuous ML analysis of sensor data (motor load, compressor run time, mix viscosity), is expected to radically minimize catastrophic downtime during crucial business hours, a massive pain point for high-volume operators. Furthermore, there is intense interest in AI's ability to fine-tune the dispensing process. Users are asking whether algorithms can dynamically adjust blend speeds and mix flow rates in real-time, compensating for slight variations in ingredient temperature or mix composition to ensure the final product viscosity and texture (overrun level) remain perfectly consistent across every single pour, irrespective of machine utilization volume or external environmental changes. This pursuit of algorithmic consistency directly addresses a core challenge in chain restaurant quality control.

Beyond maintenance and quality control, user concerns also heavily concentrate on supply chain and demand management optimization facilitated by AI. Common questions explore the integration potential between the machine’s internal consumption metrics and the restaurant’s existing Point-of-Sale (POS) and inventory systems. For instance, ML models can analyze historical sales data correlated with external variables—such as local temperature forecasts, nearby events, or localized social media trends—to generate highly accurate, location-specific demand forecasts for specific milkshake flavors. This intelligence allows store managers to optimize the preparation of perishable liquid mix base, reducing spoilage and inventory holding costs. The financial impact of reducing waste in dairy-based products, which possess short shelf lives, is significant, creating a substantial AEO optimization opportunity focused on "reducing dairy waste in QSR operations." Conversely, a pervasive concern amongst smaller operators is the complexity and prohibitive initial investment cost associated with retrofitting or purchasing AI-enabled equipment. They seek assurances that the required infrastructure (advanced sensors, robust network connectivity, cloud storage subscription fees) will yield a tangible, sustainable ROI quickly, prompting manufacturers to develop subscription-based, modular AI solutions that are scalable and accessible to SMEs rather than solely targeting large multinational chains.

The strategic deployment of AI in this sector is fundamentally about transforming data into actionable operational intelligence that enhances both throughput efficiency and consumer experience reliability. For instance, ML algorithms are used to optimize the machine’s energy consumption curve by learning the location’s specific peak demand times and adjusting chilling intensity accordingly, ensuring product readiness just before the rush while minimizing compressor activity during slow periods. This refinement of energy usage represents a critical competitive advantage, particularly in regions with high electricity costs. Data security and privacy related to operational metrics are also emerging concerns, necessitating robust, encrypted communication protocols for the transmitted IoT data to protect proprietary operational secrets and consumption patterns from external threats. Manufacturers are thus focusing R&D on developing proprietary, secure cloud ecosystems specifically tailored for food service equipment monitoring, ensuring the captured operational data remains protected and utilized solely for enhancing machine performance and service delivery. The long-term vision involves fully autonomous management systems where machines self-diagnose, self-report issues, and even interface directly with central supply chain logistics to order necessary spare parts or mix ingredients, requiring minimal human intervention for daily tasks.

- AI-driven predictive maintenance monitoring machine component stress and wear, utilizing vibration analysis and thermal sensing to forecast required interventions (GEO: minimizing commercial machine downtime).

- Optimization of ingredient dispensing and blending cycles based on real-time viscosity measurements, using ML to ensure consistent texture (overrun optimization) despite ambient temperature variability.

- Demand forecasting integration with Point-of-Sale (POS) and weather data to optimize batch preparation, thereby significantly minimizing spoilage and waste of expensive dairy mix bases.

- Automated diagnostics and remote firmware updates for faster troubleshooting by service technicians, enhancing equipment service contracts and reducing on-site visit necessity.

- Centralized, cloud-based performance monitoring and benchmarking across entire restaurant chains, utilizing ML algorithms to identify underperforming units or operator training gaps.

- Dynamic energy consumption optimization (load shedding) based on learned operational patterns and temperature stabilization requirements, contributing to lower utility expenses and sustainability goals.

- Algorithmic flavor consistency management, ensuring that programmed recipe profiles are maintained precisely, compensating for material or ambient input deviations.

DRO & Impact Forces Of Commercial Milkshake Machines Market

The market trajectory for Commercial Milkshake Machines is structurally influenced by a powerful combination of drivers, restraints, and opportunities. Key drivers include the overwhelming global consumer preference shift toward ready-to-consume, often personalized, frozen beverages, which necessitates high-throughput commercial equipment capable of handling complex recipes and continuous demand. Coupled with this is the accelerating pace of global franchising and the establishment of standardized Quick Service Restaurant (QSR) models in emerging markets, requiring reliable, standardized beverage equipment fleets. Restraints predominantly center on the substantial upfront capital expenditure required to acquire top-tier, high-capacity machines that meet stringent hygiene and efficiency standards, creating a financial barrier particularly for small, independent operators. Furthermore, the specialized maintenance required for refrigeration and complex mechanical systems, often demanding highly trained, expensive technicians, adds complexity and risk to the operational budget. Opportunities are concentrated in technological advancements, specifically the development and adoption of compact, aesthetically pleasing machines suitable for smaller retail footprints (e.g., kiosks, urban cafes) and the integration of advanced IoT and self-sanitizing technologies that address both labor dependency and regulatory compliance concerns, thereby increasing the equipment’s perceived long-term value and expanding market penetration into new channels like ghost kitchens. These factors interact dynamically, shaping the competitive environment and investment priorities.

The Impact Forces governing this market are primarily characterized by intense competition among established manufacturers like Taylor and Carpigiani, who compete fiercely on innovation, TCO, and global service network reach. This competition drives continuous technological enhancement, forcing players to focus on patented dispensing methods, advanced cooling efficiencies, and robust, durable materials that promise longer operational lifecycles. A secondary, yet crucial, impact force is the evolving landscape of global food safety regulations, particularly those set by organizations like the FDA, NSF International, and similar European bodies. These regulations mandate specific design features—such as ease of disassembly, non-porous contact surfaces, and verifiable automated cleaning protocols—which significantly raise the barrier to entry for new manufacturers and necessitate continuous, costly R&D cycles for existing players to ensure ongoing compliance. Economic impact forces, such as commodity price volatility affecting the cost of stainless steel and specialized electronic components, also dictate manufacturing costs and final equipment pricing, influencing procurement timing for large-scale operators. The overall environment is one where operational efficiency is paramount, and technological sophistication aimed at reducing labor and downtime provides the most significant leverage in market share battles.

Specific drivers include the successful leveraging of digital platforms for ordering and delivery, which has heightened the demand for consistent, deliverable beverages that travel well, placing pressure on machine consistency. The market also benefits from innovative ingredient formulations, such as plant-based mixes, requiring machines capable of handling varying viscosities that differ substantially from traditional dairy bases. Conversely, key restraints are related to utility costs; while modern machines are more energy efficient, the constant refrigeration required for mix storage is inherently power-intensive, making high energy tariffs in certain regions a constraint on profitability. Moreover, the environmental impact of certain legacy refrigerants is leading to expensive mandated transitions, challenging manufacturers to redesign systems around newer, climate-friendly alternatives (e.g., R-290 or R-744), adding to the capital outlay. Opportunities also lie in servicing the rapidly growing sector of specialized, high-alcohol frozen drinks (cocktails), which requires robust, high-torque blending capabilities and specialized cooling to maintain the integrity of complex mixtures, opening new market sub-segments for equipment designers focusing on the premium hospitality sector.

Segmentation Analysis

Market segmentation in the Commercial Milkshake Machines sector is critical for understanding targeted deployment and end-user requirements, leading to optimized product development and marketing strategies. The core segmentation by Machine Type—Spindle Mixers versus Soft Serve Dispensers—reflects a fundamental divergence in operational philosophy: mixers cater to customization, low-to-medium volume, and ingredient integration, ideal for cafes, while dispensers prioritize extreme speed, high consistency, and standardized volume for QSRs. Analyzing capacity segments further refines this understanding, separating small, single-head countertop units suitable for limited space and low throughput from massive, high-volume floor models that are central to flagship fast-food locations serving thousands daily. This capacity distinction directly influences installation requirements (electrical, plumbing, floor loading) and is a primary factor in large-scale chain procurement tenders. End-user segmentation reveals tailored feature demands: QSRs mandate reliability, easy corporate standardization, and self-cleaning functions; FSRs may prioritize aesthetics and quiet operation; and institutional buyers focus purely on durability, large batch capacity, and minimal maintenance complexity, requiring robust, industrial-grade construction capable of long cycles between servicing.

The segmentation by Operation Mode—Manual, Semi-Automatic, and Fully Automatic—highlights the ongoing trend toward labor reduction and consistency control. Fully Automatic models, often featuring programmable recipe presets and integrated self-cleaning/pasteurization, command a price premium and are increasingly adopted by major chains seeking to eliminate operator variability and reduce skilled labor dependence. Manual spindle mixers, while requiring more labor, remain crucial for highly customized, ingredient-heavy recipes where an operator's control over blending time and speed is essential for product quality. Geographic segmentation is perhaps the most defining factor in market strategy, dictating everything from machine power specifications (voltage/Hz compatibility) and material compliance (NSF vs. CE standards) to competitive pricing strategy. The demand profile varies significantly between mature replacement markets (North America/Europe) focusing on efficiency and technology, and high-growth installation markets (APAC) prioritizing volume capacity and robust affordability. Strategic market penetration requires manufacturers to optimize their product portfolio to address the specific blend of demands found within each of these intricate segments, ensuring that machine design directly aligns with the operational realities and regulatory environments of the target customer base.

- By Machine Type:

- Spindle Drink Mixers (Focus on customization and ingredient blending)

- Soft Serve/Dispensing Machines (Optimized for high-volume, continuous throughput of standardized product)

- Heavy-Duty Commercial Blenders (Used for complex, frozen, high-viscosity beverages and smoothies)

- By Capacity/Functionality:

- Single Head/Small Capacity (Ideal for small cafes, low footprint)

- Multi-Head/Standard Capacity (Common in mid-sized restaurants, balanced throughput)

- High Volume/Floor Standing Models (Essential for QSR flagship locations, maximum throughput)

- By End-User:

- Quick Service Restaurants (QSRs) (Highest volume demand, focus on standardization)

- Full Service Restaurants (FSRs) (Focus on premium/specialty beverages)

- Cafes and Dessert Parlors (Focus on aesthetics, customization, and ingredient integration)

- Institutional Catering (Schools, Hospitals, Military Bases) (Focus on durability, simplicity, and bulk capacity)

- By Operation Mode:

- Manual Operation (Operator controlled blending time and speed)

- Semi-Automatic (Preset timing/volumes, manual start/stop)

- Fully Automatic/Programmable (Recipe storage, self-diagnosis, integrated cleaning cycles)

- By Geography:

- North America (Mature market, replacement demand, efficiency focus)

- Europe (Stable market, regulatory compliance, compact design preference)

- Asia Pacific (APAC) (High-growth market, volume and affordability focus)

- Latin America (LATAM) (Emerging market, robustness against power issues)

- Middle East & Africa (MEA) (Niche premium segment, high cooling capability required)

Value Chain Analysis For Commercial Milkshake Machines Market

The upstream segment of the Commercial Milkshake Machines Value Chain is defined by the critical sourcing and procurement of specialized, high-performance components that dictate the machine’s reliability and longevity. This includes securing contracts for food-grade 304 and 316 stainless steel for internal tanks, dispensing heads, and chassis construction, ensuring resistance to corrosion and adherence to strict hygiene standards. Highly specialized refrigeration components—specifically hermetic scroll compressors, condensers, and evaporators—are sourced from global refrigeration specialists, as their efficiency and rapid cooling capabilities are paramount to machine performance. Furthermore, the sourcing of precision electronic controls, digital interface components, and high-torque motors capable of handling extremely viscous mixtures without overheating is crucial. Manufacturers focus heavily on maintaining strong relationships with a select group of high-quality suppliers to ensure component consistency and supply chain stability, as disruption in the availability of key parts like custom-machined pump systems can halt high-value production lines. Quality control at this upstream stage involves rigorous testing of sourced materials for durability, non-toxicity, and compliance with NSF standards, ensuring that the foundational elements of the equipment can withstand the demands of continuous commercial operation and frequent sanitization cycles.

The manufacturing and assembly phase constitutes the core of value addition, where raw components are transformed into complex, functional refrigeration and blending systems. This stage involves precision welding and fabrication of the stainless steel barrels and frames, the meticulous installation and charging of the closed-loop refrigeration system (which requires specialized certification), and the integration of electrical harnesses and complex digital control boards. Manufacturers often invest heavily in Lean manufacturing techniques and highly automated assembly lines to ensure repeatable quality and manage the significant labor costs associated with assembling such complex machinery. Critical to this stage is the machine testing protocol, which involves rigorous stress testing under simulated peak load conditions to verify cooling recovery rates, blending consistency, and overall operational safety before certification. The focus here is on integrating proprietary technology, such as patented pump systems designed to regulate overrun (air incorporation) for specific product textures, thereby creating a competitive edge based on demonstrable product quality and throughput efficiency, essential elements for AEO optimization targeting "consistent milkshake quality equipment."

The downstream distribution channel is bifurcated to effectively service the diverse end-user base. Direct sales channels are utilized primarily when dealing with large, international QSR chains (e.g., McDonald's, Burger King) that require centralized procurement, standardized fleet deployment contracts, and dedicated global service agreements managed directly by the manufacturer (OEM). This channel emphasizes volume discounts, long-term supply relationships, and guaranteed global parts availability. Conversely, indirect distribution relies on a network of authorized commercial kitchen equipment dealers, regional wholesalers, and specialized e-commerce platforms. This indirect network is vital for reaching independent restaurants, small regional chains, and specialty cafes, offering localized sales support, bundled financing options, and the critical services of certified third-party technicians for installation and breakdown maintenance. The effectiveness of the indirect channel is measured by the quality of the technical support and the speed of parts delivery, as machine downtime is immensely costly for small operators. Both channels are increasingly reliant on GEO-optimized logistics chains to ensure rapid and secure delivery of heavy equipment, minimizing transit time and reducing the risk of damage to the sensitive refrigeration systems during transport from manufacturing hubs, ensuring that the overall value proposition—product reliability plus exceptional service—is fully realized by the end-user.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Taylor Company, Stoelting Foodservice, Electro Freeze, Hamilton Beach Brands, Waring Commercial, Vita-Mix Corporation, Frijado International, Carpigiani Group (Ali Group), NEMCO Food Equipment, SaniServ, Prince Castle, Lancer Worldwide, Cuisinart Commercial, Vollrath Company, Robot Coupe, Gold Medal Products Co., Blendtec, Bunn-O-Matic Corporation, Spaceman USA, ICETRO America, Duke Manufacturing Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Milkshake Machines Market Potential Customers

The primary cohort of potential customers for commercial milkshake machines is dominated by multinational Quick Service Restaurant (QSR) chains, which require high-volume, continuously operating soft-serve style dispensing units to deliver standardized product quality across thousands of locations globally. These entities prioritize machines that offer robust fleet management features, including advanced telemetry for remote performance tracking, self-pasteurization capabilities to minimize downtime and labor, and modular designs that simplify parts replacement. Their purchasing decisions are driven less by initial cost and more by Total Cost of Ownership (TCO), guaranteed global service contracts, and the assurance of consistency that supports brand integrity. The demand from QSRs often dictates the necessary technological specifications and capacity standards adopted across the entire market, focusing manufacturers on maximizing throughput during peak operational windows. The shift toward specialized offerings like limited-time-offer milkshakes also necessitates highly flexible, programmable machines that can handle recipe variations without requiring manual recalibration, reinforcing the demand for automatic operation modes.

A secondary, rapidly growing customer segment consists of specialty cafes, independent dessert parlors, and artisanal ice cream shops. Unlike QSRs, these customers place high value on customization, menu diversity, and machine aesthetics, often opting for dedicated spindle mixers or high-powered commercial blenders. Their operational needs center on the ability to incorporate complex, bulky ingredients like cereals, cookies, or whole frozen fruit, requiring variable speed controls and high-torque motors. For this segment, the machine's footprint is also a significant concern, leading to higher adoption rates of compact, countertop models that preserve valuable front-of-house or small kitchen space. Institutional purchasers, including hospitals, schools, and military bases, form a distinct third category. Their requirements are focused on industrial-grade durability, large batch production capacity, and straightforward, foolproof operation to manage non-specialized staff. They prioritize machines designed for rigorous, sustained usage with easily accessible components for deep cleaning, emphasizing safety and minimal maintenance complexity over digital sophistication or premium aesthetic design. This buyer profile often leads to procurement of rugged, high-volume floor models known for their mechanical resilience.

Commercial Milkshake Machines Market Key Technology Landscape

The contemporary technology landscape in the Commercial Milkshake Machines market is undergoing a significant transformation, moving beyond basic mechanical functionality towards smart, integrated systems designed for optimal operational intelligence and minimized human intervention. A cornerstone of current innovation is the refinement of refrigeration technology. This involves migrating from traditional HFC refrigerants toward natural, low Global Warming Potential (GWP) alternatives, such as R-290 (propane), requiring significant redesigns of the sealed cooling circuits to maintain high efficiency while adhering to new environmental safety standards. Furthermore, the core engineering focus is on advanced thermal management systems, incorporating highly efficient heat exchangers and electronically controlled expansion valves alongside variable speed drive (VSD) compressors. These components allow the machine to modulate cooling output dynamically in response to real-time load, ensuring rapid recovery of the freezing barrel temperature after successive dispenses, thereby guaranteeing product consistency and achieving substantial energy savings, a key AEO metric for "most energy efficient commercial beverage machines."

Another dominant technological force is the widespread integration of embedded computing and IoT connectivity. Modern machines are equipped with internal Printed Circuit Boards (PCBs) and various sensors (e.g., thermal, pressure, current/motor load sensors) that continuously generate diagnostic and performance data. This data is aggregated and transmitted via Wi-Fi or cellular networks to cloud-based monitoring platforms. This allows chain operators to centrally manage quality control, comparing real-time performance against pre-set KPIs (Key Performance Indicators) across their entire fleet. The primary benefit derived from this IoT integration is the enablement of true predictive maintenance: algorithms analyze usage patterns and component stress signatures to accurately predict impending hardware failures long before they occur, allowing service to be scheduled proactively rather than reactively. This capability drastically reduces unexpected downtime, which can be immensely costly during peak operating hours, thus directly impacting profitability and increasing customer loyalty, making IoT integration a non-negotiable feature for large enterprise procurement contracts.

Furthermore, technology is redefining sanitation and operational ease. The adoption of advanced self-pasteurization systems has revolutionized cleaning protocols by utilizing automated heat treatment cycles (raising the mix temperature to kill bacteria before rapidly cooling it back down) to extend the required manual cleaning interval from daily to bi-weekly or even monthly, significantly addressing the labor restraint within the QSR sector. Alongside this, user interface technology has transitioned largely to sophisticated, multilingual, color touchscreens. These interfaces not only simplify machine operation by allowing non-technical staff to select complex, pre-programmed recipes instantly but also serve as the display hub for diagnostics and real-time operational feedback. In the blending segment (spindle mixers and blenders), technological advances focus on magnetic drive coupling systems, which eliminate the need for mechanical seals, reducing wear and improving sanitation potential, alongside powerful, digitally controlled brushless DC motors that offer high torque and precise speed control necessary for specialized beverage creation. The amalgamation of these technologies defines the current high-end commercial offering, providing a demonstrable competitive advantage in terms of efficiency, reliability, and regulatory compliance, positioning these units as foundational components of modern, streamlined food service operations.

Regional Highlights

- North America: This region remains the largest market by revenue, characterized by high penetration rates of QSRs and an established infrastructure for equipment distribution and service. The market is primarily driven by replacement cycles focused on superior energy efficiency, technological upgrades (IoT adoption), and high-capacity floor models capable of supporting centralized fleet management. Stringent adherence to NSF and UL standards is mandatory, and competition is fierce among major incumbent manufacturers who differentiate based on TCO and service network density.

- Europe: Europe presents a stable but technologically sophisticated market. Demand is often constrained by smaller restaurant footprints, favoring compact, highly efficient countertop units. Strict EU regulations regarding hygiene (CE marking) and environmental impact (refrigerant phase-outs and energy consumption labeling) are critical purchasing factors. Western Europe, particularly the UK, Germany, and France, shows strong adoption in the specialty coffee and dessert parlor segments, prioritizing design aesthetics alongside performance robustness.

- Asia Pacific (APAC): APAC is the global growth engine for this market, experiencing rapid double-digit expansion fueled by urbanization and the influx of international dining chains. Investment is massive, particularly in China, India, and Southeast Asia. The demand skews towards cost-effective, durable, mid-to-high capacity machines suitable for standardization across new, rapidly expanding restaurant fleets. Challenges include managing equipment performance consistency across extreme climatic variations (high humidity/temperature).

- Latin America (LATAM): This region offers emerging growth opportunities tied to the economic development and expansion of regional and international fast-food franchises in countries like Brazil and Mexico. Key equipment requirements include robust construction capable of handling voltage inconsistencies and a greater need for simplified, mechanically sound systems due to less dense and often less specialized technical support infrastructure compared to North America.

- Middle East and Africa (MEA): Growth is concentrated in the wealthy GCC nations (UAE, Saudi Arabia) driven by high-end hospitality and mall-based dining concepts. The critical technical requirement is exceptional refrigeration capability to maintain product integrity in extreme ambient heat. This segment focuses on premium, high-spec equipment, often featuring advanced digital controls and superior aesthetics to match high-end venue standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Milkshake Machines Market.- Taylor Company (A Division of Middleby Corporation)

- Stoelting Foodservice (A Division of The Vollrath Company)

- Electro Freeze (A Division of Hoshizaki America)

- Hamilton Beach Brands Inc.

- Waring Commercial

- Vita-Mix Corporation (Vitamix)

- Carpigiani Group (A Division of Ali Group)

- NEMCO Food Equipment

- SaniServ

- Prince Castle LLC

- Lancer Worldwide (A Division of Hussmann Corporation)

- Cuisinart Commercial

- Vollrath Company LLC

- Robot Coupe

- Gold Medal Products Co.

- Blendtec

- Bunn-O-Matic Corporation

- Spaceman USA

- ICETRO America

- Duke Manufacturing Co.

Frequently Asked Questions

Analyze common user questions about the Commercial Milkshake Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and ROI for a commercial milkshake machine?

The typical lifespan of a high-quality commercial milkshake machine is 8 to 15 years, provided regular maintenance and proper usage. ROI is generally high, often achieved within 18 to 36 months, driven by the high profit margin on frozen beverages and the operational efficiencies gained from high throughput.

What are the key differences between spindle mixers and soft-serve style milkshake dispensers?

Spindle mixers blend pre-chilled or frozen ingredients (like ice cream and milk) rapidly to create a milkshake, catering to customization. Soft-serve style dispensers continuously freeze and dispense a liquid mix, optimizing for high-volume, standardized output with minimal labor.

How do self-pasteurizing features benefit commercial operators?

Self-pasteurization heats and cools the stored dairy mix automatically, extending the time the product can safely remain in the machine (often up to 14 days). This significantly reduces labor time required for manual cleaning, ensures food safety compliance, and maximizes operational uptime.

Which geographical region exhibits the highest growth potential for milkshake equipment?

The Asia Pacific (APAC) region, driven by rapid urbanization and the massive expansion of QSR and fast-casual dining chains, demonstrates the highest Compound Annual Growth Rate (CAGR) and potential for new equipment installation over the forecast period.

What role does IoT play in modern commercial milkshake machine operations?

IoT enables real-time monitoring of machine performance and diagnostics, facilitating predictive maintenance (scheduling repairs before failure), ensuring centralized quality control across chains, and optimizing inventory management through cloud data aggregation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager