Commercial or Corporate Cards Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443245 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Commercial or Corporate Cards Market Size

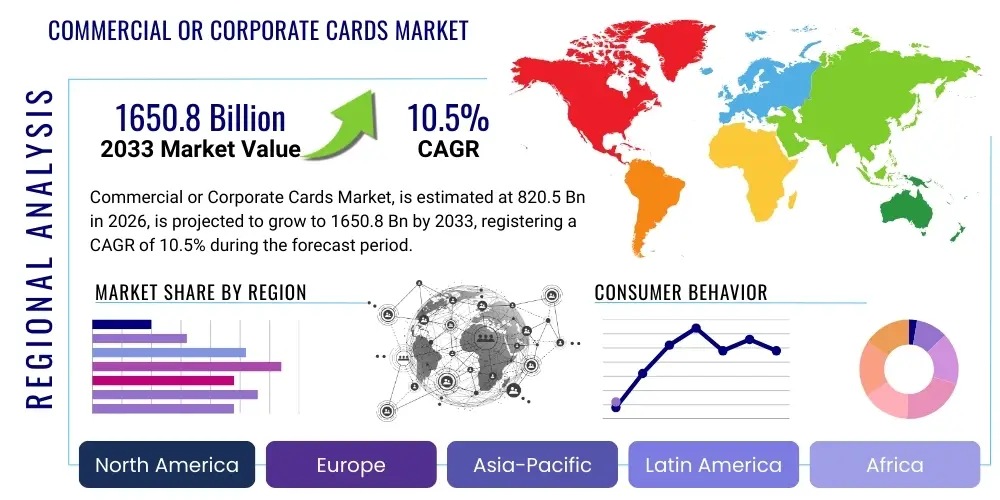

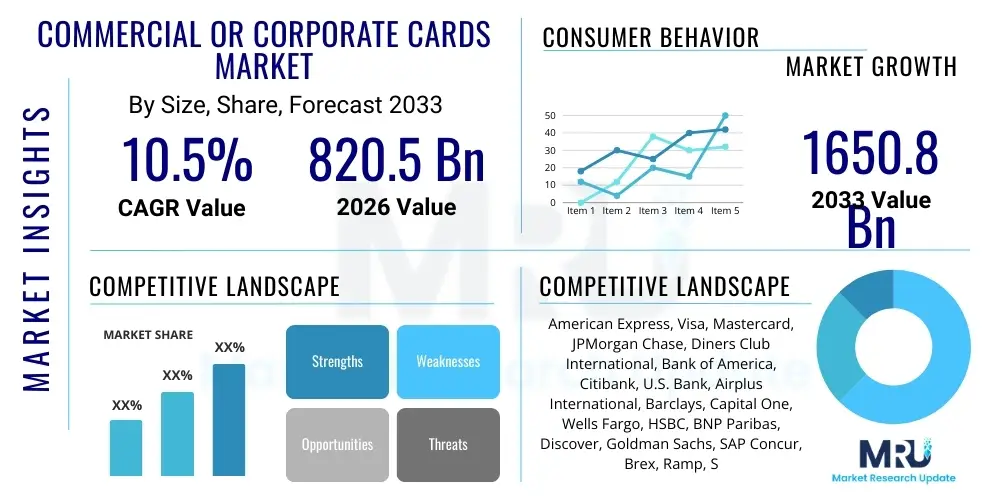

The Commercial or Corporate Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $820.5 Billion in 2026 and is projected to reach $1650.8 Billion by the end of the forecast period in 2033.

Commercial or Corporate Cards Market introduction

The Commercial or Corporate Cards Market encompasses specialized payment instruments designed for business use, facilitating efficient management of corporate expenditures, including travel and entertainment (T&E), procurement, and general operational costs. These cards serve as crucial tools for optimizing working capital and streamlining complex expense reporting processes within organizations of all sizes, from small and medium-sized enterprises (SMEs) to multinational corporations. The primary products offered include standard corporate credit cards, purchasing cards (P-Cards), and virtual cards, each tailored to specific spending needs and control requirements.

Major applications of corporate cards span various critical business functions, such as airline ticket purchasing, hotel accommodation, fleet management, and direct supplier payments for goods and services. The inherent benefits derived from utilizing these systems include enhanced financial control, reduced administrative burden through automated expense capture, improved compliance due to pre-set spending limits, and the ability to leverage detailed data analytics for spending optimization. Furthermore, corporate cards often integrate directly with enterprise resource planning (ERP) systems and accounting software, providing real-time visibility into cash flow and accelerating reconciliation.

Driving factors propelling market growth include the global trend toward digital transformation in finance, the increasing demand for secure and transparent cross-border payment solutions, and the strong expansion of the SME segment requiring scalable expense management tools. Moreover, technological advancements, such as the integration of mobile payment capabilities and biometric security features, are making corporate cards more convenient and robust against fraud, further cementing their role as indispensable financial instruments in the modern business environment. The shift away from traditional manual reimbursement processes toward integrated card solutions is a key catalyst.

Commercial or Corporate Cards Market Executive Summary

The Commercial or Corporate Cards Market is experiencing robust growth driven by accelerating digital adoption across corporate finance departments and a persistent focus on operational efficiency. Key business trends include the rapid proliferation of virtual card solutions for specific-use procurement and online subscriptions, offering enhanced security and precise spending control. There is a notable convergence between traditional card issuers and FinTech platforms, resulting in sophisticated integrated expense management ecosystems that cater to the demanding needs of global businesses, providing features like automated receipt matching and integration with treasury systems. Furthermore, the post-pandemic recovery of global business travel has significantly revitalized the T&E card segment, while remote work trends continue to bolster the demand for efficient, non-T&E related purchasing cards for distributed teams.

Regionally, North America maintains its dominance, characterized by high adoption rates among large multinational corporations and a mature digital infrastructure facilitating seamless payment integration. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by increasing foreign direct investment, rapid industrialization, and the massive growth of the SME sector, particularly in countries like India and China, which are adopting card-based solutions to professionalize their financial operations. European markets are driven by strong regulatory frameworks, such as PSD2, which encourage innovation in payment services and foster competition among providers offering specialized fleet and purchasing card services tailored to cross-border logistics and supply chain financing.

Segment trends indicate a strong shift towards large enterprise clients adopting comprehensive, integrated platforms that combine physical and virtual card options under a unified management dashboard. Within card types, the purchasing card segment is expanding faster than traditional T&E cards, reflecting a move toward automating larger volumes of non-discretionary spending. Technology-wise, the adoption of contactless payment features and tokenization for enhanced security remains paramount, demonstrating the market's commitment to security and user convenience. The rise of specialized vertical solutions, such as those targeting logistics or software procurement, highlights the ongoing fragmentation and specialization within the competitive landscape.

AI Impact Analysis on Commercial or Corporate Cards Market

User inquiries regarding AI's influence on the Commercial or Corporate Cards Market predominantly revolve around fraud mitigation, expense reporting automation, and predictive analytics for treasury management. Users are keenly interested in how Artificial Intelligence and Machine Learning (AI/ML) can move beyond simple rule-based systems to detect sophisticated, novel fraudulent activities in real-time, thereby reducing chargebacks and associated losses. Another major theme is the potential for AI to eliminate the need for manual expense submission by automatically categorizing transactions, verifying compliance against company policies, and matching receipts, thus speeding up the financial close process. Expectations are high that AI will provide predictive insights into future spending patterns, optimize budgeting, and identify opportunities for strategic negotiation with vendors based on deep spend analysis.

- Enhanced Fraud Detection: AI algorithms analyze transaction patterns, location data, and behavioral biometrics in real-time to identify and flag anomalous transactions with greater accuracy than traditional systems, significantly lowering fraud rates.

- Automated Policy Compliance: AI/ML models automatically review expenses against predefined corporate policies, highlighting out-of-policy spending and reducing compliance risk without manual intervention.

- Intelligent Data Categorization: Machine learning techniques automatically categorize transactions and match corresponding receipts, eliminating manual data entry errors and accelerating the expense reporting cycle.

- Personalized Spending Limits: AI determines dynamic, risk-adjusted spending limits for individual cardholders based on historical behavior, job function, and current travel plans, optimizing control.

- Optimized Working Capital: Predictive analytics forecasts short-term cash flow needs and identifies optimal card settlement cycles, aiding corporate treasurers in maximizing float and managing liquidity.

- Improved Customer Service: AI-powered chatbots and virtual assistants provide immediate, 24/7 support for card inquiries, transaction disputes, and technical troubleshooting, enhancing user experience.

DRO & Impact Forces Of Commercial or Corporate Cards Market

The Commercial or Corporate Cards market is significantly shaped by a confluence of accelerating drivers and persistent restraints, with strategic opportunities emerging from technological shifts, all summarized within the framework of potent impact forces. Key drivers include the overwhelming corporate demand for streamlined, digital expense management systems that replace archaic paper-based processes, coupled with the necessity for greater control and transparency over decentralized spending, particularly in remote work environments. These systems not only reduce administrative costs but also ensure regulatory compliance, which is a major motivator for adopting integrated card solutions globally. Furthermore, the continuous introduction of value-added services, such as specialized rewards programs, integrated accounting software compatibility, and improved data reporting tools, substantially enhances the appeal of commercial card products to financial decision-makers.

Conversely, significant restraints hinder growth potential. Primary among these is the pervasive issue of cybersecurity threats and the resulting necessity for massive investment in advanced fraud prevention technology, which can increase operational costs for issuers. Regulatory fragmentation across different geopolitical regions, particularly concerning data privacy and cross-border transactions, adds complexity and compliance burdens for international providers. Moreover, resistance to change within conservative organizational cultures, especially among SMEs hesitant to relinquish traditional payment methods or adopt new complex software interfaces, poses a barrier to wider market penetration. The perceived interchange fees and the complexity of integrating new card systems with legacy enterprise resource planning (ERP) platforms also contribute to implementation friction.

Opportunities for expansion are abundant, particularly through the development of highly specific vertical solutions, such as corporate cards tailored for logistics, software subscriptions, or construction procurement, addressing distinct industry needs. The rapid proliferation of virtual cards and tokenized payment solutions for enhanced security presents a major avenue for innovation and market capture, especially for subscription-based spending. Strategic alliances between established banks and innovative FinTech companies are crucial for accelerating product development, particularly in embedding AI-driven features for real-time spend control and reconciliation. These elements – the push for digitalization, regulatory friction, and technological innovation – collectively constitute the powerful impact forces dictating the pace and direction of market evolution.

Segmentation Analysis

The Commercial or Corporate Cards Market is highly segmented based on the type of card product, the size of the enterprise utilizing the solution, and the application for which the card is primarily used. Understanding these segments is crucial for providers to tailor product features, marketing strategies, and pricing structures effectively. The segmentation reflects the diverse needs of businesses, ranging from multinational corporations requiring sophisticated global travel expense management to small businesses needing simple purchasing solutions. The market structure emphasizes flexibility, offering solutions that range from general-purpose T&E cards to highly specialized fleet management and virtual procurement tools, all aimed at optimizing specific areas of corporate spending.

- By Card Type:

- Travel & Entertainment (T&E) Cards

- Purchasing Cards (P-Cards)

- Fleet Cards

- Virtual Cards

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application:

- Transportation and Travel

- Retail and E-commerce

- Healthcare and Pharmaceutical

- Logistics and Supply Chain

- Information Technology (IT) and Software Subscriptions

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Commercial or Corporate Cards Market

The value chain of the Commercial or Corporate Cards Market is complex, involving multiple interconnected entities that contribute to the delivery and management of the payment solution. The process begins with the upstream segment, dominated by payment network operators like Visa and Mastercard, which provide the essential infrastructure, processing capabilities, and global acceptance standards. Alongside them are technology providers that develop core processing systems, risk management software, and mobile applications critical for secure and efficient transaction authorization. These upstream participants lay the foundation for all subsequent services, ensuring the necessary interoperability and security protocols are in place for global usage.

The midstream section of the value chain is occupied primarily by Card Issuers (banks, credit unions, and non-bank financial institutions) who bear the credit risk, manage customer relationships, and handle the crucial functions of underwriting, card distribution, and statement generation. These issuers often collaborate with specialized third-party processors (TPPs) and FinTech partners to enhance their product offering, particularly in integrated expense management and data analytics. Direct distribution involves issuers marketing their products directly to large corporate clients through dedicated sales teams, often customizing features and pricing based on the client's spending volume and global footprint. This direct model emphasizes deep, long-term relationships and comprehensive service bundles.

The downstream flow involves merchants and acquiring banks, where the cards are accepted for payment. Merchants rely on Acquiring Banks or merchant service providers to process transactions and receive funds. Simultaneously, specialized expense management software providers and travel management companies (TMCs) sit close to the end-user, facilitating the practical application of the cards by integrating transaction data directly into corporate accounting systems. Indirect distribution often involves partnerships with corporate travel agencies, treasury consultants, or payroll providers who recommend and facilitate the implementation of specific card programs to their existing client base, demonstrating the vital role of integrated service ecosystems in maximizing adoption.

Commercial or Corporate Cards Market Potential Customers

The primary customers for Commercial or Corporate Card solutions are diverse organizations seeking to modernize and consolidate their financial processes, moving away from fragmented payment methods like personal cards, checks, or cash advances. The core user base encompasses financial controllers, Chief Financial Officers (CFOs), procurement managers, and administrative staff who are directly responsible for managing corporate spending, budgeting, and financial reporting. These individuals prioritize solutions offering strong controls, high data visibility, and seamless integration capabilities with existing accounting infrastructure. Furthermore, all employees who incur business expenses, such as sales representatives, traveling executives, and remote workers making necessary online purchases, are considered end-users benefiting from the card’s convenience.

Potential customers are segmented into two major categories: Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large Enterprises are typically focused on achieving massive cost savings through consolidated global programs, sophisticated fraud protection, and leveraging high-volume spending data for strategic vendor negotiations. Their requirements lean heavily toward customizable, high-limit Purchasing Cards and advanced Virtual Card infrastructure for secure B2B payments and automated subscription management. They require robust global acceptance and dedicated relationship management from their card providers to ensure consistent service quality across multiple international jurisdictions.

The SME segment represents a rapidly expanding customer base, driven by the need for simplified, scalable expense management tools that provide institutional control without the complexity or cost associated with enterprise-level systems. SMEs primarily seek user-friendly T&E cards and accessible P-Cards that minimize manual data entry for their small finance teams. These smaller businesses are often influenced by the integration potential with cloud-based accounting platforms like QuickBooks or Xero, valuing efficiency and transparency as they scale operations. The increasing availability of FinTech-backed commercial card programs specifically designed for SMEs is a major factor driving their heightened potential customer status.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $820.5 Billion |

| Market Forecast in 2033 | $1650.8 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Express, Visa, Mastercard, JPMorgan Chase, Diners Club International, Bank of America, Citibank, U.S. Bank, Airplus International, Barclays, Capital One, Wells Fargo, HSBC, BNP Paribas, Discover, Goldman Sachs, SAP Concur, Brex, Ramp, Stripe |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial or Corporate Cards Market Key Technology Landscape

The Commercial or Corporate Cards Market is fundamentally shaped by rapid technological advancements designed to enhance security, improve data processing, and streamline user experience. Central to this landscape is the widespread adoption of tokenization technology, which replaces sensitive card details with unique, non-sensitive identifiers (tokens) during transaction processing. This dramatically reduces the risk of data breaches and supports the secure deployment of mobile wallet solutions and contactless payments (NFC), which are now standard requirements for modern corporate card programs. The proliferation of Application Programming Interfaces (APIs) is another critical technological driver, enabling seamless integration between card issuing platforms and third-party expense management software, treasury systems, and core accounting packages, ensuring real-time data flow and minimizing reconciliation effort.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) constitutes a major technological trend, particularly in two vital areas: fraud prevention and expense automation. AI algorithms are used to analyze millions of transactional data points to establish behavioral baselines, enabling the detection of subtle, sophisticated fraud attempts that bypass traditional rule-based filters. Concurrently, ML drives the intelligence behind automated expense processing, facilitating intelligent receipt matching, optical character recognition (OCR) for data capture, and automated categorization based on merchant descriptors. This integration reduces the administrative burden on finance teams and ensures a higher level of data accuracy and compliance check integrity.

Furthermore, the infrastructure supporting virtual cards is rapidly maturing, utilizing unique, single-use, or limited-parameter card numbers for highly controlled B2B payments, software subscriptions, and digital advertising spend. This technology relies on sophisticated backend systems capable of instantaneously generating and revoking card credentials, directly addressing corporate needs for enhanced security in online transactions. Blockchain technology is also being explored, particularly for improving the transparency and efficiency of cross-border corporate payments and supply chain financing, although its mainstream adoption in the core corporate card issuance remains nascent but represents a future disruptive force.

Regional Highlights

North America maintains its position as the largest and most mature market for Commercial or Corporate Cards, driven by the extensive presence of global corporate headquarters, high levels of digitization, and a robust regulatory environment that fosters innovation. The US, in particular, showcases high adoption rates across both large enterprises and a rapidly growing segment of technology-focused SMEs. The market here is characterized by intense competition among major financial institutions and nimble FinTech disruptors offering highly integrated expense management solutions. Emphasis is placed on comprehensive T&E programs, high-limit purchasing cards, and advanced security features, including biometric authentication and real-time alerts.

- North America: Market maturity, high average spend per card, and strong emphasis on integrated software solutions (e.g., seamless integration with SAP Concur and Oracle ERPs). The US dominates, followed by Canada, which is seeing rapid modernization of its payment infrastructure.

- Europe: Driven by Pan-European cross-border business activities and specialized needs in fleet management and logistics. The adoption of PSD2 has accelerated competition, favoring challenger banks and FinTechs that offer superior mobile and digital card management tools. Germany, the UK, and France are key markets, characterized by a mix of traditional bank issuers and specialist non-bank corporate card providers.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive economic expansion, increasing foreign trade, and the professionalization of SME finance in emerging economies like India, Indonesia, and Southeast Asia. The focus is on implementing foundational card programs to replace cash-heavy operations and providing solutions tailored to regional regulatory variance and diverse currency needs.

- Latin America (LATAM): Growth is primarily driven by multinational companies standardizing expenses in high-inflation environments and the need for greater control over local subsidiary spending. Brazil and Mexico are core contributors, seeking virtual card solutions for greater security in digital procurement and simplified tax compliance.

- Middle East & Africa (MEA): Growth is tied to infrastructure projects, government digitalization mandates, and the influx of global business hubs. The UAE and Saudi Arabia are leading the adoption curve, focusing on P-Cards for large-scale procurement and T&E cards supporting increasing regional business tourism and diversified economic activity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial or Corporate Cards Market.- American Express

- Visa

- Mastercard

- JPMorgan Chase

- Diners Club International

- Bank of America

- Citibank

- U.S. Bank

- Airplus International

- Barclays

- Capital One

- Wells Fargo

- HSBC

- BNP Paribas

- Discover

- Goldman Sachs

- SAP Concur

- Brex

- Ramp

- Stripe

Frequently Asked Questions

Analyze common user questions about the Commercial or Corporate Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Corporate Cards and traditional credit cards?

Corporate cards are explicitly designed for business expenses, offering centralized billing, high-level spend data analytics, integrated expense reporting capabilities, and specific spending controls set by the corporation, distinguishing them fundamentally from personal credit instruments.

How do Virtual Cards enhance corporate payment security?

Virtual Cards significantly boost security by generating unique, temporary 16-digit card numbers for specific transactions or vendors. This limits exposure of the physical card number and minimizes fraud risk, making them ideal for B2B procurement and online subscription management.

Which geographical region is showing the fastest growth in commercial card adoption?

The Asia Pacific (APAC) region is currently demonstrating the highest growth rate, driven by the rapid digital transformation of financial services, substantial SME growth, and the shift away from cash-based business operations in key economies like India and China.

What are the main benefits of integrating corporate cards with ERP systems?

Integration provides real-time transaction data capture, automated reconciliation, immediate application of spending policies, and reduced manual data entry errors, dramatically accelerating the monthly financial close process and improving accuracy in reporting.

What role does AI play in mitigating commercial card fraud?

AI utilizes sophisticated machine learning models to analyze thousands of behavioral and transactional attributes in real-time, identifying unusual patterns and anomalies that indicate potential fraud far more effectively than traditional rule-based systems, thus improving loss prevention.

The Commercial or Corporate Cards Market, valued at $820.5 Billion in 2026, is set for exceptional expansion, driven by the global imperative to digitize financial operations and optimize operational expenditures. The market's projected growth to $1650.8 Billion by 2033, translating to a strong 10.5% CAGR, underscores the critical role these payment solutions play in modern corporate finance. This vigorous trajectory is sustained by strong tailwinds, including the accelerated deployment of virtual cards for enhanced security and the integration of AI/ML technologies for superior fraud detection and automated expense management. The shift towards integrated spend platforms that bundle card issuance with treasury management and ERP integration is creating a highly competitive environment, forcing traditional banks to collaborate closely with innovative FinTech providers to retain market share. The need for precise, real-time control over decentralized spending, particularly by large multinational enterprises and scaling SMEs, solidifies the corporate card as an essential tool for fiscal governance.

The competitive landscape is characterized by established global payment networks like Visa and Mastercard setting infrastructure standards, while major issuers such as American Express and JPMorgan Chase focus on providing premium, large-enterprise-focused T&E and P-Card programs. However, market disruption is increasingly coming from specialized FinTechs like Brex and Ramp, which target the tech-savvy SME and start-up segment with flexible credit models and deep software integration. Regional dynamics show North America as the innovation hub and dominant revenue contributor, yet APAC is anticipated to be the primary engine of future growth due to its expanding middle class and accelerating financial professionalization across nascent markets. Addressing ongoing restraints, particularly data security concerns and the complexities of international regulatory compliance, remains crucial for sustaining the high growth momentum projected throughout the forecast period, emphasizing the continuous need for robust, globally compliant payment platforms.

Segmentation analysis confirms the market's evolution from general T&E instruments toward highly specialized Purchasing Cards and Virtual Cards, reflecting the growing trend toward non-travel related spend automation. Large enterprises continue to represent the highest revenue potential, requiring customized global solutions, but the sheer volume potential lies within the burgeoning SME sector, which demands simplified, affordable, and easily deployable expense solutions. Technology remains the core differentiator, with issuers heavily investing in API connectivity for ecosystem integration and leveraging AI to move beyond reactive controls to predictive spend management. The increasing sophistication of the offerings means that corporate cards are no longer just payment mechanisms but comprehensive financial management suites, integral to corporate treasury strategy and working capital optimization across the global economy.

The Commercial or Corporate Cards Market continues its robust expansion, marked by a decisive shift towards digitally integrated platforms that redefine corporate finance management. This transformation is not merely about replacing physical cards with digital equivalents but creating holistic ecosystems that minimize fraud, enforce compliance automatically, and provide unparalleled spend visibility. The sustained 10.5% CAGR is testament to the essential nature of these tools in supporting decentralized workforces and complex global supply chains. Key drivers include the overwhelming global corporate emphasis on operational efficiency and cost reduction, achieved through automated expense processes and the strategic use of spending data provided by card platforms. As global business travel continues its steady recovery and cross-border trade intensifies, the T&E segment is regaining prominence while the Purchasing Card segment accelerates its dominance in general B2B spending automation. The market’s future is intrinsically linked to the successful deployment of AI and API technology, ensuring security, scalability, and seamless integration for businesses operating in an increasingly complex and interconnected global marketplace.

In terms of competitive strategy, success hinges on the ability of issuers to provide customizable, globally compliant solutions that cater to the granular needs of diverse industries, from logistics to software procurement. FinTech challengers are forcing traditional banks to rapidly modernize their technology stacks, focusing on user experience, instant card issuance, and highly localized compliance features. Regional disparities in growth rates highlight strategic investment opportunities; while established providers defend market share in North America and Europe by offering advanced loyalty programs and bespoke enterprise solutions, the greatest opportunity for volumetric growth lies in the APAC region, necessitating culturally and linguistically sensitive offerings. Overcoming regulatory hurdles and maintaining a high standard of data sovereignty and cybersecurity will be crucial determinants of success and longevity within this high-growth market, solidifying the trend towards specialized card issuance and integrated expense software as the market standard.

The value proposition of Commercial or Corporate Cards has broadened considerably, moving beyond simple credit provision to acting as central hubs for corporate treasury operations. The key value chain innovation is the increasing collaboration between core network processors, risk management technology vendors, and expense reporting providers, resulting in a more frictionless end-to-end experience for the corporate user. This integrated approach minimizes implementation barriers and maximizes adoption rates, particularly among the SME segment which prioritizes ease of use and immediate ROI. The projected market valuation reaching $1650.8 Billion reflects not just increased transaction volumes, but also the higher inherent value embedded in these integrated services, positioning corporate cards as indispensable drivers of corporate financial strategy and efficiency across the global economic landscape.