Commercial Ovens Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442290 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Commercial Ovens Market Size

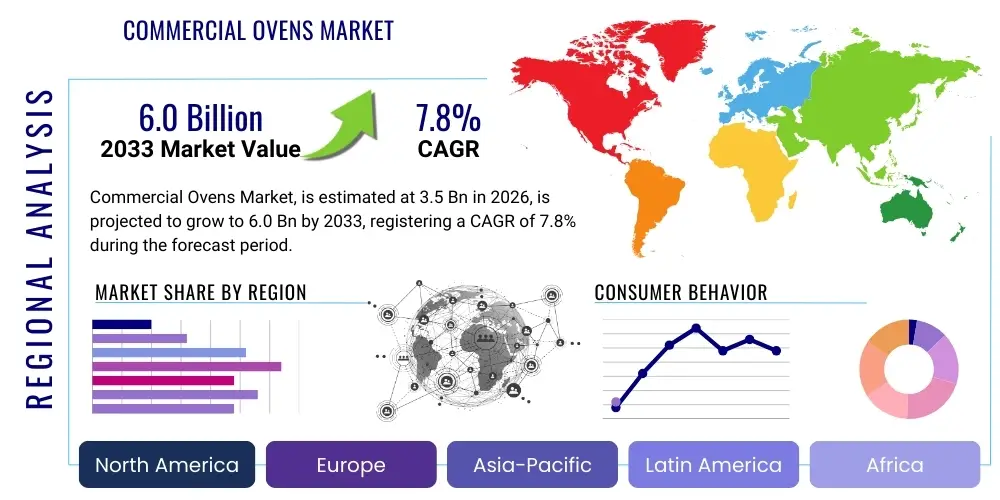

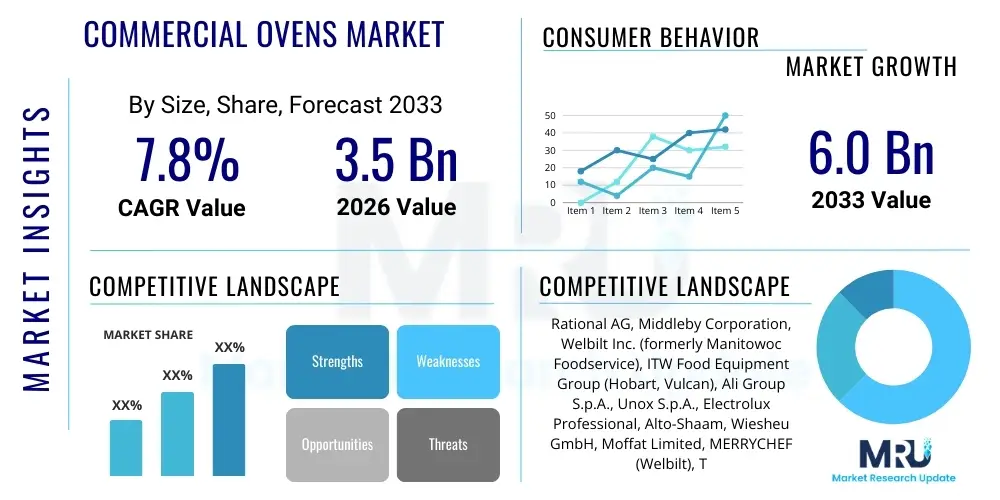

The Commercial Ovens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

Commercial Ovens Market introduction

The Commercial Ovens Market encompasses a diverse range of high-capacity cooking equipment specifically designed for professional food service establishments, including restaurants, hotels, bakeries, catering services, and institutional kitchens. These essential pieces of equipment are engineered for rapid heating, consistent temperature control, and high throughput, differentiating them significantly from residential counterparts. Key product types include conventional, convection, combination (combi), deck, and specialized conveyor ovens, each serving distinct culinary requirements and operational efficiencies within the fast-paced commercial environment. The necessity for reliability and performance drives continuous innovation in materials, heating technologies, and control systems.

Major applications span basic baking and roasting to complex steam cooking and rapid reheating processes, vital for maintaining quality and speed in quick-service restaurants (QSRs) and high-end dining alike. The primary benefits of advanced commercial ovens include enhanced energy efficiency, precise temperature accuracy, reduced labor costs through automation features, and increased production capacity. Modern models often integrate features such as programmable settings, self-cleaning mechanisms, and IoT connectivity, which optimize workflow and ensure consistent product output across multiple locations.

Driving factors for market expansion are multifaceted, anchored by the global proliferation of the food service industry, particularly the rapid growth of international restaurant chains and cloud kitchens. Furthermore, regulatory shifts favoring energy-efficient appliances, combined with rising labor costs necessitating automated cooking solutions, push establishments toward investing in modern, high-efficiency oven technologies. The increasing consumer demand for diverse, freshly prepared foods further compels commercial kitchens to adopt flexible and versatile oven systems, such as combi ovens, which minimize footprint while maximizing utility.

Commercial Ovens Market Executive Summary

The global Commercial Ovens Market is characterized by a strong shift toward digitalization and energy conservation, defining key business trends. Manufacturers are focusing on integrating smart features, including predictive maintenance sensors, remote diagnostic capabilities, and AI-driven recipe optimization, to enhance operational efficiency for end-users. Competitive strategy is increasingly centered on lifecycle cost reduction, with durability, service accessibility, and low energy consumption becoming critical differentiating factors. The dominance of large global brands continues, but specialized technology providers focusing on niche segments like high-speed cooking or artisan baking are gaining traction, leading to increased mergers and acquisitions to capture technological expertise.

Regionally, North America and Europe remain mature markets, witnessing high demand for replacement units and advanced combi-steamer ovens due to stringent energy regulations and high labor costs. The Asia Pacific (APAC) region, however, is projected to exhibit the highest growth trajectory, fueled by rapid urbanization, expanding middle-class consumption, and the subsequent explosive growth of chain restaurants and centralized food production facilities, particularly in China and India. Latin America and the Middle East and Africa (MEA) present burgeoning opportunities, driven by tourism investment and infrastructure development in the hospitality sector, although initial procurement is often skewed toward cost-effective conventional oven models.

In terms of segments, combination ovens are experiencing the most significant growth due to their versatility and multifunctionality, catering to the diverse menus required by modern establishments. By end-user, the QSR segment holds a dominant market share, necessitating highly durable and standardized equipment, while the full-service restaurant (FSR) sector drives demand for precision and aesthetic design. Technology adoption leans heavily toward electric ovens over gas alternatives, influenced by easier installation, precise control, and local environmental standards, though gas remains prevalent in areas with high energy costs or existing infrastructure limitations.

AI Impact Analysis on Commercial Ovens Market

User queries regarding AI in the Commercial Ovens Market primarily revolve around operational optimization, efficiency gains, and preventative maintenance capabilities. Users frequently ask: "How can AI optimize cooking cycles for consistent quality?" and "Will smart ovens reduce food waste?" and "What role does machine learning play in predictive equipment failure?" This collective user interest signals a strong expectation for AI to transition ovens from simple heating tools into intelligent, adaptive culinary assistants. Key themes center on leveraging AI for personalized cooking profiles based on ingredient load and environmental conditions, automating complex processes, and minimizing costly unplanned downtime through real-time operational diagnostics and efficiency monitoring, thereby moving kitchens toward autonomous function.

The integration of Artificial Intelligence is revolutionizing the operational paradigms of commercial kitchens by enabling advanced process control far beyond traditional programming. AI-powered sensors analyze cooking parameters—such as internal food temperature, humidity levels, and air flow—in real-time, adjusting heating elements and fan speeds dynamically to ensure perfect, reproducible results regardless of operator skill level or batch size variations. This adaptive control capability is particularly crucial for complex cooking methods like combi-steaming or high-speed impingement baking, where small deviations significantly impact food quality and safety. Furthermore, AI platforms consolidate data from multiple networked ovens, allowing centralized kitchen managers to benchmark performance, enforce standard operating procedures (SOPs), and ensure brand consistency globally, transforming data into actionable insights for quality assurance.

Beyond direct cooking applications, AI algorithms significantly enhance equipment longevity and reduce total cost of ownership (TCO) through predictive maintenance. By analyzing vibration patterns, temperature anomalies, and energy consumption spikes, machine learning models can accurately forecast component failure before it occurs, triggering automated service requests or alerting maintenance staff. This proactive approach minimizes unexpected breakdowns during peak service hours, which are financially detrimental to commercial operations. Additionally, AI contributes to sustainability efforts by optimizing energy use based on predicted demand patterns and load balancing, ensuring the oven operates at peak thermal efficiency only when necessary, aligning with global trends toward resource efficiency in the hospitality industry.

- Enhanced Recipe Consistency: AI adjusts parameters dynamically (temperature, time, humidity) based on ingredient characteristics and ambient conditions.

- Predictive Maintenance: Machine learning algorithms analyze operational data to forecast component failures, reducing unplanned downtime.

- Energy Optimization: Smart algorithms modulate power consumption based on real-time kitchen demand and scheduled usage patterns.

- Automated Diagnostics: Remote AI systems analyze error codes and performance metrics for faster troubleshooting and reduced service time.

- Food Waste Reduction: Precise cooking cycles minimize burnt or undercooked product, improving inventory management accuracy.

DRO & Impact Forces Of Commercial Ovens Market

The Commercial Ovens Market is propelled by the rapid global expansion of the HoReCa (Hotel, Restaurant, Catering) sector, alongside stringent regulatory pressures demanding high energy efficiency and sustainability in commercial equipment. These drivers are balanced by significant restraining factors, primarily the high initial capital expenditure associated with advanced, smart oven systems and the complexities involved in training kitchen staff on sophisticated, interconnected interfaces. Despite these restraints, substantial opportunities exist, notably in emerging markets for conveyor ovens in pizza and bakery segments, and through the development of highly specialized ovens tailored for plant-based and unique dietary requirements. These market dynamics collectively constitute strong impact forces that dictate investment cycles, technology adoption rates, and competitive market positioning.

Key drivers include the imperative for improved operational speed and consistency in QSR environments, pushing demand for rapid-cooking technologies like high-speed combination ovens and impingement cooking systems. Additionally, the labor shortage crisis across developed economies compels commercial kitchens to invest in automated equipment that simplifies cooking procedures and reduces reliance on highly skilled personnel. Regulatory drivers, particularly in Europe and North America, such as mandates on minimum energy performance standards (MEPS), force operators to retire older, inefficient models, stimulating the replacement market with technologically superior, eco-friendly alternatives.

Restraints primarily stem from economic barriers, including the steep price tag of premium combi ovens and connected equipment, which can deter smaller independent restaurants or operators in price-sensitive regions. Furthermore, the operational challenge of integrating diverse smart kitchen equipment from various vendors presents a significant hurdle for standardization. Opportunities are abundant in the cloud kitchen model, which requires modular, highly efficient equipment scaled for delivery operations, and in the growing institutional sector (hospitals, schools) seeking durable, easy-to-clean ovens meeting strict sanitation standards. The combined effect of these factors generates strong impact forces favoring innovation in multi-functional, modular, and sustainable oven designs.

Segmentation Analysis

The Commercial Ovens Market is extensively segmented based on product type, heating source, end-user application, and operating technology to capture the nuances of professional kitchen requirements worldwide. Understanding these segments is crucial for strategic market entry and product development, as demands vary significantly between a small independent bakery requiring precision deck ovens and a large institutional cafeteria needing high-volume convection or combi units. The rapid advancement in controls and energy systems means segmentation by technology, such as smart connectivity capabilities and self-cleaning functions, is increasingly defining competitive advantages.

- By Product Type: Convection Ovens, Combination Ovens (Combi-steamers), Deck Ovens, Conveyor Ovens, Impingement Ovens, Rotisserie Ovens.

- By Heating Source: Electric, Gas (Natural Gas, Propane).

- By End-User: Full-Service Restaurants (FSRs), Quick-Service Restaurants (QSRs), Hotels and Catering, Bakeries and Patisseries, Institutional Kitchens (Hospitals, Schools, Corporate Cafeterias).

- By Operating Technology: Manual/Analog, Digital/Programmable, Smart/Connected (IoT-enabled).

Commercial Ovens Market By Product Type

The segmentation by product type reflects the functional specialization required in commercial food preparation. Convection ovens, characterized by their use of fans to circulate heated air, offer rapid and uniform cooking, making them staples in nearly every type of commercial kitchen, especially for roasting meats and baking large batches of items. Their efficiency and widespread adoption contribute significantly to the market volume, although growth rates are generally moderate as they represent a mature technology. Ongoing innovations in this segment focus primarily on enhancing insulation, improving fan motor efficiency, and integrating better digital control panels for precise temperature management.

Combination ovens (Combi-steamers) represent the fastest-growing segment, offering exceptional versatility by combining three cooking modes—convection, steam, and combination (convection with adjustable humidity). This multifunctionality allows operators to bake, roast, grill, steam, poach, and even reheat foods within a single unit, drastically reducing the required kitchen footprint and associated capital costs for multiple appliances. The demand for combi ovens is particularly strong in high-end restaurants and institutional settings where diverse menus and strict quality control standards must be met, justifying their higher initial investment through labor savings and operational flexibility.

Conveyor ovens, predominantly utilized by QSRs and pizza chains, are designed for high-volume, continuous throughput operations where speed and product consistency are paramount. These ovens move food on a conveyor belt through a heated chamber, guaranteeing identical cooking times and temperatures for every item. The growth in the global pizza and sandwich chain market is directly proportional to the demand for technologically advanced conveyor systems that minimize human intervention, ensuring scalability and brand standardization across expansive networks. Impingement technology, a subtype of conveyor oven heating, further accelerates cooking times by using pressurized hot air jets, driving its adoption in the ultra-fast QSR environment.

Commercial Ovens Market By End-User

The Quick-Service Restaurant (QSR) segment is the largest consumer of commercial ovens globally, driven by the need for standardization, speed, and durability. QSRs rely heavily on robust equipment capable of continuous operation with minimal failure risk, favoring reliable conveyor ovens, high-speed cookers, and standardized convection units. Investment decisions in QSRs are often centralized, focusing on TCO (Total Cost of Ownership) and ease of maintenance, leading to strong brand loyalty among major global chains that require uniform oven models across thousands of locations to maintain strict quality protocols.

The Full-Service Restaurant (FSR) and Hotels/Catering segments demand high-quality, versatile ovens, prioritizing precision and multifunctionality, which makes them the primary drivers for the premium combination oven market. FSRs often require sophisticated steaming capabilities and precise temperature control for complex culinary preparations. The hospitality sector, including large hotels and convention centers, requires massive capacity ovens (large roll-in combi units) to handle banquet operations and simultaneous multi-kitchen demands. These users often integrate advanced monitoring systems and connectivity features to manage complex production schedules efficiently.

The Bakeries and Patisseries segment, while specialized, is a critical market for deck ovens and specialized rotating rack ovens. Deck ovens provide radiant heat essential for achieving the traditional crusts and artisanal finishes required for breads and high-end pastries. The increasing global trend toward artisan baking and specialized diet products is driving demand for compact, efficient deck oven models suitable for smaller, urban bakery formats. Institutional kitchens, including those in schools, healthcare facilities, and military bases, prioritize ovens offering high volume, robust safety features, and ease of cleaning to meet stringent health and hygiene regulations, typically opting for durable, large-capacity convection and combi ovens.

Commercial Ovens Market By Operating Technology

The market is rapidly shifting from manual/analog controls towards digitally programmable and, increasingly, smart/connected operating technologies. Digital ovens offer significant improvements in precision and repeatability compared to traditional mechanical controls, allowing chefs to store hundreds of specific recipes and execute multi-stage cooking cycles automatically. This level of control is crucial for managing quality across shifts and reducing reliance on manual adjustments, thereby mitigating skill gaps within the labor pool.

The Smart/Connected segment, powered by the Internet of Things (IoT), represents the future growth engine of the commercial oven market. IoT-enabled ovens allow for remote monitoring of operational status, real-time diagnostics, and over-the-air software updates, dramatically enhancing maintenance efficiency. Furthermore, centralized kitchen management systems can monitor performance metrics, energy consumption, and compliance with cooking standards across an entire chain of restaurants instantaneously, facilitating rapid adjustments to operational protocols and menu changes. This capability is invaluable for large multinational chains focused on standardization and cost control.

Technological advancement is heavily focused on optimizing internal performance through features such as automated self-cleaning systems, advanced humidity control sensors, and integrated heat recovery systems. These innovations not only reduce manual labor associated with cleaning and monitoring but also contribute directly to lowering operational utility costs. Manufacturers are competing fiercely on user interface design, moving toward intuitive, tablet-style touchscreens that minimize training time and integrate seamlessly with other kitchen management software, ensuring that high-tech equipment remains accessible to a broad range of kitchen personnel.

Value Chain Analysis For Commercial Ovens Market

The value chain for the Commercial Ovens Market begins with complex upstream activities involving raw material procurement, specialized component manufacturing, and the development of core heating and control technologies. Key upstream suppliers provide specialized components such as high-grade stainless steel (critical for hygiene and durability), advanced insulation materials (for energy efficiency), burners/heating elements, and sophisticated electronic control boards (PLCs and microprocessors). Strong relationships with component suppliers are vital, particularly those providing proprietary smart sensors and IoT chipsets, as these components determine the technological ceiling of the final product and influence manufacturing lead times.

Manufacturing and assembly constitute the core phase, where precision engineering ensures the oven meets stringent commercial safety and performance standards. This stage includes complex sheet metal fabrication, welding, specialized thermal calibration, and the integration of advanced software. Manufacturers often differentiate themselves here through modular design (simplifying repairs) and quality control processes that minimize warranty claims. The downstream analysis focuses intensely on distribution, installation, and after-sales service, which is particularly critical given the high investment and operational dependency on these appliances.

The distribution channel involves a mix of direct sales to large chain operators and indirect sales through specialized food service equipment dealers, distributors, and kitchen design consultants. Distributors often provide localized inventory, financing options, and critical installation and setup services. Indirect channels dominate sales to smaller independent operators, leveraging the distributor's expertise in local market requirements and service capabilities. Direct sales are preferred by large QSR and institutional chains to ensure consistent pricing and specifications across global deployments. After-sales service, including preventative maintenance contracts and rapid parts replacement, is a major profit center and a crucial competitive factor, ensuring minimal operational disruption for end-users.

Commercial Ovens Market Potential Customers

The primary consumers and end-users of commercial ovens are professional establishments within the food service and hospitality industries, driven by the necessity for reliable, high-volume cooking capabilities. These include an extensive spectrum from large multinational restaurant chains requiring standardized, durable equipment to independent gourmet restaurants demanding precision tools for complex menu items. Investment decisions are typically made by Head Chefs, Kitchen Managers, Procurement Officers, or centralized Corporate Facility Management teams, depending on the scale of the operation.

A significant segment of potential customers includes institutional buyers, such as hospitals, universities, prisons, and corporate cafeterias, which prioritize high capacity, robust construction, and ease of sanitation to meet strict health and safety protocols while preparing thousands of meals daily. Additionally, commercial bakeries and specialized food processing facilities constitute a distinct customer base, demanding specialized equipment like large rack ovens, proofers, and continuous baking lines tailored for specific product types, where volume and consistency dictate procurement choices. The emerging segment of cloud kitchens and ghost kitchens is also a rapidly growing customer demographic, requiring compact, highly efficient, and easily stackable equipment optimized for delivery-only workflows.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rational AG, Middleby Corporation, Welbilt Inc. (formerly Manitowoc Foodservice), ITW Food Equipment Group (Hobart, Vulcan), Ali Group S.p.A., Unox S.p.A., Electrolux Professional, Alto-Shaam, Wiesheu GmbH, Moffat Limited, MERRYCHEF (Welbilt), TurboChef Technologies, Crown Steam Group, Blodgett Oven Company, Ovention Ovens, Lincat Group, Fagor Industrial, BGL Rieber GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Ovens Market Key Technology Landscape

The technological landscape of the Commercial Ovens Market is dominated by advancements aimed at increasing efficiency, maximizing control, and integrating digital connectivity. Central to modern innovation is the widespread adoption of high-efficiency heat exchange systems and sophisticated insulation materials that drastically reduce energy consumption and operational heat loss, addressing both environmental concerns and escalating utility costs. Furthermore, the shift from traditional mechanical controls to intuitive, high-resolution digital interfaces with programmable memory is standardizing complex cooking processes, improving staff training efficiency, and ensuring recipe uniformity across multi-unit operations.

Another crucial technological trend involves the proliferation of steam generation technologies, particularly in combi ovens, moving beyond simple boiler systems to advanced injection systems that offer instantaneous steam production and precise humidity control. This allows for superior texture and moisture retention in food products. High-speed cooking technologies, utilizing forced air impingement and microwave assistance (hybrid ovens), are also gaining prominence, driven by the QSR sector's non-negotiable requirement for reducing service times without sacrificing quality. These high-speed systems leverage complex air flow dynamics and specialized heating elements to penetrate food rapidly and evenly.

The most transformative technology remains IoT integration and cloud connectivity. These systems enable remote software updates, real-time energy monitoring, predictive maintenance alerts, and seamless communication with kitchen management systems (KMS). Smart sensors collect vast amounts of data regarding usage patterns and component health, allowing manufacturers and operators to anticipate failures and optimize scheduling. Data analytics derived from connected ovens inform crucial business decisions, such as menu adjustments or equipment replacement cycles, ensuring that commercial ovens are no longer static assets but active participants in the digital ecosystem of the modern commercial kitchen.

Regional Highlights

North America maintains a robust market share, driven primarily by high consumer spending on dining out, the maturity of large QSR and FSR chains, and a proactive approach to adopting smart kitchen technology. The region exhibits high replacement demand for older, less energy-efficient equipment, spurred by favorable tax incentives and strong environmental regulations in states like California. The labor cost pressures in the US and Canada heavily favor investments in advanced combi and automated conveyor ovens that minimize manual labor and ensure consistency. Manufacturers focus intensely on providing superior after-sales support and reliable service networks, critical for large, decentralized chain operations.

Europe represents a highly competitive market characterized by strict energy consumption standards and a strong focus on culinary excellence, particularly in Western European nations like Germany, the UK, and France. Demand here is dominated by high-end combi steamers, often featuring proprietary steam technology and sophisticated control systems to meet the exacting standards of traditional European gastronomy and growing institutional catering sectors. The region’s drive toward sustainability pushes rapid adoption of electric models and high-efficiency gas ovens. Furthermore, centralized procurement organizations within major European hotel and restaurant groups influence significant volume purchasing decisions.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, fueled by rapid economic expansion, urbanization, and a dramatic increase in disposable incomes, which underpin the explosive growth of the hospitality sector. Countries like China and India are seeing unprecedented expansion of indigenous and international QSR chains, driving massive demand for entry-level and mid-range convection and conveyor ovens for mass market application. While initial investments might be cost-sensitive, the sheer scale of development ensures high volume sales. Moreover, the emergence of large-scale food manufacturing and central kitchen facilities to support urban populations necessitates industrial-grade, high-capacity baking and cooking equipment.

Latin America’s commercial oven market is characterized by steady growth, primarily linked to tourism development and expanding local food service infrastructure, particularly in countries such as Brazil and Mexico. Price sensitivity remains a factor, often leading to preference for robust, reliable, mid-range convection and traditional deck ovens that balance cost with essential functionality. Investment cycles are closely tied to macroeconomic stability and foreign direct investment into the hotel and tourism sectors. Demand for specialized equipment tends to lag behind North America, but increasing exposure to international food trends is gradually driving interest in versatile combi ovens.

The Middle East and Africa (MEA) market demonstrates unique dynamics, with the Middle Eastern countries (UAE, Saudi Arabia) seeing significant investment in luxury hospitality and large-scale catering facilities, driving demand for premium, high-capacity ovens, often linked to major international hotel brands and infrastructure projects. The African sub-continent presents a diverse landscape, with nascent development in formal food service driving demand for durable, fundamental commercial cooking solutions. The market here is highly reliant on imported equipment, and logistical challenges often make service and maintenance a crucial factor in purchasing decisions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Ovens Market.- Rational AG

- The Middleby Corporation

- Welbilt Inc. (formerly Manitowoc Foodservice)

- ITW Food Equipment Group (Hobart, Vulcan)

- Ali Group S.p.A.

- Unox S.p.A.

- Electrolux Professional

- Alto-Shaam

- Wiesheu GmbH

- Moffat Limited

- MERRYCHEF (Welbilt)

- TurboChef Technologies

- Crown Steam Group

- Blodgett Oven Company

- Ovention Ovens

- Lincat Group

- Fagor Industrial

- BGL Rieber GmbH

Frequently Asked Questions

Analyze common user questions about the Commercial Ovens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of combination ovens in commercial kitchens?

The primary driver is the versatility and operational efficiency combination ovens (combi-steamers) offer. They combine baking, roasting, and steaming functions in a single unit, significantly reducing kitchen footprint, labor requirements, and the need for multiple specialized appliances, making them ideal for diverse menu offerings.

How is energy efficiency impacting procurement decisions in the Commercial Ovens Market?

Energy efficiency is a critical determinant due to escalating utility costs and regulatory mandates (e.g., MEPS in Europe). Buyers prioritize ovens with advanced insulation, optimized heat recovery systems, and smart energy management features to lower long-term operating costs and achieve sustainability targets.

Which geographical region is expected to demonstrate the highest growth rate for commercial ovens?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by massive market expansion in China and India, rapid urbanization, the proliferation of global QSR chains, and the corresponding infrastructure development in the hospitality and catering sectors.

What role does IoT and connectivity play in modern commercial oven technology?

IoT enables advanced features such as remote diagnostics, predictive maintenance scheduling, centralized recipe management across multiple locations, and real-time performance monitoring. This connectivity ensures consistent food quality, minimizes downtime, and optimizes operational workflows for large chains.

What are the main challenges facing smaller independent restaurants when purchasing commercial ovens?

Smaller establishments primarily face the challenge of high initial capital expenditure associated with sophisticated combi and smart ovens. Additionally, training staff on complex digital interfaces and ensuring seamless integration with existing kitchen technology can pose operational hurdles.

The structure and complexity of the commercial oven market necessitate a deep understanding of functional requirements specific to different end-user segments. For instance, while QSR chains prioritize ovens capable of withstanding extreme volume and continuous operation with identical results, artisan bakeries focus on specialized deck ovens that provide controlled radiant heat essential for crust development and moisture retention in bread products. This divergence in core needs dictates manufacturing specialization and supply chain optimization strategies, with market leaders like Rational and Middleby offering expansive portfolios to address these varied requirements effectively.

Technological differentiation is increasingly focused on the intangible aspects of cooking, such as advanced algorithms for humidity management and self-calibration systems that account for ambient temperature and elevation changes, ensuring that cooking parameters remain accurate globally. The shift towards proprietary control software allows manufacturers to create closed ecosystems that integrate seamlessly with their own warewashing and preparation equipment, offering full-line solutions that streamline kitchen operations. This vertical integration further solidifies the market positions of major equipment manufacturers capable of delivering comprehensive smart kitchen solutions rather than just individual units.

Furthermore, the maintenance and service sector is growing into a significant component of the value chain. As commercial ovens become more technologically complex, the demand for highly skilled technicians capable of servicing sophisticated electronic control boards and specialized steam generators increases. Manufacturers are responding by offering subscription-based preventative maintenance contracts and utilizing augmented reality (AR) tools for remote technician assistance, aimed at reducing mean time to repair (MTTR) and extending the operational lifespan of the high-value assets deployed in demanding kitchen environments. This service component contributes substantially to the overall revenue streams of key market players.

Detailed Segmentation: Electric vs. Gas Ovens

The segmentation by heating source—Electric versus Gas—is pivotal, influencing installation costs, operational efficiency, and regional adoption patterns. Electric commercial ovens are increasingly dominant, particularly in newly constructed or renovated kitchens, due to several key advantages. Electric units typically offer superior precision in temperature control, which is essential for delicate baking and complex combi-steaming applications. Installation is often simpler and more flexible in diverse geographical locations, and electric power aligns better with renewable energy initiatives, appealing to large corporate entities with sustainability mandates. Their adoption is widespread in urban areas where gas infrastructure access or capacity may be limited, or where local fire codes favor electric appliances.

Conversely, gas-powered ovens (natural gas or propane) remain indispensable in high-volume operations where energy costs are a critical concern, as natural gas often offers a lower operational cost per BTU compared to electricity, depending on local tariffs. Gas convection and deck ovens are known for rapid heating recovery times and are favored in established facilities with existing gas lines. While gas ovens may not offer the same level of granular electronic control as their electric counterparts, modern gas units incorporate pulse-fire modulated burners and advanced control panels to mitigate these differences. The choice between gas and electric often comes down to a calculated TCO analysis factoring in initial infrastructure setup costs, local energy prices, and the specific application needs of the kitchen.

The market trend shows a gradual migration towards electric ovens globally, driven by technological improvements in heating element efficiency and the widespread move toward induction and electric heating technologies across the commercial kitchen equipment spectrum. However, gas remains a necessary option in regions where power grid reliability is inconsistent or where high-heat, rapid cooking capabilities (like in large pizza ovens) are critical and efficiently delivered via gas burners. Manufacturers are investing heavily in hybrid models that combine the speed and economy of gas heating with the precision and automation offered by electric controls, aiming to capture the best aspects of both technologies and address evolving regulatory landscapes.

Detailed Segmentation: Conveyor and Deck Ovens

Conveyor ovens represent a highly specialized segment focused purely on maximizing throughput and standardization, primarily serving the fast-food, pizza, and quick-casual segments. These machines are engineered for continuous, automated cooking where human interaction is minimized, guaranteeing that every product, whether it is a pizza or a toasted sandwich, exits the oven with identical specifications. Key technological advancements in this segment include adjustable impingement zones, variable speed controls, and sophisticated heat dispersion patterns to handle different food types simultaneously without cross-contamination or inconsistent cooking. Their large size and high initial investment are justified by the labor savings and unparalleled speed offered to high-volume operations.

Deck ovens, contrasting sharply with conveyor technology, emphasize radiant heat transfer and baking craftsmanship, making them indispensable to specialized bakeries and high-end pastry shops. These ovens consist of multiple stacked chambers (decks), each capable of being maintained at a distinct temperature, allowing simultaneous baking of diverse products such as baguettes, cakes, and pastries requiring different thermal environments. The stone or ceramic base of a deck oven is crucial for achieving the desired crust texture and heat stability. Although less automated than combi or conveyor ovens, the demand for deck ovens remains steady, propelled by the enduring popularity of artisan bread and craft baking globally, where quality texture supersedes speed.

Manufacturers in these segments focus on different areas of innovation. Conveyor oven producers prioritize materials science for longevity, enhanced diagnostics for remote troubleshooting, and higher energy throughput per square foot of kitchen space. Deck oven manufacturers focus on improving thermal efficiency, developing highly durable refractory materials, and integrating gentle steaming systems into each deck to optimize the baking environment. The clear functional separation of these two oven types ensures that they cater to fundamentally different end-user missions, from industrial throughput to artisanal precision, guaranteeing continued segment stability.

Regional Analysis Deep Dive: Asia Pacific

The dynamics of the APAC commercial oven market are defined by rapid infrastructure expansion and highly diversified demand profiles across sub-regions. East Asian markets like Japan and South Korea are mature, focusing on high-tech, compact, energy-efficient combi ovens to offset high real estate and labor costs. Conversely, Southeast Asian countries (e.g., Vietnam, Thailand, Indonesia) and South Asia (India) are experiencing explosive growth in mid-market restaurants and QSRs, leading to high-volume procurement of standardized convection and entry-level digital ovens. This necessitates manufacturers establishing localized production or robust distribution hubs to manage the scale and logistical complexity.

A critical factor driving high-end demand in APAC is the expanding role of centralized production kitchens (CPKs) and catering hubs that serve vast urban populations. These CPKs require immense, industrial-grade ovens—often large batch-cooking convection or rotating rack units—to prepare pre-portioned, consistent meals for subsequent distribution. This trend is amplified by the increasing adoption of Westernized diets and rapid food delivery services, requiring equipment optimized for both preparation and regeneration of chilled or frozen products. Local manufacturers are intensely competitive in the lower and mid-range segments, pushing global players to differentiate based on technology, service contracts, and superior efficiency ratings.

Investment into cold chain infrastructure and food processing facilities across APAC also stimulates specialized oven demand. Equipment must be engineered to withstand the rigorous demands of rapid chilling and reheating cycles (cook-chill technology), driving demand for sophisticated combi ovens that offer precise temperature and humidity control during the cooking phase to maximize shelf life and safety. Regulatory environments are evolving rapidly, with governments increasing oversight on food safety and hygiene, compelling operators to invest in modern stainless steel, self-cleaning, and digitally monitored oven systems to ensure compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager