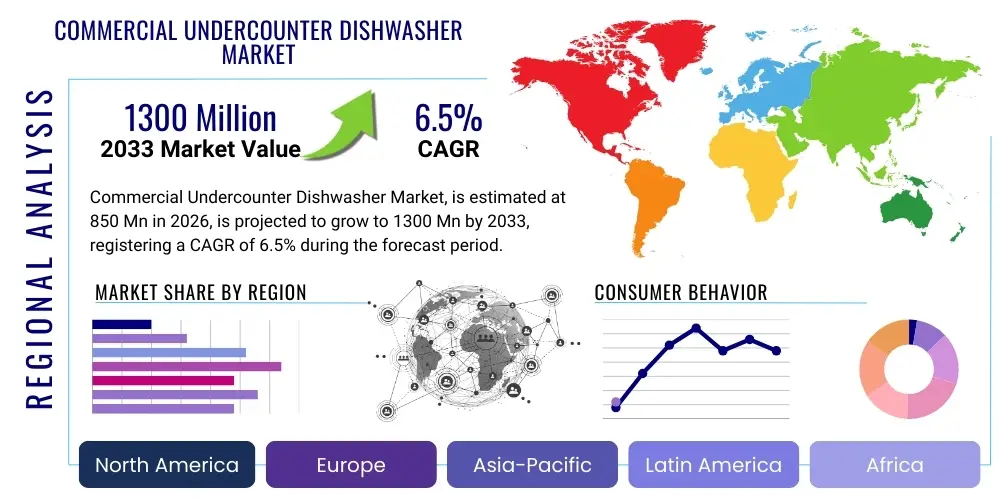

Commercial Undercounter Dishwasher Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441082 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Commercial Undercounter Dishwasher Market Size

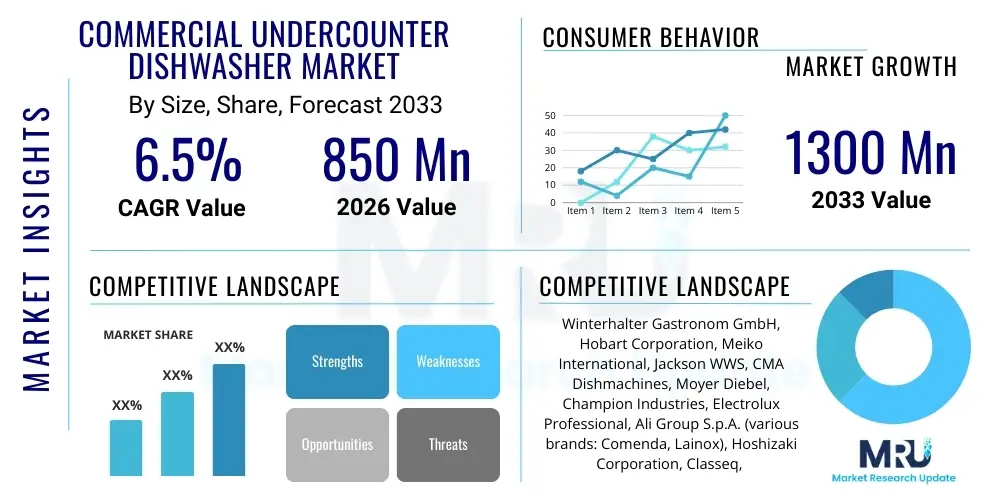

The Commercial Undercounter Dishwasher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1300 Million by the end of the forecast period in 2033.

Commercial Undercounter Dishwasher Market introduction

The Commercial Undercounter Dishwasher Market comprises specialized, compact warewashing equipment engineered for use in professional kitchens where space efficiency is paramount, yet high standards of hygiene and throughput are non-negotiable. These units are predominantly utilized in smaller to medium-sized food service operations, including independent restaurants, bustling coffee shops, high-volume bars, and dedicated floor kitchens within larger institutional settings such as healthcare facilities or corporate campuses. The core function of these dishwashers is to provide rapid, reliable, and standardized cleaning and sanitization for dishware, glassware, and cutlery, ensuring compliance with strict public health regulations globally. Modern undercounter units are far removed from their predecessors, now incorporating advanced hydraulic systems, multi-stage filtration, and precise digital controls designed to optimize water and energy consumption while delivering superior cleaning efficacy, a necessity given the increasing global focus on sustainability and utility cost reduction within the competitive hospitality sector. The strategic placement beneath existing countertops maximizes kitchen flow and operational efficiency, making them an essential asset in high-density urban environments where kitchen design dictates compact, powerful solutions. Manufacturers are continually innovating, embedding features that improve user experience, such as self-diagnostics and intuitive touch-screen interfaces, ensuring that even minimally trained staff can operate them effectively and consistently.

Major applications for commercial undercounter dishwashers extend across the entire spectrum of the food and beverage industry, serving critical roles in environments demanding rapid sanitation cycles, particularly for glassware in high-traffic bars, where throughput directly impacts revenue generation during peak hours. Beyond traditional restaurants, the equipment is increasingly adopted by specialty food preparation areas within large retail grocery stores, catering companies utilizing ghost kitchens, and specialized institutional sectors like dental clinics or veterinary practices that require sanitization of non-critical medical equipment alongside standard ware. Key benefits driving widespread adoption include the exceptional balance they strike between required footprint and operational capacity, offering industrial-grade performance in a highly compact form factor. They dramatically reduce reliance on manual labor, minimizing variable costs and ensuring consistent sanitization results, a critical factor for risk management and brand reputation. Furthermore, the inherent design allows for easy integration into existing kitchen infrastructure with minimal disruption, often requiring only standard utility connections. This ease of installation lowers the barrier to entry for smaller businesses looking to professionalize their hygiene processes and adhere to evolving industry best practices regarding food safety and microbial control.

The principal driving factors propelling the expansion of the global Commercial Undercounter Dishwasher Market are multilayered, combining regulatory pressures, economic necessity, and demographic shifts. The global proliferation of dining establishments, coupled with heightened consumer expectations for cleanliness—particularly in the aftermath of global health crises—mandates the deployment of certified professional sanitization equipment. Simultaneously, rapid urbanization globally is driving up commercial real estate costs, making space optimization a critical design criterion, inherently favoring the compact undercounter format over larger, traditional machines. Economically, the increasing minimum wage rates and labor shortages in developed markets are forcing business owners to invest in capital equipment that automates high-frequency tasks like dishwashing, achieving substantial long-term savings in operational expenditure. Finally, manufacturers’ continuous efforts in developing energy-efficient and water-saving models, often supported by government incentives or utility rebates, make the investment increasingly attractive from a financial and environmental standpoint. The competitive landscape focuses intensely on reducing the Total Cost of Ownership (TCO) through enhanced durability, minimal maintenance requirements, and superior resource management capabilities, ensuring market momentum remains positive throughout the forecast period and across diverse geographical regions.

Commercial Undercounter Dishwasher Market Executive Summary

The Commercial Undercounter Dishwasher Market is currently defined by significant technological advancements and strong macroeconomic tailwinds from the global hospitality recovery and expansion. Key business trends indicate a robust shift towards connected kitchen infrastructure, with demand soaring for models featuring IoT capabilities that facilitate remote diagnostics, performance benchmarking, and automated compliance logging. This digitalization aids multi-unit operators in standardizing hygiene protocols and maximizing asset utilization across diverse locations, offering a distinct competitive advantage through optimized maintenance planning and resource tracking. Manufacturing is increasingly concentrating on modular designs to streamline production and offer customizable features, such as specialized water treatment modules (e.g., reverse osmosis units) integrated directly into the dishwasher's footprint, addressing regional water quality variances. Furthermore, the rising cost of commodities and logistics is pressuring manufacturers to seek supply chain resilience, often leading to regionalization of production facilities to mitigate exposure to global trade volatility and fluctuating freight costs. This operational streamlining ensures consistent pricing and supply reliability, which is crucial for high-volume sales agreements with large international restaurant chains operating on thin profit margins and requiring absolute consistency.

Regionally, the market dynamics are highly differentiated. While North America and Europe lead in terms of technology adoption, particularly in premium, high-efficiency models certified by bodies like Energy Star, the Asian Pacific region is the powerhouse for volume growth. APAC's rapid expansion is attributed to the burgeoning middle class, fast-paced food service modernization, and stricter government enforcement of sanitation regulations, driving first-time adoption of professional equipment in markets previously dominated by manual washing. European markets demonstrate a strong preference for high-temperature sanitization systems, often driven by cultural preferences for chemical-free cleaning and rigorous EU directives concerning environmental impact. Conversely, Latin America and the MEA regions are characterized by demand centered on robust, easily maintainable equipment that can tolerate variable power supplies and potentially limited access to highly specialized technicians, emphasizing durability and simplicity of repair over cutting-edge smart features, although interest in resource-saving technology is growing in high-end urban establishments.

Segmentation trends highlight the increasing dominance of high-temperature sanitizing units, particularly those incorporating advanced atmospheric steam condensers that enhance safety and significantly reduce the need for specialized external ventilation, making them easier and cheaper to install in constrained spaces. In terms of end-use, the bar and pub segment exhibits distinctive requirements, driving demand for specialized glass-washing undercounter units that use softer wash pressure and precise temperature control to protect delicate stemware while ensuring spot-free drying, crucial for maintaining beverage quality and presentation. The trend across all segments points towards units that offer faster throughput (e.g., cycles under 90 seconds), are easier to clean internally (e.g., self-cleaning functions, removable wash arms), and integrate seamlessly with existing kitchen layouts, demonstrating that operational efficiency and ease of use are becoming equally critical purchasing considerations as the initial price point. The aftermarket segment for proprietary detergents, chemicals, and service contracts remains resilient, forming a foundational, high-margin component of the total market ecosystem and reinforcing manufacturer-customer loyalty. This focus on long-term relationships through service packages is vital for sustaining competitive advantages.

AI Impact Analysis on Commercial Undercounter Dishwasher Market

User queries regarding AI in the Commercial Undercounter Dishwasher Market frequently center on automation enhancement, predictive maintenance capabilities, and optimizing operational costs. Common questions include: "How can AI reduce energy consumption in commercial dishwashers?" "Are there smart dishwashers that automatically detect soil levels?" and "What is the future of maintenance using machine learning?" Based on this analysis, the key themes summarize user concerns about how AI integration can move beyond basic automation to provide genuine operational intelligence. Users expect AI to minimize utility usage by dynamically adjusting wash cycles based on actual load and soil conditions, anticipate mechanical failures before they occur, and provide real-time performance analytics accessible via cloud platforms. There is a strong expectation that AI will standardize cleaning quality, ensuring adherence to hygiene protocols while significantly lowering water and chemical usage, thus translating into substantial cost savings and enhanced environmental compliance for operators in the competitive hospitality industry. The industry is exploring integrating sensors and machine learning algorithms to revolutionize the traditional operation of these appliances, making them more adaptive and resource-efficient.

Furthermore, AI is expected to revolutionize the service and support aspects of the market. By continuously analyzing performance metrics, such as pump pressure variations, heating element cycling times, and door sensor reliability, AI algorithms can predict the likelihood of component failure days or weeks in advance. This transition to predictive maintenance minimizes catastrophic failures, reduces the necessity for expensive emergency callouts, and maximizes the operational lifespan of the equipment. Operators prioritize seamless performance, particularly during critical service periods, and AI integration offers the mechanism to ensure near-100% uptime. This enhancement in reliability is a significant value proposition, outweighing the incremental cost of the smart technology for high-volume users. The data generated by these smart systems also provides valuable feedback to manufacturers, accelerating product development cycles and informing future designs optimized for real-world usage patterns and environmental constraints, further embedding intelligence into the core product offering.

- AI-driven optimization of wash cycles, adjusting water temperature, detergent dosage, and cycle duration based on sensor-detected soil level and type, leading to up to 15% reduction in resource consumption, particularly water and energy, over a standard fixed cycle.

- Implementation of predictive maintenance algorithms that analyze continuous operational data (e.g., vibration indices, heat profile deviations, electrical current draws) to forecast component failure with high accuracy, minimizing unexpected downtime and optimizing scheduled service appointments for maximized asset utilization.

- Integration with centralized kitchen management systems via secure cloud-based IoT platforms, allowing multi-site operators to monitor operational efficiency, track resource usage, benchmark unit performance against fleet averages, and verify automated temperature logs for HACCP compliance across their entire network.

- Enhanced inventory management for consumables (detergents, rinse aids, descaling agents) through automated usage pattern analysis and predictive alerting, ensuring supply chain continuity and preventing stockouts that could halt operations during peak service hours.

- Advanced diagnostics and remote troubleshooting capabilities enabled by machine learning, allowing service technicians to diagnose over 80% of faults remotely before dispatch, reducing the need for costly physical visits and accelerating time-to-repair for minor operational interruptions.

- Real-time water quality assessment and adaptive filtration management, utilizing AI to dynamically adjust water softener regeneration cycles or filter cleaning frequency based on input water hardness variance, extending component life and maintaining optimal wash quality regardless of utility fluctuations.

- Self-learning modes that adjust operational parameters based on the specific ware inventory (e.g., detecting if a rack contains glassware or heavy pots) and local operating habits, tailoring performance for maximum efficiency and longevity in a specific installation environment.

DRO & Impact Forces Of Commercial Undercounter Dishwasher Market

The Commercial Undercounter Dishwasher Market is fundamentally shaped by several powerful strategic forces: regulatory mandates (Drivers), economic constraints (Restraints), and technological breakthroughs (Opportunities). A primary Driver (D) is the relentless pursuit of verifiable hygiene standards, internationally enforced by public health bodies, making professional-grade, high-sanitization equipment mandatory for food service businesses. This is intrinsically linked to the demographic driver of global urban population growth, which necessitates high-throughput, compact solutions. Restraints (R) include the substantial initial capital outlay required, often posing a barrier to entry for small, independent operators, and the persistent challenge of water quality variance (hardness, mineralization) globally, which accelerates equipment wear and increases maintenance costs, requiring external water treatment that adds complexity and expense. Opportunities (O) are centered around sustainable innovation: the development and mass deployment of ultra-low consumption units that integrate advanced water recycling and heat exchange technology. These forces create a dynamic environment where success is dictated by a manufacturer's ability to balance premium performance and TCO. The cumulative Impact Forces strongly favor manufacturers who can certify demonstrable reductions in energy and water usage, align with global Environmental, Social, and Governance (ESG) criteria, and embed reliability through sophisticated digital monitoring systems, justifying a higher price point through superior long-term financial benefits.

A deeper dive into drivers reveals that evolving global hospitality trends, such as the rise of smaller boutique hotels and specialized fast-casual concepts, directly fuels demand for the specialized footprint of undercounter units. Furthermore, the increasing adoption of open kitchen concepts necessitates quieter machinery, making acoustic performance a competitive driver, especially in European and North American markets where noise pollution regulations are strict. Conversely, one of the most significant restraints is the reliance on specialized consumables (proprietary detergents and rinse aids). While these ensure optimal performance, they lock customers into specific vendor ecosystems, sometimes leading to price inflexibility and supply dependency issues, which can increase overall operational costs unexpectedly. Additionally, in many developing regions, unreliable electrical infrastructure and pressure fluctuations in municipal water supplies can undermine the performance and damage the sophisticated electronics and heating elements of high-tech units, making simplified, highly durable mechanical designs more appealing in those specific geographies, thus fragmenting technological adoption globally.

The foremost Opportunity in the market lies in establishing full-service leasing and subscription models that bundle the equipment, proprietary chemicals, and preventive maintenance into a fixed monthly fee. This approach mitigates the high initial capital expenditure (R), transforming it into a predictable operating expense, thereby making advanced, efficient units accessible to a wider SME market base and addressing the financial constraint directly. This also allows manufacturers to maintain better control over equipment performance and compliance. Another critical opportunity involves leveraging material science to develop components that are highly resistant to corrosion and scale buildup, particularly the internal tanks and heating elements, drastically reducing downtime and chemical maintenance frequency. The Impact Forces ultimately steer the industry towards a digital, service-centric model where the physical machine is merely the platform for an integrated service package. Market leaders will be those who can provide the highest verifiable levels of hygiene and sustainability alongside unparalleled reliability, substantiated by predictive analytics, ensuring continuous operational flow and regulatory adherence for their client base. This convergence of technology and service excellence dictates the future competitive landscape.

Segmentation Analysis

The Commercial Undercounter Dishwasher Market is subject to comprehensive segmentation, reflecting the intricate demands and diverse operating environments of the global food service industry. Primary segmentation by operating temperature—High-Temperature versus Low-Temperature—determines the sanitization mechanism: either intense thermal energy (heat) or chemical injection. High-temperature units are favored for achieving rapid drying times and maximizing germicidal efficacy without chemical residues, which is critical for healthcare and high-end dining. Low-temperature units, while generally consuming less energy, require specific chemical sanitizers and longer contact times, appealing mostly to budget-conscious operators or those constrained by ventilation limitations, as high heat generates substantial steam. Further stratification by end-user application (e.g., Bars & Pubs, Institutional, Restaurants) allows manufacturers to tailor features, such as specialized glass washing cycles for bars or heavy-duty pot washing cycles for small bakeries, optimizing the equipment for the specific ware and soil type encountered in that environment. This granular analysis is vital for developing targeted marketing strategies and optimizing distribution channels to maximize market penetration across varied commercial settings.

Segmentation by capacity and configuration is another pivotal dimension. Capacity typically ranges from 20 racks per hour (RPH) for smaller cafes to over 40 RPH for busy pubs or QSRs. Configuration differentiation often includes specialized models for frontal loading versus corner installations, which address different physical layout constraints within tight commercial kitchens. The technological segmentation is increasingly relevant, dividing the market into standard mechanical controls, advanced digital interface models, and cutting-edge IoT-enabled smart units. The latter category, the advanced/smart segment, is the fastest growing, driven by operators’ needs for data visibility, remote asset management, and resource efficiency tracking. This technological hierarchy directly correlates with pricing, with smart, energy-recovery models commanding premium prices but promising the lowest Total Cost of Ownership over their lifespan due to superior resource conservation capabilities. Understanding these segmentation nuances provides insight into regional purchasing power and regulatory pressures, informing strategic manufacturing decisions regarding component quality, feature inclusion, and localized product certification requirements.

Finally, segmentation by sales channel—Direct vs. Indirect—reveals the primary routes to market. Indirect channels, utilizing national distributors, regional dealers, and specialized commercial kitchen equipment suppliers, remain dominant due to the necessity of local installation and post-sales technical service. These partners provide crucial last-mile support and localized stockholding. Direct sales are typically reserved for major contracts involving global hotel chains, large institutional tenders (e.g., government cafeterias, university systems), or highly custom installations where the manufacturer must maintain direct oversight of system integration and compliance. The effectiveness of the indirect channel is highly dependent on the quality of training provided by the manufacturer to the dealer network, ensuring consistent service levels and expert guidance on complex installation requirements, such as integrating the dishwasher with external water treatment or energy management systems. The profitability of the market heavily relies on optimizing this complex network, ensuring rapid access to spare parts and maximizing customer satisfaction through localized, professional technical support capabilities.

- By Operating Temperature:

- High-Temperature Dishwashers (Requires higher capital investment, lower chemical cost, superior sanitization, faster drying)

- Low-Temperature Dishwashers (Lower energy use, relies on chemical sanitizers, lower initial cost, slower drying often)

- By Application/End-User:

- Restaurants and Cafes (Standard volume, mixed ware)

- Bars and Pubs (High-volume glassware, specialized glass washers)

- Hotels and Hospitality (Satellite kitchen use, specific ware requirements)

- Institutional (High regulatory compliance, sustained high volume in canteens)

- Quick Service Restaurants (QSR) (Focus on rapid cycle times and durability)

- By Technology/Feature:

- Standard/Manual Operation (Basic functionality, robust mechanics)

- Advanced/Smart (Digital controls, IoT connectivity, self-diagnostics, data logging)

- Energy Recovery/Heat Reclaiming Models (Condensing technology, reduced utility consumption)

- By Capacity (Racks Per Hour - RPH):

- Low Capacity (Up to 25 RPH)

- Medium Capacity (25-40 RPH)

- High Capacity (Over 40 RPH)

- By Sales Channel:

- Direct Sales (Institutional, major corporate chains)

- Indirect Sales (Dealers, Distributors, E-commerce for parts/consumables)

Value Chain Analysis For Commercial Undercounter Dishwasher Market

The Value Chain in the Commercial Undercounter Dishwasher Market is anchored in strategic upstream material sourcing and specialized component manufacturing. Upstream activities begin with procuring industrial-grade stainless steel (typically 304 or 316 for enhanced corrosion resistance), which constitutes a significant portion of the cost. The quality and specification of the steel are paramount for equipment longevity, especially given the aggressive operating environment involving high temperatures, strong detergents, and hard water. Beyond steel, the procurement of complex mechatronic components—such as sophisticated wash pumps, ultra-efficient heating elements, proprietary chemical dosing units, and advanced electronic control boards—is critical. Manufacturers engage in deep integration or strategic partnerships with specialist component suppliers to ensure quality control and technological differentiation, particularly for components related to energy recovery and water filtration. Design and R&D activities focus intensely on hydrodynamic efficiency (optimizing spray arm performance and water circulation) and thermal engineering (maximizing heat retention and transfer efficiency). Risk management at this stage involves hedging against volatile global commodity prices and ensuring supply chain diversity to prevent production bottlenecks arising from geopolitical instability or logistics disruptions, which can severely impact product availability and final pricing.

The midstream focuses on the efficient and quality-controlled assembly of the final equipment. Large international manufacturers utilize advanced, often automated, production lines to achieve economies of scale and maintain precision in welding and sealing processes, crucial for preventing leaks and ensuring long-term durability. Quality assurance protocols are highly rigorous, including compliance testing for international standards such as NSF (National Sanitation Foundation) in North America and CE marking in Europe, validating the machine's ability to achieve specified sanitization levels and energy performance ratings. Distribution, which forms the key Downstream link, is predominantly channeled through a robust and fragmented indirect network, including authorized dealers, specialized kitchen integrators, and wholesale equipment suppliers. These intermediaries manage localized inventory, provide essential credit facilities to smaller buyers, and, most importantly, possess the technical expertise required for professional installation (e.g., plumbing connections, water softener integration, ventilation setup) and regulatory sign-off. The role of the distributor is moving beyond mere sales to becoming a certified service partner, crucial for maintaining the equipment’s complex systems and guaranteeing uptime.

The long-term profitability of the value chain is increasingly tied to the Aftermarket segment, encompassing consumables and technical service. Consumables, including specialized detergents, rinse aids, and descaling agents (often tailored to specific machine models), represent a recurring, high-margin revenue stream. Manufacturers often mandate the use of specific chemicals to validate warranties, effectively creating a captive market for these products. Direct and indirect sales channels both capitalize on service contracts, which cover preventive maintenance, rapid repair response, and component replacement. The rise of IoT-enabled machines further strengthens the aftermarket by allowing service providers to transition to lucrative predictive maintenance contracts, diagnosing issues remotely and preemptively replacing components before failure occurs. This focus on service excellence throughout the product lifecycle significantly increases customer retention and lifetime value. For customers, the distribution channel’s capability to deliver rapid technical support and readily available spare parts is often a decisive factor, underlining the critical importance of a high-performing downstream ecosystem in competitive mature markets, ensuring minimal business interruption and compliance maintenance.

Commercial Undercounter Dishwasher Market Potential Customers

The Commercial Undercounter Dishwasher Market's potential customer base is expansive, targeting any commercial establishment involved in high-volume, repetitive washing of food and beverage service items where space constraints prohibit larger door-type or conveyor systems. The most significant segment comprises the independent restaurant sector, including bistros, trattorias, and localized ethnic eateries, where the compact design is perfectly suited to limited back-of-house space, and the throughput satisfies moderate daily volumes. Pubs and cocktail bars represent a specialized, high-intensity customer group, requiring exceptionally fast cycle times (often under two minutes) and features dedicated to flawless glass cleaning to prevent beer foam suppression and ensure crystal clarity, which directly impacts customer experience. Furthermore, the rapid global expansion of franchised quick-service restaurants (QSRs) and fast-casual dining chains, requiring standardized, high-reliability equipment for their compact outlets, drives enormous volume demand. These customers prioritize operational consistency, energy efficiency for rapid ROI calculation, and robust build quality that withstands multi-shift, continuous use characteristic of high-traffic locations.

Beyond traditional hospitality, institutional buyers form a robust, steady customer segment. This includes facilities such as mid-sized nursing homes, daycare centers, small-to-medium corporate canteens, and university satellite cafes. For these clients, the purchasing decision is heavily influenced by compliance requirements and durability. In healthcare settings, for example, the ability to consistently achieve and log precise sanitization temperatures (often facilitated by smart, validated units) is non-negotiable for infection control protocols. Similarly, small food processors, specialized laboratories that handle non-critical glassware, and independent catering operations that require mobility or modular setup also fall into the potential customer pool. Purchasing decisions in this institutional sector are typically centralized, highly process-driven, and focused on securing long-term service agreements alongside the equipment purchase, valuing total system reliability and comprehensive warranty coverage over marginal cost savings on the unit itself, due to the high regulatory risk associated with equipment failure.

An emerging segment of potential customers includes the rapidly growing network of "dark kitchens" or ghost kitchens, which operate solely for delivery service. These operations are often located in highly condensed commercial zones, making the space-saving undercounter unit the only viable professional option. Dark kitchens prioritize speed and reliability above all, often running equipment continuously for 18-20 hours a day, thus creating a high demand for heavy-duty, premium units with excellent heat recovery to manage utility spikes. Moreover, niche market buyers, such as specialized wine bars (requiring exceptionally gentle washing cycles for delicate glassware) and artisanal bakeries (needing robust cleaning for mixing bowls and utensils), represent targeted opportunities. These customers seek customized features and specific operational settings, prompting manufacturers to develop highly configurable product lines. Effectively targeting these diverse segments requires manufacturers and distributors to offer solutions ranging from basic, durable units for emerging markets to sophisticated, IoT-integrated machines for high-cost, highly regulated mature markets in North America and Europe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1300 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Winterhalter Gastronom GmbH, Hobart Corporation, Meiko International, Jackson WWS, CMA Dishmachines, Moyer Diebel, Champion Industries, Electrolux Professional, Ali Group S.p.A. (various brands: Comenda, Lainox), Hoshizaki Corporation, Classeq, Sammic S.L., Fagor Industrial, DishStar Systems, AD System, Rational AG (indirectly), WASHTECH Ltd, Jemi S.A., COMENDA, Eswood. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Undercounter Dishwasher Market Key Technology Landscape

The technological evolution of the Commercial Undercounter Dishwasher Market is currently dominated by two parallel themes: maximizing sustainable resource efficiency and embedding digital intelligence. In sustainability, the widespread adoption of advanced heat recovery technology, specifically atmospheric steam condensing systems and internal heat exchangers, represents a cornerstone innovation. These technologies capture residual thermal energy from the exiting wash water and steam, reusing it to substantially preheat the incoming cold rinse water. This process dramatically reduces the load on the machine's booster heater, often cutting energy consumption for heating by 20% to 30%, which translates directly into lower operating utility bills and a reduced environmental footprint, a major selling point in environmentally conscious markets like Europe. Concurrently, hydraulic innovations, including variable speed pumps and geometrically optimized wash nozzles, ensure that the minimum volume of water necessary is used per cycle while achieving maximum surface coverage and impact pressure for effective soil removal. This focus on resource preservation is not just an environmental mandate but an economic necessity for operators facing rising utility costs globally.

Digital integration, primarily through IoT and sensor technology, is revolutionizing operational management. Modern undercounter units are equipped with sophisticated internal diagnostics capable of monitoring dozens of variables, including internal pressures, precise chemical concentration levels, final rinse temperature validation, and electrical current draw. This data is transmitted via integrated Wi-Fi or Ethernet modules to cloud-based platforms, enabling remote asset management, performance optimization, and automatic generation of HACCP-compliant sanitation logs, eliminating manual record-keeping errors and assuring regulatory adherence. The integration of specialized turbidity sensors allows the machine to "read" the soil load on the dishes, dynamically skipping or shortening phases of the cycle when appropriate, achieving optimal cleanliness while avoiding unnecessary energy and water usage associated with fixed cycle programs. This level of smart responsiveness marks a fundamental shift towards self-optimizing appliances that minimize human intervention and maximize operational continuity.

Further technological advancements focus on internal mechanics and material science to improve longevity and ease of maintenance. The development of self-cleaning programs, coupled with innovative filtration systems (e.g., fine mesh and sediment separation systems), ensures that food debris and particles are efficiently captured and removed, preventing recirculation and protecting internal components like pumps and seals from wear and tear. Material improvements include the use of specialized coatings or higher grades of stainless steel in high-stress areas (like the wash tank and door seals) to resist the corrosive effects of harsh chemicals and extreme temperatures, thereby extending the machine's service life and maintaining the highest standard of hygiene. Furthermore, noise reduction technology, utilizing specialized insulation and dampened motor mounts, is now standard in premium models, addressing the critical operational requirement for quieter kitchens, especially those with open designs or high employee density, demonstrating a holistic approach to technological refinement that considers both the performance and the working environment.

Regional Highlights

- North America: This region is characterized by high operational costs (labor and utilities) and stringent sanitation regulations, driving demand for high-efficiency, automated units. The U.S. market, driven by chains like Starbucks and expanding fast-casual concepts, emphasizes IoT connectivity for centralized management and Energy Star certified models for rebate eligibility. There is a strong, continuous replacement cycle for older equipment. Adoption of subscription models (equipment + service + chemicals) is gaining traction to manage high upfront costs.

- Europe: Regulatory leadership defines the European market, particularly strict directives on noise pollution (Germany, Switzerland) and resource consumption (EU Ecolabel). This results in high demand for premium, quieter, and heat-recovering undercounter dishwashers. Germany, the UK, and France are key manufacturing and consumption hubs. The market shows a pronounced preference for high-temperature sanitization solutions due to cultural and regulatory emphasis on minimal chemical residue and verifiable thermal disinfection performance.

- Asia Pacific (APAC): APAC is the global growth engine, fueled by the rapid expansion of the food service and tourism industries in China, India, and Southeast Asia. Market drivers include massive urbanization and increasing enforcement of modern hygiene standards. While cost sensitivity remains a factor in developing sub-regions, the move towards standardized, entry-level professional equipment is accelerating rapidly, moving away from manual washing. Localized manufacturing in countries like China is creating intense competition and driving down the price point for standard models, increasing accessibility.

- Latin America (LATAM): Growth is steady, driven by foreign investment in hospitality and the modernization of infrastructure in major urban centers (e.g., São Paulo, Mexico City). The key requirement is high mechanical durability and simple maintenance due to infrastructure variability (power and water) and sometimes limited access to specialized technicians outside capital cities. Customers prioritize low downtime and reliable parts supply, often favoring robust, less electronically complex units known for their resilience in challenging operational environments.

- Middle East and Africa (MEA): Demand is concentrated in the Gulf nations (UAE, Saudi Arabia) due to rapid development of luxury hotels, resorts, and international dining franchises. These high-end operations demand sophisticated, high-performance undercounter units that can handle high mineral water content typical of the region, necessitating built-in water softeners and filtration systems. Africa presents long-term growth potential, with nascent demand in regional economic hubs focusing initially on durability and foundational automation to replace labor-intensive methods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Undercounter Dishwasher Market.- Winterhalter Gastronom GmbH

- Hobart Corporation (Part of ITW Food Equipment Group)

- Meiko International

- Jackson WWS, Inc.

- CMA Dishmachines

- Moyer Diebel (Part of Ali Group S.p.A.)

- Champion Industries (Part of Ali Group S.p.A.)

- Electrolux Professional

- Ali Group S.p.A. (Parent Company)

- Hoshizaki Corporation

- COMENDA (Part of Ali Group S.p.A.)

- Classeq (Part of Winterhalter Group)

- Sammic S.L.

- Fagor Industrial

- DishStar Systems

- AD System

- Zanussi Professional (Part of Electrolux Group)

- Lainox (Part of Ali Group S.p.A.)

- MKN Maschinenfabrik Kurt Neubauer GmbH & Co. KG

- Poliwarewashing Srl

- Washtech Ltd.

- Insinger Machine Company

Frequently Asked Questions

Analyze common user questions about the Commercial Undercounter Dishwasher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a high-temperature and low-temperature undercounter unit?

High-temperature units sanitize using intense heat (180°F/82°C minimum rinse), ensuring rapid, chemical-free sanitization and fast drying. Low-temperature units use lower heat and rely on chemical sanitizers injected during the rinse cycle, typically offering lower energy costs but requiring chemical handling and monitoring for residue.

How crucial is water quality management for commercial dishwashers?

Water quality is extremely crucial. Hard water (high mineral content) leads to scale buildup, which severely reduces heating element efficiency, damages internal components, increases chemical consumption, and causes spotting on dishes. Proper water treatment (softeners or reverse osmosis) is mandatory to extend machine lifespan and guarantee optimal performance.

How much space is required for installation, beyond the unit's physical dimensions?

Installation requires additional space for utility hookups (electrical, water, drain) and essential ventilation clearance, especially for high-temperature models that generate steam. Manufacturers typically recommend a minimum of 6 inches of clearance behind the unit for access and hose connections, and adequate ventilation for steam dispersion.

What are the primary factors that determine the Total Cost of Ownership (TCO)?

TCO is determined by the initial capital cost, lifetime utility consumption (water and energy), the cost of proprietary chemicals, and ongoing maintenance and repair expenses. Highly efficient, smart units often have a higher initial cost but deliver a lower TCO due to significant reductions in energy usage and maintenance-related downtime.

Do undercounter dishwashers have sufficient capacity for busy hotel bars?

Yes, many high-capacity undercounter models are specifically designed as commercial glasswashers, capable of processing up to 40+ racks per hour with specialized cycles. They are ideal for intense, high-turnover environments like hotel bars, providing quick turnaround of glassware without sacrificing hygiene or presentation quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager