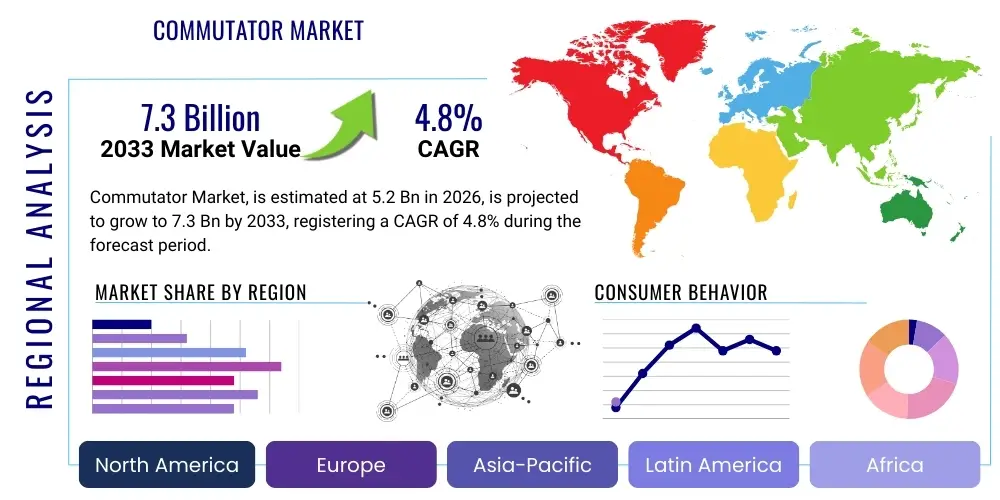

Commutator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443387 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Commutator Market Size

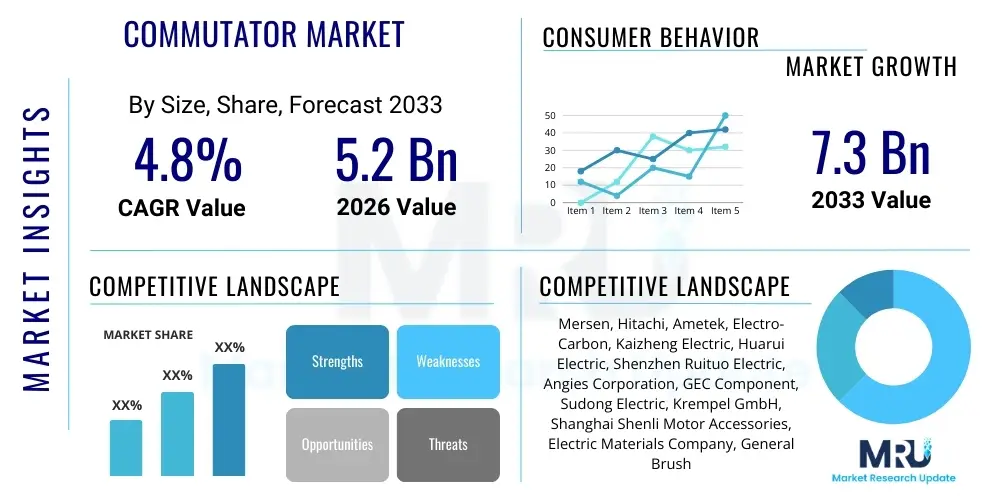

The Commutator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the continuous proliferation of electric motors across industrial, automotive, and consumer electronics sectors, necessitating reliable and efficient power transfer components. Furthermore, the sustained investment in renewable energy infrastructure, particularly wind turbines and high-efficiency generators, reinforces the demand trajectory for specialized commutator segments, including those designed for high-voltage and high-speed applications.

Commutator Market introduction

The Commutator Market encompasses the manufacturing, distribution, and utilization of specialized rotary electrical switches crucial for reversing the current direction in direct current (DC) motors and generators, ensuring continuous rotation and mechanical power conversion. These components are integral to the functionality of brushed electric motors, facilitating the necessary electrical connection between the stationary armature winding and the rotating parts of the machine. Commutators are complex assemblies typically composed of copper segments insulated from each other and held together by mechanical constraints, demanding precision engineering and high material quality to withstand operational stress, heat, and wear over extended periods.

Major applications of commutators span a wide spectrum of industries, including the automotive sector, where they are indispensable in starter motors, wiper motors, and power window mechanisms. Industrially, they are foundational elements in pumps, fans, conveyors, and various machine tools utilizing DC drive systems. The increasing global focus on energy efficiency and motor performance necessitates commutators that minimize electrical arcing and friction losses, driving innovation in material science and segment design. Benefits derived from high-quality commutators include enhanced motor lifespan, reduced maintenance requirements, and improved operational efficiency across diverse electromechanical systems.

Key driving factors propelling the market forward include the robust global demand for automobiles, both traditional and hybrid electric vehicles (HEVs), which still extensively employ DC brushed motors for auxiliary functions. Additionally, urbanization trends worldwide lead to increased construction and manufacturing activities, amplifying the need for industrial equipment containing DC motors. The rising adoption of cordless power tools in consumer and professional settings further boosts the demand for miniaturized and high-performance commutators. Technological advancements focusing on optimizing segment geometry and utilizing advanced insulating resins are critical in addressing the performance requirements of modern high-speed motors, thus solidifying the market's growth trajectory.

Commutator Market Executive Summary

The Commutator Market is characterized by moderate growth, primarily fueled by sustained demand from the automotive auxiliary systems and expanding industrial automation sectors, despite the long-term structural shift towards Brushless DC (BLDC) motors in certain high-performance applications. Business trends indicate a focus on material innovation, specifically the development of advanced copper alloys and insulating materials, to enhance thermal resistance and reduce wear, catering to demanding operational environments. Strategic initiatives include consolidation among key manufacturers to achieve economies of scale and geographical expansion, particularly into rapidly industrializing regions where the penetration of basic DC motor applications remains high. Specialized niche markets, such as high-reliability commutators for aerospace and defense, continue to command premium pricing and specialized technological expertise.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, driven by massive manufacturing bases in China, India, and Southeast Asia, encompassing high-volume production of automotive components, consumer electronics, and industrial machinery. North America and Europe maintain stable demand, characterized by a higher emphasis on replacement markets and the integration of commutators into high-efficiency industrial motors and specialized transportation equipment, aligning with stringent environmental regulations and energy efficiency standards. The Middle East and Africa (MEA) and Latin America are emerging markets exhibiting accelerated growth tied to infrastructure development and increasing industrialization, providing significant opportunities for manufacturers specializing in standardized, cost-effective solutions.

Segment trends reveal that the 'Molded' commutator type dominates due to its cost-effectiveness and suitability for high-volume production in small-to-medium motor sizes prevalent in consumer goods and automotive applications. Conversely, the 'Mica' segment, characterized by superior insulation and durability, holds a significant share in large, heavy-duty industrial motors and generators, where reliability is paramount. Application-wise, the Automotive segment remains the largest consumer, though the Industrial Machinery segment is projected to show accelerated growth due to the expansion of automation and robotics requiring specialized motor components. The shift towards higher voltage DC systems in certain industrial installations is also influencing design specifications within the market.

AI Impact Analysis on Commutator Market

User inquiries regarding AI's impact on the Commutator Market primarily center on two key themes: predictive maintenance optimization and design enhancement through simulation. Users frequently ask if AI can accurately predict commutator wear rates, segment failure, and brush replacement intervals, aiming to minimize unplanned downtime in critical industrial motors. Furthermore, there is significant interest in how AI and machine learning (ML) algorithms can be integrated into Computer-Aided Engineering (CAE) tools to simulate complex electrical and thermal stress profiles more effectively, leading to faster design iterations and improved product longevity. The general expectation is that AI will not fundamentally alter the existence of commutators but will revolutionize their quality control, operational maintenance, and optimization, especially in smart factories and connected industrial systems (Industry 4.0).

- AI-driven Predictive Maintenance: Algorithms analyze vibration and temperature data from motor sensors to forecast commutator and brush wear, optimizing scheduled maintenance and reducing catastrophic failures.

- Enhanced Quality Control (QC): ML models process high-resolution images during manufacturing (e.g., segment alignment, insulation integrity inspection) faster and more accurately than traditional methods, improving yield.

- Simulation and Design Optimization: AI assists in simulating complex electromagnetic and thermal interactions, rapidly iterating on commutator segment geometry and material selection to improve efficiency and durability.

- Supply Chain Resilience: AI tools predict raw material price fluctuations (e.g., copper, silver) and demand shifts, enabling manufacturers to optimize inventory and procurement strategies.

- Automated Manufacturing Processes: Robotics and vision systems guided by AI enhance the precision of high-speed assembly and winding processes, crucial for maintaining tight tolerances required in modern commutators.

- Data-driven Performance Tuning: Collecting real-time operational data allows manufacturers to tune commutator specifications precisely for specific end-use environments, maximizing motor efficiency.

DRO & Impact Forces Of Commutator Market

The Commutator Market is influenced by a dynamic interplay of factors characterized by robust demand from traditional applications (Drivers), structural limitations imposed by technological shifts (Restraints), and emerging opportunities in specialized segments (Opportunities). The primary driver is the sheer volume of brushed DC motors still utilized globally across cost-sensitive applications like automotive auxiliary systems and small home appliances, providing a massive foundational market base. However, the most significant restraint is the technological transition toward high-efficiency, maintenance-free Brushless DC (BLDC) and Permanent Magnet Synchronous Motors (PMSMs), which bypass the need for commutators entirely in premium and high-performance applications, potentially capping long-term revenue growth. Opportunities arise particularly in refurbishing and replacement markets, where the installed base of DC motors requires continuous parts supply, and in the niche development of highly durable commutators for extreme conditions, such as high-altitude aerospace motors or high-temperature industrial generators.

Impact forces within the market are predominantly defined by the cost pressures exerted by end-user industries, particularly the mass-market automotive sector, necessitating continuous efforts to optimize production costs without compromising reliability. Regulatory impact, specifically energy efficiency mandates (e.g., minimum efficiency standards for motors), subtly affects the market by encouraging the adoption of higher quality materials and tighter manufacturing tolerances to minimize frictional and electrical losses associated with the commutator-brush interface. Furthermore, the volatility of copper and other metal prices significantly impacts the cost of goods sold, forcing manufacturers to implement robust hedging and material substitution strategies. The combined effect of these forces demands a manufacturing environment focused on precision, scalability, and material science innovation to remain competitive.

The persistence of the Commutator Market is a testament to the continued cost advantage and simplicity of brushed DC motor technology in numerous applications where the additional cost and complexity of electronic commutation (required by BLDC motors) are unwarranted. While BLDC technology captures the high-end market, commutators dominate the high-volume, low-to-mid power range. This bifurcation ensures the longevity of the commutator market, especially as developing nations continue to prioritize accessible and robust electrical machinery. Manufacturers who successfully diversify their product portfolio to include specialized, high-durability commutators alongside high-volume molded types are best positioned to navigate the competitive landscape and capitalize on the diverse global demand profile.

Segmentation Analysis

The Commutator Market is rigorously segmented based on material composition, manufacturing process, design configuration, and end-use application, reflecting the wide range of requirements and operating environments of electric motors globally. Analyzing these segments provides crucial insight into localized demand patterns and technological maturity. The Material Type segmentation, for instance, distinguishes between high-purity copper and copper-silver alloys, directly correlating with the current density and operational temperature requirements of the end motor. The Design Configuration, including planar and radial types, dictates the physical integration and efficiency profile within the motor casing, while the Manufacturing Process segment—Molded versus Fabricated—differentiates between mass-produced, lower-cost units and highly customized, heavy-duty components.

- By Type (Design Configuration):

- Radial Commutators

- Planar Commutators

- Axial Commutators

- By Material Type:

- Copper Commutators (Pure Copper, Copper Alloys)

- Silver-bearing Copper Commutators

- Other Materials (e.g., composites for specific high-speed applications)

- By Manufacturing Process:

- Molded Commutators (Plastic Molded)

- Fabricated Commutators (Steel/Mica V-ring)

- By Application:

- Automotive (Starter Motors, Auxiliary Systems, HVAC)

- Industrial Machinery (Pumps, Fans, Compressors, Power Tools)

- Consumer Appliances (Vacuum Cleaners, Blenders, Hair Dryers)

- Aerospace and Defense

- Railway and Transportation

- Others (Medical devices, Renewable Energy Systems)

- By End-Use Power Range:

- Low Power (up to 5 kW)

- Medium Power (5 kW to 50 kW)

- High Power (above 50 kW)

Value Chain Analysis For Commutator Market

The Commutator Market value chain begins with the upstream suppliers, primarily focused on sourcing and processing key raw materials, namely high-purity copper, specialized steel, mica, and thermoset molding plastics. Precision metallurgy and material quality control at this stage are paramount, as the electrical and mechanical performance of the final commutator is highly dependent on the conductivity and hardness of the copper segments and the dielectric strength of the insulation materials. Major suppliers include large copper producers and specialized chemical companies. Manufacturers of commutators then undertake highly precise processes involving stamping, molding, assembly (V-ring construction or plastic encapsulation), and dynamic balancing, representing the core transformation step in the value chain, where technological expertise and capital investment are concentrated.

Downstream analysis focuses on the integration of the finished commutator into the motor assembly. Direct sales channels typically involve large Original Equipment Manufacturers (OEMs) in the automotive and heavy industrial sectors, who purchase commutators in high volumes under long-term contracts based on specific performance standards. Indirect distribution involves specialized industrial distributors and motor repair workshops, particularly prevalent in the aftermarket and replacement parts segment. These distributors require robust inventory management and technical support capabilities to service a vast installed base of different motor models and specifications. The trend towards globalized manufacturing means that supply chains often cross continents, demanding complex logistics and reliable quality management systems to maintain consistency.

The structure of the distribution channel is highly bifurcated. For high-volume, standard automotive and appliance commutators, direct engagement with Tier 1 and Tier 2 suppliers or large motor manufacturers is common, prioritizing efficiency and cost compression. For specialized, low-volume, high-value industrial or aerospace commutators, the distribution often relies on highly technical sales agents or direct factory engagement due to stringent certification and customization requirements. The aftermarket segment is sustained by indirect channels, relying on regional distributors who supply repair kits and replacement parts, ensuring that manufacturers capture revenue long after the initial motor sale. Successfully managing both direct OEM relationships and a resilient aftermarket network is essential for comprehensive market penetration and stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mersen, Hitachi, Ametek, Electro-Carbon, Kaizheng Electric, Huarui Electric, Shenzhen Ruituo Electric, Angies Corporation, GEC Component, Sudong Electric, Krempel GmbH, Shanghai Shenli Motor Accessories, Electric Materials Company, General Brushless DC Motors, Kwang-Ho Industry |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commutator Market Potential Customers

Potential customers for the Commutator Market are highly concentrated within industries that rely extensively on brushed DC motor technology for motion control and power generation. The largest segment of buyers comprises major Automotive OEMs and their Tier 1 suppliers (e.g., manufacturers of starter systems, actuators, and HVAC blowers), which require millions of standardized, high-volume commutators annually for vehicle assembly. These buyers prioritize reliability, consistency in dimensional tolerance, and competitive pricing due to the volume of procurement. The ongoing development of hybrid electric vehicles (HEVs) ensures continued, albeit evolving, demand from this sector, as HEVs still utilize numerous auxiliary DC motors.

Another critical customer base includes manufacturers of Industrial Machinery and Power Tools. This segment demands a higher degree of customization, especially regarding material composition (e.g., silver-bearing copper for high-current applications) and robustness, suitable for continuous, heavy-duty operation in construction equipment, factory automation, and professional-grade power tools. Buyers here focus on reducing Total Cost of Ownership (TCO) by sourcing commutators with extended lifespan and minimal maintenance requirements. Furthermore, companies specializing in motor repair and refurbishment constitute a steady demand stream, particularly for fabricated, mica-insulated commutators used in legacy industrial motors and generators.

Finally, the consumer appliance sector represents a high-volume, cost-sensitive buyer group, requiring molded commutators for products such as washing machines, vacuum cleaners, and kitchen appliances. Procurement decisions in this area are heavily driven by unit cost and supply chain efficiency, often favoring manufacturers located in or near major Asian manufacturing hubs. Niche buyers include defense contractors, railway operators, and specialized medical device manufacturers, who purchase high-reliability, often custom-designed commutators under stringent certification protocols, valuing performance consistency and long-term supply agreements over immediate cost minimization.

Commutator Market Key Technology Landscape

The technological landscape of the Commutator Market is characterized by continuous optimization of manufacturing processes, advanced material substitution, and enhanced inspection methodologies rather than disruptive innovation in core functionality. Precision stamping and V-ring assembly technologies are constantly refined to achieve tighter tolerances on segment parallelism and concentricity, which are critical factors in minimizing brush wear and electrical arcing during high-speed operation. Automated assembly lines, incorporating sophisticated vision systems, are replacing manual processes, particularly for high-volume molded commutators, ensuring uniformity and reducing manufacturing defects associated with manual handling. This operational excellence is crucial for meeting the stringent quality requirements of automotive OEMs.

Material science innovation focuses predominantly on improving the thermal and mechanical properties of the commutator components. Key areas include the development of proprietary copper alloys (often incorporating silver or cadmium replacements) that offer superior conductivity while maintaining high mechanical strength and resistance to softening at elevated operating temperatures. Furthermore, advanced polymer and resin compounds used for molding and insulation (e.g., high-performance polyimides and epoxy resins) are engineered to withstand extreme thermal cycling and chemical exposure, extending the operational life of the unit. The continuous optimization of mica-based insulation systems remains vital for heavy-duty, high-voltage commutators utilized in large industrial generators.

In addition to physical component improvements, the incorporation of advanced non-destructive testing (NDT) techniques, such as eddy current testing and ultrasound inspection, is becoming standard practice to detect internal flaws, micro-cracks, and insulation voids that could compromise reliability. Furthermore, there is a growing trend towards digital twinning and finite element analysis (FEA) for thermal and stress modeling during the design phase. This allows manufacturers to simulate various operational loads and environments, leading to 'first-time-right' designs that reduce prototyping cycles and optimize the material usage, reinforcing efficiency and lowering production costs in a highly competitive market environment.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed epicenter of the Commutator Market, holding the largest market share and demonstrating the highest growth rate. This dominance is attributed to the presence of vast manufacturing hubs in China, India, South Korea, and Japan, which collectively account for the majority of global production of automobiles, industrial equipment, and consumer electronics. The region benefits from lower manufacturing costs, extensive supply chain networks, and escalating domestic demand for motorized products driven by rapid urbanization and rising disposable incomes. China, in particular, drives high-volume demand for standard molded commutators used in ubiquitous, cost-sensitive applications.

- North America: The North American market is characterized by mature industrial sectors and a high demand for replacement parts and specialized, high-reliability commutators, particularly in the aerospace, defense, and high-end professional power tool segments. While domestic manufacturing volume for standard automotive commutators has somewhat stabilized or shifted offshore, the region retains strong technological expertise and high-value domestic demand focused on quality, durability, and customized solutions for mission-critical applications. Strict quality control standards and established infrastructure support the market stability.

- Europe: Europe represents a technologically advanced market driven by stringent environmental regulations and a focus on industrial efficiency (Industry 4.0). The demand profile leans towards high-precision and high-performance commutators integrated into advanced industrial automation systems and high-speed railway transportation. Germany, Italy, and France are key consumers, supporting robust demand for both high-end fabricated commutators and specialized molded types used in high-efficiency DC motor systems. The replacement market is also substantial due to the region's large legacy installed base of industrial machinery.

- Latin America (LATAM): The LATAM market is experiencing steady growth, closely tied to infrastructure investment, expanding automotive production (especially in Brazil and Mexico), and developing manufacturing capabilities. The market is primarily served by imported components but is seeing increasing localization of assembly operations. Cost-effectiveness and robust performance under varying climatic conditions are key buying criteria in this region, which mostly demands medium-to-low power commutators for standard industrial and vehicle applications.

- Middle East and Africa (MEA): Growth in MEA is accelerating, fueled by large-scale infrastructure projects, expansion in oil and gas sectors (requiring heavy-duty industrial motors), and burgeoning automotive assembly plants in South Africa and the Gulf Cooperation Council (GCC) countries. The demand profile is characterized by a need for components that can withstand high temperatures and dusty environments. While currently a smaller market share, sustained economic diversification and industrialization initiatives are expected to significantly boost demand over the forecast period, particularly for durable, fabricated commutators.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commutator Market.- Mersen

- Hitachi, Ltd.

- Ametek, Inc.

- Electro-Carbon, Inc.

- Kaizheng Electric (China)

- Huarui Electric Co., Ltd.

- Shenzhen Ruituo Electric Co., Ltd.

- Angies Corporation

- GEC Component (UK)

- Sudong Electric Co., Ltd.

- Krempel GmbH

- Shanghai Shenli Motor Accessories Co., Ltd.

- Electric Materials Company

- General Brushless DC Motors (Focusing on legacy components)

- Kwang-Ho Industry Co., Ltd.

- HEF Group (Carbon brush and interface expertise)

- Dalian Huada Electric Co., Ltd.

- Suzhou Gold Electric Co., Ltd.

- Precision Commutator, Inc.

- Motor Control Solutions Ltd.

Frequently Asked Questions

Analyze common user questions about the Commutator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Commutator Market?

The primary driver is the massive and sustained demand from the global automotive sector for auxiliary systems (e.g., starters, fans, power windows) and the large installed base of brushed DC motors in consumer appliances and industrial machinery requiring regular maintenance and replacement components.

How is the rise of Brushless DC (BLDC) motors affecting the Commutator Market?

The increasing adoption of BLDC motors acts as a significant restraint, particularly in high-performance and high-efficiency segments, as they do not require commutators. However, the commutator market persists due to the cost advantage of brushed DC motors in high-volume, low-to-medium power applications.

Which geographical region holds the largest market share for commutators?

The Asia Pacific (APAC) region dominates the Commutator Market share, driven by extensive manufacturing activity in the automotive, consumer electronics, and general industrial sectors across countries like China and India.

What are the key technological advancements influencing commutator manufacturing?

Key technological advancements include enhanced precision in automated assembly for tighter tolerances, the use of advanced copper alloys for improved thermal performance, and the integration of AI-driven inspection systems for rigorous quality control.

What is the difference between Molded and Fabricated commutators?

Molded commutators are typically cost-effective, high-volume units produced using plastic resins for insulation, suitable for smaller motors. Fabricated (V-ring/Mica) commutators are custom-built using mica insulation and steel rings, designed for heavy-duty, high-voltage industrial motors and generators requiring superior thermal and mechanical durability.

How do volatile copper prices impact the profitability of commutator manufacturers?

Copper is a core raw material for commutator segments; therefore, its price volatility directly impacts the cost of goods sold (COGS) and manufacturer profitability. Companies mitigate this through hedging strategies, long-term procurement contracts, and shifting towards high-efficiency alloy materials that use less pure copper.

What role does the aerospace and defense sector play in the market?

The aerospace and defense sector represents a high-value niche market. Although low-volume, it requires specialized, ultra-reliable, high-altitude, and temperature-resistant commutators, often made from silver-bearing copper and utilizing stringent quality assurance protocols, commanding premium pricing.

What are the main segments covered in the Commutator Market segmentation analysis?

Segmentation primarily covers Type (Radial, Planar), Material (Copper, Silver-bearing Copper), Manufacturing Process (Molded, Fabricated), and End-Use Application (Automotive, Industrial Machinery, Consumer Appliances).

How does the concept of Industry 4.0 interact with the demand for commutators?

Industry 4.0 integrates AI and IoT for enhanced motor monitoring. While some high-tech installations use BLDC, the massive existing base of brushed DC motors benefits from AI-driven predictive maintenance technologies, extending the operational life and replacement cycle of existing commutators.

Which factors contribute to the projected 4.8% CAGR between 2026 and 2033?

The CAGR is sustained by robust vehicle production globally, increasing industrialization in developing economies driving motor adoption, continued demand for replacement parts in mature markets, and innovations ensuring commutator reliability in auxiliary systems of emerging hybrid electric vehicles.

Are planar commutators replacing radial commutators in certain applications?

Planar commutators are gaining traction, particularly in miniaturized motors for consumer electronics and some cordless power tools, due to their compact design and efficient integration with axial air-gap motor architectures, though radial designs remain dominant in high-torque, traditional DC motor applications.

What materials are used for insulation in high-power commutators?

High-power and heavy-duty commutators predominantly rely on high-grade mica segments and specialized composite materials for insulation (V-ring construction) because of mica's superior dielectric strength, thermal resistance, and durability under mechanical stress compared to plastic molding compounds.

What is the importance of dynamic balancing in commutator manufacturing?

Dynamic balancing is crucial for high-speed motor applications to minimize vibration, reduce noise, and prevent premature bearing failure. Highly precise balancing ensures the commutator operates smoothly, extending the lifespan of both the commutator and the motor itself.

How do manufacturers ensure the longevity and durability of commutators?

Longevity is ensured through rigorous process control, selecting specialized copper alloys resistant to oxidation and wear, optimizing segment geometry to minimize sparking, and using high-quality resins or mica for insulation that can withstand operating temperatures and chemical exposure.

What are the typical end-users in the medium power range (5 kW to 50 kW) segment?

Medium power commutators are primarily utilized by manufacturers of specialized industrial pumps, ventilation systems, medium-sized machinery tools, and certain categories of electric vehicle auxiliary motors that require consistent power output and moderate durability.

What challenges do commutator manufacturers face regarding quality control?

Manufacturers face challenges in maintaining extreme precision (micrometer level) across segment alignment and insulation integrity in high-volume production, requiring sophisticated non-destructive testing (NDT) and automated visual inspection systems to catch microscopic flaws that could lead to motor failure.

Is there a significant aftermarket or replacement segment for commutators?

Yes, the aftermarket segment is significant, driven by the requirement for replacement parts for the vast global installed base of DC brushed motors. This market segment often utilizes specialized distributors and focuses heavily on compatibility and reliable supply chains for older motor models.

How are environmental regulations influencing commutator design?

Environmental regulations, particularly those concerning motor energy efficiency (e.g., IE standards), indirectly influence commutator design by pressuring manufacturers to minimize electrical losses and frictional resistance, often necessitating better materials and tighter manufacturing tolerances to meet efficiency goals.

What role do distribution channels play in reaching industrial customers?

For industrial customers, distribution channels are crucial for inventory management and technical support. Specialized industrial distributors often handle complex sales, providing technical advice and logistical support for customized, heavy-duty fabricated commutators and motor repair components.

Which technological innovation is crucial for high-speed commutator applications?

The use of silver-bearing copper alloys and precision molded segments with specific thermal properties is crucial. Additionally, rigorous quality control during the assembly process to ensure perfect concentricity and dynamic balance is mandatory for mitigating excessive wear and arcing at high RPMs.

What is the forecast growth trajectory for the fabricated commutator segment?

The fabricated commutator segment is expected to show stable, moderate growth. While lower in volume compared to molded types, it benefits from sustained demand in high-reliability applications (e.g., rail, power generation, heavy industry) where their superior lifespan and customization justify the higher unit cost.

How does the market address the issue of electrical arcing at the brush interface?

Manufacturers address electrical arcing by optimizing segment angle and undercutting the mica insulation, ensuring the brushes maintain optimal contact geometry. Material science solutions, such as high-purity copper and carbon brush composition, also play a crucial role in minimizing resistance and sparking.

What are the main applications driving demand in the Middle East and Africa (MEA) region?

In MEA, demand is driven primarily by infrastructure development projects, the oil and gas sector (requiring heavy-duty pumping equipment), and the establishment of local automotive assembly operations in countries like South Africa and Morocco.

What defines the upstream segment of the Commutator Market value chain?

The upstream segment is defined by suppliers of core raw materials: high-conductivity copper and copper alloys, specialized insulation materials (mica, resins), and high-strength steel used for the V-rings or molded supports, with material quality directly influencing final product performance.

Why is high precision critical in commutator manufacturing?

High precision in segment spacing and concentricity is critical because even minor irregularities can lead to excessive vibration, premature brush wear, increased electrical noise, and inefficient power transfer, significantly shortening the motor's operating life and reliability.

How do manufacturers optimize commutators for use in hybrid electric vehicles (HEVs)?

For HEV auxiliary systems, commutators must be optimized for variable load profiles, higher temperatures, and improved resistance to environmental contaminants. This involves using high-performance insulating materials and robust copper alloys designed for frequent stop-start conditions and diverse voltage requirements.

Which company is known globally for expertise across both commutators and related motor components?

Mersen is globally recognized as a leading player, offering expertise not only in commutators but also across related components like carbon brushes, slip rings, and comprehensive power management solutions, serving heavy industrial and high-reliability sectors.

What is the significance of the 2025 Base Year in the market forecast?

The 2025 Base Year serves as the reference point for calculating the projected 4.8% CAGR and subsequent forecast values. It incorporates the latest observed market conditions, manufacturing capacities, and immediate post-pandemic recovery trends to establish an accurate starting benchmark for the 2026-2033 forecast period.

How does the market differentiate between low-power and high-power range commutators?

The differentiation is primarily based on required current handling capacity and operational durability. Low-power (up to 5 kW) applications typically use high-volume molded commutators, whereas high-power (above 50 kW) applications demand robust, fabricated, mica-insulated commutators with specialized thermal management capabilities.

What is the core function of a commutator in a DC machine?

The core function of a commutator is to act as a mechanical rectifier. It reverses the direction of current flowing through the armature winding at the precise moment necessary to ensure that the magnetic field interactions continuously produce torque in a single direction, facilitating rotational movement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Single Phase Motors Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Phase Induction Motors, Single Phase Synchronous Motors, Commutator Motors), By Application (Household, Industrial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Commutator Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hook, Groove Commutator), By Application (Power Tools, Household Appliances, Automatic Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager