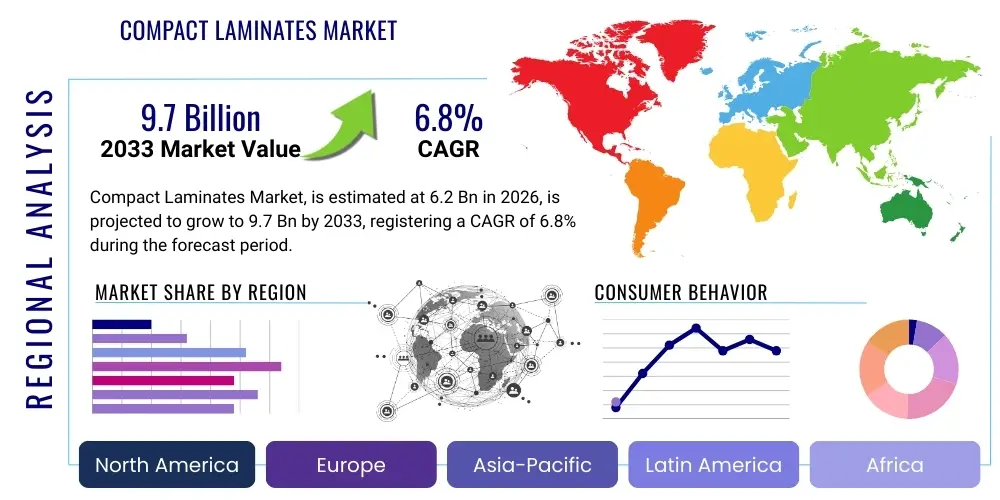

Compact Laminates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442363 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Compact Laminates Market Size

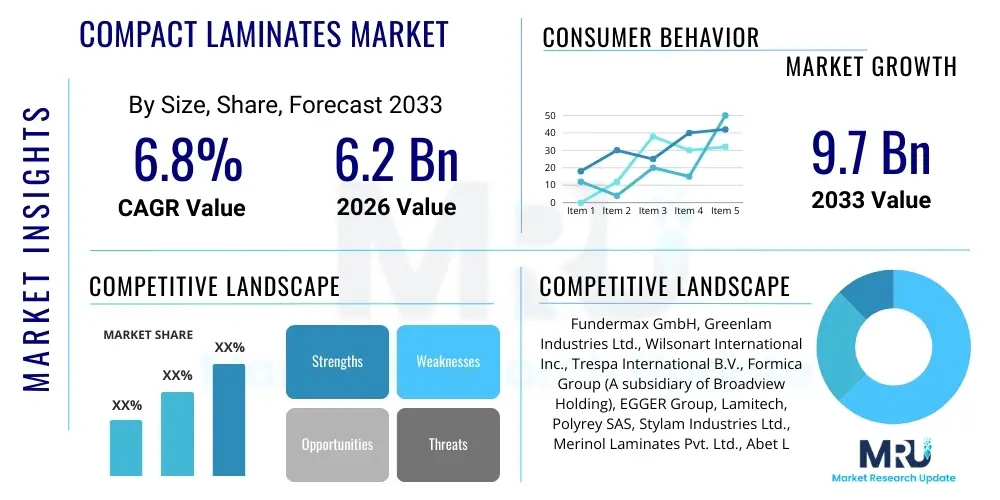

The Compact Laminates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033.

Compact Laminates Market introduction

Compact Laminates, also frequently referred to as High-Pressure Compact Laminates (HPCL) or Solid Phenolic Core Laminates, represent a highly durable and structurally sound material manufactured by impregnating multiple layers of kraft paper with phenolic resins, topped with decorative surface papers treated with melamine resins, and consolidating them under high temperature and pressure. This meticulous manufacturing process yields a self-supporting panel material that eliminates the need for substrate mounting, offering exceptional resistance to wear, moisture, impact, and chemical agents. The resulting material is significantly denser and more robust than traditional laminates, making it ideal for environments demanding high performance and longevity, such as commercial washrooms, laboratory surfaces, and exterior cladding systems.

The primary applications for compact laminates span across the commercial, institutional, and industrial sectors. In commercial spaces, they are extensively used for restroom partitions, lockers, office furniture, and specialized wall cladding due to their inherent hygienic properties and resistance to vandalism. Institutional uses include hospital surfaces, educational laboratory worktops, and public transportation interiors where stringent cleanliness standards and high traffic levels are prevalent. The aesthetic versatility offered by compact laminates, driven by advancements in digital printing and surface finishes, allows architects and designers to specify materials that are both functional and visually appealing, mimicking natural stone or wood grains without the maintenance burden associated with these traditional materials. Furthermore, the material’s resistance to fire, when treated appropriately, solidifies its position as a preferred choice in demanding architectural specifications.

The growth trajectory of the compact laminates market is intrinsically linked to global trends in infrastructure development and architectural modernization, particularly the increasing investment in green building practices and smart city initiatives. Key benefits driving adoption include superior longevity, minimal maintenance requirements, enhanced hygiene, and structural integrity. Major driving factors encompass the burgeoning construction sector in Asia Pacific, the mandatory upgrading of public sanitation facilities worldwide, and the increasing demand for robust, aesthetically pleasing, and durable interior design solutions in healthcare and institutional settings. The inherent durability and lifecycle cost efficiency of these materials provide a significant advantage over conventional materials, positioning compact laminates as a premium, high-value solution in modern construction.

Compact Laminates Market Executive Summary

The global Compact Laminates Market is characterized by robust expansion, primarily fueled by rapid urbanization and significant commercial construction activity, particularly across emerging economies. Current business trends indicate a strong pivot towards specialized, high-performance compact laminates, including those incorporating anti-microbial treatments and advanced fire-retardant properties, driven by stringent public health regulations and heightened consumer awareness regarding hygiene, especially post-pandemic. Manufacturing consolidation is occurring, with key players focusing on vertical integration to stabilize volatile raw material costs (resins and papers) and leverage economies of scale. Furthermore, sustainable manufacturing practices, such as the use of recycled content and low-VOC emissions, are becoming non-negotiable competitive differentiators, influencing procurement decisions among large institutional buyers and architectural firms committed to LEED and other green building certifications. Innovation in decorative surfaces, facilitated by advanced digital printing technology, allows for rapid customization and design flexibility, stimulating demand in high-end hospitality and retail sectors.

Regional trends distinctly highlight Asia Pacific (APAC) as the epicenter of market growth, driven by massive governmental and private investments in infrastructure, public housing, and commercial office spaces across countries like China, India, and Southeast Asia. The European market, while mature, demonstrates resilience through its emphasis on premium, aesthetically refined compact laminates conforming to strict environmental and safety standards (e.g., Euroclass fire ratings). North America maintains steady demand, predominantly within the renovation and institutional segments, focusing heavily on healthcare facilities and educational campuses where the superior hygiene and durability of compact laminates provide significant operational advantages. Conversely, Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, characterized by escalating construction projects in hospitality, retail complexes, and transportation hubs, creating new avenues for specified compact laminate solutions.

Segmentation trends reveal that the commercial application segment, dominated by washroom cubicles, partitions, and laboratory work surfaces, maintains the largest market share due to universal requirements for durable, moisture-resistant public facilities. However, the use of compact laminates in decorative wall cladding and specialized exterior applications is anticipated to register the fastest growth rate, driven by technological improvements that enhance UV stability and weather resistance, broadening their use beyond internal surfaces. Segmentally, the demand for thin-core compact laminates, which offer lighter weight while maintaining structural integrity, is increasing in furniture manufacturing and transport applications. Manufacturers are actively diversifying their product portfolios, integrating smart surface technologies, such as embedded sensors or capacitive touch capabilities, positioning compact laminates not just as passive materials but as interactive components within modern, connected built environments.

AI Impact Analysis on Compact Laminates Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Compact Laminates market reveals several key themes centered on efficiency, customization, and sustainability. Users frequently inquire about AI's role in optimizing the raw material mixing process, particularly resin formulation, to enhance specific material properties like fire resistance or moisture barrier performance. There is significant interest in how AI-driven predictive maintenance models can reduce downtime in continuous pressing and lamination machinery, thereby boosting overall manufacturing capacity and reducing costs. Furthermore, designers and architects are exploring the potential of generative AI algorithms to create unique, highly customized surface designs that respond dynamically to aesthetic trends and regional preferences, significantly accelerating the product development lifecycle from concept to market realization. The key concerns revolve around the initial capital investment required to implement AI systems and the need for specialized training to manage complex, data-driven manufacturing environments.

The integration of AI technologies across the compact laminates value chain promises transformative changes, optimizing everything from sourcing decisions to final product quality assessment. In the manufacturing phase, machine learning algorithms are utilized to analyze real-time data from presses, curing ovens, and impregnators. This analysis allows for immediate, precise adjustments to temperature, pressure, and resin-to-paper ratios, ensuring consistent quality and minimizing material waste, which is particularly crucial given the high cost of phenolic resins. AI also facilitates superior quality control through automated vision systems that scan finished laminate sheets for microscopic defects, vastly outperforming human inspection capabilities and ensuring that products meet stringent ISO and ANSI standards. This enhanced precision is pivotal for high-tolerance applications such as laboratory work surfaces and cleanroom environments, where material integrity is paramount.

In the commercial and strategic domains, AI substantially influences demand forecasting and supply chain resilience. Predictive analytics models, fueled by market data, construction permits, and regional economic indicators, enable manufacturers to optimize inventory levels of raw materials and finished goods, mitigating risks associated with supply chain disruptions and volatile commodity pricing. Moreover, AI aids in personalized marketing and product suggestion platforms, allowing manufacturers to quickly present the most suitable laminate specifications (e.g., color, thickness, fire rating) based on an architect’s project type and geographical location. This move towards intelligent sales strategy reduces sales cycles and improves specification success rates. The application of AI in sustainability modeling also allows companies to simulate the environmental impact of various production parameters, enabling the adoption of greener, more energy-efficient manufacturing processes, aligning with global green building mandates and enhancing corporate social responsibility profiles.

- AI optimizes resin formulation and curing processes for enhanced material properties.

- Machine learning drives predictive maintenance, minimizing manufacturing downtime and operational costs.

- Automated vision systems utilize AI for superior, real-time quality control and defect detection.

- Generative AI tools accelerate design creation, enabling rapid, customized surface aesthetics.

- Predictive analytics enhance supply chain efficiency and optimize raw material inventory management.

- AI models are used to simulate and minimize the environmental footprint of production, supporting sustainability goals.

DRO & Impact Forces Of Compact Laminates Market

The compact laminates market is subject to a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. The primary drivers stem from the global surge in commercial and institutional construction, notably the accelerated development of healthcare facilities, educational institutions, and public transportation infrastructure, all of which mandate high-performance, hygienic, and durable surface materials. Compact laminates excel in these demanding environments due to their resistance to bacteria, moisture, abrasion, and harsh cleaning agents. Furthermore, the burgeoning demand for aesthetically advanced and durable interior solutions in the residential sector, coupled with widespread renovation and retrofitting activities in mature economies, acts as a significant catalyst. The long-term cost-effectiveness and relatively lower lifecycle maintenance compared to traditional materials like stone or wood panels further solidify their adoption among value-conscious developers and institutional procurement managers, establishing a strong commercial momentum.

However, the market faces notable restraints, predominantly related to the volatility and upward pressure on the price of key raw materials, specifically phenolic and melamine resins, which are petroleum derivatives. Fluctuations in crude oil prices directly impact the manufacturing cost, potentially squeezing profit margins for producers and leading to price sensitivity among certain buyer segments. Another constraint lies in the intensive energy consumption required during the high-pressure and high-temperature lamination process, which poses environmental concerns and operational costs, challenging manufacturers' sustainability goals. Moreover, while compact laminates offer superior performance, the initial purchase price is generally higher than standard high-pressure laminates (HPL) or conventional wood panels, which can limit their adoption in price-sensitive, low-to-mid-tier construction projects, particularly in emerging markets where budget constraints are tight. These restraints necessitate strategic procurement planning and continuous process optimization by manufacturers to maintain competitive pricing structures.

Significant opportunities for market expansion reside in the diversification of product applications and geographical outreach. The increasing focus on smart surfaces, involving the embedding of technology such as wireless charging pads or integrated touch sensors directly within the laminate, presents a high-value niche, particularly for commercial furniture and architectural interiors. Furthermore, the development of sustainable, bio-based resin alternatives is a critical opportunity to mitigate raw material price risks and align with evolving regulatory frameworks focused on circular economy principles. Geographically, untapped potential remains high in secondary cities and developing regions of APAC and Africa, where urbanization rates are accelerating and the demand for robust public infrastructure materials is escalating rapidly. Successful exploitation of these opportunities will require focused research and development efforts, strategic partnerships with technology providers, and localized marketing strategies that emphasize the long-term total cost of ownership benefits inherent in compact laminate solutions. The market is also benefiting from the impact force of stringent global safety and hygiene standards, particularly post-COVID-19, which mandates the use of materials with inherent anti-bacterial and easy-to-clean properties in public and healthcare settings.

Segmentation Analysis

The Compact Laminates Market is highly diversified and segmented based on thickness, type, application, and end-use sectors, reflecting the material’s wide applicability across architectural and functional domains. Segmentation by thickness is crucial, differentiating standard-thickness laminates (typically 6mm to 12mm), primarily used for structural applications like partitions and furniture, from thicker variants (above 12mm) utilized in heavy-duty applications such as laboratory countertops and self-supporting exterior facades. The functional segmentation by type, including standard decorative, fire-retardant, and chemical-resistant grades, addresses specialized performance requirements mandated by specific building codes and industrial uses. The ongoing trend is towards higher performance types, driven by enhanced safety regulations in public buildings and the growing demand for specialized surfaces in the healthcare and chemical industries.

Application segmentation categorizes the market into architectural applications (wall cladding, exterior facades), functional applications (washroom cubicles, lockers), and furniture/work surface applications (desktops, laboratory benches). The functional segment remains the largest volume consumer due to the material's superior moisture resistance, making it ideal for wet areas. However, the architectural segment, particularly exterior cladding, is poised for rapid growth due to technological advancements in UV protection coatings that extend the material's lifespan when exposed to outdoor elements. This diverse application matrix underscores the material’s versatility and its ability to substitute traditional materials across various price points and performance requirements.

The end-use analysis focuses on the primary consuming sectors: Commercial, Residential, and Institutional (Healthcare, Education, Government). The commercial sector, encompassing corporate offices, retail spaces, and hospitality venues, currently dominates the market, valuing the material’s aesthetic flexibility and low maintenance. The institutional sector, however, is witnessing accelerated growth, driven by mandatory facility upgrades and the critical need for hygienic, non-porous surfaces in patient care and research environments. Understanding these segmentation nuances is vital for manufacturers to tailor their production capabilities, distribution strategies, and marketing messages to effectively capture high-growth niche markets within the broader compact laminates landscape.

- By Type:

- Standard/Decorative Compact Laminates

- Fire-Retardant Compact Laminates (FR Grade)

- Chemical Resistant Compact Laminates

- Anti-Microbial Compact Laminates

- By Thickness:

- 6 mm to 12 mm

- Above 12 mm

- By Application:

- Washroom Partitions and Cubicles

- Lockers and Cabinets

- Wall Cladding (Interior and Exterior)

- Laboratory Work Surfaces

- Furniture (Desktops and Tables)

- By End-Use Sector:

- Commercial (Retail, Hospitality, Corporate)

- Institutional (Healthcare, Education, Government)

- Residential

- Industrial

Value Chain Analysis For Compact Laminates Market

The value chain for the Compact Laminates Market is characterized by the complex interaction of material sourcing, intensive manufacturing processes, and highly specified distribution channels tailored toward architectural and construction projects. Upstream analysis focuses predominantly on the acquisition of specialized raw materials: high-quality cellulose paper (kraft paper and decorative paper), thermosetting resins (phenolic for the core and melamine for the surface), and specialized chemical additives (fire retardants, anti-microbial agents). The sourcing of phenolic resins is a critical determinant of cost and quality, often involving long-term contracts with major chemical suppliers. Efficiency at this upstream stage is crucial, as the consistency and purity of raw materials directly impact the structural integrity and aesthetic finish of the final compact laminate panel. Manufacturers constantly strive for backward integration or secure stable supply partnerships to mitigate the volatility inherent in petrochemical-derived products.

The core manufacturing process involves several energy-intensive steps: resin impregnation, drying, collating the layers, and finally, consolidation under extreme heat (typically 120°C to 150°C) and high pressure (up to 1,400 psi) in hydraulic presses. The high technical barrier to entry is maintained by the requirement for specialized continuous or multi-daylight presses and stringent quality control protocols. Downstream analysis focuses on value-added services such as specialized machining (cutting, routing, edging) tailored to specific end-user requirements, particularly for complex installations like curved partitions or highly precise laboratory furniture. The distribution channel is heavily skewed towards specification selling; direct sales efforts target architects, interior designers, and large-scale developers who specify the brand and grade of laminate during the project design phase. This direct engagement ensures technical compliance and maximizes project margins.

Indirect distribution primarily relies on a network of specialized construction material distributors and wholesale dealers who maintain inventory and provide localized processing capabilities. These intermediaries serve smaller contractors and furniture manufacturers. The shift towards digital specification tools and Building Information Modeling (BIM) platforms is rapidly transforming distribution, allowing manufacturers to integrate their product libraries directly into design workflows. Effective management of the distribution channel requires a delicate balance between maintaining close relationships with specifying architects (direct) and ensuring rapid fulfillment through stocked distributors (indirect). The market rewards companies that successfully integrate these channels, providing comprehensive technical support and installation guidance, thereby optimizing the final implementation of the compact laminate product in diverse architectural environments.

Compact Laminates Market Potential Customers

The primary customer base for the Compact Laminates Market is highly specialized, consisting predominantly of professional entities involved in commercial construction, institutional development, and interior fit-outs who prioritize durability, hygiene, and specific performance metrics. Key end-users include architectural firms and independent interior designers who specify the materials based on project requirements, often dictating the choice of compact laminate brand and grade (e.g., FR grade for high-rise buildings or chemical-resistant grade for lab environments). These specifiers are highly influential, requiring continuous technical education and samples from manufacturers. Another substantial customer segment comprises large general contractors and specialized sub-contractors focused on commercial fit-outs, such as those specializing in washroom partitions or hospital interiors, who purchase bulk quantities of fabricated or semi-fabricated sheets.

A significant portion of the demand originates from institutional buyers, including governing bodies responsible for public infrastructure maintenance, healthcare networks managing hospital refurbishments, and educational authorities overseeing school and university facility upgrades. These organizations are typically non-price sensitive when mandatory safety and performance standards (e.g., anti-microbial properties in hospitals) are required, focusing instead on long-term value, warranties, and ease of maintenance. The corporate sector, including multinational companies constructing new headquarters or large retail chains implementing standardized designs, represents another vital customer group, seeking materials that reflect corporate branding while withstanding heavy foot traffic and minimizing total lifecycle costs.

Furthermore, specialized industrial manufacturers, particularly those in the marine, transportation, and laboratory equipment sectors, are important buyers, requiring compact laminates for their inherent structural stability and specialized resistance properties. These buyers utilize the laminates as components within their finished products (e.g., train interiors or specialized laboratory casework). Successful engagement with these potential customers requires manufacturers to offer certified products, comprehensive technical data sheets, and dedicated project support, emphasizing compliance with relevant regional and international building and safety standards. The sustained growth of the market is dependent on continuously nurturing relationships with the global architectural and design community, who serve as the principal gatekeepers of material selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fundermax GmbH, Greenlam Industries Ltd., Wilsonart International Inc., Trespa International B.V., Formica Group (A subsidiary of Broadview Holding), EGGER Group, Lamitech, Polyrey SAS, Stylam Industries Ltd., Merinol Laminates Pvt. Ltd., Abet Laminati S.p.A., Merino Industries Ltd., CenturyPly, Pfleiderer Group, Royal Laminates, Sonae Arauco, Arpa Industriale S.p.A., OMNOVA Solutions Inc., Starline Laminates. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compact Laminates Market Key Technology Landscape

The technology landscape for the Compact Laminates Market is continuously evolving, driven primarily by the need for enhanced durability, aesthetic versatility, and sustainable manufacturing practices. A foundational technology remains the continuous lamination process (CLP), which has largely replaced traditional multi-daylight presses for high-volume production. CLP allows for the continuous production of compact laminate sheets, ensuring greater uniformity, higher production speeds, and reduced energy consumption per unit. Advancements in resin chemistry form a critical technological frontier, with R&D focused on developing low-formaldehyde and formaldehyde-free phenolic resins to comply with increasingly stringent indoor air quality standards (e.g., CARB and LEED certifications). The goal is to maintain the exceptional mechanical properties of the laminates while drastically reducing volatile organic compound (VOC) emissions, making them suitable for sensitive environments like healthcare and educational facilities.

Digital printing technology is profoundly impacting the aesthetic capabilities of compact laminates. High-resolution digital printers allow manufacturers to reproduce complex, custom designs, photographic imagery, and highly realistic simulations of natural materials such such as exotic woods, marbles, and weathered metals, with unmatched color fidelity and texture detail. This customization capability reduces minimum order quantities for bespoke designs, democratizing access to high-end architectural finishes. Complementary surface treatment technologies, such as Electron Beam Curing (EBC) or advanced polyurethane coatings, are applied post-lamination to enhance resistance features, particularly anti-scratch properties, anti-fingerprint finishes (known as FENIX technology in some variants), and UV resistance for exterior cladding applications. These surface innovations extend the functional lifespan of the product and broaden its market appeal beyond purely utilitarian applications.

Furthermore, manufacturing efficiency is being enhanced by robotics and automation integrated into the fabrication and handling stages. Automated cutting, routing, and edge-banding machinery ensures precise dimensional accuracy, minimizing material wastage during secondary processing for specialized projects like washroom partitions or intricate furniture components. In response to sustainability demands, leading manufacturers are investing in specialized equipment to process recycled paper content and are exploring composite technologies that incorporate alternative core materials, such as wood fiber or mineral fillers, to partially replace traditional kraft paper and phenolic resins. This technological push is focused on creating compact laminates that not only perform exceptionally but also align with the principles of the circular economy, offering verifiable low environmental impact data to environmentally conscious specifiers and procurement teams globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region in the compact laminates market, driven by unparalleled governmental investment in commercial, residential, and institutional infrastructure, particularly in rapidly urbanizing nations like China, India, and Indonesia. The region’s strong manufacturing base also enables lower production costs and localized distribution networks. Demand is particularly high for materials suitable for high-humidity environments, such as washroom partitions and outdoor cladding. Rapid growth in the hospitality and transportation sectors across Southeast Asia further fuels the market, requiring durable, low-maintenance interior solutions.

- North America: The North American market is characterized by high demand for specialized, high-specification compact laminates, with a strong focus on the renovation and refurbishment sector, especially within the established healthcare and educational infrastructure. Regulatory compliance, including ADA standards for public facilities and strict fire safety codes, drives the adoption of premium, certified fire-retardant and anti-microbial grades. Market expansion is steady, relying heavily on architectural specifications and a consumer preference for durable, aesthetically pleasing finishes that offer long-term performance guarantees.

- Europe: The European market is mature but highly focused on quality, environmental sustainability, and design excellence. Stringent environmental regulations, such as REACH compliance and emphasis on low-VOC materials, influence product innovation, favoring manufacturers who utilize sustainable raw materials and eco-friendly processes. Demand is strong in Western Europe (Germany, UK, France) for high-end exterior cladding and sophisticated interior applications in retail and corporate environments, where design flexibility and certified performance are paramount. European manufacturers are global leaders in developing highly weather-resistant and aesthetically advanced compact laminate surfaces.

- Latin America (LATAM): LATAM represents a growing market, spurred by increasing foreign direct investment in commercial construction and the development of modern retail infrastructure (shopping centers and hotels). While price sensitivity is higher compared to North America or Europe, urbanization trends in countries like Brazil and Mexico are generating substantial demand for cost-effective, durable materials for public spaces and multi-family residential projects. Market growth is heavily contingent upon stabilizing economic conditions and consistent government spending on public works projects.

- Middle East and Africa (MEA): The MEA market is experiencing robust growth, primarily centered around large-scale construction mega-projects in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), driven by tourism, logistics, and ambitious national development visions (e.g., Saudi Vision 2030). Extreme climate conditions necessitate the use of highly weather-resistant compact laminates for exterior applications. Demand is concentrated in luxury hospitality, commercial office towers, and large governmental infrastructure projects, where quality specification is generally prioritized over cost.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compact Laminates Market.- Fundermax GmbH

- Greenlam Industries Ltd.

- Wilsonart International Inc.

- Trespa International B.V.

- Formica Group (A subsidiary of Broadview Holding)

- EGGER Group

- Lamitech

- Polyrey SAS

- Stylam Industries Ltd.

- Merinol Laminates Pvt. Ltd.

- Abet Laminati S.p.A.

- Merino Industries Ltd.

- CenturyPly

- Pfleiderer Group

- Royal Laminates

- Sonae Arauco

- Arpa Industriale S.p.A.

- OMNOVA Solutions Inc.

- Starline Laminates

- Archidply Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Compact Laminates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes Compact Laminates from standard High-Pressure Laminates (HPL)?

Compact Laminates (HPC) possess a significantly thicker phenolic resin core (typically 6mm to 20mm), making them self-supporting and eliminating the need for a separate substrate. Standard HPL is thinner and requires bonding to materials like particleboard or MDF, whereas compact laminates offer superior structural stability, moisture resistance, and impact durability for heavy-duty applications.

Which end-use sector drives the highest demand for Compact Laminates globally?

The Commercial and Institutional sectors are the largest drivers. The commercial sector (offices, retail, hospitality) utilizes them for aesthetic durability, while the Institutional sector (healthcare, schools) mandates their use for superior hygiene, structural strength, and resistance to harsh cleaning chemicals, particularly for surfaces like washroom cubicles and laboratory worktops.

Are Compact Laminates suitable for exterior architectural cladding applications?

Yes, specialized exterior-grade compact laminates are engineered with enhanced UV-stabilized surface coatings and core formulations to resist fading, weathering, and moisture ingress. These products are widely used for facade cladding, balconies, and exterior wall systems, offering exceptional weather resilience and design versatility in architectural projects.

How do volatile raw material costs impact the pricing of Compact Laminates?

Raw material costs, especially for phenolic and melamine resins derived from petrochemicals, constitute a significant portion of manufacturing expenses. Volatility in global oil and chemical markets leads to fluctuations in resin prices, directly impacting the final cost of compact laminates and requiring manufacturers to implement dynamic pricing strategies or seek bio-based substitutes.

What role does sustainability play in the Compact Laminates manufacturing process?

Sustainability is critical, driving innovation toward using recycled cellulose paper and developing low-VOC or formaldehyde-free resin systems. Manufacturers prioritize certifications like FSC and PEFC for wood fiber content and adherence to stringent environmental standards (e.g., LEED requirements) to meet the growing demand from green building projects globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager