Composite Hydrogen Cylinder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443454 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Composite Hydrogen Cylinder Market Size

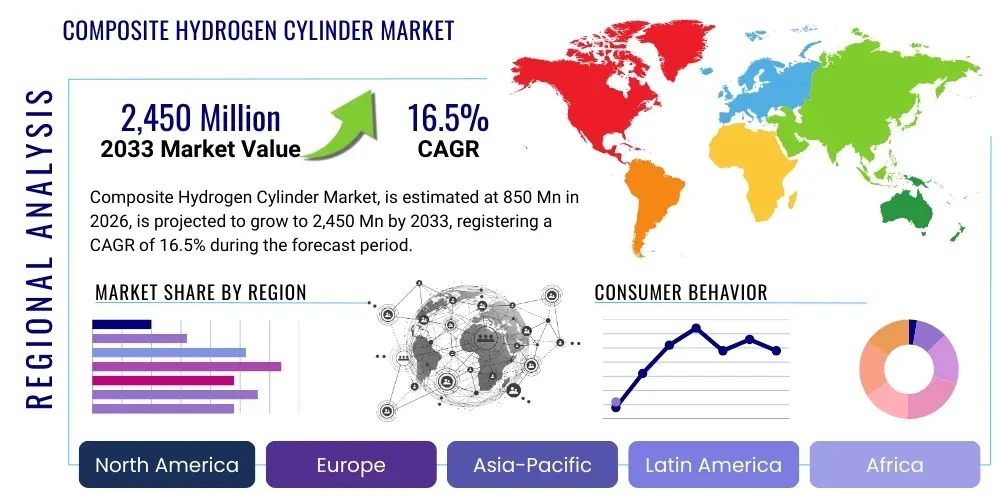

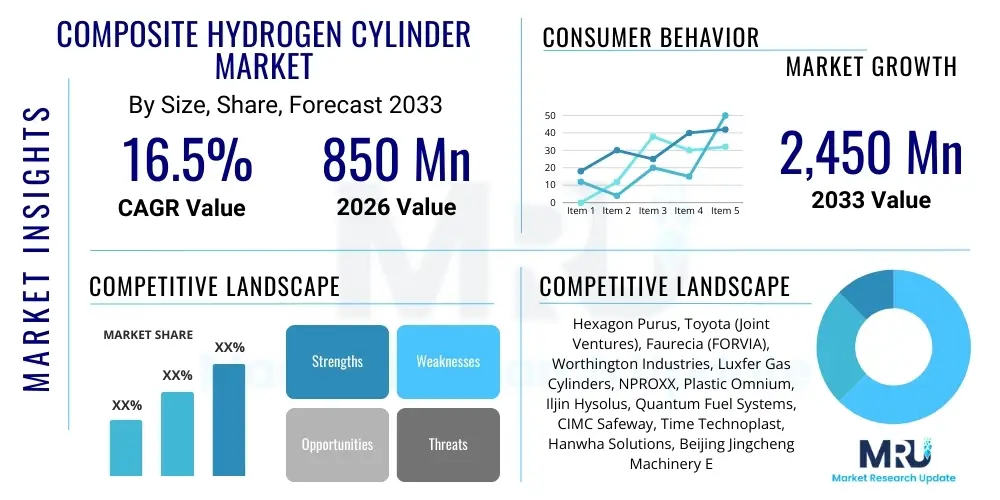

The Composite Hydrogen Cylinder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 2,450 Million by the end of the forecast period in 2033.

Composite Hydrogen Cylinder Market introduction

The Composite Hydrogen Cylinder Market encompasses the manufacturing, distribution, and utilization of high-pressure vessels specifically designed for the safe and efficient storage and transportation of gaseous hydrogen. These cylinders are crucial components in the emerging global hydrogen economy, particularly within the mobility sector and stationary power applications. Unlike traditional steel cylinders, composite cylinders utilize advanced materials such as carbon fiber or glass fiber reinforced polymers over a liner (typically aluminum or polymer), offering significant advantages in terms of reduced weight and enhanced safety performance under extreme pressures, often ranging from 35 MPa (350 bar) to 70 MPa (700 bar). The lightweight nature of these cylinders is a key enabler for fuel cell electric vehicles (FCEVs), optimizing vehicle range and energy efficiency, thereby solidifying their position as essential infrastructure for decarbonization initiatives worldwide.

The primary product categories driving market expansion include Type III (metal liner hoop-wrapped with fiber) and the increasingly dominant Type IV (plastic liner fully wrapped with fiber) cylinders, which offer the highest gravimetric density. Major applications span across transportation, encompassing passenger cars, heavy-duty trucks, buses, and increasingly, marine and aerospace hydrogen fuel systems. Beyond mobility, these cylinders are vital for hydrogen fueling stations (HRS), backup power systems, and industrial hydrogen consumption, ensuring reliable high-pressure storage solutions. The robust regulatory frameworks governing high-pressure vessels, such as standards established by ISO and recognized regional bodies, ensure stringent safety protocols are maintained across the value chain, fostering market trust and widespread adoption.

Key market benefits include superior weight reduction compared to all-metal alternatives, corrosion resistance, and high fatigue resistance, which translates directly into longer service life and reduced operational costs for end-users. The market is primarily driven by global commitments to achieving net-zero emissions, escalating investments in hydrogen production infrastructure (both green and blue hydrogen), and governmental incentives promoting the deployment of FCEVs and hydrogen logistics. Further acceleration is provided by technological advancements in fiber winding techniques, resin systems, and liner materials, continuously improving the cost-effectiveness and performance envelope of composite storage solutions, making hydrogen a commercially viable energy carrier.

Composite Hydrogen Cylinder Market Executive Summary

The Composite Hydrogen Cylinder Market is undergoing rapid transformation, characterized by aggressive technological refinement and significant capital infusion driven by global energy transition mandates. Current business trends indicate a strong shift towards Type IV cylinders, favored predominantly by the automotive sector due to their optimal weight-to-volume ratio, which directly impacts the performance and range of Fuel Cell Electric Vehicles (FCEVs). Strategic partnerships between cylinder manufacturers, material suppliers (especially carbon fiber providers), and major automotive Original Equipment Manufacturers (OEMs) are becoming central to securing long-term contracts and standardizing high-pressure storage solutions. Furthermore, market participants are actively pursuing automation in manufacturing processes, such as filament winding and curing, to reduce production costs and improve scalability, addressing the anticipated mass-market demand from the hydrogen mobility segment globally. Safety and durability standards remain a core competitive differentiator, necessitating continuous R&D expenditure to comply with evolving international safety certifications and pressure cycling requirements.

Regionally, the market exhibits strong duality, with Asia Pacific, particularly Japan, South Korea, and China, maintaining leadership due to proactive government hydrogen strategies and established FCEV infrastructure deployment. Europe follows closely, driven by the European Green Deal and massive investments in hydrogen valley projects and heavy-duty vehicle decarbonization mandates, specifically targeting 70 MPa technology for long-haul trucking. North America is experiencing accelerated growth, largely fueled by supportive policies like the Inflation Reduction Act (IRA) in the United States, which provides substantial subsidies for hydrogen production and related infrastructure, stimulating demand for robust storage solutions across transportation and stationary applications. These regional trends underscore a global consensus on hydrogen as a future energy vector, translating into diversified demand across different pressure ratings and cylinder sizes depending on specific application needs (e.g., smaller cylinders for drones/maritime, large cascade systems for refueling stations).

Segmentation trends highlight the dominance of the mobility segment, which accounts for the largest market share, though stationary storage (including refueling station cascades and industrial high-pressure storage banks) is emerging as the fastest-growing application area. Within materials, carbon fiber composites currently lead due to superior strength, but research into alternative, lower-cost fibers and hybrid structures (combining carbon and glass fibers) is ongoing to address cost challenges—the primary barrier to broader market adoption. Pressure rating segmentation shows 70 MPa cylinders dominating the passenger FCEV sector, while 35 MPa and intermediate pressures are critical for industrial logistics and light-duty commercial vehicles. Overall, the market is characterized by high barriers to entry related to certification and safety requirements, favoring established manufacturers with proven safety records and robust quality management systems.

AI Impact Analysis on Composite Hydrogen Cylinder Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Composite Hydrogen Cylinder Market center around optimizing material performance, enhancing manufacturing efficiency, and predicting component lifespan and maintenance needs. Users frequently ask: "How can AI reduce the high cost of carbon fiber cylinders?" "Can machine learning predict potential failure points in wound composites?" and "What role does AI play in accelerating design iterations for high-pressure vessels?" The overarching key themes reveal high expectations for AI to solve persistent industry challenges, namely improving manufacturing yield rates, achieving true predictive maintenance for critical safety components, and accelerating the certification process through advanced simulation, thereby making composite cylinders more affordable and reliable for mass-market adoption.

The integration of AI, particularly machine learning and deep learning algorithms, offers significant potential for revolutionizing the design and production phases of composite hydrogen cylinders. In the design stage, AI can analyze complex anisotropic material behavior under high stress and thermal cycling far more rapidly than traditional computational methods, leading to optimized fiber angles, ply thickness, and overall structural integrity while minimizing material usage. During manufacturing, AI-powered computer vision systems can monitor the filament winding process in real-time, detecting micro-defects, inconsistencies in tension, and resin curing issues immediately, thus significantly reducing scrap rates and ensuring superior quality control, which is paramount for safety-critical components operating under extreme pressure.

Furthermore, AI plays a crucial role in operational efficiency and post-deployment lifecycle management. Predictive maintenance models, trained on sensor data regarding pressure cycles, temperature fluctuations, and usage patterns, can accurately estimate the remaining useful life (RUL) of individual cylinders, optimizing recertification schedules and mitigating catastrophic failures. This capability enhances safety, reduces operational downtime, and provides significant cost savings for fleet operators. The data generated from millions of operational cylinders globally, when aggregated and analyzed by AI, will further inform material science innovation and expedite regulatory compliance by providing robust, data-backed evidence of long-term performance and durability.

- AI optimizes carbon fiber winding patterns to maximize strength while minimizing material consumption, driving down production costs.

- Machine learning algorithms enhance real-time quality control during manufacturing by detecting microscopic defects in composite layers and liners.

- Predictive maintenance models utilize operational data (pressure, temperature, usage cycles) to forecast cylinder lifespan and optimize mandatory inspection intervals.

- AI accelerates new material discovery and simulation, drastically reducing the R&D time required for developing lighter and safer composite structures.

- Deep learning enables automated, data-driven analysis of non-destructive testing (NDT) results, improving accuracy and speed of certification processes.

DRO & Impact Forces Of Composite Hydrogen Cylinder Market

The Composite Hydrogen Cylinder Market is significantly influenced by a confluence of accelerating drivers related to global energy policy and restrictive factors concerning cost and material availability, all balanced by substantial opportunities derived from emerging market sectors. Key drivers include aggressive decarbonization targets set by leading economies, which necessitates the widespread adoption of hydrogen fuel, specifically in hard-to-abate sectors like heavy-duty transport. Restraints primarily revolve around the high initial cost of carbon fiber, which constitutes the major material cost component, making composite cylinders relatively expensive compared to conventional storage solutions. Opportunities are concentrated in expanding applications beyond road transport, such as maritime shipping, rail, and stationary grid storage, coupled with advancements in automated manufacturing to reduce unit costs. These elements interact dynamically, shaping investment strategies and determining the speed of market penetration, particularly as the industry navigates the transition from niche component manufacturing to large-scale commodity production.

Major driving factors fueling market expansion are rooted in regulatory support and technological necessity. Government incentives and mandates, particularly concerning fleet turnover towards zero-emission vehicles in regions like Europe and APAC, create guaranteed demand for high-pressure storage. Furthermore, the inherent need for lightweight storage solutions (Type IV cylinders) is non-negotiable for maximizing the range and payload capacity of FCEVs, cementing composite cylinders as the only viable solution for high-pressure mobile applications. The rapidly increasing number of operational hydrogen refueling stations (HRS) globally also mandates the deployment of certified cascade storage systems (often utilizing large composite cylinders) to handle the required flow rates and pressure demands. This infrastructural build-out reinforces the entire hydrogen value chain, directly benefiting cylinder manufacturers.

Conversely, critical restraints impose constraints on the growth trajectory. The supply chain for high-grade carbon fiber required for 70 MPa cylinders remains relatively concentrated, leading to vulnerability in pricing and supply stability. Safety and certification requirements are extremely rigorous, involving extensive testing and long lead times for new product qualification, posing significant barriers to entry for smaller manufacturers and slowing down innovation deployment. Furthermore, end-user concerns regarding the perceived safety and lifetime performance of high-pressure composite structures, despite strong safety records, necessitate continuous consumer education and robust warranties. The opportunities, however, offer long-term stability, particularly the exploration of hydrogen power in aerospace and drone technology, demanding ultra-lightweight, customized storage solutions. Mass manufacturing scale-up, facilitated by advanced automation and potential recycling technologies for carbon fiber, presents the greatest long-term opportunity for cost reduction and sustained market growth.

- Drivers:

- Global mandates for decarbonization and zero-emission vehicle proliferation (FCEVs).

- Superior weight reduction and energy density capabilities of Type IV composite cylinders compared to metal alternatives.

- Government subsidies and funding programs supporting hydrogen infrastructure development (e.g., IRA, European Green Deal).

- Increasing operational pressure requirements (70 MPa) necessitating composite materials for safety and efficiency.

- Restraints:

- High cost and constrained supply chain for aerospace-grade carbon fiber precursors.

- Extremely rigorous and time-consuming international safety certification and testing procedures.

- Challenges in recycling composite materials at the end of the cylinder lifecycle.

- Need for specialized manufacturing infrastructure (automated filament winding and curing facilities).

- Opportunities:

- Expansion into non-automotive high-growth segments: rail, marine, aviation, and stationary grid storage.

- Development of hybrid composite structures and lower-cost intermediate fibers to reduce overall production cost.

- Adoption of Industry 4.0 techniques (AI, IoT) for mass production quality control and predictive maintenance services.

- Growth of modular, decentralized hydrogen generation and storage solutions for industrial sites.

- Impact Forces:

- Supplier Power: High, due to limited suppliers of high-grade carbon fiber and specialized liners.

- Buyer Power: Medium to High, driven by large-volume procurement by automotive OEMs seeking competitive pricing.

- Threat of Substitutes: Low in high-pressure mobile applications (FCEVs), but Medium in stationary/lower pressure applications where liquid hydrogen or metallic storage poses an alternative.

- Threat of New Entrants: Low, owing to massive capital investment requirements, technical expertise needed, and stringent regulatory barriers (certification).

- Competitive Rivalry: High, among established global manufacturers vying for long-term OEM contracts and market share dominance.

Segmentation Analysis

The Composite Hydrogen Cylinder Market is comprehensively segmented based on Type, defining the structural composition; on Tank Capacity, dictating the volume of hydrogen storage; on Working Pressure, reflecting the application requirements; and crucially, on Application, which identifies the major end-use sectors driving demand. This multi-dimensional segmentation provides granular insights into market dynamics, revealing that Type IV cylinders and 70 MPa working pressure units dominate the high-value mobility segment, while larger capacities are reserved for bulk transport and refueling infrastructure. Understanding these segments is vital for manufacturers to tailor product development, allocate resources effectively, and comply with varied international standards pertinent to different pressure levels and applications across diverse geographic regions.

Segmentation by Type remains the most fundamental differentiator. Type III cylinders, with their aluminum liner, offer proven durability and reliability but suffer from weight limitations compared to Type IV cylinders. Type IV, utilizing lightweight polymeric liners and full carbon fiber wrapping, represent the frontier of technology, offering the best performance metrics crucial for mass-market FCEVs. The technological progression strongly favors Type IV adoption across new applications. Capacity segmentation spans from small industrial cylinders (less than 50 liters) used for laboratory or backup power to large storage vessels (over 500 liters) deployed in cascade systems at hydrogen fueling stations, with transportable storage units representing a high-growth segment facilitating hydrogen logistics.

The Application segmentation underscores the market's dependence on the transportation sector, encompassing light-duty passenger vehicles (the highest volume segment), heavy-duty trucks, buses, and specialized vehicles like forklifts. However, non-vehicular applications are rapidly gaining traction. These include ground storage systems (stationary power generation, industrial supply), and portable applications such as drones, aerial vehicles, and specialized high-altitude systems where weight saving is absolutely critical. The interplay between pressure rating and application is highly specific; for example, 35 MPa cylinders are commonly used in industrial and material handling applications, while 70 MPa is the standard for consumer FCEVs seeking maximum range. The future growth is expected to be diversified, ensuring resilience against slowdowns in any single end-use market.

- By Type:

- Type III (Aluminum Liner, Carbon Fiber Hoop Wrap)

- Type IV (Plastic Liner, Full Carbon Fiber Wrap)

- Type V (Linerless, Pure Composite Structure - Emerging/R&D Phase)

- By Tank Capacity:

- Below 50 Liters

- 50 Liters to 150 Liters

- Above 150 Liters (Includes large cascade cylinders for refueling stations)

- By Working Pressure:

- 35 MPa (350 Bar)

- 70 MPa (700 Bar)

- Other Pressures (e.g., 50 MPa for intermediate industrial transport)

- By Application:

- Mobility/Transportation:

- Passenger Cars (FCEVs)

- Buses and Coaches

- Heavy-Duty Trucks and Commercial Vehicles

- Rail and Marine Vessels

- Aerospace (UAVs, Future Aircraft)

- Stationary Storage:

- Hydrogen Refueling Stations (HRS Cascade Storage)

- Backup Power and Grid Stabilization

- Industrial Storage and Logistics

- Residential and Distributed Energy Storage

- Portable Applications:

- Material Handling Equipment (Forklifts)

- Drones and Aerial Mobility

Value Chain Analysis For Composite Hydrogen Cylinder Market

The value chain of the Composite Hydrogen Cylinder Market is highly complex, beginning with specialized raw material procurement and extending through highly technical manufacturing, distribution, and end-user integration. The upstream segment is dominated by high-cost, high-performance material suppliers, specifically producers of aerospace-grade carbon fiber precursors (polyacrylonitrile - PAN), specialized resins (epoxies), and high-density plastic liners (e.g., HDPE or polyamide). The strong bargaining power of these upstream suppliers significantly influences the final product cost, which is the primary impediment to mass adoption. Optimization efforts in the value chain focus heavily on securing long-term supply agreements and developing automated quality control measures for these critical inputs, ensuring that the high safety requirements are met from the foundation materials onward.

Midstream activities involve the highly capital-intensive manufacturing process, primarily consisting of liner fabrication, automated filament winding (precision application of fiber and resin), curing (heat treatment), and final assembly/testing. This stage requires significant intellectual property and proprietary expertise in winding software and process control to ensure structural integrity and consistent performance under extreme pressure cycles. Due to the high regulatory hurdles (e.g., UN ECE R134, ISO 11439, DOT standards), vertical integration or deep collaborative partnerships between component manufacturers and final cylinder assemblers are common strategies to streamline certification and maintain quality assurance throughout production. Efficient, high-throughput manufacturing is essential to realize cost reduction and meet burgeoning automotive demands.

The downstream segment involves distribution, sales, and post-sales services. Distribution channels are bifurcated: direct sales channels dominate for large-volume OEM procurement (e.g., sales to Toyota, Hyundai, or Nikola for FCEV integration), while indirect channels utilizing specialized industrial distributors and gas handling equipment providers serve the stationary and portable application markets. Post-sales services, including mandatory periodic inspection, repair, and eventual decommissioning/recycling, are becoming increasingly important value-added services. The entire chain is heavily regulated, and direct customer feedback from automotive OEMs regarding integration challenges (e.g., space constraints, thermal management) drives innovation and specification changes back up the chain.

Composite Hydrogen Cylinder Market Potential Customers

Potential customers for composite hydrogen cylinders represent a diverse spectrum of industries unified by the critical need for safe, lightweight, and high-density hydrogen storage. The largest segment of end-users are major automotive manufacturers (OEMs) specializing in Fuel Cell Electric Vehicles (FCEVs), including both passenger cars and the rapidly growing heavy-duty truck and bus sectors. These buyers prioritize cylinders offering 70 MPa working pressure, minimal weight, and high volumetric efficiency, ensuring maximum vehicle range. Their procurement decisions are driven by factors such as proven safety track records, compliance with stringent international vehicular standards, and the manufacturer’s ability to guarantee large-scale, consistent supply under demanding automotive quality controls. Establishing long-term supplier relationships with these global OEMs is crucial for market stability and volume growth.

A secondary, yet significant, customer base comprises operators and developers of hydrogen refueling stations (HRS). These customers require very large capacity composite cylinders, often organized in cascading banks, operating at pressures that allow for rapid and efficient vehicle fueling (e.g., up to 900 bar in the cascade system prior to dispensing). The focus for HRS buyers is on maximum lifetime durability, minimal footprint, and reliable performance under continuous cycling stress, necessitating robust Type III or large Type IV vessels designed specifically for stationary high-pressure storage applications. These buyers often source through specialized engineering, procurement, and construction (EPC) firms involved in energy infrastructure development.

Finally, the market serves diverse industrial and specialized segments. This includes material handling equipment providers (e.g., manufacturers of fuel cell forklifts), logistics companies utilizing hydrogen-powered fleets, and developers in emerging fields such as aerospace (UAVs and future commuter aircraft) and marine transport. For these specialized buyers, the primary purchase driver is customized solutions—cylinders optimized not just for weight, but often for specific, unique spatial constraints and operational environments, such as marine anti-corrosion requirements or aviation safety standards. This diversification of end-users provides stability and resilience to the overall market structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 2,450 Million |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexagon Purus, Toyota (Joint Ventures), Faurecia (FORVIA), Worthington Industries, Luxfer Gas Cylinders, NPROXX, Plastic Omnium, Iljin Hysolus, Quantum Fuel Systems, CIMC Safeway, Time Technoplast, Hanwha Solutions, Beijing Jingcheng Machinery Electric (BJME), Tenaris, Steelhead Composites, Next Hydrogen, Gardner Denver, LGM Engineering, Cylingas, Composite Advanced Technologies (CAT). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Hydrogen Cylinder Market Key Technology Landscape

The Composite Hydrogen Cylinder Market is defined by continuous technological advancement focused on optimizing the material composition, enhancing manufacturing precision, and improving overall safety characteristics, particularly for 70 MPa applications. The core technology centers around advanced fiber winding techniques, primarily wet winding and tow-preg winding. Wet winding involves impregnating dry fibers with resin just before winding, which is cost-effective but requires rigorous control over resin distribution. Tow-preg winding, utilizing pre-impregnated fiber tows, offers superior fiber-to-resin ratio control, resulting in higher mechanical properties and repeatability, crucial for the stringent quality demands of automotive OEMs. Furthermore, research is intensely focused on high-speed winding equipment and robotics to achieve the scale and cost reduction necessary for mass-market FCEV deployment, integrating sensors and real-time monitoring to ensure consistent quality output during the entire production run.

Material science innovation is another critical technological frontier. While carbon fiber dominates the high-pressure segment, efforts are underway to refine the polymeric liner technology used in Type IV cylinders. New liner materials, such as improved grades of polyamide or high-performance plastics, are being developed to reduce hydrogen permeation rates, enhancing storage efficiency and minimizing leakage over the cylinder's service life. Hybrid composite structures, combining layers of carbon fiber with glass fiber or other low-cost structural materials, are being explored to balance performance and cost, particularly for 35 MPa applications or stationary storage systems where weight savings are less critical than overall system economics. These material improvements directly address the market constraint related to the high price point of high-modulus carbon fiber, making hydrogen storage more accessible.

Beyond the core cylinder structure, peripheral technologies such as advanced valve systems and pressure relief devices (PRDs) are integral to overall system safety and performance. Integrated cylinder management systems (CMS), utilizing smart sensors and IoT connectivity, are increasingly being adopted to monitor internal pressure, temperature, and cylinder health throughout the operational cycle. This data connectivity is foundational for enabling predictive maintenance and ensuring immediate safety shut-down capabilities in the event of an anomaly or thermal event. The convergence of hardware innovation (lighter, stronger materials) with software intelligence (CMS and AI-driven quality control) is rapidly defining the competitive technological landscape, moving the industry towards highly reliable, interconnected, and economically viable hydrogen storage solutions suitable for global deployment under various environmental and regulatory regimes.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the composite hydrogen cylinder market, primarily driven by robust government strategies in Japan, South Korea, and China focused on building a large-scale hydrogen economy. Japan and South Korea, having invested heavily in FCEV technology (e.g., Toyota Mirai, Hyundai Nexo), possess mature refueling station networks and mandates promoting hydrogen deployment in transport. China is rapidly scaling up hydrogen bus and heavy-duty truck fleets, creating massive demand for high-capacity, durable Type IV cylinders. The region benefits from established industrial supply chains and proactive regulatory support, positioning it as the epicenter for manufacturing and consumption, though cost remains a factor for achieving full mass market penetration.

- Europe: Europe is characterized by strong regulatory drivers stemming from the European Green Deal and significant funding allocated to hydrogen valley projects across Germany, France, and the Netherlands. The focus here is heavily skewed towards decarbonizing heavy-duty transport, necessitating large-volume 70 MPa storage solutions for long-haul trucks and inland shipping. Strict environmental standards and the push for green hydrogen production accelerate infrastructure development, ensuring steady, high-value demand for certified composite cylinders. Europe's market growth is supported by substantial regional manufacturers and strong collaborations between energy companies and mobility providers.

- North America: The North American market, particularly the United States, is experiencing accelerated growth driven by federal incentives, most notably the Inflation Reduction Act (IRA), which significantly lowers the cost of clean hydrogen production. Demand is concentrated in California (early FCEV adoption) and emerging logistics hubs focused on hydrogen-powered material handling equipment and long-haul trucking. The US market emphasizes robustness and compliance with DOT standards, with increasing investment in establishing domestic carbon fiber and cylinder manufacturing capabilities to secure the supply chain resilience needed for anticipated expansion across multiple states.

- Latin America (LATAM): The Composite Hydrogen Cylinder Market in LATAM is currently nascent but shows potential, tied primarily to pilot projects in Chile and Brazil focusing on green hydrogen production fueled by abundant renewable energy resources (solar, hydro). Initial demand is often industrial or related to niche applications, but large-scale energy transition plans suggest that the need for transportable high-pressure storage for regional distribution and export will increase significantly during the latter half of the forecast period. Investment in local assembly and integration capabilities will be necessary to minimize logistical costs.

- Middle East and Africa (MEA): The MEA region is emerging as a critical global hub for large-scale blue and green hydrogen production and export, particularly in the UAE, Saudi Arabia, and Oman. While domestic consumption for mobility is still developing, the substantial investment in large hydrogen export terminals and industrial applications (e.g., ammonia production) drives demand for large composite storage vessels and transportation cascades. The market here is highly project-driven, with initial focus on stationary and bulk logistics storage requirements rather than passenger vehicle fleets, emphasizing durability in extreme high-temperature environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Hydrogen Cylinder Market.- Hexagon Purus

- Toyota (Joint Ventures)

- Faurecia (FORVIA)

- Worthington Industries

- Luxfer Gas Cylinders

- NPROXX

- Plastic Omnium

- Iljin Hysolus

- Quantum Fuel Systems

- CIMC Safeway

- Time Technoplast

- Hanwha Solutions

- Beijing Jingcheng Machinery Electric (BJME)

- Tenaris

- Steelhead Composites

- Next Hydrogen

- Gardner Denver

- LGM Engineering

- Cylingas

- Composite Advanced Technologies (CAT)

Frequently Asked Questions

Analyze common user questions about the Composite Hydrogen Cylinder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Type IV composite hydrogen cylinders over Type III cylinders?

The primary advantage of Type IV composite cylinders is their superior gravimetric efficiency, meaning they offer significantly reduced weight for the same storage capacity. This is achieved through the use of a lightweight, non-metallic (polymer) liner fully wrapped in carbon fiber, making them ideal for weight-sensitive applications like FCEVs where maximizing vehicle range is crucial.

What pressure ratings dominate the automotive composite hydrogen cylinder market?

The 70 MPa (700 bar) pressure rating dominates the automotive market, particularly for passenger Fuel Cell Electric Vehicles (FCEVs). This high pressure maximizes the density of hydrogen storage, enabling vehicles to achieve competitive driving ranges comparable to gasoline vehicles, which is a key factor for consumer acceptance and widespread adoption.

How significant is the cost of carbon fiber as a restraint in this market?

Carbon fiber cost is the single most significant restraint, often accounting for the majority of the material cost in high-pressure Type IV cylinders. Reducing this cost through material optimization, automated winding techniques, and exploring hybrid composite solutions is essential for achieving the price parity required for high-volume, mass-market deployment.

Which geographical region leads the global demand for composite hydrogen cylinders?

The Asia Pacific (APAC) region currently leads the global market, driven by proactive governmental hydrogen strategies and mature FCEV manufacturing and deployment in countries such as Japan, South Korea, and China. Strong governmental support and established infrastructure projects fuel consistent high-volume demand.

What role does safety certification play in the manufacturing process?

Safety certification is paramount and extremely rigorous for composite hydrogen cylinders, involving extensive burst tests, fire tests, and pressure cycling durability evaluations (e.g., ISO 11439, UN ECE R134). These stringent requirements ensure operational reliability under extreme conditions and necessitate substantial capital investment and long lead times for qualification, acting as a high barrier to entry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager