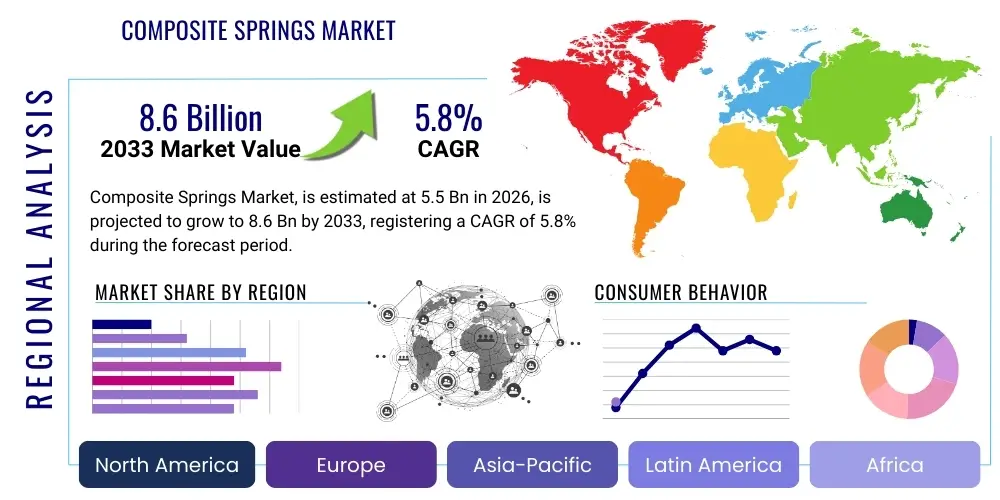

Composite Springs Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441901 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Composite Springs Market Size

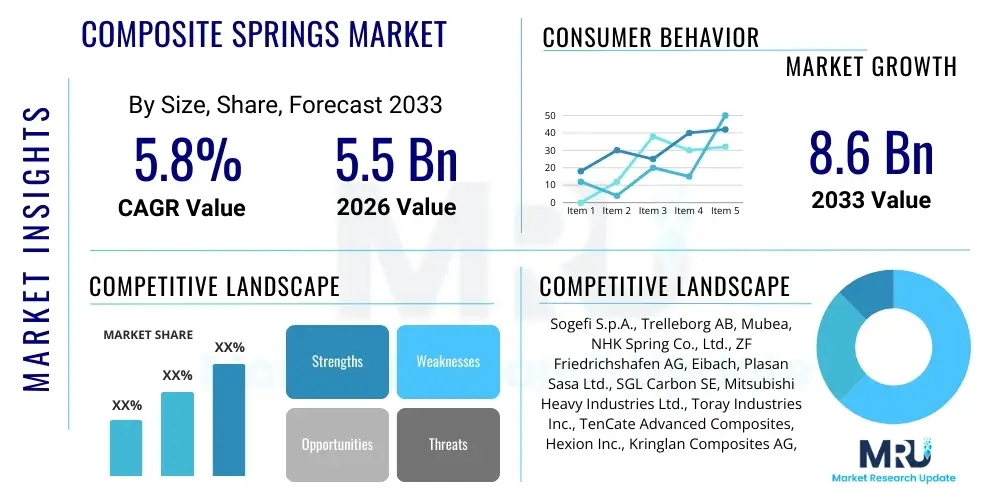

The Composite Springs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily attributed to the increasing demand for lightweight materials in the automotive and aerospace sectors, driven by stringent emission regulations and the continuous pursuit of enhanced fuel efficiency and operational performance across various mobility platforms. The inherent advantages of composite materials, such as superior fatigue resistance and reduced weight compared to traditional metallic springs, solidify their indispensable role in modern engineering applications.

Composite Springs Market introduction

Composite springs represent a paradigm shift in mechanical load-bearing components, utilizing advanced fiber-reinforced polymer (FRP) matrices, such as glass fiber or carbon fiber composites, rather than conventional steel alloys. These materials offer exceptional strength-to-weight ratios, corrosion resistance, and specific damping characteristics, making them highly suitable for demanding applications where weight reduction is critical. The primary applications span across suspension systems in electric and high-performance vehicles, aerospace landing gear components, and specialized industrial machinery requiring non-magnetic or chemically inert spring solutions. The benefits extend beyond mere weight savings, encompassing longer operational lifespan, reduced maintenance requirements, and improved vehicle dynamics due to lower unsprung mass.

Key driving factors propelling the adoption of composite springs include the global push for vehicle electrification, which necessitates significant weight reduction to offset battery mass and extend range. Furthermore, escalating regulatory pressure concerning CO2 emissions compels automotive original equipment manufacturers (OEMs) to explore all viable lightweighting solutions. The technological maturity of automated manufacturing processes, such as filament winding and resin transfer molding (RTM) tailored for high-volume production of composite components, has also lowered production costs and increased the scalability of these advanced spring systems across various platforms. The aerospace sector further contributes to market growth by increasingly specifying composites for primary and secondary structures to optimize flight performance and minimize fuel consumption.

Composite Springs Market Executive Summary

The Composite Springs Market is currently characterized by aggressive technological advancements focused on optimizing material composition and manufacturing efficiency. Business trends indicate a strong move toward strategic partnerships between raw material suppliers, specialized composite fabricators, and tier-one automotive suppliers to streamline the supply chain and accelerate product integration into mass-market platforms. Geographically, Asia Pacific, led by China and India, exhibits the highest growth potential due to rapid industrialization and the massive expansion of the automotive manufacturing base, particularly in the electric vehicle (EV) segment. North America and Europe maintain dominance in terms of technological adoption and value, driven by stringent safety standards and a high proliferation of luxury and performance vehicles utilizing high-end carbon fiber composite springs.

Segment trends reveal that Glass Fiber Reinforced Polymer (GFRP) springs currently hold a significant market share due to their cost-effectiveness and proven reliability in replacing traditional steel leaf springs, especially in commercial vehicles and certain passenger car models. Conversely, the Carbon Fiber Reinforced Polymer (CFRP) segment is projected to witness the fastest growth, primarily fueled by the premium automotive and aerospace industries where maximum weight saving and superior performance characteristics justify the higher material cost. The application segment focused on suspension systems remains the core revenue generator, although the industrial machinery and railway segments are demonstrating increasing demand for composite solutions designed to withstand harsh operating environments and high-frequency cyclical loads. Overall, the market trajectory is irreversibly geared towards lightweighting and efficiency optimization across all major end-use sectors.

AI Impact Analysis on Composite Springs Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Composite Springs Market frequently revolves around optimizing design parameters, predictive maintenance, and quality control during manufacturing. Users seek to understand how AI-driven simulation tools can refine the complex anisotropic material properties of composites to achieve optimal stress distribution and fatigue life, a process traditionally requiring extensive physical prototyping. Furthermore, significant inquiry focuses on leveraging machine learning algorithms within production lines—specifically in processes like pultrusion or filament winding—to monitor variables in real-time, anticipate defects, and maintain tight tolerance levels automatically. The prevailing themes are centered on accelerating the development cycle, enhancing product reliability through superior material predictability, and enabling advanced monitoring capabilities once the composite springs are deployed in operational environments, minimizing unexpected component failure.

AI's primary impact is transforming the simulation and design phase. Integrating sophisticated neural networks with Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) models allows engineers to rapidly evaluate thousands of material layups, fiber orientations, and resin systems under various load cases that mimic real-world scenarios. This drastically reduces the time needed for material certification and component validation, lowering costs associated with physical testing. Generative Design algorithms, powered by AI, are capable of proposing novel spring geometries that are impractical to design using traditional methods, pushing the boundaries of weight reduction while adhering to crucial performance specifications such as stiffness and rebound characteristics. This enhanced computational power allows for the creation of truly bespoke composite spring solutions tailored precisely to platform requirements.

In the manufacturing domain, AI and machine vision systems are critical for maintaining the structural integrity of composite components. These technologies analyze real-time sensor data from curing ovens, winding machines, and robotic placement systems, identifying microscopic anomalies such as voids, inadequate resin impregnation, or misalignment of fiber tow. This proactive quality assurance is essential for high-performance composite springs, where structural weaknesses can lead to catastrophic failure. Additionally, the incorporation of embedded sensors (Smart Composites) combined with predictive maintenance algorithms allows end-users, particularly in critical sectors like aerospace and heavy-duty transport, to monitor the operational health of the springs throughout their lifecycle, scheduling replacements based on actual accumulated stress rather than fixed time intervals, thereby maximizing asset uptime and reducing through-life costs.

- AI-driven Generative Design for lightweight optimization and novel spring geometries.

- Machine Learning integration in FEA for rapid validation of anisotropic material properties.

- Real-time quality control and defect detection during high-volume manufacturing processes (e.g., RTM, Filament Winding).

- Predictive maintenance analytics using sensor data (Smart Composites) to forecast operational fatigue life.

- Optimization of manufacturing parameters (temperature, pressure, curing time) using AI models for enhanced component consistency.

DRO & Impact Forces Of Composite Springs Market

The Composite Springs Market is highly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The paramount Driver is the unrelenting requirement for vehicle lightweighting across the global transportation industry, catalyzed by rigorous environmental mandates (e.g., Euro 7, CAFE standards) and the rising market share of battery electric vehicles (BEVs). The superior resilience and corrosion resistance of composites further drive their substitution for metallic components in severe operating environments. Conversely, major Restraints include the high initial material cost associated with advanced fibers (especially carbon fiber) and the complexity of repairing composite structures compared to steel. Furthermore, manufacturing composite springs often requires specialized, high-capital equipment and highly skilled labor, creating barriers to entry for new players and constraining rapid mass production scaling. These factors necessitate careful economic justification for implementation, particularly in budget-sensitive vehicle segments.

Significant Opportunities arise from the rapidly expanding application scope beyond traditional suspension systems. New designs in railway bogies, high-speed rail, and wind turbine blade components are increasingly incorporating composite spring technology for vibration dampening and structural support. The maturing technology of recycling carbon and glass fibers also presents a long-term opportunity to mitigate environmental concerns and reduce material input costs, thereby enhancing the sustainability profile of composite springs. Additionally, the development of hybrid composite systems, combining different fibers or integrating metallic inserts, provides avenues for cost optimization while retaining core performance benefits. Strategic focus on high-volume, cost-effective manufacturing techniques like continuous compression molding for leaf springs offers the potential to unlock significant economies of scale.

The market is subjected to key Impact Forces that shape its competitive landscape. Porter’s Five Forces analysis indicates a high bargaining power of suppliers, particularly for high-grade carbon fibers, as the supply chain is highly concentrated among a few global chemical entities. The bargaining power of buyers (large automotive OEMs and Tier 1 suppliers) is also substantial, as they demand strict performance standards, competitive pricing, and certified quality management systems. The threat of substitutes, while decreasing due to regulatory pressure favoring lightweighting, remains present in highly optimized steel alloys. However, the threat of new entrants is moderated by the high capital investment required for specialized tooling and process expertise, protecting established manufacturers. Overall, innovation in material science and process engineering acts as the primary force influencing market dominance.

Segmentation Analysis

The Composite Springs Market segmentation provides a granular view of demand distribution across various dimensions, including material composition, application type, end-use industry, and manufacturing process. Understanding these segments is crucial for strategic market positioning and resource allocation, reflecting diverse performance requirements, cost sensitivities, and regulatory landscapes unique to each category. The core materials differentiate products based on strength-to-weight ratio and cost, dictating suitability for performance vs. volume applications. Applications define the functional role, with suspension systems dominating due to the immediate benefits of reduced unsprung mass, which significantly enhances vehicle handling and energy efficiency. End-use categorization highlights the varying demands placed by high-tech industries like aerospace versus high-volume sectors like commercial automotive production.

Further analysis of the segmentation reveals that technological maturity and adoption rates vary significantly. While the automotive sector drives the volume growth, requiring optimized production cycles and cost controls, the aerospace and defense segments demand absolute performance, where material integrity and traceability are non-negotiable, driving higher Average Selling Prices (ASPs). Geographically, manufacturing process capabilities are often concentrated in regions with strong pre-existing composites infrastructure. The detailed segmentation structure enables manufacturers to tailor their product portfolio, supply chain strategy, and go-to-market approach to capture the most lucrative and fastest-growing sub-segments, such as composite coil springs for premium electric vehicles and composite torsion bars for high-performance off-road applications, ensuring targeted and efficient market penetration.

- By Material: Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Hybrid Composites, Aramid Fiber Reinforced Polymer (AFRP).

- By Application: Suspension Systems (Leaf Springs, Coil Springs, Torsion Bars), Engine Components, Interior and Exterior Components, Structural Dampening Systems.

- By End-Use Industry: Automotive (Passenger Vehicles, Commercial Vehicles, Electric Vehicles), Aerospace and Defense, Railway, Industrial Machinery, Construction Equipment.

- By Manufacturing Process: Filament Winding, Resin Transfer Molding (RTM), Pultrusion, Compression Molding, Prepreg Lay-up.

Value Chain Analysis For Composite Springs Market

The Value Chain for the Composite Springs Market begins with the upstream suppliers of raw materials, primarily high-performance fibers (glass, carbon, aramid) and specialty polymer resins (epoxy, vinyl ester, polyurethane). This upstream segment is highly concentrated, characterized by high production complexity and significant capital expenditure, resulting in high supplier bargaining power, particularly for aerospace-grade carbon fiber. Material preparation involves conversion into intermediate forms such as prepregs, towpreg, or specialized fiber bundles required for automated processes. Critical upstream activities focus on material qualification, chemical compatibility testing, and ensuring consistent fiber architecture and resin quality, as these factors directly impact the final spring performance characteristics and longevity.

The midstream comprises the core composite spring manufacturing processes, utilizing sophisticated techniques such as automated filament winding for coil springs, pultrusion for leaf springs, and Resin Transfer Molding (RTM) for complex shapes. Manufacturers invest heavily in automated machinery and quality assurance systems, including non-destructive testing (NDT), to meet stringent OEM standards. Downstream activities involve distribution channels, which are typically highly specialized. Direct distribution is common for large-volume customers like automotive OEMs, involving long-term supply contracts and just-in-time delivery systems. Indirect distribution through specialized aftermarket component distributors serves the replacement market and smaller industrial users, providing necessary inventory management and technical support.

The distribution channel landscape is bifurcated into OEM supply and the aftermarket. The OEM channel demands rigorous technical validation, multi-year certification processes, and highly optimized logistics. The aftermarket focuses more on accessibility, competitive pricing, and availability for repair and upgrade purposes. The inherent durability of composite springs means the aftermarket demand for replacement components is generally lower than for metallic counterparts, emphasizing the importance of securing initial large-scale OEM integration contracts. Successful value chain management requires vertical integration or strong collaborative agreements to control material quality, streamline manufacturing efficiency, and ensure seamless delivery to highly demanding global customers.

Composite Springs Market Potential Customers

The primary consumers and end-users of composite springs are large-scale Original Equipment Manufacturers (OEMs) operating within sectors where weight reduction and high performance are mandatory prerequisites for product competitiveness and regulatory compliance. The automotive industry represents the largest buyer segment, encompassing passenger vehicle manufacturers (especially high-end, sports car, and electric vehicle divisions), commercial vehicle producers (trucks, buses, trailers), and specialty vehicle builders seeking to optimize suspension performance and increase payload capacity. These customers purchase composite springs in massive volumes, often necessitating dedicated manufacturing lines and strict supply agreements to meet continuous demand cycles. The decision-making process for these customers is driven by life cycle cost analysis, performance validation, and supplier capacity/reliability.

Beyond automotive, the aerospace and defense industry represents a critical segment, demanding extremely high-specification, low-tolerance components for landing gear assemblies, primary structures, and internal vibration isolation systems. Aerospace customers prioritize material traceability, minimal maintenance overhead, and compliance with rigorous flight safety standards, willingly absorbing higher component costs for validated performance gains. The railway sector is also emerging as a significant potential customer base, utilizing composite springs in bogie suspension systems to reduce track wear, improve energy efficiency, and enhance passenger comfort in high-speed and metropolitan rail networks. These customers seek robust, long-lasting solutions capable of withstanding constant, high-amplitude cyclic loading under harsh environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sogefi S.p.A., Trelleborg AB, Mubea, NHK Spring Co., Ltd., ZF Friedrichshafen AG, Eibach, Plasan Sasa Ltd., SGL Carbon SE, Mitsubishi Heavy Industries Ltd., Toray Industries Inc., TenCate Advanced Composites, Hexion Inc., Kringlan Composites AG, Liteflex LLC, Rassini, Multimatic Inc., Benteler International AG, Owen Springs Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Springs Market Key Technology Landscape

The technological landscape of the Composite Springs Market is characterized by a focus on enhancing manufacturing scalability, reducing production cycles, and optimizing material performance through advanced processing techniques. Filament winding remains a cornerstone technology, particularly for producing composite coil springs and torsion bars, enabling precise control over fiber orientation to maximize strength in multi-axial loading conditions. Modern winding systems integrate advanced robotics and real-time tension control to ensure consistent impregnation and void reduction, critical for achieving aerospace-grade reliability. Furthermore, high-pressure Resin Transfer Molding (HP-RTM) is increasingly utilized, offering the capability to manufacture complex, near-net-shape components quickly and with minimal material waste, proving highly effective for mass production automotive leaf springs and specialized structural mounts.

Pultrusion technology, traditionally used for producing constant cross-section profiles, has been adapted to create curved composite leaf springs through specialized tooling and curing methods. This innovation allows for continuous, high-volume production of geometrically demanding springs, significantly lowering the per-unit cost compared to manual layup processes. Alongside manufacturing advancements, material technology is evolving rapidly. The emergence of nano-structured polymer resins, designed to improve the matrix toughness and resistance to micro-cracking, is enhancing the overall durability and fatigue life of composite springs. Research and development are also focused on developing thermoplastic matrix composites, which offer advantages in faster cycle times, weldability, and improved end-of-life recycling potential compared to traditional thermoset systems.

Furthermore, digital twin technology and integrated simulation platforms are central to the current R&D efforts. These platforms allow manufacturers to simulate the entire life cycle of a spring, from fiber deposition to end-use load conditions, identifying potential failure points virtually before committing to physical prototypes. The integration of sensors into the composite structure, known as 'smart springs,' represents another key technological frontier. These integrated sensors monitor strain, temperature, and damage accumulation in real-time, providing actionable data for fleet managers and enabling advanced condition-based monitoring, which is particularly valuable in high-stakes environments such as rail transport and aerospace applications.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing region in the Composite Springs Market, driven primarily by the massive automotive industry in China, India, and Japan. China’s aggressive policy push towards electrification and the sheer volume of passenger and commercial vehicle production creates unparalleled demand for lightweight components. Manufacturers in this region benefit from robust governmental support for advanced material science and rapidly expanding domestic supply chains, making it a critical hub for both GFRP and CFRP spring manufacturing focused on scalability and cost optimization.

- Europe: Europe is a dominant region in terms of technology adoption and high-value composite spring applications. Stringent EU emission regulations necessitate widespread lightweighting across vehicle fleets, driving high penetration in premium and performance car segments. Germany, France, and the UK lead in advanced R&D, focusing on sophisticated manufacturing processes like RTM and advanced simulation tools. The high concentration of high-end automotive OEMs and the burgeoning railway infrastructure upgrade projects ensure sustained demand for high-performance composite suspension and structural components.

- North America: North America demonstrates strong market maturity, especially in the utilization of composite springs within the heavy-duty commercial vehicle (CV) segment and the domestic aerospace and defense sectors. The need to improve fuel economy in long-haul trucking and the constant pursuit of payload optimization drives the adoption of composite leaf springs. The region is also characterized by significant investment in R&D into advanced composite material development, often collaborating closely with key universities and government defense contractors to pioneer next-generation spring systems.

- Latin America & Middle East/Africa (LAMEA): LAMEA currently holds a smaller, yet emerging, share of the global market. Growth is primarily observed in infrastructure projects (railway expansion) and the gradual adoption of composite springs by regional automotive assembly plants aiming to meet modern efficiency standards. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows increasing interest in composite materials for high-temperature and highly corrosive environments, creating niche market opportunities for specialized, corrosion-resistant composite springs in oil, gas, and utility applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Springs Market.- Sogefi S.p.A.

- Trelleborg AB

- Mubea (Muhr und Bender KG)

- NHK Spring Co., Ltd.

- ZF Friedrichshafen AG

- Eibach

- Plasan Sasa Ltd.

- SGL Carbon SE

- Mitsubishi Heavy Industries Ltd.

- Toray Industries Inc.

- TenCate Advanced Composites (Toray)

- Hexion Inc.

- Kringlan Composites AG

- Liteflex LLC

- Rassini

- Multimatic Inc.

- Benteler International AG

- Owen Springs Ltd.

Frequently Asked Questions

Analyze common user questions about the Composite Springs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of composite springs over traditional steel springs?

The paramount advantage is weight reduction, typically 40% to 70% lighter than steel equivalents, which significantly reduces unsprung mass. This improves vehicle handling, fuel efficiency, and extends the driving range of electric vehicles. Composite springs also exhibit excellent corrosion resistance and superior fatigue life.

Which material segment holds the largest share in the Composite Springs Market?

The Glass Fiber Reinforced Polymer (GFRP) segment generally holds the largest market volume share due to its cost-effectiveness and proven ability to replace steel leaf springs in high-volume commercial and passenger vehicle applications. However, Carbon Fiber Reinforced Polymer (CFRP) is the fastest-growing segment by value.

How do stringent emission regulations influence the demand for composite springs?

Emission regulations, such as CAFE standards and Euro norms, force automotive manufacturers to reduce vehicle mass to meet fuel economy and CO2 reduction targets. Since composite springs offer substantial lightweighting, they are integral to compliance strategies, directly boosting demand in the automotive sector.

What are the main manufacturing processes used for composite springs?

The key manufacturing processes are Filament Winding (for coil and torsion springs), Pultrusion (for leaf springs), and Resin Transfer Molding (RTM). These processes are favored because they allow for precise fiber orientation and enable high-volume, automated production necessary for mass-market integration.

Where is the highest growth potential for composite spring adoption geographically?

Asia Pacific (APAC), particularly driven by China's aggressive investment in the electric vehicle (EV) sector and overall automotive expansion, exhibits the highest growth potential. This growth is supported by large manufacturing capacities and governmental incentives favoring advanced material adoption.

The Composite Springs Market is undergoing a fundamental transformation, propelled by the intersection of environmental mandates, technological sophistication, and the relentless pursuit of operational efficiency across vital industries. The market's structural integrity is reinforced by the superior material characteristics of advanced composites, which are now seamlessly integrated into scalable manufacturing workflows.

The shift towards electrification in the global automotive industry serves as a foundational growth engine, driving component suppliers to innovate continuously and meet demanding performance metrics while aggressively managing cost structures. Furthermore, the burgeoning demand from specialized sectors, notably aerospace and railway engineering, validates the technological maturity of composite spring solutions beyond conventional automotive applications. This diversification of end-use industries ensures market resilience and provides strategic buffers against cyclical downturns in any single sector. Effective market penetration in the coming years will be highly dependent on manufacturers' abilities to reduce the perceived cost premium of composite materials, primarily through process optimization, enhanced automation, and the establishment of robust, cost-effective recycling pathways.

Looking forward, the integration of Artificial Intelligence and advanced sensing capabilities (Smart Composites) is poised to unlock the next level of performance and reliability, moving the market beyond static component substitution to dynamic, intelligently managed systems. These technological advancements will further solidify the long-term viability and indispensable nature of composite springs in high-performance mechanical systems, contributing substantially to global efforts in sustainability and efficiency improvement. Strategic investments in localized manufacturing hubs, especially within high-growth regions like APAC, coupled with vertical integration efforts to secure critical raw material supplies, will define market leadership in the forecast period extending to 2033.

The established market leaders are prioritizing investment in automated production technologies, such as advanced filament winding and HP-RTM systems, to bridge the current gap between the high performance of composite springs and the cost sensitivity of mass-market platforms. Concurrently, product development efforts are concentrated on hybrid solutions that leverage the best characteristics of both carbon and glass fibers, providing tailored stiffness and damping characteristics while managing raw material expenses. The regulatory environment acts as a consistent tailwind, guaranteeing that lightweighting remains a mandatory strategic priority for all major transportation OEMs, thereby sustaining the robust Compound Annual Growth Rate projected for the Composite Springs Market.

The complexity associated with material science and process engineering necessitates strong intellectual property protection and deep collaboration between material suppliers, Tier 1 manufacturers, and academic research institutions. The market’s continuous evolution demands a proactive stance on addressing recyclability challenges and ensuring the sustainability of composite materials throughout their life cycle, especially given the global focus on circular economy principles. As production volumes increase and technological maturity improves, composite springs are set to become the standard rather than the exception in critical structural applications where dynamic performance, longevity, and mass efficiency are non-negotiable design parameters, fundamentally altering the traditional mechanical component landscape.

Geographical expansion into emerging economies also presents opportunities for manufacturers capable of offering modular and scalable composite spring solutions suitable for diverse infrastructural needs, ranging from new railway networks to localized electric vehicle platforms. Successfully navigating the high initial capital outlay for specialized tooling and mastering the complex quality assurance requirements for high-stress components will be the defining factors separating market leaders from competitors. The total addressable market for composite springs is expected to expand significantly as confidence in their long-term durability grows, driving further displacement of conventional steel-based systems across a broader spectrum of industrial and mobility applications.

The detailed market analysis confirms that the growth trajectory is strong and fundamentally linked to megatrends in sustainability, urbanization, and industrial automation. While material cost volatility remains a key restraint, continuous innovation in resin chemistry and fiber manufacturing techniques promises incremental cost reduction and performance enhancements. The structural market advantages, including superior specific strength and resilience against environmental degradation, underpin the confident forecast for the Composite Springs Market to achieve robust value growth through the year 2033.

Further strategic considerations highlight the importance of supply chain resilience, especially given the global dynamics affecting raw fiber supply. Companies that establish diversified sourcing strategies and invest in localized material processing capabilities will mitigate geopolitical risks and ensure stable production schedules. Moreover, market entrants often focus on niche, high-performance applications (e.g., motorsport, specialized defense) to build credibility and technical expertise before scaling up for the mass market. This tiered approach to market entry demonstrates the high technical barriers present, yet confirms the long-term profitability potential once scale and trust are achieved among major OEM buyers.

The final crucial element sustaining the market's high growth is the continuous improvement in component life prediction through advanced non-destructive testing (NDT) methodologies, such as ultrasonic evaluation and X-ray computed tomography. These technologies provide the necessary validation and safety guarantees demanded by regulated industries like aerospace and automotive, assuring end-users of the structural integrity and reliability of the composite springs throughout their operational lifespan. This emphasis on quality assurance, alongside the core benefits of lightweighting, assures the market's positive outlook.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager