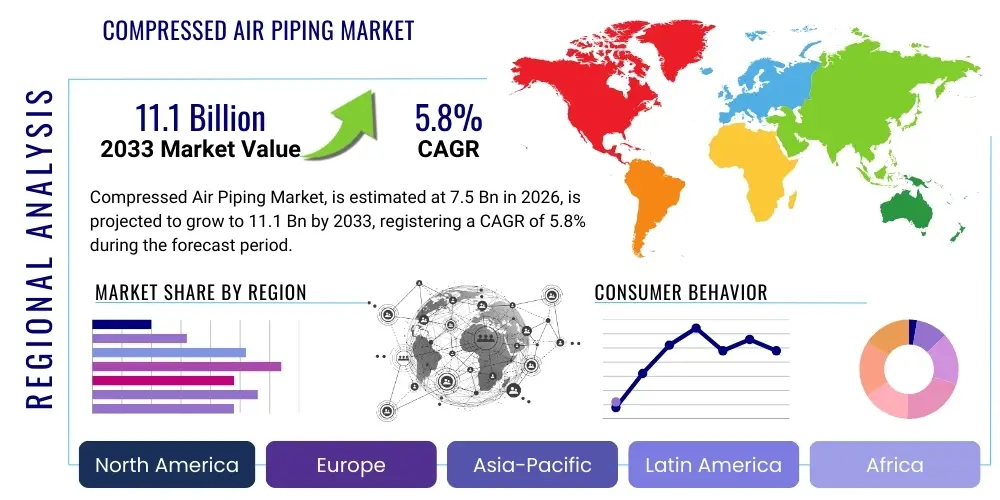

Compressed Air Piping Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441840 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Compressed Air Piping Market Size

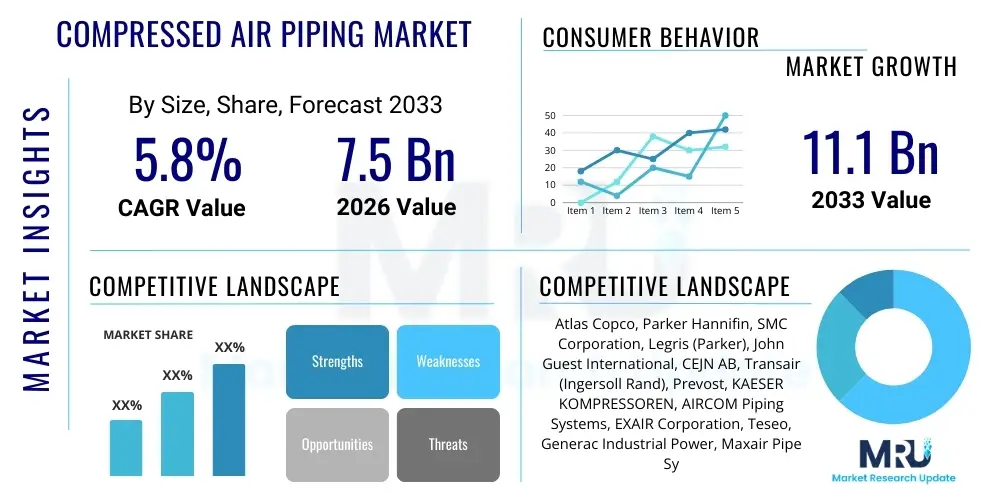

The Compressed Air Piping Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating pace of global industrialization, coupled with stringent regulatory requirements emphasizing energy conservation and reduced operational expenditures within manufacturing facilities across sectors such as automotive, aerospace, and general fabrication.

The market valuation reflects a significant shift toward higher-efficiency piping materials, particularly aluminum and specialized polymers, replacing traditional steel systems that are prone to corrosion and high levels of frictional pressure loss. Investment in new, large-scale industrial projects, especially in emerging economies of the Asia Pacific region, fuels the demand for extensive, high-performance piping networks. Furthermore, the necessity for system reliability and the integration of IoT-enabled sensors within piping infrastructure to monitor flow and detect leaks in real-time contribute substantially to the upward market trajectory, positioning compressed air piping as a critical component of modern factory automation.

Compressed Air Piping Market introduction

The Compressed Air Piping Market encompasses the manufacturing, distribution, and installation of specialized systems designed to deliver compressed air efficiently and reliably from the compressor to the point of use within industrial and commercial settings. Key products include pipes, fittings, valves, manifolds, and couplers, fabricated from materials such as aluminum, stainless steel, copper, and various plastic composites like HDPE and nylon. These systems are crucial for maintaining air quality, minimizing pressure drop, and preventing costly leaks, which can account for significant energy waste in manufacturing operations. Modern systems emphasize modularity and ease of assembly to reduce downtime and installation costs, catering to dynamic industrial environments that require frequent layout changes.

Major applications of compressed air piping span across a broad spectrum of heavy and light industries. The automotive sector relies heavily on compressed air for assembly line tools, paint applications, and robotic operations. General manufacturing utilizes these systems for pneumatic tools, material handling, and control actuators. Furthermore, sectors requiring high purity air, such as pharmaceuticals, food and beverage processing, and electronics manufacturing, drive demand for specialized piping materials like stainless steel or FDA-approved polymers that prevent contamination and ensure product integrity. The selection of the appropriate piping material and system architecture is paramount, depending on the required pressure, air quality standards, and environmental conditions of the facility.

The primary driving factors sustaining market growth include the global trend toward automation and increased production capacity in manufacturing hubs worldwide. Furthermore, legislative and corporate focus on energy efficiency is a powerful driver; leaky or corroded piping systems waste vast amounts of energy, making investment in high-performance, leak-proof aluminum or polymer piping a critical strategy for reducing utility costs. The shift away from traditional, heavy, welded steel systems towards lightweight, quick-connect modular systems enhances installation speed and flexibility, offering tangible benefits that solidify the market's forward momentum. The inherent simplicity and reliability of pneumatic power ensure the continuous relevance of compressed air infrastructure.

Compressed Air Piping Market Executive Summary

The Compressed Air Piping Market is currently characterized by several pivotal business trends, notably the increasing adoption of lightweight materials and modular connectivity solutions. Manufacturers are focusing heavily on developing quick-assembly systems, primarily using extruded aluminum alloys, which significantly reduce installation time and labor costs compared to traditional threaded or welded steel installations. This modular trend supports the industry's need for flexibility, enabling rapid expansion or reconfiguration of air systems to match evolving production requirements. Furthermore, smart manufacturing initiatives are driving the integration of IoT sensors into piping networks, allowing for continuous remote monitoring of system performance, temperature, and pressure fluctuations, thereby facilitating predictive maintenance and maximizing energy efficiency across the enterprise.

Regionally, the market dynamics are dominated by the Asia Pacific (APAC) region, primarily due to the rapid expansion of manufacturing capabilities in China, India, and Southeast Asian nations, alongside massive investments in automotive and electronics production infrastructure. North America and Europe, while mature markets, are experiencing strong growth driven by retrofitting older, inefficient piping systems. Stricter environmental regulations in Western economies necessitate replacing galvanized steel pipes—which often cause corrosion and lead to system contamination and energy waste—with modern, non-corrosive alternatives, ensuring consistent demand for replacement and upgrade projects.

Segment trends highlight the dominance of aluminum piping due to its ideal combination of strength, lightweight properties, non-corrosive nature, and affordability compared to stainless steel. The end-user segment is highly diversified, with the general manufacturing and automotive sectors maintaining the largest market shares, followed by the capital-intensive aerospace and highly regulated food and beverage industries. High-pressure applications, though constituting a smaller volume share, represent a significant value segment due to the requirement for specialized, highly durable materials and robust connection systems, ensuring safety and integrity under extreme operational stress.

AI Impact Analysis on Compressed Air Piping Market

User queries regarding AI's impact on compressed air piping primarily revolve around achieving maximum operational efficiency, specifically focusing on predictive leak detection, energy consumption optimization, and automated system design validation. Users are keen to understand how AI algorithms can move beyond simple threshold monitoring to predict potential system failures, such as pipe stress or coupling degradation, before they occur. A core concern is the integration complexity and the return on investment (ROI) associated with deploying AI-driven monitoring systems across large, existing piping infrastructures. The key expectation is that AI will transform compressed air systems from static infrastructure into dynamic, self-optimizing energy networks, minimizing the substantial energy losses typically associated with leaks.

The application of Artificial Intelligence within the compressed air piping market is focused primarily on enhancing operational sustainability and reducing total ownership costs. AI-powered software analyzes massive datasets—including pressure, flow rate, ambient temperature, humidity, and machine uptime—to create highly accurate models of system performance. These models can identify subtle anomalies indicative of emerging leaks, inefficient compressor cycling, or pressure drops caused by internal corrosion buildup, far earlier than traditional monitoring methods. This transition to predictive maintenance extends the lifespan of both the piping and the associated compression equipment, optimizing scheduled maintenance windows and minimizing unplanned outages critical for continuous production environments.

Furthermore, AI algorithms are being employed during the initial design and installation phases of compressed air systems. Using digital twins and simulation environments, AI can rapidly evaluate thousands of piping layouts, selecting the most energy-efficient configuration that minimizes total pipe run, elbows, and connections, thereby drastically reducing the potential for frictional losses and future leak points. This intelligent design phase ensures that capital expenditure is optimized for maximum long-term energy savings, establishing AI as a foundational tool for designing future-proof, high-efficiency pneumatic networks, moving the industry standard toward zero leakage tolerances.

- AI-driven predictive maintenance modeling minimizes unexpected system failures and maximizes operational uptime.

- Optimization of compressor cycling and energy consumption based on real-time demand forecasting.

- Automated detection and localization of micro-leaks using acoustic and pressure data analysis.

- AI-assisted layout design for new installations, ensuring minimal pressure drop and material usage.

- Real-time material degradation assessment, forecasting corrosion rates in traditional systems.

- Integration with Digital Twin technology for comprehensive virtual system performance simulation.

DRO & Impact Forces Of Compressed Air Piping Market

The market is significantly propelled by the confluence of strict industrial regulations demanding energy efficiency and the rising global operational costs, forcing manufacturers to invest in leak-proof, low-maintenance piping solutions. The necessity to adhere to international standards (e.g., ISO 50001 for Energy Management) directly drives the replacement of obsolete, inefficient piping with modern, lightweight materials like aluminum. Conversely, the market faces restraints primarily due to the high initial capital investment required for installing advanced, modular piping systems, which can be prohibitive for smaller enterprises or facilities with restricted budget allocations. Furthermore, the specialized knowledge required for correct installation and maintenance of complex piping matrices poses a challenge in regions lacking adequately trained technical personnel.

Opportunities for market expansion are vast, particularly within the integration of Internet of Things (IoT) sensors and smart monitoring capabilities into piping infrastructure. This integration allows for unprecedented levels of data collection and analysis, enabling proactive system management and remote diagnostics, thus creating a high-value service market segment. The growing trend toward green manufacturing and sustainable industrial practices also creates significant avenues for specialized, recyclable materials and energy-optimized system components. The shift in global manufacturing supply chains necessitates flexible, easily reconfigurable piping systems, further accelerating the adoption of modular connection technologies designed for rapid scalability.

Key impact forces shaping the market include competitive pricing strategies among material manufacturers (e.g., aluminum vs. polymer producers), the regulatory pressure concerning workplace safety and environmental compliance, and the overarching macroeconomic trend toward industrial automation. The continuous evolution of quick-connect fitting technology impacts adoption rates, as ease of installation becomes a critical differentiator. Moreover, the increasing demand for high-purity air in niche markets (e.g., semiconductors, medical devices) forces innovation in piping materials and filtration systems, driving premium pricing and technological advancement within specific high-specification segments of the market.

Segmentation Analysis

The Compressed Air Piping Market is extensively segmented based on material type, pressure range, end-user industry, and product component. Material segmentation is crucial, differentiating between traditional metals (steel, copper) and modern lightweight options (aluminum, polymers/plastics like HDPE and ABS). Aluminum dominates in general manufacturing due to its corrosion resistance and lightweight handling, while stainless steel remains essential for high-purity environments. Pressure range segmentation divides the market into low, medium, and high-pressure systems, with high-pressure applications demanding specialized, robust, and often custom-engineered solutions due to inherent safety requirements.

End-user industry segmentation reveals the market’s primary demand centers, with the automotive, general manufacturing, and textile industries driving volume demand, utilizing compressed air for tools and automation. Conversely, pharmaceutical, food and beverage, and electronics industries focus intensely on air quality, driving demand for specific non-contaminating materials and robust filtration systems. Product component segmentation covers the entire system architecture, including pipes, fittings (couplings, elbows, tees), valves, and air treatment accessories, with fittings and connectors forming a critical segment due to their direct impact on system leak integrity and ease of modification.

- By Material:

- Aluminum

- Stainless Steel

- Copper

- Plastics (HDPE, ABS, PVC, PEX)

- Galvanized Steel

- By Pressure Range:

- Low Pressure (Up to 150 psi)

- Medium Pressure (150 psi to 500 psi)

- High Pressure (Above 500 psi)

- By End-User Industry:

- Automotive

- General Manufacturing & Fabrication

- Food & Beverage

- Pharmaceutical & Biotechnology

- Aerospace & Defense

- Textiles

- Oil & Gas

- By Component:

- Pipes/Tubes

- Fittings & Connectors

- Valves & Regulators

- Filtration & Air Treatment Equipment

Value Chain Analysis For Compressed Air Piping Market

The value chain for the Compressed Air Piping Market begins with upstream activities involving the extraction and processing of raw materials, primarily focusing on aluminum billet production, steel manufacturing, and polymer resin synthesis. These raw materials undergo specialized fabrication processes where manufacturers transform them into pipes, tubes, and precision-engineered fittings using extrusion, casting, and machining. Quality control is paramount at this stage, focusing on material traceability, dimensional accuracy, and ensuring internal surface finishes meet air quality requirements, particularly for high-purity applications. Upstream efficiency and stable pricing of metals like aluminum directly influence the final cost structure of the piping systems.

Midstream activities involve the primary manufacturing and assembly of piping components, followed by branding, packaging, and inventory management. The distribution channel is bifurcated into direct sales and indirect channels. Direct sales are typically used for large-scale, complex industrial projects where manufacturers provide engineering consultation and installation supervision directly to the end-user (e.g., new automotive plant construction). This channel focuses on high-value contracts and tailored solutions, often involving customized system designs and proprietary fittings.

The downstream segment is dominated by indirect distribution through specialized industrial supply distributors, wholesalers, and third-party certified installers. These intermediaries manage localized inventory, provide technical support, and offer rapid supply for maintenance, repair, and operational (MRO) activities. The aftermarket segment, supported heavily by distributors, is crucial for growth, encompassing replacement fittings, leak detection services, and system expansion kits. The final stage involves installation and continuous maintenance services provided by certified technicians, which are essential for guaranteeing system integrity, leak prevention, and optimal energy efficiency for the end-user.

Compressed Air Piping Market Potential Customers

The core customer base for compressed air piping systems consists of large-scale industrial facilities that rely heavily on pneumatic power for continuous, high-volume production. The automotive manufacturing sector is a primary purchaser, utilizing extensive piping networks for assembly tools, robotic welders, and crucial paint booths where air quality and pressure stability are non-negotiable for product quality. Similarly, major players in the general fabrication and machinery manufacturing industries require reliable, high-flow systems to power heavy-duty pneumatic tooling and control systems used across multiple production lines, prioritizing materials that offer durability and minimal pressure loss over long distances.

Another significant segment comprises industries with stringent regulatory requirements concerning hygiene and contamination control, namely the food and beverage and pharmaceutical sectors. These customers require non-corrosive materials like stainless steel or specialized FDA-approved polymers to prevent any risk of oil residue, rust, or microbial contamination entering the air stream used in direct contact processes or packaging. For these buyers, the total cost of ownership is often secondary to compliance and ensuring product safety, leading to demand for premium, certified piping solutions and advanced air filtration systems integrated directly into the network architecture.

Smaller commercial and specialized industrial customers, such as printing facilities, furniture manufacturers, and independent workshops, also constitute a substantial volume of the market, albeit focusing on smaller-diameter systems. These buyers typically prioritize ease of installation and cost-effectiveness, making modular plastic and small-diameter aluminum systems highly appealing. The recurring need for system expansion or modification within these dynamic businesses ensures continuous demand for fittings and MRO components, supported largely by the indirect distribution network of local industrial suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Parker Hannifin, SMC Corporation, Legris (Parker), John Guest International, CEJN AB, Transair (Ingersoll Rand), Prevost, KAESER KOMPRESSOREN, AIRCOM Piping Systems, EXAIR Corporation, Teseo, Generac Industrial Power, Maxair Pipe Systems, Aluminum Air Pipe Systems (AAPS), Aignep S.p.A., Unipipe, Allied Group, Airpipe, Duratec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compressed Air Piping Market Key Technology Landscape

The technology landscape of the compressed air piping market is rapidly evolving, driven primarily by the pursuit of minimizing system leaks and maximizing energy throughput. A fundamental technological shift involves the transition from traditional heavy metallic piping (requiring welding or extensive threading) to quick-connect, modular piping systems, predominantly made from extruded aluminum or advanced polymer composites. These modern systems utilize specialized O-rings and push-to-connect or press-fit technologies, ensuring a leak-proof seal without the need for specialized welding or sealing compounds, drastically reducing installation time and complexity while allowing for easy disassembly and reuse during facility modifications.

Another critical technology area is the widespread integration of smart monitoring and sensor technology into the piping network itself—a key element of Industry 4.0 adoption. Flow meters, pressure transducers, and temperature sensors are being incorporated directly into critical points of the system to gather real-time data on air usage and pressure drop. This data feeds into centralized management systems that use proprietary algorithms (often cloud-based) to identify energy waste patterns, pinpoint the exact location of pressure leaks through acoustic analysis, and optimize compressor operation cycles based on instantaneous demand rather than fixed schedules, thereby transforming system maintenance from reactive to predictive.

Furthermore, material science continues to play a vital role, particularly in developing internal pipe coatings and surface treatments that minimize friction, reducing the energy required to move air through the system over long distances. Innovations in polymer formulations have created lightweight, high-pressure rated plastic alternatives that are chemically inert and ideal for applications sensitive to moisture or oil contamination. The standardization of fitting sizes and modular components across various materials (aluminum to polymer transitions) also represents a significant technological advancement, promoting interoperability and simplifying the design and execution of hybrid piping solutions tailored to diverse operational needs within a single facility.

Regional Highlights

The Asia Pacific (APAC) region stands out as the dominant and fastest-growing market for compressed air piping. This growth is directly attributable to the mass industrialization occurring in China, India, South Korea, and Southeast Asian nations, characterized by massive greenfield manufacturing investments, particularly in automotive, electronics, and heavy machinery production. Government policies supporting rapid infrastructure development and the relocation of global manufacturing supply chains to this region ensure sustained high demand for both new installations and system expansions, driving volume sales for aluminum and plastic piping materials due to their cost-effectiveness and speed of deployment.

Europe and North America represent mature but highly valuable markets, characterized by stringent environmental regulations and a strong focus on operational efficiency. Growth in these regions is primarily driven by the replacement and upgrading of legacy galvanized steel and copper systems. European facilities are mandated by energy efficiency directives to aggressively minimize air leakage, fueling intense demand for advanced, leak-proof modular systems. North American manufacturers, particularly in the automotive and aerospace sectors, prioritize reliable, high-specification systems that can integrate seamlessly with sophisticated factory automation environments, often leading to higher average selling prices for premium products like stainless steel and high-pressure aluminum systems.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions experiencing moderate growth. LATAM's market is spurred by developing manufacturing bases in countries like Brazil and Mexico, focusing on optimizing existing infrastructure. MEA growth is tied closely to oil and gas extraction projects, petrochemical processing, and rapidly developing construction sectors. While initial purchasing decisions in these regions might be more cost-sensitive, large-scale energy projects demand high-integrity, corrosion-resistant systems, ensuring a steady, albeit segmented, demand for robust piping solutions.

- Asia Pacific (APAC): Market leader driven by rapid greenfield industrial investments, focusing on volume manufacturing across automotive and electronics sectors. Key demand centers include China and India.

- North America: Strong market for high-specification upgrades and retrofitting, emphasizing energy efficiency improvements and advanced IoT integration in mature industrial facilities.

- Europe: Growth propelled by strict energy efficiency legislation (leak reduction), driving high adoption rates for premium, leak-proof aluminum and modular polymer piping systems.

- Latin America (LATAM): Moderate growth supported by growing industrialization and resource sector investments, focused on optimizing existing manufacturing infrastructure.

- Middle East and Africa (MEA): Emerging market primarily driven by large-scale oil and gas, petrochemical, and infrastructure construction projects demanding robust, high-pressure systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compressed Air Piping Market.- Atlas Copco

- Parker Hannifin

- SMC Corporation

- Legris (Parker)

- John Guest International

- CEJN AB

- Transair (Ingersoll Rand)

- Prevost

- KAESER KOMPRESSOREN

- AIRCOM Piping Systems

- EXAIR Corporation

- Teseo S.p.A.

- Generac Industrial Power

- Maxair Pipe Systems

- Aluminum Air Pipe Systems (AAPS)

- Aignep S.p.A.

- Unipipe

- Allied Group

- Airpipe

- Duratec

Frequently Asked Questions

Analyze common user questions about the Compressed Air Piping market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are considered best for modern, energy-efficient compressed air piping systems?

The best modern materials are high-grade extruded aluminum and advanced polymers (like HDPE or nylon). Aluminum is highly favored for industrial applications due to its lightweight nature, excellent corrosion resistance, high flow capacity, and compatibility with quick-connect modular fittings, which drastically minimize the potential for system leaks compared to traditional galvanized steel.

How does compressed air piping contribute to operational energy efficiency in manufacturing?

Efficient compressed air piping contributes significantly by reducing pressure drop and eliminating leaks. Modern, non-corrosive materials and quick-connect systems maintain higher internal pressure over long runs and prevent the common leaks associated with traditional threaded joints, minimizing the load on compressors and directly cutting electricity consumption, which can account for up to 30% of a facility's total energy bill.

What is the primary driver for the adoption of quick-connect fittings over traditional threading?

The primary driver is the reduction in installation time and labor costs, alongside superior leak integrity. Quick-connect systems allow facility maintenance teams to rapidly modify, expand, or repair the piping network without specialized welding or lengthy threading processes, resulting in minimal production downtime and ensuring a consistently leak-proof connection that enhances overall system performance.

Which end-user industries require the highest air purity standards and specialized piping?

The pharmaceutical, biotechnology, food and beverage, and semiconductor industries require the highest air purity standards. These sectors typically demand stainless steel or FDA-approved polymer piping to prevent contamination from oil residue, rust, or particulates, ensuring that compressed air used in critical processes meets strict hygiene and regulatory compliance mandates.

How is IoT technology currently utilized within compressed air piping infrastructure?

IoT technology is utilized through integrated sensors (flow, pressure, temperature) that provide real-time performance data. This data is analyzed by smart management systems to perform predictive maintenance, accurately locate micro-leaks using acoustic signatures, and dynamically optimize compressor operation based on instantaneous pneumatic demand, moving systems toward Industry 4.0 standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager