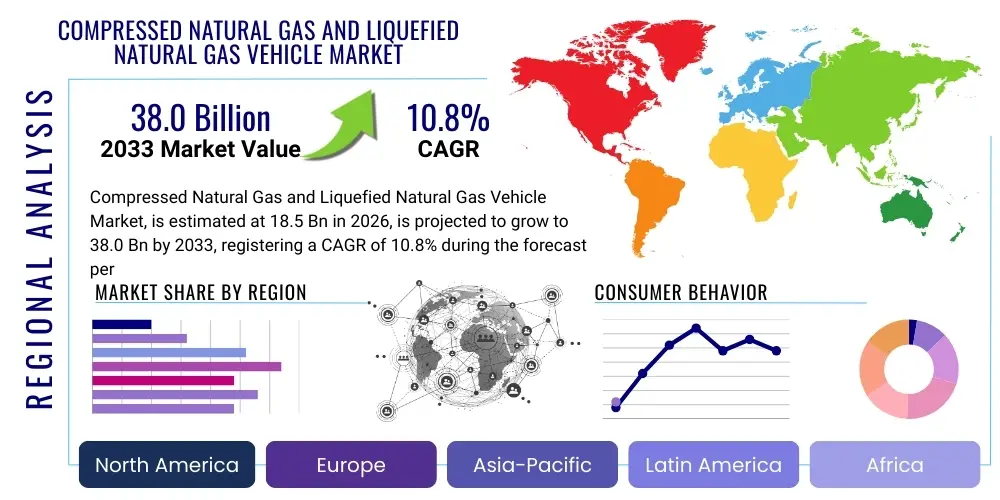

Compressed Natural Gas and Liquefied Natural Gas Vehicle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443552 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Compressed Natural Gas and Liquefied Natural Gas Vehicle Market Size

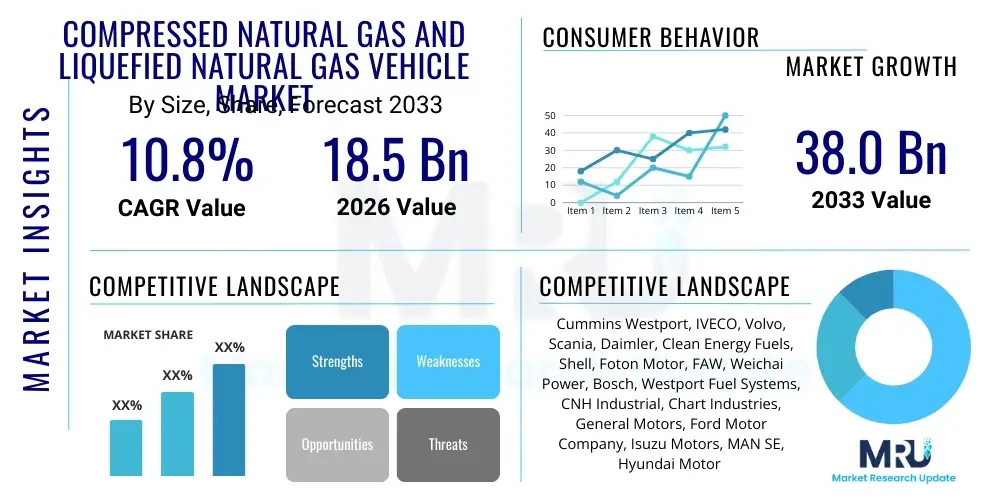

The Compressed Natural Gas and Liquefied Natural Gas Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 38.0 Billion by the end of the forecast period in 2033.

Compressed Natural Gas and Liquefied Natural Gas Vehicle Market introduction

The Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) Vehicle Market encompasses the manufacturing, sales, and deployment of vehicles utilizing natural gas as their primary fuel source. Natural gas vehicles (NGVs) are widely recognized for their lower carbon emissions, particularly reduced particulate matter and nitrogen oxides, compared to traditional gasoline and diesel internal combustion engine vehicles. This market includes diverse vehicle classes, ranging from passenger cars and light-duty commercial vehicles (LDCVs) to heavy-duty trucks (HDTs) and buses, primarily driven by stringent global environmental regulations aimed at mitigating climate change and improving urban air quality. The increasing availability and relatively stable pricing of natural gas, especially in regions with robust shale gas production, further solidify its appeal as a viable transition fuel.

Major applications for CNG and LNG vehicles are concentrated within the commercial logistics and public transportation sectors. LNG, with its higher energy density, is predominantly favored for long-haul heavy-duty trucking, intercity buses, and maritime transport, where range and payload capacity are critical factors. CNG, conversely, is widely adopted for short-haul delivery fleets, city buses, and taxis due to the feasibility of establishing urban refueling infrastructure and lower initial vehicle costs. The dual advantage of NGVs—providing environmental benefits without the range anxiety concerns associated with pure battery electric vehicles (BEVs)—positions them strategically in the contemporary shift toward sustainable mobility solutions, particularly for applications requiring high utilization rates and constant operational availability.

Key driving factors supporting market expansion include significant governmental incentives, such as tax credits and subsidies for NGV adoption and infrastructure development, particularly across Asia Pacific and Europe. Furthermore, corporations are increasingly adopting NGVs to meet their internal sustainability and Environmental, Social, and Governance (ESG) mandates. The technological advancements in natural gas engine efficiency, coupled with improvements in fuel storage technology (like Type IV composite cylinders for CNG), are enhancing the performance and attractiveness of these vehicles, directly addressing historical concerns related to fuel tank size and vehicle weight. The gradual but persistent tightening of emission standards, such as Euro VII and similar regional regulations, serves as a powerful catalyst accelerating the transition from diesel to cleaner alternatives like natural gas.

Compressed Natural Gas and Liquefied Natural Gas Vehicle Market Executive Summary

The Compressed Natural Gas and Liquefied Natural Gas Vehicle Market is poised for substantial growth, driven fundamentally by the imperative for cleaner transportation fuels and supportive government policies globally. Business trends indicate a strong focus on strategic alliances between vehicle Original Equipment Manufacturers (OEMs) and energy providers to expedite the development of integrated vehicle and refueling ecosystems. OEMs are investing heavily in dedicated natural gas engine platforms rather than merely adapting diesel engines, leading to improved fuel efficiency and performance. Furthermore, the rising interest in Renewable Natural Gas (RNG), or biomethane, is elevating the value proposition of NGVs, offering a path to carbon-neutral operations that appeals strongly to logistics companies and municipal fleets seeking immediate decarbonization solutions.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily fueled by massive infrastructure investments in China and India, coupled with rapid urbanization and stringent local air quality standards. Europe demonstrates robust growth, particularly in the LNG segment for heavy transport, where the focus on establishing "Green Corridors" across major transport routes is making LNG a preferred interim solution over diesel. North America, benefiting from abundant, low-cost domestic natural gas supplies, shows steady adoption, particularly in regional haul trucking and municipal sanitation fleets. These regional trends underscore a varied approach, with APAC prioritizing CNG for mass transit and Europe and North America leaning into LNG for heavy-duty freight.

Segment trends reveal that the heavy-duty commercial vehicle category (trucks and buses) represents the largest and fastest-growing segment, largely due to the efficiency benefits of LNG for high mileage operations and the heavy regulatory pressure on diesel emissions in this sector. CNG remains dominant in light-duty commercial and passenger vehicle segments, particularly in high-density urban areas. Fuel storage technology advancements, specifically the proliferation of lighter, safer, and more durable Type III and Type IV composite cylinders, are boosting the effective range and payload capacity of CNG vehicles, thereby expanding their applicability beyond traditional city limits. The market is consolidating around optimized storage and propulsion systems to maximize the practical utility of NGVs across diverse operational requirements.

AI Impact Analysis on Compressed Natural Gas and Liquefied Natural Gas Vehicle Market

User inquiries concerning AI's integration into the CNG and LNG vehicle sector frequently center on how these technologies can overcome existing operational hurdles, specifically related to infrastructure accessibility, vehicle maintenance costs, and fuel consumption optimization. Key questions revolve around predictive maintenance algorithms for complex natural gas systems, optimizing refueling stop locations and timing based on real-time infrastructure status, and integrating AI into fleet management systems to maximize the utilization of NGVs. Users express expectations that AI will significantly reduce the Total Cost of Ownership (TCO) for NGV fleets and improve the reliability of vehicles, thereby making them a more competitive choice against conventional fuels and electric alternatives. The core themes involve predictive efficiency improvements and mitigating infrastructure uncertainty through smart optimization.

Artificial Intelligence is set to revolutionize the efficiency and operational viability of CNG and LNG fleets through advanced data analytics and machine learning. In fleet management, AI algorithms can process vast datasets, including engine performance metrics, driver behavior, and route topography, to generate highly accurate fuel consumption forecasts and route recommendations. This predictive capability ensures optimal use of the natural gas fuel capacity, significantly extending effective range and reducing detours to refueling stations. Furthermore, the integration of AI-driven telematics allows fleet operators to dynamically adjust schedules and load distribution, maximizing logistical efficiency while minimizing emissions, thereby addressing the commercial pressure points faced by transportation providers.

For NGV maintenance, AI’s primary impact is through sophisticated predictive diagnostics. Natural gas engines and high-pressure fuel systems require specialized monitoring. Machine learning models analyze vibrational data, temperature fluctuations, and pressure readings in real-time to anticipate component failures—such as issues with injectors, regulators, or storage tanks—long before they occur. This transition from reactive or scheduled maintenance to predictive maintenance substantially decreases vehicle downtime, lowers repair costs, and enhances vehicle safety and operational reliability. As refueling infrastructure remains a challenge in many nascent NGV markets, AI-powered geo-mapping services can provide real-time status updates on station availability and queuing times, optimizing the refueling network experience for drivers and logistics planners.

- Predictive Maintenance: AI algorithms analyze engine parameters to forecast component failures (e.g., spark plugs, fuel injectors), reducing unexpected downtime and lowering maintenance expenditure.

- Route Optimization: Machine learning determines the most fuel-efficient routes, incorporating factors like traffic, topography, and the location/availability of CNG/LNG stations, maximizing vehicle range.

- Demand Forecasting for Infrastructure: AI assists in planning new refueling station locations by analyzing future fleet adoption rates and logistics demands, leading to optimized capital deployment.

- Fleet Management Automation: Automated scheduling and dispatching, optimizing the use of NGV assets based on real-time operational costs and emission performance targets.

- Emissions Reporting and Compliance: AI models provide granular, auditable data on fuel usage and associated emissions, simplifying compliance reporting for regulatory bodies and internal ESG mandates.

DRO & Impact Forces Of Compressed Natural Gas and Liquefied Natural Gas Vehicle Market

The Compressed Natural Gas and Liquefied Natural Gas Vehicle Market is shaped by a complex interplay of regulatory drivers, economic constraints, and technological opportunities, all mediated by powerful external forces. Key drivers include stringent global mandates forcing the reduction of nitrogen oxides (NOx) and particulate matter (PM), making NGVs an immediate compliance solution, particularly in urban environments. The economic attractiveness of natural gas, often priced lower and experiencing less volatility than diesel or gasoline in specific regions like North America, provides a compelling operational cost advantage for high-mileage commercial fleets. Conversely, the market is restrained by the high initial capital investment required for dedicated NGV fleets and the persistent challenge of establishing a sufficiently widespread and interoperable refueling infrastructure, especially for LNG, which requires complex cryogenic storage.

Significant opportunities are emerging from the push toward Renewable Natural Gas (RNG), derived from waste and biological sources. RNG allows NGV fleets to achieve near-zero carbon intensity, transforming natural gas from a transition fuel into a sustainable, long-term solution. This potential attracts major corporate commitments focused on achieving net-zero goals. Technological progress in high-pressure storage tanks (Type IV composites) and more efficient engine designs further enhance vehicle performance and address range concerns. The impact forces acting upon the market are primarily regulatory and environmental; tightening emissions standards globally, coupled with public pressure for cleaner air in densely populated areas, exert continuous upward pressure on NGV adoption rates. However, fluctuating global energy prices and geopolitical instability affecting natural gas supply chains represent critical external impact forces that can introduce economic uncertainty and potentially restrain growth.

The balance of these forces determines the market trajectory. While regulatory drivers and technological advancements provide a strong foundation for growth, the high initial cost and the slow pace of comprehensive infrastructure deployment in certain geographies remain primary limiting factors. The market’s resilience depends heavily on sustained governmental support—through tax breaks, subsidies, and strategic infrastructure investment—to lower the barriers to entry for commercial users. Furthermore, competition from rapidly evolving battery electric vehicle (BEV) and hydrogen fuel cell electric vehicle (FCEV) technologies, particularly in the heavy-duty sector, acts as a powerful competitive impact force, compelling NGV stakeholders to continually innovate and maximize the environmental benefits and operational TCO advantage of natural gas solutions.

Segmentation Analysis

The Compressed Natural Gas and Liquefied Natural Gas Vehicle Market is fundamentally segmented based on Fuel Type, Vehicle Type, and End-User. Analyzing these segments provides a clear delineation of demand trends and technological specialization across the industry. CNG vehicles dominate in urban logistics and passenger transport due to easier refueling logistics and lower storage costs, appealing primarily to taxis and last-mile delivery fleets. LNG vehicles, demanding sophisticated cryogenic storage, are positioned as the superior solution for long-haul heavy-duty trucking and high-capacity buses, offering significantly improved range necessary for inter-regional transportation corridors. The segmentation underscores the market's adaptability, catering to distinct operational requirements ranging from high-frequency, low-range city driving to intense, high-mileage freight logistics.

- By Fuel Type:

- Compressed Natural Gas (CNG)

- Liquefied Natural Gas (LNG)

- Renewable Natural Gas (RNG/Bio-CNG/Bio-LNG)

- By Vehicle Type:

- Heavy-Duty Vehicles (Trucks > 6t, Buses)

- Medium-Duty Vehicles (Trucks 3.5t–6t)

- Light-Duty Vehicles (Passenger Cars, Vans, Taxis)

- By End-User:

- Commercial Fleet Operators (Logistics, Freight)

- Government & Municipal Fleets (Buses, Sanitation)

- Private Consumers

- Original Equipment Manufacturers (OEMs)

- By Storage Cylinder Type:

- Type I (Steel)

- Type II (Hoop-Wrapped)

- Type III (Fully Wrapped, Aluminum Liner)

- Type IV (Fully Wrapped, Plastic Liner)

Value Chain Analysis For Compressed Natural Gas and Liquefied Natural Gas Vehicle Market

The value chain for the CNG and LNG Vehicle Market begins upstream with the exploration, extraction, and processing of natural gas. This phase involves complex infrastructure, including pipelines and liquefaction plants (for LNG), crucial for preparing the fuel for transport. Key upstream activities also include the production of components necessary for vehicle modification and manufacturing, such as high-pressure valves, cryogenic tanks, and specialized engine components. Efficiency at this stage directly influences the final price and availability of natural gas fuel, making the stability of natural gas producers and refiners a critical factor in market dynamics. The increasing focus on sourcing Renewable Natural Gas (RNG) is adding a new dimension to the upstream segment, involving waste management and biogas refinement companies.

The middle segment of the value chain is dominated by vehicle manufacturing and distribution. This involves OEMs who design and produce dedicated natural gas engines or convert conventional vehicles. Simultaneously, dedicated infrastructure providers handle the creation and maintenance of the widespread refueling network (CNG stations, LNG bunkering facilities). Distribution channels are critical, involving direct sales to large fleet operators, dealer networks for smaller commercial buyers and individual consumers, and specialized channels for public sector procurement (e.g., city bus contracts). The distribution must ensure seamless integration between the vehicle technology and accessible fueling infrastructure, which often requires collaboration between energy companies and vehicle retailers.

Downstream activities center on the end-user operations, maintenance, and fleet management. Direct distribution channels primarily cater to large logistics companies and municipal authorities who purchase vehicles and fuel directly under long-term contracts, benefiting from scale. Indirect distribution includes third-party maintenance providers and financial institutions offering specialized leasing and financing for NGVs. The downstream value is heavily influenced by after-sales service quality, including the availability of specialized technicians trained in NGV maintenance and the continuous optimization of fleet operations through telematics and fuel management systems. Success in the downstream phase relies on minimizing downtime and proving the long-term operational cost advantages of the natural gas fleet.

Compressed Natural Gas and Liquefied Natural Gas Vehicle Market Potential Customers

Potential customers for the Compressed Natural Gas and Liquefied Natural Gas Vehicle Market are primarily high-utilization commercial and public sector entities focused on predictable operational costs and compliance with environmental regulations. The largest segment of end-users consists of commercial fleet operators, including large logistics and trucking companies responsible for long-haul freight (LNG focus) and parcel/last-mile delivery services (CNG focus). These businesses are motivated by the lower price per mile of natural gas compared to diesel and the growing need to satisfy customer demand for sustainable shipping practices, often integrated with corporate ESG policies. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) assessments and the reliability of the refueling infrastructure along key routes.

Another major customer group comprises Government and Municipal Fleets, which are essential buyers for public transit buses, refuse collection vehicles, and sanitation fleets. For this segment, the primary drivers are local air quality improvements and adherence to strict municipal sustainability mandates. CNG buses, in particular, are favored in urban areas due to their lower noise pollution and immediate reduction in particulate matter emissions. These entities typically procure through large-scale tenders, where proven reliability, maintenance costs, and guaranteed fuel supply contracts are paramount considerations. The public sector’s purchasing power often catalyzes infrastructure development, benefiting commercial operators indirectly.

While smaller, the market also serves industrial users requiring stable energy sources for material handling and specialized equipment, and, in regions like India and parts of Latin America, a growing segment of private consumers and taxi/ride-sharing fleets looking for lower running costs compared to conventional gasoline vehicles. The decision for private consumers often hinges on the density of CNG refueling stations within their commuting radius and the availability of affordable, purpose-built OEM passenger vehicles. The common thread among all potential customers is the strategic requirement for a reliable, cleaner-burning fuel that provides a tangible economic benefit or regulatory advantage over existing fossil fuels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 38.0 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cummins Westport, IVECO, Volvo, Scania, Daimler, Clean Energy Fuels, Shell, Foton Motor, FAW, Weichai Power, Bosch, Westport Fuel Systems, CNH Industrial, Chart Industries, General Motors, Ford Motor Company, Isuzu Motors, MAN SE, Hyundai Motor Company, Tata Motors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compressed Natural Gas and Liquefied Natural Gas Vehicle Market Key Technology Landscape

The technological landscape of the CNG and LNG Vehicle Market is centered on two crucial areas: enhancing engine performance and increasing the safety and efficiency of fuel storage. Engine technology is moving toward dedicated natural gas engines designed for optimal combustion characteristics, often employing advanced spark-ignited (SI) systems or high-pressure direct injection (HPDI) technology. HPDI, developed by companies like Westport Fuel Systems, allows natural gas to be injected directly into the cylinder at high pressure, mimicking diesel engine combustion and maintaining high torque and efficiency suitable for heavy-duty applications. Furthermore, improvements in turbocharging and thermal management systems are critical for maintaining performance parity with modern diesel engines while meeting strict emission standards, ensuring that NGVs remain a high-performance option for commercial fleets.

Fuel storage advancements represent perhaps the most critical technological breakthrough, directly mitigating historical concerns about range and payload reduction. The shift from heavy steel (Type I) and limited composite (Type II) cylinders to advanced carbon fiber-wrapped tanks (Type III and Type IV) is transformational. Type IV cylinders, utilizing a non-metallic liner, significantly reduce weight and allow for higher storage pressures (up to 3,600 psi or more), thereby increasing the onboard fuel capacity and vehicle range. This technology is vital for the widespread adoption of CNG in commercial vehicles. For LNG, technological focus is on improving the insulation efficiency of cryogenic tanks and developing smaller, more robust liquefaction technologies suitable for localized station deployment, reducing boil-off losses and ensuring fuel availability.

Beyond the vehicles themselves, the refueling infrastructure relies on sophisticated compression and pumping technology. CNG stations utilize multi-stage compressors and sequential fill systems to maximize efficiency and minimize refueling time. LNG stations require high-efficiency cryogenic pumps and vaporizers. Furthermore, the integration of telematics and smart metering systems is essential. These technologies allow for accurate monitoring of fuel usage, pressure levels, and maintenance requirements across the network, facilitating the broader adoption of NGV fleets by providing the reliability and operational intelligence that logistics operators demand. The continuous refinement of these technologies is pivotal in achieving competitive TCO and ensuring the long-term viability of the natural gas vehicle segment.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for the NGV market, characterized by massive government support, particularly in China, India, and Pakistan, aimed at combating severe urban air pollution. China leads the world in NGV adoption, focusing heavily on CNG for city buses and light logistics, alongside a rapidly expanding LNG network catering to long-haul heavy-duty logistics connecting economic zones. India's mandate for CNG use in public transport and taxis in metropolitan areas drives significant market volume. The region benefits from localized manufacturing capabilities and strong consumer acceptance of compressed gas as a transition fuel.

- Europe: Europe exhibits strong growth, driven by ambitious decarbonization goals and the European Union’s Alternative Fuels Infrastructure Directive (AFID). The focus here is heavily skewed toward LNG for heavy transport corridors (e.g., Germany, Italy, Spain) where incentives and infrastructure development are robust. Italy possesses one of the most developed CNG networks for passenger cars and light vehicles. The European market is increasingly emphasizing Renewable Natural Gas (RNG) to offer a direct low-carbon alternative to diesel, aligning NGV technology with strict EU climate targets.

- North America: The North American market (US and Canada) is characterized by the abundance of low-cost domestic shale gas, providing a substantial economic advantage. Adoption is concentrated in high-mileage commercial sectors, primarily refuse collection, municipal services, and regional heavy-duty trucking (especially natural gas-powered fleet operations near production hubs). While passenger car adoption is limited, the growth in LNG infrastructure for freight along major interstate highways ensures steady commercial segment expansion, supported by federal and state environmental grants aimed at reducing diesel dependence.

- Latin America: This region is a mature market for CNG, particularly for passenger vehicles and taxis, due to historically high gasoline prices and subsidized natural gas pricing (e.g., Argentina, Brazil, Colombia). The market relies heavily on vehicle conversion kits, though OEM offerings are increasing. Infrastructure density is high in major urban centers, making CNG highly accessible to the general public and small commercial operators seeking immediate fuel cost savings.

- Middle East and Africa (MEA): MEA presents varied dynamics. Countries rich in natural gas (e.g., Iran, Egypt) have mandated or heavily incentivized CNG use for economic and environmental reasons, resulting in high NGV penetration rates in public and private transport. Investment in LNG infrastructure is growing in parallel with developing maritime and heavy industry logistics sectors, positioning NGVs as a strategic tool for local energy monetization and transport diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compressed Natural Gas and Liquefied Natural Gas Vehicle Market.- Cummins Westport (Joint Venture focused on Natural Gas Engines)

- IVECO (CNH Industrial Group)

- Volvo Group

- Scania (Volkswagen Group)

- Daimler Truck AG

- Clean Energy Fuels Corp. (Infrastructure and Fuel Supply)

- Shell plc (Integrated Energy and LNG Bunkering)

- Foton Motor (Beiqi Foton Motor Co., Ltd.)

- FAW Group

- Weichai Power Co., Ltd.

- Bosch (Components and Systems)

- Westport Fuel Systems Inc. (Engine Technology and Components)

- CNH Industrial N.V. (Parent Company of IVECO)

- Chart Industries (Cryogenic Equipment and LNG Storage)

- General Motors Company

- Ford Motor Company

- Isuzu Motors Ltd.

- MAN SE (Volkswagen Group)

- Hyundai Motor Company

- Tata Motors Limited

Frequently Asked Questions

Analyze common user questions about the Compressed Natural Gas and Liquefied Natural Gas Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary environmental advantages of using CNG/LNG vehicles?

CNG and LNG vehicles significantly reduce emissions of particulate matter (PM) and nitrogen oxides (NOx) compared to diesel engines, leading to improved urban air quality. When using Renewable Natural Gas (RNG), NGVs can achieve near-zero or even carbon-negative lifecycle emissions, addressing critical climate concerns.

How does the range of NGV heavy-duty trucks compare to diesel equivalents?

Modern LNG heavy-duty trucks are engineered to provide ranges comparable to or exceeding their diesel counterparts, often achieving 500 to 800 miles on a single tank. CNG vehicles typically have shorter ranges, making them more suitable for regional haul and fixed urban routes.

What is the current challenge regarding the refueling infrastructure for NGVs?

The main challenge is the high capital cost and geographic disparity in refueling station density. While CNG infrastructure is growing in urban hubs, LNG stations are sparse outside major transport corridors, requiring strategic planning and substantial governmental investment to ensure widespread commercial viability across all regions.

Are natural gas vehicles significantly more expensive to purchase initially than conventional vehicles?

Yes, NGVs generally have a higher upfront purchase price due to the specialized high-pressure fuel systems and tanks required. However, the operational cost savings from lower fuel prices, coupled with governmental incentives, often lead to a lower Total Cost of Ownership (TCO) over the vehicle's lifespan, particularly for high-mileage commercial fleets.

What role does Renewable Natural Gas (RNG) play in the future of the NGV market?

RNG, chemically identical to conventional natural gas but derived from biomass/waste, is crucial for the NGV market's long-term sustainability. It enables fleets to meet aggressive decarbonization targets, enhancing the NGV value proposition and attracting investments from ESG-conscious corporate entities seeking to maximize their environmental returns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager