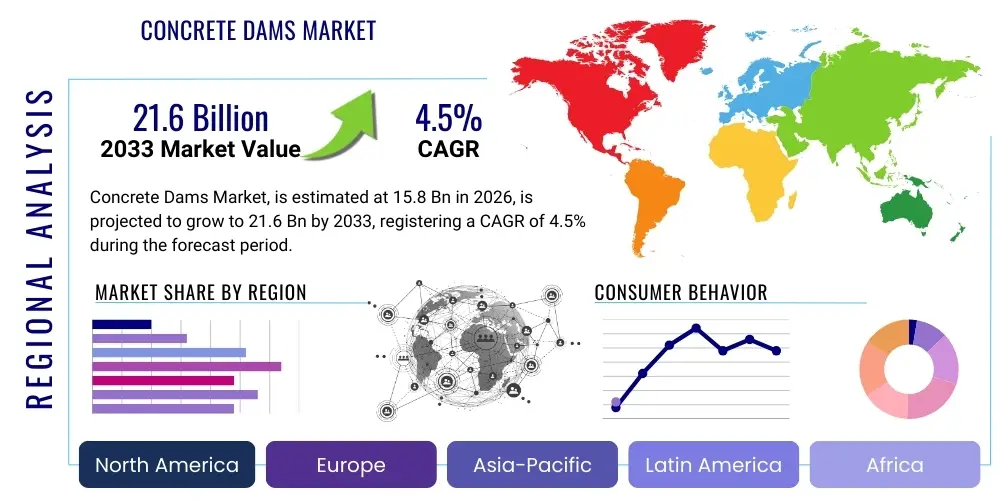

Concrete Dams Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441757 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Concrete Dams Market Size

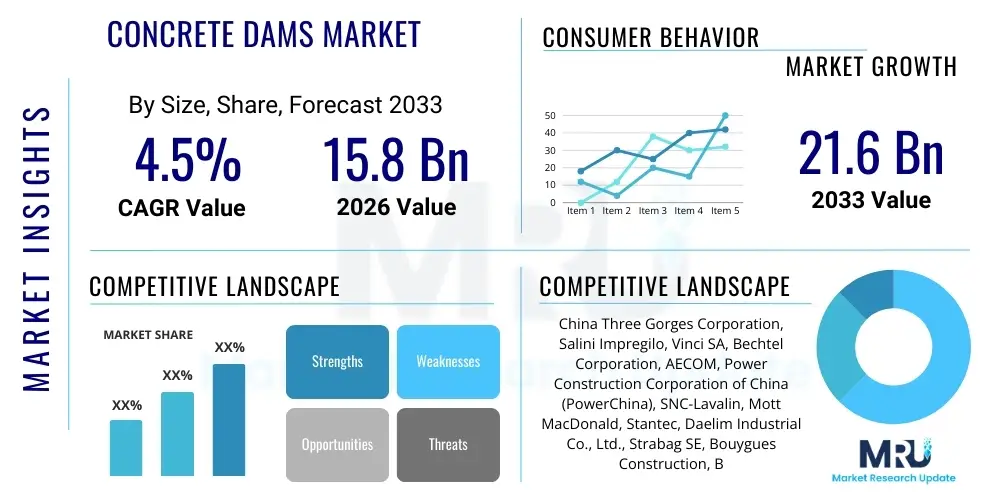

The Concrete Dams Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 21.6 Billion by the end of the forecast period in 2033. This steady expansion is primarily driven by global infrastructure rejuvenation efforts, increasing demand for renewable energy sources, especially hydropower, and the critical need for effective water resource management systems to combat climate change-induced water stress and frequent flood events across emerging and developed economies.

Concrete Dams Market introduction

The Concrete Dams Market encompasses the planning, design, construction, repair, and decommissioning of large-scale concrete hydraulic structures used primarily for water impoundment. These structures, categorized mainly as Gravity, Arch, and Buttress dams, are essential infrastructure assets serving multiple critical functions, including hydroelectric power generation, municipal and agricultural water supply, flood mitigation, and navigation regulation. The inherent durability and structural integrity of concrete make it the preferred material for mega-projects requiring high resistance to seismic activity and massive hydraulic pressures over long lifespans, often exceeding 100 years.

Major applications of concrete dams center around sustainable energy production, particularly in regions transitioning away from fossil fuels, where pumped storage hydro and conventional hydropower provide indispensable grid stability. Furthermore, rapid urbanization and population growth place immense pressure on existing water infrastructure, necessitating new dam construction and significant rehabilitation projects to secure reliable drinking water and irrigation resources. The benefits derived from these structures extend far beyond energy and water supply, including substantial economic development in surrounding areas and enhanced resilience against extreme weather patterns.

Key driving factors accelerating market growth include substantial governmental investment in large-scale infrastructure projects, particularly in Asia Pacific and Africa, focused on establishing energy independence and securing water equity. Technological advancements, such as the adoption of Roller-Compacted Concrete (RCC) methods, have significantly reduced construction time and cost, making concrete dams more economically viable compared to traditional construction methods. Safety standards and environmental mandates also drive the need for dam upgrades, maintenance, and modernization of aging structures in North America and Europe, further fueling market expansion.

Concrete Dams Market Executive Summary

The global Concrete Dams Market demonstrates robust growth, underpinned by sustained investment in hydropower and water security globally. Business trends indicate a strong shift toward digitalization in dam construction and management, employing Building Information Modeling (BIM) for design optimization and utilizing advanced sensor technologies for structural health monitoring (SHM). Consolidation among major engineering, procurement, and construction (EPC) firms is increasing, aiming to handle complex, multi-billion-dollar projects that require specialized expertise in geotechnical and seismic engineering. Furthermore, the rising focus on sustainability mandates the use of low-carbon concrete alternatives and improved site management practices to minimize environmental impact during the construction phase.

Regionally, Asia Pacific maintains market dominance due to massive dam construction projects, particularly in China and India, aimed at meeting soaring energy demand and addressing critical water shortages. North America and Europe are characterized by high-value maintenance, rehabilitation, and seismic retrofitting projects, driven by aging infrastructure and increasingly stringent regulatory oversight regarding public safety. Latin America and Africa represent significant emerging markets, propelled by nascent hydropower potential and urgent requirements for agricultural irrigation infrastructure, often supported by international development financing.

Segment trends highlight the growing preference for Gravity Dams and Arch Dams due to their scalability and high performance in complex terrains. The Hydropower application segment remains the largest revenue generator, benefiting from governmental incentives promoting renewable energy infrastructure. The adoption of Roller-Compacted Concrete (RCC) is rapidly increasing across all segments as it offers substantial cost savings and accelerated construction timelines compared to traditional mass concrete pouring methods, positioning it as a pivotal technological trend influencing future project execution across various geographical locations.

AI Impact Analysis on Concrete Dams Market

Common user questions regarding AI's impact on the Concrete Dams Market frequently revolve around optimizing complex design parameters, improving construction scheduling efficiency, and enhancing long-term operational safety and monitoring. Users are primarily concerned with how Artificial Intelligence (AI) and machine learning (ML) algorithms can be integrated into large-scale engineering processes to predict potential structural failures, manage huge datasets generated by structural health monitoring (SHM) systems, and simulate environmental risks, such as high inflow events or seismic loading. The key theme is leveraging AI to move from reactive maintenance to predictive management, thereby minimizing risk, reducing costly downtime, and extending the service life of these critical assets. Expectations center on AI serving as a decision-support tool for engineers and operators, standardizing quality control during construction, and automating routine inspection tasks through drone and computer vision systems.

- AI-driven optimization of concrete mix design for enhanced durability and lower carbon footprint, minimizing material waste.

- Predictive maintenance scheduling utilizing machine learning models based on real-time sensor data for anticipating structural degradation.

- Automated quality control (QC) during construction via computer vision analysis of poured concrete and formwork installation compliance.

- Enhanced hydrological forecasting and reservoir management optimization using ML algorithms for improved flood control and water allocation efficiency.

- Integration of AI with Building Information Modeling (BIM) for clash detection, construction sequence planning, and resource allocation optimization.

- Advanced seismic analysis and structural response simulation, providing faster and more accurate assessments of dam stability under extreme load conditions.

- Autonomous inspection systems (drones and robotics) guided by AI for routine visual and thermal surveys of dam faces, detecting anomalies early.

DRO & Impact Forces Of Concrete Dams Market

The Concrete Dams Market is significantly influenced by macro-level factors, where the imperative for sustainable water management and clean energy production acts as a primary driver. Restraints often include stringent environmental regulations concerning biodiversity and displacement of communities, leading to protracted approval timelines and increased project costs. Opportunities are abundant in the repair and rehabilitation sector, particularly in developed regions where aging infrastructure requires significant investment to meet modern safety standards. The market operates under the influence of strong impact forces, notably the regulatory environment dictating design standards and safety compliance, and the macroeconomic climate influencing government infrastructure spending capabilities globally.

Drivers include the accelerating demand for reliable clean energy, positioning hydropower as a stable baseload power source crucial for supporting intermittent renewables like wind and solar. Moreover, increasing global water scarcity and the frequency of extreme weather events necessitate large-scale water storage and flood protection projects, directly translating into demand for new concrete dams and expansions of existing reservoirs. Technological advancements such as RCC and innovative construction techniques enhance project feasibility, offering faster deployment and reduced financial outlay, thus mitigating some project complexity risks traditionally associated with dam construction.

Conversely, major restraints involve the massive upfront capital expenditure required for dam projects, which often necessitates long-term government financing or complex public-private partnerships. Public opposition regarding environmental impact assessments (EIAs) and resettlement issues can significantly delay or halt projects, adding complexity and uncertainty. The concrete industry itself faces challenges regarding the high carbon footprint of traditional Portland cement, necessitating investment in low-carbon materials and sustainable construction practices to meet global environmental goals. Furthermore, geopolitical instability in key resource-rich regions can impact project continuity and supply chain reliability for specialized equipment and construction materials.

Opportunities are strongly concentrated in the modernization and safety enhancement of legacy dams, focusing on implementing advanced instrumentation, seismic retrofitting, and spillway capacity upgrades. Emerging economies in Africa and Southeast Asia offer substantial greenfield potential for large hydropower and irrigation projects. The application of advanced digital tools, including AI, IoT, and digital twin technology, represents an opportunity for firms to differentiate themselves by offering superior efficiency and operational reliability services. The shift towards small and medium-sized modular concrete dams for localized water management also opens up new market niches outside the traditional large-scale project domain.

Segmentation Analysis

The Concrete Dams Market segmentation provides a detailed structure for analyzing market dynamics based on the type of dam structure, the primary application, and the construction material used. This layered analysis is crucial for stakeholders to understand shifting consumer and governmental preferences, pinpoint high-growth areas, and tailor technological offerings accordingly. The market is primarily bifurcated by Dam Type, including Gravity Dams, Arch Dams, and Buttress Dams, each suited to specific geological and topographical conditions. Application segmentation reveals the end-use priorities of investment, dominated by Hydropower and followed by water supply and flood control needs. Material segmentation, distinguishing between traditional Mass Concrete and modern Roller-Compacted Concrete (RCC), illustrates the industry's drive toward efficiency and cost-effectiveness.

- By Type:

- Gravity Dams

- Arch Dams

- Buttress Dams

- Other Types (e.g., Barrages, Weirs)

- By Application:

- Hydropower Generation

- Water Supply (Municipal and Industrial)

- Agricultural Irrigation

- Flood Control and Management

- Recreation and Navigation

- By Material:

- Mass Concrete (Conventional Vibrated Concrete - CVC)

- Roller-Compacted Concrete (RCC)

- Composite Concrete Structures

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Concrete Dams Market

The value chain for the Concrete Dams Market is intricate, spanning from raw material extraction and specialized engineering consultation to long-term operation and maintenance. Upstream activities are dominated by providers of construction materials, primarily cement, aggregates, and specialized additives (e.g., supplementary cementitious materials like fly ash and slag). High quality and timely sourcing of these bulk materials are critical, given the massive volumes required. Engineering and design firms, positioned early in the chain, hold significant value, providing geotechnical surveys, hydraulic modeling, and structural design expertise necessary to ensure feasibility and safety compliance.

Midstream activities involve core construction processes, managed predominantly by large EPC (Engineering, Procurement, and Construction) contractors. These firms manage heavy equipment, specialized labor, and the crucial processes of concrete production, transport, and placement, particularly mastering complex techniques like Roller-Compacted Concrete (RCC) pouring which dramatically impacts project schedules. Procurement efficiency and rigorous quality control throughout the construction phase are vital value-drivers in this stage. Direct channels involve national governments or state-owned enterprises contracting directly with major EPC firms, especially for nationally significant hydropower or water security projects.

Downstream activities center on the long-term operation, maintenance, and monitoring of the completed dam structure. This includes the installation and management of hydraulic machinery, gates, and sophisticated structural health monitoring (SHM) systems. Indirect channels involve consulting firms, technology providers, and specialized service companies offering predictive maintenance services, seismic retrofitting, and regulatory compliance checks. The highest value addition in the downstream segment comes from firms that can integrate digital twin technology and AI-powered operational optimization, ensuring efficient energy generation or water release management over the asset's extended lifespan.

Concrete Dams Market Potential Customers

The primary customers and end-users of concrete dams are large governmental bodies, regional state-owned utilities, and international development organizations focused on national infrastructure development. These entities typically initiate and finance major projects aimed at addressing national resource deficits in energy and water. State-owned power generation companies, particularly those specializing in hydroelectric power, represent a massive segment of buyers, as concrete dams form the core infrastructure for their energy portfolio. Municipal and regional water authorities also constitute a significant customer base, requiring reservoirs for urban water supply, irrigation, and drought resilience programs.

Furthermore, international financial institutions and multilateral development banks, such as the World Bank, Asian Development Bank (ADB), and African Development Bank (AfDB), act as indirect but influential customers by funding and mandating the construction of dams in developing nations. Private developers, particularly in regions with established frameworks for Public-Private Partnerships (PPPs) in the infrastructure sector, also purchase construction and engineering services for dams, although government involvement remains paramount due to the strategic nature of the assets. The end-users of the dam’s services—the population receiving electricity, safe water, and flood protection—drive the societal need that underpins market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 21.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China Three Gorges Corporation, Salini Impregilo, Vinci SA, Bechtel Corporation, AECOM, Power Construction Corporation of China (PowerChina), SNC-Lavalin, Mott MacDonald, Stantec, Daelim Industrial Co., Ltd., Strabag SE, Bouygues Construction, Balfour Beatty, Acciona, General Electric (Hydro division), Andritz Hydro, Voith Hydro, Kiewit Corporation, Boral Limited, HeidelbergCement AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Concrete Dams Market Key Technology Landscape

The technological landscape within the Concrete Dams Market is rapidly evolving, moving away from purely manual construction toward heavily digitized and automated processes focused on improving efficiency, precision, and long-term asset management. The core technological advancement influencing construction methods is Roller-Compacted Concrete (RCC). RCC technology allows concrete to be placed and compacted using vibratory rollers similar to those used for earthfill, drastically accelerating construction speed and reducing costs compared to traditional conventional vibrated concrete (CVC). This method requires sophisticated batching plants and precise logistics management to maintain a continuous, high-volume flow of material, making supply chain technology crucial.

In the design and engineering phase, Building Information Modeling (BIM) has become indispensable. BIM enables multidisciplinary teams to collaborate on 3D models, predicting structural performance, managing interfaces between civil structures and electromechanical systems, and optimizing material usage, thereby minimizing errors and rework. Furthermore, advanced computational fluid dynamics (CFD) are used extensively for spillway design and hydraulic structure optimization to ensure safety during maximum flood events. The integration of advanced geotechnical analysis software allows engineers to accurately model rock mechanics and foundation stability under various loading scenarios.

Post-construction and operational technologies are equally critical. Structural Health Monitoring (SHM) systems, leveraging thousands of integrated sensors (e.g., piezometers, extensometers, accelerometers, fiber optics) connected through IoT networks, provide real-time data on the dam’s performance, movement, and internal pressures. This massive data stream is increasingly analyzed using AI and machine learning algorithms to detect subtle anomalies that might indicate emerging structural issues well before they become critical failures. The development and implementation of digital twins—virtual replicas of the physical dam structure—allow operators to simulate maintenance scenarios, operational changes, and the impact of environmental stressors with high fidelity, ensuring proactive and data-informed decision-making throughout the dam's service life.

Regional Highlights

- Asia Pacific (APAC): Market Dominance and Growth Engine

The APAC region holds the largest market share and is expected to exhibit the highest growth rate during the forecast period, primarily driven by massive government investments in China, India, and Southeast Asian nations focused on energy security and addressing escalating water demands. China, as a global leader in dam construction, continues to undertake mega-projects, utilizing advanced RCC technology for rapid deployment. India’s focus on interlinking rivers and expanding hydropower capacity to meet its vast energy needs fuels significant demand for concrete dam construction and related engineering services. The need for flood protection infrastructure, particularly in low-lying coastal and river basin areas, further stimulates market activity across countries like Vietnam and Indonesia. The sheer scale of ongoing and planned projects related to hydropower generation ensures APAC remains the undeniable center of gravity for the global concrete dams industry.

The competitive environment in APAC is characterized by strong local players supported by government policies, although international firms participate heavily in large, technically demanding projects requiring specialized equipment and advanced structural expertise. Regulatory frameworks are increasingly emphasizing sustainable construction and minimizing environmental impact, pushing for better materials management and stringent waste control. Financial feasibility remains high due to readily available government or state-backed financing options, enabling the execution of long-term, multi-phase projects that sustain regional market demand over the entire forecast window. This dynamic intersection of critical resource need and strong governmental backing solidifies APAC's influential position in the market.

- North America: Focus on Rehabilitation and Safety Retrofitting

North America, encompassing the United States and Canada, presents a mature market characterized by extensive infrastructure aging, leading to a strong focus on maintenance, repair, and rehabilitation (MRR) projects rather than greenfield construction. Thousands of dams built in the mid-20th century require seismic retrofitting, spillway capacity upgrades, and foundation stabilization to comply with contemporary safety regulations and manage the threat of climate change-induced extreme precipitation events. Demand is highly stable, driven by regulatory mandates from agencies such as the Federal Energy Regulatory Commission (FERC) in the U.S. and provincial authorities in Canada, prioritizing public safety.

Technological uptake is high in this region, with strong adoption of advanced SHM systems, drone inspections, and digital twin technology to manage risk effectively and optimize operational performance of existing assets. The market requires specialized engineering firms capable of handling complex rehabilitation challenges, often involving working around operational hydropower plants or maintaining reservoir levels during construction. The investment cycle is sustained by state and federal funding programs dedicated to infrastructure modernization, ensuring continuous, high-value demand for specialized concrete repair materials and engineering consulting services throughout the U.S. and Canadian markets.

- Europe: Strict Environmental Standards and Hydropower Modernization

Europe is defined by stringent environmental protection laws and a mature, interconnected power grid. New dam construction is exceptionally rare due to regulatory barriers and high population density, meaning the market is heavily weighted toward modernizing existing hydropower facilities, enhancing flood defenses, and upgrading safety mechanisms. Countries like Norway, Switzerland, and Austria, with significant existing hydropower assets, invest continuously in turbine upgrades, pressure relief systems, and dam safety instrumentation to maximize efficiency and extend asset lifespan.

A key trend in Europe is the focus on sustainable concrete solutions, driven by EU climate goals. This pushes manufacturers toward low-carbon concrete mixes, including the increased use of recycled aggregates and alternative binders, significantly influencing material segment demand. Furthermore, cross-border infrastructure initiatives aimed at grid balancing and energy storage (such as pumped hydro storage) represent a stable stream of demand for structural upgrades and associated civil engineering works, requiring specialized expertise in complying with complex pan-European directives and environmental impact mitigation strategies.

- Latin America (LATAM): High Potential for New Hydropower

LATAM represents a substantial emerging market, rich in untapped hydrological resources, particularly in Brazil, Colombia, and Peru. The market is primarily driven by the need for new hydropower generation capacity to support industrialization and growing urban populations. While economic volatility and political risks can occasionally impact project initiation, the long-term potential for greenfield concrete dam construction, especially large gravity and arch dams, remains significant, often financed through private sector concessions or international development loans.

The emphasis here is on cost-effective construction, leading to strong uptake of RCC technology to reduce project timelines and costs. Infrastructure improvements, particularly those aimed at increasing agricultural productivity through major irrigation schemes, also contribute substantially to market activity. Regulatory challenges often include navigating complex land rights and environmental opposition, requiring developers to adopt international best practices for social and environmental governance to secure project financing and government approvals.

- Middle East and Africa (MEA): Water Security and Irrigation Focus

The MEA region is characterized by high water stress, making water supply and irrigation the dominant application drivers for concrete dam construction. Significant governmental projects, such as those along the Nile basin in Africa or large-scale irrigation schemes in the Gulf Cooperation Council (GCC) states, underpin market growth. Hydropower development is crucial in specific regions, such as East Africa and Ethiopia, where large concrete dams are seen as foundational to national energy stability and regional power trade agreements.

Market growth in MEA is highly dependent on governmental budgetary allocations and international funding mechanisms. The construction environment is challenging, often requiring highly specialized logistics for transporting bulk materials and equipment to remote sites. There is a rapidly increasing adoption of modern dam technologies, including SHM and remote sensing, driven by the necessity to protect these critical, high-value assets in arid and seismically active areas, securing the long-term resilience of regional water resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Concrete Dams Market.- China Three Gorges Corporation

- Salini Impregilo

- Vinci SA

- Bechtel Corporation

- AECOM

- Power Construction Corporation of China (PowerChina)

- SNC-Lavalin

- Mott MacDonald

- Stantec

- Daelim Industrial Co., Ltd.

- Strabag SE

- Bouygues Construction

- Balfour Beatty

- Acciona

- General Electric (Hydro division)

- Andritz Hydro

- Voith Hydro

- Kiewit Corporation

- Boral Limited

- HeidelbergCement AG

Frequently Asked Questions

Analyze common user questions about the Concrete Dams market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Concrete Dams Market?

The primary factor driving demand is the global imperative for achieving water security and expanding renewable energy capacity, specifically hydropower. The consistent need for reliable municipal water supply, agricultural irrigation, and robust flood control infrastructure, exacerbated by climate variability, necessitates continuous investment in new concrete dams and the structural rehabilitation of existing large reservoirs worldwide, particularly utilizing cost-effective construction methods like Roller-Compacted Concrete (RCC).

How is Roller-Compacted Concrete (RCC) impacting concrete dam construction?

Roller-Compacted Concrete (RCC) is profoundly impacting the market by offering significant construction advantages over traditional conventional vibrated concrete (CVC). RCC reduces material costs and dramatically accelerates construction timelines because it can be placed using standard earth-moving equipment and compacted with vibratory rollers, eliminating the need for extensive internal formwork and curing periods, thereby enhancing the economic viability and competitive position of major dam projects globally.

What are the key technological advancements utilized in modern concrete dam management?

Key technological advancements center on digitalization and predictive maintenance. This includes the widespread adoption of Building Information Modeling (BIM) for design precision, advanced Structural Health Monitoring (SHM) systems employing IoT sensors for real-time data collection, and the application of Artificial Intelligence (AI) and machine learning for analyzing sensor data to predict structural integrity issues and optimize reservoir operation and flood release management efficiently.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC) holds the largest market share, predominantly due to vast ongoing infrastructure projects in China and India. These nations are heavily investing in large-scale hydropower and extensive water management schemes to address rapidly increasing energy demands and critical water shortages stemming from population growth and industrialization. Strong governmental support and readily available financing mechanisms solidify APAC's leading position in terms of both construction volume and total project value.

What major restraints hinder growth in the Concrete Dams Market?

The major restraints inhibiting market growth include the substantial upfront capital expenditure required for project initiation and the significant regulatory hurdles associated with environmental impact assessments (EIAs) and social issues, such as community resettlement. Furthermore, heightened public scrutiny regarding the ecological footprint of large dams, alongside the lengthy and unpredictable project approval processes, often contribute to delays and increased financial risk for developers and government sponsors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager