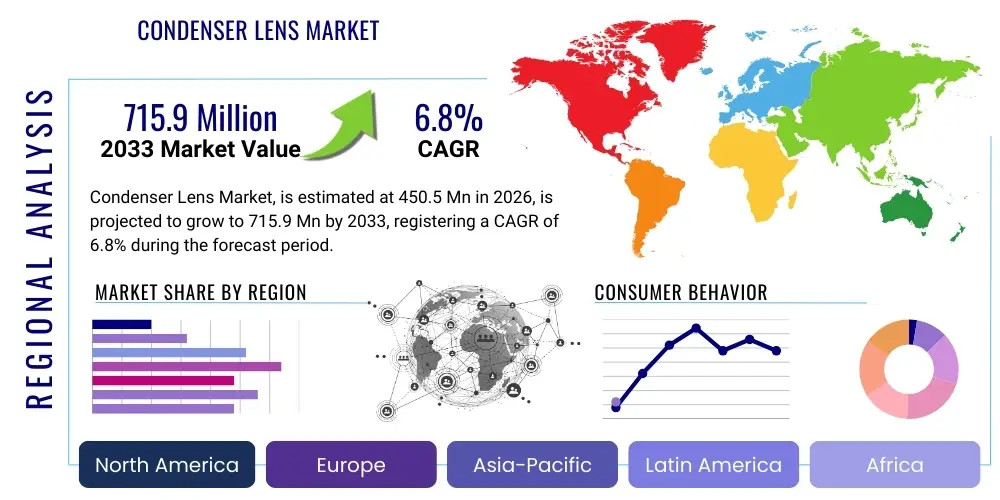

Condenser Lens Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441351 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Condenser Lens Market Size

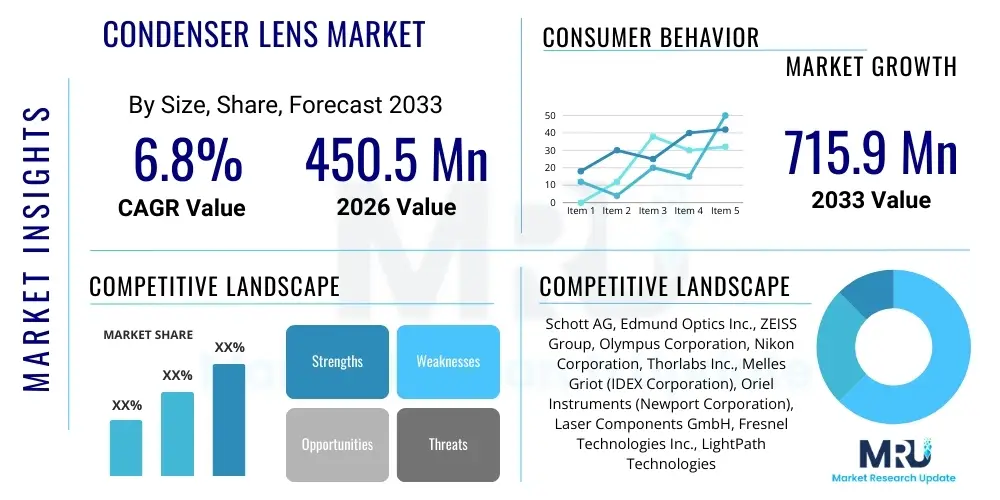

The Condenser Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.9 Million by the end of the forecast period in 2033.

Condenser Lens Market introduction

The Condenser Lens Market encompasses specialized optical components primarily designed to gather incident light rays and focus them uniformly onto a specific specimen or target plane. These lenses are crucial elements in illumination systems, particularly in microscopy, projection systems, and certain diagnostic instruments, ensuring high-quality, even illumination necessary for accurate imaging or effective light delivery. The core product functions to maximize the numerical aperture of the illumination system, thereby optimizing the resolution and contrast achievable by the overall optical setup.

Major applications of condenser lenses span diverse high-technology sectors, including biomedical research, semiconductor manufacturing (photolithography), industrial quality inspection, and digital projection systems. Key benefits derived from high-performance condenser lenses include improved image clarity, enhanced signal-to-noise ratio in sensitive measurements, and increased throughput in automated optical systems. The demand for these lenses is intrinsically linked to the growing sophistication of scientific research and the miniaturization trends in electronics manufacturing, necessitating superior control over light management.

Driving factors fueling market expansion include sustained growth in life sciences R&D, particularly in advanced techniques like confocal and fluorescence microscopy, which require highly precise and uniform illumination. Furthermore, the global proliferation of high-resolution projectors for commercial and educational use, alongside the increasing adoption of machine vision systems in factory automation, significantly contributes to the steady demand for specialized condenser optics, often requiring custom designs for optimal performance.

Condenser Lens Market Executive Summary

The Condenser Lens Market is characterized by robust growth, driven primarily by technological advancements in imaging and photonics, and exhibits distinct business trends favoring high-precision manufacturing and specialized materials. Business trends indicate a strong shift towards aspheric and achromatic condenser designs, aimed at minimizing spherical and chromatic aberrations, crucial for high-fidelity applications in biomedical diagnostics and advanced industrial inspection systems. Strategic partnerships between lens manufacturers and instrument OEMs are becoming vital to ensure seamless integration and optimized performance of next-generation microscopy and photolithography equipment.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, largely due to significant government and private investment in semiconductor fabrication facilities, rapid expansion of contract research organizations (CROs), and increasing academic R&D expenditure in countries like China, South Korea, and Japan. North America and Europe maintain substantial market share, fueled by established life science infrastructure and high adoption rates of advanced automated optical inspection tools, though growth rates are comparatively moderated compared to the rapidly developing APAC region. The Middle East and Africa (MEA) are emerging areas, showing increased uptake in clinical laboratory settings.

Segment trends reveal that the microscopy application segment dominates the market due to the essential role of condenser lenses in various light microscope types (brightfield, darkfield, phase contrast). Furthermore, the Material segment highlights increasing traction for precision-molded glass and fused silica lenses over traditional crown glass, particularly where stringent thermal stability and deep-UV transparency are required. The continued demand for customization across all segments emphasizes the requirement for manufacturers to offer flexible production capabilities, ranging from prototyping to large-scale mass production for consumer electronics integration.

AI Impact Analysis on Condenser Lens Market

User queries regarding AI's influence on the Condenser Lens Market frequently center on how machine learning algorithms optimize illumination uniformity, whether AI-driven quality control improves lens manufacturing precision, and the potential for AI to automate complex optical system alignment. Key themes emerging from these concerns include expectations regarding increased yield rates in precision optics production, the development of "smart" microscopes capable of adaptive illumination adjustments based on sample characteristics, and the integration of predictive analytics to manage chromatic and spherical aberrations dynamically. Users anticipate that AI will primarily enhance the performance ceiling of existing optical systems while simultaneously lowering operational complexity for end-users in challenging imaging environments.

The integration of AI technologies is poised to revolutionize the design and operational lifecycle of condenser lens systems, moving beyond simple automation to genuine intelligent optimization. Computational optics, heavily reliant on AI, allows for the creation of optimized freeform surfaces that are impossible to design using classical analytical methods, enabling unprecedented light collection efficiency and aberration correction. Furthermore, in the manufacturing phase, AI-powered visual inspection systems detect sub-micron defects faster and more accurately than human operators, leading to higher consistency and quality in mass-produced high-numerical aperture (NA) lenses essential for advanced applications.

This computational shift not only impacts manufacturing but also the end-use functionality. AI enables adaptive microscopy where illumination parameters (such as angle, intensity, and aperture setting) are dynamically adjusted in real-time based on the input image quality and the specific requirements of the experiment being conducted. This adaptive control maximizes contrast and resolution without requiring extensive manual calibration by the scientist, broadening the accessibility and efficiency of high-end optical instruments that rely heavily on precision condenser systems for effective light delivery.

- AI-driven optimization of freeform condenser surface geometries for superior light efficiency and minimal aberration.

- Implementation of machine learning algorithms for real-time, adaptive illumination control in automated microscopy systems.

- Enhancement of quality control processes using AI vision systems to detect minute defects in lens polishing and coating.

- Predictive modeling of thermal and mechanical stress impacts on condenser performance in high-power projection systems.

- Automation of complex optical alignment procedures, reducing calibration time and minimizing human error in setup.

DRO & Impact Forces Of Condenser Lens Market

The Condenser Lens Market is fundamentally shaped by several interacting dynamic forces, combining strong foundational drivers with inherent technical restraints and significant disruptive opportunities. The primary driver is the pervasive requirement for precise light management across key industrial and scientific disciplines, demanding lenses that offer unparalleled uniformity and efficiency, directly correlating to the resolution limits achievable in instruments like electron microscopes and sophisticated ophthalmic imaging devices. However, this precision requirement simultaneously imposes stringent restraints related to manufacturing complexity, involving multi-stage grinding, polishing, and specialized coating processes that significantly drive up unit costs and necessitate highly controlled production environments.

Opportunities for market expansion are strongly rooted in the integration of specialized optics into emerging high-volume applications, particularly in the fields of Augmented Reality (AR) and Virtual Reality (VR) head-mounted displays, where compact, high-performance illumination delivery systems are paramount. The shift towards miniaturization in consumer electronics, demanding thinner and lighter optical assemblies, presents manufacturers with the chance to innovate using materials like molded glass and high-index plastics, bypassing some of the constraints associated with traditional machining methods. Furthermore, the global push for point-of-care diagnostics fuels demand for cost-effective, durable optical components in portable analytical instruments.

The impact forces within this ecosystem are significant. The high cost of raw materials (e.g., specific optical glasses or crystalline materials) coupled with intense price competition for standard components impacts profitability, driving differentiation toward specialty high-NA lenses. The regulatory landscape, especially concerning medical devices utilizing these lenses, imposes rigorous quality standards, acting as a crucial barrier to entry for smaller or less established manufacturers. Ultimately, successful players must balance the increasing complexity required by application demands with the pressure to reduce costs through scalable and automated manufacturing processes.

Segmentation Analysis

The Condenser Lens Market is comprehensively segmented based on material composition, geometric type, design complexity, and its diverse range of end-user applications, allowing for a detailed analysis of specific growth areas and technological preferences. The core differentiation often lies in the balance between optical performance (uniformity, NA, aberration control) and cost-effectiveness, which dictates material choices ranging from highly pure fused silica for UV applications to cost-efficient optical plastic for consumer-grade projectors. Understanding these segmented demands is essential for manufacturers tailoring their R&D and production capabilities.

Key segments demonstrate distinct market dynamics. For instance, the demand for achromatic and aplanatic condenser types is concentrated heavily within high-end research and medical microscopy, where correcting both chromatic and spherical aberrations is non-negotiable for obtaining publication-quality images. Conversely, simpler plano-convex or basic bi-convex condensers continue to hold substantial volume share in general lighting and low-power educational instruments. Application segmentation underscores the strong dependency on growth sectors such as advanced photolithography, which requires the most precise, highest-NA deep-UV condensers available.

Regional segmentation further highlights disparities in adoption, with advanced regions demanding custom, application-specific optics, while developing regions prioritize standardized, durable, and easily maintainable components for widespread clinical and educational deployment. The continuous evolution of optical manufacturing techniques, such as precision glass molding (PGM), is allowing certain complex lens types, previously prohibitively expensive, to enter volume segments, blurring the traditional lines between performance and price point across the market structure.

- By Material:

- Glass (Crown Glass, Flint Glass, Fused Silica)

- Plastic (Acrylic, Polycarbonate)

- Other Specialty Materials (e.g., Sapphire, Germanium for IR)

- By Type/Design:

- Achromatic Condensers

- Aplanatic Condensers

- Aspheric Condensers

- Bi-convex and Plano-Convex Condensers

- Specialized Darkfield and Phase Contrast Condensers

- By Application:

- Microscopy (Brightfield, Fluorescence, Confocal)

- Projection Systems (DLP, LCD, Cinema Projectors)

- Photolithography and Semiconductor Processing

- Medical Imaging and Diagnostics (Ophthalmic, Endoscopy Illumination)

- Industrial Inspection and Machine Vision

- General Illumination and Lighting

- By Numerical Aperture (NA) Range:

- Low NA (Below 0.5)

- Medium NA (0.5 to 0.9)

- High NA (Above 0.9)

Value Chain Analysis For Condenser Lens Market

The value chain for the Condenser Lens Market is characterized by highly specialized, multi-stage processes beginning with the procurement of high-purity optical raw materials (upstream) and culminating in the integration of the final precision component into complex optical instruments (downstream). Upstream activities involve specialized suppliers providing highly consistent glass blanks, optical plastics, and advanced coatings. Consistency in the chemical purity and refractive index of these raw materials is paramount, as variations directly compromise the final optical performance, necessitating stringent quality control at the very start of the chain. Manufacturers often secure long-term contracts with specialized glass foundries (like Schott or Hoya) to ensure material quality and supply stability.

The midstream phase, dominated by the lens manufacturers, involves intricate design, grinding, polishing, testing, and coating processes. For high-end condenser lenses (e.g., those used in deep-UV lithography), manufacturing relies on ultra-precision CNC machining and complex metrology equipment to achieve sub-micron tolerances, which constitutes the highest value-addition step. The decision between traditional polishing and advanced techniques like precision glass molding significantly influences production scale and cost structure. Furthermore, expertise in applying complex multi-layer anti-reflective (AR) coatings is critical to minimize light loss and ghosting, adding another layer of complexity and value.

Downstream distribution channels typically bifurcate into direct and indirect routes. Direct sales are common for highly customized, high-NA lenses sold directly to Original Equipment Manufacturers (OEMs) in microscopy and semiconductor equipment, involving significant technical consultation and integration support. Indirect channels utilize specialized optical component distributors and resellers to reach academic institutions, smaller industrial consumers, and replacement markets. The success of the downstream operation relies heavily on efficient logistics to handle fragile, high-value components and technical support expertise to assist end-users with proper installation and alignment, which is critical for the final performance of the optical system.

Condenser Lens Market Potential Customers

The primary consumers and end-users of condenser lenses are diverse organizations and entities operating highly sophisticated optical instruments where precise light delivery and uniformity are non-negotiable prerequisites for operational success. This group includes manufacturers of complex scientific instrumentation, major research institutions, and large-scale industrial quality control departments. The reliance of these sectors on high-fidelity imaging ensures a persistent and growing demand for specialized condenser optics tailored to specific spectral requirements and numerical apertures.

A significant portion of the demand originates from the biomedical sector, comprising university research laboratories, pharmaceutical companies engaged in drug discovery, and hospitals performing diagnostic pathology. These end-users rely on condenser lenses embedded within high-end fluorescence and confocal microscopes to visualize subcellular structures and analyze complex biological processes. The increasing sophistication of life science research, particularly in genomics and proteomics, drives the requirement for condenser lenses capable of handling multiple wavelengths and high-speed switching capabilities.

Furthermore, the industrial and technological sectors form a substantial customer base. Semiconductor fabricators are heavy consumers of ultra-high-precision condenser lenses for photolithography machines and wafer inspection systems, where defects of a few nanometers can halt production. Additionally, manufacturers of commercial and professional projection systems (e.g., cinema projectors, large venue displays) consistently seek high-efficiency, durable condenser optics to maximize light throughput and image brightness. Machine vision system integrators also rely on specialized illumination systems that incorporate high-quality condensers for industrial automation and quality assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schott AG, Edmund Optics Inc., ZEISS Group, Olympus Corporation, Nikon Corporation, Thorlabs Inc., Melles Griot (IDEX Corporation), Oriel Instruments (Newport Corporation), Laser Components GmbH, Fresnel Technologies Inc., LightPath Technologies, OptoSigma Corporation, Precision Glass & Optics (PG&O), Syntec Optics, Qioptiq (Excelitas Technologies). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Condenser Lens Market Key Technology Landscape

The technology landscape for the Condenser Lens Market is characterized by an increasing reliance on ultra-precision manufacturing techniques and advanced material science to meet the demanding specifications of modern optical systems, particularly those requiring high numerical aperture (NA) and broad spectral coverage. Precision Glass Molding (PGM) represents a critical technological shift, allowing for the high-volume production of complex aspheric condenser lenses with superior surface accuracy and repeatability compared to traditional grinding and polishing methods. This is crucial for applications where weight and size reduction are critical, such as portable diagnostics and consumer electronics integration, while maintaining stringent optical performance standards.

Another significant technological pillar is the evolution of anti-reflection (AR) and specialty coatings. As modern systems increasingly operate across wide spectral bands (from deep UV through NIR), manufacturers must deploy sophisticated multi-layer dielectric coatings that maintain high transmission and durability under intense illumination and thermal stress. The development of coatings resistant to laser damage and harsh chemical environments is particularly important for high-power projection and photolithography applications. Furthermore, computer-aided design tools and optimization algorithms are continuously improving the initial lens design, reducing reliance on physical prototyping by accurately modeling ray tracing and aberration characteristics under various operating conditions.

Finally, the growing adoption of computational optics is profoundly impacting how condenser lenses function within a system. This involves integrating the lens structure with adaptive components, such as liquid lenses or micro-mirror devices, enabling dynamic, real-time correction of aberrations or adjustments to the illumination field shape. This move towards ‘smart illumination’ systems, coupled with advanced metrology using interferometry and profilometers to ensure sub-micron accuracy in production, solidifies the market's technical trajectory toward highly integrated, performance-driven optical modules rather than standalone components.

Regional Highlights

- North America: This region holds a significant market share, driven by extensive R&D spending, the presence of major life sciences and biotechnology companies, and robust demand from the aerospace and defense sectors for specialized imaging systems. The U.S. remains the core consumer, characterized by high adoption rates of automated inspection equipment and cutting-edge microscopy techniques in academic and clinical settings.

- Europe: Dominated by countries like Germany, the UK, and France, Europe is a mature market known for its strong precision engineering and optical manufacturing heritage. Growth is fueled by regulatory pushes for advanced medical diagnostics and significant industrial automation adoption, particularly in automotive and machinery manufacturing where high-speed visual inspection is critical.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR due to rapid expansion in semiconductor manufacturing (Taiwan, South Korea, China), booming electronics production, and substantial government investments in scientific research infrastructure. China, in particular, is a massive consumer market and a growing hub for optical component manufacturing, increasing both regional supply and demand.

- Latin America (LATAM): The market in LATAM is gradually developing, primarily driven by increasing healthcare expenditure and modernization of educational institutions. Brazil and Mexico are key markets, focusing primarily on standard and medium-performance condenser lenses used in clinical laboratories and basic educational microscopy.

- Middle East and Africa (MEA): This region represents the smallest, yet growing, segment. Demand is concentrated in oil and gas exploration (requiring specialized inspection equipment) and expanding clinical laboratories in the UAE and Saudi Arabia. Infrastructure limitations and political instability in parts of the region often constrain growth, pushing demand towards durable, standardized optical components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Condenser Lens Market.- Schott AG

- Edmund Optics Inc.

- ZEISS Group

- Olympus Corporation

- Nikon Corporation

- Thorlabs Inc.

- Melles Griot (IDEX Corporation)

- Oriel Instruments (Newport Corporation)

- Laser Components GmbH

- Fresnel Technologies Inc.

- LightPath Technologies

- OptoSigma Corporation

- Precision Glass & Optics (PG&O)

- Syntec Optics

- Qioptiq (Excelitas Technologies)

- Jenoptik AG

- Asahi Glass Co., Ltd. (AGC)

- Go Foton Corporation

- Sydor Optics, Inc.

- Hoya Corporation

Frequently Asked Questions

Analyze common user questions about the Condenser Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between achromatic and aplanatic condenser lenses?

Achromatic condenser lenses are designed to correct chromatic aberration (color fringing) for two specific wavelengths. Aplanatic condensers, however, correct both chromatic aberration and spherical aberration (focusing errors based on aperture size) simultaneously, offering superior performance for high-resolution imaging, particularly in research microscopy.

How does the Numerical Aperture (NA) of a condenser lens impact image quality?

The Numerical Aperture (NA) determines the maximum angle at which light can enter the objective lens, directly influencing the resolution and brightness of the image. A higher condenser NA ensures maximum light collection efficiency and allows the overall microscope system to achieve its theoretical maximum resolution and contrast capabilities.

Which application segment holds the largest share in the Condenser Lens Market?

The Microscopy application segment, encompassing instruments used in scientific research, clinical diagnostics, and industrial inspection, currently holds the largest market share. This dominance is due to the fundamental requirement for highly precise, uniform illumination systems across various microscopy techniques like brightfield, phase contrast, and fluorescence imaging.

What is Precision Glass Molding (PGM) and why is it important for condenser lens manufacturing?

Precision Glass Molding (PGM) is a manufacturing process where heated glass is pressed into a high-precision mold to form the final lens shape, particularly complex geometries like aspherics. PGM is crucial as it enables high-volume, cost-effective production of high-performance condenser lenses with superior surface accuracy and reduced lead times compared to traditional grinding methods.

What are the major restraint factors affecting the growth of the high-end condenser lens market?

Major restraints include the extremely high cost associated with manufacturing ultra-precision optics, particularly achieving nanometer-level tolerances required for high-NA lenses used in photolithography. Furthermore, the specialized raw materials (e.g., fluorides for deep-UV transmission) are expensive and require complex handling and quality assurance protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager