Confocal Raman Microscopes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441078 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Confocal Raman Microscopes Market Size

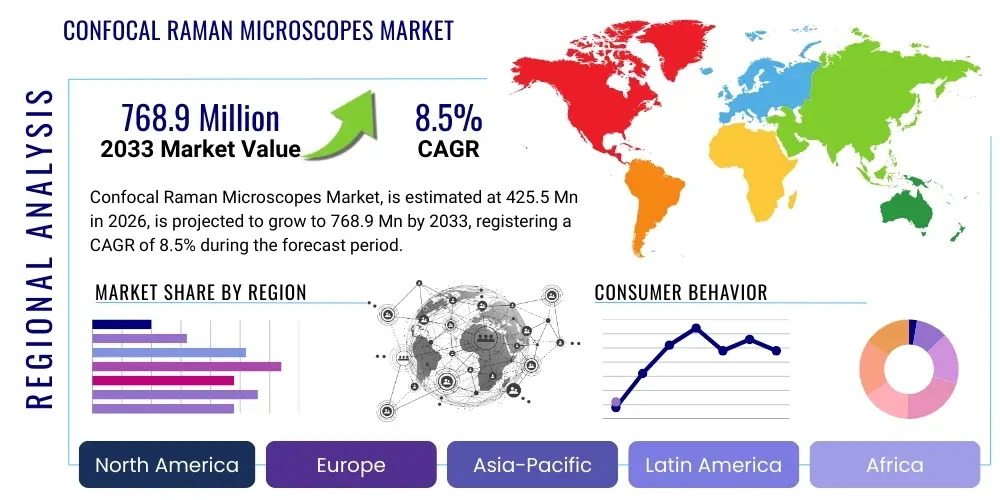

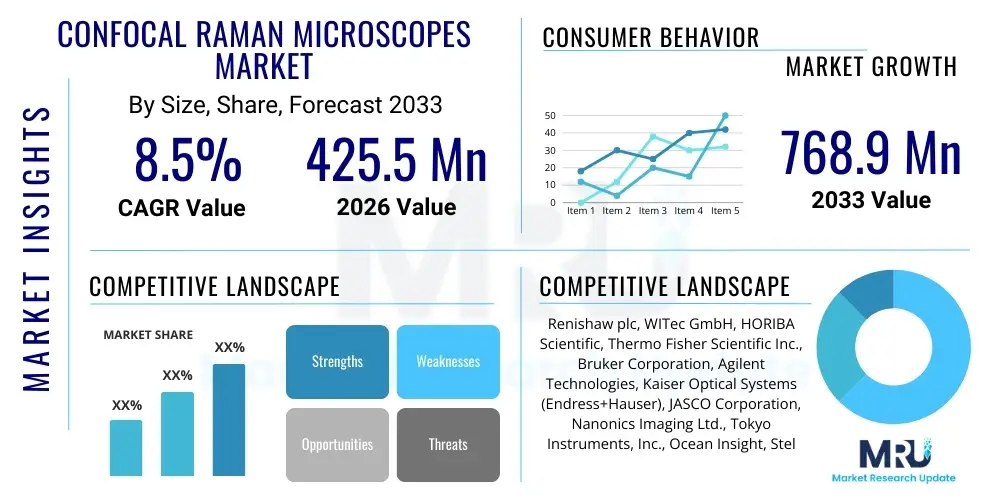

The Confocal Raman Microscopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 425.5 Million in 2026 and is projected to reach USD 768.9 Million by the end of the forecast period in 2033.

Confocal Raman Microscopes Market introduction

Confocal Raman Microscopy (CRM) represents a sophisticated analytical technique integrating the principles of Raman spectroscopy with confocal microscopy. This powerful synergy enables non-destructive, label-free chemical analysis with extremely high spatial resolution, often reaching the sub-micrometer level, alongside depth profiling capabilities. The fundamental product captures inelastic scattering of monochromatic light, providing unique vibrational signatures specific to molecular bonds within a sample. This capability is paramount in fields requiring detailed structural and chemical mapping, such as materials science, life sciences, pharmaceuticals, and semiconductor manufacturing. CRM systems typically comprise a high-stability laser source, a confocal setup utilizing pinholes to reject out-of-focus light, a high-sensitivity spectrometer, and advanced detection systems like CCD or EMCCD cameras, all managed by sophisticated software packages for data acquisition and chemometric analysis. The complexity and precision of these instruments justify their specialized market positioning and premium pricing structure.

Major applications of Confocal Raman Microscopes span a broad spectrum of research and industrial quality control. In materials science, CRM is indispensable for characterizing polymer structures, identifying stress and strain in advanced ceramics, and analyzing the composition of novel nanomaterials like graphene and carbon nanotubes. Within the pharmaceutical industry, CRM is crucial for polymorph screening, studying drug-excipient interactions, and ensuring dosage uniformity in solid oral formulations. Furthermore, in biological and medical research, the technology allows for chemical imaging of cellular components, analysis of tissue morphology, and early-stage disease diagnostics by identifying characteristic biochemical changes without extensive sample preparation. These diverse high-value applications solidify CRM's role as a critical tool in modern analytical laboratories globally. The demand is heavily influenced by continuous innovation in laser and detector technologies, leading to enhanced sensitivity and faster data acquisition times, which expands the range of feasible research endeavors.

The primary benefits driving market expansion include the technique's inherent non-destructive nature, its unparalleled ability to provide detailed chemical information spatially resolved in three dimensions (3D imaging), and minimal sample preparation requirements. Driving factors contributing to the robust market growth encompass rising global investment in nanoscience and nanotechnology research, stringent quality control mandates in drug development and manufacturing, and the accelerating integration of Raman spectroscopy into clinical diagnostics, particularly pathology. Moreover, technological advancements focusing on automated systems, integration with other microscopy techniques (e.g., AFM or SEM), and the development of portable, user-friendly benchtop models are significantly broadening the accessibility and utility of Confocal Raman Microscopes across various end-user sectors, moving the technology from specialized central facilities to routine departmental use.

Confocal Raman Microscopes Market Executive Summary

The Confocal Raman Microscopes Market demonstrates a robust growth trajectory, fundamentally driven by pervasive technological advancements in detector sensitivity and spectral resolution, alongside burgeoning research funding allocated to specialized materials and biological sciences globally. Business trends emphasize strategic collaborations between instrument manufacturers and leading research institutions, focusing on developing application-specific CRM solutions tailored for high-throughput analysis, particularly in pharmaceutical quality assurance and advanced semiconductor inspection. Key players are aggressively pursuing miniaturization and automation, integrating artificial intelligence (AI) and machine learning (ML) for enhanced spectral data processing, automated artifact removal, and rapid chemical component identification, thus improving efficiency and lowering the required expertise level for operation. The competitive landscape is characterized by innovation in modular systems allowing for versatile combinations with other spectroscopic techniques, offering enhanced analytical depth and addressing complex interdisciplinary research needs. Furthermore, the increasing adoption of cloud-based data management solutions is streamlining large-scale spectral library comparisons and remote analytical services, setting a new standard for operational effectiveness in this niche market.

Regionally, North America and Europe maintain dominance, primarily due to established, high-capacity research infrastructure, strong governmental funding for scientific research, and the presence of numerous major pharmaceutical and biotechnology companies utilizing CRM for regulatory compliance and R&D. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate throughout the forecast period. This acceleration is fueled by massive investments in domestic semiconductor fabrication capabilities, rapid expansion of contract research and manufacturing organizations (CROs/CMOs), and increasing government initiatives promoting material science and nanotechnology centers in countries like China, India, South Korea, and Japan. Latin America and the Middle East and Africa (MEA) are emerging markets, showing consistent, albeit slower, adoption driven by improvements in local academic infrastructure and increasing focus on petroleum chemistry and mineral analysis, creating pockets of opportunity for specialized instrument sales and service provision.

Segment trends reveal that the academic and research institutions segment remains the largest consumer, valuing flexibility and cutting-edge specification required for fundamental discovery science. Nevertheless, the industrial segment, particularly pharmaceuticals and materials science, is experiencing the highest proportional growth, stimulated by the need for inline monitoring, advanced failure analysis, and strict adherence to regulatory standards (e.g., FDA guidelines). By component, the software and services segment is growing faster than hardware, reflecting the increasing importance of advanced analytical algorithms, multivariate statistical analysis (MVA), and continuous support contracts necessary to maximize the utility of complex spectral data generated by high-end instruments. Moreover, the trend towards high-performance systems incorporating dual-laser capabilities and sophisticated environmental chambers (e.g., high pressure or cryogenic stages) indicates a deepening specialization within the hardware market, moving away from general-purpose spectrometers toward highly customized analytical platforms.

AI Impact Analysis on Confocal Raman Microscopes Market

User queries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in Confocal Raman Microscopy predominantly center on three core themes: enhancement of data throughput and processing speed, the capability for automated chemical identification and classification, and the potential for real-time quality control implementation. Users are particularly keen on understanding how AI can overcome the inherent challenges associated with large, complex hyperspectral datasets, such as baseline correction, cosmic ray removal, and multivariate curve resolution (MCR), which traditionally require significant manual intervention and expert interpretation. Concerns often revolve around the validation of AI-derived models, ensuring their reliability across diverse sample types and preventing algorithmic bias that might compromise analytical accuracy, especially in regulated environments like pharmaceutics. Expectations are high regarding AI's role in accelerating biomarker discovery in biological samples and enabling automated fault detection in industrial materials, fundamentally shifting the technology's application from a specialized research tool to a widely deployable, high-speed analytical solution.

The transition toward high-speed mapping in CRM generates terabytes of raw spectral data, a volume that traditional processing methods struggle to handle efficiently. AI, specifically convolutional neural networks (CNNs) and deep learning algorithms, is addressing this bottleneck by rapidly processing and segmenting large spectral images, identifying chemical heterogeneity with unprecedented speed and accuracy. This dramatic reduction in processing time is critical for applications like high-content screening in drug discovery and fast, automated quality assurance in material production lines where instantaneous feedback is essential. Furthermore, AI enables the creation of robust, generalized spectral libraries accessible via cloud platforms, allowing instruments worldwide to immediately benefit from collective knowledge, significantly enhancing the ability to identify unknown or trace components in complex matrices without prolonged, iterative experimentation.

Moreover, AI is pivotal in pushing the boundaries of autonomous microscopy. By integrating ML models, CRM systems can dynamically adjust acquisition parameters (e.g., laser power, exposure time, focus) in real-time based on the sample's observed spectral response. This intelligent feedback loop optimizes data quality, protects sensitive samples from photothermal damage, and drastically simplifies the operational complexity, potentially allowing non-expert technicians to run highly specialized analyses. This enhanced autonomy and accuracy driven by AI are crucial factors expanding the CRM market reach into industrial settings that demand minimal variability and maximum uptime, securing AI's position as a transformative force in both research productivity and commercial deployment strategy.

- Accelerated hyperspectral image processing and artifact removal via deep learning algorithms.

- Automated classification and segmentation of chemical components in complex samples (e.g., polymers, cells).

- Real-time quality control (QC) and defect detection in manufacturing environments (e.g., semiconductor inspection).

- Enhanced multivariate data analysis (MVA) and chemometrics for complex mixture deconvolution.

- Development of intelligent, self-optimizing CRM systems that adjust acquisition parameters autonomously.

- Predictive modeling for material performance based on spectroscopic signatures.

DRO & Impact Forces Of Confocal Raman Microscopes Market

The dynamics of the Confocal Raman Microscopes market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary driving forces include the exponential increase in global nanotechnology research and development activities, requiring nanoscale chemical characterization, and the rising global mandate for stringent quality control and formulation analysis within the highly regulated pharmaceutical sector. These powerful drivers are underpinned by the technology's core advantage: its capability for non-invasive, high-resolution 3D chemical mapping. However, the market faces significant restraints, chiefly the substantially high initial acquisition cost of advanced CRM systems, which limits adoption, particularly among smaller academic labs and emerging market companies, alongside the requirement for highly skilled personnel to operate the complex instrumentation and accurately interpret the specialized spectral data. Opportunities are abundant, centered on integrating CRM with atomic force microscopy (AFM-Raman) and scanning electron microscopy (SEM-Raman) for multimodal analysis, and the expansion into clinical diagnostics and specialized environmental monitoring applications, promising long-term growth and application diversification.

Market expansion is particularly sensitive to technological advancements in detector and laser stability. Drivers such as the increasing commercialization of two-dimensional (2D) materials like graphene and molybdenum disulfide (MoS2) mandate high-precision structural and defect analysis, making CRM indispensable for characterizing these novel materials' electronic and mechanical properties. Furthermore, the pharmaceutical sector's pivot toward personalized medicine and complex drug delivery systems (e.g., liposomes, nanoparticles) demands comprehensive, localized chemical verification, driving the adoption of high-end CRM units for formulation stability and in-vivo interaction studies. These high-impact applications demonstrate a clear return on investment despite the cost barriers, sustaining the demand from top-tier research and industry clients. The growing availability of specialized, high-numerical aperture optics and specialized environmental stages (e.g., cooling or heating stages) also expands the experimental possibilities, further driving the need for advanced CRM systems.

Conversely, market growth is often hampered by restrictive factors beyond initial cost, including the potential for sample fluorescence interference, which can overwhelm the weak Raman signal, requiring sophisticated filtering or alternative excitation wavelengths. This inherent limitation necessitates specialized sample preparation or equipment additions, adding complexity and cost. However, the opportunity landscape is transforming due to increasing governmental support for scientific infrastructure upgrades, particularly in APAC countries. The development of compact, user-friendly benchtop CRM models and systems optimized for specific industrial tasks, such as automated polymorph screening in pharma or rapid material identification in forensics, represents a major opportunity to penetrate new customer segments. These advancements, coupled with robust software development focusing on user accessibility and standardized operating procedures, are instrumental in mitigating the technical expertise restraint and broadening the market appeal.

Segmentation Analysis

The Confocal Raman Microscopes market is comprehensively segmented based on various critical parameters including type, components, application, and end-user, reflecting the diverse technical configurations and specialized functional demands across different research and industrial sectors. Segmentation by type differentiates between High-Performance Systems (HPS), characterized by ultra-high spatial resolution and sensitivity, often incorporating multiple laser lines and highly specialized optics for fundamental research, and Benchtop/Portable Systems (BPS), which prioritize ease of use, lower cost, and industrial deployability for routine quality control and field applications. The distinction in component segmentation highlights the growing economic significance of the software and services associated with data interpretation and system maintenance, often surpassing the cost and complexity of the core hardware units over the product lifecycle. Analyzing these segments is crucial for manufacturers to tailor their product offerings, marketing strategies, and pricing models to effectively address the specialized requirements of their target clientele, ensuring optimal market penetration and sustained revenue growth across the technology's lifecycle.

The segmentation based on application further delineates the key vertical markets driving demand. The Materials Science segment, encompassing polymers, ceramics, metallurgy, and nanomaterials, consistently demands systems capable of deep structural and chemical characterization, particularly for defect analysis and phase transition studies. The Life Sciences and Pharmaceutical segments require highly sensitive systems for biological sample analysis, focusing on cellular component imaging, drug penetration studies, and dosage form verification, where non-destructive analysis is paramount. The specialized area of Geology and Mineralogy utilizes CRM for analyzing inclusions and phase compositions under high pressure or temperature, driving demand for specialized environmental stages. Understanding these application needs guides R&D investment towards necessary performance enhancements, such as improved spectral range or advanced environmental control capabilities.

End-user segmentation clearly indicates the primary consumption centers. Academic and Research Institutions, while often budget-constrained, represent the largest volume segment, requiring versatile, state-of-the-art instruments for fundamental discovery. Conversely, the Industrial sector, including Semiconductor, Pharmaceutical, and Chemical companies, demands highly robust, reliable, and often automated systems for continuous process monitoring and quality assurance, where uptime and compliance are critical financial considerations. The governmental segment, including forensics and defense labs, focuses on specialized, sometimes ruggedized, instruments for unique security and analytical tasks. The differential needs across these end-user groups in terms of budget, operational environment, and required analytical complexity significantly influence market dynamics and product positioning for key market players.

- By Type:

- High-Performance Systems (HPS)

- Benchtop/Portable Systems (BPS)

- By Component:

- Hardware (Lasers, Spectrometers, Detectors, Optics)

- Software (Acquisition, Processing, Chemometrics)

- Services (Maintenance, Training, Calibration)

- By Application:

- Materials Science (Polymers, Composites, 2D Materials)

- Life Sciences & Biotechnology (Cellular Imaging, Tissue Analysis)

- Pharmaceuticals & Drug Discovery (Polymorph Screening, Formulation Analysis)

- Geology & Mineralogy

- Semiconductor & Electronics Inspection

- Forensics and Security

- By End User:

- Academic & Research Institutions

- Industrial Sector (Pharma, Chemical, Semiconductor)

- Government Agencies & Forensics Laboratories

Value Chain Analysis For Confocal Raman Microscopes Market

The value chain for the Confocal Raman Microscopes market is intricate, beginning with specialized upstream suppliers who provide high-purity laser sources, custom-designed spectrometer components (gratings, mirrors), and high-sensitivity detectors (e.g., EMCCD or scientific CMOS). This upstream phase requires deep expertise in photonics and precision engineering, as the performance and stability of the final instrument are highly dependent on the quality and synchronization of these core components. Major CRM manufacturers often maintain strategic, long-term relationships with a select few specialized component suppliers to ensure reliable supply chains and consistent quality control, given the tight tolerances required for confocal operation and high-resolution spectroscopy. Price volatility and technological obsolescence of these core components, particularly laser technology, represent a continuous challenge in managing the upstream supply cost structure.

The midstream phase involves the core activities of system integration, instrument manufacturing, and software development by key market players. This stage adds significant value through proprietary optical design (e.g., optimizing confocal pinhole alignment and coupling efficiency), complex mechanical assembly, and rigorous calibration procedures. Crucially, the differentiation often lies in the sophistication of the proprietary software, which handles data acquisition, advanced chemometric analysis (e.g., Principal Component Analysis, Partial Least Squares Regression), and automated measurement routines. Direct distribution channels, involving the manufacturer's internal sales teams and technical application specialists, are predominant for high-end systems, enabling close customer interaction, specialized pre-sales consultation, and customized system configuration tailored to specific research needs, particularly in North America and Europe.

Downstream activities focus on installation, training, maintenance, and long-term service contracts, which constitute a growing revenue stream and are essential for maximizing instrument uptime and user proficiency. Indirect distribution channels, utilizing specialized third-party regional distributors and scientific equipment dealers, are more common in emerging markets like APAC and MEA, providing local support and logistics capabilities. These indirect partners often manage initial sales, but complex servicing typically reverts to the original equipment manufacturer (OEM) or highly trained authorized service centers. The complexity of the technology mandates high-quality, continuous post-sales support, making the services segment a critical determinant of customer satisfaction and repeat business. The entire chain is heavily regulated by international standards for scientific instrumentation, demanding robust quality management systems throughout.

Confocal Raman Microscopes Market Potential Customers

The primary end-users, or potential customers, of Confocal Raman Microscopes are broadly categorized into academic and governmental research institutions, and various segments of the specialized industrial sector. Academic institutions, including universities and national laboratories, constitute a foundational customer base. These entities require high-specification, versatile CRM systems for fundamental research across physics, chemistry, biology, and material science departments. Their purchasing decisions are primarily influenced by technological performance (resolution, sensitivity, multi-modal capabilities) and are funded through competitive research grants and institutional capital expenditure budgets. The utility of CRM in characterizing novel nanomaterials, studying cellular pathology, and analyzing complex chemical kinetics ensures continuous, high-volume demand from this sector, driving the need for instruments that are both flexible and capable of incorporating cutting-edge technological advancements.

The industrial segment represents the fastest-growing customer base, particularly within the pharmaceutical, semiconductor, and advanced materials manufacturing industries. Pharmaceutical companies leverage CRM for critical quality assurance tasks, including identifying polymorphs, assessing drug uniformity in tablets, and performing non-destructive analysis of blister packaging to detect counterfeits or degradation products. The semiconductor industry uses CRM for stress analysis in silicon wafers, thin film characterization, and defect inspection, demanding highly automated, integrated systems capable of high throughput compatible with cleanroom environments. These industrial customers prioritize robustness, automation, compliance with regulatory standards (e.g., GMP), and low cost of ownership, making efficiency and reliability paramount in their procurement decisions.

Furthermore, specialized governmental agencies, including forensic laboratories, environmental monitoring bodies, and defense research organizations, are significant potential buyers. Forensic labs utilize CRM for rapid, non-destructive analysis of trace evidence such as fibers, paints, inks, and explosive residues, demanding instruments with high specificity and comprehensive spectral databases. Environmental bodies employ CRM for microplastic identification and characterization in water and air samples. Their purchase criteria often include ruggedness, portability (for field analysis), and compliance with specific safety and security protocols. The increasing global focus on security and environmental protection mandates expanding the application scope of CRM beyond traditional laboratory settings, opening new market niches defined by specialized operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 425.5 Million |

| Market Forecast in 2033 | USD 768.9 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Renishaw plc, WITec GmbH, HORIBA Scientific, Thermo Fisher Scientific Inc., Bruker Corporation, Agilent Technologies, Kaiser Optical Systems (Endress+Hauser), JASCO Corporation, Nanonics Imaging Ltd., Tokyo Instruments, Inc., Ocean Insight, StellarNet Inc., Toptica Photonics AG, CRAIC Technologies, Photon Systems Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Confocal Raman Microscopes Market Key Technology Landscape

The technological landscape of the Confocal Raman Microscopes market is characterized by continuous innovation aimed at overcoming traditional limitations, particularly low signal intensity and long acquisition times. A pivotal technological focus is the development and implementation of advanced detection systems, moving away from standard charge-coupled device (CCD) detectors toward more sensitive alternatives like Electron Multiplying CCD (EMCCD) and scientific Complementary Metal-Oxide-Semiconductor (sCMOS) cameras. EMCCD detectors are crucial for ultra-low light applications, enabling faster acquisition of high-quality data from intrinsically weak Raman scatterers, such as biological samples. Furthermore, the integration of Tunable Diode Laser (TDL) and frequency-doubled solid-state lasers allows for optimized excitation wavelengths, mitigating the disruptive effects of background fluorescence, a common challenge in organic and biological sample analysis, thereby expanding the applicability of CRM to historically difficult sample matrices.

Another major technological trend involves the integration of CRM with complementary analytical techniques to form powerful multimodal systems. The most commercially significant integration is with Atomic Force Microscopy (AFM-Raman), which allows for simultaneous high-resolution topographic mapping (from AFM) and chemical identification (from Raman spectroscopy) at the nanometer scale. This synergy provides unparalleled insight into structure-function relationships in nanomaterials and biological systems. Similarly, coupling CRM with Scanning Electron Microscopy (SEM-Raman) offers simultaneous ultrastructural imaging and chemical composition analysis, particularly valuable in material failure analysis and geology. These hybrid systems represent the premium segment of the market, offering specialized solutions that dramatically enhance analytical capabilities beyond standalone microscopy or spectroscopy.

The third critical technological pillar is the evolution of software and data processing techniques. The shift towards automated, high-throughput mapping necessitates sophisticated software featuring advanced algorithms for spectral pre-processing (e.g., automated baseline subtraction, cosmic ray filtering) and multivariate statistical analysis (MVA). Technologies like MCR (Multivariate Curve Resolution) and PCA (Principal Component Analysis) are routinely embedded, allowing users to accurately deconvolute complex spectra arising from mixtures and identify subtle chemical variations within heterogeneous samples. Furthermore, the increasing adoption of telecentric optics and specialized confocal aperture designs, such as spatial filtering techniques, ensures high spectral purity and superior spatial resolution, consistently pushing the detection limits and operational capabilities of modern Confocal Raman Microscopes, thereby cementing their position as essential tools in advanced analytical science.

Regional Highlights

Regional dynamics play a crucial role in shaping the Confocal Raman Microscopes market, driven by differential investment levels in R&D infrastructure, regulatory environments, and the concentration of high-technology industries. North America, particularly the United States, commands the largest market share. This dominance is attributed to substantial public and private funding directed toward advanced scientific research, a dense concentration of leading pharmaceutical and biotechnology companies utilizing CRM for drug development and quality control, and the pervasive presence of key market players ensuring excellent local sales and support infrastructure. High adoption rates are sustained by continuous technological upgrades demanded by the rigorous academic research environment and specialized governmental defense and space research initiatives.

Europe represents the second-largest market, characterized by strong governmental support for nanotechnology and materials research (e.g., Horizon Europe initiatives), high spending on advanced instrumentation in countries like Germany, the UK, and France, and a robust regulatory framework that mandates sophisticated analytical tools for quality assurance in the chemical and automotive sectors. European pharmaceutical manufacturing centers rely heavily on CRM for process analytical technology (PAT) and polymorph screening, contributing significantly to regional demand. The market here is mature but experiences steady growth fueled by the replacement cycles of older equipment and the integration of multimodal systems across university consortia.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This rapid expansion is primarily driven by massive governmental investments in developing world-class research infrastructure and increasing manufacturing capabilities in electronics, semiconductors, and pharmaceuticals, particularly in China, South Korea, and India. The burgeoning electronics industry’s need for non-destructive stress analysis and defect detection in micro-electronic components is a major driver. While initial capital constraints exist, the establishment of major contract research organizations (CROs) and increased focus on domestic technological self-reliance are overcoming these hurdles, leading to substantial adoption of both high-performance and benchtop CRM systems across the region. Latin America and MEA remain nascent markets, with adoption driven primarily by mineral and petroleum analysis, and slowly growing academic demand.

- North America (USA, Canada): Market leader due to high R&D spending and strong presence of pharma/biotech industries.

- Europe (Germany, UK, France): Second-largest market; driven by stringent regulatory QC and academic material science research.

- Asia Pacific (China, Japan, South Korea): Fastest-growing region; fueled by semiconductor industry expansion and massive investment in research infrastructure.

- Latin America and MEA: Emerging markets with growing adoption in petroleum chemistry, geology, and nascent life science research.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Confocal Raman Microscopes Market.- Renishaw plc

- WITec GmbH

- HORIBA Scientific

- Thermo Fisher Scientific Inc.

- Bruker Corporation

- Agilent Technologies

- Kaiser Optical Systems (Endress+Hauser)

- JASCO Corporation

- Nanonics Imaging Ltd.

- Tokyo Instruments, Inc.

- Ocean Insight

- StellarNet Inc.

- Toptica Photonics AG

- CRAIC Technologies

- Photon Systems Instruments

- Zolix Instruments Co., Ltd.

- B&W Tek (Metrohm Group)

- Timegate Instruments Ltd.

- Teledyne Princeton Instruments

- AIST-NT (now part of Bruker)

Frequently Asked Questions

Analyze common user questions about the Confocal Raman Microscopes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Confocal Raman Microscopy over standard Raman spectroscopy?

The primary advantage of CRM is its ability to provide high-resolution spatial information, specifically 3D chemical mapping and depth profiling, by utilizing a confocal pinhole. This feature effectively rejects out-of-focus light, significantly improving image contrast and enabling non-destructive, localized analysis crucial for complex heterogeneous samples like tissue or multilayer thin films.

Which key industries are driving the demand for high-performance CRM systems?

The key industries driving demand are the Pharmaceutical Sector for polymorph screening and quality control, Materials Science for characterizing advanced nanomaterials (e.g., graphene, polymers), and the Semiconductor Industry for stress analysis and defect inspection in microelectronic components. These sectors require the precision and sensitivity offered by high-performance systems.

How is Artificial Intelligence (AI) transforming Confocal Raman data analysis?

AI, through deep learning algorithms, is transforming CRM data analysis by enabling rapid processing of hyperspectral images, automated spectral artifact removal (e.g., fluorescence), and sophisticated chemometric modeling for accurate chemical component classification. This significantly reduces data interpretation time and enhances analytical throughput in high-volume applications.

What are the main financial and technical challenges restricting market growth?

The main financial challenge is the high initial capital expenditure (CapEx) required for advanced CRM hardware. Technical challenges include the potential for strong sample fluorescence interference overwhelming the weak Raman signal and the necessity for highly specialized technical expertise to operate the instrument and interpret complex spectral data accurately.

What is the forecasted growth rate (CAGR) for the Confocal Raman Microscopes Market?

The Confocal Raman Microscopes Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 8.5% throughout the forecast period from 2026 to 2033, driven by innovation in nanotechnology and increasing adoption in regulated industrial quality control applications globally.

What is the significance of multimodal integration in Confocal Raman Microscopy?

Multimodal integration, such as combining Raman with Atomic Force Microscopy (AFM-Raman), is highly significant as it offers simultaneous acquisition of nanoscale topographic information and localized chemical signatures. This synergy provides comprehensive structure-function correlations, which are invaluable for complex surfaces, biological membranes, and advanced material interfaces.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is expected to demonstrate the fastest market growth due to massive regional investments in scientific infrastructure development, rapid expansion of domestic semiconductor manufacturing capacities, and increasing governmental focus on domestic pharmaceutical and material science R&D across key economies like China and South Korea.

What role does software play in differentiating CRM products?

Software is a critical differentiator, often providing the proprietary analytical edge. It encompasses specialized features for automated data acquisition control, advanced spectral processing techniques, comprehensive chemometric toolkits (e.g., PCA, MCR), and user-friendly interfaces, determining the efficiency and sophistication of the chemical intelligence derived from the instrument.

How do Benchtop/Portable Systems differ from High-Performance Systems?

Benchtop/Portable Systems (BPS) prioritize ease of use, compactness, and lower cost, typically intended for routine industrial quality control or field analysis, sacrificing some level of ultimate spatial resolution and laser versatility. High-Performance Systems (HPS) offer superior resolution, sensitivity, and greater customization (e.g., multiple lasers, environmental stages) for complex academic and specialized R&D applications.

What is the crucial application of CRM in the semiconductor industry?

In the semiconductor industry, Confocal Raman Microscopy is critically applied for non-destructive stress and strain analysis in silicon wafers and thin films, enabling precise characterization of material quality and structural integrity. It is also used for identifying subtle defects and analyzing the chemical composition of microelectronic layers during fabrication processes.

How is the Value Chain structured in the CRM market?

The Value Chain starts with highly specialized upstream suppliers (lasers, detectors). The midstream involves core instrument manufacturing and proprietary software development. The downstream focuses on direct and indirect distribution, installation, continuous technical support, and profitable long-term service contracts, which are vital for maintaining system performance.

What specific benefit does CRM offer to biological research?

CRM offers the unique benefit of label-free, non-invasive chemical imaging of biological samples, allowing researchers to study the intrinsic biochemical composition of cellular components, analyze metabolic changes, and observe tissue pathology without the need for extrinsic fluorescent dyes or complex sample fixation, preserving the native biological state.

What are the technological advancements addressing fluorescence interference?

Technological advancements addressing fluorescence include the use of longer-wavelength excitation lasers (e.g., 785 nm or 1064 nm) to shift excitation energy away from the sample's electronic transitions, and the implementation of advanced filtering techniques combined with algorithmic baseline correction within the system software to isolate the weak Raman signal.

What types of components constitute the Confocal Raman Microscope market?

The market components are segmented into Hardware (lasers, spectrometers, detectors, optical systems), Software (data acquisition, processing, chemometrics), and Services (installation, training, maintenance, and comprehensive support contracts). The software and services segments exhibit higher growth potential due to recurring revenue streams.

How do regulatory requirements influence CRM adoption in pharmaceuticals?

Stringent regulatory requirements from bodies like the FDA and EMA mandate high levels of quality assurance and reliable analytical validation in pharmaceutical manufacturing. CRM adoption is accelerated because it provides high-fidelity, non-destructive chemical identity verification and quantitative analysis necessary for regulatory compliance, particularly for polymorphism and dosage uniformity testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager