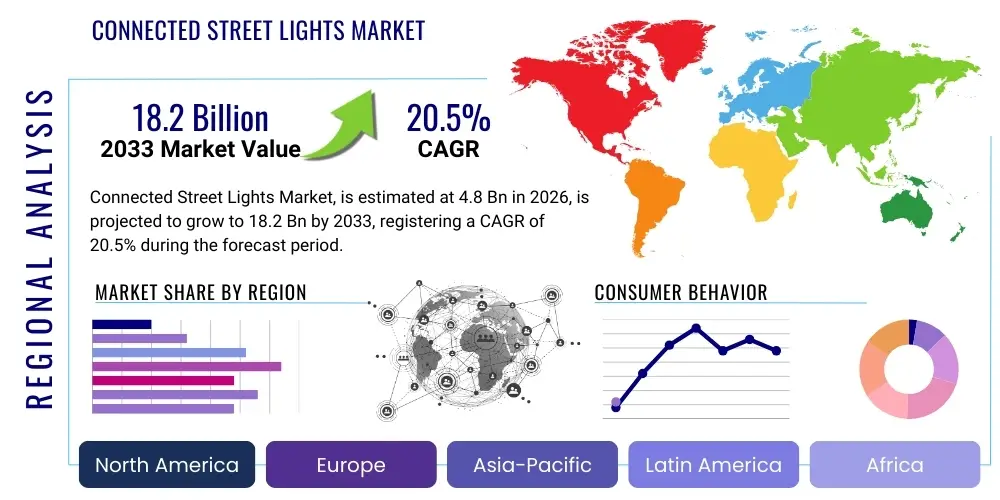

Connected Street Lights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441616 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Connected Street Lights Market Size

The Connected Street Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by accelerated global smart city initiatives, stringent governmental mandates concerning energy efficiency, and the necessity for scalable, resilient urban infrastructure management systems that reduce operational overheads while improving public safety and quality of life.

Connected Street Lights Market introduction

The Connected Street Lights Market encompasses intelligent lighting systems that utilize communication networks (such as cellular, Wi-Fi, LoRaWAN, and PLC) to enable remote monitoring, control, and asset management of individual street light fixtures or groups. These systems often integrate advanced sensors for environmental monitoring, traffic detection, and security purposes, transforming passive infrastructure into active data collection hubs essential for modern urban environments. Major applications span municipal lighting infrastructure, highways, commercial districts, and private campuses, offering benefits such as significant energy savings (up to 50-70% compared to traditional HPS lights), reduced maintenance costs through predictive failure detection, and enhanced citizen services via integrated smart city platforms. Key driving factors include the rapid global deployment of IoT infrastructure, increasing pressure on municipalities to meet sustainability goals, and the falling costs of LED fixtures and connectivity modules, making large-scale deployment economically feasible.

Connected Street Lights Market Executive Summary

Current business trends indicate a strong shift towards comprehensive Light-as-a-Service (LaaS) models, where vendors manage the entire lifecycle, from installation and maintenance to data analytics, easing the financial burden on city governments. Technology integration is paramount, with platforms emphasizing interoperability across diverse IoT devices and utilizing edge computing for real-time decision-making, moving beyond simple centralized control systems. Regionally, North America and Europe remain the leaders in adoption due to robust smart grid infrastructure and early policy adoption favoring connected technologies, while the Asia Pacific region is expected to demonstrate the fastest growth rate, driven by large-scale urbanization projects in countries like China and India. Segment-wise, network communication technologies, particularly mesh networks and NB-IoT, are witnessing rapid growth, preferred for their reliability and coverage scalability, while the software and services segment continues to capture the highest market value share due to the recurring revenue associated with advanced analytics and platform maintenance.

AI Impact Analysis on Connected Street Lights Market

User queries frequently center on how Artificial Intelligence (AI) enhances the efficiency and predictive maintenance capabilities of smart street lighting systems. Common questions revolve around the use of machine learning algorithms for optimizing dimming schedules based on real-time traffic flow, pedestrian density, and weather patterns, moving beyond simple sensor-based activation. Users are keen to understand the role of AI in anomaly detection—identifying early signs of fixture failure, cable faults, or energy spikes—which allows proactive servicing rather than reactive repairs. Furthermore, there is significant interest in AI's integration with broader smart city platforms, specifically how street light networks can become distributed sensor hubs feeding data for public safety and environmental monitoring, requiring robust edge computing powered by AI. The overall expectation is that AI will drastically reduce operational expenses (OPEX) and improve the sustainability footprint of municipal lighting infrastructure.

The implementation of AI significantly transforms connected street lighting from basic utility management into a dynamic, data-driven service platform. By leveraging deep learning models, smart systems can now accurately forecast energy needs hours or days in advance, integrating seamlessly with smart grid initiatives and peak load management strategies. This transition elevates the street light network from an energy consumer to a crucial piece of urban data infrastructure. AI ensures the reliability of the system through constant self-diagnosis, which is vital for critical urban services where failure is unacceptable. This advanced capability shifts the municipal spending model from high CapEx/high OpEx to moderate CapEx/low OpEx, making long-term smart city investments financially viable.

Furthermore, AI-driven video analytics, often embedded within connected light poles, are emerging as a core functionality for public safety. These analytics can count vehicles, detect suspicious activity, manage parking availability, and even monitor air quality fluctuations, translating raw sensor data into actionable insights for city administrators. The adoption of robust, scalable AI frameworks, typically deployed through fog or edge computing layers, addresses latency concerns inherent in cloud-based processing, enabling real-time responsiveness required for critical services like pedestrian safety illumination adjustments. This continuous evolution of intelligent features is what primarily drives market adoption and user satisfaction, solidifying the street light pole as the preferred vertical infrastructure for smart city sensor deployment.

- Predictive Maintenance: AI algorithms analyze operational data to forecast equipment failure, dramatically reducing unplanned outages and maintenance costs.

- Dynamic Dimming Optimization: Machine learning models adjust lighting levels in real-time based on actual usage patterns, traffic density, and external environmental factors, maximizing energy savings and public safety.

- Integrated Urban Data Hubs: AI processes sensor data (e.g., air quality, sound) gathered by light poles, transforming the lighting grid into a multi-purpose data collection platform for urban planning and environmental monitoring.

- Enhanced Public Safety: Utilization of video analytics and anomaly detection on edge devices to identify incidents, manage traffic flow, and automatically notify emergency services with minimal latency.

- Energy Grid Balancing: AI optimizes energy consumption schedules across the network, allowing the lighting infrastructure to participate actively in demand response programs for greater smart grid stability and efficiency.

DRO & Impact Forces Of Connected Street Lights Market

The Connected Street Lights Market is primarily driven by the imperative need for energy cost reduction in municipal budgets and the acceleration of smart city projects globally, promoting rapid technology adoption. Restraints include high initial capital expenditure (CapEx) required for large-scale retrofitting projects, concerns regarding cybersecurity and data privacy associated with extensive urban sensor networks, and the complexity of integrating diverse legacy municipal systems with modern IoT platforms. Opportunities are vast, centered on leveraging street light infrastructure as a backbone for 5G small cell deployment, EV charging stations, and comprehensive environmental sensing networks, creating new revenue streams for cities and utility providers. Key impact forces include regulatory pressure favoring energy-efficient lighting solutions (such as the widespread global phase-out of conventional mercury vapor and high-pressure sodium lamps) and technological advancements in low-power wide-area network (LPWAN) protocols like LoRaWAN and NB-IoT, which significantly lower connectivity costs and expand deployment reach.

A major impact force reshaping this market is the convergence of lighting management with broader urban mobility and environmental monitoring goals. Cities are realizing that the existing infrastructure of street light poles offers the most cost-effective mounting points for sensors critical to smart parking management, noise pollution tracking, and hyperlocal air quality analysis. This multifunctionality dramatically increases the Return on Investment (ROI) beyond mere energy savings, providing compelling financial justification for large-scale connectivity rollouts. However, the regulatory environment presents a complex challenge, particularly concerning standardized communication protocols and data ownership rules, which can slow down large cross-jurisdictional projects and restrain market harmonization. Addressing these standardization gaps is crucial for unlocking the full global potential of connected street light systems.

Furthermore, the persistent challenge of cybersecurity acts as a significant restraint. As millions of light fixtures become IP-enabled nodes, they represent an expanded attack surface for cyber threats, potentially compromising critical city infrastructure. Mitigation efforts require continuous investment in robust, decentralized security architectures, often involving hardware-level security measures and frequent software updates, increasing the complexity and ongoing operational cost (OpEx) for city authorities. Conversely, the opportunity to integrate public Wi-Fi hot spots and digital advertising displays into connected poles presents an attractive opportunity for municipalities to offset implementation costs, transforming street lights from cost centers into potential revenue generators, which substantially boosts market demand.

Segmentation Analysis

The Connected Street Lights Market is fundamentally segmented based on the component, connectivity type, application, and control method, reflecting the technological diversity and varied operational needs of end-users. The component segmentation highlights the division between hardware (LED fixtures, communication modules, sensors, and controllers) and software/services (central management systems, data analytics platforms, and maintenance contracts). Connectivity types define the network backbone, with wired solutions offering reliability and wireless solutions providing scalability and ease of deployment. Application segmentation differentiates between municipal adoption, which dominates the market, and specialized uses in private sectors like industrial parks or university campuses. This detailed segmentation allows stakeholders to focus on areas where high-speed data transfer or maximum energy savings are the priority, tailoring deployment strategies accordingly.

The control method segment is crucial, categorizing solutions into centralized (requiring high bandwidth to control all devices from a single point) and decentralized/hybrid architectures (utilizing localized edge processing for faster response times and resilience). Hybrid systems are gaining significant traction as they optimize bandwidth usage while maintaining centralized oversight. Moreover, the segmentation by light source, dominated by LEDs, reinforces the trend toward highly efficient and dimmable fixtures, which are prerequisite for integration into connected systems. The services segment, encompassing integration, maintenance, and cloud hosting, is rapidly expanding due to the increasing sophistication of data analytics required to maximize the benefits of the connected infrastructure. Understanding these layered segmentations is key for providers aiming to meet specific infrastructural requirements across diverse urban environments globally.

The fastest-growing segment in terms of component contribution is the sensor and controller unit, driven by the desire to monetize the pole infrastructure beyond illumination. These controllers, often integrated with AI chips, facilitate multi-purpose functionality such as noise monitoring, traffic flow measurement, and environmental data collection. This trend emphasizes that connectivity is now table stakes, and value generation is shifting toward the quality and variety of data extracted. From an operational perspective, the software platform and managed services segment exhibits the highest profitability, characterized by long-term contracts and the need for continuous platform updates, reflecting a transition from product sales to solution subscription models within the market ecosystem.

- Component:

- Hardware (LED Fixtures, Communication Modules, Sensors, Controllers)

- Software (Central Management System, Data Analytics Platform)

- Services (Installation, Maintenance, Integration, Consulting)

- Connectivity Type:

- Wired (Power Line Communication - PLC)

- Wireless (RF Mesh, Cellular - NB-IoT, LTE-M, 5G, LoRaWAN)

- Application:

- Highways and Roadways

- General Urban/Municipal Streets

- Commercial and Industrial Areas

- Control Method:

- Centralized Management

- Distributed/Hybrid Control

- Light Source:

- Light Emitting Diode (LED)

- High-Intensity Discharge (HID) (Legacy/Replacement Market)

Value Chain Analysis For Connected Street Lights Market

The value chain for the Connected Street Lights Market begins with upstream activities involving raw material procurement (semiconductors, metals, LED components) and the manufacturing of core hardware components like LED drivers, fixtures, and communication chips. Key suppliers in this phase include specialized semiconductor companies and global lighting manufacturers. The midstream involves system integration, where communication modules and sensors are coupled with fixtures, followed by the development and licensing of proprietary Central Management Systems (CMS) software. This integration phase is critical for ensuring interoperability and security across the entire network infrastructure. Downstream activities are dominated by distribution channels, primarily system integrators, utilities, and dedicated smart city solution providers, who interface directly with municipal and governmental end-users. Sales occur through both direct contracts with major global players and indirect channels utilizing local electrical distributors and engineering firms specialized in public works.

Upstream efficiency directly dictates the cost-competitiveness of the final product; improvements in LED driver efficiency and the miniaturization of IoT controllers are constant drivers of innovation. Manufacturers must manage complex global supply chains, often reliant on key components sourced from Asia, requiring robust logistical planning. Midstream, the focus is increasingly on providing comprehensive solutions rather than standalone products. System integrators play a pivotal role, translating complex technological requirements into scalable deployments, often managing the necessary network infrastructure build-out (e.g., gateway installation for LoRaWAN networks). The intellectual property surrounding the CMS and data analytics platform holds significant value in this stage, differentiating market leaders.

The downstream market is characterized by long sales cycles typical of government procurement, requiring vendors to demonstrate long-term reliability and favorable financing models (such as LaaS). Utilities often act as crucial distribution partners, leveraging their existing relationship with municipal authorities and their expertise in managing power infrastructure. Direct sales channels are typically used for high-value, bespoke smart city projects, ensuring customized solution delivery and closer client relationships. Indirect channels help penetrate smaller municipalities and regional markets efficiently, relying on established local partnerships. The value proposition increasingly relies on the quality of maintenance and data services provided post-installation, solidifying the role of the service segment in the downstream value creation.

Connected Street Lights Market Potential Customers

The primary end-users and buyers of connected street lighting systems are municipal governments and public works departments globally, driven by mandates to reduce electricity consumption, lower maintenance expenditures, and enhance public safety. These entities typically procure solutions through competitive tenders or long-term public-private partnerships (PPPs) that often involve guaranteed energy savings clauses. Secondary but rapidly growing customer segments include large utility companies, which increasingly manage and operate city lighting assets as part of their smart grid modernization programs, viewing the lighting infrastructure as a valuable extension of their energy distribution network. Utilities are focused on network resilience and the integration of lighting control with demand-response mechanisms.

Furthermore, private sector entities constitute a significant emerging customer base, particularly operators of large commercial real estate portfolios, industrial parks, university campuses, and private toll roads. These buyers prioritize operational efficiency, asset utilization tracking, and often seek integrated security and wayfinding features within their connected lighting systems. For example, large logistics hubs use connected lighting to manage security camera feeds and optimize lighting based on vehicle movement within the premises, thereby improving safety and cost management in highly controlled environments. The purchasing decision for private entities is often faster and less bureaucratic than municipal procurement, favoring customized, quick-deployment solutions.

The decision-making process for municipal customers is complex, typically involving multiple stakeholders, including IT departments (for network infrastructure), finance departments (for budget justification), and public safety officials (for operational benefits). Therefore, successful vendors must provide solutions that offer not only quantifiable energy savings but also robust cybersecurity compliance and seamless integration with existing city data platforms. The shift toward LaaS models lowers the entry barrier for smaller municipalities by converting large CapEx costs into manageable OpEx payments, expanding the addressable market dramatically, particularly in developing regions facing budgetary constraints but high energy demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), Cisco Systems, Inc., GE Current (A Daintree Company), Itron Inc., Silver Spring Networks (Itron), Sensus (Xylem), Echelon Corporation (Adesto Technologies), Hubbell Incorporated, Acuity Brands, Inc., Osram Licht AG, Verizon Communications Inc., Telematics Wireless (LPWAN), Schreder Group, Dimonoff, Led Roadway Lighting (LRL), Petra Systems, Wipro Lighting, Enevo, Tata Communications, Telensa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connected Street Lights Market Key Technology Landscape

The technology landscape of the Connected Street Lights market is highly diverse and rapidly evolving, characterized by the convergence of solid-state lighting (LEDs), robust communication networks, and advanced sensing capabilities. LEDs form the foundational element, offering superior energy efficiency and long lifespans, coupled with dimming capabilities essential for dynamic control. Communication technologies are segmented between wired Power Line Communication (PLC), favored for its reliability using existing infrastructure, and various wireless protocols. Wireless solutions are dominated by low-power wide-area networks (LPWAN) such as LoRaWAN and Narrowband IoT (NB-IoT), which offer wide coverage, low power consumption, and cost-effective connectivity necessary for deployments spread across large urban areas, overcoming the range limitations and high operating costs of older mesh networks.

Central to system functionality is the Central Management System (CMS) software platform, which utilizes cloud architecture and, increasingly, edge computing to manage data streams, schedule operations, and execute control commands across millions of devices. Edge computing deployed at the gateway or pole controller level is a critical technological advancement, enabling real-time data processing for latency-sensitive applications like public safety alerts and dynamic traffic management, reducing reliance on constant cloud communication. Furthermore, standardization efforts, particularly through organizations like TALQ Consortium and open API initiatives, are vital for ensuring interoperability between different hardware vendors and software platforms, minimizing vendor lock-in for municipal buyers.

The integration of advanced sensor technology, including radar, high-resolution cameras, and specialized environmental sensors (air quality, sound), transforms the smart pole into a multipurpose Smart City infrastructure asset. Power management technology, involving smart meters and over-the-air firmware update capabilities (FOTA), ensures the longevity and adaptability of installed hardware. Future technological trends point towards deeper integration with 5G small cell technology, positioning street poles as the default vertical asset for next-generation mobile network deployment, fundamentally altering the revenue model and increasing the strategic importance of this infrastructure sector.

Regional Highlights

- North America: This region is a mature and leading market, characterized by early adoption of sophisticated smart grid technologies and strong regulatory support for energy conservation. Key drivers include large-scale city-wide deployment projects (e.g., Los Angeles, Chicago) focusing on operational efficiency, coupled with rapid integration of ancillary services like smart parking and air quality monitoring into the lighting platform. The presence of major technology vendors and favorable federal funding mechanisms ensures sustained high growth and market value.

- Europe: Europe exhibits high adoption, particularly in Western countries (UK, Germany, France), driven by ambitious EU climate targets and smart city funding initiatives. The market is distinguished by a strong preference for open standards and interoperability, favoring LPWAN technologies (LoRaWAN) and robust data privacy frameworks (GDPR), which mandate secure data handling in connected systems. Eastern European cities are accelerating retrofitting projects, contributing to strong regional CAGR.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by unprecedented rates of urbanization, massive infrastructure spending, and government-led smart city projects in high-population countries like China, India, and South Korea. While initial deployments often focus on basic centralized control for maximum energy savings, the trend is quickly moving toward advanced features and 5G integration, driven by local manufacturing capabilities and competitive pricing.

- Latin America: This region is an emerging market, where deployment is primarily driven by the need to combat high energy costs and improve public security. Financing remains a key challenge, making LaaS and performance-based contracts highly popular. Brazil and Mexico are leading markets, focusing on basic connected LED retrofits combined with robust asset management tracking to reduce theft and vandalism.

- Middle East and Africa (MEA): The MEA region is characterized by high-profile, greenfield smart city developments (e.g., NEOM in Saudi Arabia) focusing on state-of-the-art integrated systems from the outset. Gulf Cooperation Council (GCC) countries are investing heavily in advanced sensor integration and high-speed cellular networks, prioritizing system resilience and advanced analytics for environmental management, while Africa sees growth focused on basic LED connectivity for critical infrastructure improvement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connected Street Lights Market.- Signify (Philips Lighting)

- Cisco Systems, Inc.

- Itron Inc.

- GE Current (A Daintree Company)

- Acuity Brands, Inc.

- Osram Licht AG

- Hubbell Incorporated

- Schreder Group

- Sensus (Xylem Inc.)

- Verizon Communications Inc.

- Telematics Wireless

- Flashnet (Intra Lighting)

- Led Roadway Lighting (LRL)

- Silver Spring Networks (Itron)

- Echelon Corporation (Adesto Technologies)

- Dimonoff

- Telensa (Signify)

- Petra Systems

- Tata Communications

- Enevo

Frequently Asked Questions

Analyze common user questions about the Connected Street Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary communication technology used in connected street lights?

The market primarily utilizes Low-Power Wide-Area Network (LPWAN) technologies, such as LoRaWAN and NB-IoT, along with RF mesh networks. These wireless solutions offer reliable, long-range connectivity at low power consumption, crucial for managing widely dispersed urban assets efficiently.

How do connected street lights contribute to smart city goals beyond energy savings?

Connected street lights serve as multi-functional platforms supporting various smart city initiatives, including hosting 5G small cells, monitoring air quality, managing traffic flow and parking availability, and enhancing public safety through integrated video analytics and real-time incident detection.

What are the main financial models for implementing connected street lighting projects?

The two main models are traditional Capital Expenditure (CapEx) procurement and the increasingly popular Light-as-a-Service (LaaS) model. LaaS shifts the financial burden to operational expenditures (OpEx), allowing cities to fund deployments through guaranteed savings on energy and maintenance costs over the contract period.

What cybersecurity risks are associated with smart street lighting networks?

The primary risks include unauthorized access to the network through unsecured endpoints, data breaches compromising collected sensor information (e.g., video feeds), and potential denial-of-service attacks that could disrupt critical city lighting services. Robust, decentralized security protocols are essential for mitigation.

Which geographical region is expected to demonstrate the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by massive government investments in new urbanization projects, high population density requiring efficient infrastructure, and significant adoption of connected technologies in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager