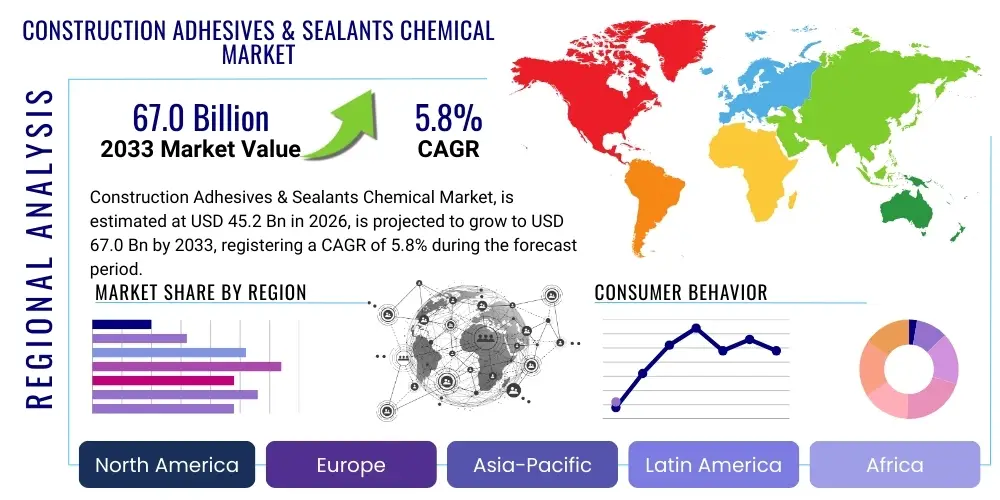

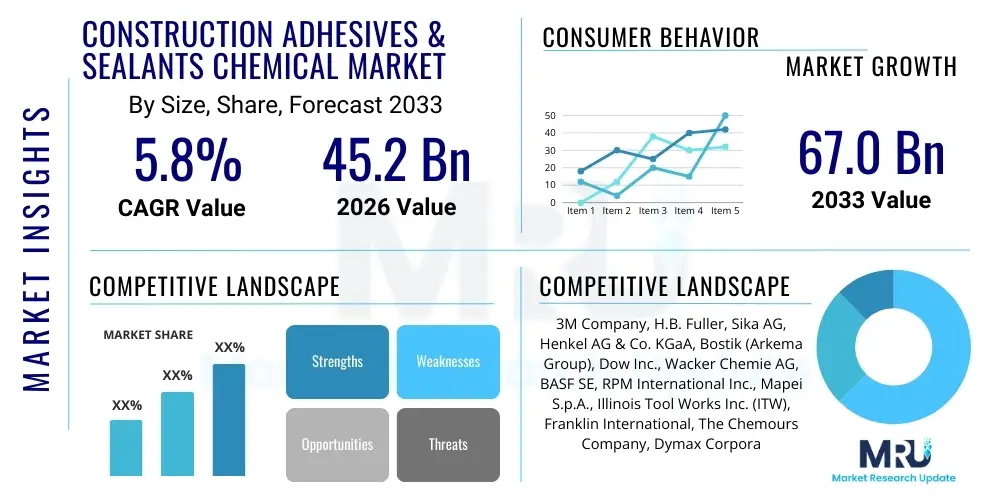

Construction Adhesives & Sealants Chemical Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442631 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Construction Adhesives & Sealants Chemical Market Size

The Construction Adhesives & Sealants Chemical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 62.5 Billion in 2026 and is projected to reach USD 101.5 Billion by the end of the forecast period in 2033.

Construction Adhesives & Sealants Chemical Market introduction

The Construction Adhesives & Sealants Chemical Market encompasses high-performance chemical formulations critical for binding, fixing, and sealing various structural and non-structural components within building and infrastructure projects. These materials, derived primarily from synthetic polymers such as polyurethanes, silicones, epoxies, and acrylics, replace traditional mechanical fasteners like nails and screws, offering superior flexibility, aesthetic finishes, enhanced durability, and improved thermal insulation properties. Modern construction practices demand materials that contribute to energy efficiency and accelerated project timelines, making advanced adhesives and sealants indispensable across residential, commercial, and heavy civil engineering sectors.

Product descriptions within this market vary significantly based on their chemical composition and curing mechanisms. Adhesives are formulated to bear high structural loads and provide permanent bonding in applications such as flooring installation, façade assembly, and prefabricated modular construction. Sealants, conversely, are designed primarily for gap filling, expansion joint sealing, and weatherproofing, maintaining elasticity and resilience against thermal expansion, contraction, and moisture ingress. The technological evolution is currently centered on developing sustainable, low-VOC (Volatile Organic Compound), and solvent-free products, driven by stringent environmental regulations and a global push toward green building certifications.

Major applications span a vast range, from critical waterproofing in roofing systems and façade glazing to interior applications like drywall installation, tiling, and window framing. The primary benefits include increased structural integrity, reduced labor costs due to faster application methods, aesthetic superiority achieved through invisible bonds, and significant enhancements in building energy performance by eliminating thermal bridges. Key driving factors include the rapid urbanization across developing economies, massive government investments in infrastructure rehabilitation and expansion, and technological advancements leading to the commercialization of hybrid polymers that offer the best attributes of both silicone and polyurethane chemistries.

Construction Adhesives & Sealants Chemical Market Executive Summary

The Construction Adhesives & Sealants Chemical Market demonstrates robust growth, primarily fueled by global infrastructure modernization programs and a persistent shift towards lightweight, prefabricated construction techniques which inherently rely on advanced chemical bonding solutions. Business trends indicate a strong move toward specialization, where manufacturers are focusing R&D efforts on developing high-strength, single-component formulations, particularly in the fast-curing MS Polymer and polyurethane segments. Furthermore, the rising cost of traditional construction labor, coupled with the need for enhanced longevity in structures, solidifies the market position of chemical bonding solutions over conventional methods. Strategic partnerships between chemical suppliers and major construction contractors are becoming commonplace to tailor solutions for large-scale, complex projects.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, characterized by unparalleled growth rates driven by rapid residential and commercial development, especially in China, India, and Southeast Asian nations. North America and Europe, while mature, exhibit high value penetration, focusing on refurbishment, sustainability mandates, and the mandatory adoption of low-VOC products. Regulatory frameworks such as REACH in Europe and similar environmental standards in North America are forcing a continuous innovation cycle, pushing companies towards water-based, solvent-free, and bio-based alternatives. The Middle East and Africa (MEA) are emerging areas, showing significant potential due to substantial investments in mega-projects and oil diversification strategies, driving demand for high-performance sealants suitable for harsh climatic conditions.

Segment trends confirm that polyurethane and silicone chemistries collectively hold the largest market share due to their versatility and superior performance in critical sealing and bonding applications. However, the fastest growth is anticipated in the hot-melt adhesives sector, driven by increased automation in prefabrication facilities, offering rapid processing times and immediate handling strength. Application-wise, the residential construction segment remains the largest consumer, but infrastructure and non-residential segments—including high-rise commercial buildings and transportation networks—are exhibiting accelerated demand for specialized, durable structural adhesives. Manufacturers are increasingly integrating digitalization into their processes, utilizing IoT and cloud technology for optimizing supply chains and improving product traceability across construction sites.

AI Impact Analysis on Construction Adhesives & Sealants Chemical Market

User queries regarding the impact of Artificial Intelligence (AI) on the construction chemicals sector predominantly revolve around material innovation, quality assurance, predictive application, and supply chain efficiency. Key themes center on whether AI can accelerate the discovery of novel, sustainable polymer formulations (Material Informatics), how machine learning algorithms can ensure optimal mixing and curing times on complex construction sites, and the potential for AI-driven robotics to standardize application processes, thereby reducing waste and labor dependence. Users are also keen to understand AI's role in predicting raw material price volatility and optimizing complex, multi-regional logistics networks inherent to the chemical supply chain, seeking assurances on cost reduction and operational stability.

The primary area of immediate impact is R&D and quality control. AI-driven Material Informatics leverages machine learning to simulate and predict the properties of millions of potential polymer combinations, drastically reducing the time and cost associated with laboratory experimentation. This capability accelerates the development of new, high-performance, and sustainable materials, such as bio-based or ultra-low VOC sealants, tailored to specific environmental and structural requirements. Furthermore, AI systems are now being integrated into manufacturing processes to monitor variables like temperature, pressure, and catalyst concentration in real-time, ensuring batch-to-batch consistency and minimizing product defects, which is crucial for high-reliability structural adhesives.

In application and logistics, AI is transforming how construction chemicals are deployed. Predictive maintenance algorithms, utilizing sensor data from curing environments, can alert site managers to suboptimal conditions that might compromise bond strength, ensuring quality compliance and longevity. Additionally, supply chain optimization using AI tools addresses the chronic issues of fluctuating petrochemical feedstock costs and complex international logistics. These systems provide demand forecasting accuracy, optimize warehousing locations, and schedule transportation routes dynamically, thereby reducing inventory costs and ensuring the just-in-time delivery of often temperature-sensitive products to global construction sites.

- AI accelerates new polymer discovery via Material Informatics, targeting sustainability.

- Machine learning optimizes chemical manufacturing processes, ensuring consistent quality and reducing defects.

- AI-driven sensors monitor curing conditions on-site, enhancing bond strength reliability and quality assurance.

- Predictive analytics stabilize raw material procurement by forecasting price fluctuations.

- Robotic systems utilize AI vision to ensure precise, automated sealant and adhesive application, minimizing waste.

- Cloud-based platforms integrate construction planning with material delivery schedules for optimized logistics.

DRO & Impact Forces Of Construction Adhesives & Sealants Chemical Market

The market is predominantly driven by significant global urbanization, necessitating continuous construction of new infrastructure and housing, particularly in emerging economies. The rising adoption of advanced building techniques, such as modular construction and prefabrication, inherently increases the reliance on high-performance adhesives over mechanical fastening due to requirements for speed and structural uniformity. Furthermore, environmental regulations mandating sustainable, energy-efficient buildings globally act as a powerful driver, pushing demand specifically for low-VOC, water-based, and highly insulating sealants that contribute to LEED and BREEAM certifications. This regulatory push elevates the value proposition of modern chemical solutions.

Restraints primarily revolve around the volatility and complexity of raw material pricing, particularly petrochemical-derived feedstocks (e.g., crude oil derivatives used in polyurethanes and acrylics), which impacts manufacturing costs and profit margins unpredictably. Another significant restraint is the need for specialized application training and equipment; improper use of certain high-performance adhesives can lead to structural failures, necessitating rigorous quality control and technical support, which increases operational overhead for manufacturers. Furthermore, in price-sensitive markets, the higher initial cost of advanced chemical solutions compared to traditional fasteners can occasionally deter adoption, despite the superior long-term performance benefits.

Opportunities abound in developing bio-based chemistries and smart/functional adhesives that incorporate embedded sensing capabilities for monitoring structural health in real-time. The untapped potential in refurbishment and retrofitting markets in mature economies offers substantial avenues for growth, requiring specialized sealants and adhesives for aging infrastructure and energy-saving upgrades. Impact forces include significant infrastructure spending mandates by governments worldwide, which exponentially increase demand for durable bridge and road construction sealants, alongside stringent environmental performance standards which consistently force incremental innovation in product formulation, ensuring market stability and continuous technological progression.

Segmentation Analysis

The Construction Adhesives & Sealants Chemical Market is highly fragmented and segmented based on chemistry, technology, application, and end-use. Detailed segmentation provides manufacturers with targeted strategies for product development and market penetration. The chemical type segmentation is crucial, differentiating products by base polymer, which dictates performance characteristics such as tensile strength, flexibility, curing time, and resistance to environmental factors like UV exposure and moisture. The key segments—polyurethane, silicone, epoxy, and acrylic—each serve distinct functional requirements across various construction phases, from heavy structural bonding to delicate finish work.

Segmentation by technology—water-based, solvent-based, hot melt, and reactive—is vital for understanding environmental impact and ease of application. The global trend is accelerating the shift from solvent-based systems (due to high VOC content) towards safer, more sustainable water-based and reactive (100% solids) formulations. Hot melts, driven by their rapid setting time, are expanding significantly within the prefabrication segment. Application segmentation further refines market analysis by classifying consumption across critical areas like glazing, flooring, roofing, panel bonding, and civil applications (tunnels, bridges), where performance specifications are highly regulated and demanding.

The end-use segmentation categorizes demand drivers into residential, non-residential (commercial, industrial, institutional), and infrastructure construction. Residential consumption remains volume-dominant, while non-residential and infrastructure projects often necessitate higher-value, specialized structural adhesives and high-movement sealants, driving revenue growth. Understanding the interplay between these segments is essential for market players to anticipate shifts in demand caused by governmental spending cycles, housing market fluctuations, and specific regional infrastructure mandates, ensuring a comprehensive view of market dynamics and opportunity mapping.

- By Chemical Type:

- Polyurethane

- Silicone

- Epoxy

- Acrylic

- Polysulfide

- MS Polymers (Hybrid)

- Others (Silyl-modified, Butyl, etc.)

- By Technology:

- Water-Based

- Solvent-Based

- Hot Melt

- Reactive (100% Solids)

- By Application:

- Flooring & Tiling

- Roofing

- Glazing

- Facade Bonding

- Concrete Joints & Gap Filling

- Wall Paneling

- HVAC

- Sanitary & Kitchen

- By End-Use Sector:

- Residential Construction

- Non-Residential Construction (Commercial, Institutional, Industrial)

- Infrastructure & Civil Engineering

Value Chain Analysis For Construction Adhesives & Sealants Chemical Market

The value chain begins with upstream analysis, focusing on the procurement of primary raw materials, which are overwhelmingly petrochemical-derived, including monomers (like acrylic esters, vinyl acetate), oligomers, polyols, isocyanates, and silicone precursors (siloxanes). This stage is characterized by high price volatility, dependence on geopolitical stability, and oligopolistic supply structures from major chemical companies. Manufacturers in the construction chemical market must maintain robust supply chain management, often engaging in long-term contracts or implementing hedging strategies to mitigate fluctuating feedstock costs, which account for a significant portion of the final product price. The purity and consistency of these raw materials directly impact the final adhesive or sealant performance, demanding stringent quality checks at the input stage.

The core manufacturing process involves chemical synthesis, compounding, and formulation, where specialized chemical companies convert raw polymers into functional adhesive and sealant products by adding curing agents, plasticizers, fillers (like calcium carbonate, fumed silica), pigments, and rheology modifiers. Formulation expertise is a key differentiator, as it determines the product’s viscosity, application characteristics, cure rate, and ultimate physical properties. Downstream analysis focuses on the distribution and market delivery channels. Products are rarely sold directly to end-users unless dealing with very large, bespoke infrastructure projects. Instead, they move through a complex network including large chemical distributors, specialized construction material suppliers, and retail channels (hardware stores, DIY outlets).

Distribution channels are critical for market access and inventory management. Indirect channels, utilizing national and regional distributors, provide wide geographic coverage and handle smaller order quantities required by mid-sized contractors and maintenance companies. Direct channels are typically reserved for large-volume sales to major construction firms, governmental agencies for infrastructure work, or OEM manufacturers (e.g., window and façade producers) who integrate the chemicals directly into their production lines. Effective inventory management is paramount, particularly for products with limited shelf lives, such as two-component epoxies and moisture-sensitive polyurethanes. The final stage involves application and post-sales technical support, ensuring correct usage, which often requires significant investment in training construction professionals, solidifying the relationship between the manufacturer and the end-user.

Construction Adhesives & Sealants Chemical Market Potential Customers

The primary customer base for construction adhesives and sealants is highly diversified, spanning professional contractors and industrial consumers across the building lifecycle. Large-scale general contractors involved in commercial and institutional building (e.g., hospitals, high-rise offices) are major consumers, demanding structural-grade adhesives (epoxies, high-strength polyurethanes) for facade systems, precast concrete segments, and heavy flooring applications. These customers prioritize technical specifications, certification compliance (fire ratings, seismic resistance), and timely bulk delivery, often seeking customized technical support and on-site training from suppliers. Their purchasing decisions are heavily influenced by performance warranties and long-term durability metrics.

Specialized subcontractors represent another critical segment, including HVAC installers, roofing specialists, glazing companies, and tile setters. These end-users require niche, high-performance sealants (silicones, polysulfides) optimized for specific environmental conditions or substrates, such as flexible, UV-resistant sealants for window perimeter joints or specialized waterproofing membranes for roofing systems. For this segment, ease of application, quick curing time, and compatibility with specific substrates (e.g., PVC, glass, metal) are paramount factors in product selection, and they often purchase through specialized regional distributors rather than direct manufacturer channels.

Furthermore, the growing DIY (Do-It-Yourself) and retail sector, served through large hardware chains and home improvement stores, constitutes a substantial volume market, typically favoring user-friendly, general-purpose acrylic and small-format silicone sealants. Finally, government and municipal agencies, particularly those managing large infrastructure projects (roads, bridges, wastewater systems), act as significant end-users for high-durability, civil engineering grade sealants and protective coatings, purchased either directly or through tenders managed by major engineering firms. These buyers prioritize products certified to meet national standards for durability and environmental safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 62.5 Billion |

| Market Forecast in 2033 | USD 101.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, Henkel AG & Co. KGaA, 3M Company, BASF SE, Arkema S.A. (Bostik), Dow Inc., Wacker Chemie AG, H.B. Fuller Company, Selena Group, Mapei S.p.A., Huntsman Corporation, RPM International Inc. (Tremco CPG), ITW (Plexus), PPG Industries, Permabond LLC, KCC Corporation, Franklin International, Soudal N.V., Uniseal, and GCP Applied Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Adhesives & Sealants Chemical Market Key Technology Landscape

The current technological landscape is defined by the pervasive shift towards high-performance, environmentally conscious formulations. One of the most impactful advancements is the widespread adoption of Silyl Modified Polymer (SMP) or MS Polymer technology. These hybrid sealants combine the best attributes of silicones (UV stability, durability) and polyurethanes (paintability, mechanical strength) while eliminating the need for solvents or isocyanates, making them highly favored for sustainable and health-conscious building projects in regulated markets like Europe and North America. Their versatility allows them to replace traditional solvent-based systems in facade bonding, floor installation, and roofing, driving premium segment growth and setting new benchmarks for sustainability.

Another significant technological focus lies in improving application efficiency through advanced curing mechanisms and automation-friendly formulations. Rapid-curing adhesives, particularly in the hot-melt and reactive polyurethane segments, are essential for modern prefabrication and modular construction, where cycle times are extremely short. UV-curing and moisture-curing technologies are being refined to ensure consistent performance regardless of variable on-site environmental conditions, reducing project delays. Furthermore, manufacturers are heavily investing in nanotechnology to incorporate materials like carbon nanotubes or nano-silica, which enhance mechanical properties such as shear strength, impact resistance, and thermal stability without significantly increasing product viscosity or complexity.

The third major technological trend is the development of intelligent or functional coatings and sealants. This involves formulations designed not just for bonding but also to perform secondary functions, such as phase change materials (PCMs) integrated into sealants for passive temperature regulation, or anti-microbial additives crucial for healthcare and food processing facilities. Moreover, the integration of digital tools, such as mobile apps and IoT sensors, assists contractors in calculating precise material needs, monitoring application conditions, and verifying the optimal curing status of structural bonds, transforming chemical products into integrated solutions that enhance overall construction site management and quality control.

Regional Highlights

Regional dynamics heavily influence the demand for specific adhesive and sealant chemistries, driven by local building codes, climate, and economic development pace. The Asia Pacific (APAC) region is the undisputed leader in both volume and growth rate, primarily due to monumental urbanization and large-scale infrastructure projects across China, India, and ASEAN countries. Demand here is characterized by high volume consumption in residential construction, favoring cost-effective yet reliable acrylic and general-purpose polyurethane sealants. However, as standards improve, particularly in commercial centers like Singapore and Japan, there is a burgeoning demand for high-end silicone and MS Polymer products required for complex glazing and seismic-resistant structures. Environmental regulations, though historically less strict than the West, are rapidly tightening, especially regarding VOC emissions, pushing regional manufacturers towards developing compliant water-based alternatives.

North America represents a mature, high-value market defined by stringent safety and environmental regulations. The focus is heavily on repair, renovation, and energy efficiency upgrades, driving strong demand for high-performance insulating foam sealants and low-VOC acrylic and hybrid polymer products. The market benefits significantly from investments in residential renovation and commercial property refurbishment, adhering to strict green building standards like LEED. Key drivers include the adoption of structural glazing systems and mass timber construction, both of which require specialized, certified structural adhesives. Technological adoption, particularly of robotic application systems and smart site management tools, is accelerating, emphasizing productivity and labor cost reduction.

Europe stands out as the pioneering region for environmental and health standards, with regulations like REACH driving innovation toward solvent-free and bio-based chemistries. Germany, the UK, and France are primary markets, characterized by a stable but demanding construction sector focused on achieving nearly zero-energy buildings (NZEB). This mandates the use of highly insulating perimeter sealants and air-tight bonding systems. The European market exhibits a strong preference for hybrid (MS Polymer) and 100% solids reactive adhesives due to their compliance and superior performance characteristics in demanding weather conditions. Political initiatives favoring sustainable construction and the renovation wave across the EU ensure continuous demand for technically advanced and certified products.

Latin America (LATAM) presents a dynamic, yet fragmented market, heavily influenced by localized economic cycles and infrastructure deficits. Brazil and Mexico are the largest consumers, with demand driven by urbanization and government spending on transportation infrastructure. The market leans heavily on traditional, cost-effective solvent-based and acrylic formulations, though awareness and adoption of high-performance polyurethanes and silicones are increasing in major metropolitan commercial projects. Economic instability in certain nations can pose a restraint, leading to project delays, yet the long-term need for modernized housing and improved public works guarantees underlying market growth.

The Middle East and Africa (MEA) region is characterized by large, capital-intensive mega-projects (e.g., NEOM, Dubai Expo projects) demanding premium, specialized sealants and adhesives capable of withstanding extreme temperatures, high UV radiation, and arid conditions. Saudi Arabia and the UAE are critical centers of demand, focusing on high-specification silicone and polysulfide sealants for durable exterior applications and infrastructure. The African continent, particularly South Africa and Nigeria, offers emerging potential driven by housing needs and infrastructure modernization, though market adoption often requires balancing performance requirements with cost constraints, leading to a complex mix of high-end imports and locally formulated, mid-grade products.

- Asia Pacific (APAC): Dominates market share, driven by rapid urbanization, high-volume residential construction, and significant infrastructure expansion (China, India). Key focus on balancing cost and evolving environmental standards.

- North America: High-value market focused on renovation, energy efficiency, and low-VOC product adherence. Strong demand for structural adhesives in specialized construction methods (mass timber, structural glazing).

- Europe: Regulatory leader (REACH), emphasizing sustainable, bio-based, and NZEB-compliant materials. High adoption rates for MS Polymers and reactive, solvent-free systems.

- Latin America (LATAM): Growth tied to national infrastructure investments (Brazil, Mexico). Gradual shift from basic acrylics to high-performance polyurethanes in major urban centers.

- Middle East & Africa (MEA): Demand concentrated in high-specification sealants for extreme climate resistance, fueled by government-backed mega-projects (Saudi Arabia, UAE).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Adhesives & Sealants Chemical Market.- Sika AG

- Henkel AG & Co. KGaA

- 3M Company

- BASF SE

- Arkema S.A. (Bostik)

- Dow Inc.

- Wacker Chemie AG

- H.B. Fuller Company

- Selena Group

- Mapei S.p.A.

- Huntsman Corporation

- RPM International Inc. (Tremco CPG)

- ITW (Plexus)

- PPG Industries

- Permabond LLC

- KCC Corporation

- Franklin International

- Soudal N.V.

- Uniseal

- GCP Applied Technologies

Frequently Asked Questions

Analyze common user questions about the Construction Adhesives & Sealants Chemical market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of sustainable sealants and adhesives in construction?

Growth is primarily driven by increasingly stringent environmental regulations (like European VOC limits), global green building certification standards (LEED, BREEAM), and rising consumer demand for healthier, low-emission materials that contribute to energy-efficient building envelopes.

Which chemical type holds the largest share in the construction market and why?

Polyurethane and Silicone chemistries collectively hold the largest market share. Polyurethanes are valued for their versatility, high strength, and flexibility in structural bonding and joint sealing, while Silicones are essential for their superior UV resistance, durability, and resilience in glazing and weatherproofing applications.

How is modular construction impacting the demand for chemical products?

Modular construction significantly increases demand for high-performance, rapid-curing adhesives (especially hot melts and reactive polyurethanes). These materials enable faster assembly, reduce the need for mechanical fasteners, and provide the necessary structural integrity for transported and stacked modules.

What are MS Polymers and why are they gaining popularity?

MS Polymers (Silyl Modified Polymers) are hybrid sealants gaining popularity because they offer the performance benefits of silicones and polyurethanes without containing harmful isocyanates or solvents. They are known for excellent paintability, strong adhesion to diverse substrates, and superior environmental compliance (low-VOC).

Which region offers the most significant growth opportunities for new market entrants?

The Asia Pacific (APAC) region, particularly emerging economies like India and Southeast Asia, offers the most significant growth opportunities due to massive government-backed infrastructure development and a rapidly expanding residential housing sector, although cost competitiveness is a major factor for success.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager