Construction Cost Estimating Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440849 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Construction Cost Estimating Software Market Size

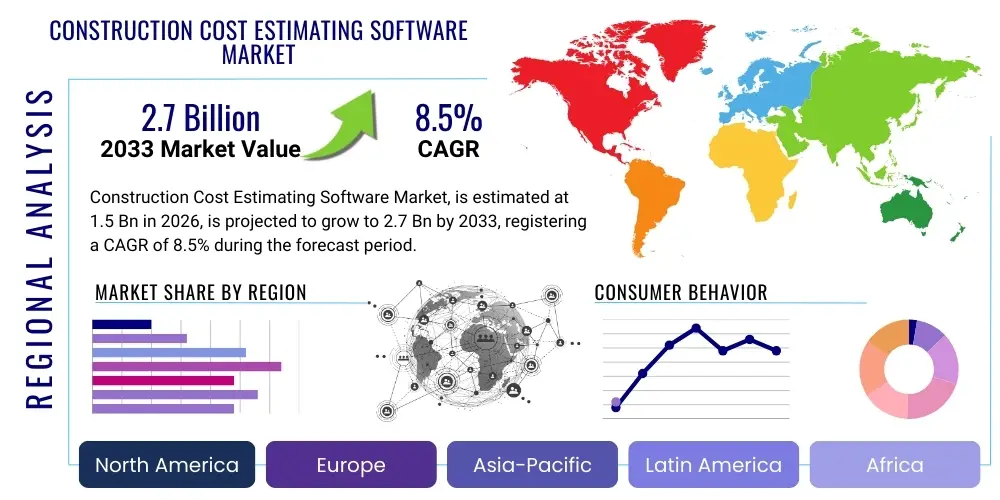

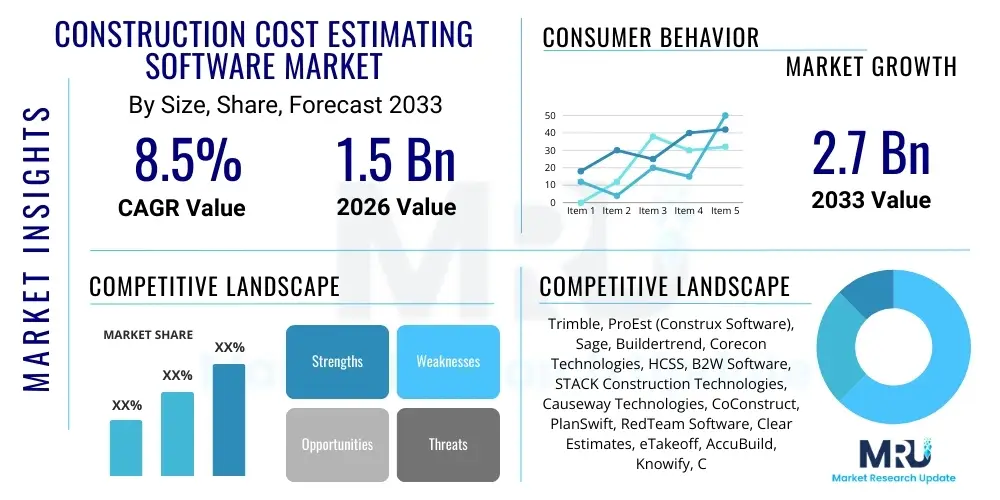

The Construction Cost Estimating Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2033.

Construction Cost Estimating Software Market Introduction

The Construction Cost Estimating Software Market encompasses a range of digital tools designed to automate and streamline the process of forecasting the costs associated with construction projects. These sophisticated platforms assist contractors, builders, developers, and project managers in accurately calculating material, labor, equipment, subcontractor, and overhead expenses, ensuring bids are competitive yet profitable. The core product offering includes features such as bid management, takeoff capabilities, proposal generation, and integration with accounting and project management systems, providing a holistic view of project financials from inception to completion. This market's evolution is driven by the increasing complexity of construction projects, the need for enhanced financial predictability, and a widespread industry shift towards digital transformation and efficiency.

Major applications for construction cost estimating software span across residential, commercial, industrial, and infrastructure sectors. In residential construction, it aids in precise budgeting for custom homes and large-scale developments. For commercial projects, it helps manage the intricate costs of office buildings, retail spaces, and hospitality venues. Industrial applications involve complex facility builds, where accurate estimates are critical for capital allocation and project viability. Furthermore, infrastructure projects like roads, bridges, and utilities heavily rely on these tools for managing massive scale and long-term financial planning. The software provides substantial benefits by reducing manual errors, improving bid accuracy, accelerating the bidding process, enhancing collaboration among project stakeholders, and ultimately leading to better project outcomes and increased profitability. This improved precision minimizes risk associated with cost overruns and allows companies to secure more projects through competitive and well-justified pricing strategies.

Driving factors propelling the growth of this market include the global surge in construction activities, particularly in developing economies, necessitating advanced tools for project financial management. The increasing adoption of Building Information Modeling (BIM) mandates integrated solutions that can leverage detailed models for quantity takeoffs and cost estimation. Moreover, the persistent demand for greater operational efficiency, cost reduction, and improved project delivery timelines across the construction industry is a significant catalyst. The shift towards cloud-based solutions offering enhanced accessibility, scalability, and collaborative features is also a key driver, alongside the growing recognition of data-driven decision-making in project lifecycle management. Regulatory pressures for transparency and accountability in project financials further stimulate market expansion.

Construction Cost Estimating Software Market Executive Summary

The Construction Cost Estimating Software Market is experiencing robust growth, primarily fueled by the accelerating digital transformation within the global construction sector. Business trends indicate a strong emphasis on integration, with software solutions increasingly offering seamless interoperability with BIM platforms, ERP systems, and project management tools to create a unified data environment. There is a discernible shift towards subscription-based, Software-as-a-Service (SaaS) models, reflecting the industry's preference for flexible, scalable, and cost-effective solutions that reduce upfront IT infrastructure investments. Furthermore, competitive pressures are driving continuous innovation in features like artificial intelligence for predictive analytics and machine learning for historical data analysis, aiming to provide more accurate and efficient estimations.

Regional trends highlight North America and Europe as mature markets with high adoption rates, driven by stringent regulatory frameworks and a strong focus on technological advancement. The Asia Pacific region is emerging as a high-growth market, propelled by rapid urbanization, extensive infrastructure development projects, and increasing foreign direct investment in construction, leading to a surge in demand for sophisticated estimating tools. Latin America and the Middle East & Africa are also showing promising growth, albeit at an earlier stage of adoption, as construction sectors in these regions embrace digital solutions to enhance productivity and project control. Government initiatives promoting smart cities and sustainable construction practices are further stimulating market penetration across diverse geographies, creating a fertile ground for market expansion.

Segmentation trends reveal a strong demand for cloud-based deployment models due to their inherent flexibility, scalability, and accessibility from any location. Small and Medium-sized Enterprises (SMEs) are increasingly adopting these solutions, often through more affordable SaaS offerings, recognizing the critical role of accurate cost estimation in their competitive positioning. The application segment sees significant growth across all construction types, with a notable uptick in infrastructure and large commercial projects where complex estimations are paramount. The market is also witnessing a demand for specialized modules, such as advanced quantity takeoff tools and risk assessment modules, indicating a move towards more comprehensive and specialized software capabilities. Services segments, including implementation, training, and support, are also expanding as companies seek to maximize their investment in these critical software platforms.

AI Impact Analysis on Construction Cost Estimating Software Market

Common user questions regarding AI's impact on construction cost estimating software often revolve around its ability to enhance accuracy, automate repetitive tasks, predict future costs, and integrate with existing workflows. Users are keen to understand how AI can mitigate human error, analyze vast datasets for better insights, and provide a competitive edge in bidding. Concerns frequently include data privacy, the learning curve for new AI-powered tools, the potential for job displacement, and the reliability of AI algorithms in handling unique project complexities and unforeseen circumstances. The core expectation is that AI will revolutionize efficiency, reduce project risks, and drive more intelligent, data-driven decision-making throughout the estimation process, moving beyond traditional methods.

- Enhanced Accuracy: AI algorithms can analyze historical project data, market trends, and risk factors to provide more precise and reliable cost estimates, significantly reducing the likelihood of overruns or underbidding.

- Automated Takeoffs: Machine learning can automate the tedious process of quantity takeoffs from blueprints and BIM models, identifying materials and their quantities with greater speed and accuracy than manual methods.

- Predictive Analytics: AI can forecast future material prices, labor costs, and project timelines by identifying patterns in vast datasets, allowing for more proactive and strategic financial planning.

- Risk Assessment: AI-powered tools can identify potential project risks and their associated cost implications by analyzing similar past projects and external factors, helping estimators account for contingencies more effectively.

- Bid Optimization: By simulating various scenarios and analyzing competitor data, AI can help optimize bid strategies, enabling companies to submit more competitive and profitable proposals.

- Resource Allocation: AI can suggest optimal allocation of resources, including labor and equipment, based on project demands and availability, thereby improving efficiency and cost-effectiveness.

- Integration with BIM: AI can seamlessly integrate with Building Information Modeling (BIM) to extract comprehensive data for detailed cost breakdowns, ensuring consistency and accuracy across design and estimation phases.

- Personalized Insights: AI can offer customized recommendations and insights based on a company's specific historical project performance and financial objectives.

- Error Reduction: By flagging anomalies and inconsistencies in data inputs, AI significantly reduces human errors in complex calculations and data entry.

- Faster Estimation Cycles: Automation and intelligent data processing allow for significantly shorter estimation cycles, enabling companies to respond to tenders more rapidly and efficiently.

DRO & Impact Forces Of Construction Cost Estimating Software Market

The Construction Cost Estimating Software Market is shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. Key drivers include the global push for digital transformation within the construction industry, aiming to enhance productivity and reduce operational inefficiencies. The increasing complexity of modern construction projects, coupled with volatile material costs and labor shortages, necessitates advanced tools for precise financial planning and risk mitigation. Furthermore, the growing adoption of Building Information Modeling (BIM) across the globe creates a natural demand for integrated estimating solutions that can leverage detailed project models for accurate quantity takeoffs and cost analyses, thereby fostering greater collaboration and data consistency throughout the project lifecycle. These factors collectively push companies to invest in robust software solutions.

However, the market also faces significant restraints. The initial high upfront investment associated with advanced estimating software, particularly for smaller contractors or those with limited capital, can be a barrier to entry. There is also a notable resistance to change within the traditionally conservative construction sector, with many companies accustomed to manual or spreadsheet-based estimation methods, making the adoption of new technologies a challenge. A lack of skilled personnel capable of effectively utilizing sophisticated software and interpreting complex data further impedes market growth. Data security concerns, especially with cloud-based solutions handling sensitive financial information, also pose a restraint, as companies prioritize the protection of proprietary project details. These obstacles require robust support and training infrastructure from software providers.

Opportunities within the market are abundant and promising. The increasing focus on green building and sustainable construction practices opens avenues for specialized estimating software that can factor in environmental costs, energy efficiency, and lifecycle assessments. Emerging markets, particularly in Asia Pacific, Latin America, and Africa, present vast untapped potential due to rapid urbanization, significant infrastructure development, and a burgeoning construction sector eager to adopt modern technologies. The integration of cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and automation offers significant growth opportunities, promising unprecedented levels of accuracy and efficiency. Additionally, the proliferation of cloud computing and mobile solutions provides new ways to deliver and access estimating software, enhancing flexibility and accessibility for users globally. The ongoing digital revolution in construction continues to create a fertile ground for innovation and market expansion, transforming traditional estimation processes.

Segmentation Analysis

The Construction Cost Estimating Software Market is comprehensively segmented to provide a detailed understanding of its diverse components and evolving dynamics. This segmentation helps analyze market trends, identify lucrative opportunities, and assess competitive landscapes across various dimensions such as deployment models, enterprise sizes, specific applications, and the core functionalities offered by the software solutions. Understanding these segments is crucial for stakeholders to tailor their strategies, product development, and market penetration efforts effectively within the industry. Each segment represents distinct user needs and technological preferences, driving varied demand patterns and growth trajectories across the global market. The market's complexity necessitates a multi-faceted approach to segmentation for accurate analysis.

- By Deployment Type

- On-premise

- Cloud-based

- By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Projects

- By Component

- Software

- Services (Implementation, Training, Support & Maintenance)

- By Module

- Bidding & Estimating

- Quantity Takeoff

- Project Management & Scheduling

- Cost Control & Tracking

- Reporting & Analytics

- Contract Management

Value Chain Analysis For Construction Cost Estimating Software Market

The value chain for the Construction Cost Estimating Software Market begins with upstream activities centered around research and development. This initial stage involves substantial investment in understanding industry needs, technological advancements, and user experience design to create innovative and effective software solutions. Key upstream suppliers include technology providers for operating systems, cloud infrastructure, AI/ML components, and database management systems, as well as talent pools of software engineers, data scientists, and industry domain experts. The quality and efficiency of these upstream inputs directly impact the sophistication and competitive edge of the final software product. Continuous innovation in algorithms, user interfaces, and integration capabilities is paramount at this stage.

Midstream activities involve the core development, testing, and customization of the software. This phase includes coding, quality assurance, cybersecurity testing, and the integration of various modules (e.g., takeoff, bidding, project management). Companies often engage in strategic partnerships with BIM software developers, CAD providers, and ERP system vendors to ensure seamless interoperability and enhance the value proposition of their estimating solutions. Marketing and sales efforts also fall into this category, encompassing branding, lead generation, demonstrations, and negotiation of contracts. The effectiveness of these midstream processes determines the market readiness, scalability, and overall adoption rate of the construction cost estimating software across diverse user segments.

Downstream activities focus on product distribution and post-sales support, directly impacting customer satisfaction and retention. Distribution channels are primarily direct, through the software vendor's sales force and online platforms, allowing for direct engagement and tailored solutions. Indirect channels may involve value-added resellers (VARs), system integrators, and consulting firms who implement the software as part of broader digital transformation projects for their construction clients. Post-sales support includes comprehensive training programs, technical assistance, regular software updates, and ongoing customer success initiatives. The robustness of this downstream segment is critical for ensuring that end-users maximize the benefits of the software, leading to long-term client relationships, positive referrals, and sustained market growth. Efficient support contributes significantly to product stickiness.

Construction Cost Estimating Software Market Potential Customers

The primary potential customers and end-users of construction cost estimating software are diverse entities within the construction and related industries, all seeking to enhance accuracy, efficiency, and profitability in their project bidding and financial management. This broad spectrum includes general contractors who manage and execute large-scale projects, requiring robust tools for comprehensive cost breakdowns and subcontractor management. Specialty contractors, focusing on specific trades such as electrical, plumbing, HVAC, or masonry, also form a significant customer base, needing specialized modules for their niche requirements. These contractors rely on the software to produce precise bids, manage material procurement, and track labor costs effectively across numerous projects.

Beyond contractors, real estate developers are crucial buyers, utilizing the software for feasibility studies, project budgeting, and investor presentations, ensuring the financial viability of their proposed ventures before breaking ground. Architects and engineering firms often leverage estimating software in the design phase to provide clients with early cost projections and make design decisions based on budget constraints. Public sector entities, including government agencies and municipal departments responsible for infrastructure development, are also major users, employing these tools for transparent bidding processes, project allocation, and ensuring accountability in public works projects. Their need for detailed, auditable cost estimates is paramount.

Furthermore, construction project management companies and owners' representatives employ the software to monitor project costs, track progress against budget, and manage change orders, ensuring projects remain on schedule and within financial parameters. Financial institutions involved in construction lending or project financing may also use these tools for risk assessment and valuation purposes. Educational institutions and vocational training centers represent an emerging customer segment, integrating estimating software into their curricula to prepare future construction professionals. Ultimately, any organization involved in planning, bidding, executing, or overseeing construction projects stands to benefit significantly from adopting these advanced cost estimating solutions, driving demand across the entire construction ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble, ProEst (Construx Software), Sage, Buildertrend, Corecon Technologies, HCSS, B2W Software, STACK Construction Technologies, Causeway Technologies, CoConstruct, PlanSwift, RedTeam Software, Clear Estimates, eTakeoff, AccuBuild, Knowify, CMiC, UDA Technologies, Viewpoint (Trimble), CostX (Exactal) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Cost Estimating Software Market Key Technology Landscape

The technological landscape of the Construction Cost Estimating Software Market is rapidly evolving, driven by the imperative for greater accuracy, efficiency, and integration within the construction ecosystem. Central to this evolution is the pervasive adoption of cloud computing, enabling Software-as-a-Service (SaaS) models that offer unparalleled flexibility, scalability, and accessibility. Cloud-based platforms allow users to access their estimating data and tools from anywhere, at any time, fostering real-time collaboration among project stakeholders and reducing the need for significant on-premise IT infrastructure investments. This shift empowers both large enterprises and SMEs to leverage advanced software solutions without the burden of complex installations or maintenance. The move to the cloud also facilitates continuous updates and feature enhancements, ensuring users always have access to the latest capabilities.

Another foundational technology shaping the market is Building Information Modeling (BIM) integration. Modern estimating software is increasingly designed to seamlessly import and interpret data from BIM models, enabling automated quantity takeoffs and highly detailed cost breakdowns directly from 3D designs. This integration significantly reduces manual data entry, minimizes errors, and ensures consistency between design and cost estimation, leading to more accurate bids and fewer design-related cost overruns. The ability to visualize costs in the context of a 3D model enhances understanding and communication, making the estimation process more transparent and collaborative. As BIM becomes standard practice, the demand for deeply integrated estimating solutions will only intensify.

Furthermore, the market is profoundly influenced by advancements in Artificial Intelligence (AI) and Machine Learning (ML). These technologies are being deployed to analyze vast datasets of historical project costs, market prices, labor rates, and risk factors to provide predictive analytics and refine cost models. AI-powered algorithms can identify trends, forecast future expenses, and even optimize bidding strategies based on probability and past performance. Mobile technology also plays a crucial role, with many platforms offering mobile applications that allow on-site data collection, progress tracking, and access to estimates from tablets and smartphones. This mobile capability enhances flexibility and responsiveness, enabling estimators and project managers to stay connected and make informed decisions while on the go. The convergence of these technologies creates a powerful suite of tools that are transforming construction cost estimation from a manual, error-prone process into a highly data-driven and intelligent operation.

Regional Highlights

- North America: Dominant market share attributed to early technology adoption, high investment in construction, and a strong regulatory environment favoring digital tools. The U.S. and Canada lead in implementing advanced software solutions, driven by large-scale commercial and infrastructure projects.

- Europe: Stable growth driven by stringent building codes, sustainable construction initiatives, and a mature construction sector prioritizing efficiency and innovation. Countries like Germany, the UK, and France are key contributors, with increasing adoption of BIM and cloud-based solutions.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid urbanization, significant infrastructure development, and increasing foreign direct investment in construction. Emerging economies such as China, India, and Southeast Asian nations are witnessing substantial demand for cost-estimating software to manage complex projects and improve productivity.

- Latin America: Emerging market with growing adoption rates, as countries invest in improving infrastructure and housing. Brazil and Mexico are at the forefront, driven by a need for greater project control and cost efficiency.

- Middle East and Africa (MEA): Significant potential due to mega-projects, diversification away from oil economies, and smart city initiatives. Countries like UAE, Saudi Arabia, and South Africa are key markets, focusing on advanced technology to modernize their construction industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Cost Estimating Software Market.- Trimble Inc.

- ProEst (Construx Software)

- Sage Group plc

- Buildertrend

- Corecon Technologies Inc.

- HCSS

- B2W Software (Hexagon AB)

- STACK Construction Technologies

- Causeway Technologies

- CoConstruct

- PlanSwift (Textura Corporation)

- RedTeam Software

- Clear Estimates

- eTakeoff (ConstructConnect)

- AccuBuild Construction Software

- Knowify

- CMiC (Computer Methods International Corp.)

- UDA Technologies

- Viewpoint (Trimble Inc.)

- CostX (Exactal)

Frequently Asked Questions

Analyze common user questions about the Construction Cost Estimating Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is construction cost estimating software and why is it important?

Construction cost estimating software is a specialized digital tool designed to calculate all expenses associated with a construction project, including materials, labor, equipment, and overhead. It is crucial for generating accurate bids, managing project budgets, and ensuring profitability by minimizing errors and streamlining the estimation process. Its importance stems from its ability to enhance financial predictability and reduce risks for contractors and developers.

How does cloud-based estimating software compare to on-premise solutions?

Cloud-based estimating software offers greater flexibility, accessibility, and scalability, allowing users to work from any location with an internet connection and reducing the need for significant upfront IT infrastructure. On-premise solutions provide more direct control over data security and customization but typically require higher initial investment and ongoing maintenance from the user's IT department. The choice often depends on an organization's size, security preferences, and IT capabilities.

What are the key benefits of integrating BIM with cost estimating software?

Integrating BIM (Building Information Modeling) with cost estimating software enables automated quantity takeoffs directly from 3D models, ensuring higher accuracy and consistency between design and cost data. This integration streamlines the estimation process, reduces manual errors, enhances visualization of costs, and facilitates better collaboration among project stakeholders, leading to more reliable bids and improved project outcomes.

How is AI impacting the accuracy and efficiency of construction cost estimates?

AI significantly impacts cost estimation by analyzing vast datasets to provide more accurate predictions for material and labor costs, identify potential risks, and optimize bidding strategies. It automates repetitive tasks like quantity takeoffs and can learn from historical project data to refine estimates, leading to faster, more precise, and data-driven financial projections, thereby enhancing overall efficiency and reducing human error.

What challenges do SMEs face in adopting construction cost estimating software?

SMEs often face challenges such as high initial investment costs for advanced software, a resistance to change from traditional methods, and a lack of skilled personnel to effectively utilize complex tools. Data security concerns and the perceived steep learning curve can also be deterrents. However, the increasing availability of affordable, user-friendly cloud-based solutions and comprehensive support services is helping to mitigate these barriers for smaller enterprises.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager