Construction Site Monitoring Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440990 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Construction Site Monitoring Market Size

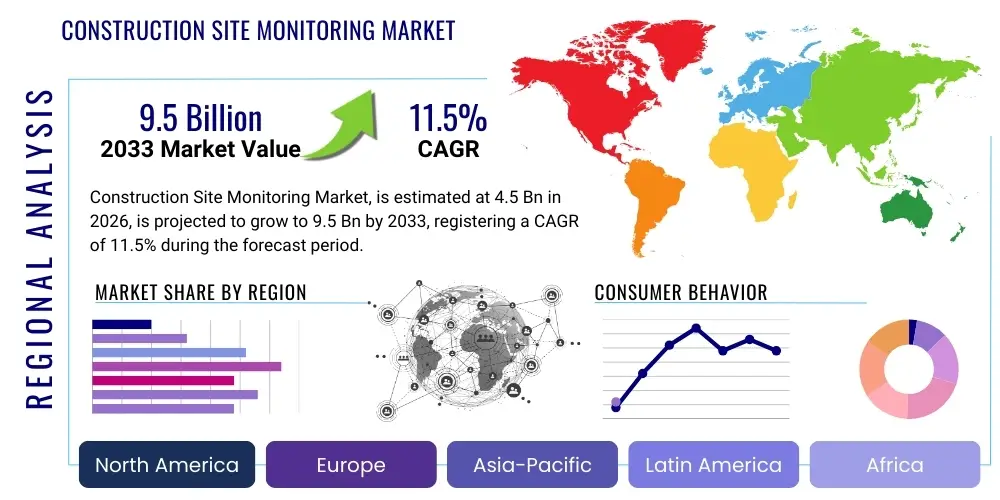

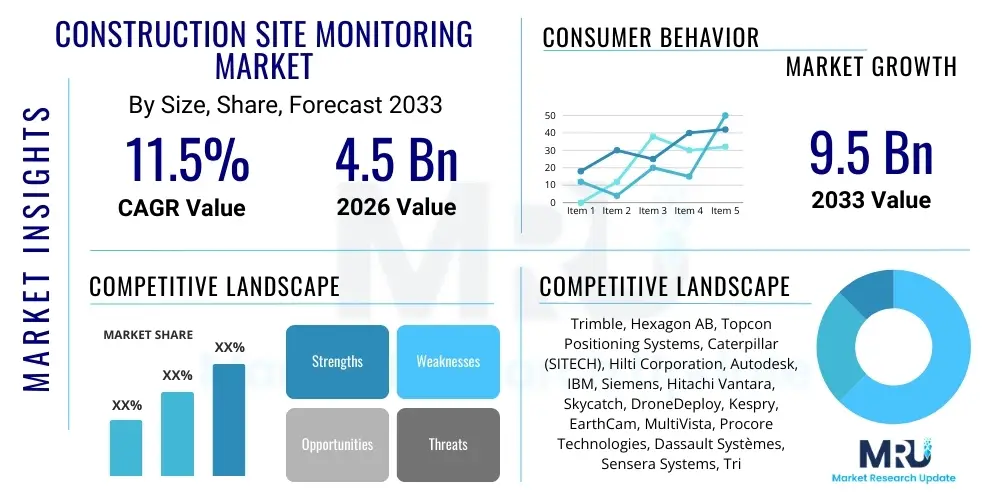

The Construction Site Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global emphasis on operational efficiency, stringent safety regulations governing construction activities, and the imperative to minimize project delays and cost overruns. The adoption of advanced monitoring technologies, including sensor networks, sophisticated software platforms, and drone-based surveillance, is becoming standard practice across large-scale infrastructure and commercial construction projects, significantly contributing to market valuation growth. The convergence of Building Information Modeling (BIM) with real-time site data also provides a powerful mechanism for centralized project oversight, enhancing stakeholder visibility and control, thereby justifying higher technological investment across the sector.

Construction Site Monitoring Market introduction

The Construction Site Monitoring Market encompasses technologies and services designed to track, manage, and analyze operational parameters, security status, and progress metrics on active construction sites. This market provides solutions, including Internet of Things (IoT) sensors, high-resolution cameras, autonomous drone systems, and specialized software platforms that integrate data streams for real-time visualization and predictive analytics. Major applications span asset tracking, worker safety monitoring, equipment health diagnostics, environmental compliance, and volumetric progress measurement. The primary benefits realized by end-users include significant reductions in safety incidents, optimized resource allocation, proactive identification of potential construction defects or delays, and enhanced compliance with increasingly complex global labor and environmental standards. The integration of data analytics transforms raw site information into actionable insights, moving the industry toward data-driven decision-making processes. This capability is pivotal for managing mega-projects where minor deviations can escalate into massive budgetary and schedule setbacks, positioning monitoring as a critical risk mitigation tool.

Driving factors for this market’s rapid growth include the global trend toward urbanization and infrastructure modernization, particularly in developing economies, which necessitates faster and safer construction methodologies. Furthermore, insurance premiums associated with high-risk construction environments incentivize contractors to deploy robust monitoring systems to demonstrate due diligence and mitigate liability risks. The widespread availability and decreasing cost of sensing hardware, coupled with advancements in cloud computing and mobile accessibility, have lowered the barrier to entry for smaller and medium-sized enterprises (SMEs), expanding the overall adoption base. Regulatory pushes for sustainable and environmentally conscious construction also require monitoring solutions for tracking material usage, waste generation, and energy consumption on site, creating further demand. These factors collectively establish a compelling case for widespread deployment, transcending traditional manual inspection methods.

The core product offering involves integrated platforms that provide a singular pane of glass view for project managers, enabling them to compare planned BIM models against executed work in real-time. These solutions not only track physical progress but also monitor qualitative aspects such as worker fatigue, unauthorized access, and material stock levels. This comprehensive visibility is essential for maintaining project momentum and ensuring that all contractual obligations and quality checkpoints are met efficiently. The continuous evolution of deep learning algorithms further refines the monitoring process, allowing systems to automatically detect anomalies and generate alerts with minimal human intervention, thereby shifting the industry paradigm from reactive problem-solving to proactive prevention.

Construction Site Monitoring Market Executive Summary

The Construction Site Monitoring Market is experiencing a major transformation driven by digital integration and automation imperatives. Current business trends indicate a strong move toward subscription-based Software-as-a-Service (SaaS) models for analytics and visualization platforms, minimizing upfront capital expenditure for construction firms. Strategic mergers and acquisitions are common, as technology providers seek to integrate hardware capabilities (like specialized sensors and drones) with sophisticated software suites (BIM integration, machine learning analytics). Key regional trends show North America and Europe leading in terms of sophisticated technology adoption due to higher labor costs and strict safety regulations, while the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid infrastructural development and government mandates for digital construction methods, particularly in China and India. Segmentation trends highlight the software segment's dominant growth, primarily due to the increasing reliance on complex data interpretation and predictive modeling tools rather than just raw data collection. This executive summary underscores a market shift from simple surveillance to integrated, intelligent operational management systems, prioritizing real-time data flow and actionable insights across all project phases.

Regional variations in market maturity dictate distinct growth strategies. North American firms prioritize solutions offering robust legal documentation and compliance features, utilizing monitoring data for insurance and litigation support, reflecting a focus on risk mitigation. European markets emphasize environmental sustainability monitoring and energy efficiency tracking, often driven by EU directives favoring green construction practices. Conversely, the high growth in APAC is largely attributable to the sheer volume of new construction projects and a governmental push toward standardization and productivity gains in densely populated urban centers. The rapid deployment of 5G networks in these regions is also facilitating seamless data transfer from massive sensor arrays, accelerating adoption rates significantly.

Analyzing segment trends further reveals that hardware innovations, especially high-durability, ruggedized sensors and advanced LiDAR technologies, remain critical foundational components, but their growth is closely tethered to the explosive expansion of the software layer. Solutions focused on worker health and safety, utilizing wearable technology and spatial awareness monitoring, are becoming mandatory, significantly influencing the fastest-growing application segment. Furthermore, the increasing adoption of offsite construction and modular building techniques still requires robust monitoring for logistics and assembly, ensuring that the market remains diverse and resilient against fluctuations in traditional on-site activity. Overall, the market narrative is defined by integration, intelligence, and compliance, driving sustained investment across the value chain.

AI Impact Analysis on Construction Site Monitoring Market

Common user questions regarding AI's influence in the Construction Site Monitoring Market frequently center on its ability to enhance safety, predict project delays, and automate labor-intensive processes. Users are keenly interested in determining the ROI of AI implementation, specifically asking how machine learning algorithms can analyze vast amounts of camera footage and sensor data to automatically detect safety violations (e.g., lack of Personal Protective Equipment or proximity hazards) far quicker and more consistently than human observers. Another critical area of inquiry involves predictive maintenance—how AI can forecast equipment failure, thus minimizing expensive downtime. Concerns often revolve around data privacy, the complexity of integrating AI models with legacy systems, and the necessary skill gap that needs addressing among site personnel. The collective user expectation is clear: AI should provide proactive, autonomous, and cost-effective operational intelligence, transforming site monitoring from a historical recording function into a real-time risk management and optimization engine, ensuring project continuity and adherence to stringent quality standards across the lifecycle.

- AI-driven real-time risk assessment, automatically identifying safety compliance breaches (e.g., fall hazards, unauthorized zones).

- Predictive analytics leveraging historical project data and real-time sensor feedback to forecast potential schedule slippages or material shortages.

- Automated progress tracking through computer vision analysis of drone imagery and 3D models, comparing execution against BIM plans.

- Optimization of equipment utilization and fuel consumption through machine learning scheduling algorithms based on operational demands.

- Enhancement of security protocols by identifying unusual activities or intrusions using pattern recognition in surveillance footage.

- Streamlining of quality assurance by detecting deviations in built structures or material placement against specified tolerances.

The deployment of sophisticated Artificial Intelligence (AI) algorithms is fundamentally reshaping the operational landscape of construction site monitoring, moving beyond simple surveillance to deeply integrated, intelligent decision support systems. AI's core value proposition lies in its capability to process and derive meaning from the exponentially increasing volumes of unstructured data generated by modern construction sites—data that includes high-definition video feeds, environmental telemetry, and detailed resource tracking logs. This capability allows for the creation of precise digital twins of the construction site, enabling simulations and scenario testing that drastically improve logistical planning and resource allocation efficiency. For example, AI can analyze traffic patterns of heavy machinery to suggest optimized routes, reducing collision risk and improving cycle times for material delivery, thus directly impacting profitability and project timelines.

Furthermore, AI is instrumental in achieving advanced levels of safety monitoring, a paramount concern in the inherently dangerous construction industry. By applying deep learning to video streams, systems can instantly recognize dangerous behaviors, detect unsecure scaffolding, or confirm that all workers are wearing required PPE, generating immediate alerts to supervisors. This proactive monitoring dramatically lowers the reliance on human inspectors, allowing them to focus on complex, non-routine tasks. The continuous feedback loop established by AI systems also contributes significantly to overall process improvement, allowing construction management firms to refine their operational methodologies based on statistically validated performance data derived across multiple projects, fostering a culture of continuous operational excellence and minimizing exposure to regulatory penalties or expensive insurance claims.

DRO & Impact Forces Of Construction Site Monitoring Market

The Construction Site Monitoring Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers include increasing global construction activity, particularly large-scale infrastructure projects, coupled with stringent government regulations enforcing workplace safety and environmental standards. Technology adoption is further spurred by the imperative to reduce escalating operational costs associated with project delays and liability claims. Restraints primarily revolve around the high initial capital investment required for comprehensive monitoring systems, data security and privacy concerns related to worker tracking, and the challenge of integrating disparate hardware and software solutions from various vendors into a unified platform. Opportunities are immense, notably in the integration of 5G and edge computing for ultra-low-latency real-time data processing, expansion into maintenance and post-construction monitoring services, and the development of highly specialized AI models tailored for niche construction applications like underground tunneling or high-rise facade installation. These forces create a robust environment, pushing stakeholders toward holistic, integrated monitoring solutions that maximize efficiency and safety while mitigating inherent industry risks.

Segmentation Analysis

The Construction Site Monitoring Market is comprehensively segmented based on Component, Application, End-User, and Technology, reflecting the diverse needs of the global construction industry. Segmentation by Component distinguishes between the tangible hardware (sensors, cameras, drones, wearables) used for data collection and the essential software (BIM integration tools, analytics platforms, visualization dashboards) required for data processing and actionable insights, alongside necessary professional services (installation, maintenance, consulting). Application segmentation provides clarity on the primary functions served by these systems, such as Asset Monitoring, Worker Safety, Progress Tracking, and Quality Control. End-User classification categorizes deployment across various construction types, including Commercial, Residential, Industrial, and Infrastructure sectors. This granular analysis is crucial for stakeholders to tailor their product offerings and strategic investments to specific high-growth areas, particularly where the intersection of advanced software and robust safety applications is mandated by evolving regulatory frameworks and competitive pressures.

- By Component: Hardware (Sensors, Cameras, Drones, GPS/GNSS Devices, Wearables), Software (Data Analytics, Project Management, BIM Integration, Cloud Platforms), Services (Installation, Maintenance, Consulting, Training).

- By Application: Asset Monitoring and Management (Equipment Tracking, Material Inventory), Safety and Security Monitoring (Worker Tracking, Site Access Control, Hazard Detection), Progress and Productivity Tracking (Volumetric Measurement, Schedule Adherence), Quality Control and Inspection.

- By Technology: Internet of Things (IoT), Sensing Technology (Temperature, Vibration, Movement), Telematics, Positioning Technologies (GPS, RFID), Robotics and Automation, Computer Vision, Artificial Intelligence (AI).

- By End-User: Commercial Construction (Offices, Retail), Residential Construction (Housing Projects), Industrial Construction (Factories, Power Plants), Infrastructure Construction (Roads, Bridges, Utilities, Tunnels).

Value Chain Analysis For Construction Site Monitoring Market

The value chain for the Construction Site Monitoring Market starts with upstream activities focused on the manufacturing and supply of core technological components, including specialized IoT sensors, high-definition ruggedized cameras, telematics hardware, and aerial platforms (drones). Key upstream players are semiconductor manufacturers, sensor developers, and specialized industrial hardware providers. These foundational technologies are then integrated and assembled by midstream system integrators and monitoring solution providers who develop the proprietary software platforms, cloud infrastructure, and data analytics engines necessary to transform raw data into actionable intelligence. The integrity and robustness of the data collection hardware are crucial, but the differentiation increasingly occurs in the sophistication of the middleware and software layers, which handle data aggregation, normalization, and advanced machine learning application.

The downstream segment involves the critical steps of implementation, maintenance, and distribution. Distribution channels are typically a mix of direct sales teams targeting major EPC (Engineering, Procurement, and Construction) firms and indirect channels leveraging specialized construction technology distributors, system integrators, and consulting partners who often customize solutions for specific project needs. Direct distribution is common for high-value, bespoke enterprise installations, ensuring close client relationships and tailored service level agreements. Indirect distribution channels, through Value-Added Resellers (VARs) and regional partners, are essential for reaching smaller contractors and ensuring broader geographical market penetration, particularly in regions with diverse technical requirements and local regulatory nuances. These partners often provide the necessary localized installation and ongoing maintenance support, forming a crucial link between the technology provider and the end-user construction site.

Service delivery forms a significant portion of the downstream value proposition, encompassing initial system configuration, employee training on data interpretation, and continuous maintenance of deployed sensor networks and cloud services. The long-term recurring revenue generated from software subscriptions (SaaS) and managed monitoring services solidifies the profitability of the value chain. Effective value chain management focuses on seamless integration between hardware components and software platforms, robust cybersecurity measures to protect sensitive project data, and ensuring scalable cloud infrastructure capable of handling the massive influx of real-time telemetry from multiple concurrent construction sites globally. Efficiency gains achieved through optimization of the downstream service delivery cycle directly translate into higher customer satisfaction and retention rates within this technically demanding market segment.

Construction Site Monitoring Market Potential Customers

Potential customers and primary end-users of Construction Site Monitoring solutions span the entire construction ecosystem, encompassing large-scale General Contractors (GCs), Engineering, Procurement, and Construction (EPC) firms, specialized subcontractors, and infrastructure owners. Major international EPC firms managing multi-billion dollar projects are leading adopters, utilizing integrated monitoring platforms to mitigate risk, ensure contractual compliance, and optimize global supply chain logistics across diverse geographical locations. Government agencies and public works departments are also significant buyers, especially for critical national infrastructure projects like highways, utility plants, and public transport systems, where safety and timely completion are paramount public concerns. These entities often mandate the use of digital monitoring to ensure transparency and accountability in public spending and infrastructure delivery.

Furthermore, specialized construction companies focusing on high-risk areas, such as demolition, tunneling, or high-rise construction, are crucial niche customers. These firms require highly specialized monitoring solutions, including structural health monitoring sensors and ground movement detection systems, which command premium pricing due to the complexity and necessity of the technology for risk prevention. Insurance and surety companies are indirectly influential customers; they often recommend or require the implementation of advanced site monitoring solutions to lower liability exposure before underwriting large project bonds. Lastly, real estate developers, particularly those involved in commercial and residential developments, utilize monitoring solutions to verify project timelines for financing milestones and ensure quality standards are met before handing over assets to property management entities.

The buyer profile is increasingly sophisticated, prioritizing solutions that offer seamless integration with existing enterprise resource planning (ERP) systems and Building Information Modeling (BIM) software, seeking holistic operational control rather than standalone surveillance tools. Decisions are typically made by project managers, technology officers, and safety directors, who prioritize scalability, data security, and demonstrable Return on Investment (ROI) derived from efficiency gains and reduced incidents. Smaller contractors, while slower to adopt full-scale platforms, are increasingly engaging with mobile and modular monitoring solutions, often through rental or usage-based payment models, reflecting the market’s efforts to democratize access to advanced construction technology across the SME segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble, Hexagon AB, Topcon Positioning Systems, Caterpillar (SITECH), Hilti Corporation, Autodesk, IBM, Siemens, Hitachi Vantara, Skycatch, DroneDeploy, Kespry, EarthCam, MultiVista, Procore Technologies, Dassault Systèmes, Sensera Systems, Triax Technologies, Buildots, OpenSpace |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Site Monitoring Market Key Technology Landscape

The technology landscape of the Construction Site Monitoring Market is defined by the convergence of several sophisticated digital and physical technologies, forming interconnected systems that enable comprehensive site oversight. Central to this landscape is the Internet of Things (IoT), which comprises vast networks of interconnected sensors, often wireless, deployed across the construction environment to gather real-time data on parameters such as temperature, humidity, vibration, and air quality. These IoT devices, frequently embedded within materials or machinery, utilize various connectivity protocols, including low-power wide-area networks (LPWAN) and 5G cellular technologies, ensuring reliable and high-throughput data transmission, which is crucial for real-time applications like hazard detection and machine control. This robust data collection layer feeds into cloud-based platforms where the real power of the monitoring system resides, supporting instantaneous data visualization and historical trend analysis necessary for iterative project improvements.

Another fundamental technology is Computer Vision, which utilizes high-resolution cameras, often mounted on fixed structures, drones, or autonomous ground vehicles, coupled with sophisticated machine learning algorithms. Computer Vision systems automatically analyze video streams to perform tasks such as verifying worker PPE compliance, counting material inventories, tracking equipment movement, and assessing volumetric progress by comparing captured images to the BIM model. Drones (UAVs) equipped with LiDAR and photogrammetry capabilities enable rapid, high-accuracy 3D mapping and surveying, dramatically reducing the time required for site inspections and progress reporting compared to traditional manual methods. The data generated by these aerial surveys is crucial for generating precise digital twins, facilitating superior collaboration among project stakeholders and significantly enhancing the overall quality assurance process.

Furthermore, positioning technologies, including high-precision GPS (GNSS) and indoor location systems like Ultra-Wideband (UWB) or RFID, are essential for tracking the precise location and movement of workers, assets, and tools across the site. This tracking capability is vital for optimizing workflow, preventing asset theft, and most importantly, ensuring worker safety through geofencing and collision avoidance systems, which are increasingly mandated in busy operational areas. Telematics is specifically deployed in heavy machinery to monitor engine performance, fuel consumption, and operational usage hours, enabling predictive maintenance schedules and maximizing fleet uptime. The integration of all these disparate data streams—from IoT, Computer Vision, and Positioning—is managed by robust, often AI-enhanced, software platforms that utilize Edge Computing to process time-sensitive data locally before sending aggregated data to the cloud, ensuring operational responsiveness and data integrity across the most complex and remote construction sites.

Regional Highlights

The global Construction Site Monitoring Market exhibits distinct adoption rates and maturity levels across key geographical regions, driven by local regulatory environments, investment in infrastructure, and labor costs. Regional analysis provides critical insights into market penetration and growth opportunities for solution providers.

- North America: This region is characterized by high adoption rates, driven primarily by stringent Occupational Safety and Health Administration (OSHA) regulations and high labor costs, making automation and risk mitigation a priority. The U.S. market leads in implementing advanced AI and computer vision solutions, particularly for commercial and large-scale infrastructure projects.

- Europe: Europe emphasizes structural health monitoring, sustainability tracking, and compliance with EU data protection regulations (GDPR). Scandinavian countries and Germany are pioneers in integrating monitoring data with sophisticated BIM execution plans, focusing heavily on energy efficiency and environmental impact minimization throughout the construction phase.

- Asia Pacific (APAC): Expected to be the fastest-growing market due to massive investments in urbanization and public infrastructure (e.g., China's Belt and Road Initiative and India's smart city projects). Adoption is primarily driven by productivity demands and government initiatives promoting construction digitalization, though initial cost sensitivity remains a factor in widespread adoption among smaller local firms.

- Latin America (LATAM): Market adoption is nascent but accelerating, particularly in major economies like Brazil and Mexico. Growth is spurred by foreign direct investment in large mining and energy sector construction projects, which demand international safety standards and efficient project management methodologies utilizing technology.

- Middle East and Africa (MEA): This region is seeing significant uptake driven by mega-projects in the GCC countries (e.g., Saudi Arabia, UAE) focused on diversification and smart city development. These projects have large budgets and strict delivery timelines, necessitating the immediate deployment of state-of-the-art monitoring and security technologies, often procured from international vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Site Monitoring Market, encompassing technology providers, software developers, and system integrators essential to the market ecosystem.- Trimble Inc.

- Hexagon AB

- Topcon Positioning Systems, Inc.

- Caterpillar (SITECH)

- Hilti Corporation

- Autodesk, Inc.

- International Business Machines Corporation (IBM)

- Siemens AG

- Hitachi Vantara

- Skycatch, Inc.

- DroneDeploy

- Kespry, Inc.

- EarthCam, Inc.

- MultiVista

- Procore Technologies, Inc.

- Dassault Systèmes SE

- Sensera Systems

- Triax Technologies, Inc.

- Buildots Ltd.

- OpenSpace

Frequently Asked Questions

Analyze common user questions about the Construction Site Monitoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety benefits of implementing construction site monitoring systems?

The primary safety benefits include real-time hazard detection, automated enforcement of PPE compliance through computer vision, prompt detection of unauthorized access, and precise tracking of workers in high-risk zones, significantly reducing incident rates and improving emergency response times across the site.

How does BIM integration enhance the effectiveness of construction site monitoring solutions?

BIM integration allows monitoring data to be compared instantly against the project's digital blueprint. This capability enables automated progress validation, identifies deviations from planned specifications, and provides crucial visual context for optimizing construction sequences and improving quality control processes efficiently.

What is the typical Return on Investment (ROI) for advanced monitoring systems?

The ROI is typically realized through reduced operational expenses, primarily derived from minimizing costly safety incidents, preventing equipment downtime via predictive maintenance, optimizing labor productivity, and avoiding financial penalties associated with project delays or non-compliance with regulatory requirements, often achieving payback within two to three project cycles.

Are there significant data privacy concerns related to tracking workers on site?

Yes, data privacy is a significant concern, particularly regarding wearable devices and facial recognition technologies. Solutions must comply strictly with regional data protection laws (like GDPR) and incorporate robust anonymization and secure data storage practices, ensuring transparency with employees regarding the types of data collected and how it is utilized strictly for safety and operational purposes.

Which technological component drives the highest growth within the market segmentation?

The Software segment, including AI-powered analytics, cloud platforms, and specialized project management solutions, currently drives the highest growth. While hardware is foundational, the ability to derive actionable, predictive intelligence from collected data provides the greatest value proposition and sustained revenue through highly scalable SaaS models.

The comprehensive deployment of these monitoring technologies fundamentally changes the risk profile of construction projects, fostering a highly data-centric approach to project governance and execution. The continued proliferation of 5G infrastructure is expected to further enhance the market by enabling instantaneous data transmission necessary for critical real-time decision-making processes, particularly in complex and geographically dispersed construction environments. This robust analytical framework ensures that project outcomes are predictable, safe, and aligned with increasingly stringent global industry standards, positioning the market for sustained and accelerated growth throughout the forecast period due to the clear economic and safety advantages provided to all stakeholders involved in the capital project lifecycle. The shift toward integrated platform solutions minimizes vendor fragmentation and maximizes interoperability, which is a major driver for enterprise-level adoption. The increasing scarcity of skilled manual labor globally also underscores the necessity of these automation and monitoring tools to maintain high levels of productivity without increasing safety risks, thereby reinforcing the core value proposition of the construction site monitoring technology sector.

Furthermore, the demand for monitoring solutions extends beyond active construction to include post-construction structural health monitoring, especially for bridges, high-rise buildings, and aging infrastructure. This long-term monitoring requirement creates a substantial recurring services revenue stream for market players, transforming short-term project engagement into long-term asset management partnerships. These post-construction services focus on detecting subtle structural degradation, assessing environmental wear, and ensuring resilience against extreme weather events, using highly durable sensor arrays and sophisticated data modeling techniques. This expansion into the operational lifespan of built assets broadens the total addressable market considerably and provides technological solution providers with opportunities to forge deeper, sustained relationships with infrastructure owners and facility management companies. The regulatory push for better maintenance protocols in developed economies acts as a strong catalyst for this segment expansion.

In summary, the Construction Site Monitoring Market is evolving into an essential component of the digital construction ecosystem. Its growth is characterized by the strategic application of AI and IoT to achieve safety excellence and operational efficiency. The integration challenges are being rapidly overcome through standardized APIs and platform consolidation, ensuring that data flow remains central to project management. As urbanization continues globally, the reliance on these sophisticated monitoring tools will only intensify, cementing the market’s trajectory toward becoming a mandatory feature rather than a competitive advantage in the modern construction sector. The continued focus on sustainability and worker well-being further mandates investments in monitoring solutions that can verify adherence to environmental and social governance (ESG) criteria throughout the construction phase and beyond, contributing robustly to the market's long-term commercial viability and growth forecast projections.

The rigorous implementation of monitoring systems facilitates transparent communication among project stakeholders, including investors, contractors, and regulatory bodies. This transparency minimizes disputes and fosters trust, leading to smoother project execution and faster closeouts. For large infrastructure projects often funded by public-private partnerships, the ability to provide auditable, real-time data on progress and expenditure is invaluable, securing future funding and public support. The standardization of monitoring protocols and data reporting formats, often driven by industry consortia and leading technology firms, simplifies cross-project data analysis, allowing construction giants to benchmark performance across their global portfolio. This benchmarking capability is a strong driver for the adoption of comprehensive, standardized monitoring platforms, further solidifying the dominance of market leaders who can offer global scalability and robust technical support tailored to diverse operational environments and regulatory frameworks across North America, Europe, and the rapidly expanding Asia Pacific region.

Technological advancement is not solely limited to sensors and software; it also includes the integration of robotics and autonomous systems. Semi-autonomous robotic systems are increasingly used for routine, repetitive monitoring tasks such as site scanning, material inspection, and initial layout validation. These robotics, guided by the site monitoring platform, can operate in hazardous environments, gathering data without exposing human personnel to risk. This blending of automation and monitoring exemplifies the future direction of the market—a highly automated, data-rich construction environment where human intervention is focused on complex problem-solving and strategic oversight, rather than tedious data collection or physical inspection tasks. The long-term implications involve a significant transformation of construction labor requirements, demanding higher technological proficiency among site management teams and further increasing the value proposition of robust digital monitoring and management solutions. The continuous need for system upgrades and maintenance ensures a steady revenue stream for service providers, stabilizing market growth over the long term.

The market also benefits significantly from the increasing emphasis on sustainable construction practices. Monitoring systems are now crucial for tracking the source and use of sustainable materials, managing construction waste according to circular economy principles, and optimizing energy consumption of temporary site facilities and heavy equipment. This environmental monitoring capability is a non-negotiable requirement for obtaining green building certifications (like LEED or BREEAM) and complying with emerging carbon neutrality mandates. By providing verifiable data on environmental performance, monitoring platforms enable contractors to demonstrate their commitment to corporate social responsibility (CSR), enhancing their competitive edge when bidding for environmentally sensitive projects. This regulatory and corporate governance pressure acts as a powerful, non-cyclical driver for sustained investment in monitoring solutions, ensuring the market’s resilience even during broader economic downturns that might affect new construction starts. The complex task of managing environmental impact further validates the need for sophisticated, AI-driven data processing capabilities inherent in advanced construction site monitoring platforms.

The demand for rigorous geotechnical and structural monitoring, particularly in complex civil engineering projects such as tunneling, foundation work, and bridge construction, represents another critical driver for specialized market growth. These projects require highly accurate, reliable sensing technologies—such as strain gauges, tiltmeters, and piezometers—to monitor ground movement, structural integrity, and potential stress points in real time. Failure to detect anomalies in these contexts can lead to catastrophic consequences. Monitoring solutions in this niche must offer exceptional data reliability, rapid anomaly detection, and seamless integration with geological modeling software. The high cost and critical nature of these applications mean that buyers in this segment prioritize technical precision and proven reliability over initial capital cost, maintaining a strong demand for high-end, specialized monitoring components and professional services. This specialization illustrates the market’s diversity and its capacity to address highly specific engineering challenges with tailored technological solutions. The ongoing need for calibration and expert interpretation of this complex data ensures a sustained demand for consulting and specialized service contracts.

The competitive landscape is evolving rapidly, with traditional equipment manufacturers, pure-play software providers, and telecommunications companies entering strategic partnerships to offer holistic packages. This convergence of hardware, software, and connectivity expertise is creating robust, all-in-one solutions that simplify procurement and deployment for construction firms. Future growth is strongly linked to the adoption of augmented reality (AR) and virtual reality (VR) interfaces, which utilize monitoring data to provide site personnel with real-time overlays of critical information, such as utility locations, installation sequence details, or potential hazard warnings directly in their field of view. This advanced visualization dramatically improves on-site decision-making and reduces human error. The continuous push toward greater interoperability and standardization of data protocols (e.g., COBie standards) ensures that data captured by monitoring systems can be easily utilized across different stages of the asset lifecycle, further enhancing the long-term utility and value of these technological investments. This technical standardization is critical for achieving true digitalization within the global construction sector.

The complexity of securing massive data streams generated by hundreds or thousands of IoT devices across a site is leading to increased investment in edge computing capabilities. By processing the vast majority of raw data locally before transmitting only key insights or aggregated summaries to the cloud, edge computing mitigates latency issues, reduces bandwidth requirements, and significantly strengthens data security protocols. This technological approach is vital for critical safety applications where millisecond response times are essential, such as preventing heavy equipment collisions or alerting workers to immediate structural failures. The development of robust, secure edge devices specifically designed for the rugged conditions of a construction site represents a crucial area of hardware innovation. Furthermore, the reliance on predictive maintenance models, which use machine learning to analyze equipment operational data (telematics), significantly minimizes unexpected downtime, a major contributor to project delays and cost overruns. By proactively scheduling repairs based on actual usage and condition rather than fixed intervals, contractors can maximize asset utilization and operational efficiency, directly impacting project profitability and supporting the overall economic justification for investing in advanced site monitoring platforms and their associated technological infrastructure. This comprehensive focus on data integrity, processing speed, and security will define the next generation of competitive monitoring solutions.

The influence of government incentives and public sector spending on infrastructure continues to be a central determinant of market expansion, particularly in regions like North America and APAC. Governments are increasingly tying funding disbursements for major projects to the mandatory use of digital oversight and monitoring technologies that prove compliance with safety, budget, and schedule requirements. This regulatory push elevates site monitoring from a technological preference to a core contractual obligation. Moreover, the integration of monitoring data into project financing and insurance underwriting processes is evolving. Insurers are beginning to offer premium reductions or preferential terms to contractors who can demonstrate consistently lower risk profiles substantiated by real-time monitoring data, creating a strong financial incentive for adoption across the entire spectrum of construction firms, including smaller and mid-sized contractors previously hesitant to adopt high-cost digital solutions. This shift in financial and regulatory ecosystems confirms the market's trajectory toward necessary, widespread adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager