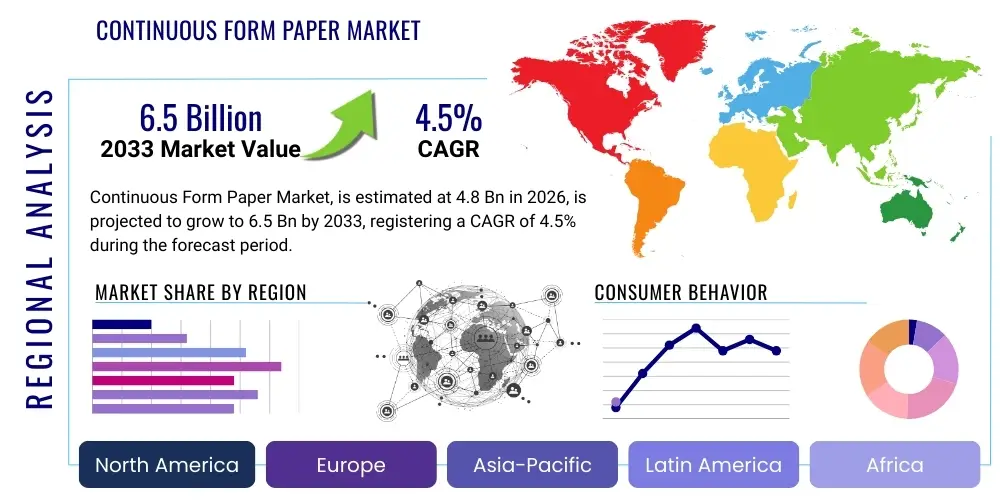

Continuous Form Paper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443257 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Continuous Form Paper Market Size

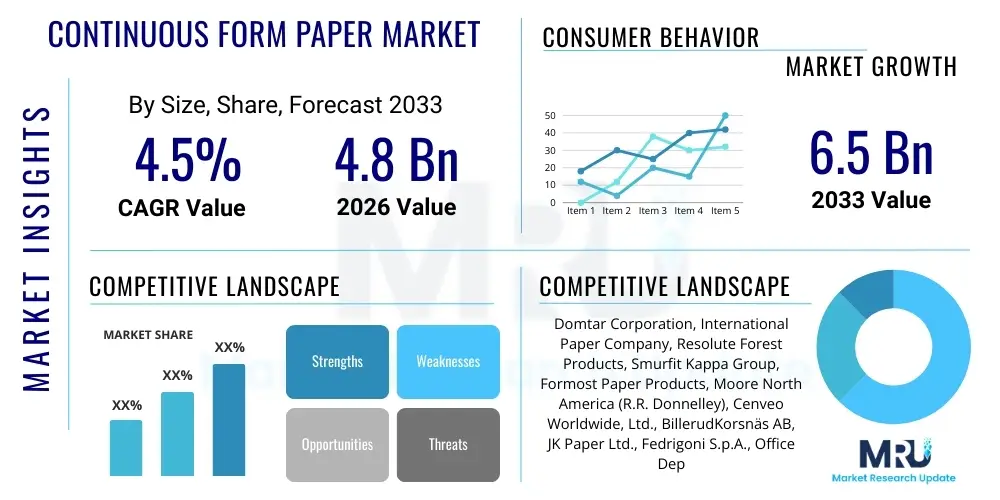

The Continuous Form Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033. This growth, while moderate, reflects the persistent demand from sectors relying on high-volume sequential printing, coupled with technological advancements in paper coatings and sustainable pulp sourcing, mitigating the overall decline observed in heavily digitized industries.

Continuous Form Paper Market introduction

The Continuous Form Paper Market encompasses specialized paper products designed for high-speed impact and non-impact printers, primarily utilized in large enterprises for printing sequentially numbered documents, invoices, statements, and delivery manifests. These papers are characterized by interconnected sheets separated by perforations, often featuring tractor feed holes along the margins for continuous movement through industrial printers. Products range from standard single-ply forms to complex multi-ply carbonless forms (NCR), critical for creating instantaneous duplicates without using carbon interleaving sheets. The market remains resilient in specific application areas where legal or logistical requirements mandate physical, sequential documentation and audit trails.

Major applications of continuous form paper span logistics and supply chain management, financial services (especially legacy banking systems), government administration, and large-scale manufacturing operations. In logistics, they are indispensable for generating shipping labels, waybills, and picking slips, ensuring rapid, reliable data capture and transfer within warehouses and distribution centers. Financial institutions utilize them extensively for check printing, account statements, and internal audit reports, capitalizing on their cost-effectiveness and compatibility with existing infrastructure. The enduring benefit of continuous forms lies in their reliability, ease of sequential numbering, and suitability for archival purposes, which often surpasses the reliability and regulatory compliance of purely digital alternatives in certain operational environments.

Driving factors for this market include the sustained expansion of global e-commerce, which necessitates increased physical documentation for fulfillment and shipping processes, particularly in emerging economies where digital transformation is slower. Furthermore, the requirement for robust disaster recovery and redundant physical record-keeping in regulated industries prevents a complete shift to paperless environments. While the general office paper consumption declines, the niche industrial and high-volume transaction segments continue to ensure steady, albeit specialized, demand for continuous form paper products that provide an inexpensive, verifiable, and established medium for critical transactional data.

Continuous Form Paper Market Executive Summary

The Continuous Form Paper Market demonstrates a nuanced performance influenced by divergent regional business trends and specific sectoral requirements. Globally, the market is characterized by a stability driven by essential applications in logistics, manufacturing, and financial record-keeping, counterbalancing the decline in general office administrative use. Business trends highlight increasing optimization of supply chains by continuous form manufacturers, focusing on weight reduction, enhanced print quality for high-resolution graphics, and the integration of security features (e.g., micro-printing, tamper-proof inks) to meet stringent regulatory demands in banking and healthcare. Consolidation among major players is also a key trend, aimed at achieving economies of scale and better managing volatile raw material costs, particularly wood pulp.

Regional trends reveal significant disparity in market maturity and growth prospects. North America and Europe, characterized by rapid digital transformation, show modest declines in overall volume but higher demand for specialized, premium continuous forms like secure check stock and highly customized multi-part sets. Conversely, the Asia Pacific (APAC) region, driven by burgeoning manufacturing hubs, burgeoning financial services sectors, and less stringent mandates for digitalization in government sectors, represents the primary engine for volume growth. Countries like India and China maintain substantial consumption rates for transaction-intensive continuous forms used in taxation, utility billing, and logistics operations. Latin America and MEA exhibit moderate growth, primarily tied to infrastructure development and industrial expansion.

Segment trends underscore the sustained dominance of the carbonless segment, particularly multi-ply forms (2-part, 3-part, 4-part), due to their efficiency in creating duplicate records instantly for invoices, receipts, and order forms without traditional carbon paper. Demand is also rising for continuous pressure-sensitive labels integrated into form stock, reflecting the needs of modern shipping and tracking systems. From a weight perspective, lighter basis weights are gaining traction as companies seek to reduce shipping costs and material consumption, provided these forms maintain sufficient strength and stiffness for high-speed printing environments. The industry is also pivoting towards sustainable paper options, using recycled content or fibers from certified sustainable forestry sources, aligning with corporate social responsibility goals and regulatory mandates.

AI Impact Analysis on Continuous Form Paper Market

User inquiries regarding AI's impact on the Continuous Form Paper Market primarily revolve around two key themes: whether AI-driven automation and digitalization will completely eliminate the need for physical forms, and how AI can optimize the continuous form paper supply chain. Users express concerns about obsolescence, contrasting the speed of digital transformation with the perceived necessity of physical records in legal and logistical contexts. Key expectations include AI integrating seamlessly with ERP and WMS systems to predict and manage paper inventory levels, minimizing waste, and automating the procurement process. Furthermore, there is interest in how machine vision and AI algorithms can interpret data printed on continuous forms for archival and internal audit purposes, bridging the gap between physical record generation and digital data utilization.

The direct application of AI does not target the production of paper itself, but rather the processes surrounding its use. AI-powered supply chain management tools are increasingly optimizing continuous form paper delivery, reducing lead times, and managing complex inventory across multi-site operations based on predictive consumption modeling. This efficiency enhancement minimizes instances of overstocking or stockouts, benefiting both users and suppliers. However, AI also accelerates the push toward digitization, as advanced algorithms can process and authenticate digital documents more rapidly and securely, posing a long-term substitution threat to continuous forms in certain administrative roles.

Ultimately, AI’s primary influence is accelerating the shift of non-critical documents to digital formats while simultaneously making the remaining critical continuous form usage highly optimized and specialized. AI tools enhance the efficiency of the physical-to-digital data capture process (e.g., automated scanning and OCR processing of continuous form data for immediate integration into databases), thereby making the physical records easier to manage and archive digitally, but not yet eliminating their initial generation requirement in highly regulated or equipment-dependent settings.

- AI drives supply chain efficiency, optimizing inventory management and reducing waste in paper procurement.

- Increased use of Optical Character Recognition (OCR) systems enhanced by AI to convert continuous form data into digital datasets, bridging physical and digital records.

- Acceleration of paperless policies in non-critical administrative functions due to AI-driven workflow automation.

- AI-enabled predictive maintenance for high-speed continuous form printers, ensuring operational uptime.

- Enhanced security features integration (via smart tracking systems) for high-value continuous forms (e.g., checks, titles).

DRO & Impact Forces Of Continuous Form Paper Market

The Continuous Form Paper Market is shaped by a complex interplay of persistent operational necessity and significant digital transformation pressures. The primary drivers stem from the growth of global logistics and e-commerce requiring reliable, high-volume shipping documentation, alongside the entrenched use of legacy mainframe systems in critical sectors like banking and government which mandate continuous forms. Opportunities arise in the development of specialized, environmentally sustainable products and the integration of smart tracking technologies (like RFID tags embedded in form stock) to enhance form functionality and data linkage. However, these forces are constantly being challenged by the fundamental restraint of widespread corporate and governmental initiatives promoting digitalization and paperless offices, significantly eroding demand for general-purpose continuous forms. The overall market dynamic is one of stabilizing demand in niche applications coupled with declining consumption in traditional office settings.

Key drivers center on regulatory compliance requirements in logistics and financial services, where physical signatures, audit trails, and sequentially numbered hardcopies remain mandatory for legal and accounting purposes. Furthermore, continuous form printing offers cost advantages over laser printing for extremely high volumes, especially in environments utilizing decades-old, fully depreciated printing equipment. This capital expenditure avoidance reinforces demand, particularly in large centralized data processing centers. The robust infrastructure in emerging economies, where investment in new digital systems may lag behind industrial growth, also acts as a powerful driver maintaining high consumption rates for accessible and proven paper-based documentation methods. The reliability of matrix and line printers using continuous forms under harsh industrial conditions further cements their necessity.

The major restraint is the pervasive and irreversible global trend toward digital transformation, fueled by advancements in cloud computing, e-signature technologies, and secure digital archiving solutions. This structural shift continuously reduces the addressable market size, particularly in developed regions. Additionally, the market faces significant challenges from fluctuating raw material costs, specifically wood pulp and chemical coatings necessary for carbonless forms, which directly impact manufacturing margins and require continuous operational efficiency improvements. Opportunities lie primarily in product differentiation through value-added features, such as integrated labels, enhanced security papers, and the use of sustainable or recycled fiber content, appealing to environmentally conscious corporate procurement policies and opening new sales channels in specialized high-security application areas.

Segmentation Analysis

The Continuous Form Paper Market is typically segmented based on crucial attributes including the number of plies (multi-part vs. single-part), the technology used to create copies (carbonless vs. carbon-interleaved), the material type (wood-free, recycled, thermal), and the end-use application. Understanding these segments is vital as the market dynamics vary significantly; for instance, multi-ply carbonless forms command higher value and are less susceptible to immediate substitution than basic single-ply forms. Geographical segmentation remains critical, distinguishing high-growth volume markets in APAC from high-value, niche markets in North America and Europe. The continuous market shift necessitates manufacturers focus their resources on the fastest-growing and highest-margin segments, predominantly multi-part continuous carbonless paper for logistics and specialized security applications.

Further analysis reveals segmentation based on form size and weight. Standard sizes remain crucial for transactional processing, but customization based on printer specifications and application needs (e.g., forms integrated with return envelopes or perforated for easy remittance) are increasing. The end-use segmentation highlights that while the market is contracting overall, the logistics and transportation sector continues to exhibit the most resilient demand, driven by the sheer volume of package movement globally. Conversely, administrative and billing services segments, especially utility companies, are among the fastest to transition to digital formats, presenting the most significant challenge to manufacturers focused on standard, non-specialized forms.

- By Type:

- Single-Part Continuous Forms

- Multi-Part Continuous Forms (2-part, 3-part, 4-part, etc.)

- By Mechanism:

- Carbonless Continuous Forms (NCR)

- Carbon Interleaved Forms (Declining segment)

- Plain Continuous Stock

- By Basis Weight:

- Lightweight (Below 50 gsm)

- Standard Weight (50–70 gsm)

- Heavyweight (Above 70 gsm)

- By End-Use Industry:

- Logistics and Transportation

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Manufacturing and Industrial

- Healthcare (e.g., patient records, billing)

- Retail and E-commerce Fulfillment

- By Material:

- Standard Wood Pulp

- Recycled Content Paper

- Specialty Coated Paper (e.g., security features)

Value Chain Analysis For Continuous Form Paper Market

The value chain for continuous form paper begins with upstream activities dominated by the procurement of raw materials, primarily wood pulp and specialized chemical coatings (for NCR products). Integrated paper mills that control pulp sourcing often enjoy a competitive advantage due to better management of input costs and consistency of quality. Pulp manufacturing involves significant capital expenditure and adherence to stringent environmental regulations, particularly regarding sustainable forestry and water usage. Key upstream challenges include volatile global pulp prices, driven by energy costs and international trade policies, which directly impact the final cost of the continuous form paper product.

Midstream activities involve the specialized conversion and printing processes. Paper reels sourced from the mills are converted into continuous form stock, which includes critical processes such as perforating, fan-folding, sprocket hole punching, printing of customized logos and text, and application of specialized coatings (e.g., chemical capsulation for carbonless paper). This stage requires precision machinery and high technical expertise to ensure the forms meet demanding specifications for high-speed printer compatibility and multi-part registration accuracy. Quality control at this stage is paramount, as printer jams or illegible copies can lead to significant operational disruptions for end-users. Manufacturers often integrate graphic design and pre-press services to handle complex customer orders.

Downstream distribution channels are characterized by a mix of direct sales to very large corporate and government customers and indirect sales through a network of specialized paper distributors, office supply wholesalers, and print management companies. Direct sales are common for high-volume, highly customized security forms, ensuring tight control over the supply chain. Indirect channels leverage the geographical reach and established customer relationships of distributors who can manage smaller, diversified orders across multiple industries. E-commerce platforms are also becoming important for standardized, low-volume continuous forms. The choice of channel significantly impacts profitability, with direct sales offering higher margins but requiring substantial sales infrastructure, while indirect channels provide market penetration and inventory risk mitigation.

Continuous Form Paper Market Potential Customers

The continuous form paper market primarily targets large enterprises and governmental entities that execute high volumes of repetitive, transaction-intensive printing tasks requiring verifiable physical documentation. These customers possess legacy data processing infrastructure and operational workflows optimized for continuous feeding paper, particularly line printers and high-speed impact printers. Key sectors include global logistics firms that rely on these forms for mandatory shipping manifests, customs documentation, and internal routing slips, as the durability and ease of handling the folded forms are ideal for warehouse environments.

Another major segment is the financial services industry, encompassing commercial banks, insurance companies, and credit unions. They utilize continuous forms extensively for printing checks, official customer statements, internal ledger summaries, and regulatory reports. The requirement for security features (such as micro-printing and watermarks) embedded in the paper stock makes these customers particularly valuable, driving demand for specialized, higher-margin products. Healthcare providers also represent a significant end-user base, employing continuous forms for patient billing, explanation of benefits (EOBs), and internal medical records where immediate, verifiable hard copies are necessary for compliance and immediate patient service delivery.

Government agencies at federal, state, and local levels are among the largest consumers globally. These institutions use continuous forms for mass mailing official notices, tax forms, vehicle registration documentation, and internal audit paperwork. The sheer volume and regulatory necessity of sequential numbering ensure persistent demand. Finally, the manufacturing sector uses continuous forms for production control, work-in-progress tracking, inventory tags, and quality assurance documentation. For all these potential customers, the continuity, reliability, and established legal precedent of paper documentation outweigh the efficiencies offered by digital alternatives in mission-critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domtar Corporation, International Paper Company, Resolute Forest Products, Smurfit Kappa Group, Formost Paper Products, Moore North America (R.R. Donnelley), Cenveo Worldwide, Ltd., BillerudKorsnäs AB, JK Paper Ltd., Fedrigoni S.p.A., Office Depot, Inc. (OPI), Mitsubishi Paper Mills Limited, Nekoosa Coated Products, Premier Paper Group, Asia Pulp & Paper (APP), P. H. Glatfelter Company, Sonoco Products Company, Standard Register (Taylor Corporation), WestRock Company, Reliance Paper. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Continuous Form Paper Market Key Technology Landscape

The technology landscape in the Continuous Form Paper Market revolves around optimizing production efficiency, enhancing paper functionality, and ensuring compatibility with diverse printing equipment. Core manufacturing technology involves high-speed rotary presses and specialized converting machines capable of precisely handling processes like micro-perforation, fan-folding, gluing, and punching of sprocket holes, often at speeds exceeding traditional sheet-fed processes. Continuous advancements focus on reducing machine downtime, increasing throughput, and minimizing paper waste during the conversion process. Modern facilities utilize sensors and automated quality inspection systems to ensure form registration accuracy, particularly critical for multi-ply carbonless forms where misregistration can render the entire form unusable.

In terms of paper technology, the primary innovation is the continuous evolution of Carbonless Paper (NCR). Manufacturers are focused on developing solvent-free and improved chemical coating systems that offer superior image darkness, quicker image transfer, and lower environmental impact compared to older chemical formulations. Furthermore, specialty coating technologies are being used to introduce features such as security marks, thermochromic inks, and water resistance to the forms, broadening their application in sensitive environments like pharmaceuticals and secure financial transactions. Research into lighter-weight papers that maintain optimal opacity and tensile strength is also crucial for minimizing material costs and reducing the logistics footprint of the paper.

The integration of digital printing technologies is another significant element. While continuous forms are historically associated with impact printing (dot matrix/line printers), there is a rising trend of continuous form stock being adapted for specialized high-speed continuous feed inkjet and digital press systems. These systems allow for variable data printing (VDP) on continuous forms, enabling greater customization and personalization of high-volume transaction documents (e.g., customized bank statements or personalized promotional inserts). This technological adaptation allows continuous form paper to remain relevant in a hybrid printing environment, catering to customers transitioning partially toward digital but still requiring sequential physical records.

Regional Highlights

Regional dynamics are critical to the overall market assessment, reflecting vastly different paces of technological adoption and regulatory environments globally. North America and Europe, representing mature economies, face structural declines in commodity continuous form usage due to pervasive digitalization efforts across government and corporate sectors. However, these regions exhibit strong demand for highly specialized, premium products, such as secure document stock (checks, prescriptions) and complex carbonless forms utilized by logistics giants. Innovation here is centered on high-security features and sustainable paper sourcing.

The Asia Pacific (APAC) region is the most significant growth area for the Continuous Form Paper Market by volume. Driven by robust growth in manufacturing, strong e-commerce expansion, and massive populations demanding physical transactional services (e.g., banking services, utility payments) in countries like India, China, and Southeast Asia, the region maintains substantial reliance on continuous forms. Digital infrastructure rollout, while accelerating, has not entirely displaced paper in administrative and logistical backbones, creating stable demand for standard and multi-ply forms. Economic growth and industrialization here ensure that the sheer volume of transactions sustains market strength.

Latin America and the Middle East and Africa (MEA) represent moderate growth opportunities. Growth in Latin America is tied to political stability, economic reforms, and infrastructure investments that boost industrial and commercial activities, subsequently generating demand for transactional paperwork. In MEA, the market is heterogeneous; while digitalization is strong in the Gulf Cooperation Council (GCC) countries, vast non-urban areas in Africa continue to rely heavily on conventional continuous forms for government documentation, telecom billing, and supply chain tracking, where IT infrastructure is nascent or unreliable.

- Asia Pacific (APAC): Highest volume growth attributed to massive manufacturing sectors, e-commerce fulfillment, and large-scale government documentation needs in populous nations.

- North America: Stable value demand focused on specialized, high-security forms for BFSI and healthcare, offsetting general volume decline due to digitalization.

- Europe: Transitioning toward sustainable and recycled continuous forms; demand sustained by strict auditing requirements and specialized industrial applications.

- Latin America: Moderate, fluctuating growth driven by commodity and industrial sectors; reliance on continuous forms for inventory and customs documentation.

- Middle East and Africa (MEA): Varied demand; strong urbanization drives specialized form demand, while remote areas maintain high use of basic transactional forms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Continuous Form Paper Market.- Domtar Corporation

- International Paper Company

- Resolute Forest Products

- Smurfit Kappa Group

- Formost Paper Products

- Moore North America (R.R. Donnelley)

- Cenveo Worldwide, Ltd.

- BillerudKorsnäs AB

- JK Paper Ltd.

- Fedrigoni S.p.A.

- Office Depot, Inc. (OPI)

- Mitsubishi Paper Mills Limited

- Nekoosa Coated Products

- Premier Paper Group

- Asia Pulp & Paper (APP)

- P. H. Glatfelter Company

- Sonoco Products Company

- Standard Register (Taylor Corporation)

- WestRock Company

- Reliance Paper

Frequently Asked Questions

Analyze common user questions about the Continuous Form Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the continued demand for continuous form paper?

The primary driving force is the persistent operational necessity for physical, verifiable audit trails and transaction records in high-volume sectors like global logistics, banking (for check printing), and government services. Many mission-critical legacy printing systems also remain optimized only for continuous forms.

How is the rise of digitalization impacting the continuous form paper market size?

Digitalization exerts downward pressure on the overall market volume, particularly in administrative and general office use in developed economies. However, it simultaneously increases demand for specialized, high-security continuous forms used for mandatory documentation that cannot yet be legally or practically replaced by digital alternatives.

Which geographical region represents the highest growth opportunity for continuous form paper manufacturers?

The Asia Pacific (APAC) region, particularly emerging economies like India and China, offers the highest volume growth opportunity. This is due to rapidly expanding manufacturing and logistics sectors and high transactional volumes requiring paper documentation before full digital saturation.

What is carbonless continuous form paper (NCR) and why is it important?

Carbonless continuous form paper (NCR - No Carbon Required) is a multi-ply form stock chemically treated to transfer images instantly without the need for messy carbon interleaving sheets. It is critical for generating simultaneous duplicates of invoices, receipts, and order forms efficiently, making it the most dominant and resilient product segment.

What sustainability initiatives are manufacturers implementing in the continuous form paper industry?

Manufacturers are increasingly focusing on sustainable pulp sourcing (FSC or PEFC certification), increasing the use of post-consumer recycled content (PCR) in their paper products, and developing eco-friendly chemical coatings for NCR forms to minimize the environmental footprint and meet corporate green procurement standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager