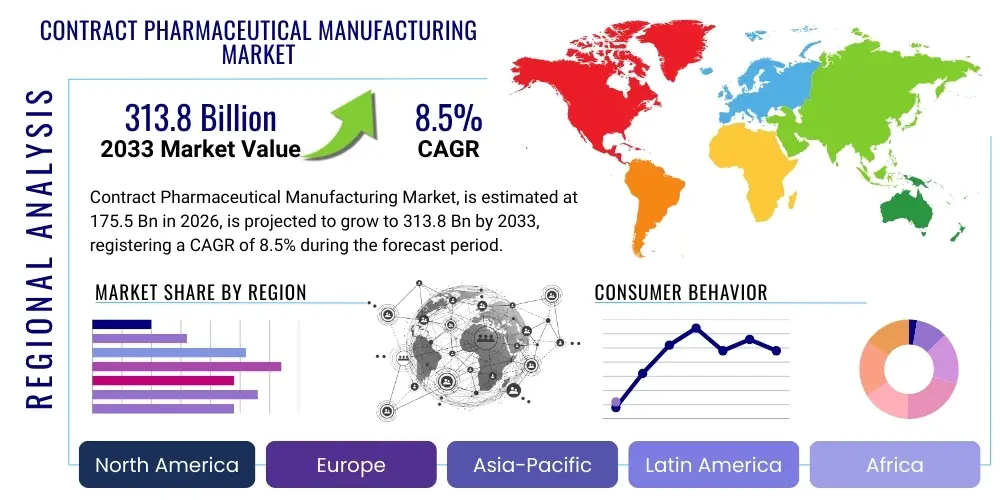

Contract Pharmaceutical Manufacturing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443610 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Contract Pharmaceutical Manufacturing Market Size

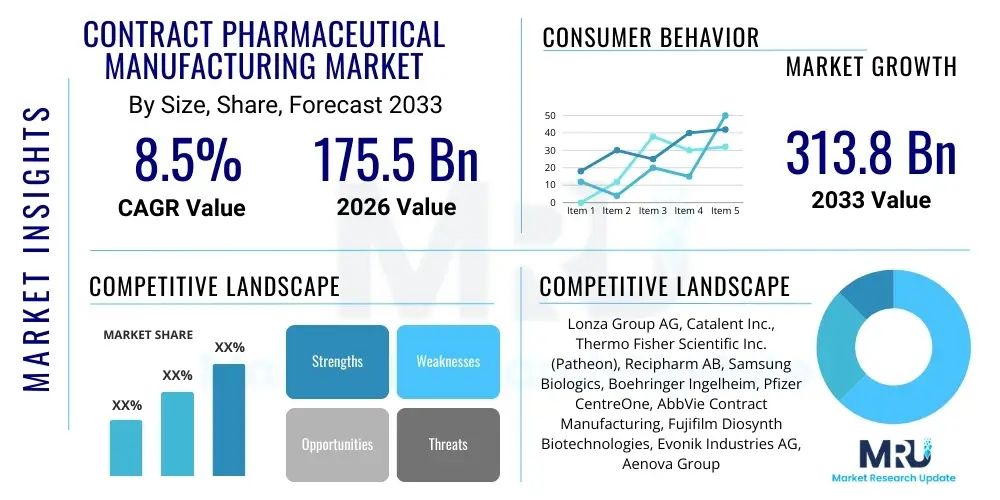

The Contract Pharmaceutical Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 175.5 Billion in 2026 and is projected to reach USD 313.8 Billion by the end of the forecast period in 2033.

Contract Pharmaceutical Manufacturing Market introduction

The Contract Pharmaceutical Manufacturing (CPM) market encompasses the outsourcing of various stages of pharmaceutical production, including drug substance (Active Pharmaceutical Ingredient or API) manufacturing, drug product (Finished Dosage Form or FDF) manufacturing, and associated services such as packaging, logistics, and quality control. This domain has witnessed robust expansion due to pharmaceutical and biotechnology companies increasingly focusing on core competencies like research and development (R&D) and commercialization, while relying on specialized Contract Manufacturing Organizations (CMOs) or Contract Development and Manufacturing Organizations (CDMOs) for efficient, compliant, and flexible production capabilities. The services provided span the entire drug lifecycle, from preclinical phase material supply through large-scale commercial production.

Major applications of CPM services involve the manufacture of small molecule drugs, biologics (including monoclonal antibodies and recombinant proteins), vaccines, and, increasingly, complex advanced therapeutic medicinal products (ATMPs) such as cell and gene therapies. The product description of a CMO typically includes a diverse portfolio of dosage forms, including sterile injectables, solid oral dosages (tablets, capsules), and specialized forms like transdermal patches or inhaled medicines. This broad offering allows pharmaceutical clients to access sophisticated technologies and regulatory expertise they might lack internally, accelerating time-to-market and reducing internal capital expenditure burdens.

The primary benefits driving market growth include the operational flexibility offered by CDMOs, their ability to manage complex global supply chains, and the inherent cost-effectiveness derived from economies of scale and specialized equipment utilization. Driving factors prominently feature the rising global incidence of chronic diseases demanding constant therapeutic supply, the increasing complexity of new chemical entities (NCEs) and biologics requiring niche manufacturing expertise, and the global trend of patent expiration of blockbuster drugs, which necessitates swift generic and biosimilar production utilizing specialized contract capacity. Furthermore, stringent regulatory landscapes worldwide compel pharmaceutical firms to partner with organizations possessing established compliance records and state-of-the-art Quality Management Systems (QMS).

Contract Pharmaceutical Manufacturing Market Executive Summary

The Contract Pharmaceutical Manufacturing market is defined by rapid consolidation driven by mergers and acquisitions (M&A), as CDMOs seek to expand their service portfolios, geographical footprint, and technological capabilities, particularly in high-growth segments like biologics and high-potency APIs (HPAPIs). Business trends show a strong shift towards integrated CDMO models, offering comprehensive development-to-commercialization services, thereby reducing complexity for pharmaceutical clients and establishing long-term strategic partnerships. This vertical integration addresses the critical need for seamless technology transfer and robust supply chain resilience, especially following global disruptions. Innovation is concentrated around adopting advanced manufacturing techniques, such as continuous processing and single-use technologies, to improve efficiency and flexibility, particularly for complex and personalized medicines.

Regionally, while North America and Europe remain dominant in terms of market value due to established regulatory frameworks and high R&D spending, the Asia Pacific (APAC) region exhibits the highest growth trajectory. This growth in APAC is fueled by lower operating costs, increasing government support for domestic pharmaceutical manufacturing, and the emergence of specialized local players offering competitive pricing structures. Countries like China and India are transforming from mere low-cost production centers into sophisticated hubs for API synthesis and biosimilar manufacturing, attracting significant investment from global pharmaceutical companies seeking diversified manufacturing bases. This geographical rebalancing impacts global pricing strategies and supply chain design.

Segment trends confirm the substantial market shift towards biologics manufacturing, which requires complex sterile filling and specialized handling capabilities, commanding premium pricing and driving significant capital investment among CDMOs. The sterile injectables segment, encompassing vaccines and complex parenteral formulations, continues to outpace overall market growth, reflecting the rise in targeted therapies and biopharmaceuticals. Furthermore, specialized services like advanced drug formulation and analytical testing are gaining traction, complementing core manufacturing services and allowing CDMOs to capture greater value across the development lifecycle. The solid dosage segment, though mature, remains essential, focusing now on controlled-release and high-barrier containment systems for increasingly potent small molecules.

AI Impact Analysis on Contract Pharmaceutical Manufacturing Market

Common user questions regarding AI's impact on the Contract Pharmaceutical Manufacturing Market often center on its ability to enhance production efficiency, predict and mitigate manufacturing failures, accelerate drug development timelines, and ensure higher quality control amidst increasingly complex processes. Key concerns revolve around the initial high capital investment required for AI infrastructure, the need for specialized data scientists and AI engineers in a traditional manufacturing environment, and critical intellectual property (IP) and data security risks associated with sharing sensitive manufacturing data across AI platforms. Users are keen to understand how AI can personalize manufacturing processes for niche markets, particularly in advanced therapies, and its role in optimizing resource allocation and energy consumption across large-scale facilities. These expectations highlight a demand for AI not just as a tool for data processing, but as a transformative element reshaping the operational core of CDMOs.

AI adoption is profoundly influencing several critical areas within CPM, moving beyond simple automation to predictive intelligence. In process development, Machine Learning (ML) algorithms analyze high-dimensional process data to identify optimal parameters for yield and purity, drastically reducing the experimental cycles required for scale-up. This predictive capability minimizes wasted batches and operational downtime, translating directly into faster project completion times for pharmaceutical sponsors. Furthermore, in quality assurance, computer vision systems coupled with AI are revolutionizing quality control, enabling real-time inspection of millions of dosage units, significantly surpassing the speed and accuracy of traditional manual inspection methods and ensuring compliance with stringent regulatory standards like Current Good Manufacturing Practice (cGMP).

From a strategic business perspective, AI-powered demand forecasting and supply chain optimization tools are enabling CDMOs to manage complex, multi-site global operations more effectively. By analyzing historical data, market trends, and raw material availability, AI can generate highly accurate forecasts, optimizing inventory levels and ensuring timely delivery of complex therapeutics. This capability is especially vital for biologics and personalized medicine supply chains, where material shelf-life and cold-chain requirements are critical. While challenges exist regarding data interoperability and standardizing data formats across legacy systems, the long-term trend indicates that AI-driven efficiency and risk reduction will become standard competitive differentiators in selecting high-tier contract manufacturing partners.

- AI drives predictive maintenance, minimizing equipment downtime and maximizing asset utilization in highly complex cleanroom environments.

- Machine learning optimizes upstream and downstream bioprocessing parameters, leading to higher product yields and reduced batch-to-batch variability.

- Real-time quality monitoring systems using computer vision and AI enhance batch release speed and accuracy, reducing human error.

- AI aids in complex scheduling and resource allocation across multiple client projects, improving capacity utilization and financial forecasting for CDMOs.

- Natural Language Processing (NLP) is increasingly used to analyze vast regulatory documents and standard operating procedures (SOPs), ensuring automated compliance checking and documentation efficiency.

DRO & Impact Forces Of Contract Pharmaceutical Manufacturing Market

The Contract Pharmaceutical Manufacturing Market is shaped by a powerful confluence of drivers, restraints, and opportunities that dictate strategic direction and investment decisions. The key drivers include the intensifying complexity of novel drug entities, particularly large molecules requiring highly specialized manufacturing expertise and capital-intensive infrastructure, which most originator companies prefer to outsource rather than build internally. This is coupled with the global pressure on pharmaceutical companies to accelerate time-to-market for new drugs and biosimilars, making the scalable and regulatory-compliant capacity offered by CDMOs indispensable. Furthermore, the persistent need for cost optimization by pharmaceutical majors, alongside the strategic choice to divest non-core manufacturing assets, further solidifies the outsourcing model. These forces collectively create a high demand for flexible and technologically advanced production solutions.

However, the market faces significant restraints that necessitate careful risk management. Foremost among these is the inherent risk associated with intellectual property (IP) protection and technology transfer when sharing proprietary manufacturing processes with third parties, despite robust contractual agreements. Regulatory compliance remains a persistent challenge; any regulatory lapse or inspection failure at a CMO facility can halt production and severely impact the client’s product supply chain and brand reputation. Additionally, managing the global supply chain for critical raw materials and specialized reagents is increasingly difficult due to geopolitical volatility and increased scrutiny over material origins, contributing to price volatility and potential production delays. Successfully mitigating these risks requires CDMOs to invest heavily in advanced security, stringent quality systems, and diversified sourcing strategies.

The market opportunities are concentrated in high-growth, technically demanding therapeutic areas, particularly cell and gene therapies, where manufacturing scale-up and commercialization still present profound technical hurdles. CDMOs specializing in viral vector production, cell expansion, and aseptic filling for these Advanced Therapeutic Medicinal Products (ATMPs) are positioned for exponential growth. Another major opportunity lies in the adoption and implementation of continuous manufacturing (CM) processes. CM offers significant advantages in reduced facility footprint, lower energy consumption, and enhanced quality control compared to traditional batch processing, and CDMOs can offer this capital-intensive technology as a service, thereby democratizing access for smaller biotech firms. Successfully capitalizing on these opportunities demands substantial, targeted capital investment in specialized personnel and advanced infrastructure.

Segmentation Analysis

The Contract Pharmaceutical Manufacturing market is highly fragmented yet exhibits distinct segmentation based on service type, dosage form, and end-user, reflecting the diverse needs of the global pharmaceutical industry. Analyzing these segments provides strategic insight into growth pockets and areas of market maturity. The service type segmentation—API manufacturing, FDF manufacturing, and Packaging—reveals a significant push toward integrated FDF services, driven by the increasing complexity of formulation development and the desire for single-source suppliers who can manage the entire drug product workflow. Meanwhile, the API segment is seeing growth particularly in highly potent and specialty APIs required for targeted oncology treatments, demanding specialized containment capabilities.

Dosage form segmentation highlights the contrast between mature segments like solid dosage and rapidly growing, high-value segments such as sterile injectables and specialized formulations. Sterile injectables, encompassing pre-filled syringes, vials, and cartridges for vaccines and biologics, require the highest level of regulatory scrutiny and aseptic manufacturing environment, ensuring sustained investment in this area. Furthermore, the segmentation by end-user differentiates the strategic partnerships: large pharmaceutical companies often outsource capacity management and legacy products, while smaller biotech firms rely on CDMOs for virtually all aspects of development and manufacturing due to limited internal infrastructure and regulatory expertise, making them crucial drivers of R&D-stage outsourcing demand.

Understanding these segments allows market participants to tailor their operational focus and capital expenditure. For instance, CDMOs targeting the rapidly expanding biotech sector must offer strong development capabilities and regulatory support, whereas those focusing on large pharma require massive, compliant capacity and cost efficiency in commercial manufacturing. The market dynamics increasingly favor CDMOs that can operate across multiple segments, offering flexibility and robustness that meet both high-volume commercial needs and low-volume, high-complexity clinical trial requirements, thus cementing their role as essential strategic partners rather than mere transactional manufacturers.

- By Service Type:

- Active Pharmaceutical Ingredient (API) Manufacturing

- Finished Dosage Form (FDF) Manufacturing

- Solid Dosage Forms (Tablets, Capsules)

- Liquid Dosage Forms (Syrups, Suspensions)

- Semi-Solid Dosage Forms (Creams, Gels)

- Injectable Dosage Forms (Vials, Ampoules, Pre-filled Syringes)

- Packaging and Labeling

- Drug Development and Clinical Trial Manufacturing

- Regulatory Services and Quality Testing

- By Dosage Form:

- Solid Dosage Forms

- Liquid and Semi-Solid Dosage Forms

- Injectable Dosage Forms

- Specialty Dosage Forms (Inhalers, Transdermal Patches, Suppositories)

- By End-User:

- Big Pharmaceutical Companies

- Small and Medium-Sized Pharmaceutical and Biotechnology Companies

- Generic Drug Manufacturers

Value Chain Analysis For Contract Pharmaceutical Manufacturing Market

The value chain for Contract Pharmaceutical Manufacturing is extensive, starting from the procurement of raw materials and extending through complex manufacturing steps to final distribution. Upstream analysis focuses primarily on the supply of critical starting materials, excipients, solvents, and highly specialized manufacturing equipment, particularly single-use bioreactors and advanced chromatography systems crucial for biologics. Supplier reliability and quality control in this phase are paramount, as the integrity of the final drug product depends entirely on the quality and consistency of these inputs. CDMOs must maintain rigorous supplier qualification programs to mitigate risks associated with material sourcing, which often involves global procurement across volatile geopolitical landscapes.

The core of the value chain involves the CDMO’s internal operations, including process development, analytical method validation, clinical manufacturing, and large-scale commercial production. This is where significant value is added through expertise in complex chemical synthesis, sterile processing, formulation science, and regulatory compliance (cGMP adherence). CDMOs differentiate themselves through advanced technology adoption, such as continuous manufacturing or high-potency API handling capabilities. The profitability of the CDMO hinges on efficient capacity utilization, successful technology transfer, and minimizing costly batch failures, requiring substantial investment in automation and highly skilled technical personnel.

Downstream activities include secondary packaging, quality assurance release, warehousing, and distribution channel management. Distribution can be classified as direct, where the CDMO hands over the finished, released product directly to the pharmaceutical client's internal logistics network, or indirect, where the CDMO manages third-party logistics (3PL) providers to deliver products to global distribution hubs or specialized markets. The selection of distribution channel depends heavily on the product type—particularly cold chain requirements for biologics—and the contractual agreements defining responsibility for late-stage supply chain risk. Maintaining control over temperature and humidity during transit is essential for preserving drug efficacy and integrity.

Contract Pharmaceutical Manufacturing Market Potential Customers

The primary customer base for the Contract Pharmaceutical Manufacturing Market spans the entire spectrum of drug developers, ranging from established multinational pharmaceutical giants to emerging, venture-backed biotechnology startups. Large pharmaceutical companies (Big Pharma) represent the highest volume customers, typically utilizing CDMOs for capacity augmentation during peak demand, strategic outsourcing of non-core or older product lines, and accessing specialized capabilities, such as oncology drug manufacturing or complex formulation development, that they choose not to maintain internally. For Big Pharma, the decision to outsource is often driven by capital expenditure avoidance and maximizing operational flexibility.

Conversely, small and medium-sized biotechnology companies constitute the fastest-growing customer segment, relying heavily on CDMOs for comprehensive end-to-end services. These firms often possess robust intellectual property (IP) and advanced research findings but lack the necessary infrastructure, regulatory expertise, and capital to establish manufacturing facilities. CDMOs provide these smaller entities with a critical pathway from preclinical development to commercialization, serving as indispensable strategic partners who manage process scale-up, quality systems implementation, and regulatory filings. The complexity of manufacturing advanced therapies like cell and gene therapies further binds these biotech innovators to specialized CDMO partners.

Generic drug manufacturers also form a significant customer segment, particularly utilizing CDMO services for high-volume API synthesis and FDF production, aiming to achieve highly competitive cost structures quickly following patent expiration. Their focus is primarily on efficiency, scale, and global regulatory compliance (e.g., FDA, EMA approvals) for established compounds. In essence, the potential customer market is segmented based on need: established companies seek operational flexibility and cost advantages, while emerging companies seek technical expertise and capital replacement, ensuring sustained and diversified demand across the contract manufacturing ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 175.5 Billion |

| Market Forecast in 2033 | USD 313.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group AG, Catalent Inc., Thermo Fisher Scientific Inc. (Patheon), Recipharm AB, Samsung Biologics, Boehringer Ingelheim, Pfizer CentreOne, AbbVie Contract Manufacturing, Fujifilm Diosynth Biotechnologies, Evonik Industries AG, Aenova Group, WuXi Biologics, Siegfried Holding AG, Jubilant HollisterStier, Vetter Pharma, PCI Pharma Services, Albany Molecular Research Inc. (AMRI), CordenPharma, Fareva, and Takeda. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contract Pharmaceutical Manufacturing Market Key Technology Landscape

The technological landscape within the Contract Pharmaceutical Manufacturing Market is rapidly evolving, driven by the necessity to produce increasingly complex molecules with higher efficiency and quality control. One of the most significant shifts is the transition towards Continuous Manufacturing (CM) from traditional batch processing. CM involves integrating and automating all synthesis and processing steps into a single, seamless, non-stop flow, drastically reducing equipment footprint, processing time, and material wastage. CDMOs adopting CM technology gain a critical competitive edge, particularly for high-volume, small-molecule drug production, allowing for faster response to market demand and superior control over crystallization and blending processes.

In the biologics sector, the adoption of Single-Use Systems (SUS), also known as disposable systems, has become mainstream and is considered a foundational technology for modern CDMOs. SUS components, including bioreactors, mixing bags, and tubing, are pre-sterilized and disposed of after use, eliminating the time-consuming and costly cleaning and validation procedures associated with traditional stainless-steel equipment. This technology significantly enhances operational flexibility, accelerates facility changeovers between different products, and mitigates the risk of cross-contamination, making it ideal for the multi-product, high-variability environment typical of contract manufacturing, especially for early-stage clinical trial materials and specialized vaccines.

Furthermore, the integration of Industry 4.0 concepts, often referred to as Pharma 4.0, is transforming the manufacturing floor. This involves utilizing advanced sensor technologies, Industrial Internet of Things (IIoT), and digital twins to create highly monitored and predictive manufacturing environments. Key implementations include real-time process analytical technology (PAT) sensors that monitor critical quality attributes (CQAs) continuously, enabling immediate adjustment of process parameters and facilitating 'quality by design' (QbD) principles. These technological advancements ensure higher data integrity, streamline regulatory reporting, and enable highly responsive production systems, positioning technologically advanced CDMOs as indispensable partners for quality-conscious pharmaceutical clients.

Regional Highlights

The Contract Pharmaceutical Manufacturing market exhibits profound regional diversity, reflecting varying regulatory maturity, cost structures, and R&D concentration globally. North America, particularly the United States, commands a significant share of the market value, underpinned by high spending on pharmaceutical R&D, a robust biotechnology industry focusing on novel and complex therapies (especially cell and gene therapies), and the presence of numerous specialized, high-compliance CDMOs. The demand here is skewed toward high-value services, including clinical manufacturing, sterile injectables, and advanced formulation development, often requiring FDA expertise and large, specialized capital investments. This region drives innovation in manufacturing standards and technology adoption.

Europe represents another cornerstone of the global market, characterized by stringent regulatory environments (EMA) and a mature base of established contract manufacturers, particularly in Germany, Switzerland, and Ireland. The market in Europe is strong in traditional small molecule manufacturing and is rapidly scaling up its biologics capacity to serve the region's strong biopharmaceutical pipeline. European CDMOs often specialize in global distribution compliance and complex niche technologies, such as high-potency API handling and advanced sterile filling, maintaining a strong focus on quality systems and regulatory excellence to serve both local and export markets.

Asia Pacific (APAC) is recognized as the fastest-growing market, driven by favorable governmental policies, lower operating costs, and increasing domestic demand for pharmaceuticals across densely populated markets like China and India. Initially focused on generic API production, the region is rapidly ascending the value chain, attracting substantial foreign investment to build large-scale biologics and FDF facilities capable of meeting international cGMP standards. This geographic shift offers pharmaceutical companies attractive dual benefits: lower manufacturing costs and diversified supply chain resilience, although navigating the varied regulatory requirements across different APAC countries remains a complexity factor. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are experiencing steady growth fueled by local drug development initiatives and increasing reliance on imported manufactured medicines.

- North America (NA): Dominant market share fueled by large biotech presence, heavy R&D investment, and specialization in advanced therapies like cell and gene manufacturing. High-cost environment mandates focus on premium, complex services.

- Europe: Mature market with strong regulatory adherence (EMA), specialization in high-potency APIs and complex sterile injectables. Concentration of major global CDMO headquarters.

- Asia Pacific (APAC): Highest growth rate driven by cost advantages, expanding local pharmaceutical industries, and increasing investment in biologics capacity (China, India, South Korea). Becoming critical for global supply chain diversification.

- Latin America (LATAM): Emerging market focused primarily on serving regional demand, slowly increasing reliance on contract manufacturing for generic and essential medicines.

- Middle East and Africa (MEA): Smallest regional segment, growth linked to government initiatives aiming to establish domestic pharmaceutical manufacturing self-sufficiency and reduce import dependence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contract Pharmaceutical Manufacturing Market.- Lonza Group AG

- Catalent Inc.

- Thermo Fisher Scientific Inc. (Patheon)

- Recipharm AB

- Samsung Biologics

- Boehringer Ingelheim

- Pfizer CentreOne

- AbbVie Contract Manufacturing

- Fujifilm Diosynth Biotechnologies

- Evonik Industries AG

- Aenova Group

- WuXi Biologics

- Siegfried Holding AG

- Jubilant HollisterStier

- Vetter Pharma

- PCI Pharma Services

- Albany Molecular Research Inc. (AMRI)

- CordenPharma

- Fareva

- Takeda

Frequently Asked Questions

Analyze common user questions about the Contract Pharmaceutical Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards outsourcing in pharmaceutical manufacturing?

The primary drivers are the increasing complexity of new drug molecules (especially biologics and advanced therapies), the necessity for specialized manufacturing infrastructure that is too costly for many companies to build internally, and the global pharmaceutical industry's persistent focus on reducing capital expenditure and accelerating time-to-market. Outsourcing provides flexible capacity and rapid access to niche expertise.

How does the growth of cell and gene therapy affect the CDMO market?

Cell and gene therapies (CGTs) are profoundly impacting the CDMO market by creating demand for ultra-specialized, highly regulated manufacturing services, such as viral vector production and aseptic cell handling. This segment commands premium pricing and necessitates significant capital investment in highly specialized, smaller-scale flexible facilities, driving consolidation and technological specialization among top-tier CDMOs.

What are the main risks associated with using a Contract Manufacturing Organization (CMO)?

The main risks include the potential for intellectual property (IP) leakage, reliance on a third party for critical supply, and regulatory compliance failure at the CMO's facility, which can severely disrupt the client's product launch or commercial supply. Thorough due diligence and robust contractual agreements regarding quality and IP protection are essential for mitigation.

Which geographical region is experiencing the fastest growth in contract pharma manufacturing?

The Asia Pacific (APAC) region, specifically countries like China and India, is experiencing the fastest growth. This surge is attributed to cost advantages, expanding local pharmaceutical consumption, and aggressive government investment and foreign direct investment aimed at building modern, cGMP-compliant biologics and high-volume API manufacturing capacity.

How is Continuous Manufacturing (CM) changing the operational model of CDMOs?

Continuous Manufacturing (CM) allows CDMOs to produce drugs non-stop, eliminating traditional batch processing inefficiencies. CM significantly reduces facility size, lowers operating costs, and enhances product quality control through integrated Process Analytical Technology (PAT). This shift allows CDMOs to offer faster scale-up and greater operational flexibility to clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager