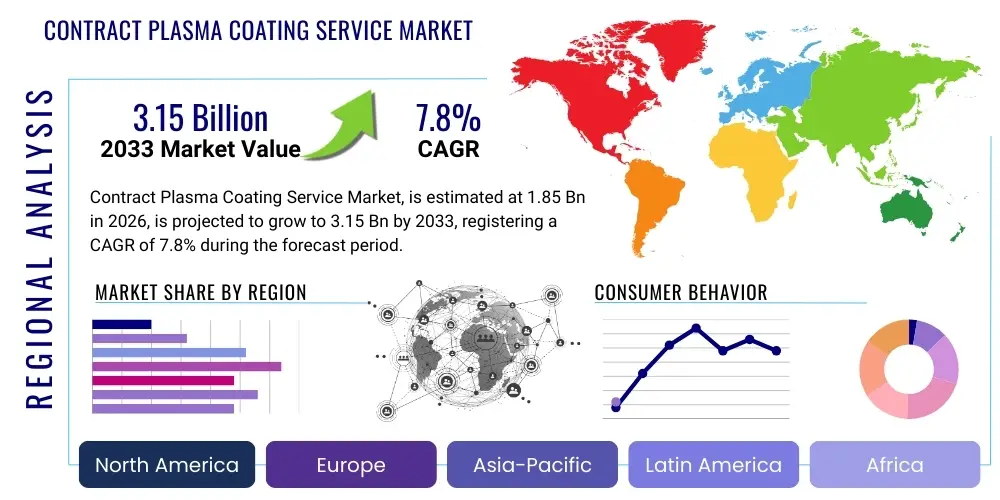

Contract Plasma Coating Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442146 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Contract Plasma Coating Service Market Size

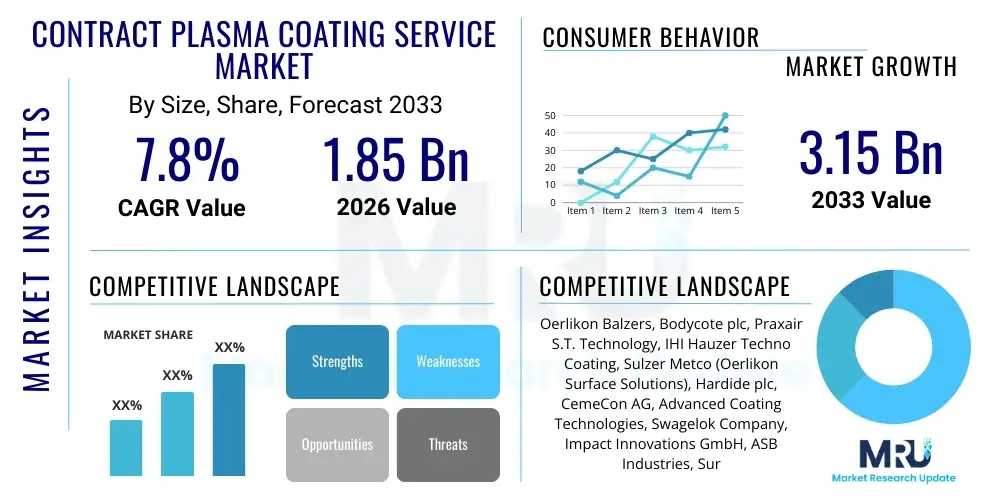

The Contract Plasma Coating Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at 1.85 Billion USD in 2026 and is projected to reach 3.15 Billion USD by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing complexity of material science requirements across key industrial sectors, including aerospace, medical devices, and automotive manufacturing. Outsourcing plasma coating services allows Original Equipment Manufacturers (OEMs) to leverage specialized expertise, advanced equipment, and stringent quality control protocols without incurring massive capital expenditure or maintaining highly specialized internal labor forces.

The consistent need for enhanced surface performance—such as increased hardness, superior corrosion resistance, and specific dielectric properties—is driving demand for high-precision contract services. Furthermore, stricter regulatory standards, particularly in the biomedical and aviation industries, mandate highly controlled and documented coating processes, which contract service providers are better equipped to deliver. The market growth is also supported by the proliferation of specialized material substrates, including composite materials and advanced ceramics, which require tailored plasma treatment processes that are often proprietary to leading service bureaus.

Contract Plasma Coating Service Market introduction

The Contract Plasma Coating Service Market encompasses specialized third-party services dedicated to applying advanced surface coatings onto components using plasma-based technologies. Plasma coating involves utilizing ionized gas (plasma) to deposit thin films of materials, offering superior adhesion, density, and functional properties compared to traditional coating methods. Key plasma technologies utilized include Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), Plasma Enhanced CVD (PECVD), and various forms of thermal plasma spray. These coatings serve critical functional roles, protecting underlying substrates from wear, corrosion, thermal degradation, and electrical conductivity issues, thereby extending component lifespan and enhancing operational efficiency.

Major applications of these services span mission-critical components in the aerospace sector (turbine blades, landing gear), intricate medical implants (stents, joint replacements), high-performance tools (cutting inserts, molds), and advanced semiconductors and electronics. The demand for contract services stems from the substantial capital investment required for plasma equipment, the technical expertise needed for process optimization, and the strict quality assurance protocols necessary, making outsourcing an economically viable and strategically sound choice for manufacturers globally. The market is highly differentiated based on the specific coating material (e.g., TiN, AlTiN, DLC) and the complexity of the treated geometry.

The primary benefits driving this market include access to cutting-edge coating formulations, reduced operational costs for end-users, and expedited time-to-market for new products requiring surface enhancement. Driving factors include the continuous push for lightweight yet durable materials in transportation, rapid growth in minimally invasive medical procedures requiring biocompatible coatings, and the increasing adoption of Industry 4.0 principles, which demand components capable of enduring harsh operational environments. Furthermore, globalization of manufacturing supply chains necessitates standardized coating quality, often best achieved through specialized contract providers.

Contract Plasma Coating Service Market Executive Summary

The Contract Plasma Coating Service Market is characterized by robust growth, driven by outsourcing trends among major industrial OEMs seeking specialized expertise and scalability. Current business trends indicate a strong focus on high-performance coatings, particularly Diamond-Like Carbon (DLC) and advanced ceramics, catering to the burgeoning electric vehicle (EV) and precision medical device industries. Consolidation and strategic acquisitions are notable trends, as large service providers seek to expand their geographical footprint and diversify their technological portfolios, integrating specialized niche providers focused on specific processes like atomic layer deposition (ALD) or high-volume thermal spray applications. Sustainability is also emerging as a critical factor, with increasing demand for environmentally friendly coating processes that minimize waste and energy consumption, pushing innovation in plasma source efficiency.

Regionally, the Asia Pacific (APAC) area, particularly China and India, is registering the fastest expansion due to rapid industrialization, large-scale infrastructure development, and growing indigenous manufacturing capabilities in automotive and electronics sectors. North America and Europe, while mature, maintain leadership in high-value, stringent regulatory compliance segments such as aerospace and advanced biomedical devices, driving demand for ultra-precision contract work. Emerging markets in Latin America and the Middle East are showing accelerated adoption rates, especially within oil and gas extraction equipment maintenance and localized defense manufacturing initiatives, necessitating wear-resistant coatings.

Segment trends highlight the dominance of the Physical Vapor Deposition (PVD) segment due to its versatility and established application history, although Plasma Enhanced Chemical Vapor Deposition (PECVD) is witnessing higher growth rates owing to its ability to deposit films at lower temperatures, suitable for heat-sensitive substrates. By end-user, the medical and aerospace sectors command the highest revenue share due to the high regulatory barriers and the critical nature of component performance. The trend is moving towards multi-functional coatings that combine corrosion, wear, and thermal barrier properties in a single application cycle, streamlining manufacturing processes for customers.

AI Impact Analysis on Contract Plasma Coating Service Market

Common user questions regarding AI's impact on the Contract Plasma Coating Service Market frequently revolve around optimizing complex process parameters, improving quality control consistency, and predicting equipment maintenance requirements. Users are concerned about how AI can handle the vast multivariate data generated during plasma processes (e.g., gas flow, pressure, power levels, temperature) to achieve zero-defect coatings consistently across large batches. There is significant interest in AI's role in automated visual inspection, replacing manual or semi-automated inspection steps, thus improving throughput and accuracy. Furthermore, manufacturers are keenly exploring AI-driven predictive maintenance models to minimize costly downtime associated with high-vacuum and high-power plasma reactors, ensuring high equipment utilization rates and timely service delivery in contract environments. The summary of user expectations indicates a transition towards AI-managed coating operations that promise enhanced efficiency, greater material yield, and reduced dependence on human expertise for real-time adjustments.

- AI-driven optimization of coating recipes, reducing trial-and-error R&D cycles and accelerating time-to-market for customized applications.

- Enhanced process monitoring and control through Machine Learning (ML) algorithms that adjust plasma parameters in real-time to maintain specified coating thickness and stoichiometry.

- Automated defect detection and quality assurance using Computer Vision (CV) integrated with microscopy and spectral analysis, leading to near-perfect batch consistency.

- Predictive Maintenance (PdM) of plasma reactors, power supplies, and vacuum systems, minimizing unscheduled downtime and improving overall equipment effectiveness (OEE).

- Improved supply chain forecasting and inventory management of target materials and precursor gases based on anticipated contract demands and historical usage patterns.

- Simulation and modeling of plasma behavior using sophisticated AI tools, enabling virtual prototyping of new coating materials and applications.

DRO & Impact Forces Of Contract Plasma Coating Service Market

The Contract Plasma Coating Service Market is significantly influenced by a dynamic interplay of driving factors, inherent restraints, and emerging opportunities, all culminating in substantial impact forces that define market trajectory. Drivers include the increasing demand for outsourced specialized manufacturing processes, the proliferation of complex engineering materials requiring high-performance surface modifications, and stringent regulatory demands, particularly in medical and aerospace sectors, mandating certified coating procedures. Conversely, restraints such as the high initial capital investment required for state-of-the-art plasma equipment, the scarcity of highly trained technical personnel capable of operating and maintaining these complex systems, and the long and sensitive qualification cycles for new coating processes can hinder rapid expansion and pose barriers to entry for new service providers. These factors create a concentrated market structure where specialized knowledge is a critical competitive asset.

Opportunities are largely centered around the growing adoption of Additive Manufacturing (3D Printing), as post-processing of 3D-printed parts often necessitates specialized plasma coatings for surface finish improvement and enhanced durability. Furthermore, the expansion into niche applications such as flexible electronics, advanced sensor protection, and development of antimicrobial coatings presents significant avenues for service diversification and revenue growth. Strategic geographical expansion into rapidly industrializing regions where indigenous coating capabilities are underdeveloped represents another substantial opportunity. The ability to offer integrated surface solutions, combining preparation, coating, and testing, positions providers favorably to capture higher value contracts.

The primary impact force shaping the market is the intense pressure for zero-defect output and process repeatability, forcing service providers to continuously invest in automation, robotics integration for component handling, and advanced sensor technology. This focus on reliability and quality control acts as a multiplier force on the adoption of high-cost, high-precision equipment. Furthermore, material science breakthroughs that introduce new coating materials or target compositions quickly shift competitive dynamics, requiring rapid technological adaptation from contract service providers to remain relevant and meet evolving customer specifications. This technological velocity is a constant, potent impact force.

Segmentation Analysis

The Contract Plasma Coating Service Market is meticulously segmented based on the type of technology employed, the specific coating material utilized, the substrate material being treated, and the key end-use industries served. Understanding these segmentations is critical for market participants to tailor their offerings and identify high-growth niches. The primary technological split occurs between vacuum-based deposition methods, such as PVD and CVD, which offer dense, high-purity films, and atmospheric or low-pressure thermal spray techniques, which are generally used for thicker protective layers. Geographic segmentation dictates regulatory adherence and customer base characteristics, driving regional variations in preferred coating types and industry dominance.

- By Technology Type:

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Plasma Enhanced Chemical Vapor Deposition (PECVD)

- Atmospheric Plasma Spray (APS)

- Vacuum Plasma Spray (VPS)

- High Velocity Oxygen Fuel (HVOF) (Often utilized by plasma service providers)

- By Coating Material:

- Metal Nitrides (e.g., TiN, CrN, AlTiN)

- Diamond-Like Carbon (DLC)

- Oxides (e.g., Alumina, Zirconia)

- Carbides (e.g., Tungsten Carbide)

- Ceramics and Composite Materials

- By End-Use Industry:

- Aerospace and Defense

- Medical and Healthcare Devices

- Automotive and Transportation (including EV components)

- Tool & Die / Precision Engineering

- Energy (Oil & Gas, Power Generation)

- Electronics and Semiconductors

- Textiles and Consumer Goods

- By Substrate Material:

- Metals (Steel, Titanium Alloys, Aluminum)

- Polymers and Plastics

- Composites

- Ceramics

Value Chain Analysis For Contract Plasma Coating Service Market

The value chain for the Contract Plasma Coating Service Market initiates with upstream activities focused on the sourcing and preparation of high-purity raw materials. This includes procuring sputtering targets, precursor gases (e.g., Argon, Nitrogen, Acetylene), and specialized powder feedstocks. Key upstream stakeholders are high-ppurity material suppliers and equipment manufacturers specializing in complex plasma reactors, vacuum systems, and automated handling robotics. The quality and stability of these input materials directly impact the final coating performance, making supplier qualification a critical step. Research and development institutions also play a vital upstream role by developing proprietary coating formulations and process improvements.

The core value creation lies in the midstream, where contract service providers execute surface preparation (cleaning, polishing, masking), the plasma coating process itself, and subsequent quality control and certification. This stage involves significant capital expenditure on plasma equipment and highly specialized labor. Downstream, the coated components are delivered to Original Equipment Manufacturers (OEMs) or tier-one suppliers across various industries, where the functional performance of the coating is realized in final products like medical implants or jet engine components. Logistics and final inspection services constitute the end of the technical value chain.

Distribution channels are predominantly direct, given the custom nature of contract services. Most contracts involve direct negotiation and continuous communication between the service provider and the customer's engineering teams to define precise coating specifications and adherence to regulatory standards. Indirect channels may include partnerships with tooling distributors or specialized material brokers who aggregate coating needs from smaller manufacturers. The consultative nature of selling complex coating services requires a strong technical sales force, distinguishing this market from standard commodity sales. Efficiency in the logistics of high-value components is essential, especially when dealing with international clients.

Contract Plasma Coating Service Market Potential Customers

Potential customers, or end-users, of the Contract Plasma Coating Service Market are diverse, highly sophisticated entities requiring component reliability and surface optimization to meet stringent performance or regulatory criteria. The largest consumers are manufacturers in highly regulated and capital-intensive sectors, where component failure is economically disastrous or life-threatening. These customers typically prioritize technical capability, quality assurance certifications (e.g., ISO 13485 for medical, AS9100 for aerospace), and scalability over marginal cost savings. They view contract coating services not merely as a cost center, but as a strategic partnership enabling superior product performance and accelerated innovation cycles.

The medical device industry represents a consistently growing customer segment, utilizing coatings for biocompatibility (e.g., titanium nitride on surgical tools), reduced friction (DLC on artificial joints), and enhanced material adhesion for drug-eluting surfaces. Aerospace customers, including commercial aircraft and military component manufacturers, require thermal barrier coatings (TBCs) for hot sections of turbines and wear-resistant coatings for landing gear components. These users require extremely high documentation standards and traceability throughout the coating process, often demanding dedicated process lines.

Furthermore, the automotive sector, especially manufacturers transitioning to Electric Vehicles (EVs), is becoming a critical customer base. EV manufacturers require specialized dielectric and anti-wear coatings for battery components, motors, and cooling systems to handle high power densities and friction reduction. Lastly, precision engineering firms and tool manufacturers are evergreen customers, consistently needing coatings like AlTiN and TiCN to extend the life of cutting tools and molds, significantly reducing operational expenditure by minimizing tool replacement frequency. The common thread among these buyers is the need for highly consistent, reproducible results delivered under strict quality management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.85 Billion USD |

| Market Forecast in 2033 | 3.15 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oerlikon Balzers, Bodycote plc, Praxair S.T. Technology, IHI Hauzer Techno Coating, Sulzer Metco (Oerlikon Surface Solutions), Hardide plc, CemeCon AG, Advanced Coating Technologies, Swagelok Company, Impact Innovations GmbH, ASB Industries, Surface Technology Inc., Richter Precision Inc., Kurt J. Lesker Company, Materion Corporation, Vapor Technologies Inc., Precision Coating Inc., Kolsteris N.V., Ionbond (IHI Group), OC Oerlikon Management AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contract Plasma Coating Service Market Key Technology Landscape

The technological landscape within the Contract Plasma Coating Service Market is constantly evolving, driven by the need for greater coating precision, enhanced adhesion, and the ability to process increasingly complex geometries and heat-sensitive materials. One of the fundamental technologies remains Physical Vapor Deposition (PVD), specifically arc evaporation and magnetron sputtering, favored for generating dense, hard, wear-resistant coatings like TiN and AlTiN. Recent advancements in PVD focus on High Power Impulse Magnetron Sputtering (HiPIMS), which offers superior film density, reduced macroparticle formation, and exceptionally smooth surface finishes, making it ideal for high-stress applications such as gear components and surgical instruments. Service providers are rapidly adopting HiPIMS to gain a competitive edge in quality.

Another crucial technological area is Plasma Enhanced Chemical Vapor Deposition (PECVD). This technology is gaining momentum because it operates at lower temperatures than traditional CVD, allowing for the coating of temperature-sensitive substrates like polymers, certain high-strength steels, and specialized tool inserts without compromising their metallurgical integrity. PECVD is essential for applying Diamond-Like Carbon (DLC) coatings, which are highly valued in the automotive sector for friction reduction and in the medical field for biocompatibility. Innovation here focuses on optimizing plasma chemistry and reactor design to ensure uniform deposition across large batches and complex, three-dimensional parts, particularly those produced via additive manufacturing.

Furthermore, the thermal spray segment, encompassing Vacuum Plasma Spray (VPS) and Atmospheric Plasma Spray (APS), continues to mature, specializing in the deposition of thick ceramic or metallic layers, predominantly used as thermal barriers (TBCs) in aerospace or protective layers in power generation turbines. Key technological improvements involve closed-loop control systems utilizing sophisticated sensors to monitor plasma jet enthalpy and powder feed rates in real-time. This level of process control ensures precise microstructural characteristics of the deposited layer, which is vital for performance. The integration of robotic arms for component manipulation is standard across all major plasma coating technologies, ensuring highly repeatable trajectory and coating uniformity, addressing the core requirement of the contract service model: reliability and consistency.

Regional Highlights

The global Contract Plasma Coating Service Market exhibits significant regional variations in growth rate, technological focus, and end-user dominance, reflecting regional industrial maturity and regulatory environments. These regional highlights dictate strategic investment decisions for global service providers.

- North America: This region is a major revenue contributor, characterized by high demand from the aerospace and medical device industries. It boasts a high concentration of technologically advanced service providers and strict adherence to certification standards (e.g., FAA, FDA). Growth is stable, focusing on advanced R&D, customized coatings, and highly complex, low-volume contract work.

- Europe: Similar to North America, Europe maintains strong market maturity, driven by the precision engineering, automotive (luxury and performance segments), and established tool manufacturing sectors. Germany, Switzerland, and the UK are technological hubs, prioritizing sustainable coating solutions and adopting Industry 4.0 automation rapidly in contract facilities.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally. This is powered by massive manufacturing bases in China, Korea, and India across electronics, general industrial, and automotive manufacturing. While cost competitiveness is a factor, rising quality demands are pushing local manufacturers toward high-quality contract services, particularly PVD coatings for tooling and electronics packaging.

- Latin America (LATAM): Growth is primarily linked to the oil and gas sector (requiring corrosion and wear resistance coatings) and domestic automotive production in countries like Brazil and Mexico. The market is developing, relying on imported expertise and equipment, but regional players are emerging to meet localized industrial demands.

- Middle East and Africa (MEA): This region's demand is concentrated in the energy sector (oil and gas infrastructure maintenance), defense, and infrastructure projects. Coatings for extreme environmental resilience (high heat, high salinity) are paramount, driving focused contract service needs, particularly in Saudi Arabia and the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contract Plasma Coating Service Market.- Oerlikon Balzers (OC Oerlikon Management AG)

- Bodycote plc

- Praxair S.T. Technology (Linde plc)

- IHI Hauzer Techno Coating B.V. (IHI Group)

- Sulzer Metco (Oerlikon Surface Solutions)

- Hardide plc

- CemeCon AG

- Advanced Coating Technologies

- Swagelok Company

- Impact Innovations GmbH

- ASB Industries Inc.

- Surface Technology Inc.

- Richter Precision Inc.

- Kurt J. Lesker Company

- Materion Corporation

- Vapor Technologies Inc.

- Precision Coating Inc.

- Kolsteris N.V.

- Ionbond (IHI Group)

- General Magnaplate Corporation

Frequently Asked Questions

Analyze common user questions about the Contract Plasma Coating Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of outsourcing plasma coating services over in-house solutions?

Outsourcing provides access to specialized, high-capital equipment and proprietary coating recipes without requiring significant upfront investment or maintaining expert staff. It ensures regulatory compliance, scalability for production peaks, and access to the latest technological advancements like HiPIMS or advanced DLC applications, leading to superior component performance and faster time-to-market.

Which plasma coating technology segment is exhibiting the fastest growth?

The Plasma Enhanced Chemical Vapor Deposition (PECVD) segment is showing rapid growth, driven by its suitability for depositing films like Diamond-Like Carbon (DLC) at lower temperatures. This is critical for automotive components (especially EVs) and sensitive medical devices that cannot withstand the high heat required by traditional CVD or some PVD processes.

How does the aerospace industry utilize Contract Plasma Coating Services?

The aerospace industry relies on these services for critical components requiring extreme thermal and wear resistance. Applications include Thermal Barrier Coatings (TBCs) for turbine blades, erosion-resistant coatings for fan blades, and solid lubrication films for mechanisms, all requiring strict AS9100 certification and full component traceability provided by contract specialists.

What key factors influence the cost of a contract plasma coating service?

The cost is primarily determined by the complexity of the part geometry (influencing handling and coating uniformity), the type and cost of the coating material (e.g., exotic ceramics versus standard nitrides), the required coating thickness, batch size, and the stringency of quality assurance and regulatory documentation required by the end-user industry (e.g., medical versus general industrial).

What role does automation play in the future of the Contract Plasma Coating Service Market?

Automation, including robotics for material handling and AI-driven process control, is essential. It ensures high repeatability, minimizes human error, optimizes complex multi-variable plasma processes, and supports zero-defect manufacturing standards demanded by regulated industries, directly contributing to higher throughput and service reliability for contract providers.

The detailed analysis above provides a robust overview of the market dynamics, technological shifts, and strategic considerations essential for stakeholders within the Contract Plasma Coating Service ecosystem. The market’s future is intrinsically linked to material science innovation and the increasing reliance of manufacturing sectors on outsourced, specialized surface modification capabilities.

Further market movements are expected in the convergence of plasma coating with additive manufacturing post-processing, where surface finish and density requirements necessitate advanced PVD or PECVD solutions tailored specifically for complex, often porous, 3D-printed geometries. This convergence represents a significant revenue opportunity, compelling service providers to adapt their equipment and process expertise rapidly.

Ultimately, the competitive landscape will be defined by providers who can demonstrate consistent quality control, technological agility in adopting new coating recipes (such as advanced multilayer and nanocomposite coatings), and the capacity to meet global supply chain requirements efficiently and reliably. Investment in green technologies and energy-efficient plasma sources will also become a differentiating factor for sustainable market leadership.

This market analysis confirms that the Contract Plasma Coating Service sector is not merely a supportive industry, but a critical enabler of high-performance manufacturing globally, driving innovation across aerospace, medical technology, and advanced precision engineering segments through specialized surface functionalization.

The ongoing miniaturization of electronic components necessitates ultra-thin film deposition capabilities, pushing service providers toward Atomic Layer Deposition (ALD) techniques, often integrated with existing plasma reactors, to achieve atomic-level control over film thickness and uniformity. This high-precision requirement is particularly acute in the semiconductor and advanced sensor markets, where surface properties directly dictate device functionality and lifespan. Contract providers offering certified ALD services are uniquely positioned to capture high-value, highly specialized niche segments, demanding continuous strategic investment in research and capital equipment that offers combined capabilities across multiple deposition platforms.

The stringent demands from the medical sector regarding biocompatibility, hemocompatibility, and resistance to sterilization cycles mandate specialized R&D efforts focusing on non-toxic, highly adhesive coating materials. Outsourced contract services in this field must adhere to rigorous validation protocols, including pre-clinical testing support and extensive documentation required for FDA and CE approvals. This regulatory burden acts as a natural barrier to entry, solidifying the position of incumbent providers who possess established quality management systems and regulatory expertise. The trend toward customized implants and patient-specific devices further increases reliance on specialized contract coaters capable of handling low-volume, high-mix production efficiently.

Environmental regulations, particularly in Europe, are placing pressure on the entire manufacturing ecosystem to reduce hazardous waste and energy consumption. Plasma coating processes, especially certain PVD and PECVD techniques, inherently offer a more environmentally friendly alternative to traditional wet chemical plating processes. Contract service providers are leveraging this advantage in their marketing and supply chain agreements, promoting the ecological benefits of plasma deposition. This shift towards 'green' coating solutions is not just regulatory-driven but is becoming a significant competitive differentiator as major OEMs prioritize sustainable sourcing practices throughout their value chains, influencing procurement decisions heavily.

The complexity of processing components from Additive Manufacturing (AM) processes cannot be overstated. Parts produced via methods like Selective Laser Melting (SLM) or Electron Beam Melting (EBM) often possess high surface roughness and internal porosity, requiring intensive pre-treatment before plasma coating. Contract service providers are increasingly integrating advanced polishing and surface homogenization steps, sometimes including specialized chemical etching or plasma etching, prior to the final deposition step. This holistic service offering, combining surface refinement with advanced coating, positions the contract service provider as a crucial partner in optimizing the functional characteristics of AM parts for high-stress applications such as aerospace heat exchangers or automotive turbocharger impellers. The technical challenge requires significant interdisciplinary expertise.

Investment in data infrastructure and cybersecurity is becoming paramount for contract coaters. As AI and ML algorithms are increasingly deployed to manage proprietary coating recipes and monitor sensitive customer IP (Intellectual Property), protecting these digital assets is critical. Customers in highly competitive markets, such as tooling and defense, require assurance that their component specifications and processing parameters are securely managed. Service providers that demonstrate robust cybersecurity protocols and provide transparent data management systems gain substantial trust and competitive advantage, enabling them to secure long-term, high-value contracts where IP protection is non-negotiable.

Geographically, expansion strategies for key players often involve establishing regional "hubs" in strategic locations within APAC or LATAM to minimize logistics costs and reduce turnaround times for high-volume customers. These hubs typically replicate the core technology and quality standards of the parent company while adapting to local labor conditions and regulatory requirements. This localized service delivery model, supported by global technical expertise, is essential for capitalizing on the rapid industrial growth observed in emerging markets, ensuring that quality standards remain globally consistent despite decentralized operations. This global reach capability is a core value proposition for large multinational service providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager