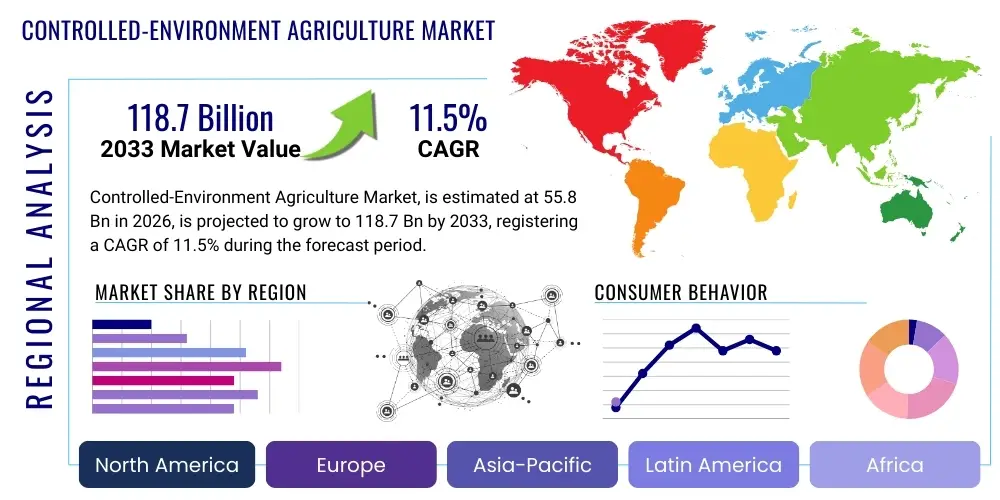

Controlled-Environment Agriculture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441666 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Controlled-Environment Agriculture Market Size

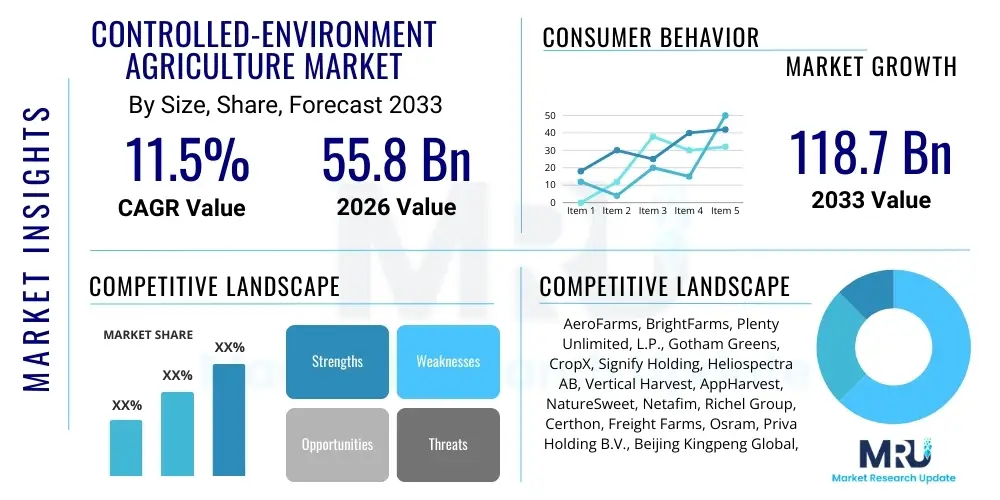

The Controlled-Environment Agriculture (CEA) Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $55.8 Billion USD in 2026 and is projected to reach $118.7 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for sustainable and locally sourced food production, coupled with increasing climate volatility that renders traditional open-field agriculture unreliable in many regions. Technological integration, particularly in climate control and resource management, acts as a primary catalyst for this aggressive market trajectory.

Controlled-Environment Agriculture Market introduction

The Controlled-Environment Agriculture (CEA) market encompasses technologies and systems designed to optimize the growing environment for crops, often through highly regulated structures like greenhouses, vertical farms, and plant factories. These systems precisely control factors such as temperature, humidity, light intensity, CO2 concentration, and nutrient delivery to maximize crop yield, quality, and consistency, irrespective of external climatic conditions. The CEA model serves as a critical solution for addressing global food security challenges, land scarcity, and the need for year-round production of high-value crops, particularly in urban areas or regions with harsh climates.

Major applications of CEA span the cultivation of leafy greens, tomatoes, cucumbers, strawberries, and increasingly, medicinal plants and cannabis. The immediate benefits include significant water savings (up to 95% compared to conventional farming), reduced pesticide usage due to contained environments, and minimized transportation costs by locating facilities near consumption centers. Furthermore, CEA allows for highly reliable production schedules, enhancing supply chain predictability for retailers and food service providers, which is a major advantage in volatile consumer markets.

Driving factors for market growth are manifold and interdependent. Firstly, the rapid urbanization trend worldwide necessitates localized food production solutions to maintain freshness and reduce logistics complexity. Secondly, consumer demand for organic, pesticide-free, and sustainably produced food is continually escalating, aligning perfectly with the core promises of CEA. Finally, decreasing costs associated with LED lighting and advancements in sensor technology and automation systems are lowering the operational expenditures (OPEX) barrier for establishing and scaling CEA facilities, attracting significant venture capital and corporate investment globally.

Controlled-Environment Agriculture Market Executive Summary

The global CEA market exhibits robust growth, characterized by significant business trends focusing on vertical integration and technological convergence. Key business stakeholders are increasingly moving beyond just hardware supply, venturing into operational farm management and high-tech software development (Agritech AI) to optimize complex facility operations. Strategic partnerships between technology providers and large agricultural conglomerates are accelerating the deployment of advanced automation systems, particularly in large-scale hydroponic and aeroponic vertical farms, targeting maximum density and yield per square foot. The shift towards modular and scalable farm designs is also a noticeable trend, facilitating quicker deployment and adaptation across various geographical locations.

Regionally, North America and Europe remain the dominant markets due to high consumer spending capacity, established technological infrastructure, and substantial government support for sustainable agriculture initiatives. However, the Asia Pacific region, driven by countries like Japan, China, and Singapore, is emerging as the fastest-growing market segment. This rapid expansion in APAC is primarily fueled by severe limitations in arable land, high population density, and governmental mandates focused on enhancing domestic food production capabilities, particularly through the implementation of large-scale plant factories utilizing multi-layer cultivation systems.

Segmentation trends highlight the increasing dominance of vertical farming within the market structure, especially utilizing hydroponic systems, as they offer the highest density potential for leafy greens and herbs. Technology-wise, the lighting segment (LEDs) and the climate control systems segment are experiencing accelerated innovation, focusing on energy efficiency—a critical factor given that energy consumption remains the largest operational restraint for CEA. The primary end-user segment is shifting from solely food production to also include pharmaceutical applications and specialized research, broadening the commercial viability and revenue streams for CEA operators.

AI Impact Analysis on Controlled-Environment Agriculture Market

Common user inquiries regarding AI in CEA predominantly center on four areas: yield maximization, resource efficiency, disease prediction, and labor automation. Users seek confirmation on whether AI-driven systems truly deliver higher ROI compared to traditional automated controls and are keenly interested in the specifics of predictive analytics—specifically, how machine learning algorithms can anticipate crop stress or optimize nutrient delivery schedules in real-time. Concerns frequently revolve around the initial capital expenditure required for sophisticated sensor networks and proprietary AI software, as well as the need for robust data governance to manage the vast quantities of environmental and plant-specific metrics generated by these advanced farms.

AI’s influence is revolutionizing CEA by transitioning operations from reactive adjustments to proactive, predictive management. Machine learning models analyze historical and real-time sensor data—including nutrient absorption rates, light spectrum efficiency, and atmospheric vapor pressure deficit (VPD)—to create optimal growth recipes specific to genotype and desired phenotype. This sophisticated modeling capability drastically reduces guesswork, minimizing resource wastage (water, fertilizer, energy) and ensuring crops reach their peak harvest potential with consistent quality. Furthermore, computer vision, powered by AI, autonomously monitors plant health, identifying minor signs of pests, diseases, or nutritional deficiencies long before human inspection, allowing for targeted intervention rather than broad-spectrum chemical treatments, enhancing the clean label promise of CEA produce.

The integration of AI is crucial for addressing the primary economic challenge of CEA: high operational costs, particularly labor. Robotics guided by AI handle repetitive tasks like seeding, transplanting, harvesting, and packaging. This automation not only solves labor scarcity issues but also ensures precision and consistency, contributing to the overall cost competitiveness of CEA facilities. As AI algorithms become more sophisticated and proprietary growth recipes become standardized across large farm networks, the economic models of CEA facilities improve significantly, paving the way for wider adoption and justifying the substantial initial investment required for high-tech vertical farming infrastructures.

- Enhanced Predictive Yield Modeling: AI analyzes growth patterns and environmental inputs to accurately forecast harvest volume and timing.

- Optimized Resource Allocation: Machine learning fine-tunes irrigation, nutrient solution pH, and EC levels in closed-loop systems, maximizing water and fertilizer efficiency.

- Automated Climate Control: AI algorithms dynamically adjust HVAC, lighting, and humidity based on plant physiological needs rather than static set points.

- Early Disease and Pest Detection: Computer vision systems identify initial signs of pathogens or insects, enabling preventative localized treatment.

- Autonomous Robotics Integration: AI guides robotic arms and internal logistics systems for efficient seeding, harvesting, and tray movement, reducing human labor dependency.

DRO & Impact Forces Of Controlled-Environment Agriculture Market

The dynamics of the Controlled-Environment Agriculture (CEA) market are shaped by powerful Drivers and Opportunities (DO) that are often counterbalanced by significant Restraints (R), which together constitute the critical Impact Forces. The primary drivers include the urgent need for climate-resilient food systems and the push towards sustainable, localized production to feed rapidly expanding urban populations. Simultaneously, rapid technological advancements in LED efficiency and sensor miniaturization reduce capital expenditure and improve operational effectiveness, making high-density farming increasingly feasible. Opportunities arise from expanding applications beyond standard produce into high-value crops like cannabis and specialized ingredients for the pharmaceutical and nutraceutical industries, offering diversified revenue streams and higher margins.

Conversely, the market faces considerable restraints, dominated by the high initial capital investment required for constructing and equipping state-of-the-art vertical farms or large greenhouse facilities. Crucially, the substantial ongoing energy consumption, necessary for climate control, ventilation, and supplemental lighting, poses the greatest operational challenge and cost impediment. Fluctuating energy prices and a reliance on non-renewable energy sources in certain regions significantly impact the profitability and environmental footprint of CEA operations. Furthermore, the specialized skillset required to manage these complex, data-intensive farms presents a barrier to entry, demanding highly specialized labor that is often scarce.

These forces create a complex impact landscape. While governmental pressure for sustainability and consumer demand for localized food provide a strong foundational push for growth, the economic viability hinges entirely on continuous technological innovation aimed at reducing energy demand and automating labor. Success in the CEA market is therefore dictated by an operator’s ability to leverage geothermal, solar, or wind power inputs and integrate advanced AI systems to minimize energy waste and labor costs, effectively transforming a high-cost operational model into a competitive one capable of scaling efficiently. The market momentum suggests that technological breakthroughs will increasingly overcome current economic restraints, particularly as energy storage and management technologies improve.

Segmentation Analysis

The Controlled-Environment Agriculture market is comprehensively segmented based on three key dimensions: the type of growing facility, the core technology employed, and the crops cultivated. Understanding these segments is crucial for strategic investment and market positioning, as each type of system caters to different yield objectives, capital requirements, and regional suitability. The facility type segment distinguishes between traditional glass or plastic greenhouses, which primarily utilize natural sunlight and supplemental controls, and fully closed-loop vertical farms (Plant Factories), which rely entirely on artificial lighting and offer maximum environmental control and density.

The technology segmentation differentiates between hydroponics (water-based nutrient delivery), aeroponics (mist-based nutrient delivery), and aquaponics (integrated fish and plant systems). Hydroponics currently holds the largest share due to its proven scalability and efficiency for common crops like lettuce and herbs. The crop type segmentation reveals a clear focus on high-margin produce such as leafy greens, herbs, and vine crops (tomatoes, peppers), which show excellent performance and quick turnover in controlled settings. However, there is growing interest in diversifying cultivation to include staples and specialized medicinal plants.

This market structure demonstrates that while traditional greenhouse technology still dominates in terms of sheer installed capacity (especially for vine crops needing height), vertical farming and advanced technological integration, particularly aeroponics, represent the fastest-growing segments. This trend reflects the market’s pivot towards high-density urban production and maximizing yield consistency, offering a pathway for CEA operators to achieve the necessary scale and efficiency to compete effectively with conventional agriculture supply chains, despite the higher initial investment.

- By Facility Type:

- Greenhouses (Glass/Plastic)

- Vertical Farms (Indoor)

- Container Farms

- Screenhouses/Net Houses

- By Growing Medium/Technology:

- Hydroponics

- Aeroponics

- Aquaponics

- Soil-based Systems (High-tech Greenhouses)

- By Component:

- Hardware (Sensors, HVAC, Irrigation Systems, Lighting Systems)

- Software & Services (Farm Management Software, AI/ML Analytics, Consulting)

- By Crop Type:

- Leafy Greens and Herbs (Lettuce, Spinach, Basil)

- Vine Crops (Tomatoes, Cucumbers, Peppers)

- Fruits (Strawberries, Berries)

- Flowers and Ornamentals

- Medical Plants and Cannabis

- By Offering:

- Fully Integrated Solutions

- Individual Components

Value Chain Analysis For Controlled-Environment Agriculture Market

The Value Chain for the Controlled-Environment Agriculture market is complex and technology-centric, starting with the upstream suppliers who provide the core technological components necessary for creating and maintaining the controlled environment. Upstream activities involve manufacturers of critical infrastructure, including advanced LED lighting systems (crucial for optimizing photosynthetic active radiation), sophisticated Heating, Ventilation, and Air Conditioning (HVAC) units, specialized sensors for environmental monitoring (temperature, humidity, CO2), and irrigation and nutrient delivery systems (pumps, drippers, mixing tanks). The quality and efficiency of these components directly dictate the initial capital expenditure and the long-term operational costs of the CEA facility, highlighting the significance of partnerships with reliable technology vendors.

The midstream stage is dominated by the CEA operators themselves—the vertical farms, greenhouses, and plant factories responsible for cultivation, monitoring, and harvesting. These operators leverage advanced software, often including proprietary Farm Management Systems (FMS) and AI platforms, to convert raw environmental data into actionable insights and optimize growth recipes. The distribution channel structure is bifurcated: direct and indirect. Direct distribution often involves operators selling directly to nearby consumers, restaurants, and institutional food services, leveraging the local production advantage and freshness guarantee. Indirect channels involve conventional food distributors and major retailers who purchase and manage the broader supply chain logistics.

Downstream activities center on reaching the end-user, primarily the retail sector (supermarkets, specialty food stores) and the Food Service industry (restaurants, catering). Due to the high-value, high-quality nature of CEA produce, operators often target premium market segments, emphasizing attributes like zero pesticide residue, exceptional freshness, and sustainability credentials (water saving, reduced food miles). The integration of CEA firms into the supply chains of large grocery chains, often through exclusive supply contracts, is a defining feature of the downstream market, ensuring stable demand and predictable revenue for CEA ventures.

Controlled-Environment Agriculture Market Potential Customers

The potential customers and primary end-users for the CEA market span diverse sectors driven by the need for high-quality, consistent, and locally produced agricultural inputs. The largest customer base remains the Consumer Goods and Retail sector, encompassing major supermarket chains, hypermarkets, and specialty grocery stores that seek year-round availability of fresh produce, especially leafy greens, tomatoes, and berries, which command higher price points when domestically and sustainably grown. These buyers value the predictable supply schedule and consistent quality that CEA facilities guarantee, mitigating supply chain risks associated with seasonality or international transport.

Another significant customer segment is the Food Service industry, including high-end restaurants, institutional catering (schools, hospitals, corporate canteens), and fast-casual dining chains. These customers prioritize culinary quality, demanding unique or hyper-fresh herbs and specialty crops that benefit significantly from minimal time between harvest and plate. Localized CEA farms allow food service providers to market their commitment to local sourcing and premium ingredients, enhancing their brand value and operational flexibility by minimizing reliance on volatile, long-distance supply lines.

Beyond traditional food consumers, the pharmaceutical and nutraceutical industries represent a rapidly expanding customer base. These sectors require highly specialized, bio-active plant materials cultivated under strictly controlled, sterile conditions to ensure precise chemical composition and purity. Crops grown for drug development, supplements, and specialized botanical extracts thrive in CEA environments where factors like active compound levels can be rigorously controlled and standardized, offering unparalleled consistency compared to open-field cultivation. Furthermore, research institutions and governmental bodies focusing on sustainable agriculture and food security also act as key buyers for pilot projects and advanced farming systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.8 Billion USD |

| Market Forecast in 2033 | $118.7 Billion USD |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AeroFarms, BrightFarms, Plenty Unlimited, L.P., Gotham Greens, CropX, Signify Holding, Heliospectra AB, Vertical Harvest, AppHarvest, NatureSweet, Netafim, Richel Group, Certhon, Freight Farms, Osram, Priva Holding B.V., Beijing Kingpeng Global, Hydrofarm Holdings Group, Bowery Farming, and Green Sense Farms. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Controlled-Environment Agriculture Market Key Technology Landscape

The technological core of the Controlled-Environment Agriculture market revolves around three interdependent systems: advanced lighting, precise climate control, and comprehensive automation/data analytics. LED lighting technology represents a major technological driver, with manufacturers continually enhancing spectral tuning capabilities and energy efficiency (measured in micromoles per joule, or PPF/W). Modern LEDs allow operators to customize light recipes—adjusting intensity and specific light wavelengths (red, blue, green)—to optimize specific crop attributes such as flavor profiles, nutritional density, or biomass growth, moving far beyond simple supplemental light provision and enabling true photomorphogenesis control in fully indoor environments.

Climate control systems are fundamental, encompassing high-efficiency Heating, Ventilation, and Air Conditioning (HVAC), dehumidification units, and CO2 enrichment technologies. The current technological focus is on closed-loop or semi-closed loop systems that dramatically reduce air exchange, thereby minimizing energy required to heat or cool incoming air and maximizing the recycling of water vapor through condensation. This pursuit of energy minimization is critical; advancements in technologies like evaporative cooling and optimized airflow management through computational fluid dynamics (CFD) simulation are essential for making large-scale vertical farming economically sustainable in warmer climates.

Finally, the rapid evolution of sensor technology and data integration is central to maximizing operational efficiency. Wireless sensor networks collect high-resolution data on nutrient concentration (EC/pH), substrate moisture, leaf temperature, and atmospheric conditions. This vast dataset feeds into sophisticated Farm Management Software (FMS), often coupled with Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These systems are responsible for precision agriculture within the controlled setting, automating tasks, predicting maintenance needs, and generating optimized growth protocols. The shift towards proprietary software platforms that offer seamless integration of hardware inputs represents the cutting edge of technological development in this market.

Regional Highlights

The global CEA market exhibits pronounced regional variations driven by differing regulatory frameworks, consumer acceptance levels, climate constraints, and capital availability. North America, particularly the United States and Canada, stands as a market leader, characterized by early adoption of large-scale vertical farming and significant venture capital influx. This region benefits from a robust technological ecosystem, sophisticated supply chains, and high consumer awareness regarding sustainable and organic produce. Key drivers here include the need for year-round fresh produce in diverse climates and the burgeoning market for specialized crops like medicinal cannabis, where precision control is non-negotiable. The operational focus in North America is on achieving scale and mitigating high labor costs through extensive automation and AI integration.

Europe represents another mature CEA market, heavily influenced by strong governmental policies favoring sustainable resource management and reducing carbon footprints in agriculture. Countries like the Netherlands possess world-leading expertise in high-tech greenhouse technology, focusing on energy efficiency through geothermal heating and advanced climate control to maximize yield per unit of energy. Scandinavian countries and the UK are rapidly adopting indoor vertical farming to overcome limited sunlight hours and improve self-sufficiency. European market growth is driven by regulatory compliance standards for pesticide use and high consumer demand for locally sourced, transparently produced food items, encouraging continuous innovation in low-energy CEA operations.

Asia Pacific (APAC) is projected to be the fastest-growing region, primarily fueled by demographic pressures, urbanization, and critical food security concerns in densely populated nations. Countries like Japan, known for their high-tech plant factories, and Singapore, which mandates local food production targets, are leading the charge. China is investing massively in large-scale smart greenhouse complexes. The APAC market dynamics are characterized by governmental funding for sustainable agriculture infrastructure and a focus on high-density production solutions to maximize output from limited urban land parcels. While initial capital barriers are high, the necessity for stable, clean food supply outweighs these challenges, making technology transfer and local adaptation crucial growth factors.

The Middle East and Africa (MEA) region, although starting from a smaller base, presents compelling growth opportunities driven by extreme climatic conditions (water scarcity, high temperatures) that render traditional agriculture challenging. Gulf Cooperation Council (GCC) countries are heavily investing in large-scale CEA projects (both high-tech greenhouses and vertical farms) to drastically improve food independence and reduce reliance on imported food, leveraging abundant capital for technology acquisition. Similarly, Latin America is showing nascent growth, driven by export demands and the need to stabilize supply chains in climatically vulnerable areas, often focusing on advanced greenhouse solutions tailored to subtropical conditions.

- North America: Leading in technology adoption, large-scale vertical farm deployment, and investment in cannabis cultivation infrastructure.

- Europe: Dominated by high-tech greenhouse technology (Netherlands) and strongly supported by sustainability and low-carbon agricultural policies.

- Asia Pacific (APAC): Highest projected growth, driven by food security imperatives, urbanization, and heavy government investment in plant factories (Japan, Singapore).

- Middle East & Africa (MEA): High potential driven by the necessity of climate resilience to overcome severe water stress and extreme heat, leveraging capital for technology import.

- Latin America: Emerging market focused on enhancing export quality and stabilizing food supply through localized greenhouse investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Controlled-Environment Agriculture Market.- AeroFarms

- BrightFarms

- Plenty Unlimited, L.P.

- Gotham Greens

- CropX

- Signify Holding

- Heliospectra AB

- Vertical Harvest

- AppHarvest

- NatureSweet

- Netafim

- Richel Group

- Certhon

- Freight Farms

- Osram

- Priva Holding B.V.

- Beijing Kingpeng Global

- Hydrofarm Holdings Group

- Bowery Farming

- Green Sense Farms

- Illumitex

- LumiGrow

- Rijk Zwaan

- Soli Organic (formerly Shenandoah Growers)

- Tyson Foods (Venture investments)

- Vertical Future

- iFarm

Frequently Asked Questions

Analyze common user questions about the Controlled-Environment Agriculture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining the widespread profitability of Controlled-Environment Agriculture?

The most significant restraint is the high operational expenditure related to energy consumption. Electricity is required to power LED lighting, HVAC systems, and climate controls continuously, making the economic viability of CEA systems highly sensitive to utility costs and grid sustainability.

How does Controlled-Environment Agriculture address global food security challenges?

CEA enhances food security by ensuring consistent, year-round production of high-value crops regardless of adverse climate events or seasonality. It allows for localized food production in regions lacking arable land or water, reducing reliance on long, fragile international supply chains.

Which technology segment is expected to show the highest growth rate in the CEA market?

The software and services segment, particularly solutions integrating AI, Machine Learning, and advanced sensor technology for farm management and operational optimization, is projected to experience the fastest growth, driven by the need to maximize efficiency and reduce labor costs.

Is vertical farming economically competitive with traditional outdoor farming?

For high-value, fast-cycle crops (like leafy greens and herbs), vertical farming is becoming increasingly competitive, especially when considering the premium price points, zero food mileage, and minimal waste. However, for staple row crops, traditional agriculture maintains a substantial cost advantage.

What are the main environmental benefits of adopting Controlled-Environment Agriculture?

Key environmental benefits include massive water savings (typically over 90% compared to field farming due to closed-loop recycling), elimination or drastic reduction of chemical pesticide use, and reduced carbon emissions associated with long-distance transport (food miles).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager