Cooking Oils and Fats Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443559 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Cooking Oils and Fats Market Size

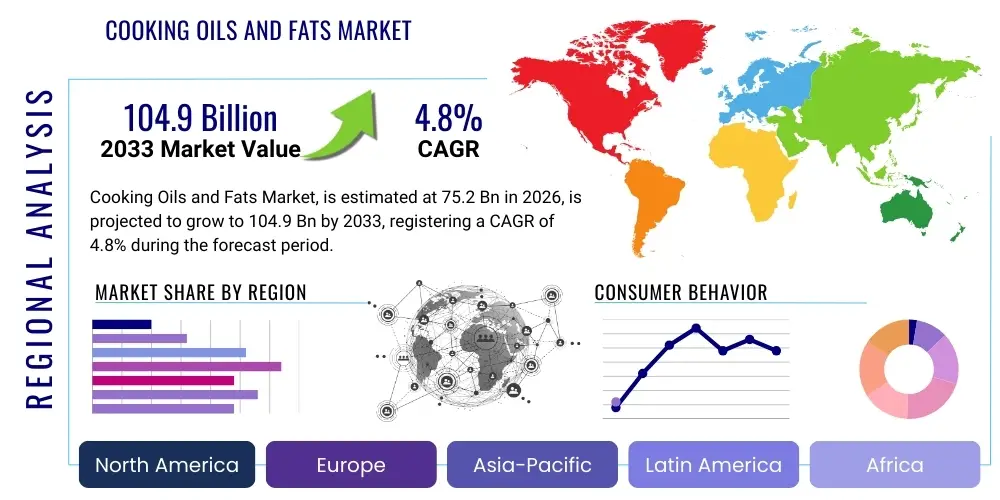

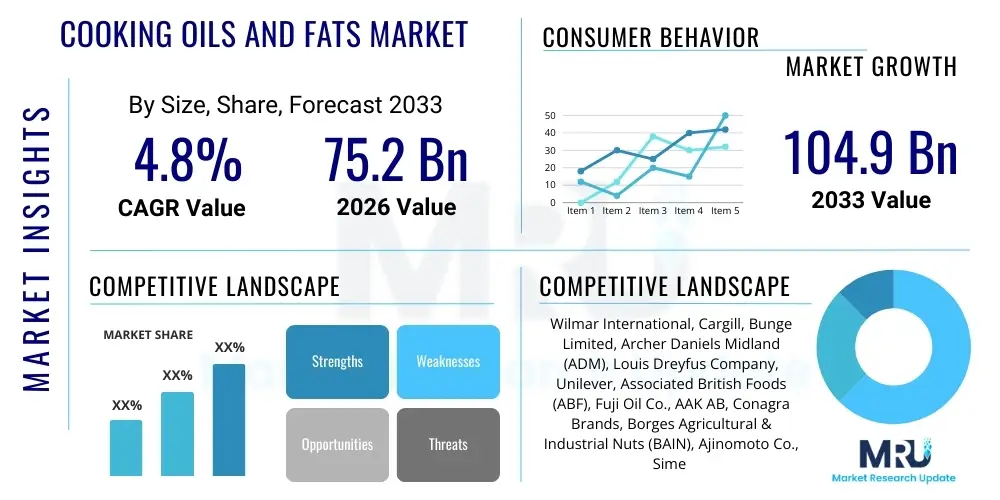

The Cooking Oils and Fats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $75.2 Billion USD in 2026 and is projected to reach $104.9 Billion USD by the end of the forecast period in 2033.

Cooking Oils and Fats Market introduction

The Cooking Oils and Fats Market encompasses a vast array of lipid products derived from vegetable, seed, animal, and marine sources, essential for culinary purposes, food processing, and industrial applications. These products serve fundamental roles in cooking, including frying, baking, sautéing, and dressing, providing flavor, texture, and nutritional value, primarily energy and essential fatty acids. The market is highly dynamic, influenced significantly by fluctuating raw material prices, evolving consumer health consciousness, and stringent regulatory frameworks concerning labeling and ingredient sourcing. Key product segments include refined oils (such as palm, soybean, sunflower, and canola), specialty oils (like olive, avocado, and coconut), and animal fats (e.g., butter, lard, and tallow).

Major applications span three primary sectors: household/retail consumption, the food service industry (HORECA), and industrial food manufacturing, particularly in processed foods, snacks, and confectionery. The intrinsic benefits of cooking oils and fats, beyond their functional role in heat transfer, include delivering fat-soluble vitamins (A, D, E, K) and providing essential omega fatty acids, crucial for human health. The driving factors for market expansion include rapid urbanization in developing economies, leading to increased consumption of packaged and processed foods, coupled with a global shift toward healthier, functional oils that offer specific health benefits, such as high monounsaturated fatty acids (MUFAs) or polyunsaturated fatty acids (PUFAs).

Furthermore, technological advancements in extraction, refinement, and modification processes, such as hydrogenation and interesterification, allow manufacturers to customize lipid profiles for specific industrial needs, enhancing shelf stability and texture properties. The demand for sustainable sourcing, particularly for palm and soybean oil, has also become a critical market driver, compelling major players to adopt certified sustainable practices (e.g., RSPO, RTRS) to meet consumer and regulatory expectations. This focus on traceability and sustainability ensures long-term viability and caters to ethically conscious consumer segments across North America and Europe.

Cooking Oils and Fats Market Executive Summary

The Cooking Oils and Fats Market is poised for stable expansion, underpinned by converging business trends that prioritize both cost efficiency and consumer health. Business trends indicate a robust focus on vertical integration among major producers to mitigate commodity price volatility and secure supply chains. There is a discernible shift in product innovation towards heart-healthy variants, including high-oleic oils and blends fortified with Omega-3s, driven by increasing public awareness of dietary fats' role in cardiovascular health. Furthermore, the industrial segment is seeing heightened demand for specialized fats suitable for plant-based and vegan food formulations, reflecting the growing alternative protein movement globally. Strategic mergers and acquisitions are commonplace as companies seek to expand regional presence and acquire specialized processing technologies, particularly those focused on sustainable extraction methods and non-GMO sourcing.

Regionally, Asia Pacific (APAC) remains the dominant consumption hub, propelled by large populations, evolving dietary habits, and robust food processing industries in countries like China and India, where traditional cooking practices still heavily rely on oils such as palm, soybean, and mustard. North America and Europe, while mature, lead in premiumization and specialization, demanding certified organic, non-GMO, and single-source specialty oils (e.g., cold-pressed olive and avocado oils), often commanding higher price points. Latin America and the Middle East and Africa (MEA) are emerging as significant growth markets due to increasing disposable incomes and the expansion of modern retail infrastructure, facilitating wider distribution of branded and packaged edible fats.

Segmentation trends highlight the increasing fragmentation of the oil category based on source and perceived health benefits. The Vegetable & Seed Oil segment, particularly palm and soybean, maintains the largest volume share due to cost efficiency and versatility in industrial use, though facing sustainability scrutiny. However, specialty oils like olive oil and blends are experiencing the fastest value growth as consumers trade up for nutritional superiority and sensory attributes. Within distribution, modern retail formats (supermarkets/hypermarkets) continue to dominate, but the e-commerce channel is exhibiting accelerated growth, especially for high-value, niche products, offering greater transparency and direct-to-consumer access, which is appealing to health-conscious urban populations seeking detailed product information and independent third-party certifications.

AI Impact Analysis on Cooking Oils and Fats Market

User inquiries regarding AI's impact on the Cooking Oils and Fats Market primarily revolve around optimizing agricultural yields, enhancing quality control and traceability, and predicting volatile commodity prices. Consumers and industry stakeholders are keen to understand how AI-driven predictive analytics can stabilize procurement costs, how machine learning (ML) algorithms can refine oil blending and formulation for desired nutritional profiles (e.g., optimizing Omega ratios), and how computer vision can expedite and standardize quality inspections during the refining and bottling processes. A major concern is the transparency and reliability of AI systems in certifying sustainable sourcing and detecting adulteration, especially given the history of fraud in high-value oils like olive oil. Expectations center on AI significantly improving supply chain efficiency, reducing waste, and facilitating precision agriculture for oilseed cultivation.

- AI-driven Predictive Analytics: Forecasting oilseed yields and volatile commodity prices, enabling optimized procurement and risk management for large-scale processors.

- Supply Chain Optimization: Utilizing ML algorithms for real-time tracking of raw materials from farm to processing plant, enhancing traceability, and reducing logistical bottlenecks and spoilage.

- Automated Quality Control: Deployment of computer vision and sensor technology during refining to instantly detect contaminants, measure free fatty acid content, and ensure consistency in color, clarity, and purity.

- Precision Agriculture: Implementation of satellite imagery and AI analysis to monitor soil health, optimize irrigation, and schedule harvesting for improved oilseed crop productivity and quality.

- Product Formulation and Blending: Using AI to simulate thousands of formulation combinations to achieve specific functional properties (e.g., smoke point, oxidative stability) or target nutritional profiles for specialized industrial applications.

DRO & Impact Forces Of Cooking Oils and Fats Market

The Cooking Oils and Fats Market is shaped by a complex interplay of consumer health trends, economic factors, and regulatory mandates. Key drivers include the escalating global demand for convenience and processed foods, particularly in emerging economies, which rely heavily on bulk oils. The persistent consumer shift towards healthy fats, moving away from saturated and trans fats toward monounsaturated and polyunsaturated options (like olive, avocado, and high-oleic sunflower oils), strongly influences product development and market positioning. Concurrently, technological innovation in oil processing, such as advanced fractionation and deodorization techniques, allows manufacturers to produce oils with specific functional attributes, meeting sophisticated industrial demands for improved stability and texture in complex food matrices. These drivers collectively amplify the market's growth trajectory, especially in premium and specialized segments.

Restraints primarily revolve around the severe volatility of raw material prices, which are susceptible to climatic conditions, geopolitical events (affecting major oilseed exporters), and trade tariffs. This price fluctuation complicates long-term planning and procurement for processors and often translates into higher retail prices, potentially suppressing consumer demand in price-sensitive markets. Furthermore, the stringent and evolving global regulations concerning trans-fat content, mandatory labeling of allergens, and requirements for sustainable sourcing (e.g., regulations targeting deforestation linked to palm oil) necessitate significant capital investment in operational adjustments and certification, which can be challenging, particularly for smaller market participants.

Opportunities for growth lie in the untapped potential of novel oil sources (e.g., algal oil, hemp oil) that offer superior nutritional profiles and sustainability credentials, attracting high-end consumers and specialized food manufacturers. The continuous expansion of the food service sector globally, coupled with the burgeoning demand for high-quality, stable frying oils, presents a robust avenue for commercial growth. The most significant impact force on the market is sustainability and ethical sourcing, compelling large multinational corporations to invest heavily in traceability technologies and certified sustainable supply chains, which acts as both a competitive differentiator and a prerequisite for accessing lucrative Western markets. Health consciousness remains a strong foundational impact force, continuously shifting market share towards products marketed with clear, verifiable health benefits.

Segmentation Analysis

The Cooking Oils and Fats Market is comprehensively segmented based on the raw material source, the end-user application, and the distribution channel through which the products reach consumers and industries. This structure helps in understanding the diverse dynamics within the market, ranging from high-volume commodity oils used extensively in industrial food processing to niche, high-value specialty oils favored by health-conscious retail consumers. Segmentation by source is critical, differentiating between vegetable/seed oils (dominant in global volume) and animal fats, reflecting consumer dietary preferences and regional culinary traditions. Application segmentation clarifies demand patterns across household, food service, and industrial sectors, revealing varying requirements for stability, flavor neutrality, and processing suitability.

- By Type: Vegetable & Seed Oil (Soybean Oil, Palm Oil, Sunflower Oil, Rapeseed/Canola Oil, Olive Oil, Corn Oil, Peanut Oil, Specialty Oils), Animal Fat (Butter, Lard, Tallow, Ghee).

- By Application: Household/Retail Consumption, Food Service/HORECA (Hotels, Restaurants, Cafes), Industrial Food Processing (Bakery and Confectionery, Snacks and Savories, Frying Applications, Sauces and Dressings).

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Traditional Grocery Stores (Wet Markets, Kirana Stores).

Value Chain Analysis For Cooking Oils and Fats Market

The value chain of the Cooking Oils and Fats Market is extensive, starting at the upstream agricultural phase involving oilseed cultivation and harvesting (e.g., soybean, palm, sunflower). Upstream activities are characterized by high dependence on climatic conditions, sophisticated farming techniques, and large-scale commodity trading. Key challenges in this phase include yield optimization and ensuring sustainable land use. The next critical stage involves crushing and extraction, where raw materials are processed to yield crude oils. This highly capital-intensive stage uses large-scale industrial machinery, often integrated with refineries for efficiency.

Midstream processing encompasses the refinement, bleaching, and deodorization (RBD) of crude oils to remove impurities and unwanted flavors, making them suitable for consumption. This stage also includes modification processes like hydrogenation and interesterification to achieve specific melting profiles and oxidative stability required by industrial users. Downstream activities involve packaging, branding, and distribution. Packaging innovations are crucial for maintaining oil quality (e.g., UV protection, oxygen barrier packaging) and catering to different consumer sizes (from large bulk containers for HORECA to small retail bottles).

Distribution channels are highly diversified, catering to direct and indirect sales. Direct distribution often involves bulk sales from refineries to large industrial customers (e.g., major food manufacturers) who utilize the fats directly in their products. Indirect distribution relies heavily on an intricate network of logistics providers, wholesalers, and retailers (Supermarkets, convenience stores, and the rapidly growing e-commerce platforms). The efficiency of this downstream network is paramount in minimizing costs and ensuring product freshness, especially in geographically dispersed markets, requiring robust supply chain management and cold chain logistics for certain animal fats like butter and ghee.

Cooking Oils and Fats Market Potential Customers

The market for cooking oils and fats serves a highly diversified customer base, ranging from individual household consumers to massive, globally integrated food manufacturing conglomerates. Household consumers represent the largest volume segment in many regions, driven by daily cooking needs and purchasing based on factors such as price, brand loyalty, and perceived health benefits (e.g., preference for heart-healthy or low-cholesterol options). These end-users are highly sensitive to retail promotions and are increasingly influenced by digital media and health education campaigns regarding optimal fat intake, making them receptive to specialty oil offerings.

The food service industry, including HORECA establishments, constitutes a critical and demanding customer segment. These buyers prioritize high-performance oils that offer superior heat stability, a high smoke point, and neutral flavor profiles, essential for large-volume frying and consistent recipe execution. Consistency of supply and bulk packaging options are key procurement criteria for these businesses. The industrial food processing sector, however, is the most technically demanding customer segment, requiring fats and oils with precise physical and chemical specifications (e.g., specific melting curves for bakery shortenings, highly stable fats for snack manufacturing) to ensure product quality, shelf life, and compliance with strict food safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $75.2 Billion USD |

| Market Forecast in 2033 | $104.9 Billion USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wilmar International, Cargill, Bunge Limited, Archer Daniels Midland (ADM), Louis Dreyfus Company, Unilever, Associated British Foods (ABF), Fuji Oil Co., AAK AB, Conagra Brands, Borges Agricultural & Industrial Nuts (BAIN), Ajinomoto Co., Sime Darby Plantation, Richardson International, Viterra, Ag Processing Inc (AGP), The J.M. Smucker Company, Ventura Foods, Döhler GmbH, Saporito Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cooking Oils and Fats Market Key Technology Landscape

The core technological landscape in the Cooking Oils and Fats Market is dominated by advanced methods aimed at maximizing yield, enhancing purity, and customizing the physical properties of lipids. Extraction technologies have evolved beyond traditional pressing to include solvent extraction (predominantly using hexane) for maximizing oil recovery from oilseeds, followed by advanced desolventizing and toasting processes. A major technological focus is on green extraction methods, such as supercritical fluid extraction (SCFE) using CO2, which eliminates chemical residues and is increasingly preferred for high-value specialty oils marketed as clean label or organic, despite the higher operational costs involved.

Refining technologies represent another critical area of innovation. Physical refining is gaining traction over chemical refining because it minimizes waste and utilizes fewer chemicals, aligning with sustainability goals. Furthermore, enzymatic interesterification has emerged as a crucial technology, replacing traditional chemical hydrogenation. Interesterification allows manufacturers to create tailor-made solid fats (shortenings, margarines) with desirable textural properties and stability, while crucially avoiding the formation of harmful trans fatty acids, addressing a major global regulatory concern and consumer preference for healthier processed foods.

In quality assurance and monitoring, the adoption of sophisticated analytical chemistry techniques is mandatory. These include Gas Chromatography-Mass Spectrometry (GC-MS) and Nuclear Magnetic Resonance (NMR) spectroscopy, used not only for routine quality checks (like measuring peroxide value and anisidine value to track oxidation) but also for rigorous detection of adulteration, particularly in premium oils like extra virgin olive oil. Continuous, inline monitoring systems are increasingly integrated into refining lines to provide real-time data, ensuring optimal process parameters are maintained, minimizing batch variation, and supporting the rigorous traceability requirements demanded by modern supply chain management systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, driven by massive population bases, rising disposable incomes, and the sustained expansion of the processed food industry, especially in China, India, and Indonesia. Palm oil and soybean oil remain staple commodities due to affordability and versatility, although demand for healthier alternatives like rice bran and groundnut oil is accelerating among the urban middle class. Regulatory efforts around food safety and the shift from loose oil sales to packaged, branded oils are key market dynamics in this region.

- North America: Characterized by high consumer health consciousness and a preference for premium, specialty oils. The market is dominated by soybean, canola, and corn oils, but growth is significantly higher in segments such as avocado, olive, and functional oil blends fortified with omega fatty acids. Stringent regulations concerning trans fat elimination and mandatory non-GMO labeling heavily influence product innovation and market penetration strategies. The region exhibits high adoption of advanced, traceable supply chain systems.

- Europe: A mature market with a strong emphasis on sustainability, traceability, and certified organic products. Olive oil holds significant cultural and market dominance, particularly in Southern European nations. Northern Europe drives demand for rapeseed/canola oil and specialty fats for the confectionery and bakery industries. European regulations (e.g., EU Novel Foods regulation) and commitments to environmental standards (e.g., RSPO certification for palm oil) are among the strictest globally, setting a benchmark for industry best practices.

- Latin America: Experiencing steady growth fueled by economic development and the modernization of retail sectors. Soybean oil is the predominant cooking oil, especially in major producing nations like Brazil and Argentina. Increased penetration of global fast-food chains and processed food manufacturers is boosting demand for stable industrial fats. Economic instability in some countries, however, poses a restraint on premium product uptake, favoring volume and price efficiency.

- Middle East and Africa (MEA): Growth is propelled by expanding urban populations, rising tourism, and significant foreign investment in the food processing sector. Palm oil and sunflower oil are widely consumed. Health concerns regarding obesity and diabetes are gradually increasing consumer interest in heart-healthy oils like olive oil (especially in the Mediterranean littoral) and blended vegetable oils, although the market remains highly price-sensitive across much of the African continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cooking Oils and Fats Market.- Wilmar International

- Cargill

- Bunge Limited

- Archer Daniels Midland (ADM)

- Louis Dreyfus Company

- Unilever

- Associated British Foods (ABF)

- Fuji Oil Co.

- AAK AB

- Conagra Brands

- Borges Agricultural & Industrial Nuts (BAIN)

- Ajinomoto Co.

- Sime Darby Plantation

- Richardson International

- Viterra

- Ag Processing Inc (AGP)

- The J.M. Smucker Company

- Ventura Foods

- Döhler GmbH

- Saporito Foods

Frequently Asked Questions

Analyze common user questions about the Cooking Oils and Fats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Cooking Oils and Fats Market?

The primary factor driving market demand is the increased global consumption of convenience and processed foods, particularly in rapidly urbanizing developing economies. This trend elevates the requirement for high-volume, cost-effective industrial fats and oils, alongside the growing consumer preference for packaged, branded oils over loose alternatives.

Which geographical region holds the largest market share for cooking oils and fats?

The Asia Pacific (APAC) region holds the largest market share, characterized by its immense population, high domestic consumption, and dominant role in global palm and soybean oil processing and trade. China and India are the pivotal markets driving both volume and value growth in this segment.

How is regulatory pressure influencing product innovation in the oils and fats industry?

Regulatory pressure, specifically the global push to eliminate industrially produced trans fats, is compelling manufacturers to innovate by adopting technologies like enzymatic interesterification. This allows for the creation of structured, solid fats (margarines, shortenings) with functional properties similar to partially hydrogenated oils but without harmful trans fat content.

What are 'specialty oils' and why are they experiencing high growth rates?

Specialty oils (e.g., olive, avocado, coconut, and high-oleic variants) are defined by their unique source, often specific extraction methods (like cold pressing), and superior nutritional profiles (high MUFA content). They are experiencing high growth because health-conscious consumers are willing to pay a premium for perceived health benefits, single-source traceability, and clean-label attributes.

What are the main sustainability challenges faced by key market players?

The main sustainability challenges involve ensuring the ethical sourcing of high-volume commodities, notably palm and soybean oil, to mitigate impacts related to deforestation, biodiversity loss, and labor practices. Key market players address this through rigorous traceability programs and adherence to certification bodies like the Roundtable on Sustainable Palm Oil (RSPO).

How do commodity price fluctuations impact the profitability of oil processors?

Commodity price fluctuations, driven by unpredictable weather, geopolitical factors, and trade policies, severely impact the operating margins of oil processors. Companies utilize sophisticated hedging strategies and focus on vertical integration—owning crushing and refining facilities—to stabilize input costs and manage inventory risk more effectively against volatile global market prices.

What role does the food service sector play in the market?

The food service sector (HORECA) is a crucial high-volume purchaser, demanding specialized oils that offer high smoke points, prolonged stability under heat, and minimal flavor transfer. This sector drives demand for bulk packaging and continuous supply chains, essential for commercial frying and baking applications in hotels, restaurants, and institutional catering.

What is the significance of the "Non-GMO" label in the North American market?

The "Non-GMO" label is highly significant in the North American retail segment, reflecting strong consumer preference for genetically unmodified products. Manufacturers leverage this claim, particularly for oils derived from common GMO crops like corn and soybean, to differentiate premium offerings and capture the segment of the population prioritizing ingredient purity and natural sourcing.

How does technological advancement in extraction impact oil quality?

Technological advancements, such as the implementation of supercritical CO2 extraction (SCFE) and improved cold-pressing techniques, impact oil quality by enabling the isolation of lipids with minimal thermal or chemical degradation. This results in oils that retain higher levels of natural vitamins, antioxidants, and native flavors, leading to superior quality products for the specialty and gourmet segments.

Which distribution channel is showing the fastest growth rate?

The Online Retail (e-commerce) distribution channel is exhibiting the fastest growth rate, particularly for specialty, premium, and imported oils. This platform facilitates direct-to-consumer sales, offers transparency through detailed product information, and allows niche brands to bypass traditional retail bottlenecks, reaching sophisticated urban consumers effectively.

What are MUFAs and PUFAs, and why are they preferred by consumers?

MUFAs (Monounsaturated Fatty Acids) and PUFAs (Polyunsaturated Fatty Acids) are unsaturated fats considered healthier than saturated or trans fats. Consumers prefer them because they are associated with reduced risk of cardiovascular disease, lower bad cholesterol levels (LDL), and often contain essential fatty acids (Omega-3 and Omega-6) that the body cannot produce, driving the high demand for olive, canola, and sunflower oils.

What is the role of interesterification in modern fat production?

Interesterification is a catalytic process that rearranges fatty acids within triglyceride molecules. Its key role is to produce functional solid fats (like shortenings and margarines) with optimized crystallization and melting profiles, eliminating the need for partial hydrogenation, thereby providing a crucial method for manufacturing trans fat-free industrial and retail products while maintaining textural integrity.

How does urbanization in emerging markets affect oil consumption patterns?

Urbanization in emerging markets leads to smaller household sizes, less time for traditional cooking, and increased reliance on packaged and processed foods, dramatically increasing the demand for pre-packaged, branded cooking oils. It also drives the expansion of food service establishments and modern retail, fundamentally altering the traditional supply chains.

Why is olive oil segmentation critical in Europe?

Olive oil segmentation is critical in Europe due to its cultural significance and price hierarchy, differentiating products based on quality grades (Extra Virgin, Virgin, Refined). Strict regulation is enforced to protect the Extra Virgin segment from adulteration, making certification and geographical indication (PGI, PDO) paramount for market credibility and consumer trust across Mediterranean nations.

What defines the upstream segment of the value chain?

The upstream segment is defined by the agricultural activities of growing and harvesting oilseeds (e.g., palm fruit, soybeans, sunflowers) and the initial steps of handling and storage. It is characterized by high seasonality, dependence on large-scale farming logistics, and significant exposure to volatile commodity pricing determined by global supply and demand dynamics.

What impact does the growth of plant-based foods have on the fats market?

The rapid growth of the plant-based food industry significantly boosts demand for functional vegetable fats and oils that can mimic the texture and mouthfeel of animal fats in products like dairy alternatives and meat substitutes. Specialized fats, such as modified coconut oil and shea butter fractions, are essential ingredients for achieving desired melting points and structure in these novel food formulations.

How do major companies utilize vertical integration?

Major companies like Wilmar and Cargill utilize vertical integration by controlling key stages of the supply chain, from oilseed crushing and refining to packaging and distribution. This strategy minimizes reliance on external commodity markets, secures consistent supply, and allows for better quality control and cost management, providing a significant competitive advantage in a high-volume, low-margin industry.

What is the significance of the smoke point for cooking oils?

The smoke point, the temperature at which an oil begins to burn and smoke, is a critical technical specification, especially for the food service industry. Oils with a high smoke point (like refined soybean or sunflower oil) are preferred for high-heat applications such as deep frying, ensuring food quality, minimizing degradation, and preventing the release of harmful compounds.

How is AI expected to enhance traceability in the market?

AI is expected to enhance traceability by analyzing vast datasets from sensors, satellite imagery, and logistical systems in real-time. This allows for instant verification of the origin and journey of oilseeds and crude oil, providing robust proof of sustainability claims and quickly isolating sources of contamination or fraud, thereby increasing consumer and regulatory confidence.

What distinguishes physical refining from chemical refining?

Chemical refining uses caustic soda (sodium hydroxide) to remove free fatty acids, creating soapy byproducts (soapstock) that require disposal. Physical refining, however, uses high-temperature steam distillation under vacuum, eliminating the chemical step. Physical refining is generally preferred due to its lower environmental impact, reduced chemical usage, and suitability for specific crude oils like palm and high-quality coconut oil.

Which type of oil dominates global industrial usage by volume?

Palm oil dominates global industrial usage by volume due to its high yield, low cost, exceptional oxidative stability, and specific solid fat content, making it highly versatile for a wide range of industrial applications including confectionery, bakery, and processed snacks, often serving as a primary component or base for specialized industrial fats.

What is the primary constraint limiting growth in premium oil segments?

The primary constraint limiting widespread growth in premium oil segments (such as organic or single-estate oils) is the significant price difference compared to commodity oils. While affluent consumer segments embrace these products, general market penetration is hindered by the high production costs, lower yields, and the price-sensitivity of the mass retail consumer base globally.

How is the packaging sector innovating for cooking oils?

Packaging innovation focuses on preserving oil freshness and extending shelf life by using materials that offer improved barriers against oxygen and light (UV radiation), which cause rancidity. Furthermore, there is a strong trend toward sustainable packaging, including lighter-weight plastic bottles (PET), glass, and eco-friendly bulk containers for the industrial sector to minimize environmental footprint.

What impact does climate change have on oilseed supply?

Climate change introduces significant volatility and unpredictability to oilseed supply through increased instances of severe weather, such as droughts or excessive rainfall, which directly impact crop yields of key sources like soybean, sunflower, and palm. This unpredictability necessitates greater investment in climate-resilient farming techniques and diversified sourcing strategies to maintain supply consistency.

Define the downstream analysis in the market value chain.

Downstream analysis covers all activities from packaged product preparation to the final sale. This includes branding, final packaging, warehousing, and the crucial logistics of transporting products through various distribution channels—supermarkets, specialty stores, and e-commerce platforms—focusing intensely on marketing strategies and retail shelf placement to influence consumer purchasing decisions.

Why are fortified oil blends gaining popularity?

Fortified oil blends are gaining popularity because they offer added health benefits, often incorporating essential nutrients like Vitamin D, Vitamin A, or Omega-3 fatty acids, which appeal directly to health-conscious consumers seeking functional foods. These blends often combine cost-effective base oils with smaller amounts of nutrient-rich, specialty ingredients to deliver a value proposition.

What makes the bakery and confectionery segment a key application area?

The bakery and confectionery segment is a key application area because it requires specialized solid fats (shortenings and margarines) with precise melting points and crystal structures. These fats are essential for achieving the desired crumb texture, flakiness, shelf stability, and mouthfeel in products like cookies, pastries, and chocolate, driving demand for technologically modified and high-stability industrial fats.

How do traditional grocery stores maintain relevance against modern retail?

Traditional grocery stores (like Kirana stores in India or wet markets) maintain relevance by offering convenience, catering to micro-local consumer preferences, and often selling products in small, affordable quantities. They remain critical channels in rural areas and dense urban segments where modern retail infrastructure is less developed or less accessible.

What are the key differences between butter and margarine in the market?

Butter is an animal fat derived from cream, prized for its flavor but high in saturated fat. Margarine, a vegetable fat emulsion, serves as a popular substitute, often chemically or interesterified to achieve butter-like texture. Market dynamics show consumers prefer butter for flavor purity while margarine is favored for its lower cost, plant-based status, and often better-for-you formulations (low saturated fat, trans-fat-free).

What is the average shelf life expectation for highly refined cooking oils?

Highly refined cooking oils, such as soybean or canola oil, generally have an expected shelf life of 18 to 24 months when packaged correctly and stored under cool, dark conditions. Refining processes, particularly deodorization and the addition of antioxidants, are crucial in minimizing oxidative rancidity and ensuring maximum shelf life for both industrial and retail applications.

How does the HORECA sector procure its supply?

The HORECA sector typically procures its oil supply through specialized food service distributors and wholesalers rather than general retail channels. This process is focused on bulk purchasing (large drums or containers), credit terms, rigorous supplier contracts guaranteeing volume and quality consistency, and demanding punctual, large-scale logistical delivery directly to kitchens.

What is a key risk associated with cold-pressed oils?

A key risk associated with cold-pressed oils (such as Extra Virgin Olive Oil or sesame oil) is their lower oxidative stability and shorter shelf life compared to heat-refined oils. Because the minimal processing retains natural impurities and highly sensitive bioactive compounds, these oils are more susceptible to rancidity upon exposure to light and air, requiring careful storage and packaging.

How do trade agreements influence the global oil market?

Trade agreements significantly influence the global oil market by establishing tariffs, quotas, and sanitary and phytosanitary (SPS) standards, which dictate the flow of raw materials and finished products between major producing and consuming nations. Favorable agreements can boost exports (e.g., US soybean oil to Asia), while trade disputes can severely disrupt established supply routes and inflate costs.

What is the consumer perception of palm oil in Western markets?

In Western markets (Europe, North America), consumer perception of palm oil is often negative, primarily due to associations with environmental concerns like deforestation and habitat destruction. Consequently, manufacturers must either source certified sustainable palm oil (CSPO) or substitute it with other fats to meet ethical consumer demand, despite palm oil's technical superiority and cost-efficiency.

What metric is used to measure oil quality regarding rancidity?

Oil quality regarding rancidity is primarily measured using the Peroxide Value (PV) and the Anisidine Value (AV). PV measures primary oxidation products, while AV measures secondary oxidation products. The Totox value (2*PV + AV) provides a comprehensive metric of the total oxidation state of the oil, critical for determining freshness and storage stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager