Copper Plating Chemicals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443467 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Copper Plating Chemicals Market Size

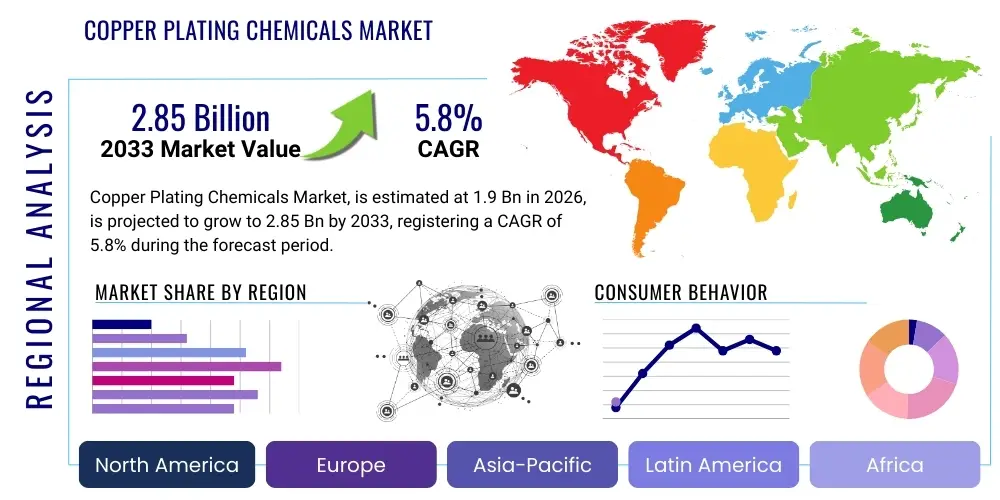

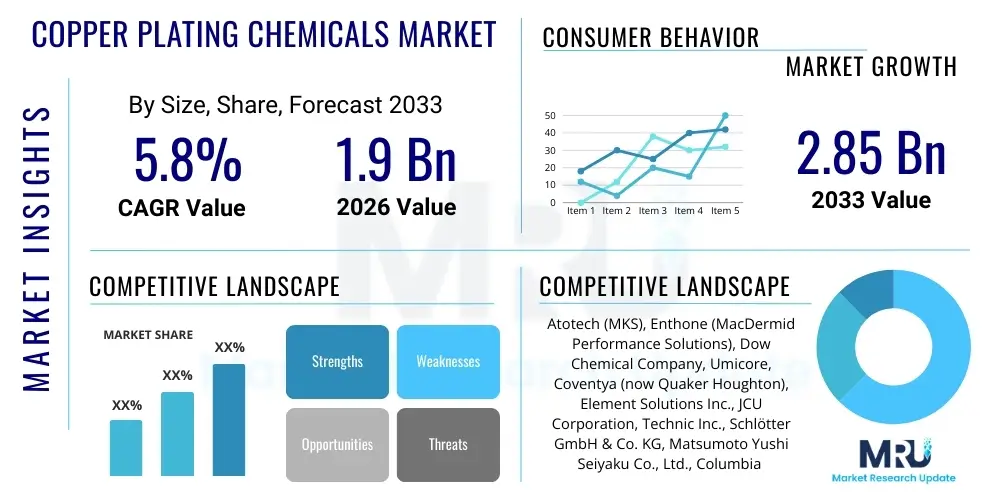

The Copper Plating Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

The steady expansion is primarily attributed to the burgeoning demand for high-performance electronic devices, particularly in the telecommunications and computing sectors, which rely heavily on copper plating for printed circuit board (PCB) manufacturing. Furthermore, the global shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) in the automotive industry is significantly boosting the consumption of copper plating chemicals, as these technologies require complex and reliable electrical interconnects, thermal management solutions, and decorative finishes. The market size reflects both the volume growth in end-user industries and the increasing sophistication of chemical formulations required for high-speed, high-tolerance plating processes.

Market valuation growth also incorporates the continuous research and development efforts aimed at minimizing the environmental impact of plating processes. Leading chemical suppliers are investing in developing robust, non-cyanide, and low-VOC (Volatile Organic Compound) solutions that meet stringent global regulatory standards, especially in North America and Europe. This transition towards sustainable chemistry, while often increasing the cost of specialized additives and brighteners, ensures the long-term viability and growth trajectory of the market by facilitating adoption across highly regulated manufacturing environments, thereby justifying the strong CAGR forecasted through 2033.

Copper Plating Chemicals Market introduction

The Copper Plating Chemicals Market encompasses a diverse range of proprietary chemical formulations and raw materials essential for electroplating copper onto various substrates, including plastics, metals, and composite materials. This critical surface finishing process, known as electrodeposition, imparts superior electrical conductivity, corrosion resistance, solderability, and decorative appeal to components. Key product categories include acid copper plating baths (sulfate and fluoborate), cyanide and non-cyanide alkaline copper systems, and essential functional additives such as brighteners, leveling agents, wetting agents, and grain refiners, which control the physical and aesthetic properties of the deposited copper layer.

Major applications of copper plating chemicals are dominated by the electronics industry, specifically in the production of Printed Circuit Boards (PCBs) and semiconductor packaging, where copper serves as the primary conductive pathway for reliable signal transmission. Beyond electronics, these chemicals are indispensable in the automotive sector for improving connectivity in wiring harnesses and providing functional corrosion protection for engine components. Other significant applications involve electroforming for mold creation, and general metal finishing where a robust, adherent copper layer is required before subsequent plating layers (such as nickel or chrome) are applied for decorative or enhanced functional purposes.

The market is driven fundamentally by global industrialization, the proliferation of complex electronic infrastructure (5G, IoT), and mandatory requirements for efficient thermal and electrical management across high-tech domains. The benefits of using high-quality copper plating chemicals include achieving superior uniformity in deposit thickness, enhanced throwing power within complex geometries (e.g., deep PCB vias), and ultimately, ensuring the longevity and performance of the finished product. Market growth is further bolstered by innovation in high-speed plating technology and the necessity for chemistries compatible with increasingly demanding manufacturing specifications for miniaturized electronic components.

Copper Plating Chemicals Market Executive Summary

The Copper Plating Chemicals Market is characterized by robust growth, primarily fueled by strong business trends in the high-tech electronics and mobility sectors. Business trends show a strategic pivot towards specialized functional chemistries that offer superior performance metrics, such as enhanced thermal stability and improved deposit ductility, which are crucial for advanced semiconductor packaging and multilayer PCB manufacturing. Consolidation among major players, particularly through strategic acquisitions, is shaping the competitive landscape, allowing companies to integrate vertically and offer comprehensive surface finishing solutions. Furthermore, the emphasis on sustainable chemistry, including the development of cyanide-free alkaline baths and improved waste treatment solutions, represents a significant investment area and market differentiator.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in consumption, driven by the massive concentration of electronics manufacturing hubs in China, South Korea, Taiwan, and Japan. While North America and Europe maintain strong market shares due to high-value-added processes like aerospace and precision automotive components, APAC’s sheer volume of PCB production and growing EV manufacturing base dictates global demand patterns. European growth is primarily mandated by strict environmental compliance (e.g., REACH regulations), pushing innovation towards greener formulations faster than other regions, while North American trends focus on reshoring high-security electronics manufacturing, requiring ultra-pure chemical inputs.

Segment trends underscore the dominance of Acid Copper Plating chemicals due to their excellent throwing power and suitability for high-speed electronics plating, particularly for through-hole plating in PCBs. However, the fastest-growing segment is expected to be the Non-Cyanide Alkaline Copper Plating chemicals, driven by regulatory pressures demanding alternatives to toxic cyanide-based systems, offering safer operating environments. Application-wise, Printed Circuit Boards remain the largest consumer, but the Automotive segment, particularly coatings for battery components and power electronics within EVs, is exhibiting the highest growth trajectory, demanding specialized plating chemistries that withstand extreme thermal cycling and provide high current density capabilities.

AI Impact Analysis on Copper Plating Chemicals Market

User queries regarding the impact of Artificial Intelligence (AI) on the Copper Plating Chemicals Market often revolve around operational efficiency, process control, and formulation optimization. Key user themes include the application of machine learning for predicting plating bath degradation, optimizing additive dosing in real-time to maintain consistent deposit quality, and utilizing neural networks for analyzing complex electrochemical data to accelerate R&D cycles for new chemical formulations. Users are concerned with how AI can mitigate labor dependency, reduce chemical waste by tightly controlling bath parameters, and ultimately ensure 100% process repeatability, especially in high-volume, precision manufacturing environments like advanced semiconductor plating. Expectations are centered on achieving "smart plating" systems that automatically adjust based on real-time feedback loops, moving away from scheduled, manual chemical analysis and adjustments.

- Real-time chemical bath analysis and maintenance optimization using Machine Learning (ML) algorithms.

- Predictive maintenance for plating equipment, reducing downtime and operational variability.

- Automated dosing systems driven by AI to precisely control brighteners and leveling agents, ensuring superior deposit quality.

- Enhanced quality control through AI-powered vision systems that detect microscopic plating defects instantly.

- Accelerated R&D of novel, high-performance copper plating additives through computational chemistry and AI simulation.

- Optimization of energy consumption during the electrodeposition process based on fluctuating grid costs and operational schedules.

- Improved supply chain management for raw chemical inputs using predictive analytics for demand forecasting.

DRO & Impact Forces Of Copper Plating Chemicals Market

The Copper Plating Chemicals Market is principally driven by the explosive demand for advanced electronics, particularly multilayer PCBs required for 5G infrastructure, IoT devices, and data centers, necessitating chemistries capable of high-aspect ratio plating. Simultaneously, the restraints revolve heavily around stringent environmental regulations, particularly concerning heavy metal waste disposal and the use of hazardous materials like cyanide, which mandate significant capital expenditure for waste treatment or necessitate the expensive transition to environmentally friendlier, albeit often complex, alternatives. Opportunities lie in the rapidly expanding Electric Vehicle (EV) market, which requires specialized copper coatings for battery connections, heat sinks, and power conversion components, alongside the ongoing push for developing sustainable and efficient non-cyanide formulations that satisfy regulatory mandates without sacrificing performance. These dynamics create significant impact forces, pushing manufacturers to invest heavily in R&D to meet both performance and ecological compliance needs simultaneously.

The primary driving force is the fundamental requirement for conductivity and corrosion resistance in modern technological infrastructure. Every increase in computing power or electronic complexity translates directly into a demand for more refined and reliable copper plating processes. Conversely, the inherent toxicity associated with traditional copper plating methods acts as a powerful dampener, increasing operational costs related to safety, compliance audits, and waste processing. This tension between performance needs and regulatory burden dictates the direction of technological innovation, forcing chemical suppliers to evolve their product portfolios continually. The development of advanced functional additives that enable higher plating speeds while maintaining micro-uniformity is a key commercial driver.

Opportunities for growth are strategically aligned with emerging mega-trends, especially the electrification of transportation and the development of sustainable manufacturing practices. The ability of chemical companies to partner effectively with major EV manufacturers or specialized PCB fabricators that service high-reliability industries (like aerospace and medical) creates significant avenues for specialized market penetration. The major impact forces thus include technological substitution risks if new deposition methods (e.g., vapor deposition) become cost-effective, intense price competition in commodity segments, and the continuous geopolitical shifts affecting global supply chains for key raw materials (e.g., copper salts, specialized polymers, and surfactants). Successful navigation requires balancing competitive pricing with high-level technical support and regulatory expertise.

Segmentation Analysis

The Copper Plating Chemicals Market is segmented based on the type of plating bath, the functional role of the chemicals (e.g., additives vs. raw salts), and the end-use application. Segmentation by type differentiates between acid, cyanide, and non-cyanide alkaline baths, reflecting the technological maturity, regulatory compliance levels, and specific deposit requirements of various end-user industries. The largest market share is held by acid copper plating due to its cost-effectiveness and superior mechanical properties for general electroplating and PCB production, though the demand for specialized functional additives within all segments is rising rapidly as manufacturers seek to enhance bath performance and deposit characteristics such as ductility and brightness.

Segmentation by end-use application clearly indicates the market’s reliance on the electronics sector, particularly PCBs, which demand high-purity chemicals to achieve micro-uniformity in deep trenches and vias. However, significant growth is forecast in the Automotive segment, fueled by the complex electroplating needs of EV components, including heat exchangers, power distribution units, and charging infrastructure connectors. The decorative and general metal finishing segments, while mature, remain stable consumers, requiring chemistries optimized for aesthetic appeal and long-term corrosion protection.

The granularity of segmentation is critical for market players to tailor product offerings. For instance, high-speed plating lines in semiconductor manufacturing require specific additive packages that differ significantly from those used in barrel plating for general hardware. Understanding these sub-segments allows suppliers to target high-margin, specialized applications where technical expertise and proprietary formulations offer a decisive competitive edge over commodity chemical suppliers. This strategic focus ensures that market growth is driven by value-added solutions rather than sheer volume.

- By Type:

- Acid Copper Plating (Sulfate, Fluoborate)

- Cyanide Copper Plating

- Non-Cyanide Alkaline Copper Plating (Pyrophosphate, Other Complexes)

- By Form:

- Chemical Salts (Copper Sulfate, Copper Cyanide, etc.)

- Functional Additives (Brighteners, Levelers, Wetting Agents, Carriers)

- Anodes and Ancillary Materials

- By Application:

- Printed Circuit Boards (PCBs) and Electronics

- Automotive Components (EV, ADAS, Interior/Exterior)

- General Metal Finishing (GMF)

- Decorative Plating

- Electroforming and Semiconductor Packaging

Value Chain Analysis For Copper Plating Chemicals Market

The value chain for the Copper Plating Chemicals Market begins with the upstream procurement of raw materials, primarily copper compounds (such as copper sulfate and copper oxide), acids (sulfuric acid), and complex organic chemicals required for specialized additives (e.g., thioureas, polyamines, and surfactants). Key upstream suppliers are often large commodity chemical manufacturers and base metal refiners. The profitability at this stage is highly sensitive to fluctuating global commodity prices and geopolitical stability, which affects the supply of refined copper and certain niche raw chemical intermediates. Quality control at the raw material stage is paramount, as impurities can significantly degrade the performance of the final plating bath solution, especially in high-purity electronics applications.

The mid-stream stage involves specialized chemical formulators, who purchase these raw materials and integrate them into proprietary, multi-component chemical systems (brighteners, levelers, carrier solutions). This stage is characterized by high intellectual property protection, rigorous R&D, and substantial investment in application testing labs to ensure consistency and performance across different plating parameters. Distribution channels typically involve a mix of direct sales teams for large, global manufacturing customers (like Tier 1 automotive suppliers or major PCB houses) and indirect distribution through specialized local distributors or agents who provide technical support and smaller-volume deliveries to general metal finishers. Direct channels are preferred for highly complex or custom chemical packages, ensuring closer technical collaboration.

The downstream analysis focuses on the end-users, encompassing diverse sectors such as electronics, automotive, and general manufacturing. The demand structure is highly dependent on the manufacturing output of these industries; for instance, a slowdown in smartphone production directly impacts the demand for specialized PCB plating additives. Success at the downstream level is dictated by the chemical supplier’s ability to provide superior technical service, fast troubleshooting, and localized inventory management. The final stage involves the management of chemical waste and spent bath solutions, which often requires collaboration with environmental services companies specializing in heavy metal remediation and recycling, closing the loop on the value chain and addressing circular economy objectives.

Copper Plating Chemicals Market Potential Customers

The primary customers for copper plating chemicals are entities engaged in high-precision surface finishing and electronic component manufacturing. The largest segment of buyers consists of Printed Circuit Board (PCB) fabricators, who use these chemicals extensively for through-hole plating, surface finishing (via electroless copper processes), and creating fine-line circuitry required for advanced multilayer boards. These customers demand highly stable, high-throwing power baths capable of uniform deposition in micro-vias, requiring specialized additive packages from suppliers.

A rapidly growing customer base is the automotive industry, particularly manufacturers and Tier 1 suppliers specializing in Electric Vehicle (EV) components, battery interconnects, power electronics (inverters/converters), and sensory systems for Advanced Driver-Assistance Systems (ADAS). These buyers require plating processes that provide exceptional thermal management, long-term durability, and robust corrosion resistance under harsh operating conditions, often favoring proprietary, high-reliability copper systems over standard commodity formulations. Furthermore, electroformers, who create molds, stamps, and high-precision parts using copper deposition, are also significant consumers.

Other substantial segments include general metal finishing (GMF) shops that offer plating services to diverse industries (e.g., plumbing fixtures, consumer goods, hardware) and specialized semiconductor packaging companies. GMF customers often prioritize cost-effectiveness and versatility, opting for standard acid copper or non-cyanide alkaline baths. Regardless of the end-market, the purchasing decision is heavily influenced by total cost of ownership, chemical sustainability profile, regulatory compliance status, and the technical support provided by the chemical supplier, making technical service a non-negotiable requirement for all potential buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atotech (MKS), Enthone (MacDermid Performance Solutions), Dow Chemical Company, Umicore, Coventya (now Quaker Houghton), Element Solutions Inc., JCU Corporation, Technic Inc., Schlötter GmbH & Co. KG, Matsumoto Yushi Seiyaku Co., Ltd., Columbia Chemical, Allied-Kelite (Pavco), Ronatec C2, Okuno Chemical Industries Co., Ltd., Chemetco, Raschig GmbH, Sirio Electrodes, Growel, Shanghai Huajing Chemical Group, TIB Chemicals AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Plating Chemicals Market Key Technology Landscape

The technology landscape within the Copper Plating Chemicals Market is characterized by continuous innovation aimed at optimizing the electrodeposition process for micro-scale features and enhanced functional performance. A crucial technological focus is on high-speed plating additives, particularly those designed to improve the "throwing power" of the bath, ensuring uniform copper deposition deep within high-aspect ratio vias in advanced PCBs and semiconductor wafers. This involves proprietary formulations of carrier compounds, brighteners (which refine the grain structure), and levelers (which minimize surface roughness), often utilizing advanced polymer and surfactant chemistry. The evolution of these additive packages is vital for the next generation of electronics requiring greater component density and reliability.

Another dominant technological trend is the development and commercialization of eco-friendly and non-cyanide plating systems. Driven by global health, safety, and environmental (HSE) regulations, particularly in developed regions, chemical manufacturers are investing heavily in replacing toxic cyanide-based alkaline copper baths with alternatives such as pyrophosphate, sulfamate, or specialized complexing agents. While early non-cyanide baths faced challenges regarding stability and operational efficiency, modern formulations offer comparable or superior deposit quality and brightness, significantly expanding their application scope, particularly in decorative and certain functional plating areas.

Furthermore, the integration of real-time monitoring and control technologies constitutes a major technological advancement. This includes sophisticated analytical techniques like Cyclic Voltammetry Stripping (CVS) coupled with automation systems, allowing operators to measure the concentration of organic additives in the bath precisely and implement automated dosing. These smart bath management systems minimize chemical usage, reduce waste, and ensure maximum process stability and repeatability, which are crucial for high-volume automotive and electronics production lines. The synergy between advanced chemical formulations and sophisticated process control hardware defines the cutting edge of the market technology.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily due to its central role as the global manufacturing hub for electronics, semiconductors, and automotive components. Countries like China, Taiwan (leading PCB manufacturing), South Korea, and Japan host massive fabrication facilities that drive colossal demand for both commodity copper salts and high-end functional additives. The rapid expansion of electric vehicle (EV) production lines in China and South Korea is significantly increasing the consumption of high-reliability copper plating solutions for battery components and power electronics.

- North America: The North American market is characterized by high demand for specialized, high-reliability plating chemicals utilized in aerospace, defense, medical devices, and advanced semiconductor manufacturing. Although the overall volume is lower than APAC, the focus is on high-margin, technically demanding applications. The region faces stringent environmental regulations, prompting early adoption of sustainable and non-cyanide technologies. Market activity is also bolstered by governmental initiatives aimed at reshoring critical manufacturing supply chains, particularly in microelectronics.

- Europe: Europe represents a mature market with growth heavily constrained and shaped by the EU’s strict regulatory framework, notably the REACH regulation, which forces accelerated phase-out of hazardous chemicals. This pressure has made Europe a leader in the innovation of eco-friendly plating solutions. Key demand drivers include the premium automotive sector (especially high-end decorative finishes and EV components) and industrial machinery. Germany, being a major industrial power, is a dominant consumer of functional copper plating chemicals.

- Latin America, Middle East, and Africa (LAMEA): This region is an emerging market characterized by localized growth tied to infrastructure development, burgeoning domestic electronics assembly, and general metal finishing for construction and consumer goods. While current consumption is modest compared to the Triad regions, rapid industrialization, particularly in Mexico (automotive) and select Middle Eastern countries (infrastructure), presents long-term potential for standardized and cost-effective copper plating chemical systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Plating Chemicals Market.- Atotech (MKS Instruments)

- Enthone (MacDermid Performance Solutions)

- Dow Chemical Company

- Umicore

- Coventya (Quaker Houghton)

- Element Solutions Inc.

- JCU Corporation

- Technic Inc.

- Schlötter GmbH & Co. KG

- Matsumoto Yushi Seiyaku Co., Ltd.

- Columbia Chemical

- Allied-Kelite (Pavco)

- Ronatec C2

- Okuno Chemical Industries Co., Ltd.

- Chemetco

- Raschig GmbH

- Sirio Electrodes

- Growel

- Shanghai Huajing Chemical Group

- TIB Chemicals AG

Frequently Asked Questions

Analyze common user questions about the Copper Plating Chemicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for copper plating chemicals in the current market?

The primary drivers are the massive global growth in the electronics industry, specifically in advanced Printed Circuit Boards (PCBs) for 5G, IoT, and data centers, and the exponential expansion of the Electric Vehicle (EV) sector, which requires specialized copper coatings for reliable battery and power electronics components.

How do environmental regulations impact the formulation and sale of copper plating chemicals?

Environmental regulations, particularly regarding cyanide use and heavy metal effluent, mandate that manufacturers invest heavily in developing sustainable, non-cyanide, and low-VOC alternatives. These regulations increase operational costs and accelerate the shift toward complex, high-performance eco-friendly chemical systems.

Which application segment holds the largest share in the Copper Plating Chemicals Market?

The Printed Circuit Boards (PCBs) and Electronics segment holds the largest market share globally. Copper plating is fundamental for creating conductive pathways and through-hole connections essential for all modern electronic devices, ranging from consumer electronics to complex defense systems.

What is the technological difference between acid copper plating and non-cyanide alkaline copper plating?

Acid copper plating (typically sulfate-based) offers excellent deposit properties, high throwing power, and is cost-effective for general and PCB plating, but it cannot plate directly onto steel or zinc. Non-cyanide alkaline copper plating is safer than traditional cyanide systems and is often used as a strike layer due to its superior adherence to passive metals, though it generally requires more complex additive management.

Which region offers the highest growth potential for copper plating chemical suppliers?

Asia Pacific (APAC) offers the highest growth potential, driven by the concentration of global electronics and automotive manufacturing. The region's sustained investment in new fabrication facilities and its massive scale of output ensure continuous, high-volume demand across all segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager