Copper Tungsten Alloys Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442638 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Copper Tungsten Alloys Market Size

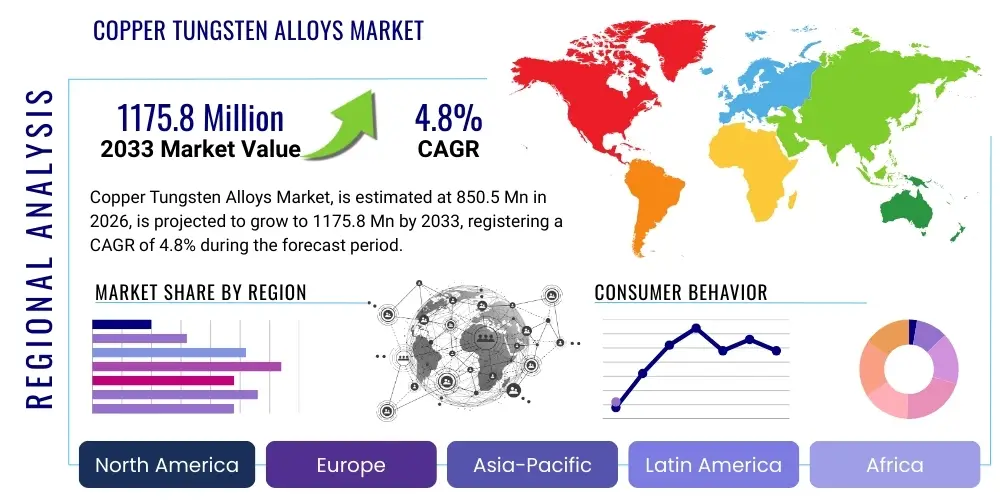

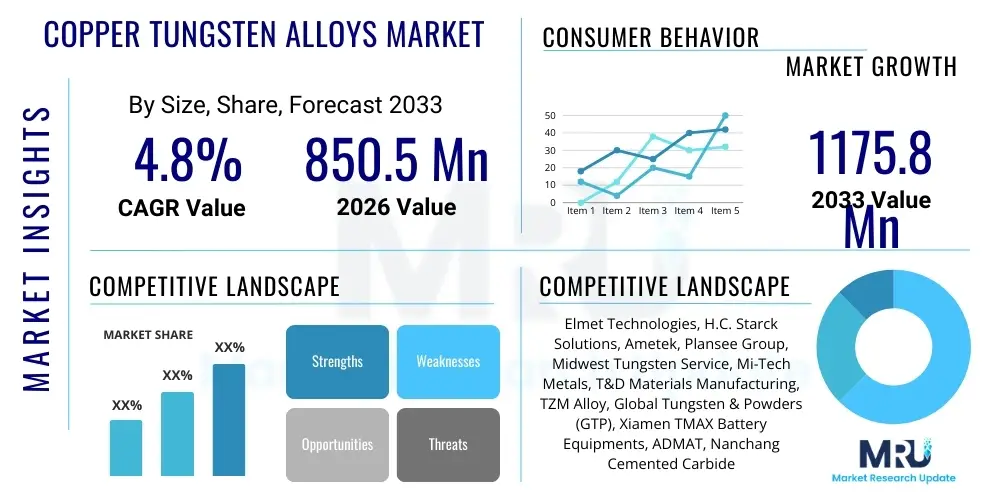

The Copper Tungsten Alloys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1175.8 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the increasing integration of these alloys in high-performance applications across critical industries, particularly in electronics, aerospace, and resistance welding, where their unique combination of high thermal and electrical conductivity, coupled with excellent arc resistance and high wear resistance, is indispensable for operational reliability and efficiency.

Market expansion is further supported by technological advancements in powder metallurgy (P/M) and infiltration techniques, which enable the production of complex shapes and tailored material properties necessary for specialized functions. The growing global focus on miniaturization in electronic components and the necessity for robust thermal management solutions contribute significantly to the demand for Copper Tungsten (CuW) materials, particularly for use as heat sinks and substrates in high-power devices. Furthermore, the stringent requirements of the aerospace and defense sectors for materials capable of withstanding extreme thermal stress and mechanical wear solidify the market’s positive growth trajectory throughout the forecast period.

Copper Tungsten Alloys Market introduction

Copper Tungsten alloys are pseudocomposite materials that combine the high thermal and electrical conductivity of copper with the outstanding arc and wear resistance, low thermal expansion, and high temperature strength of tungsten. These alloys are manufactured primarily through powder metallurgy techniques, involving pressing, sintering, and often infiltrating porous tungsten structures with molten copper. This manufacturing process allows for precise control over the composition, leading to grades such as W-Cu 10, W-Cu 20, or W-Cu 30, where the numbers denote the copper content by weight. The resulting material exhibits properties unattainable in single metals or traditional alloys, making them crucial for demanding electrical and thermal management applications.

Major applications of Copper Tungsten alloys span diverse high-tech industries. In electrical discharge machining (EDM) and electrochemical machining (ECM), CuW is utilized for electrodes due to its resistance to erosion and high melting point. The material's robust nature in arc environments makes it ideal for electrical contacts in high and medium voltage switchgear, circuit breakers, and vacuum interrupters. Crucially, the semiconductor and microelectronics industries heavily rely on CuW for heat sinks, chip carriers, and thermal spreaders, where rapid and efficient dissipation of heat is essential for device longevity and performance, driven by the alloys’ excellent thermal conductivity matching the thermal expansion characteristics of various substrate materials.

The primary driving factors for the Copper Tungsten Alloys Market include the accelerated growth of the global semiconductor industry, particularly in Asia Pacific, the increasing adoption of electric vehicles (EVs) necessitating high-performance switching and thermal management components, and persistent investment in infrastructure projects requiring reliable electrical switchgear. The unparalleled combination of high density, high hardness, excellent thermal fatigue resistance, and superior electrical properties ensures that Copper Tungsten remains the material of choice for applications facing extreme operating conditions, thereby maintaining robust market demand and pushing manufacturers towards continuous innovation in alloy composition and processing efficiency.

Copper Tungsten Alloys Market Executive Summary

The Copper Tungsten Alloys Market is characterized by intense specialization, driven primarily by the high-growth trajectory of the electronics and power transmission sectors. Business trends indicate a strong move towards optimizing alloy composition for specific end-use requirements, focusing on enhancing thermal fatigue resistance and maintaining dimensional stability under cyclical loading. Key market players are investing significantly in advanced powder production techniques and additive manufacturing processes to improve material purity, density, and reduce manufacturing costs, responding to the ongoing pressure from high raw material prices, specifically tungsten. Strategic partnerships between alloy manufacturers and semiconductor device producers are becoming more prevalent to streamline supply chains and co-develop tailored thermal management solutions, reflecting a vertical integration trend essential for navigating the complex high-tech demand landscape.

Regionally, Asia Pacific commands the largest market share, predominantly fueled by the unparalleled expansion of its manufacturing bases for consumer electronics, automotive components, and extensive semiconductor fabrication facilities, particularly in China, South Korea, and Taiwan. North America and Europe maintain significant market presence, specializing in high-value, niche applications such as aerospace, defense, and specialized resistance welding components, where stringent performance specifications necessitate premium CuW materials. The regional trend is marked by a shift in manufacturing focus, with developed economies concentrating on R&D and high-purity production, while emerging economies scale up volume manufacturing to meet global electronic assembly needs, thereby balancing innovation and cost-effectiveness across the global supply chain.

Segmentation trends highlight the dominance of the Electrical Discharge Machining (EDM) electrode segment and the Heat Sink/Thermal Spreader segment. The EDM segment benefits from continued industrial metalworking demands requiring precision cutting and shaping of hardened materials, where CuW electrodes offer superior wear rate and material removal capabilities. Concurrently, the Heat Sink segment is witnessing exponential growth driven by the proliferation of high-power density modules, 5G infrastructure deployment, and data centers. Regarding product type, alloys containing 20% to 30% copper are widely preferred due to their optimal balance between electrical conductivity and mechanical hardness, catering effectively to the majority of high-performance electrical contact and thermal management applications.

AI Impact Analysis on Copper Tungsten Alloys Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Copper Tungsten Alloys Market primarily center on two key themes: the application of AI in materials discovery and optimization, and the demand implications arising from AI-driven infrastructure growth. Users are keen to understand how AI and Machine Learning (ML) can accelerate the identification of optimal CuW compositions, predict material performance under extreme conditions (such as thermal cycling in power electronics), and refine complex powder metallurgy processes to reduce defects and improve yield. The second major area of concern is the indirect impact: the massive computational needs of AI infrastructure, including data centers and advanced graphics processing units (GPUs) and specialized AI accelerators, which mandate high-efficiency thermal management solutions, directly boosting the demand for high-performance Copper Tungsten heat sinks and thermal spreaders.

- AI-Enhanced Materials Optimization: Utilization of ML algorithms to simulate and predict the optimal Copper-Tungsten ratio, grain size, and pore structure required for specific applications (e.g., maximizing thermal conductivity while maintaining required hardness).

- Process Control Automation: Deployment of AI-powered sensors and feedback loops in sintering and infiltration processes to ensure precise temperature control, minimizing contamination and achieving ultra-high density in finished components.

- Predictive Maintenance for EDM: AI models analyzing electrode wear rates in Electrical Discharge Machining applications, optimizing usage, and predicting replacement needs, enhancing operational efficiency for end-users.

- Increased Demand from Data Centers: The proliferation of AI and High-Performance Computing (HPC) necessitates sophisticated cooling solutions, directly fueling the market for high-grade CuW thermal management components used in server racks and chip packaging.

- Supply Chain Forecasting: AI-driven analytics improving the forecasting of raw material prices (tungsten) and optimizing inventory management, mitigating risks associated with volatile commodity markets.

DRO & Impact Forces Of Copper Tungsten Alloys Market

The dynamics of the Copper Tungsten Alloys Market are shaped by a complex interplay of positive demand drivers, inherent structural restraints, and emerging technological opportunities. The market is fundamentally driven by the inescapable need for materials that can operate reliably in high-temperature, high-current density environments, particularly within specialized equipment like vacuum interrupters, high-voltage switchgear, and high-power electronic devices. However, this growth is significantly tempered by the high and often volatile costs associated with tungsten raw materials, alongside the energy-intensive and technologically demanding nature of the manufacturing processes required to achieve the desired high density and low porosity, which act as primary market restraints impacting global pricing strategies and profitability margins.

A critical opportunity lies in the rapid adoption of Silicon Carbide (SiC) and Gallium Nitride (GaN) power modules, especially within the electric vehicle and renewable energy sectors. These next-generation semiconductors generate significantly more heat and operate at higher frequencies, demanding superior thermal management solutions that only Copper Tungsten alloys, with their tailored thermal expansion coefficients (CTE) matching those of the ceramic substrates, can effectively provide. Furthermore, the development of specialized grades for use in fusion energy research and high-energy physics experiments represents a niche but highly lucrative future market segment, requiring alloys with exceptional resistance to plasma erosion and neutron irradiation, pushing the boundaries of material science and application scope.

The impact forces within this market are substantial, dictating competitive dynamics and technological evolution. The escalating demand for reliable power distribution infrastructure globally, particularly in developing economies, strongly reinforces the driver segment. Conversely, the environmental scrutiny regarding mining practices and processing associated with tungsten contributes to the restraint factor, urging manufacturers to explore sustainable sourcing and recycling methodologies. The most significant impact force stems from substitution risk; while few materials possess the combined properties of CuW, innovations in composite materials, such as diamond-based composites or specialized molybdenum alloys, pose a long-term threat, requiring continuous performance enhancement and cost reduction in CuW production to maintain market dominance.

Segmentation Analysis

The Copper Tungsten Alloys Market is systematically segmented based on composition, end-use application, and manufacturing process, enabling a granular understanding of demand patterns and regional consumption characteristics. Compositional segmentation, based on the percentage of copper by weight (e.g., 10W-90Cu, 20W-80Cu, 30W-70Cu), is critical as it dictates the material’s performance profile, balancing electrical conductivity (higher copper content) against hardness and arc erosion resistance (higher tungsten content). Application segmentation provides insight into the primary market drivers, distinguishing between high-volume uses like resistance welding tips and high-value, performance-critical uses such as aerospace nozzles and sophisticated microelectronic heat sinks. The market structure reflects the highly technical nature of the product, where customization is often necessary to meet stringent operational parameters.

The primary revenue generator historically has been the Electrical Contacts and Switchgear segment, leveraging the alloy's superb arc quenching and anti-welding properties necessary for reliable high-current switching. However, the fastest-growing segment is projected to be Thermal Management, fueled by the explosive growth of high-density packaging in servers, high-power LEDs, and advanced radar systems. Geographically, manufacturing expertise and demand concentration are heavily weighted towards the Asia Pacific region due to its leading role in global electronics manufacturing. Successful market navigation requires manufacturers to possess specialized equipment, deep expertise in powder metallurgy, and stringent quality control protocols, particularly for applications requiring military or aerospace certification.

- By Composition (Copper Content by Weight):

- W-Cu 10 (10% Copper)

- W-Cu 20 (20% Copper)

- W-Cu 30 (30% Copper)

- W-Cu 40 and Above

- By Application:

- Electrical Discharge Machining (EDM) Electrodes

- Resistance Welding Electrodes and Inserts

- Heat Sinks, Thermal Spreaders, and Chip Carriers

- Electrical Contacts and Vacuum Interrupters

- High-Density Components (e.g., Radiation Shielding)

- Aerospace and Defense Components (e.g., Rocket Nozzles)

- By Manufacturing Process:

- Pressing and Sintering (P/S)

- Sintering and Infiltration (S/I)

- Hot Pressing

- Additive Manufacturing/3D Printing (Emerging)

Value Chain Analysis For Copper Tungsten Alloys Market

The value chain for the Copper Tungsten Alloys Market is characterized by highly specialized stages, beginning with the extraction and refining of primary raw materials: copper and tungsten. The upstream segment is dominated by mining companies and global commodity traders responsible for supplying high-purity tungsten powder (often derived from ammonium paratungstate - APT) and electrolytic copper powder. Tungsten sourcing is particularly complex due to its geographical concentration and market volatility, making strategic inventory management and long-term procurement contracts critical for alloy manufacturers. The midstream stage involves specialized alloy producers who utilize sophisticated powder metallurgy techniques, including precise blending, cold/hot pressing, and high-temperature sintering followed by copper infiltration in controlled atmospheres, to produce billets, plates, or near-net-shape components. This stage requires significant capital investment in specialized furnaces and quality assurance systems.

The distribution channel is generally bifurcated into direct sales for large, customized industrial clients (such as major aerospace contractors or leading semiconductor foundries) and indirect channels utilizing technical distributors or specialized material suppliers for smaller, standardized components or maintenance, repair, and operations (MRO) stock. Direct channels ensure technical alignment and specification adherence, crucial for high-reliability applications, while indirect channels provide broader market reach and quicker turnaround for general EDM and resistance welding consumables. Specialized distributors often provide value-added services such as component machining, surface treatment, and precise cutting to end-user specifications, enhancing the overall utility of the product.

The downstream analysis reveals that the primary consumers are sophisticated manufacturing operations across diverse high-tech sectors. These include power electronics packaging companies, electrical equipment OEMs (Original Equipment Manufacturers) fabricating circuit breakers and switchgear, precision engineering shops using EDM technology, and defense/aerospace contractors building high-reliability systems. The demand pull is characterized by high performance specifications, requiring manufacturers to maintain extremely tight tolerances on density, conductivity, and thermal expansion coefficient. The criticality of the material to the performance of the end product means that price sensitivity often takes a backseat to proven reliability and certified quality, placing significant emphasis on the reputation and track record of the alloy supplier.

Copper Tungsten Alloys Market Potential Customers

The potential customer base for Copper Tungsten alloys is highly concentrated within industries demanding exceptional performance characteristics under extreme electrical, thermal, or mechanical stress. Primary end-users include manufacturers of medium and high-voltage electrical distribution equipment, where CuW is indispensable for vacuum interrupters, contacts, and arc-runners due to its ability to quench electrical arcs efficiently and resist welding or material transfer under high current loads. Another crucial customer segment encompasses the global semiconductor and microelectronics packaging industry, which uses these alloys as heat sinks and thermal planes for high-power devices like insulated-gate bipolar transistors (IGBTs), RF power transistors, and laser diodes, leveraging the material's tailor-made thermal expansion characteristics to prevent device failure.

Beyond the electrical and electronic sectors, a significant customer base exists within the precision metalworking and tooling industry, primarily consuming Copper Tungsten as electrodes for Electrical Discharge Machining (EDM). Companies specializing in mold making, die casting, and complex component fabrication rely on CuW electrodes for their superior longevity and dimensional stability during the demanding erosion process, especially when working with hardened tool steels and exotic alloys. Furthermore, the aerospace and defense sectors represent high-value, if lower volume, customers. They utilize the material in extreme environments, such as blast tube components for missile systems and protective facings in military hardware, valuing its high melting point and density. The burgeoning electric vehicle (EV) market and associated charging infrastructure developers are also rapidly becoming key customers, requiring reliable, high-current switching components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1175.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elmet Technologies, H.C. Starck Solutions, Ametek, Plansee Group, Midwest Tungsten Service, Mi-Tech Metals, T&D Materials Manufacturing, TZM Alloy, Global Tungsten & Powders (GTP), Xiamen TMAX Battery Equipments, ADMAT, Nanchang Cemented Carbide, Shanghai Changrui, Refractory Metal Technology, Dalian Jinzhong, Advanced Technology & Materials Co., Ltd., Sumitomo Electric, Metalwerks, HOSKIN SCIENTIFIC, Sandvik. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Tungsten Alloys Market Key Technology Landscape

The production of Copper Tungsten alloys relies heavily on advanced powder metallurgy (P/M) techniques, which are crucial for achieving the non-alloyed, composite structure necessary for high performance. The core technological process is Sintering and Copper Infiltration. This method involves pressing high-purity tungsten powder into a porous skeleton, followed by sintering at temperatures above 1800°C to achieve mechanical strength and high density. Subsequently, the porous tungsten structure is infiltrated with molten copper in a vacuum or inert atmosphere. This infiltration technique ensures high structural integrity and the absence of voids, resulting in the material’s characteristic high thermal and electrical conductivity, essential for high-reliability applications.

Beyond the standard infiltration process, significant technological advancements are focusing on microstructure engineering and purity control. Techniques such as Spark Plasma Sintering (SPS) and Hot Isostatic Pressing (HIP) are increasingly being adopted, particularly for high-end applications like aerospace and defense components, to achieve near-theoretical density and ultra-fine grain structures. These advanced methods minimize porosity and improve mechanical properties, ensuring superior thermal fatigue resistance and hardness compared to traditionally produced alloys. Furthermore, the development of customized tungsten powders, including nanostructured or modified grain boundary powders, is key to tailoring the alloy's Coefficient of Thermal Expansion (CTE) precisely to match ceramics used in semiconductor packaging, thereby mitigating thermal stress and enhancing device lifespan.

An emerging technology gaining traction is the use of Additive Manufacturing (AM) or 3D printing techniques for Copper Tungsten alloys. While challenging due to the extreme differences in melting points between copper and tungsten, specialized methods like Binder Jetting followed by infiltration, or Laser Powder Bed Fusion (LPBF) using highly tailored composite powders, are being researched to create complex, near-net-shape geometries that are impossible to achieve through conventional pressing and sintering. AM promises to revolutionize prototyping and small-batch production, reducing material waste and enabling the fabrication of integrated heat dissipation structures, although achieving the required high density and microstructure remains a technical hurdle for mass production applications.

Regional Highlights

- Asia Pacific (APAC): Dominance in Manufacturing and Consumption

The APAC region holds the dominant share of the Copper Tungsten Alloys Market, driven primarily by its immense manufacturing capacity in the semiconductor, consumer electronics, and automotive industries. Countries like China, South Korea, Taiwan, and Japan are global hubs for semiconductor fabrication and assembly, creating substantial demand for CuW heat sinks, chip carriers, and advanced EDM electrodes. The rapid proliferation of 5G networks, coupled with significant governmental investment in advanced manufacturing and EV infrastructure, ensures that APAC will remain the fastest-growing market throughout the forecast period. The region benefits from both high-volume production requirements and the increasing demand for high-performance thermal management solutions necessary for next-generation electronic devices.

China is central to this growth, not only as a massive consumer but also as a major producer of Copper Tungsten products, serving both domestic and international markets. The shift in manufacturing complexity towards high-end power modules and dense integrated circuits necessitates superior alloy quality, driving local manufacturers to adopt advanced P/M techniques. Furthermore, the massive investments in electrical grid modernization and railway electrification projects across Southeast Asia contribute substantially to the demand for CuW electrical contacts and switchgear components, solidifying the region's indispensable role in the global supply chain.

- North America: Focus on Aerospace, Defense, and High-Reliability Niche

North America constitutes a mature but high-value market, characterized by stringent quality standards and a strong focus on specialized, high-reliability applications. The aerospace and defense sectors are major consumers, utilizing CuW for blast nozzles, balancing weights, and radiation shielding, where failure is not an option and the material's high density and thermal shock resistance are critical requirements. The market here is driven less by volume and more by highly complex specifications and long-term contracts for mission-critical systems.

The region is also a key innovation hub for high-power semiconductor technology and specialized electrical equipment. Growth is tied to ongoing modernization efforts within the U.S. power grid and increasing adoption of cutting-edge thermal management solutions in advanced computing and data centers. Key market players in North America often focus on producing high-purity, customized CuW alloys and leveraging advanced manufacturing processes like Hot Isostatic Pressing to service niche markets requiring exceptional material integrity and traceable quality certifications.

- Europe: Industrial and Green Energy Transition Demand

Europe represents a stable market with significant demand emanating from its robust automotive sector, particularly in precision tooling (EDM) and the rapid transition towards electric mobility. European automotive OEMs and Tier 1 suppliers are major consumers of CuW alloys for resistance welding electrodes, essential for joining high-strength steels and aluminum alloys used in lightweight vehicle structures. Furthermore, the region’s strong focus on renewable energy and efficient power transmission drives the need for reliable CuW electrical contacts in specialized circuit breakers and switchgear designed for high-voltage DC applications (HVDC), crucial for integrating intermittent renewable sources into the grid.

Germany, France, and the UK lead the European market, characterized by sophisticated industrial manufacturing bases and strong environmental regulations encouraging the adoption of efficient electrical components. The emphasis on high-precision engineering means European companies often source specialized, smaller-volume batches with demanding material specifications. Research institutions and companies involved in fusion energy experiments, such as ITER, also contribute to the demand for highly specialized CuW components capable of handling extreme plasma environments and heat fluxes.

- Latin America, Middle East, and Africa (LAMEA): Infrastructure Development and Resource Extraction

The LAMEA region currently holds a smaller share but exhibits potential driven by infrastructure expansion and resource extraction activities. Demand in Latin America is primarily tied to mining equipment maintenance (requiring hard-wearing EDM electrodes) and ongoing investments in electrical power distribution networks. In the Middle East, large-scale construction and energy projects, alongside emerging investments in advanced data center infrastructure, fuel the consumption of both electrical contacts and thermal management solutions.

Growth in Africa is nascent but is accelerating with increased industrialization and the need for reliable power infrastructure. Overall demand across LAMEA is closely linked to government spending on modernization and the lifecycle requirements of heavy industry equipment, creating a steady, growing market for replacement parts and new installations of switchgear and power components. The complexity of the alloys often leads to reliance on imports from established manufacturers in APAC, Europe, and North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Tungsten Alloys Market.- Elmet Technologies

- H.C. Starck Solutions

- Ametek (Reading Alloys)

- Plansee Group

- Midwest Tungsten Service

- Mi-Tech Metals

- T&D Materials Manufacturing

- TZM Alloy

- Global Tungsten & Powders (GTP)

- Xiamen TMAX Battery Equipments

- ADMAT Inc.

- Nanchang Cemented Carbide Co., Ltd.

- Shanghai Changrui Metal Material Co., Ltd.

- Refractory Metal Technology

- Dalian Jinzhong Special Metal Materials Co., Ltd.

- Advanced Technology & Materials Co., Ltd. (AT&M)

- Sumitomo Electric Industries, Ltd.

- Metalwerks, Inc.

- HOSKIN SCIENTIFIC

- Sandvik AB (Kanthal)

Frequently Asked Questions

Analyze common user questions about the Copper Tungsten Alloys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Copper Tungsten alloys over conventional materials?

Copper Tungsten (CuW) alloys offer a unique combination of high thermal and electrical conductivity (from copper) coupled with exceptional hardness, resistance to arc erosion, and low thermal expansion (from tungsten). This makes them superior for applications involving high current density and extreme thermal cycling, unlike single metals or traditional alloys which typically sacrifice one property for another.

In which applications is the thermal management property of Copper Tungsten most critical?

The thermal management property is most critical in high-power electronic devices, particularly in the semiconductor industry. CuW is used for heat sinks, chip carriers, and thermal spreaders in IGBT modules, GaAs/GaN power amplifiers, and laser diodes, where its low and adjustable Coefficient of Thermal Expansion (CTE) precisely matches ceramic substrates, minimizing mechanical stress and ensuring device longevity.

How does the composition (W/Cu ratio) affect the performance characteristics of the alloy?

The composition directly dictates the balance of properties. Higher copper content (e.g., 30% Cu) maximizes electrical and thermal conductivity but reduces hardness and wear resistance. Conversely, higher tungsten content (e.g., 90% W) significantly increases hardness, density, and arc erosion resistance, making it ideal for EDM electrodes and heavy-duty electrical contacts, albeit with lower conductivity.

What manufacturing processes are predominantly used to produce Copper Tungsten alloys?

The primary method is Powder Metallurgy, specifically the Sintering and Copper Infiltration technique. High-purity tungsten powder is sintered into a porous skeleton, which is then infiltrated with molten copper. This ensures a dense, near-net-shape component with the desired non-alloyed composite structure, crucial for achieving the required thermal and electrical performance.

What is the impact of rising tungsten prices on the Copper Tungsten Alloys Market?

Rising tungsten prices, often due to supply chain concentration and volatility, act as a significant restraint on the CuW market. High raw material costs increase the final product price, potentially encouraging end-users in less performance-critical applications to seek lower-cost substitutes, thereby placing continuous pressure on manufacturers to improve processing efficiency and explore material recycling strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager