Copper Wire Crushing And Recycling Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442998 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Copper Wire Crushing And Recycling Machine Market Size

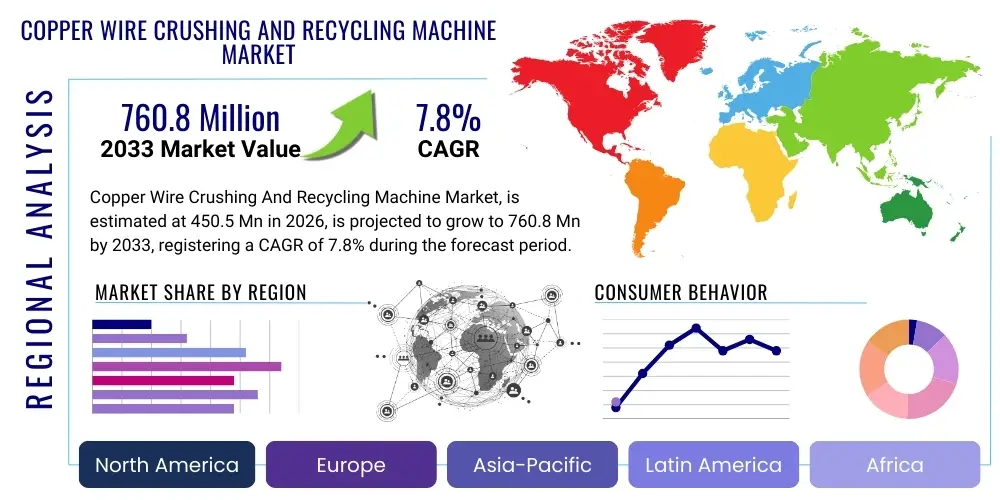

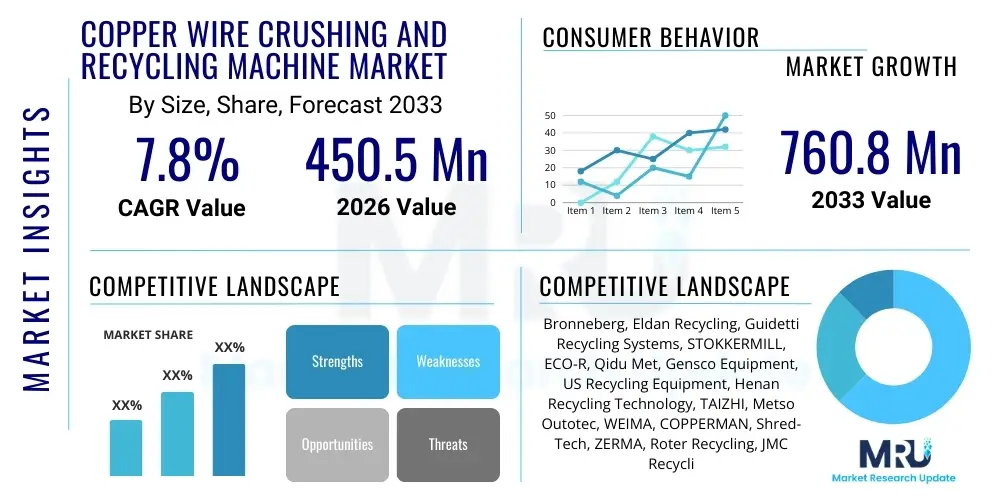

The Copper Wire Crushing And Recycling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.8 Million by the end of the forecast period in 2033.

Copper Wire Crushing And Recycling Machine Market introduction

The Copper Wire Crushing and Recycling Machine Market encompasses equipment specifically designed to process end-of-life or scrap copper cables and wires into marketable granular copper material and separated insulation components (plastics, rubber). These machines utilize sophisticated physical separation techniques, including crushing, shredding, granulation, and subsequent air or vibration separation, to maximize the recovery rate and purity of the valuable copper content. The primary objective is to transform heterogeneous scrap materials into homogeneous, high-purity secondary raw materials, thereby feeding the industrial demand for recycled copper, which is essential for sustainability objectives and reducing reliance on primary mining operations. Key products within this market include specialized wire granulators, separation tables, pre-shredders, and complete integrated recycling lines capable of handling diverse cable types, ranging from thin household wiring to heavy industrial armored cables.

The core applications of recycled copper recovered through these machines span critical industrial sectors, notably electrical manufacturing, construction, automotive production, and electronics. High-ppurity copper granules are highly sought after by smelters and manufacturers for producing new wires, pipes, and electrical components. The increasing global regulatory emphasis on circular economy principles, combined with fluctuating virgin copper prices, significantly enhances the economic viability of investment in advanced crushing and recycling machinery. Furthermore, the efficiency and automation capabilities of modern recycling equipment allow processors to handle large volumes of scrap material with minimized labor input and operational costs, accelerating the transition from traditional, less efficient incineration or manual stripping methods.

Major driving factors fueling market expansion include stringent environmental regulations banning landfill disposal of electronic waste and scrap metal, the inherent economic advantages of sourcing recycled copper (which requires significantly less energy input than primary production), and the accelerating infrastructure development in emerging economies, which generates substantial volumes of obsolete wiring. The market is characterized by ongoing technological advancements focused on improving separation efficiency for complex composite cables and minimizing dust and noise pollution during operation, aligning with global occupational safety and environmental standards. The consistent demand for high-quality secondary copper necessitates continuous innovation in granulation and separation technology.

Copper Wire Crushing And Recycling Machine Market Executive Summary

The Copper Wire Crushing and Recycling Machine Market is exhibiting robust growth, propelled primarily by global sustainability mandates and the volatile cost environment of primary copper sourcing. Current business trends indicate a strong pivot towards fully automated, modular recycling systems capable of processing mixed scrap streams with high throughput and purity. Investment is heavily concentrated in sophisticated air and vibration separation technology integrated with advanced dust collection systems to meet increasingly rigorous environmental compliance requirements globally. Key market participants are focused on developing versatile machines that can handle high-density armored cables and extremely fine communications wires efficiently, optimizing yield recovery rates for processing facilities ranging from small scrap yards to large-scale industrial recyclers. The demand for systems featuring integrated Artificial Intelligence (AI) for material recognition and sorting is emerging as a significant market differentiator.

Regionally, the Asia Pacific (APAC) area dominates the market both in terms of consumption and manufacturing, driven by massive infrastructure projects, rapid urbanization, and a large volume of end-of-life electronics and automotive components. China, India, and Southeast Asian nations are undergoing significant development of their domestic scrap processing infrastructure, fostering high demand for high-capacity recycling machinery. North America and Europe, characterized by mature regulatory frameworks, are focusing on high-efficiency, environmentally compliant machines and retrofitting existing facilities with advanced separation units to boost operational performance and meet stricter purity standards for recycled materials. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by localized economic development and government initiatives aimed at reducing raw material import dependency through effective resource management.

Segmentation trends highlight the increasing preference for high-capacity granulator machines (over 1000 kg/h processing capacity) among large industrial recyclers seeking economies of scale, while smaller scrap operations continue to rely on medium-capacity integrated units (300-800 kg/h) offering flexibility across different wire gauges. The stationary segment holds the largest market share due to the stability and high throughput required for large facilities, but the demand for mobile or semi-mobile crushing units is steadily rising, particularly for on-site processing or rapid deployment applications. The focus across all segments remains firmly on maximizing copper purity levels, often requiring multi-stage separation processes that incorporate magnetic sorting, air density tables, and electrostatic separation to achieve minimum 99.5% copper content, which is mandated by premium buyers.

AI Impact Analysis on Copper Wire Crushing And Recycling Machine Market

Common user inquiries concerning AI integration often center on how automation can improve material input identification, increase separation efficiency for complex cables, and predict maintenance failures in high-wear components like crushing blades and granulator screens. Users are specifically keen to understand the return on investment (ROI) associated with implementing vision systems powered by machine learning for rapid categorization of mixed input streams (e.g., distinguishing PVC insulation from rubber or Teflon), which directly impacts processing parameters and final purity. There is significant anticipation regarding predictive maintenance schedules derived from sensor data analyzed by AI, aiming to maximize uptime in capital-intensive recycling facilities where unexpected breakdowns lead to substantial financial losses. Furthermore, recyclers are exploring AI models to optimize energy consumption during the crushing process based on real-time load monitoring and material density.

The application of Artificial Intelligence within the Copper Wire Crushing and Recycling Machine Market is fundamentally transforming operational efficiency and material yield. AI-powered vision systems are being deployed at the pre-sorting stage, enabling automated recognition and segregation of various cable types based on insulation color, diameter, and anticipated material composition, allowing the recycling line to dynamically adjust crushing speeds and separation parameters for optimal recovery. This sophisticated material intelligence minimizes cross-contamination and significantly elevates the purity of the resultant copper granules, reducing the need for manual inspection and subsequent reprocessing.

Beyond sorting, AI is deeply embedded in the maintenance and optimization lifecycle of the machinery. Predictive maintenance algorithms analyze vibration data, temperature fluctuations, and motor loads from integrated sensors to forecast potential mechanical failures, allowing operators to schedule proactive maintenance before catastrophic equipment failure occurs. This proactive approach drastically reduces unplanned downtime, extends the lifespan of expensive wear parts, and ensures consistent throughput critical for meeting contractual obligations. The continuous feedback loop provided by AI enhances overall process stability, making high-capacity recycling operations more reliable and economically viable.

- Enhanced Pre-Sorting Accuracy: AI-powered vision systems rapidly categorize mixed cable streams, improving input consistency.

- Optimized Process Parameters: Machine learning adjusts granulator speeds and separation forces dynamically based on material composition.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature) to forecast equipment failure, minimizing downtime.

- Increased Copper Purity: Automated identification reduces contaminants, boosting copper granule purity above industry standards (99.5%+).

- Energy Consumption Reduction: AI optimizes motor load and throughput based on real-time density, improving operational energy efficiency.

- Autonomous Fault Diagnosis: Self-diagnosis capabilities reduce troubleshooting time and associated labor costs.

DRO & Impact Forces Of Copper Wire Crushing And Recycling Machine Market

The market dynamics are primarily shaped by robust environmental legislation and strong economic incentives tied to resource efficiency. Drivers include the rising global scrap generation from automotive and electronics waste, the lower environmental footprint and energy requirements of secondary copper production compared to primary mining, and consistent legislative pushes toward circular economy models across industrialized nations. Restraints encompass the high initial capital expenditure required for purchasing and installing advanced, high-capacity machinery, the operational challenge posed by the increasingly complex and composite nature of modern wiring (e.g., complex armor, multiple insulation layers), and the volatility in global scrap copper prices, which influences short-term investment decisions. Opportunities are abundant in the untapped potential of emerging markets for establishing decentralized recycling infrastructure, the development of modular and smaller-scale recycling solutions for localized processing, and the integration of highly sophisticated sensor-based sorting technologies to handle challenging materials like fine ‘hair wire’ and low-grade cable mixes. The impact forces are generally positive, favoring market expansion due to irreversible trends in environmental accountability and sustained industrial demand for conductive materials.

Specific market drivers include the substantial growth in Electric Vehicle (EV) production globally, which generates complex battery wiring and high-voltage cable scrap streams requiring specialized processing capabilities. Furthermore, government subsidies and incentives, such as tax breaks for recycling investments or mandatory recycled content quotas in public procurement, provide predictable financial motivation for recyclers to upgrade their equipment. The consistent depletion of high-grade copper ore reserves globally also structurally supports the long-term viability and competitiveness of the secondary copper market. These factors collectively create a positive feedback loop, driving continuous technological refinement in crushing and separation efficiency.

However, significant restraining factors persist, notably the substantial operational costs related to replacement parts, especially high-wear components like rotor blades, which require frequent replacement due to the abrasive nature of processing armored cables. Furthermore, the varying quality and consistency of global scrap imports necessitate machinery capable of flexible processing, which adds complexity and cost to design. The successful navigation of these restraints depends heavily on manufacturers delivering machines with superior component longevity, integrated remote monitoring for predictive maintenance, and highly adaptable software controls for managing diverse input material specifications. Ultimately, the cumulative impact of regulatory pressure and economic benefits outweighs the friction caused by capital intensity and material complexity, ensuring market upward trajectory.

Segmentation Analysis

The Copper Wire Crushing and Recycling Machine Market is segmented comprehensively across machine type, capacity, degree of mobility, and end-use application, providing a detailed view of current market demands and evolving technological adoption. Segmentation by machine type primarily distinguishes between highly integrated Granulation Systems, which combine crushing, grinding, and separation in a single line, and dedicated Pre-shredders, used to reduce the size of bulkier, armored cables before final granulation. Capacity segmentation is critical, reflecting the scale of recycling operations, ranging from small-scale (under 300 kg/h) for local collection centers to high-capacity industrial machines (over 1500 kg/h) utilized by major scrap processors. Understanding these segment dynamics is vital for manufacturers to tailor their product offerings to specific geographical market needs and operational profiles.

The mobility segment differentiates between Stationary systems, favored for permanent high-throughput facilities due to their stability and integration capabilities, and Mobile or Semi-Mobile units, which offer flexibility for on-site dismantling operations or temporary installations in regions with dispersed scrap sources. Stationary systems account for the largest revenue share owing to their high efficiency and throughput consistency, essential for large-scale urban recycling centers. However, mobile units are gaining traction in construction and demolition waste management where processing needs to occur close to the source of generation. End-use segmentation confirms that the largest demand originates from Professional Scrap Processors and Large Industrial Recycling Facilities, followed by Automotive and Electronic Waste (E-waste) Processing plants, each requiring specific machine configurations optimized for their unique material inputs.

Technological segmentation often involves differentiating separation methods, highlighting the maturity and precision of Air Separation Tables, Vibration Tables, and the emerging adoption of Electrostatic Separators, which are crucial for recovering ultra-fine copper dust and achieving extremely high purity levels (99.9%). The trend shows increasing integration of these advanced multi-stage separation technologies, often bundled into complete, automated recycling lines. The ability of manufacturers to offer scalable, modular solutions that allow recyclers to start with a medium-capacity unit and easily integrate additional pre-shredders or advanced separation stages later, provides a competitive edge in a market where capital investment decisions are phased and cautious.

- By Machine Type:

- Integrated Granulation Systems (Crusher, Grinder, Separator)

- Pre-shredders and Choppers (Primary Reduction)

- Dedicated Separation Units (Air/Vibration Tables, Electrostatic Separators)

- By Capacity (Throughput):

- Small Capacity (<300 kg/h)

- Medium Capacity (300 kg/h – 800 kg/h)

- High Capacity (800 kg/h – 1500 kg/h)

- Very High Capacity (>1500 kg/h)

- By Mobility:

- Stationary Machines

- Mobile and Semi-Mobile Units

- By Application/End-Use:

- Professional Scrap Processors

- E-Waste Recycling Facilities

- Automotive Recycling Centers

- Cable Manufacturing Plants (Internal Scrap Management)

Value Chain Analysis For Copper Wire Crushing And Recycling Machine Market

The value chain for the Copper Wire Crushing and Recycling Machine Market begins with the upstream suppliers, primarily providing high-grade steel and specialized alloys for the manufacture of critical components such as rotor blades, screens, and machine bodies, alongside sophisticated electronic controls and sensor technology necessary for advanced automation. High reliance is placed on the quality and durability of these input materials, as machinery longevity directly impacts the Total Cost of Ownership (TCO) for the end-user. Key upstream risks include volatility in raw steel prices and the availability of specialized wear parts, which are often proprietary or sourced from niche alloy manufacturers. Innovation at this stage focuses on materials science to develop longer-lasting, more impact-resistant blades and screens, thereby reducing maintenance frequency and costs for the recycler.

The central segment of the value chain involves the Original Equipment Manufacturers (OEMs), who design, assemble, and test the crushing and recycling systems. This stage is highly knowledge-intensive, requiring expertise in mechanical engineering, fluid dynamics (for air separation), and sophisticated process control software. Differentiation among OEMs is achieved through optimizing throughput-to-purity ratios, minimizing energy consumption per ton of processed material, and providing comprehensive after-sales service and remote diagnostics. Downstream analysis involves the direct users—the scrap processors and industrial recyclers—who purchase and operate these machines to convert scrap into marketable commodities. The value captured downstream is heavily dependent on the efficiency of the machine in achieving the required copper purity (typically 99.5% or higher) and the operational costs, including energy and maintenance, associated with achieving that output.

Distribution channels are multifaceted, utilizing both direct sales models, particularly for large, custom-built industrial lines where technical consultation is required, and indirect channels through authorized distributors or regional sales agents, especially for standard, medium-capacity units. Direct channels allow OEMs to maintain higher margins and direct customer relationships crucial for collecting feedback and providing tailored service agreements. Indirect channels leverage local expertise in specific regions, aiding in installation, training, and rapid localized maintenance support. Financing options and leasing agreements provided through these channels are becoming increasingly important, reducing the initial capital burden on recyclers. The entire value chain is pressured by the market's need for sustainability, requiring adherence to environmental standards not only in the machine’s operation but also in the sourcing and disposal of manufacturing components.

Copper Wire Crushing And Recycling Machine Market Potential Customers

The primary customer base for Copper Wire Crushing and Recycling Machines consists of dedicated scrap processing enterprises, industrial waste management organizations, and specialized electronic waste (E-waste) recycling facilities globally. These entities require high-efficiency machinery to handle the vast volumes of discarded wiring generated from residential, commercial, and industrial dismantling activities. Professional scrap processors represent the largest and most frequent buyers, constantly seeking equipment upgrades to improve the purity and scale of their copper output, enabling them to command premium prices in the secondary metals market. Their purchasing decisions are highly sensitive to throughput capacity, operational uptime, and the total lifetime maintenance costs associated with the equipment.

A rapidly expanding segment of potential customers includes automotive dismantling centers and vehicle manufacturing plants, particularly those involved in the processing of end-of-life internal combustion and electric vehicles. EVs, in particular, generate substantial amounts of high-voltage copper wiring, which necessitates specialized granulators capable of safely handling complex insulation materials and heavy gauge cables. Furthermore, large infrastructure project developers and utility companies, often managing vast amounts of obsolete transmission and distribution infrastructure, are increasingly investing in their own recycling units to process scrap internally, maximizing material recovery and reducing transportation logistics costs associated with external scrap sales. These customers prioritize machine robustness and compliance with high safety standards.

Finally, a significant, though geographically dispersed, customer segment involves cable manufacturers themselves. These companies use crushing and recycling machines to process internal manufacturing defects and off-cuts, ensuring that zero-waste principles are adhered to and minimizing reliance on purchasing new feedstock for production. For this segment, integration capability within existing manufacturing lines, high reliability, and precise separation accuracy to maintain feedstock integrity are paramount buying criteria. The breadth of the customer base, ranging from small local scrap yards needing entry-level integrated systems to multinational corporations requiring customized, heavy-duty processing lines, underscores the market’s diverse demand profile.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bronneberg, Eldan Recycling, Guidetti Recycling Systems, STOKKERMILL, ECO-R, Qidu Met, Gensco Equipment, US Recycling Equipment, Henan Recycling Technology, TAIZHI, Metso Outotec, WEIMA, COPPERMAN, Shred-Tech, ZERMA, Roter Recycling, JMC Recycling, MAC/Saturn, SSI Shredding Systems, UNTHA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Wire Crushing And Recycling Machine Market Key Technology Landscape

The technological landscape of the Copper Wire Crushing and Recycling Machine Market is defined by a continuous drive toward achieving higher copper purity with minimum environmental impact and energy consumption. Modern machinery utilizes advanced multi-stage processing lines that commence with robust pre-shredding via low-speed, high-torque shredders to manage large volumes and armored material, followed by precision granulation using high-speed hammer mills or rotating knife granulators. The critical innovation lies in the design of these granulators, which are optimized for clean cutting action rather than crushing, thereby minimizing copper dust generation and maximizing the size consistency of the granules, which is essential for subsequent separation stages. Dust suppression systems, incorporating sophisticated vacuum technology and filtration, are now standard features, ensuring compliance with strict occupational health standards.

The centerpiece of technological advancement is the separation technology. While traditional Air Density Tables remain common, their efficiency is constantly improved through optimized fluid dynamics and variable frequency drives (VFDs) for precise airflow control, necessary to distinguish between materials with minute differences in density (copper vs. polyethylene/PVC). Furthermore, the integration of Vibration Separation technology works synergistically with air separation, using oscillating tables to stratify materials based on size and specific gravity before air currents lift the lighter insulating components away. This dual approach significantly boosts recovery rates for fine copper strands (hair wire) that were historically lost or contaminated the final product.

The emerging technological frontier includes Electrostatic Separation, primarily used as a tertiary or polishing stage to refine the copper output purity beyond 99.5%, effectively removing minute traces of insulating plastic or dust. This technology leverages the electrical conductivity difference between copper and plastics under high-voltage fields, pulling the conductive copper away from non-conductive residue. Alongside physical separation, the integration of advanced sensors (e.g., Near-Infrared or X-ray sorting) and AI-driven control systems facilitates real-time material analysis and dynamic process adjustment, minimizing manual intervention and maximizing system uptime. Modular design and quick-change tooling systems are also key technological features, improving machine flexibility and reducing maintenance downtime significantly.

Regional Highlights

Regional dynamics heavily influence demand patterns, regulatory compliance, and technological adoption within the Copper Wire Crushing and Recycling Machine Market.

- Asia Pacific (APAC): Dominates the global market, driven by the massive scale of electronic and automotive manufacturing, leading to huge volumes of scrap generation. Countries like China, India, and Southeast Asia are experiencing rapid growth in infrastructure development and urbanization, necessitating robust domestic recycling infrastructure. Demand is high for both high-capacity, heavy-duty machines to handle armored industrial cables and smaller, flexible units for localized E-waste processing. Regulatory support for circular economy initiatives, particularly in China and India, further accelerates market penetration.

- Europe: Characterized by stringent environmental regulations (WEEE Directive) and a mature recycling industry. The focus here is on precision, energy efficiency, and low emissions. European recyclers demand highly automated systems incorporating advanced separation technologies (like electrostatic sorting) to meet strict purity standards for recycled copper used in high-end manufacturing. Market growth is stable, driven primarily by technological upgrades and replacement of older, less efficient machinery.

- North America: A significant market characterized by high operational costs and a preference for durable, high-throughput machinery with integrated safety features. The expansion of the Electric Vehicle (EV) sector and the need to process complex high-voltage cables are major demand drivers. Investments are strong in automated pre-sorting and materials handling systems to mitigate labor costs and increase processing efficiency.

- Latin America: An emerging market showing substantial growth potential, particularly in Brazil and Mexico, fueled by increasing industrial activity and government efforts to formalize waste management sectors. Demand is centered on medium-capacity, robust, and easy-to-maintain integrated granulation systems that can handle diverse, often poorly sorted, scrap inputs.

- Middle East and Africa (MEA): Growth is incipient but accelerating, driven by large infrastructure projects and increasing awareness of resource scarcity and waste management necessity, particularly in the GCC states and South Africa. Investment is often targeted toward turnkey solutions that offer quick deployment and reliable operation in challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Wire Crushing And Recycling Machine Market.- Bronneberg

- Eldan Recycling

- Guidetti Recycling Systems

- STOKKERMILL

- ECO-R

- Qidu Met

- Gensco Equipment

- US Recycling Equipment

- Henan Recycling Technology

- TAIZHI

- Metso Outotec

- WEIMA

- COPPERMAN

- Shred-Tech

- ZERMA

- Roter Recycling

- JMC Recycling

- MAC/Saturn

- SSI Shredding Systems

- UNTHA

Frequently Asked Questions

Analyze common user questions about the Copper Wire Crushing And Recycling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the demand for copper wire recycling machinery?

Demand is primarily driven by strict global environmental regulations mandating efficient e-waste processing, the economic advantages of recycled copper (lower energy consumption than virgin metal), and the steady rise in global scrap wire generation from sectors like construction and electric vehicle manufacturing.

How do modern recycling machines achieve high copper purity levels?

Modern machines achieve high purity (typically 99.5%+) through multi-stage processing involving precision granulation followed by advanced physical separation techniques, including optimized air density tables, vibration screens, and sometimes tertiary electrostatic separation, to accurately isolate copper from insulation materials.

What is the typical operational lifespan of critical wear parts in these machines?

The operational lifespan of critical wear parts, such as rotor blades and granulator screens, varies significantly based on the input material (armored vs. thin wire) and machine maintenance. While standard industrial blades may last 100-300 operating hours, advancements in specialized alloy technology and AI-driven predictive maintenance are significantly extending useful life and reducing replacement frequency.

Which geographical region shows the highest investment potential in this market?

The Asia Pacific (APAC) region, particularly China and India, exhibits the highest investment potential. This is due to rapid industrialization, massive infrastructure projects, and developing regulatory frameworks pushing for comprehensive domestic scrap recycling capabilities to manage enormous volumes of waste cables and wiring.

How does the integration of AI improve the efficiency of copper wire crushing and recycling?

AI integration improves efficiency by utilizing machine vision for rapid and accurate material pre-sorting, optimizing processing parameters in real-time based on material input density, and implementing predictive maintenance algorithms that maximize machine uptime and significantly reduce unplanned operational halts.

The escalating global focus on resource efficiency and environmental compliance ensures that the Copper Wire Crushing and Recycling Machine Market will continue its upward trajectory, providing essential technological solutions for the sustainable management of copper resources worldwide. Further market expansion will rely heavily on continuous innovation in separation technologies, integration of smart manufacturing principles, and the adaptability of machinery to increasingly complex scrap materials generated by new technological applications, particularly in the renewable energy and electric mobility sectors. The competitive landscape is characterized by established European and North American manufacturers focusing on quality and automation, while Asian counterparts drive volume and cost competitiveness, leading to a vibrant environment of technological development and strategic partnerships across the entire value chain, securing the future supply of high-purity secondary copper for global industry needs.

The strategic imperative for market participants is the development of modular and scalable recycling solutions that allow smaller enterprises to enter the market while simultaneously serving the high-throughput requirements of multinational conglomerates. Customization options, particularly in handling challenging inputs such as fine communications cables or heavily armored submarine cables, represent a key area for competitive differentiation. Moreover, the provision of comprehensive digital services, including remote diagnostics, performance monitoring dashboards, and automated parts ordering, is transitioning from a value-add to an expectation within the industry, underpinning the technological maturation of the recycling machinery sector. Ensuring compliance with local emission and noise standards also remains a non-negotiable prerequisite for market entry in developed economies, driving R&D toward advanced dust capture and acoustic dampening technologies integrated seamlessly into machine design.

The forecasted growth is inherently linked to global commodity price trends; however, the structural regulatory shift toward mandatory recycling minimizes the market's exposure to short-term price volatility compared to other commodity-dependent sectors. Long-term stability is guaranteed by copper’s essential role in electrification and digital infrastructure, ensuring perennial demand. Therefore, companies investing in high-efficiency, durable, and environmentally sound crushing and recycling technologies are strategically positioning themselves to capture sustained growth across diverse geographic and application segments over the forecast period. The market's evolution will increasingly favor closed-loop systems that offer complete traceability and audited recovery rates, aligning with corporate sustainability reporting requirements and enhanced transparency in the global recycled materials supply chain.

Technological refinement is paramount for sustained competitive advantage, specifically focusing on innovations that reduce the energy intensity of the crushing process. Optimizing the kinetic energy transfer in the granulators, coupled with highly efficient motor systems, minimizes electricity consumption per ton of copper recovered, addressing one of the primary operational expenditures for recyclers. Furthermore, the development of specialized coatings and materials for wear parts significantly extends their operational life, directly enhancing the profitability of recycling operations by decreasing maintenance downtime and replacement costs. The transition towards Industry 4.0 principles, including full system integration and data analytics, is reshaping the market, enabling predictive modeling for throughput optimization and continuous process improvement across multi-machine recycling lines, ensuring the maximum possible financial return on investment for the end-user.

In summary, the Copper Wire Crushing and Recycling Machine Market offers a critical intersection of industrial necessity and global sustainability objectives. The market is resilient, driven by structural demand and regulatory mandates, with growth concentrated in high-efficiency, automated, and technologically advanced machinery. The integration of digital technologies, particularly AI and advanced sensor systems, marks the current phase of evolution, promising unprecedented levels of purity, operational efficiency, and minimized environmental footprint. Key players must prioritize R&D into material science for durable components and software integration for intelligent operation to solidify their leadership in this essential segment of the circular economy transition.

The market faces ongoing challenges related to the heterogeneous nature of scrap input, necessitating flexible and robust machinery capable of handling widely varied cable compositions and sizes without significant operational changes or compromised output quality. This versatility is a core differentiator for leading OEMs. The trend toward miniaturization in electronics, producing increasingly fine and complex wiring (e.g., in communication technologies), requires granulators with extremely tight tolerances and highly sensitive separation mechanisms to ensure these valuable fine wires are not lost in the insulation fraction. Successfully processing these low-diameter, high-complexity inputs efficiently is becoming a benchmark for technological leadership. Furthermore, stringent regulatory scrutiny on emissions extends beyond particulate matter to include noise pollution, especially for urban recycling facilities, compelling manufacturers to invest heavily in machine enclosures and sound dampening materials, adding to overall equipment complexity and cost, but ensuring regulatory adherence.

Regulatory compliance within the European Union (EU) and advanced North American states mandates continuous monitoring of air quality and metal recovery rates, pushing the adoption of sophisticated monitoring and reporting software integrated directly into the crushing and recycling systems. This trend transforms the machinery from purely mechanical processing units into smart, data-generating assets, providing verifiable evidence of material recovery efficiency and environmental performance. The ability of OEMs to provide standardized reporting formats compatible with global environmental auditing requirements adds significant value to their product offering, especially for large multinational recycling corporations. This digitization of the recycling process is fundamental to meeting the evolving demands of corporate environmental, social, and governance (ESG) reporting.

The competitive strategy within this marketplace increasingly revolves around life-cycle support and servicing agreements. Given the high initial investment, recyclers prioritize suppliers who offer comprehensive maintenance packages, rapid spare parts availability, and guaranteed performance metrics (throughput and purity guarantees). The provision of training programs for specialized machine operators is also a crucial element of the service offering, ensuring that customers can maximize the complex machinery's potential. Strategic acquisitions and vertical integration, where machinery manufacturers partner with or acquire suppliers of high-wear components, help stabilize the supply chain for critical parts, reducing downtime risk for end-users and offering a significant competitive advantage in terms of cost control and delivery speed.

Innovation in modularity allows recyclers to scale their operations incrementally, adapting to fluctuating scrap supply volumes and changing material compositions without completely overhauling their existing setup. A key aspect of this modular design is the seamless integration of pre-shredding units with main granulators and subsequent separation stages, enabling customized system configurations optimized for specific scrap streams (e.g., dedicated lines for automotive harness vs. industrial power cable). This flexibility reduces capital risk for recyclers and accelerates the adoption of new technologies, ensuring the overall market infrastructure remains modern and responsive to evolving waste streams. The emphasis on minimizing material losses at every processing stage, often through highly specialized air classification techniques to capture ultra-fine metal dust, directly translates into increased profitability, reinforcing the economic driver for continuous technological upgrades.

The long-term outlook for the Copper Wire Crushing and Recycling Machine Market is exceptionally positive, underpinned by macroeconomic trends toward electrification, renewable energy integration, and mandatory waste reduction targets globally. As virgin copper sources become more challenging and environmentally costly to extract, the secondary market provides a stable, high-quality, and environmentally preferable alternative. Manufacturers who successfully combine robust mechanical engineering with intelligent, automated process control and comprehensive service support will lead the market, facilitating the essential transition to a truly circular economy for one of the world's most critical industrial metals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager