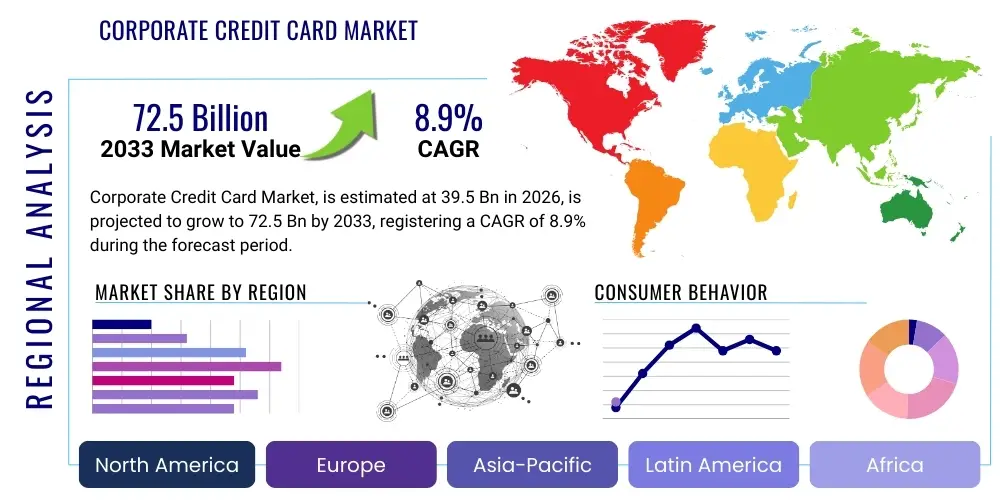

Corporate Credit Card Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442103 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Corporate Credit Card Market Size

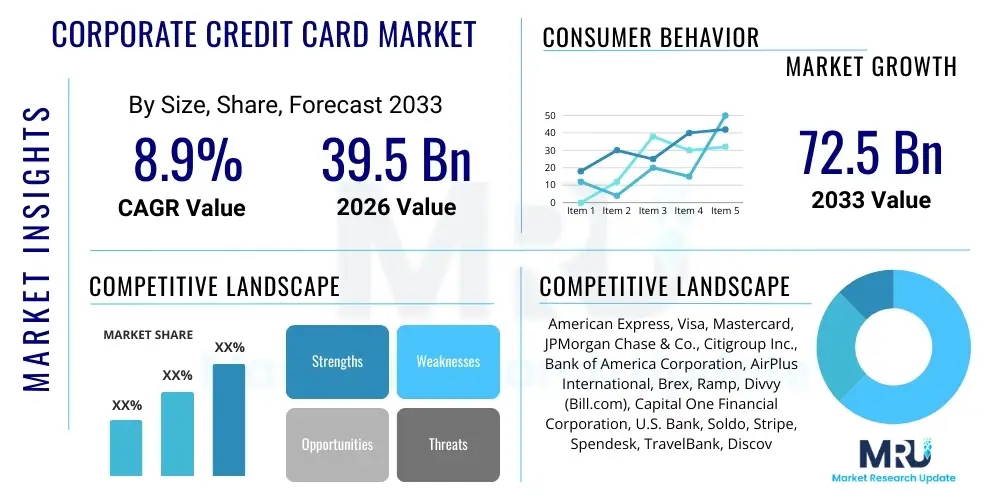

The Corporate Credit Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 39.5 Billion in 2026 and is projected to reach USD 72.5 Billion by the end of the forecast period in 2033.

Corporate Credit Card Market introduction

The Corporate Credit Card Market encompasses financial products designed specifically for businesses to manage and streamline operational expenses, travel and entertainment (T&E) costs, procurement expenditures, and vendor payments. These cards offer functionalities far beyond typical consumer credit, integrating with sophisticated expense management software to provide real-time data, enhanced security, and controlled spending limits. The primary product descriptions include general-purpose cards, purchasing cards (P-Cards), and virtual cards, each tailored for different organizational needs. Major applications span enterprise resource planning (ERP) integration, automated reconciliation, supply chain financing, and optimized cash flow management. The core benefits for corporations involve significant time savings in expense reporting, reduced administrative overhead, improved regulatory compliance, and access to robust analytical tools for expenditure tracking. Driving factors include the global shift towards digitalization in financial operations, the necessity for tighter financial controls in a distributed work environment, and the increasing adoption of cloud-based spend management platforms that require seamless payment solutions.

Modern corporate credit cards are transforming from mere payment instruments into integral components of treasury and finance technology ecosystems. The value proposition centers on providing transparency and control over decentralized spending, particularly critical for multinational corporations and fast-growing mid-market companies. The integration of corporate cards with AI-driven software allows businesses to enforce spending policies proactively, rather than relying on reactive auditing post-spend. Furthermore, the expansion of card programs into areas like employee benefits and recurring SaaS subscriptions is broadening the market scope. The convergence of banking services, payment networks, and expense technology providers is fostering innovation, leading to highly customized and API-driven card solutions that cater to the evolving demands of corporate finance departments focused on operational efficiency and cost optimization.

The market is characterized by intense competition among traditional financial institutions, specialized FinTech providers, and technology companies offering embedded finance solutions. The primary strategic focus for market players is enhancing the technological infrastructure supporting the cards, emphasizing features such as instant issuance, multi-currency support, advanced fraud protection through biometric and behavioral analytics, and seamless mobile integration. The market growth trajectory is heavily influenced by the expansion of small and medium-sized enterprises (SMEs) globally, which increasingly require formalized, automated spending tools to support rapid scale and international operations. This dynamic environment necessitates continuous innovation in reward structures, underwriting models, and integrated software services to maintain competitive advantage.

Corporate Credit Card Market Executive Summary

The Corporate Credit Card Market is experiencing robust growth driven by accelerating digital transformation in corporate finance departments, positioning integrated spend management platforms as key disruptors. Business trends emphasize the adoption of virtual cards and P-Cards over traditional physical cards, offering enhanced security and precise spending controls, particularly valuable in managing remote workforce expenses and complex procurement cycles. The competitive landscape is being reshaped by FinTech startups that prioritize API-driven integration and superior user experience, forcing established banks to heavily invest in technological upgrades and strategic partnerships to modernize legacy systems. A dominant trend involves the shift towards real-time reconciliation and automated receipt capture, minimizing manual intervention and accelerating the financial close process for businesses of all sizes. Furthermore, the expansion of card programs into emerging markets and sectors previously reliant on checks or cash is opening up significant growth avenues, reinforcing the global move towards cashless B2B transactions.

Regionally, North America maintains its dominance due to high adoption rates of advanced financial technologies, the large presence of multinational corporations, and stringent regulatory environments that favor traceable, structured spending methods. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by the massive influx of SMEs adopting formal expense management solutions and rapid digitalization in markets like India and Southeast Asia. European markets, particularly Western Europe, are characterized by high regulatory fragmentation, yet the demand for pan-European, multi-currency card solutions is driving innovation, particularly in integrating cards with local VAT reclaim processes. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging as critical frontier markets, where rising foreign direct investment and evolving banking regulations are creating favorable conditions for corporate card penetration, focusing initially on large domestic enterprises and T&E management.

Segment trends reveal that the Small and Medium Enterprise (SME) segment is the fastest-growing customer group, attracted by bundled solutions that offer both payment processing and expense management software at accessible price points. By card type, virtual corporate cards are showing explosive growth, driven by their utility in managing online subscriptions, securing large one-off payments, and mitigating fraud risks inherent in distributed procurement. Application-wise, Travel and Entertainment (T&E) remains a foundational segment, but the Procurement segment, encompassing supplier payments and inventory acquisition, is gaining significant traction, fueled by the demand for P-Cards integrated directly into purchasing systems. Finally, the Technology and IT sector continues to be a primary adopter of advanced corporate card services due to its high volume of SaaS subscriptions and rapid global expansion requirements.

AI Impact Analysis on Corporate Credit Card Market

User queries regarding the impact of AI on corporate credit cards predominantly revolve around enhanced fraud detection capabilities, the feasibility of real-time spend audit and policy compliance, and the future of personalized credit underwriting. Users are intensely interested in how AI can move credit card management from a reactive process to a predictive one, particularly in areas like identifying suspicious spending patterns before they result in large losses and automating the categorization and reconciliation of complex multi-currency transactions. Key concerns center on data privacy implications related to behavioral monitoring and the reliability of AI algorithms in making critical financial decisions, such as adjusting credit limits or flagging compliance breaches. The market expects AI integration to drastically reduce operational costs associated with manual expense processing and usher in an era of ultra-customized card programs based on granular spend intelligence.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally redefining the risk management and efficiency paradigms within the Corporate Credit Card Market. AI models analyze vast datasets of past transaction behavior, merchant codes, geographic locations, and time-of-day patterns to establish dynamic baselines for each user and organization. This allows for significantly faster and more accurate identification of anomalous transactions, differentiating sophisticated fraud attempts from legitimate unusual expenditures. Furthermore, AI algorithms are instrumental in optimizing the credit underwriting process for corporate clients, utilizing alternative data sources beyond traditional balance sheets, such as real-time cash flow metrics and vendor relationships, leading to more flexible and tailored credit limits that align precisely with a company’s operational needs and growth potential.

Beyond security and risk, AI drives unprecedented efficiency in the back office. Automated policy enforcement is perhaps the most revolutionary application; ML systems instantly review expense details, receipts, and adherence to company policies (e.g., spending limits per category or per diem rules) at the point of transaction or immediately thereafter. This reduces the burden on finance teams who previously spent considerable time manually auditing reports. Moreover, AI excels at data enrichment—automatically categorizing cryptic merchant descriptions, assigning tax codes, and integrating the data seamlessly into ERP systems, thereby eliminating common errors and accelerating the entire expense reimbursement and reconciliation cycle. This shift from manual compliance checks to automated, predictive control is a primary driver of enterprise-level adoption.

- AI-driven real-time fraud detection and anomaly scoring using behavioral biometrics.

- Machine Learning (ML) optimization of corporate credit risk assessment and dynamic limit adjustments.

- Automated expense categorization and data enrichment for streamlined accounting integration.

- Predictive analytics for cash flow management and optimized working capital decisions.

- Intelligent policy compliance checks performed instantaneously at the point of sale.

- Personalized rewards and spending advice based on ML-analyzed corporate spending habits.

DRO & Impact Forces Of Corporate Credit Card Market

The Corporate Credit Card Market is primarily driven by the imperative for centralized spend control and the widespread adoption of automated expense management solutions, countered by significant resistance stemming from concerns over data security and fragmentation of regulatory frameworks. Opportunities are abundant in the underserved SME segment and through the expansion of virtual card applications in the burgeoning B2B e-commerce sector. The impact forces are currently skewed strongly toward market facilitators, notably technological innovation and favorable economic shifts promoting corporate efficiency, but restrained by the inherent inertia of legacy banking systems and the complexity of global compliance requirements. The net effect of these dynamics ensures steady, yet highly competitive, market growth characterized by rapid technological iteration.

Drivers: The dominant driver is the global trend toward digital transformation in financial services, forcing corporations to abandon cumbersome, paper-based expense reporting systems in favor of integrated digital platforms. The post-pandemic shift to hybrid and remote work models necessitates tools that allow finance teams to securely monitor and control decentralized employee spending, making corporate cards with robust reporting essential. Furthermore, the economic advantage derived from efficient cash flow management—through extended payment terms and optimized reconciliation—incentivizes rapid adoption. The proliferation of affordable, cloud-based expense management software, often bundled with corporate card offerings, has made sophisticated financial control accessible even to smaller organizations, significantly expanding the addressable market. Lastly, the desire for granular data analytics on spending behavior drives corporations to adopt systems that provide categorized, time-stamped transaction records immediately.

Restraints: Significant barriers to entry and expansion include the persistent fear of security breaches and data privacy violations, particularly when integrating payment data with cloud-based services. Another major restraint is the regulatory complexity and fragmentation across different geographies; multinational corporations face challenges standardizing card programs due to varied laws on data localization, payment processing, and consumer protection (even for corporate cards). High interchange fees in certain regions, coupled with the initial setup and integration costs associated with migrating from existing systems, also dampen enthusiasm, especially for highly price-sensitive mid-market companies. Finally, the market still contends with the legacy reluctance of some traditional banking institutions to swiftly integrate new, API-driven technologies, slowing down overall market modernization.

Opportunities: The most compelling opportunity lies in scaling specialized virtual card offerings for distinct use cases such as advertising spend, SaaS subscriptions, and internal cross-departmental budgeting, allowing unprecedented control and security. The untapped potential in the Small and Medium Enterprise (SME) segment, often overlooked by large legacy issuers, represents a massive addressable market for FinTechs offering flexible, low-cost integrated solutions. Geographically, emerging economies in APAC and LATAM, experiencing rapid industrialization and digitization, offer high growth potential as local businesses formalize their financial operations. Furthermore, the convergence of corporate cards with broader embedded finance solutions, where payment capabilities are seamlessly integrated into non-financial platforms (e.g., procurement software), creates new distribution channels and value propositions.

Segmentation Analysis

The Corporate Credit Card Market segmentation provides a granular view of market dynamics based on the product characteristics, the size of the adopting enterprise, the specific application of the card, and the industry vertical utilizing the service. This comprehensive approach helps identify key growth sectors, target customer profiles, and the specific technological needs driving purchasing decisions. Understanding these segments is crucial for issuers and technology providers aiming to tailor their offerings—whether focusing on the high-volume procurement needs of large enterprises or the simplified expense management requirements of small businesses. The market's complexity necessitates detailed segmentation across Card Type (distinguishing between T&E, P-Cards, and Virtual Cards), ensuring strategic alignment with evolving corporate financial workflows and diverse operational demands across global sectors.

Market growth within each segment is heavily influenced by macroeconomic factors and sector-specific digitalization maturity. For instance, the Large Enterprise segment, while mature, drives demand for complex, globally compliant platforms, whereas the SME segment seeks accessible, highly integrated, and user-friendly mobile solutions. Application segments dictate feature sets; T&E demands robust receipt capture and mobile capabilities, while Procurement requires high limits and integration with e-procurement systems. This multi-dimensional segmentation allows stakeholders to accurately project technological investment requirements, ranging from blockchain implementation for enhanced payment security to advanced API development for seamless third-party software integration, ensuring product-market fit in a rapidly evolving financial landscape.

- By Card Type:

- Travel and Entertainment (T&E) Corporate Cards

- Purchasing Cards (P-Cards)

- Virtual Cards

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Travel and Entertainment Management

- Procurement Management

- Supplier Payments

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare and Pharmaceuticals

- Retail and E-commerce

- Manufacturing

- Others (Government, Education, Utilities)

Value Chain Analysis For Corporate Credit Card Market

The Corporate Credit Card Value Chain is a complex network involving multiple interdependent layers, beginning with upstream providers, flowing through core issuance and processing, and concluding with downstream enterprise adoption and integration. Upstream analysis focuses on the entities providing the foundational infrastructure: Payment Network Operators (e.g., Visa, Mastercard, American Express) and core Processing Service Providers. These entities define the rules, global acceptance, and fundamental transaction clearance mechanisms. Strategic partnerships at this stage determine the reach and technological capabilities, such as tokenization standards and cross-border currency conversion efficiency, which are essential for creating viable corporate card products tailored for multinational use.

The core of the value chain is occupied by Card Issuers, which include traditional banks (global and regional), specialized FinTech companies, and non-bank financial institutions. These entities are responsible for underwriting credit risk, managing compliance, and issuing the physical or virtual cards directly to corporations. Distribution channels are varied, involving both direct sales teams targeting large enterprises and indirect channels such as partnerships with expense management software vendors (SaaS providers) who bundle the card product with their platform. The shift towards API-driven distribution means that FinTechs can integrate their card-as-a-service offering directly into third-party ERP or accounting systems, rapidly expanding their market footprint without needing traditional branch networks.

Downstream analysis centers on the End-Users and the integrated technologies utilized for expense management. This includes the corporate clients (finance teams, department heads, and employees) and the providers of Expense Management Software (EMS). The greatest value is created when the card transactions feed instantaneously and accurately into the EMS, facilitating automated reconciliation and reporting. This critical downstream integration determines the overall adoption rate and customer satisfaction, as corporations increasingly prioritize technological ease and seamless workflow over interest rates or rewards alone. Efficient downstream integration, particularly with major ERP systems like SAP and Oracle, transforms the credit card from a simple payment tool into a central hub for corporate financial control.

Corporate Credit Card Market Potential Customers

Potential customers for the Corporate Credit Card Market span the entire spectrum of organizational size and industry, unified by the need to efficiently manage operational spending and mitigate financial risk. The primary end-users are corporate finance departments, including Chief Financial Officers (CFOs), Treasurers, and Accounts Payable (AP) managers, who seek tools for centralized visibility and control over decentralized spending. Employees across all functional areas—sales, marketing, R&D, and procurement—are secondary users, needing flexible payment methods for T&E, vendor payments, and subscription services. The fastest-growing demographic of buyers includes high-growth, globally expanding mid-market companies (SMEs) transitioning away from personal credit cards or rudimentary expense systems, characterized by high demand for bundled software solutions that scale easily.

The market also heavily targets specific industries with high volumes of decentralized or specialized spending. Technology companies, for instance, are significant consumers of virtual cards for managing global SaaS subscriptions and digital advertising spend, valuing speed and flexibility. Manufacturing and retail sectors heavily utilize P-Cards for procurement and inventory management, requiring deep integration with supply chain software. Professional services firms, with extensive travel needs, remain primary consumers of T&E focused cards. Ultimately, any organization with an operational budget, regardless of size, that processes more than a few dozen expense reports monthly is a potential candidate, as the return on investment through process efficiency and fraud reduction becomes compelling.

In terms of geographical targeting, mature markets in North America and Europe prioritize sophisticated features like advanced analytics and integrated VAT recovery, reflecting high standards of financial governance. Conversely, emerging markets often seek basic, secure digital card solutions that replace cash transactions and facilitate easier international business transactions. Issuers must therefore segment potential customers not just by size or industry, but also by their current state of digital maturity and regulatory environment, customizing features such as multi-currency support and localized compliance modules to maximize penetration across global potential customer bases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 39.5 Billion |

| Market Forecast in 2033 | USD 72.5 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Express, Visa, Mastercard, JPMorgan Chase & Co., Citigroup Inc., Bank of America Corporation, AirPlus International, Brex, Ramp, Divvy (Bill.com), Capital One Financial Corporation, U.S. Bank, Soldo, Stripe, Spendesk, TravelBank, Discover Financial Services, Comdata Inc., Wells Fargo & Company, Global Payments Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corporate Credit Card Market Key Technology Landscape

The technology landscape for the Corporate Credit Card Market is dominated by advancements in API-first banking, embedded finance architecture, and enhanced real-time data analytics capabilities. The adoption of Open Banking principles, facilitated by robust Application Programming Interfaces (APIs), allows corporate card issuers to seamlessly integrate payment functionalities directly into third-party Enterprise Resource Planning (ERP) systems, accounting software, and expense management platforms. This API infrastructure enables rapid innovation, allowing FinTechs to launch customized card products with specific controls and reporting features tailored to niche industry requirements. The focus is shifting from hardware security (the physical chip) to software-based security via tokenization and advanced encryption, ensuring transactional integrity in digital environments.

A major technological trend is the rise of embedded finance, positioning corporate credit cards as native features within non-financial platforms, such as procurement marketplaces or HR management systems. This integration leverages the principle of "card-as-a-service," where the core payment infrastructure is provided by specialized platforms (like Stripe or Marqeta) allowing non-bank entities, including software companies like Brex or Ramp, to offer sophisticated card products without holding a traditional banking license. This architecture democratizes access to corporate payment solutions, significantly accelerating speed to market and fostering competition based on software quality rather than just interchange fees. Furthermore, the development of sophisticated proprietary underwriting models based on AI and ML is leveraging non-traditional corporate data (e.g., spending velocity, vendor relationships) to offer higher, more flexible credit limits than traditional bank models.

Real-time analytics and mobile-centric capabilities represent the operational forefront of the technological landscape. Modern corporate card platforms provide finance managers with instantaneous visibility into employee spending, enabling proactive policy intervention and immediate fund reconciliation, eliminating the typical lag associated with monthly closing cycles. Mobile applications are critical, offering functionalities like instant receipt capture via optical character recognition (OCR), GPS-verified expense tagging, and virtual card issuance on-the-go. These mobile solutions enhance the user experience for employees, driving compliance, while simultaneously providing finance teams with live, actionable data essential for optimizing working capital and enforcing expense policies dynamically, cementing the technological transition from simple payment cards to intelligent spend management systems.

Regional Highlights

- North America: Dominates the global corporate credit card market share due to the large presence of multinational corporations, early adoption of integrated expense management software, and a highly competitive FinTech ecosystem. The region is a leader in virtual card innovation and AI-driven spend governance. The demand here is centered on sophisticated fraud prevention and robust integration with global ERP systems like SAP and Oracle. The U.S. market, driven by large commercial banks and aggressive tech-enabled entrants, dictates global trends in product features and service models.

- Europe: Characterized by high regulatory fragmentation (e.g., GDPR, PSD2), driving demand for pan-European, multi-currency corporate card solutions that simplify compliance and tax reclaim processes (especially VAT recovery). The UK and Germany are mature markets, focusing on API-driven solutions. PSD2 has fostered collaboration between traditional banks and local FinTechs, emphasizing transparent pricing and highly localized service offerings catering to diverse EU member state requirements.

- Asia Pacific (APAC): Expected to register the highest CAGR, fueled by rapid economic growth, massive SME digitalization, and increasing urbanization. Markets such as India, China, and Southeast Asia are transitioning swiftly from cash/legacy systems to digital corporate payments. Growth is driven by the need for simplified, mobile-first payment solutions that support cross-border commerce and efficient expense management for rapidly scaling businesses.

- Latin America (LATAM): An emerging market experiencing significant growth, primarily focused on stabilizing local currencies and providing tools for transparent, US Dollar-denominated international business spending. Regulatory reforms aimed at increasing financial inclusion and combating corruption are favorable drivers. Key markets like Brazil and Mexico are seeing intense competition between local banks and specialized international FinTechs offering robust security features.

- Middle East and Africa (MEA): Growth is concentrated in the GCC nations, driven by large infrastructure projects, high foreign business activity, and government initiatives promoting financial digitalization (e.g., Saudi Vision 2030). Demand focuses on premium T&E services for executive travel and secure procurement cards for oil, gas, and construction sectors, increasingly adopting virtual cards to manage complex vendor ecosystems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corporate Credit Card Market.- American Express Company

- Visa Inc.

- Mastercard Incorporated

- JPMorgan Chase & Co.

- Citigroup Inc.

- Bank of America Corporation

- Brex Inc.

- Ramp Financial Inc.

- Divvy (Bill.com Holdings, Inc.)

- Capital One Financial Corporation

- U.S. Bank (U.S. Bancorp)

- Soldo Ltd.

- Stripe, Inc.

- AirPlus International GmbH

- WEX Inc.

- TravelBank (Acquired by U.S. Bank)

- Comdata Inc.

- Discover Financial Services

- Wells Fargo & Company

- Global Payments Inc.

Frequently Asked Questions

Analyze common user questions about the Corporate Credit Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Corporate Card and a Purchasing Card (P-Card)?

The primary distinction lies in application and control. Corporate Cards are typically issued to individual employees for Travel and Entertainment (T&E) and general business expenses, often linked to expense reporting software. P-Cards are designed for procurement, offering centralized control over supply chain and vendor payments, usually having higher limits and fewer individual user controls, integrating directly into enterprise procurement systems.

How is the Corporate Credit Card Market being impacted by FinTech companies?

FinTechs are disrupting the market by offering integrated spend management software bundled with payment services (Embedded Finance). They utilize advanced technology such as AI for underwriting and real-time expense reconciliation, providing greater flexibility, transparency, and superior user experience compared to traditional bank offerings, particularly attracting the SME segment.

What role do Virtual Cards play in corporate spending?

Virtual cards are unique, digitally generated 16-digit card numbers used for specific, controlled transactions, enhancing security and budgeting. They are crucial for managing online subscriptions, digital advertising spend, and one-off vendor payments, as they can be instantly issued, deactivated, or limited to exact amounts, significantly reducing fraud risk associated with physical cards.

Which geographical region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapid digital transformation across small and medium-sized enterprises (SMEs) and high government investment in cashless payment infrastructure throughout countries like India, China, and Southeast Asia.

What are the key benefits of integrating corporate cards with expense management software?

Integration automates the entire expense workflow. Key benefits include real-time transaction reporting, automated receipt matching using OCR technology, instant policy compliance checks, and streamlined data feeding directly into accounting systems, drastically reducing administrative burden and accelerating the financial close process for corporations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager