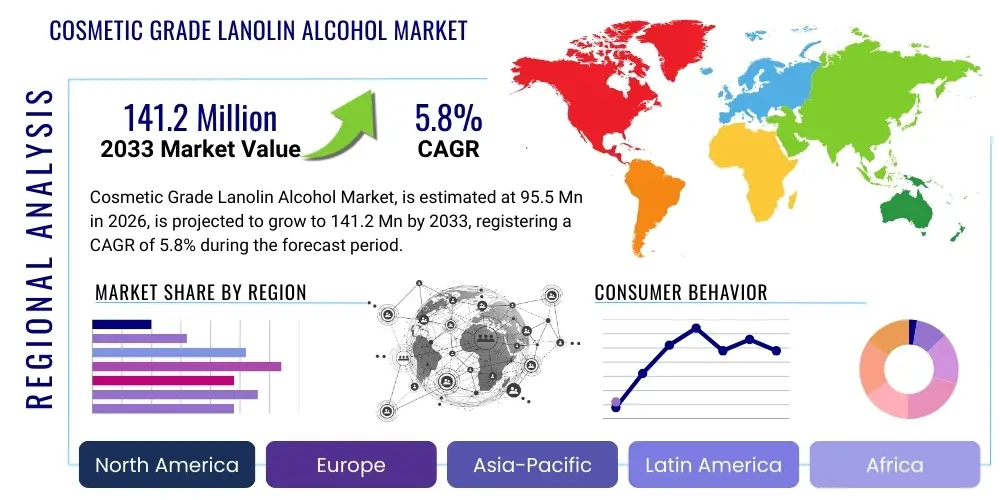

Cosmetic Grade Lanolin Alcohol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441889 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cosmetic Grade Lanolin Alcohol Market Size

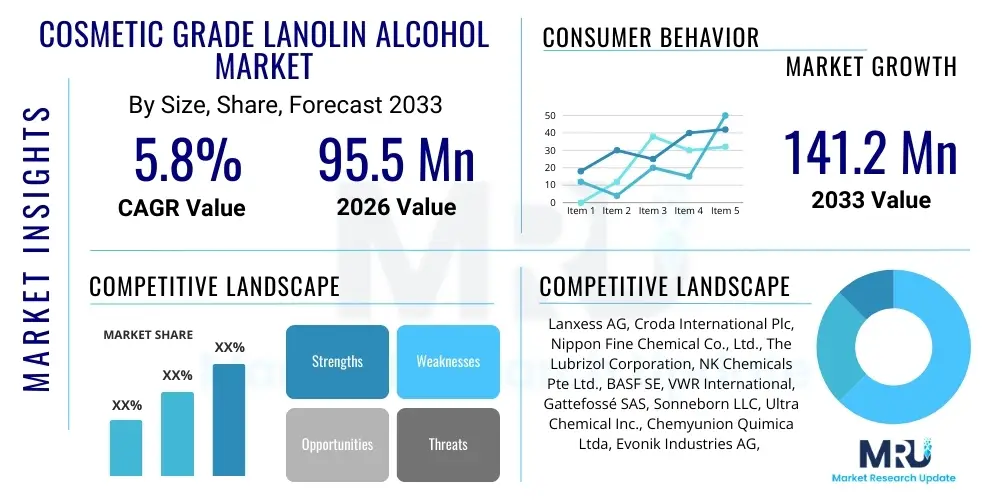

The Cosmetic Grade Lanolin Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 95.5 Million in 2026 and is projected to reach USD 141.2 Million by the end of the forecast period in 2033.

Cosmetic Grade Lanolin Alcohol Market introduction

The Cosmetic Grade Lanolin Alcohol Market encompasses highly refined fractions derived from raw lanolin, specifically optimized for integration into sensitive cosmetic formulations. Lanolin alcohol, chemically distinct from lanolin wax or fatty acids, is a complex mixture of high molecular weight esters, diols, and sterols (primarily cholesterol), which impart superior emulsifying, moisturizing, and emollient properties. This substance is crucial for stabilizing water-in-oil emulsions, making it a foundational ingredient in rich creams, lotions, and heavy-duty barrier repair products, particularly where intense hydration and occlusivity are required.

Major applications for cosmetic grade lanolin alcohol span across skincare, haircare, and specialized dermatological treatments. In skincare, it serves as a powerful moisturizer and skin conditioning agent, aiding in the restoration of the skin barrier function. Its high compatibility with human sebum minimizes irritation and enhances product absorption. The primary driving factors fueling market expansion include the increasing consumer demand for natural or naturally derived ingredients, growing awareness of skin barrier health, and the continuous innovation in anti-aging and specialized skincare sectors that require robust, long-lasting emollients.

Furthermore, the pharmaceutical industry’s reliance on high-purity lanolin derivatives for topical drug delivery systems bolsters the demand for cosmetic grade variants, often sharing similar purity standards and extraction techniques. The shift towards sustainable sourcing of wool grease, the raw material for lanolin, and advancements in purification technologies to remove potential allergens (such as residual pesticides) are key trends that ensure the ingredient remains viable and competitive against synthetic alternatives. These technological improvements guarantee a consistently safe and effective product for high-end cosmetic formulations globally.

Cosmetic Grade Lanolin Alcohol Market Executive Summary

The Cosmetic Grade Lanolin Alcohol market demonstrates robust growth driven by its indispensable role as a primary emulsifier and emollient in premium skincare and pharmaceutical applications. Key business trends highlight a heightened focus on high-purity, hypo-allergenic formulations, necessitating sophisticated refining processes such as molecular distillation and chromatography to meet stringent regulatory standards, especially in the European Union and North America. Strategic partnerships between lanolin refiners and major cosmetic contract manufacturers are defining the supply landscape, emphasizing traceability and sustainable wool sourcing practices.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market segment, primarily propelled by expanding middle-class consumption, increased spending on sophisticated beauty products in countries like China and South Korea, and the burgeoning prevalence of advanced localized dermatitis treatments requiring superior barrier ingredients. North America and Europe, while mature, maintain dominant market shares due to established regulatory frameworks and high demand for anti-aging and specialized clinical skincare lines. These regions show strong preference for certified sustainable and ethically sourced materials, pushing manufacturers toward transparent supply chains.

Segmentation analysis underscores the dominance of the high-purity, low-pesticide residual (LPR) segment, particularly within the anti-aging and baby care categories, reflecting consumer sensitivity toward product safety. The market also sees growth in solid and semi-solid formulations (creams and sticks) over liquid bases, capitalizing on lanolin alcohol's exceptional viscosity-enhancing properties. Competitive strategies are increasingly centering on proprietary blends and functional modifications of lanolin alcohol to optimize skin penetration and compatibility with modern preservative systems, thereby maintaining its relevance against competitive synthetic esters.

AI Impact Analysis on Cosmetic Grade Lanolin Alcohol Market

User queries regarding AI's influence on the Cosmetic Grade Lanolin Alcohol market frequently revolve around how artificial intelligence can optimize the complex purification processes, enhance supply chain transparency, and personalize product formulation. Users are particularly concerned with AI's potential in predicting raw material availability (wool grease cycles), managing quality control to ensure ultra-low pesticide residue (LPR) levels, and automating laboratory analysis to expedite regulatory compliance. The core expectation is that AI will drastically improve efficiency and purity in manufacturing, while simultaneously aiding R&D in tailoring lanolin alcohol variants for specific dermatological indications, such as enhanced stability in extreme temperatures or superior dermal penetration capabilities. However, there is also interest in whether AI-driven consumer analysis might identify synthetic alternatives that could potentially displace lanolin derivatives, forcing innovation in natural sourcing and derivatization.

- AI-driven optimization of multi-stage purification processes (e.g., fractional distillation) leading to higher yields and reduced energy consumption.

- Predictive modeling for wool grease availability and quality forecasting, stabilizing raw material pricing and securing supply chains.

- Automated quality control systems utilizing machine vision and spectral analysis to ensure consistent ultra-low pesticide residual (LPR) standards.

- AI algorithms assisting cosmetic chemists in formulating high-stability emulsions, predicting interactions between lanolin alcohol and novel active ingredients.

- Enhanced consumer trend analysis identifying niche applications for lanolin alcohol, driving targeted product development in customized skincare regimens.

- Improved supply chain traceability and sustainability auditing through blockchain integration managed by AI platforms.

DRO & Impact Forces Of Cosmetic Grade Lanolin Alcohol Market

The market is primarily driven by the ingredient's unmatched performance as a natural, highly effective emulsifier and emollient, coupled with rising global demand for specialized dermatological and anti-aging products. However, the market faces significant restraints, chiefly concerning public perception issues related to the animal origin of lanolin (sheep wool), despite ethical sourcing efforts, and regulatory scrutiny over potential residual impurities like pesticides. Opportunities lie in developing ultra-pure, hypo-allergenic grades and leveraging bio-fermentation technology to create functional analogs, ensuring supply consistency and addressing ethical concerns. These forces collectively shape the market trajectory, demanding continuous investment in advanced purification techniques and robust certification programs.

Drivers: The fundamental driver is the recognized clinical efficacy of lanolin alcohol in barrier repair and intense moisturization, particularly suitable for sensitive skin and compromised dermal barriers. The ingredient’s high molecular weight and sterol content provide an exceptional occlusive effect, minimizing Transepidermal Water Loss (TEWL) far surpassing many synthetic alternatives. Furthermore, the global expansion of the premium beauty and cosmeceutical sectors, where formulators prioritize ingredients with long-standing safety profiles and superior stability, continually boosts demand. The increasing prevalence of skin conditions requiring barrier support, such as eczema and severe dry skin, further solidifies its position in medicinal and high-end consumer products.

Restraints: Key restraints center around supply chain limitations, as lanolin is a byproduct of the wool industry, making its volume and quality subject to climatic conditions and farming practices. The historical association with allergens, although largely mitigated by modern purification (reducing free lanolin alcohol content), necessitates detailed labeling and continuous consumer education. Crucially, the stringent regulatory environment in developed markets mandates extremely low limits for pesticide residues (LPR), requiring intensive capital expenditure in advanced refining equipment, which poses a significant hurdle for smaller manufacturers and impacts final product cost.

Opportunities: Significant growth opportunities exist in the development of specialized derivatives, such as acetylated lanolin alcohol, offering altered physical properties like lower tackiness and enhanced spreadability, thereby broadening its applicability in lightweight cosmetic formulations. Furthermore, capitalizing on the demand for certified organic and sustainably sourced materials allows companies to differentiate their products and command higher premiums. The penetration into the Asian cosmetics market, specifically for traditional beauty rituals and natural ingredient preferences, presents substantial untapped potential, particularly in high-volume sun care and BB cream applications where moisturizing stability is paramount.

Impact Forces: The overarching impact force is the complex interplay between raw material availability and regulatory pressure. High-impact forces include technological advancements in analytical chemistry, enabling detection of contaminants at parts-per-billion levels, effectively raising the quality bar for all market participants. Competitive pressure from plant-derived pseudoceramides and synthetic cholesterol derivatives constitutes a persistent force, requiring lanolin producers to continuously demonstrate superior performance and cost-effectiveness. The rising influence of environmental, social, and governance (ESG) factors dictates sourcing and processing ethics, heavily influencing brand reputation and purchasing decisions among major multinational cosmetic conglomerates.

Segmentation Analysis

The Cosmetic Grade Lanolin Alcohol Market is meticulously segmented based on purity level, application type, and physical form, reflecting the diverse requirements of the cosmetic and pharmaceutical industries. Purity level is the most critical segment, differentiating standard cosmetic grades from Ultra-Pure or Pharmaceutical Grades, which are essential for baby care and sensitive dermatological products due to their stringent low-pesticide residual (LPR) requirements. The application segmentation highlights the dominant role of lanolin alcohol in moisturizers and barrier creams, followed by its use in specialized haircare treatments and color cosmetics where its binding and emollient properties are utilized.

Segmentation by physical form (solid/flake, semi-solid paste, and liquid derivatives) allows manufacturers to cater to different formulation needs; for instance, solid forms are ideal for stick formulations and anhydrous products, while liquid derivatives offer ease of integration into liquid emulsions. Analyzing these segments provides strategic insights into consumer preferences and regulatory hotspots. The growth rate disparity between basic and high-purity grades indicates a clear market trend favoring premiumization and safety, where consumers are willing to pay a premium for certified hypoallergenic ingredients.

The market structure is highly fragmented yet dominated by a few key global refiners who possess the technology required for high-grade purification. Segmentation aids in targeting specific end-user industries, such as veterinary medicine or industrial lubrication (though non-cosmetic), which utilize lower grades of lanolin but influence overall raw material pricing. The continuing expansion of the anti-pollution skincare segment is creating a new demand segment, as lanolin alcohol acts as a superior film-former protecting the skin barrier from environmental stressors.

- By Purity Level:

- Standard Cosmetic Grade (Non-LPR specific)

- Ultra-Pure/Hypoallergenic Grade (LPR Certified)

- Pharmaceutical Grade

- By Application:

- Skincare (Moisturizers, Barrier Creams, Anti-Aging)

- Haircare and Conditioners

- Color Cosmetics (Lipsticks, Foundations)

- Baby Care Products

- Dermatological/Topical Pharmaceuticals

- By Form:

- Solid (Flakes/Pellets)

- Semi-Solid/Paste

- Liquid Derivatives (Enhanced Spreadability)

Value Chain Analysis For Cosmetic Grade Lanolin Alcohol Market

The value chain for Cosmetic Grade Lanolin Alcohol is characterized by highly specialized processing stages, starting from the extensive wool grease extraction phase in the upstream segment. Upstream analysis focuses on wool shearing operations, primarily concentrated in Australia, New Zealand, and parts of South America, followed by crude wool grease collection and preliminary washing. This stage is crucial as the quality of the raw lanolin directly impacts the difficulty and cost of downstream purification, particularly regarding pesticide and heavy metal contamination. Ethical sourcing and shearer welfare standards are increasingly integrated into the upstream segment due to rising consumer consciousness, placing pressure on raw material suppliers to obtain certified sustainable wool.

The midstream segment involves the highly technical refining and fractional distillation process, transforming crude lanolin into specific lanolin alcohols and esters. Key players invest heavily in proprietary technologies, such as sophisticated vacuum distillation and solvent extraction methods, to achieve the ultra-high purity levels required for cosmetic and pharmaceutical grades. This stage represents the highest value addition, converting a commodity byproduct into a specialized functional ingredient. Quality control measures, particularly LPR testing and microbial stabilization, dictate market viability and access to premium cosmetic brands. Manufacturers often integrate backward to secure consistent access to high-quality raw materials.

Downstream analysis includes distribution channels and the final end-user formulation. Distribution channels are typically bifurcated: direct sales to major multinational cosmetic manufacturers requiring bulk quantities and consistent supply, and indirect sales through specialized chemical distributors and agents servicing smaller formulators and regional players. The product then enters the consumer goods value chain, where formulators integrate the lanolin alcohol into high-margin products like clinical moisturizers, anti-chapping creams, and premium lip balms. The direct channel benefits from high transparency and tailored technical support, while the indirect channel offers greater market reach and logistical flexibility across various geographical regions.

Cosmetic Grade Lanolin Alcohol Market Potential Customers

Potential customers for Cosmetic Grade Lanolin Alcohol primarily encompass large multinational corporations specializing in skincare and personal care, followed by mid-sized contract manufacturers who produce private label goods for various brands. The product is highly sought after by global pharmaceutical companies developing topical medications, specifically those requiring an effective, non-irritating base for transdermal drug delivery systems. Customers value the high emollient content, superior emulsifying capability, and the proven track record of safety and skin compatibility, making it indispensable in high-performance formulations targeting compromised skin barriers.

Specific end-user segments include pediatric product manufacturers, who rely on the Ultra-Pure (LPR Certified) grade for sensitive baby creams and lotions, emphasizing the need for ingredients free from potentially harmful residues. Furthermore, specialized beauty brands focusing on natural, intensive repair, or cold-weather protective cosmetics constitute a significant customer base. These customers often prioritize suppliers who can demonstrate full traceability back to the wool source and provide extensive documentation supporting the product's hypoallergenic claims, ensuring compliance with strict global regulatory standards like REACH and FDA guidelines.

Beyond traditional cosmetic applications, the veterinary dermatological sector represents an emerging customer group, utilizing lanolin alcohol in products designed for animal skin barrier repair and coat conditioning. Industrial customers requiring specialized lubricants or corrosion inhibitors occasionally overlap, purchasing lower or technical grades, although the cosmetic market necessitates distinctly higher purification standards. Customer loyalty in this market is predominantly driven by consistency in quality, reliable supply, competitive pricing relative to synthetic alternatives, and robust technical partnership offered by the raw material supplier.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.5 Million |

| Market Forecast in 2033 | USD 141.2 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, Croda International Plc, Nippon Fine Chemical Co., Ltd., The Lubrizol Corporation, NK Chemicals Pte Ltd., BASF SE, VWR International, Gattefossé SAS, Sonneborn LLC, Ultra Chemical Inc., Chemyunion Quimica Ltda, Evonik Industries AG, P&G Chemicals, Sigma-Aldrich (Merck KGaA), Phoenix Chemical Inc., Florachem Corporation, A S Harrison & Co, Koster Keunen, Inc., Stepan Company, Specialty Chemical Sales, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Grade Lanolin Alcohol Market Key Technology Landscape

The production of cosmetic grade lanolin alcohol relies heavily on sophisticated chemical engineering and purification technologies designed to achieve extremely high levels of purity, often surpassing standards for general industrial use. The primary technical process involves the multi-stage fractional distillation and solvent-free extraction of the fatty acid components from the raw lanolin wax. Modern techniques utilize high-vacuum distillation to separate the volatile impurities and undesired components, ensuring the final lanolin alcohol fraction is rich in high molecular weight sterols, which are responsible for the superior emulsification properties. Advanced filtration systems, including specialized membrane filtration and activated carbon treatment, are critical for removing color, odor, and particularly, trace pesticide residues (LPR certification requirements).

A key technological advancement driving market quality is the development of chromatographic purification methods. While cost-intensive, chromatography allows for the highly specific removal of trace impurities, enabling manufacturers to meet the stringent standards required for pharmaceutical and hypoallergenic cosmetic applications, such as baby care products. Furthermore, advancements in derivatization technology permit the modification of lanolin alcohol's structure, creating specialized compounds like acetylated lanolin alcohol. This acetylation process reduces the intrinsic tackiness of the ingredient while maintaining its emollient benefits, expanding its functional utility into lighter, more aesthetically pleasing cosmetic textures, thus challenging synthetic alternatives based solely on feel.

The landscape is also characterized by substantial investment in analytical technology for Quality Assurance and Quality Control (QA/QC). High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS) are standard operational tools, indispensable for verifying LPR compliance at parts-per-billion levels. Future technological trajectory focuses on greener chemistry, exploring supercritical fluid extraction (SFE) as a sustainable alternative to traditional solvent-based systems. SFE utilizes pressurized carbon dioxide, which is non-toxic and easily recovered, reducing environmental impact and eliminating residual solvent concerns, further enhancing the appeal of lanolin derivatives in eco-conscious formulations.

Regional Highlights

- North America: North America holds a substantial share of the Cosmetic Grade Lanolin Alcohol market, primarily driven by a highly developed cosmeceutical sector and high consumer disposable income allocated to premium, specialized skincare, particularly anti-aging and clinical dermatology products. The U.S. market is highly regulated, placing intense demand on suppliers to provide Ultra-Pure and Pharmaceutical Grades (LPR certified), leading to stable, high-value demand. Innovation in drug delivery systems and strong R&D in barrier repair therapy solidify the region's position as a critical market segment.

- Europe: The European market is characterized by stringent regulatory environments, particularly under REACH, mandating meticulous documentation on substance safety, environmental impact, and traceability. This focus on compliance means European formulators strongly favor suppliers with certified sustainable sourcing and verifiable LPR standards. Demand is particularly high in Germany and France for natural cosmetics and baby care, capitalizing on lanolin alcohol's long history of safe use and effectiveness as a natural occlusive agent.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period. This growth is underpinned by rising consumer awareness of ingredient efficacy, coupled with increasing personal care expenditure in emerging economies like China, India, and Southeast Asia. The local cosmetic industry's rapid adoption of Western formulation techniques, combined with a cultural preference for naturally derived ingredients in countries like South Korea, accelerates the use of high-quality lanolin derivatives in BB creams, intensive moisturizers, and sheet mask formulations.

- Latin America (LATAM): The LATAM market, while smaller, offers significant potential, driven by rapid urbanization and the expansion of the middle class in Brazil and Mexico. Demand is concentrated in affordable, yet effective, barrier creams and sun protection products, where lanolin alcohol provides superior water resistance and long-lasting emollience. Market access is often dependent on local distribution partnerships and competitive pricing strategies against regional oil-based alternatives.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, largely spurred by the demand for high-performance, moisturizing products tailored to harsh, arid climates. High-purity lanolin alcohol is sought after for use in protective creams and specialized treatments addressing severe dry skin conditions. Investment in localized pharmaceutical manufacturing hubs in the Gulf Cooperation Council (GCC) countries also supports the uptake of pharmaceutical-grade lanolin derivatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Grade Lanolin Alcohol Market.- Croda International Plc

- Lanxess AG

- Nippon Fine Chemical Co., Ltd.

- The Lubrizol Corporation

- NK Chemicals Pte Ltd.

- BASF SE

- VWR International

- Gattefossé SAS

- Sonneborn LLC

- Ultra Chemical Inc.

- Chemyunion Quimica Ltda

- Evonik Industries AG

- P&G Chemicals

- Sigma-Aldrich (Merck KGaA)

- Phoenix Chemical Inc.

- Florachem Corporation

- A S Harrison & Co

- Koster Keunen, Inc.

- Stepan Company

- Specialty Chemical Sales, Inc.

Frequently Asked Questions

Analyze common user questions about the Cosmetic Grade Lanolin Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Cosmetic Grade Lanolin Alcohol used for primarily?

It is primarily utilized as an exceptionally effective water-in-oil emulsifier and a superior emollient in high-end skincare, barrier repair creams, and dermatological formulations, ensuring intense moisturization and stability.

Is Cosmetic Grade Lanolin Alcohol safe for sensitive skin and baby products?

Yes, specifically the Ultra-Pure and LPR (Low Pesticide Residue) certified grades are extensively used in hypoallergenic and baby care products due to their stringent purification standards and excellent compatibility with human skin lipids.

What is the main driver of market growth for Lanolin Alcohol?

The primary driver is the ingredient's proven efficacy in restoring the skin barrier function and its irreplaceable role in stabilizing robust cosmetic emulsions, coupled with rising global consumer demand for high-performance, natural emollients.

How do manufacturers ensure the sustainability and ethical sourcing of Lanolin Alcohol?

Leading manufacturers engage in certified programs that ensure ethical treatment of sheep (wool sourcing) and implement advanced purification technologies to minimize environmental impact and meet ethical sourcing demands from multinational cosmetic brands.

How does Lanolin Alcohol compare to synthetic emollients?

Lanolin alcohol offers superior occlusivity and molecular similarity to human skin lipids (due to its high sterol content, primarily cholesterol), often providing better, longer-lasting barrier function and moisturizing benefits compared to many common synthetic esters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager