Cough Suppressant Drugs Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441565 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Cough Suppressant Drugs Market Size

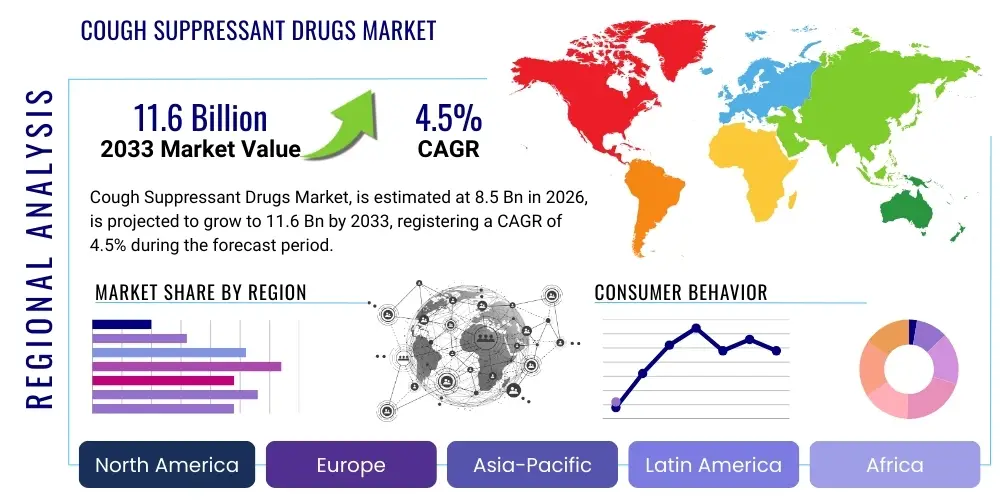

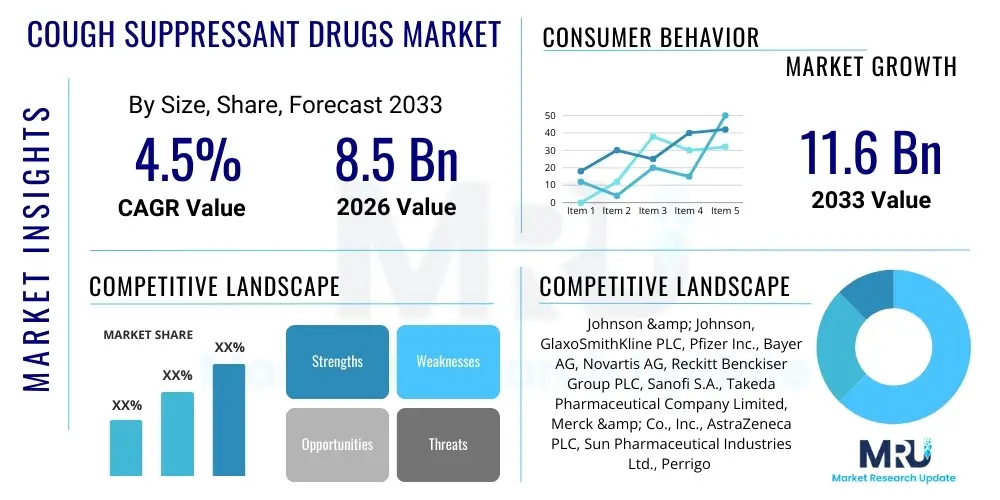

The Cough Suppressant Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.6 Billion by the end of the forecast period in 2033.

Cough Suppressant Drugs Market introduction

The Cough Suppressant Drugs Market encompasses pharmaceutical preparations designed to alleviate or control the urge to cough, primarily through central action on the cough reflex located in the medulla oblongata. These medications, often referred to as antitussives, are crucial components in the management of acute and chronic respiratory tract infections, allergic reactions, and environmental irritations that provoke coughing. Key product categories include opioid derivatives such as codeine and hydrocodone (though increasingly restricted), and non-opioid antitussives like dextromethorphan (DM), which is widely available over-the-counter (OTC). The primary applications span the treatment of symptoms associated with the common cold, influenza, bronchitis, pneumonia, and various allergies, offering symptomatic relief that enhances patient comfort and quality of sleep.

The therapeutic benefits of cough suppressants extend beyond simple symptomatic relief; they help prevent complications arising from excessive coughing, such as throat irritation, exhaustion, and in severe cases, rib fractures or pneumothorax, particularly in susceptible populations. The market is continuously driven by the high prevalence and recurrence of seasonal respiratory illnesses globally, compounded by increasing levels of air pollution, which acts as a persistent irritant to the respiratory mucosa. Furthermore, the growing geriatric population, which is often afflicted by chronic respiratory conditions like Chronic Obstructive Pulmonary Disease (COPD) and asthma, necessitates consistent access to effective cough management solutions.

Driving factors stimulating market expansion include proactive consumer health awareness, leading to increased self-medication with OTC antitussives, alongside ongoing research and development focusing on novel, non-addictive antitussive agents with improved efficacy and safety profiles. Pharmaceutical companies are investing significantly in advanced drug delivery systems, such as sustained-release formulations and pediatric-friendly delivery formats (e.g., chewable tablets and palatable syrups), to cater to diverse patient needs. The rapid urbanization and exposure to varying climates also contribute significantly to the epidemiological landscape, ensuring a steady demand for these drugs across both developed and emerging economies.

Cough Suppressant Drugs Market Executive Summary

The Cough Suppressant Drugs Market is characterized by robust resilience driven by recurring viral outbreaks and chronic respiratory health issues, witnessing a discernible shift in business trends towards non-narcotic and natural cough relief solutions due to increased regulatory scrutiny on opioid-based formulations. Pharmaceutical companies are focusing on synergistic combination therapies that address multiple symptoms (cough, congestion, pain) simultaneously, streamlining patient treatment regimens. A significant business trend involves strategic divestments and acquisitions aimed at consolidating market share in the high-growth OTC segment, particularly in flavor masking and formulation technologies for improved patient compliance, especially among pediatric and geriatric cohorts. Furthermore, digitalization in healthcare has led to a rise in tele-consultations, influencing consumer choices based on online recommendations and digital prescriptions.

Regionally, the Asia Pacific (APAC) market is forecasted to exhibit the highest growth trajectory, primarily fueled by massive, dense populations highly susceptible to infectious disease transmission, intensifying air quality degradation in major urban centers, and rapidly expanding access to organized healthcare and retail pharmacy networks. North America and Europe, while mature, maintain strong market shares driven by high per capita healthcare spending, advanced regulatory frameworks facilitating the introduction of new formulations, and a high awareness level regarding seasonal disease prophylaxis and symptomatic management. Regulatory harmonization, particularly within the European Union, is facilitating easier market entry for standardized products, while strict controls on prescription antitussives containing scheduled substances continue to reshape product availability in Western markets.

Segment trends highlight the dominance of the non-opioid segment, largely propelled by Dextromethorphan (DM) due to its efficacy and wide accessibility, aligning with consumer demand for safe, readily available solutions. However, the herbal and natural ingredients segment is experiencing accelerated growth, reflecting a strong consumer preference for plant-derived remedies perceived as having fewer side effects. Based on dosage form, syrups and liquids retain the largest share due to ease of administration, particularly for children and elderly individuals with dysphagia, although solid dose forms like lozenges and tablets are gaining traction due to convenience and portability. These segment dynamics underscore a market responding to safety concerns, demographic shifts, and evolving consumer health preferences.

AI Impact Analysis on Cough Suppressant Drugs Market

User queries regarding AI's influence on the Cough Suppressant Drugs Market primarily center on three core areas: accelerating the discovery of novel antitussive agents with targeted efficacy and minimal side effects, optimizing personalized dosing based on individual biometric data and cough patterns, and enhancing supply chain efficiency and forecasting during seasonal outbreaks. Consumers and industry stakeholders are concerned about whether AI can help differentiate between various types of coughs (e.g., wet vs. dry, productive vs. non-productive) to recommend the most appropriate drug class, thereby reducing unnecessary medication use. The analysis indicates strong expectations for AI in leveraging real-world evidence (RWE) derived from smart cough monitoring devices and electronic health records (EHRs) to refine clinical trial designs and post-market surveillance for enhanced drug safety and effectiveness.

- AI-driven identification of novel drug targets and receptor pathways involved in refractory chronic cough.

- Optimization of chemical synthesis and lead compound optimization, drastically shortening the preclinical drug discovery phase.

- Development of personalized medicine protocols, using machine learning to predict optimal antitussive dosage based on patient genomics and co-morbidities.

- Advanced forecasting models to predict regional outbreaks of respiratory diseases, enabling pharmaceutical manufacturers to optimize inventory and distribution.

- Enhanced quality control and manufacturing process automation using AI-powered vision systems in pharmaceutical production lines.

- Real-time patient monitoring via smart devices integrated with AI algorithms to track cough frequency and severity, improving treatment adherence and feedback loops.

DRO & Impact Forces Of Cough Suppressant Drugs Market

The Cough Suppressant Drugs Market is shaped by dynamic interactions among Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. Key drivers include the escalating global burden of respiratory diseases such as COPD, asthma, and seasonal infections, amplified by an aging population increasingly susceptible to chronic pulmonary issues. Furthermore, persistent environmental factors, notably rising air pollution and particulate matter exposure in developing and industrialized nations, act as constant triggers for chronic cough, sustaining market demand. These intrinsic epidemiological drivers are complemented by improved consumer access to OTC medications and effective marketing strategies that promote early symptom management.

However, the market faces significant restraints. The most critical constraint involves the regulatory backlash and societal concern surrounding the misuse, abuse, and potential dependency associated with opioid-based antitussives (like codeine), leading to severe restrictions on their availability and necessitating costly reformulation efforts by pharmaceutical companies. Other limitations include the common side effects of existing non-opioid drugs, such as sedation and dizziness, and the limited efficacy of current suppressants against certain complex or refractory cough syndromes, which necessitates continuous investment in targeted research. The increasing trend towards herbal and natural remedies also serves as a competitive restraint to conventional pharmacological agents.

Opportunities for market growth are abundant, centering on the development of novel, non-sedating, and non-addictive antitussive agents, potentially utilizing emerging targets like P2X3 receptors, which are involved in sensory nerve activation in the airways. Significant opportunities also exist in exploring combination therapies that simultaneously address underlying inflammation or allergy alongside cough suppression, maximizing therapeutic outcomes. Investing in advanced drug delivery technologies, particularly localized delivery systems or sustained-release oral dosage forms, offers a competitive advantage. The combined effect of these DRO elements establishes a moderately high impact force trajectory, favoring innovation in the non-opioid and botanical segments while necessitating strict regulatory compliance for traditional products.

Segmentation Analysis

The segmentation analysis of the Cough Suppressant Drugs Market provides a granular view of market dynamics based on product type, dosage form, distribution channel, and application, enabling stakeholders to identify high-growth areas and tailored investment strategies. The market is primarily categorized by active ingredient, distinguishing between opioid and non-opioid preparations, with the latter commanding a significantly larger and faster-growing share due to safety profiles and accessibility. Dosage form segmentation reflects consumer preference for convenience and palatability, while distribution channels illuminate the crucial role of OTC retail pharmacies versus institutional procurement in hospitals and clinics.

- By Product Type:

- Opioid Antitussives (e.g., Codeine, Hydrocodone)

- Non-opioid Antitussives (e.g., Dextromethorphan, Benzonatate)

- Herbal and Natural Suppressants

- By Dosage Form:

- Liquids and Syrups

- Tablets and Capsules

- Lozenges and Sprays

- By Application:

- Common Cold and Flu

- Allergies

- Chronic Obstructive Pulmonary Disease (COPD)

- Other Respiratory Disorders (e.g., Bronchitis, Pneumonia)

- By Distribution Channel:

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy/E-commerce

Value Chain Analysis For Cough Suppressant Drugs Market

The value chain for the Cough Suppressant Drugs Market begins with the upstream segment, involving the sourcing and synthesis of Active Pharmaceutical Ingredients (APIs) and excipients. This phase is critical, especially for synthetic antitussives like dextromethorphan, where the supply chain stability and purity of raw materials directly impact the final product quality and cost. For herbal suppressants, this involves sustainable cultivation and extraction processes. High regulatory requirements necessitate strict quality control at the API manufacturing stage, often leading to geographical concentration of specialized API producers, primarily in Asia Pacific (India and China), which significantly influences global market pricing and operational risk.

The midstream stage involves pharmaceutical formulation and manufacturing, where APIs are converted into finished dosage forms—syrups, tablets, or lozenges. This segment requires substantial capital investment in GMP (Good Manufacturing Practices) facilities, specializing in technologies like taste masking for syrups or sustained-release coating for solid forms. The distribution channel forms the critical downstream component. For OTC cough suppressants, a broad network encompassing wholesalers, major retail pharmacy chains (CVS, Walgreens), supermarkets, and increasingly, e-commerce platforms is utilized (indirect sales). Prescription (Rx) products, particularly those containing controlled substances, follow a more restrictive, direct channel from manufacturers to regulated hospital or specialized pharmacy networks.

The direct and indirect distribution dichotomy significantly influences market strategy. Direct sales often characterize high-volume government or institutional contracts, whereas the indirect retail channel necessitates extensive marketing and shelf-space negotiation. Pharmacists and primary care physicians act as vital intermediaries, influencing consumer choice at the point of sale (PoS), especially for OTC products where brand loyalty is often low. Efficient logistics, temperature control for certain liquid formulations, and robust compliance tracking are essential elements defining the successful execution of the downstream value chain, impacting final consumer availability and pricing structure across various regional markets.

Cough Suppressant Drugs Market Potential Customers

The market for cough suppressant drugs targets a diverse and expansive customer base, categorized broadly into general consumers seeking relief from acute symptoms (the common cold or flu) and specific patient populations managing chronic respiratory conditions. General consumers, particularly during peak flu seasons, represent the highest volume buyers, primarily purchasing accessible, non-opioid OTC formulations through retail and online pharmacies for short-term symptomatic relief. This segment is highly sensitive to price, brand recognition, and advertising effectiveness, making it a critical focus area for consumer health divisions of major pharmaceutical companies.

Specific patient groups constitute high-value buyers, often requiring prescription-strength or specialized formulations. This includes the geriatric population, which frequently experiences chronic cough related to underlying conditions such as COPD, heart failure, or medication side effects (e.g., ACE inhibitors). The pediatric segment is also a major consumer base, driving demand for child-friendly dosage forms like flavored syrups and chewables, though this segment is subject to stringent regulatory warnings regarding use in very young children, necessitating specialized product development.

Furthermore, patients with chronic inflammatory or allergic conditions, such as persistent allergic rhinitis or asthma, serve as regular consumers, relying on combination therapies that often include an antitussive component alongside an antihistamine or decongestant. The end-users or buyers are predominantly individuals or caretakers, but institutional buyers—hospitals, long-term care facilities, and government health services—also represent substantial bulk purchasers of both branded and generic antitussives for in-patient treatment protocols and pandemic preparedness inventories. Understanding the specific purchasing drivers, whether self-medication convenience or physician prescription necessity, is key to tailored market penetration strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc., Bayer AG, Novartis AG, Reckitt Benckiser Group PLC, Sanofi S.A., Takeda Pharmaceutical Company Limited, Merck & Co., Inc., AstraZeneca PLC, Sun Pharmaceutical Industries Ltd., Perrigo Company PLC, Cipla Ltd., Zydus Cadila, Viatris Inc., Daiichi Sankyo Company, Limited, Aurobindo Pharma, Bristol-Myers Squibb Company, Mylan N.V., Amneal Pharmaceuticals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cough Suppressant Drugs Market Key Technology Landscape

The technology landscape for the Cough Suppressant Drugs Market is primarily centered on enhancing drug efficacy, improving patient compliance, and achieving targeted delivery to minimize systemic side effects. A crucial area of innovation involves advanced formulation technologies, specifically microencapsulation and liposomal delivery systems, designed to achieve sustained-release kinetics. This technological advancement allows for longer dosing intervals, improving convenience and ensuring consistent plasma concentration of the active ingredient, which is particularly beneficial for chronic cough management. Furthermore, taste-masking technology remains paramount, especially for pediatric and liquid formulations, where palatability is directly linked to treatment adherence and overall market success.

In addition to formulation science, significant technological strides are being made in the development of targeted antitussive agents through sophisticated receptor pharmacology. Research is actively exploring novel molecular targets beyond the traditional central mechanisms, such as Transient Receptor Potential (TRP) channels and P2X3 receptors located in the peripheral sensory afferent nerves of the airway. High-throughput screening (HTS) and computational chemistry platforms are employed to identify compounds that selectively modulate these peripheral receptors, promising effective cough suppression without the central nervous system side effects (like sedation) associated with older drug classes. This shift represents a fundamental technological pivot from broad-spectrum central agents to highly specific peripheral suppressants.

Another emerging technology involves smart monitoring systems. The integration of wearable sensors and acoustic analysis software, often leveraging Artificial Intelligence (AI) and Machine Learning (ML), allows for objective quantification of cough frequency and intensity in real-time. This technology not only aids in personalized dosing and treatment adjustment but also provides pharmaceutical companies and clinicians with invaluable objective endpoints for clinical trials, replacing subjective patient reporting. This fusion of pharmaceutical chemistry with digital health technology is poised to redefine how cough severity is assessed and managed, moving the market towards highly objective, data-driven therapeutic approaches.

Regional Highlights

North America holds a dominant position in the Cough Suppressant Drugs Market, primarily driven by high consumer awareness, robust healthcare expenditure, and the presence of major pharmaceutical corporations heavily invested in OTC market growth and R&D activities. The United States accounts for the largest share due to the significant prevalence of seasonal respiratory illnesses, coupled with advanced retail distribution infrastructure ensuring widespread product availability. Although regulatory restrictions on controlled antitussives are stringent in both the U.S. and Canada, this fuels innovation in the non-opioid and combination product segments, maintaining the region's technological leadership. High levels of disposable income allow consumers to opt for premium, multi-symptom relief products.

Europe represents a mature market characterized by diverse regional regulations and high adoption of phytomedicines and herbal suppressants, particularly in countries like Germany and France. Western Europe exhibits stable growth, driven by an aging population and high standards of clinical care, while Eastern European markets are expanding rapidly due to increasing healthcare access and improving economic conditions. The market dynamics are heavily influenced by regulatory bodies like the European Medicines Agency (EMA), which ensures standardized safety profiles but often requires complex approval pathways for novel formulations. Strong public health campaigns related to flu vaccination also indirectly influence the demand for symptomatic cold and cough relief.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, presenting immense growth opportunities. Key drivers include massive population bases, rapid urbanization leading to increased exposure to air pollutants, and the highest incidence rates of infectious respiratory diseases, exacerbated by dense living conditions. Countries such as China and India are seeing explosive growth due to the expansion of their middle class, increased spending on healthcare, and the development of local manufacturing capabilities for generic and proprietary antitussive agents. Latin America and the Middle East & Africa (MEA) are emerging regions, where market expansion is gradual but steady, supported by infrastructure improvements and increasing global healthcare integration, though often constrained by fluctuating economies and fragmented distribution networks.

- North America: Market dominance driven by advanced healthcare, high per capita spending, and robust OTC market innovation, particularly in the U.S.

- Europe: Stable growth, high demand for herbal and natural suppressants, and regulatory consistency across major economic blocs.

- Asia Pacific (APAC): Highest growth rate projected due to large populations, poor air quality, and expanding access to modern medicine in China and India.

- Latin America: Emerging market characterized by improving healthcare access and growing demand for affordable generic formulations.

- Middle East and Africa (MEA): Growth driven by infrastructure projects, increasing prevalence of respiratory infections, and rising pharmaceutical imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cough Suppressant Drugs Market.- Johnson & Johnson (McNeil Consumer Healthcare)

- GlaxoSmithKline PLC (GSK)

- Pfizer Inc.

- Bayer AG (Consumer Health)

- Novartis AG

- Reckitt Benckiser Group PLC

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Merck & Co., Inc.

- AstraZeneca PLC

- Sun Pharmaceutical Industries Ltd.

- Perrigo Company PLC

- Cipla Ltd.

- Zydus Cadila

- Viatris Inc.

- Daiichi Sankyo Company, Limited

- Aurobindo Pharma

- Bristol-Myers Squibb Company

- Mylan N.V.

- Amneal Pharmaceuticals

Frequently Asked Questions

Analyze common user questions about the Cough Suppressant Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between opioid and non-opioid cough suppressants?

Opioid cough suppressants, such as codeine, act centrally by depressing the cough center in the brain, offering high efficacy but carrying risks of sedation, dependency, and potential misuse, leading to increased regulatory oversight. Non-opioid suppressants, like dextromethorphan (DM), also act centrally but without significant dependency risk, making them widely available OTC and preferred for mild to moderate cough symptoms.

Which geographical region is expected to demonstrate the fastest growth in the market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate in the Cough Suppressant Drugs Market. This acceleration is attributed to massive population density, rising pollution levels leading to chronic respiratory irritation, rapid economic development enhancing healthcare access, and the high incidence of seasonal infectious diseases requiring symptomatic management.

What are the key drivers propelling the demand for cough suppressant drugs globally?

Key drivers include the persistently high global prevalence of chronic respiratory diseases (COPD, asthma), the recurrent nature of acute upper respiratory infections (cold/flu), demographic shifts favoring an aging population susceptible to chronic cough, and the increasing impact of environmental factors such as severe air pollution and industrial irritants.

How is technological innovation affecting the development of antitussive therapies?

Technological innovation is focusing on advanced drug delivery systems, such as sustained-release formulations and microencapsulation, to improve patient compliance and therapeutic consistency. Furthermore, pharmaceutical research is utilizing high-throughput screening to identify novel molecular targets (e.g., P2X3 receptors) for developing non-sedating, non-addictive antitussive agents with targeted efficacy.

What role do distribution channels play in the market success of cough suppressants?

Distribution channels are crucial, with retail pharmacies and e-commerce platforms dominating the sales of high-volume OTC non-opioid suppressants, capitalizing on consumer convenience and self-medication trends. Hospital pharmacies and specialized clinics remain vital for prescription-strength or controlled substances, requiring stringent supply chain management and compliance protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager