Counter-UAV Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441331 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Counter-UAV Systems Market Size

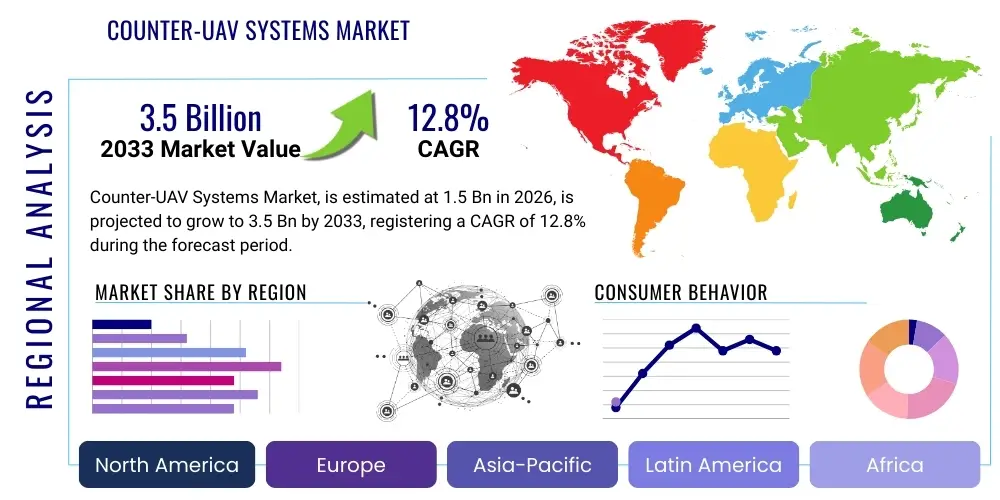

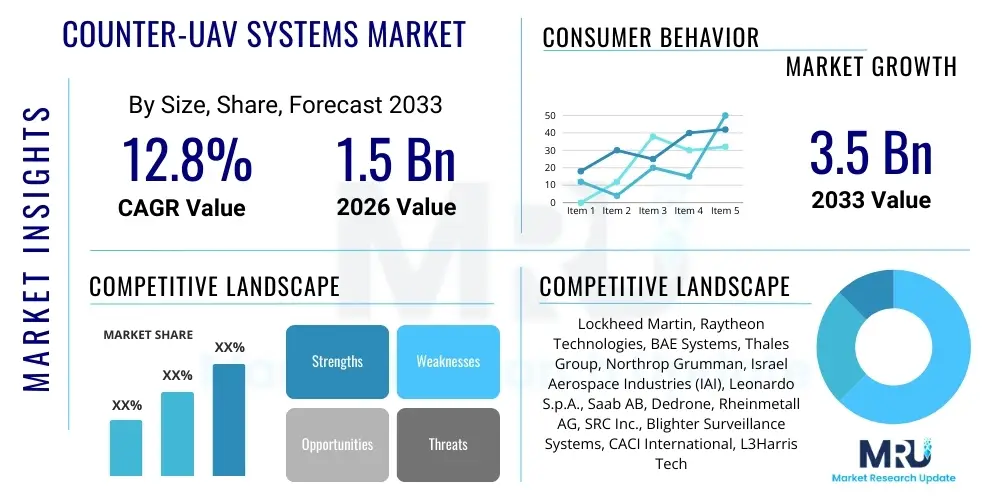

The Counter-UAV Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $1.5 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Counter-UAV Systems Market introduction

The Counter-Unmanned Aerial Vehicle (C-UAV) Systems Market encompasses a suite of technologies designed to detect, track, identify, and neutralize unauthorized or malicious drones and UAVs operating in restricted or sensitive airspace. These systems are crucial components of modern air defense infrastructure, addressing the increasing threat posed by the proliferation of small, commercially available, and often weaponized unmanned aircraft. The core product category includes sophisticated radar systems, Radio Frequency (RF) jammers, directed energy weapons (lasers), and kinetic interception solutions, integrated through advanced command and control software.

Major applications of C-UAV systems span critical infrastructure protection, military base defense, border security, VIP protection, and homeland security operations. For instance, commercial airports and nuclear power plants represent significant end-users, requiring robust layered defense mechanisms against potential aerial disruption or attacks. The increasing ease of access to sophisticated drone technology by non-state actors and criminal organizations necessitates the continuous evolution and deployment of these countermeasure systems globally, driving technological investments in detection and neutralization capabilities that minimize collateral damage.

The market growth is fundamentally driven by escalating geopolitical tensions, the observable shift in warfare tactics favoring asymmetric threats utilizing drones, and the imperative need for governments and private entities to ensure airspace sovereignty and safety. Benefits of advanced C-UAV deployment include rapid threat identification, precise neutralization capability, minimal disruption to protected environments, and the ability to adapt to swarming drone tactics. Key driving factors include supportive government defense spending, regulatory adjustments recognizing drone threats, and rapid advancements in artificial intelligence (AI) and machine learning (ML) to enhance threat classification and response automation.

Counter-UAV Systems Market Executive Summary

The Counter-UAV Systems Market is experiencing robust expansion driven by asymmetric warfare developments and the increasing civilian threat from unauthorized aerial operations, compelling military, government, and commercial sectors to prioritize advanced air domain awareness solutions. Business trends indicate a strong move toward integrated, multi-layered C-UAV architectures, often incorporating passive detection (RF, acoustic) alongside active neutralization (jamming, kinetic, directed energy) technologies. Strategic alliances and mergers between traditional defense contractors and niche technology providers are accelerating the deployment of sophisticated, miniaturized systems. Furthermore, lifecycle management and service contracts related to software updates and platform maintenance are becoming increasingly vital revenue streams for market leaders, shifting the focus beyond initial hardware sales.

Regional trends highlight North America and Europe as foundational markets due to substantial defense budgets and early adoption of regulatory frameworks concerning drone usage near critical infrastructure, particularly airports and government facilities. The Asia Pacific region, however, is projected to demonstrate the highest growth rate, fueled by escalating maritime border disputes, ambitious national security modernization programs in countries like India and South Korea, and significant investments in homeland security technologies aimed at protecting high-density urban areas. Emerging markets in the Middle East and Africa are characterized by high urgency procurement cycles driven by ongoing conflicts and immediate needs for base protection against immediate UAV threats.

Segmentation trends reveal that the Electronic Warfare segment, particularly RF jamming and spoofing technologies, currently dominates the market due to its versatility, lower cost relative to kinetic systems, and potential for deployment on mobile platforms. However, the Directed Energy Weapons (DEW) segment is forecasted to exhibit the highest CAGR, propelled by continuous technological breakthroughs in laser power efficiency, reduced system size, and the promise of unlimited, low-cost engagements against small UAV swarms. Within end-users, the Military and Defense segment remains the largest purchaser, yet the Homeland Security and Commercial segment is rapidly catching up, driven by the acute requirement for protecting airports, prisons, stadiums, and VIP movements from persistent drone surveillance and delivery threats.

AI Impact Analysis on Counter-UAV Systems Market

User inquiries regarding the role of Artificial Intelligence (AI) in Counter-UAV Systems predominantly revolve around four core themes: the speed and accuracy of threat identification, the efficacy of autonomous response capabilities, the challenge of adapting to complex drone swarms, and the ethical/regulatory implications of automated decision-making in kinetic engagements. Users frequently ask how AI can differentiate between benign and malicious drones in dense urban airspace and whether current ML models are sophisticated enough to predict drone trajectory and intent rapidly enough for effective interception. The consensus expectation is that AI integration is mandatory for future system viability, specifically to handle the sheer volume and complexity of data generated by advanced sensors and to coordinate multi-system responses simultaneously against coordinated attacks. The key concern remains ensuring algorithmic resilience against adversarial AI techniques employed by sophisticated threats.

AI's primary transformative impact lies in enhancing the system’s ability to move beyond simple detection thresholds to predictive analysis and automated threat classification, dramatically reducing the cognitive load on human operators. Machine learning algorithms are crucial for processing complex radar signatures, RF spectral data, and electro-optical inputs simultaneously, allowing C-UAV platforms to maintain near-zero false alarm rates while accurately tracking small, fast-moving targets. This level of automated situational awareness is vital when defending expansive areas or managing dynamic threats. Furthermore, AI enables the crucial integration layer where multiple, disparate countermeasure platforms—such as combining a kinetic interceptor launch sequence with simultaneous RF jamming—are orchestrated seamlessly to achieve maximum probability of kill (PK) while minimizing unintended consequences.

The future trajectory of AI in this market points toward fully autonomous, decentralized defense networks capable of learning and adapting in real-time. This involves using deep reinforcement learning to optimize countermeasure deployment based on environmental conditions, target characteristics, and available assets. While the regulatory landscape surrounding autonomous kinetic responses is still evolving, the current utilization focuses heavily on AI-driven decision support and automation of non-lethal responses, such as identifying the drone operator’s location via signal triangulation and automating electronic takeover protocols. This ensures that response times meet the demands of high-velocity threats while maintaining human oversight for engagement authorization, addressing key ethical concerns raised by end-users and the public.

- AI enables rapid, real-time classification of UAVs, distinguishing malicious intent from benign operations based on flight patterns and payload analysis.

- Machine Learning algorithms enhance sensor fusion, integrating data from radar, RF, acoustic, and EO/IR systems to maintain highly accurate tracking in cluttered environments.

- Autonomous threat prioritization and resource allocation optimize the deployment of multiple countermeasures (e.g., directed energy vs. jamming) against complex, multi-layered attacks.

- Predictive analysis powered by AI allows C-UAV systems to anticipate drone trajectories and potential targets, increasing the intercept success rate and minimizing reaction time.

- AI drives the development of sophisticated electronic warfare techniques, automatically adjusting jamming waveforms to defeat adaptive frequency hopping employed by modern drones.

- Deep learning models facilitate the identification and mitigation of advanced swarm tactics, coordinating distributed defense nodes for collective neutralization efforts.

- AI supports cyber-takeover protocols, utilizing machine learning to exploit vulnerabilities in drone communication links for non-kinetic neutralization.

DRO & Impact Forces Of Counter-UAV Systems Market

The Counter-UAV Systems Market is primarily driven by the exponential proliferation of affordable, commercially available drone technology, which necessitates robust defensive measures by both military and civilian security agencies globally. This growth is restrained by the high acquisition cost and the complexity associated with integrating multi-sensor platforms into existing security architectures, particularly for non-defense end-users. Significant opportunities exist in the commercial security domain and through technological advancements like miniaturization and AI integration, which lower the operational footprint and enhance system effectiveness against sophisticated threats. These forces collectively dictate the market dynamics, pushing innovation toward more automated, scalable, and cost-effective solutions while simultaneously navigating stringent regulatory environments regarding electronic spectrum use and kinetic engagement rules of authorization.

Drivers: The fundamental driver is the pervasive threat profile generated by Unmanned Aerial Systems (UAS), ranging from intelligence gathering and smuggling to direct weaponized attacks against critical national infrastructure. Increased defense spending across major economies, spurred by geopolitical instability and the demonstrated effectiveness of drones in contemporary conflicts (e.g., Ukraine, Middle East), fuels procurement cycles for advanced countermeasure technology. Furthermore, regulatory bodies, such as aviation authorities, are increasingly mandating C-UAV installations near high-risk areas like airports and governmental zones following several high-profile security breaches, creating a compulsory demand across the homeland security sector. The shift from state-level threats to accessibility by non-state actors amplifies the urgency for deployment.

Restraints: Significant barriers to market growth include the high initial capital investment required for state-of-the-art C-UAV systems, particularly those utilizing Directed Energy (DE) or complex kinetic interceptors, which limits adoption by smaller commercial entities or regional security forces with limited budgets. Regulatory complexity presents another major hurdle; strict government regulations on the use of electromagnetic spectrum necessary for effective RF jamming often restrict the operational effectiveness of such systems in civilian airspace, where interference with licensed communications must be avoided. Moreover, the rapid technological evolution of drone threats requires continuous, expensive upgrades to C-UAV systems, leading to high lifecycle costs and potential obsolescence risks for early adopters, delaying large-scale deployment.

Opportunities: Key opportunities lie in the development of modular and platform-agnostic C-UAV solutions that can be easily adapted to various deployment scenarios, including vehicle-mounted, fixed site, and portable soldier systems. The commercial market, including large event security (stadiums, concerts), prison systems, and large corporate campuses, represents an untapped growth vector as the threat landscape expands beyond military bases. Technological maturation in solid-state laser systems promises a reduction in size and cost while increasing efficiency, opening avenues for widespread adoption of Directed Energy platforms. Furthermore, the integration of advanced data fusion and AI for cognitive jamming and non-kinetic cyber-takeover capabilities offers high-margin opportunities for specialized software and integration providers.

Impact Forces: The relative impact of these forces is dynamic. Currently, the driving force of escalating drone threats (high impact) significantly outweighs the restraining forces, compelling rapid, immediate market expansion. The increasing accessibility and low cost of threat platforms (drones) pressure manufacturers to develop sophisticated, yet cost-effective, countermeasures (high velocity, high impact). Regulatory complexity acts as a medium-to-high restraining force, especially in densely populated urban environments where RF interference is a concern. However, technological opportunities, particularly the advancement in AI and DEW, provide a strong, positive long-term impulse, setting the stage for the market to transition toward automated, affordable, and highly precise neutralization capabilities, mitigating the current high-cost constraint over the forecast period.

Segmentation Analysis

The Counter-UAV Systems Market is meticulously segmented based on key parameters including the type of countermeasure technology deployed, the operational platform on which the system is mounted, and the specific end-user category demanding the defense capability. This segmentation allows for precise market analysis regarding investment focus, technological maturity, and regional penetration. The primary technological segmentation separates kinetic interception methods, which physically destroy the threat, from non-kinetic methods, which rely on electronic or directed energy neutralization. Platform differentiation addresses whether the system is designed for fixed ground installations, mobile vehicular deployment, or naval/airborne applications, reflecting the need for both static and dynamic protection.

Technology remains the most critical dimension of segmentation, driving research and development efforts toward layered defense strategies that combine passive detection with active mitigation. The market exhibits a clear trend toward integrating multiple technologies (e.g., radar, RF sensors, and EO/IR cameras) into a single Command and Control (C2) system, ensuring maximum detection probability and appropriate countermeasure selection based on threat level and location. The increasing demand for mobile and easily deployable systems reflects the military and law enforcement requirement to protect convoys, forward operating bases, and temporary high-security zones, highlighting the importance of the Platform segment.

The End-User segment demonstrates the evolving threat perception, with the traditional dominance of Military and Defense procurement beginning to see substantial proportional growth from the Homeland Security, Commercial, and Critical Infrastructure Protection sectors. These non-military segments are increasingly investing in sophisticated systems to protect airports from disruption, oil and gas facilities from espionage, and correctional facilities from contraband delivery. This shift necessitates C-UAV systems that prioritize low collateral damage, high precision, and compliance with civilian air traffic regulations, contrasting with military systems that often prioritize high kinetic engagement efficacy.

- By Technology

- Kinetic Systems (Missiles, Projectiles, Nets)

- Electronic Warfare (RF Jammers, GPS Spoofers)

- Directed Energy Weapons (High-Energy Lasers, High-Power Microwave)

- Acoustic and Visual Detection Systems

- By Platform Type

- Ground-based (Fixed Site, Vehicle-Mounted)

- Naval (Shipborne Systems)

- Airborne (Mounted on Helicopters or Fighters)

- Handheld/Portable Systems

- By End-User

- Military and Defense

- Homeland Security and Border Patrol

- Critical Infrastructure (Airports, Power Plants, Oil & Gas)

- Commercial and Private Security (Stadiums, Data Centers)

- By Range

- Short Range (< 5 km)

- Medium Range (5 - 15 km)

- Long Range (> 15 km)

Value Chain Analysis For Counter-UAV Systems Market

The value chain for the Counter-UAV Systems Market begins with upstream activities focused on the research, development, and supply of core components, including high-frequency radar units, specialized RF antennae, high-power solid-state lasers, and sophisticated sensor arrays (EO/IR). This stage is highly capital-intensive and relies heavily on specialized semiconductor manufacturers and defense material suppliers. Midstream activities involve the integration and assembly of these components into functional C-UAV platforms, requiring highly specialized systems engineering expertise to ensure sensor fusion and software interoperability. Major defense primes and specialized technology integrators dominate this crucial stage, focusing on developing proprietary Command and Control (C2) software that manages the layered defense strategy.

Downstream activities center on distribution, deployment, and ongoing support. The distribution channel is often direct-to-customer for high-value military contracts, facilitated through government procurement agencies and regulated by international arms trade agreements. For commercial and homeland security applications, distribution may involve specialized security integrators who provide customized installation and localized maintenance services. Post-deployment support, including mandatory software updates, sensor calibration, and maintenance training, forms a significant part of the value chain, ensuring system resilience against evolving drone technologies and providing recurring revenue opportunities for vendors.

The value chain is characterized by a mix of direct and indirect channels. Direct sales are predominant in the military segment, often involving high-value, multi-year contracts requiring extensive security clearances and customized specifications. Indirect channels, utilizing system integrators and regional security solution providers, are more common in the commercial and critical infrastructure protection segment, allowing manufacturers to reach fragmented smaller markets without maintaining extensive localized service operations globally. The profitability margins are generally highest in the upstream technology and midstream integration phases due to the proprietary nature of the technology and the high barriers to entry.

Counter-UAV Systems Market Potential Customers

The primary customers for Counter-UAV Systems are governmental and military organizations focused on national defense, border security, and maintaining strategic advantage in airspace superiority. These entities, including departments of defense, air forces, and specialized military intelligence units, purchase sophisticated, long-range, multi-layered systems, often prioritizing kinetic and high-power directed energy capabilities for absolute threat neutralization in contested environments. Their requirements are typically non-negotiable on performance and prioritize robust C2 integration with existing air defense architectures, driving demand for premium, customized, and often classified solutions.

The rapidly expanding secondary customer segment consists of homeland security agencies, law enforcement, and critical infrastructure operators. This includes national and regional police forces, coast guards, aviation authorities responsible for airport security, and private operators of facilities like nuclear power plants, major refineries, and public utilities. These buyers are primarily interested in non-kinetic, short-to-medium range systems that offer high detection accuracy with minimal collateral risk, such as RF jamming and acoustic detection systems. Their purchasing decisions are heavily influenced by regulatory compliance, ease of operation in civilian environments, and overall cost-effectiveness.

A third, emerging category of customers encompasses large commercial enterprises and entities responsible for public events and sensitive private spaces. This includes professional sports leagues, large concert venues, correctional facilities (prisons), and private security firms protecting high-net-worth individuals or corporate headquarters. These customers seek highly discrete, easily deployable, and mobile C-UAV solutions, often favoring handheld jammers or small, rapidly movable fixed-site systems. The emphasis here is on preventing surveillance, protecting intellectual property, and mitigating physical security risks related to unauthorized payload drops, marking a highly lucrative growth area for specialized portable systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, Raytheon Technologies, BAE Systems, Thales Group, Northrop Grumman, Israel Aerospace Industries (IAI), Leonardo S.p.A., Saab AB, Dedrone, Rheinmetall AG, SRC Inc., Blighter Surveillance Systems, CACI International, L3Harris Technologies, Moog Inc., Teledyne FLIR, General Dynamics, DroneShield Ltd., Elbit Systems, Airbus SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Counter-UAV Systems Market Key Technology Landscape

The Counter-UAV Systems Market is defined by a rapidly evolving technological landscape focused on achieving higher detection fidelity, faster reaction times, and lower engagement costs. The foundational technologies include advanced radar systems, particularly AESA (Active Electronically Scanned Array) and 3D radar, which are essential for accurately tracking small, low-RCS (Radar Cross Section), and slow-moving targets in complex airspaces. Complementing radar are passive sensors, such as sophisticated Radio Frequency (RF) detection and geolocation systems that passively monitor drone command and control signals, and Electro-Optical/Infrared (EO/IR) cameras, which provide visual confirmation and high-resolution tracking once a target is detected by other means.

In terms of neutralization, the market showcases three distinct, competitive, and often complementary approaches. Electronic Warfare (EW) remains dominant for civilian applications, utilizing GPS spoofing to confuse the drone's navigation or RF jamming to sever the connection between the operator and the drone, forcing a safe landing or return-to-home protocol. The kinetic approach, involving physical interception via high-speed projectiles, nets, or specialized interceptor drones, is preferred by military users for guaranteed neutralization, but suffers from high cost per engagement. The most promising long-term technology is Directed Energy Weapons (DEW), specifically high-energy lasers (HEL) and high-power microwaves (HPM). DEW offers the potential for near-instantaneous, precise neutralization at the speed of light with a very low cost per shot, representing the future standard for defense against drone swarms, despite current challenges related to size, power, and beam stability in adverse weather.

The crucial technology tying these disparate systems together is the sophisticated Command, Control, Communications, Computers, and Intelligence (C4I) software layer. Modern C-UAV systems increasingly leverage AI and machine learning within their C4I frameworks to perform sensor fusion, automated threat assessment, and coordinated, synchronized countermeasure deployment across multiple assets. This software layer is responsible for distinguishing friend from foe, predicting complex swarm behavior, and executing sophisticated cyber-takeover attempts. Further innovation includes developing quantum radar technology for improved stealth detection, and integrating 5G communication protocols for rapid data transfer between dispersed C-UAV nodes, enhancing system resilience and responsiveness in large-area protection scenarios.

Regional Highlights

Geographical analysis of the Counter-UAV Systems Market reveals pronounced variance in threat priorities, regulatory environments, and expenditure patterns across major regions, influencing the type of technology adopted and the pace of market growth.

- North America: This region holds a significant market share, driven primarily by the robust defense spending of the United States and Canada, focused heavily on military base protection and federal critical infrastructure security (e.g., White House, military installations). Adoption is characterized by high integration of cutting-edge technologies, including advanced radar, AI-driven sensor fusion, and substantial investment in Directed Energy Weapons research and fielding programs. The market here is highly mature, with stringent regulatory frameworks influencing technology deployment, particularly concerning civil aviation safety and spectrum usage. Key market drivers include the development of mobile C-UAV platforms for border security and rapid deployment units.

- Europe: The European market is characterized by a high degree of fragmentation but substantial overall expenditure, motivated by homeland security concerns, major sporting event security (e.g., Olympics, UEFA events), and airport protection against disruptions. Countries such as the UK, France, and Germany are leading the adoption curve, focusing mainly on Electronic Warfare solutions due to the high density of civilian air traffic and the reluctance to use kinetic interceptors in urban settings. Regulatory harmonization through bodies like the European Union Aviation Safety Agency (EASA) regarding drone risk management is a critical factor driving standardized C-UAV procurement.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by escalating maritime and territorial disputes, and ambitious military modernization programs, particularly in China, India, Japan, and South Korea. These nations face significant military threats from state-level UAV technology as well as high-density urban security challenges. The market exhibits high demand for long-range surveillance and tracking systems alongside versatile neutralization methods. Investment is strong in both kinetic systems for military use and affordable RF jamming solutions for rapidly deploying security in densely populated areas and commercial critical infrastructure.

- Middle East and Africa (MEA): This region demonstrates a high urgency for C-UAV deployment, driven by ongoing internal and cross-border conflicts and frequent documented attacks on energy infrastructure and military assets using sophisticated weaponized drones. Demand here is immediate and heavily focused on ruggedized, proven military-grade systems, often procured through foreign military sales (FMS) from North American and European suppliers. The threat profile mandates robust, high-power solutions, including advanced kinetic interceptors and heavy-duty jamming capabilities designed to operate effectively in challenging desert and maritime environments.

- Latin America: This market is comparatively nascent but growing steadily, driven by the need for border security against drug trafficking, internal security monitoring, and protecting high-value national resources like mining operations and oil fields. The primary focus is on cost-effective, easily maintainable detection and RF neutralization systems. Market maturity is accelerating due to the rising awareness of drone misuse by criminal organizations, leading to increasing budgetary allocations for localized and portable C-UAV technologies in key countries like Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Counter-UAV Systems Market.- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Thales Group

- Northrop Grumman

- Israel Aerospace Industries (IAI)

- Leonardo S.p.A.

- Saab AB

- Dedrone

- Rheinmetall AG

- SRC Inc.

- Blighter Surveillance Systems

- CACI International

- L3Harris Technologies

- Moog Inc.

- Teledyne FLIR

- General Dynamics

- DroneShield Ltd.

- Elbit Systems

- Airbus SE

Frequently Asked Questions

Analyze common user questions about the Counter-UAV Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between kinetic and non-kinetic C-UAV systems?

Kinetic C-UAV systems physically destroy the drone using projectiles, missiles, or nets, guaranteeing neutralization but often resulting in debris and high cost per engagement. Non-kinetic systems, such as Electronic Warfare (RF jamming, GPS spoofing) and Directed Energy Weapons (lasers), disable the drone without physical impact, offering lower collateral risk and operational cost.

How is Artificial Intelligence (AI) enhancing the effectiveness of Counter-UAV technology?

AI significantly enhances C-UAV effectiveness by providing rapid, autonomous threat classification and real-time sensor fusion across radar, RF, and EO/IR inputs. This allows systems to accurately distinguish between benign and malicious targets, prioritize responses in complex environments, and coordinate layered countermeasure deployments automatically.

Which end-user segment is experiencing the fastest growth in C-UAV adoption?

The Homeland Security and Critical Infrastructure Protection segment, including airports, oil and gas facilities, and government buildings, is exhibiting the fastest growth. This acceleration is driven by regulatory mandates and the acute need to mitigate security risks and prevent operational disruptions caused by the increasing prevalence of civilian drone misuse.

What are the main regulatory challenges facing the widespread deployment of C-UAV systems?

The primary regulatory challenge involves the legal restrictions on using the electromagnetic spectrum (Radio Frequency jamming) in civilian airspace, which can interfere with licensed communications and navigation systems. Obtaining necessary frequency authorization and ensuring compliance with civil aviation safety standards are major hurdles for commercial C-UAV deployment.

What is the future potential of Directed Energy Weapons (DEW) in the C-UAV market?

Directed Energy Weapons, particularly high-energy lasers, represent the future of C-UAV technology due to their low cost per shot, high precision, and ability to engage drone swarms rapidly. Ongoing advancements are focused on miniaturizing systems, improving beam stability in various weather conditions, and increasing power output to make DEW the standard for long-term defense solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager