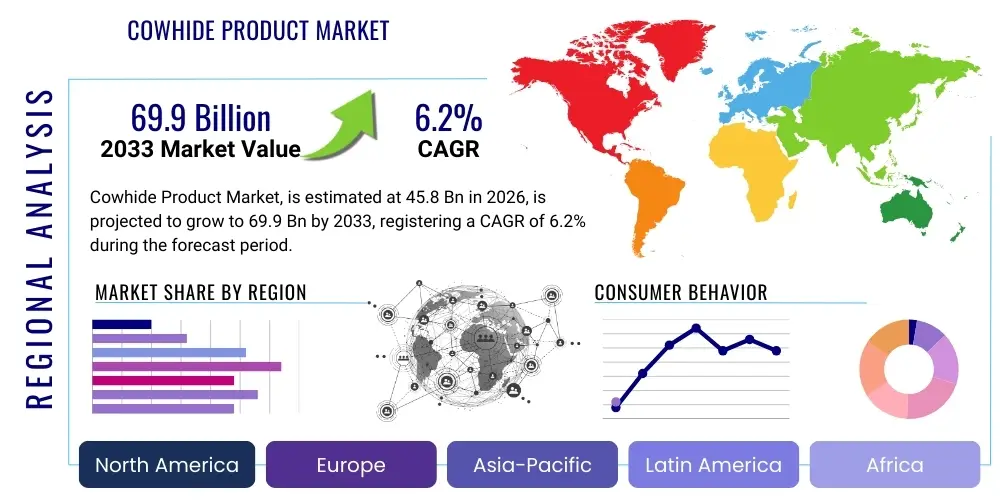

Cowhide Product Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443637 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Cowhide Product Market Size

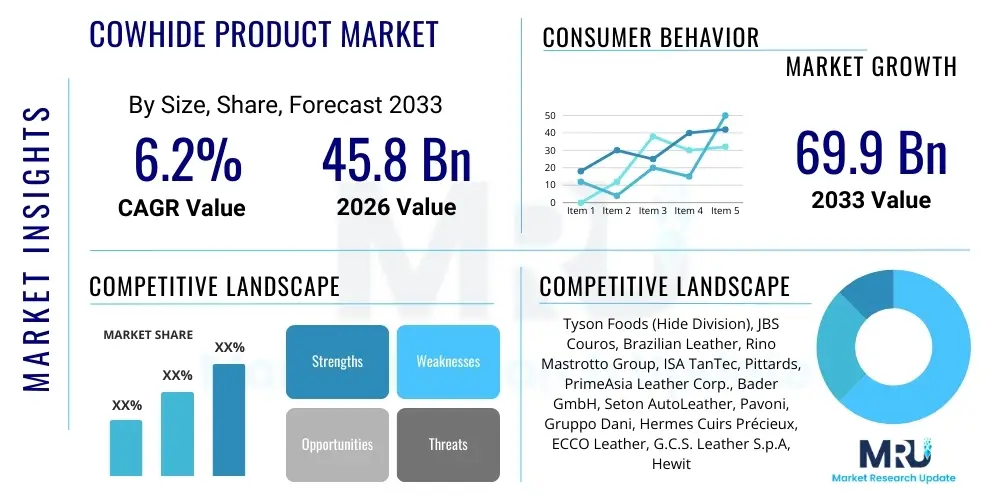

The Cowhide Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 69.9 Billion by the end of the forecast period in 2033.

Cowhide Product Market introduction

The Cowhide Product Market encompasses the entire value chain involved in transforming raw bovine hides into finished goods, spanning from primary processing (tanning and finishing) to the manufacturing of high-value consumer products such as luxury footwear, automotive upholstery, apparel, and durable accessories. This market is fundamentally driven by the inherent durability, aesthetic appeal, and versatility of cowhide leather, making it a preferred material across various industries including fashion, furniture, and transportation. Key applications include luxury goods production where authenticity and quality are paramount, the automotive sector requiring high performance and longevity for interiors, and the residential and commercial furnishing markets demanding robust, aesthetically pleasing materials.

The primary benefits derived from cowhide products include superior tensile strength, natural moisture resistance, and an ability to develop a desirable patina over time, which enhances the product's value and lifespan. Furthermore, advancements in tanning technology, particularly the shift toward chrome-free and vegetable-tanning methods, are mitigating environmental concerns, thereby sustaining consumer demand for premium leather goods. The complexity of the market is amplified by the diverse range of hide grades and finishes available, such as full-grain, top-grain, corrected-grain, and suede, each catering to specific price points and end-use applications, ensuring market resilience across varying economic climates globally.

Driving factors for the substantial growth of the Cowhide Product Market include rapid urbanization and rising disposable incomes in emerging economies, particularly across the Asia Pacific region, leading to increased purchasing power for luxury and branded leather items. The growing demand for comfortable, durable, and aesthetically appealing car interiors is significantly boosting the usage of cowhide in the automotive sector. Moreover, the robust supply chain connecting the meat industry (the primary source of raw hides) and the processing industry, coupled with innovations in chemical processing that improve leather quality and consistency, continue to propel market expansion despite intermittent challenges posed by synthetic alternatives. Sustainability initiatives focused on traceability and ethical sourcing are further positioning natural cowhide leather as a premium, long-term material choice.

Cowhide Product Market Executive Summary

The Cowhide Product Market is poised for significant expansion, characterized by a fundamental shift toward sustainable sourcing practices and technological integration within the tanning process. Current business trends indicate a strong bifurcation in the market: the luxury segment is focusing heavily on ethical traceability using blockchain technology to verify the origin and processing of hides, while the mass-market segment is optimizing production efficiencies through automation and advanced chemical formulations. Key stakeholders are strategically investing in vertical integration, acquiring tanning and finishing operations to ensure consistent quality control and streamline the supply chain from raw hide to finished consumer product, thereby mitigating risks associated with volatile raw material prices and stringent regulatory standards related to environmental protection.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive consumer bases in China and India exhibiting increasing appetite for high-quality footwear, apparel, and accessories. Europe and North America, while mature, remain dominant in terms of value generation, setting global trends in premium and specialty leather finishing, particularly vegetable-tanned and chrome-free leathers favored by luxury brands. Manufacturers in these regions are responding to stringent European Union (EU) regulations regarding chemical usage (e.g., REACH compliance) by adopting cleaner processing technologies. Meanwhile, regions like Latin America and the Middle East are critical suppliers of high-quality raw hides, focusing on optimizing livestock husbandry and primary preservation techniques to meet international quality specifications demanded by major global tanneries.

Segmentation trends highlight the dominance of the Footwear and Apparel segments due to their high volume and consumer frequency, though the Automotive segment exhibits the highest growth potential driven by persistent demand for premium vehicle interiors offering enhanced comfort and longevity. Within the type segmentation, full-grain leather maintains its premium position, favored for its natural aesthetics and durability in luxury applications, while split and corrected-grain leathers dominate the mid-range and mass-market segments. The upholstery sector, covering both furniture and auto interiors, is seeing innovations in finish coatings to enhance stain resistance and UV protection, broadening the applicability of cowhide products in demanding environments.

AI Impact Analysis on Cowhide Product Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cowhide Product Market frequently revolve around optimizing quality control, improving raw hide grading accuracy, and enhancing supply chain traceability. Users are highly concerned with how AI can minimize defects during the crucial tanning stage, which significantly impacts material yield and final product cost. There is significant interest in predictive analytics for demand forecasting based on fashion trends and seasonal retail data, allowing tanneries and manufacturers to optimize inventory management and reduce material waste. Furthermore, users expect AI solutions to deliver more robust mechanisms for verifying ethical sourcing and ensuring compliance with complex global regulatory frameworks, leveraging image recognition and machine learning to authenticate hide origin and processing records effectively. This adoption is viewed as essential for maintaining competitive advantage and meeting the transparency demands of modern consumers and brand partners.

- Quality Inspection Automation: AI-powered computer vision systems deployed during the sorting and finishing stages to detect subtle defects, scars, or inconsistencies in hides with precision far exceeding manual inspection, thereby optimizing cut yield and material grading.

- Predictive Tanning Analytics: Machine learning models analyzing large datasets on tanning liquor composition, temperature, and duration to predict optimal process parameters, ensuring consistent color, texture, and physical properties of the finished leather, minimizing batch variability.

- Supply Chain Traceability Enhancement: Implementation of blockchain linked with AI validation tools to record and verify every step from farm (slaughterhouse) to finished product, improving transparency and facilitating compliance with sustainability standards (e.g., deforestation-free pledges).

- Inventory and Demand Forecasting: AI algorithms analyzing historical sales, economic indicators, and fashion trend data to forecast future demand for specific leather types, colors, and finishes, leading to reduced stockouts and optimized production scheduling for tanneries.

- Waste Reduction Optimization: Using sensor data and machine learning in the cutting room to optimize pattern nesting, significantly reducing material waste (scrap leather) during the manufacturing of footwear, apparel, and upholstery components.

- Customer Experience Personalization: AI tools assisting retailers in providing highly personalized recommendations for cowhide products based on user preferences, purchase history, and aesthetic data captured through online interactions.

DRO & Impact Forces Of Cowhide Product Market

The Cowhide Product Market is shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces that dictate long-term viability and profitability. Primary drivers include sustained global demand for high-quality, durable goods in the luxury and automotive sectors, coupled with increasing consumer awareness regarding the superior longevity of natural leather compared to many synthetic alternatives. However, the market faces significant restraints, chiefly volatility in raw hide prices tied directly to the beef industry cycle and intense scrutiny over the environmental footprint of conventional chrome tanning processes, which can restrict market access in environmentally sensitive regions. Opportunities emerge through technological innovation, specifically the development and scaling of bio-based and chrome-free tanning chemicals, alongside the strategic expansion into emerging markets seeking affordable yet robust leather goods, positioning sustainability as a key differentiator and growth avenue.

Impact forces currently reshaping the competitive landscape include rigorous global regulatory pressures, such as the aforementioned EU REACH mandates and evolving standards concerning ethical labor practices throughout the supply chain, demanding increased investment in compliance infrastructure. Furthermore, the accelerating trend toward circular economy models exerts pressure on manufacturers to design products for repair and longevity, favoring high-quality cowhide. The rise of sophisticated synthetic and bio-engineered leather alternatives poses a constant competitive threat, forcing traditional cowhide producers to continually innovate texture, finish, and performance characteristics to justify the premium price point and maintain material preference among designers and consumers globally.

- Drivers (D): Robust demand for luxury goods; high durability and natural aesthetic appeal; growth in automotive upholstery segment; improving livestock quality impacting raw hide availability.

- Restraints (R): Extreme volatility and dependence on the beef industry for raw materials; high capital investment required for compliant tanning facilities; strict environmental regulations (water usage, chemical discharge); competition from advanced synthetic leather substitutes.

- Opportunities (O): Expansion into fast-growing APAC consumer markets; adoption of chrome-free and vegetable tanning technologies for premiumization; development of traceable, ethically sourced supply chains (blockchain integration); increased usage in high-end aerospace and marine interiors.

- Impact Forces: Global regulatory compliance mandates; consumer demand for verifiable ethical sourcing and sustainability; technological advancements in finishing and coating techniques; geopolitical instability affecting cross-border raw material trade.

Segmentation Analysis

The Cowhide Product Market is highly heterogeneous, categorized comprehensively based on product type, end-use application, and processing method, reflecting the vast range of qualities and finished goods derived from bovine hides. Segmentation by product type primarily distinguishes between Full-Grain, Top-Grain, Corrected-Grain, and Suede, reflecting the surface quality, durability, and corresponding price tier. Full-Grain leather, retaining the natural texture and imperfections of the hide, commands the highest premium, predominantly used in high-end luxury items. Conversely, Corrected-Grain and Split Leather are foundational for mass-market items like low-cost footwear and economical upholstery, having undergone significant surface modification to minimize natural defects and achieve uniformity.

Application segmentation reveals the dominance of sectors requiring material durability and prestige. Footwear and apparel remain the largest volume consumers due to mass market penetration and cyclical fashion trends. The automotive sector, however, is a critical growth area, demanding specialized cowhide that meets stringent requirements for UV stability, fire resistance, and abrasion tolerance over extended periods. Processing method segmentation highlights the environmental evolution of the industry, differentiating between chrome tanning (the most common and fast method) and chrome-free alternatives such as vegetable tanning (favored for traditional aesthetics and ecological appeal) and newer wet-white tanning processes, indicating the industry's response to regulatory and consumer-driven sustainability mandates.

- By Type:

- Full-Grain Leather

- Top-Grain Leather

- Corrected-Grain/Split Leather

- Suede/Nubuck

- By Application:

- Footwear (Dress, Casual, Industrial)

- Apparel (Jackets, Gloves, Accessories)

- Upholstery (Furniture, Residential, Commercial)

- Automotive Interiors (Seats, Dashboards, Trims)

- Luggage and Bags (Handbags, Wallets, Briefcases)

- Industrial and Safety Goods

- By Processing Method:

- Chrome Tanning (Wet Blue)

- Vegetable Tanning

- Aldehyde Tanning (Wet White/Chrome-Free)

Value Chain Analysis For Cowhide Product Market

The value chain of the Cowhide Product Market is intricate, commencing significantly upstream with the meat processing industry, which generates raw hides as a crucial byproduct. Upstream analysis involves livestock farming and slaughterhouses, which determine the initial quality and quantity of the raw material. Preservation methods, primarily salting or chilling immediately after slaughter, are critical to prevent deterioration before the hide reaches the tannery. The efficiency and hygiene standards maintained at this initial stage profoundly impact the final leather quality and yield. Tanneries constitute the central, highly technical midstream segment, performing soaking, dehairing, liming, tanning, and finishing processes. This stage is capital-intensive and subject to rigorous environmental controls, where chemical expertise transforms the perishable hide into durable leather (known as 'wet-blue' or 'crust').

The distribution channel is segmented into direct and indirect routes. Direct distribution often involves large tanneries supplying finished leather directly to major manufacturers (e.g., automotive companies or high-end luxury brands) under long-term contracts, ensuring specified quality and volume. Indirect channels utilize specialized leather traders and distributors who cater to smaller manufacturers, boutique designers, and artisanal workshops, offering a wider variety of finishes and smaller batch sizes. These intermediaries play a crucial role in consolidating supply and managing the geographical dispersion between tanneries and thousands of end-product manufacturers globally. The downstream segment involves the extensive manufacturing of consumer goods, where leather is cut, stitched, and assembled into final products such as shoes, jackets, and furniture, followed by retail distribution.

Downstream analysis focuses on the manufacturing efficiency and brand strength of the final product producers. For instance, footwear manufacturers employ specialized lasting and stitching technologies, while automotive suppliers must adhere to Original Equipment Manufacturer (OEM) specifications for safety and durability testing. The final stage involves marketing and retail, where brand image, material sourcing narrative (sustainability and traceability), and consumer perception heavily influence purchasing decisions. The integration of digital platforms and e-commerce has shortened the distance between manufacturers and consumers, particularly for smaller, artisanal cowhide product brands, demanding greater transparency about the provenance and environmental credentials of the leather utilized.

Cowhide Product Market Potential Customers

The primary end-users and buyers of cowhide products are highly segmented across various industries demanding superior material performance, longevity, and natural aesthetic appeal. Major potential customers include global luxury fashion houses that depend on full-grain and top-grain cowhide for premium handbags, wallets, and high-end apparel where material quality validates high price points. Additionally, large-scale mass-market footwear manufacturers represent a significant customer base, utilizing corrected-grain and split leathers for durable and cost-effective everyday shoes and boots. The automotive industry, specifically OEM suppliers and vehicle manufacturers, constitutes a high-value customer group demanding vast quantities of specialized, highly finished leather for seating, steering wheel wraps, and interior trims that meet stringent safety and longevity specifications.

Beyond fashion and transportation, the furniture and interior design sectors are key buyers, purchasing finished cowhide for residential and commercial upholstery applications, emphasizing natural texture, color consistency, and durability against wear and tear in high-traffic areas. Specialized industrial sectors also serve as consistent potential customers, utilizing rugged, thicker cowhide for protective gear, industrial gloves, and specialized machinery components where tear resistance and physical protection are paramount. Finally, the growing segment of consumers focused on sustainable and ethical consumption represents an increasingly important customer demographic, preferentially seeking products made from traceable, chrome-free, or vegetable-tanned cowhide, driving manufacturers to adopt transparent sourcing practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 69.9 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tyson Foods (Hide Division), JBS Couros, Brazilian Leather, Rino Mastrotto Group, ISA TanTec, Pittards, PrimeAsia Leather Corp., Bader GmbH, Seton AutoLeather, Pavoni, Gruppo Dani, Hermes Cuirs Précieux, ECCO Leather, G.C.S. Leather S.p.A, Hewitt & Booth, Atlantic Leather, Whitehouse Cox, Moore & Giles, Pergamena Tannery, Hermann Oak Leather Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cowhide Product Market Key Technology Landscape

The technology landscape within the Cowhide Product Market is undergoing a rapid evolution, driven primarily by the need for improved sustainability, process efficiency, and enhanced material performance. A critical technological shift involves advanced chrome-free tanning methods, such as wet-white (using glutaraldehyde or syntans) and comprehensive vegetable tanning systems. These technologies address regulatory constraints on heavy metals while providing leathers with properties increasingly suitable for automotive and infant product applications, traditionally dominated by chrome. Furthermore, sophisticated water treatment and recycling technologies are being universally adopted by leading tanneries to manage and significantly reduce the high water consumption and effluent discharge characteristic of traditional leather production, ensuring compliance with global environmental standards.

In the finishing stage, innovation focuses on high-performance coatings and digital printing technologies. Polyurethane-based finishes are being refined to offer superior abrasion, stain, and fade resistance, crucial for the automotive and commercial upholstery segments. Digital printing on finished leather allows for bespoke designs, textures, and patterns without compromising the material’s natural integrity, providing customization capabilities previously unavailable. This enhances the appeal of cowhide products in fast-fashion and design-led furniture markets. Crucially, in-line quality inspection systems utilizing advanced machine vision and spectral analysis are becoming standard, offering real-time defect detection and color matching, significantly reducing waste and improving batch consistency, thereby streamlining production flow.

The increasing focus on traceability has necessitated the widespread adoption of digital identity technologies, including RFID tags and blockchain integration. These tools are applied immediately upon hide acquisition and follow the material through every processing step—from pre-tanning to shipment. This infrastructure enables brands and consumers to verify the origin, processing history, and compliance status (e.g., animal welfare, chemical usage) of the cowhide product, directly supporting premium pricing and corporate social responsibility goals. The convergence of bio-chemistry (for eco-friendly chemicals), automation (for material handling), and digital tracking forms the core technological advancements driving market modernization and competitive differentiation in the global cowhide industry.

Regional Highlights

The global Cowhide Product Market exhibits distinct regional dynamics reflecting variations in consumption patterns, production capacities, regulatory environments, and raw hide availability. Asia Pacific (APAC) stands out as the primary growth engine, characterized by a massive manufacturing base (particularly in China, Vietnam, and India) for footwear and accessories, coupled with rapidly expanding domestic consumer markets fueled by increasing affluence. APAC is both a major processor and consumer, with strategic investments pouring into modernizing tanning infrastructure to meet export quality demands, although facing significant challenges in environmental management.

Europe maintains its position as the global benchmark for luxury and specialized leather finishing. European tanneries, concentrated in Italy, Spain, and Germany, dominate the production of high-end, vegetable-tanned, and technically demanding leathers for the premium fashion and automotive sectors. This region’s market strength is driven by heritage, design leadership, and strict adherence to stringent environmental regulations (e.g., EU REACH), positioning European-processed cowhide as a high-value commodity globally.

North America, while having significant raw hide production (driven by large beef processing industries), is primarily a consumer market for finished cowhide products, particularly high-quality automotive upholstery and premium goods. The Middle East and Africa (MEA) and Latin America (LATAM) are critical suppliers of raw hides due to vast livestock populations, with Brazil and Argentina being major global exporters. These regions are increasingly focused on improving primary hide preservation and enhancing internal processing capacity to capture more value from the raw material before export.

- Asia Pacific (APAC): Dominant in manufacturing and fastest-growing consumer market; key hubs include China, India, and Vietnam, driving demand for footwear and apparel leather.

- Europe: Leader in high-value, specialized, and sustainable tanning (e.g., vegetable tanning); strong market due to established luxury fashion and premium automotive industries.

- North America: Major consumer of finished cowhide products, especially in the automotive and high-end furniture sectors; significant producer of raw hides tied to the US beef industry.

- Latin America (LATAM): Major global source of raw hides (Brazil, Argentina); increasing focus on modernizing local tanning operations to compete globally on finished leather quality.

- Middle East and Africa (MEA): Emerging market with increasing domestic demand for upholstery and apparel; key supplier of certain specialized raw hides.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cowhide Product Market, spanning raw material suppliers, specialized tanneries, and finished product manufacturers.- Tyson Foods (Hide Division)

- JBS Couros

- Brazilian Leather

- Rino Mastrotto Group

- ISA TanTec

- Pittards

- PrimeAsia Leather Corp.

- Bader GmbH (Automotive Leather Specialist)

- Seton AutoLeather

- Pavoni

- Gruppo Dani

- Hermes Cuirs Précieux

- ECCO Leather

- G.C.S. Leather S.p.A

- Hewitt & Booth

- Atlantic Leather

- Whitehouse Cox

- Moore & Giles

- Pergamena Tannery

- Hermann Oak Leather Co.

- Wollsdorf Leder Schmidt & Co. GmbH

- General Leather Co. Ltd.

- F.lli Rosati S.R.L.

- Conceria Pasubio S.p.A.

Frequently Asked Questions

Analyze common user questions about the Cowhide Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for high-quality cowhide products?

Demand is primarily driven by the luxury and automotive sectors where cowhide offers unmatched durability, natural aesthetics, and material longevity. Furthermore, rising disposable incomes in APAC regions increase consumer spending on premium leather goods.

How is the cowhide product market addressing environmental concerns?

The market is shifting towards sustainable processing technologies, including the widespread adoption of chrome-free (wet-white) and vegetable tanning methods. Key players are also investing heavily in water recycling systems and traceable sourcing mechanisms to minimize ecological impact and ensure regulatory compliance.

Which geographical region shows the highest growth potential for cowhide products?

Asia Pacific (APAC) exhibits the highest growth potential due to rapid industrialization, massive manufacturing output for global supply chains, and increasing domestic consumer demand for leather footwear, accessories, and furniture in countries like China and India.

What is the role of AI and technology in modern cowhide production?

AI is crucial for enhancing efficiency and quality control. It is used in automated vision systems for defect detection, predictive analytics for optimizing tanning parameters, and blockchain integration for robust, transparent supply chain traceability from farm to finished product.

What is the difference between Full-Grain and Corrected-Grain cowhide?

Full-Grain leather retains the entire original surface of the hide, including all natural marks and textures, offering the highest durability and breathability. Corrected-Grain leather has had its surface sanded and heavily finished to remove imperfections, resulting in a more uniform appearance and making it suitable for lower-cost, mass-market applications.

What are the main segments of the cowhide product market by application?

The main segments by application are Footwear, Apparel, Upholstery (residential and commercial), Automotive Interiors, and Luggage/Accessories. Footwear and Automotive are particularly dominant due to volume and value requirements, respectively.

How does raw hide pricing affect the overall market?

Raw hide pricing is a significant restraint because it is a byproduct of the beef industry, meaning supply and price volatility are often dictated by meat demand, not leather demand. Price instability creates challenges for tanneries and manufacturers in managing production costs and profit margins.

Is vegetable-tanned cowhide environmentally superior to chrome-tanned leather?

Vegetable tanning generally uses natural tannins derived from plants and is biodegradable, often considered more environmentally friendly than traditional chrome tanning, which uses heavy metals. However, vegetable tanning is more water-intensive and time-consuming, while modern chrome tanning methods are increasingly employing high-efficiency recycling systems to mitigate environmental impact.

Which companies are dominating the raw hide supply chain?

Companies with large-scale meat processing operations, such as JBS and Tyson Foods (through their hide divisions), are major global suppliers of raw bovine hides, dictating the initial flow of raw materials to tanneries worldwide, particularly those located in Brazil, the US, and Australia.

How is the increasing use of electric vehicles (EVs) impacting the market?

The EV transition is positively impacting the market as EV manufacturers often prioritize luxury, high-quality, sustainable interior materials to differentiate their vehicles. This drives demand for specialized, lightweight, and high-performance cowhide leathers that meet stringent durability and sustainability criteria.

What is the significance of the wet-white tanning process?

Wet-white is a chrome-free tanning method using organic compounds (aldehydes) that produces a light-colored, easily dyeable, and sustainable leather intermediate. This process is favored for leathers used in baby products and the automotive industry due to its hypoallergic and non-toxic properties.

How do global trade disputes affect the cowhide market?

Global trade disputes, particularly between major raw material exporters (like the US and Brazil) and key processing regions (like China and the EU), introduce volatility through tariffs and logistical hurdles. This forces market participants to frequently reroute supply chains and adjust long-term procurement strategies, increasing operational costs.

What role do independent leather traders play in the value chain?

Independent leather traders act as crucial intermediaries, consolidating smaller batches of finished leather from various tanneries and distributing them to manufacturers who require specialized finishes or lower volumes. They manage credit risk and logistical complexity, particularly serving artisanal businesses and localized production hubs globally.

Which specific technology is essential for confirming ethical sourcing?

Blockchain technology, often combined with AI-enabled image verification and immutable digital ledgers, is essential for confirming ethical sourcing. It provides an auditable, decentralized record of the hide's origin, animal welfare practices, and processing chemicals used, ensuring transparency for luxury brands and regulatory bodies.

What is the typical lifespan of a high-quality cowhide product?

A high-quality, full-grain cowhide product, such as premium footwear or luxury furniture upholstery, can often last several decades with proper care, showcasing superior durability compared to most synthetic materials, thereby justifying the initial investment and aligning with circular economy principles.

How do cowhide product manufacturers differentiate themselves in a competitive market?

Differentiation is achieved through specialization in niche finishes (e.g., highly resistant automotive leather, unique vegetable-tanned aesthetics), verifiable ethical sourcing and sustainability certifications, brand reputation for consistency, and close collaboration with luxury designers to drive material innovation and trend setting.

What types of defects are most costly in raw hides?

The most costly defects include brands (fire brands), parasite damage (e.g., ticks), physical cuts (knife cuts during flaying), and grain damage from improper preservation. These defects reduce the usable area of the hide, leading to lower grading, reduced yield, and significant financial losses for tanneries.

How is digital transformation affecting leather retail?

Digital transformation is enabling personalized virtual product fittings, enhanced transparency via digital traceability tags accessible by consumers, and direct-to-consumer (D2C) e-commerce models that bypass traditional retail channels, offering customized cowhide product options.

What regulations pose the greatest challenge to European tanneries?

The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation poses the greatest challenge, strictly limiting the use of certain chemicals (like specific AZO dyes and heavy metals) in tanning and finishing, necessitating constant investment in costly, compliant chemical formulations.

Why is cowhide preferred over other hides like sheep or goat?

Cowhide is preferred due to its superior thickness, strength, and durability, making it ideal for structural applications like footwear outers and durable upholstery. While sheep and goat hides are softer and lighter, cowhide offers the necessary resilience and abundance for large-scale industrial and luxury goods production.

What innovations are emerging in the surface finishing of cowhide?

Innovations include the development of self-healing polymer coatings that reduce scuffing and scratches, advanced water-repellent finishes for outdoor applications, and digital laser etching and printing techniques to apply highly detailed, consistent patterns and textures that mimic exotic skins or natural aging.

How does the economic health of the beef industry correlate with the cowhide market?

The economic health of the beef industry is directly correlated as raw hides are a co-product. High beef demand increases raw hide supply, potentially lowering hide prices, while falling beef demand restricts hide availability, generally leading to higher raw material costs for the leather market.

What are the implications of the "deforestation-free" mandates on sourcing?

Deforestation-free mandates, especially those affecting Latin American sourcing, require tanneries and brands to implement stringent tracking systems to prove that the livestock generating the hides were not raised on recently deforested land. This dramatically increases transparency requirements and reliance on satellite monitoring and blockchain technologies.

Which specific application segment is expected to show the highest CAGR?

The Automotive Interiors segment is expected to show the highest CAGR, driven by persistent consumer demand for luxurious, durable, and comfortable cabins in both traditional internal combustion engine (ICE) vehicles and increasingly in high-end electric vehicles (EVs) globally.

What is the primary challenge faced by tanneries in emerging markets?

The primary challenge for tanneries in emerging markets is often securing the necessary capital investment and technical expertise to upgrade facilities to meet stringent international environmental and chemical compliance standards required by major global brands in Europe and North America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager