Crane Mounted Waste Compactor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442972 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Crane Mounted Waste Compactor Market Size

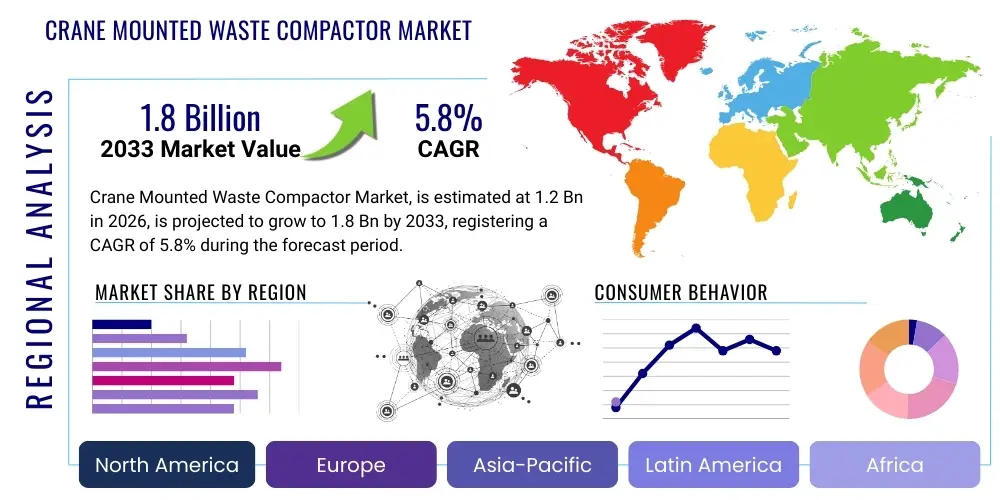

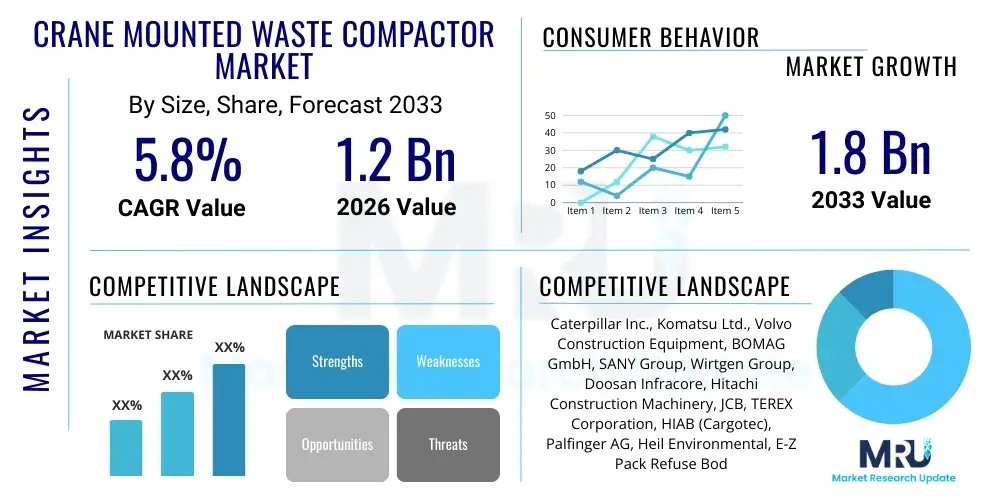

The Crane Mounted Waste Compactor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the escalating global urbanization trends and the resultant pressure on municipal authorities to manage growing volumes of solid waste efficiently. The increased adoption of high-density compaction techniques is essential for maximizing landfill lifespan and reducing transportation logistics costs, thereby driving market value.

The core value proposition of crane mounted compactors lies in their high mobility and superior compressive force compared to static units or traditional landfill compactors. These systems are particularly valuable in emerging economies where space constraints and rapid waste generation necessitate flexible and powerful compaction solutions. Investment in sophisticated hydraulic systems and automated controls is enhancing the operational efficiency of these units, contributing significantly to the overall market expansion and the achievement of higher throughput rates in waste management facilities globally. The demand profile is shifting towards compactors capable of handling diverse waste streams, including construction and demolition (C&D) waste, further solidifying the market size increase over the forecast period.

Crane Mounted Waste Compactor Market introduction

The Crane Mounted Waste Compactor Market involves the manufacturing and deployment of specialized compaction equipment affixed to hydraulic cranes or heavy-duty vehicles, designed to achieve maximum density reduction of municipal solid waste (MSW) or industrial waste at transfer stations, temporary storage sites, or directly within landfill areas. These systems offer significant operational flexibility, allowing deep vertical compaction and precise material handling, which is critical for maintaining site integrity and compliance with environmental regulations. The primary applications include optimizing storage capacity in high-volume transfer depots, improving payload weights for subsequent transportation, and enhancing safety protocols by minimizing the loose material footprint.

Key benefits derived from utilizing these compactors include substantial savings in transportation costs due to increased payload density, maximization of existing landfill airspace, and enhanced operational speed in dynamic waste handling environments. Driving factors propelling this market include increasingly stringent governmental policies mandating waste volume reduction, technological advancements in hydraulic efficiency and remote monitoring systems, and the persistent global challenge of dwindling landfill availability, particularly in densely populated regions. The product's ability to efficiently process heterogeneous waste streams positions it as an essential tool for modern waste infrastructure development, ensuring sustained market relevance and expansion.

Crane Mounted Waste Compactor Market Executive Summary

The Crane Mounted Waste Compactor Market exhibits robust growth driven primarily by global regulatory shifts favoring sustainable waste management practices and the critical need for operational cost optimization in large-scale waste processing facilities. Business trends indicate a strong move towards integrated solutions offering telemetry and predictive maintenance capabilities, enhancing equipment uptime and reliability. Regional trends show rapid adoption in the Asia Pacific due to massive urbanization and infrastructure projects, while mature markets in North America and Europe focus on replacing aging fleets with high-efficiency, low-emission models. Segments trends highlight the dominance of the hydraulic compactor type segment, alongside increasing demand for high-capacity models tailored for municipal solid waste applications, reflecting a focus on efficiency gains across the entire waste value chain. Strategic alliances between equipment manufacturers and specialized waste management service providers are becoming commonplace, aimed at offering comprehensive solutions that include equipment supply, maintenance, and operational guidance, further accelerating market maturity and competitiveness.

AI Impact Analysis on Crane Mounted Waste Compactor Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the physical operation and logistical planning associated with crane mounted waste compactors, particularly focusing on autonomous operation, predictive maintenance, and spatial efficiency in landfill management. Key themes revolve around AI's ability to analyze real-time data from compactor sensors—such as pressure, volume, and material composition—to automatically adjust compaction cycles for optimal density and energy usage. Concerns often center on the initial investment costs for integrating AI-driven systems and ensuring data security in complex operational environments. Expectations are high regarding AI's potential to revolutionize landfill management by predicting settlement patterns, optimizing vehicle routing for maximum airspace utilization, and automating routine tasks, thereby reducing labor costs and improving environmental compliance through more precise operational control.

AI’s influence extends into the design phase of these compactors, utilizing machine learning algorithms to simulate and test hydraulic performance under varying load conditions, leading to more durable and energy-efficient equipment. Furthermore, AI-powered image recognition systems integrated with crane-mounted units can rapidly identify hazardous or non-compactable materials within the waste stream, triggering immediate alerts or automatic shutdown procedures, significantly enhancing site safety and preventing equipment damage. This intelligent material sorting capability ensures that the compaction process maintains consistency and complies with pre-sorting requirements, driving operational excellence.

The long-term impact of AI integration involves the creation of fully autonomous waste compaction systems that interact seamlessly with other smart city infrastructure, such as waste collection vehicles and material recovery facilities (MRFs). These systems utilize deep learning to continuously improve compaction strategies based on historical data and real-time inputs, promising unprecedented levels of efficiency and significantly extending the functional life of existing waste disposal sites. However, the successful adoption requires standardization of data protocols and substantial investment in training specialized technicians capable of maintaining and troubleshooting these complex, intelligent machines.

- AI optimizes compaction force and cycle time based on real-time waste density analysis.

- Predictive maintenance algorithms reduce unexpected downtime by forecasting component failures in hydraulic systems.

- Machine vision systems utilize AI to identify and flag non-compactable or hazardous waste materials automatically.

- AI-driven spatial mapping maximizes landfill airspace utilization by optimizing compactor pathing and layer thickness.

- Autonomous operation capabilities are being developed for repetitive compaction tasks, improving safety and labor efficiency.

DRO & Impact Forces Of Crane Mounted Waste Compactor Market

The Crane Mounted Waste Compactor Market is powerfully influenced by regulatory drivers focusing on waste reduction and disposal efficiency, countered by significant initial investment restraints. Opportunities are emerging through infrastructure development in developing nations and the integration of smart compaction technologies. The primary driver is the global crisis of landfill saturation, compelling municipalities and private operators to invest in highly efficient volume reduction technologies like crane mounted compactors to extend the lifespan of costly disposal sites. Restraints include the high capital expenditure required for purchasing and integrating heavy industrial equipment, coupled with the need for specialized training for operating and maintaining complex hydraulic systems, particularly in regions with underdeveloped technical labor pools. Opportunities are abundant in the aftermarket service sector and through the development of hybrid power systems that address environmental concerns related to fuel consumption and emissions.

Impact forces are currently leaning toward positive growth, primarily influenced by governmental mandates and environmental accountability. Policy pressure, such as the European Union’s Circular Economy Package or similar initiatives globally, places a premium on waste efficiency, making high-density compaction an economic necessity rather than a technological luxury. However, global commodity price volatility, particularly for steel and heavy machinery components, presents a constant financial pressure point that can slow adoption rates, especially among smaller municipal operations. The development and commercialization of lighter, more powerful composite materials offer a chance to mitigate weight and fuel consumption, representing a significant technological opportunity that could shift the cost dynamics favorably.

Furthermore, the competitive landscape is shaping the market, with key players continually innovating to offer modular and customizable compaction heads that can be rapidly adapted to various crane types or operational requirements, increasing the overall versatility and attractiveness of the technology. This innovation, coupled with favorable financing models for essential infrastructure equipment, acts as a long-term driver. Conversely, the market faces potential threats from alternative waste treatment technologies, such as advanced thermal treatment or waste-to-energy incineration, which, while more expensive, offer complete volume elimination rather than reduction, requiring constant comparative assessment by stakeholders.

- Drivers: Increasing landfill scarcity and disposal costs; stringent environmental regulations demanding waste volume reduction; rapid urbanization and subsequent municipal waste growth; need for optimized logistics and payload maximization.

- Restraints: High initial capital expenditure and specialized maintenance requirements; operational challenges related to complex material handling and site conditions; competition from alternative waste disposal methods.

- Opportunities: Integration of IoT and remote monitoring for enhanced operational efficiency; expanding waste infrastructure development in APAC and MEA; retrofitting existing heavy machinery with compaction modules; demand for low-emission and hybrid powered units.

- Impact Forces: Strong regulatory push for sustainability; macroeconomic factors influencing commodity prices and financing costs; rapid technological development in hydraulic power systems and automation.

Segmentation Analysis

The Crane Mounted Waste Compactor Market is comprehensively segmented based on compactor type, application, operating capacity, and end-user. Analyzing these segments provides a granular view of market dynamics and aids stakeholders in identifying high-growth niches. The segmentation by compactor type primarily distinguishes between fixed-arm and telescopic-arm systems, impacting the operational depth and reach capacity. Application segmentation delineates demand across municipal solid waste (MSW) management, construction and demolition (C&D) waste processing, and industrial waste handling, with MSW typically constituting the largest revenue share due to pervasive urban needs. Capacity segmentation helps classify equipment based on throughput efficiency, catering to facilities ranging from small transfer stations to massive regional landfills. Understanding these distinctions is vital for product development and targeted marketing strategies.

The operating capacity spectrum reveals a clear trend towards high-capacity units, particularly in regions managing centralized waste streams, as these offer the lowest cost-per-ton processing capability. Smaller capacity compactors maintain relevance in densely populated urban centers where access constraints necessitate highly maneuverable and compact equipment. End-user segmentation reveals that municipal corporations and large private waste management contractors are the primary consumers, driving bulk purchasing and demanding high reliability and long-term service contracts. However, increasing focus on specialized industrial waste management is opening doors for smaller, niche compactor manufacturers targeting specific material types like bulky electronic waste or specialized industrial residues.

Furthermore, geographic segmentation underscores the varied regulatory landscapes influencing demand; for instance, European markets prioritize compactors with advanced emission controls and noise reduction features, whereas Asian markets emphasize sheer throughput and rugged durability. The interplay between these segment variables—type, capacity, application, and region—determines the profitability profile of various market offerings, influencing manufacturers' strategic decisions regarding production location, R&D allocation, and partnership formation. The shift towards modular designs is blurring some traditional segmentation lines, allowing for quicker reconfiguration based on changing operational demands.

- By Compactor Type:

- Fixed-Arm Compactors

- Telescopic-Arm Compactors

- Articulated Compactors

- By Operating Capacity:

- Low Capacity (Under 50 Metric Tons/Hour)

- Medium Capacity (50-150 Metric Tons/Hour)

- High Capacity (Above 150 Metric Tons/Hour)

- By Application:

- Municipal Solid Waste (MSW) Management

- Construction and Demolition (C&D) Waste

- Industrial Waste Processing

- Transfer Stations and Ports

- By End-User:

- Municipal Corporations and Government Bodies

- Private Waste Management Contractors

- Industrial and Manufacturing Facilities

- Mining and Resource Extraction Sites

Value Chain Analysis For Crane Mounted Waste Compactor Market

The value chain for the Crane Mounted Waste Compactor Market begins with upstream activities centered around the procurement of high-grade raw materials, primarily specialized steel alloys for structural integrity and high-pressure hydraulic components. These raw materials, sourced from global suppliers, undergo rigorous manufacturing processes, including precision engineering of the compaction head, robust hydraulic power units, and complex control systems. Efficiency in the upstream segment is heavily dependent on maintaining stable supply chains and managing volatile raw material costs. Manufacturers must maintain high quality control standards, given the extreme forces and demanding environmental conditions under which these compactors operate, requiring advanced welding and material testing techniques.

The core manufacturing and assembly stage transforms these components into the final product. Distribution channels are typically a mix of direct sales to large municipal or corporate clients and indirect sales through specialized heavy equipment distributors and regional dealers who provide localized maintenance and aftermarket support. The complexity of the equipment necessitates strong technical support throughout the distribution channel. Downstream activities involve the operational deployment, including installation, operator training, and continuous maintenance services provided under contract. These aftermarket services, including the supply of replacement parts (e.g., compaction teeth and hydraulic seals), represent a significant and stable revenue stream in the value chain, crucial for profitability.

The end-use segment involves integration into municipal and private waste management infrastructure, where the compactor's efficiency directly impacts the client’s operational costs and environmental compliance. The relationship between manufacturers and end-users is often long-term, built on the reliability and durability of the equipment. Direct distribution allows manufacturers to retain greater control over branding and service quality, particularly for highly customized units, while indirect channels provide wider geographical reach and leveraging local distributor expertise in regulatory requirements and market penetration. Optimization of the value chain is increasingly focusing on digitalization to track component lifecycle and optimize maintenance schedules, reducing total cost of ownership for the end-user.

Crane Mounted Waste Compactor Market Potential Customers

Potential customers for the Crane Mounted Waste Compactor Market primarily consist of entities engaged in large-scale waste processing and disposal operations where volume reduction is paramount to economic viability and legal compliance. The primary buyers are governmental municipal corporations responsible for city-wide sanitation and landfill management, as these organizations typically handle the largest volumes of municipal solid waste (MSW) and require heavy-duty, reliable compaction solutions to maximize the use of public resources. Their procurement decisions are often influenced by public tender processes, emphasizing durability, longevity, and adherence to specific environmental standards.

Another major segment of buyers includes large, international private waste management contractors who operate on behalf of municipalities or manage privately-owned transfer stations and disposal facilities. Companies such as Waste Management, Veolia Environnement, and Suez are key purchasers, driven by the need for operational efficiency, integration with existing logistics chains, and maximizing profitability through reduced transport costs. These private contractors often invest in the most advanced, high-capacity, and technologically integrated compactors to maintain a competitive edge and optimize multi-site operations across vast geographical areas.

Furthermore, buyers extend to specialized industrial sectors, including large construction and infrastructure development companies, mining operations, and large port authorities. These entities require compactors tailored for specific waste streams, such as high-volume inert C&D debris or bulky industrial refuse. For these users, the flexibility and high compressive force of crane mounted units are essential for on-site volume reduction and ensuring rapid clearance of materials, minimizing disruption to primary operations. These diverse customer profiles highlight the specialized nature of the market, necessitating tailored product offerings and service agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, BOMAG GmbH, SANY Group, Wirtgen Group, Doosan Infracore, Hitachi Construction Machinery, JCB, TEREX Corporation, HIAB (Cargotec), Palfinger AG, Heil Environmental, E-Z Pack Refuse Bodies, McNeilus Companies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crane Mounted Waste Compactor Market Key Technology Landscape

The technological landscape of the Crane Mounted Waste Compactor Market is rapidly evolving, driven by the imperative for higher efficiency, reduced environmental impact, and enhanced operational safety. Central to this evolution is the deployment of advanced hydraulic systems incorporating variable displacement pumps and proportional valve technology. These components allow for precise control over compaction force and speed, optimizing energy consumption and maximizing the pressure applied to heterogeneous waste materials. The integration of high-strength, lightweight steel alloys (such as Hardox) in the construction of the compaction head improves durability and reduces the overall dead weight of the mounted unit, thereby enhancing fuel economy and maneuverability of the crane or vehicle platform. Furthermore, sophisticated sensor arrays are now standard, providing real-time data on load dynamics, internal pressures, and operational temperature, which feed into onboard diagnostic and maintenance systems.

Connectivity and telematics represent another critical technological advancement. Modern compactors are increasingly equipped with integrated IoT solutions that enable remote monitoring of performance metrics, GPS tracking, and geo-fencing capabilities. This data enables fleet managers to optimize scheduling, track operational effectiveness across multiple sites, and facilitates predictive maintenance routines, minimizing costly unplanned downtime. The transition towards alternative power sources is also a key area of innovation; while diesel engines remain dominant, there is a growing development of hybrid electric and potentially full battery-electric crane mounted compactors, particularly for operations within stringent urban emission control zones. These greener technologies address public demand for reduced noise pollution and lower carbon footprints, although battery limitations in heavy-duty applications still pose a challenge.

A burgeoning technological trend involves the use of automation and semi-autonomous operational aids. This includes features like automated layer thickness control, guided compaction pathing using geospatial data, and collision avoidance systems integrated into the crane’s operating mechanisms. These systems enhance operator safety, reduce the physical strain of repetitive tasks, and ensure optimal, uniform compaction across the working area, significantly extending the life and stability of the waste site. Manufacturers are also focusing on modular design, allowing the compaction heads to be quickly swapped or repaired, thus improving maintenance logistics and operational flexibility. This commitment to robust, intelligent, and connected machinery defines the competitive technological edge in the contemporary crane mounted waste compactor market, pushing towards the realization of fully optimized, data-driven waste management ecosystems.

Regional Highlights

The global demand for crane mounted waste compactors is geographically diverse, reflecting varying stages of economic development, waste management infrastructure maturity, and regulatory stringency across key regions. Each region presents a unique set of market drivers and competitive dynamics that dictate adoption rates and technology preferences. A comprehensive analysis of these regional markets is crucial for stakeholders developing global expansion and sales strategies.

North America (U.S., Canada, Mexico): North America represents a mature, high-value market characterized by stringent environmental regulations and a strong emphasis on operational efficiency through technological adoption. The U.S., in particular, is a major consumer due to its reliance on large, regional mega-landfills and the continuous push to maximize airspace utilization to defer new site development. Demand is primarily driven by large private waste management firms seeking advanced, high-capacity compactors integrated with sophisticated telematics and predictive maintenance systems. The trend in this region focuses on replacing aging fleets with lower-emission (Tier 4 Final compliant) and higher-automation models to reduce labor costs and ensure regulatory compliance. Canada also shows consistent demand, particularly for rugged, high-durability compactors capable of operating effectively in extreme climate variations.

- Dominance of private waste management contractors and large-scale regional landfills.

- High demand for low-emission, automated, and IoT-enabled compactors.

- Regulatory environment (EPA standards) drives replacement cycles and technology upgrades.

- Focus on maximizing landfill airspace efficiency and reducing operational footprint.

Europe (Germany, UK, France, Italy, Spain, Rest of Europe): Europe is defined by its commitment to the Circular Economy, leading to high landfill diversion targets. Although overall landfill volumes are decreasing, the compactors remain essential at transfer stations and for processing specialized waste streams like C&D debris and non-recyclable industrial refuse. The market is highly regulated, prioritizing low noise, reduced vibration, and high energy efficiency. German and Scandinavian markets lead in adopting hybrid and alternative-fuel compactors due to strong environmental mandates. The competitive landscape is characterized by niche manufacturers providing highly specialized, often modular, equipment tailored to specific urban environments and material types. Investment is also strong in R&D focusing on material sorting capabilities integrated with compaction units.

- Strong regulatory framework (Circular Economy) necessitates high efficiency in residual waste compaction.

- Focus on low-noise operation and stringent emission controls in urban environments.

- Market shift toward specialized, lower-capacity units for transfer stations and industrial sites.

- Significant technological uptake of hybrid and alternative energy power systems.

Asia Pacific (China, Japan, India, South Korea, Southeast Asia): APAC is the fastest-growing market globally, driven by unprecedented urbanization, massive population growth, and rapid development of modern waste management infrastructure. Countries like China and India face enormous challenges in managing growing MSW volumes, making high-capacity, robust crane mounted compactors essential for immediate volume reduction at disposal sites. Government investment in infrastructure and waste management modernization projects is the primary driver. While cost sensitivity remains higher than in Western markets, there is a burgeoning demand for quality, reliable equipment that can handle diverse, high-volume waste streams under demanding operating conditions. Japan and South Korea, being technologically advanced, focus on incorporating AI and automation into their smaller, highly efficient units, often operating in constrained spaces.

- Highest growth rates driven by rapid urbanization and infrastructure expansion.

- Strong government focus on modernization of municipal solid waste (MSW) systems.

- Demand centers on high-capacity, rugged compactors for large regional disposal facilities.

- India and China represent massive latent demand due to expanding waste processing needs.

Latin America (Brazil, Argentina, Rest of Latin America): The market in Latin America is characterized by uneven development and varying regulatory enforcement across nations. Brazil, with its large economy and significant waste generation, is the major market driver, with both municipal and private operations investing in compaction technology to extend the life of existing sanitary landfills. Economic volatility and currency fluctuations can act as restraints, often delaying large-scale equipment procurement. However, increasing awareness of environmental health impacts and international development bank funding often fuel essential infrastructure purchases. The region typically opts for reliable, proven technology rather than cutting-edge, high-cost automation.

- Market growth linked closely to infrastructure development and governmental financial stability.

- Brazil is the largest market, focusing on sanitary landfill operations.

- Preference for reliable, durable, and easily maintainable equipment with lower initial investment.

- Funding often supported by international environmental initiatives and foreign direct investment.

Middle East and Africa (MEA): The MEA market is projected for substantial growth, propelled by major construction projects, rapid urbanization, and diversified economic strategies away from oil dependence (especially in the GCC countries). The Middle East (Saudi Arabia, UAE) is investing heavily in world-class waste management facilities, demanding high-specification, technologically advanced compactors to manage the construction debris from mega-projects and rising MSW volumes. Africa presents a market of immense potential, particularly in South Africa and North African countries, where governments are establishing foundational waste infrastructure. Challenges include logistical complexities and high dependence on imported machinery, but the need for waste volume reduction in rapidly expanding urban centers ensures steady market uptake.

- Major infrastructure and construction booms (GCC region) drive demand for C&D compactors.

- Focus on establishing modern, efficient sanitary landfill and transfer station infrastructure.

- High purchasing power in the Middle East allows adoption of advanced, high-cost machinery.

- Market development in Africa focuses on foundational technology for urban waste management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crane Mounted Waste Compactor Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- BOMAG GmbH

- SANY Group

- Wirtgen Group

- Doosan Infracore

- Hitachi Construction Machinery

- JCB

- TEREX Corporation

- HIAB (Cargotec)

- Palfinger AG

- Heil Environmental

- E-Z Pack Refuse Bodies

- McNeilus Companies

- Geith International

- Indeco North America

- Hammer Equipment

- ALLU Group

- Rammer (Sandvik)

Frequently Asked Questions

Analyze common user questions about the Crane Mounted Waste Compactor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a crane mounted waste compactor over traditional landfill compactors?

Crane mounted compactors offer superior flexibility and targeted, high-density vertical compaction, enabling operation in difficult-to-access areas and maximizing the volume reduction of waste at transfer stations or specialized industrial sites where mobility is key, unlike large, fixed traditional landfill compactors.

How is the efficiency of a crane mounted compactor measured?

Efficiency is typically measured by the throughput capacity (metric tons per hour) and the achieved density ratio (volume reduction percentage). Modern units also use key performance indicators (KPIs) like fuel consumption per compacted ton and equipment uptime, often tracked via telematics systems.

Which geographical region exhibits the fastest growth rate for this market?

The Asia Pacific (APAC) region is projected to experience the fastest growth rate due to rapid urbanization, increasing governmental investment in modern waste management infrastructure, and the immense volume of municipal solid waste (MSW) requiring efficient processing.

What are the key technological advancements influencing new compactor models?

Key advancements include the integration of IoT and telematics for remote diagnostics and predictive maintenance, sophisticated variable-pressure hydraulic systems for optimizing energy use, and the development of semi-autonomous operational controls that enhance safety and operational precision.

What are the main segments driving the demand in the Crane Mounted Waste Compactor Market?

The municipal solid waste (MSW) management segment is the primary driver, focused on utilizing high-capacity compactors to extend the lifespan of landfills and optimize transfer station throughput. The construction and demolition (C&D) waste sector is also a critical, growing segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager