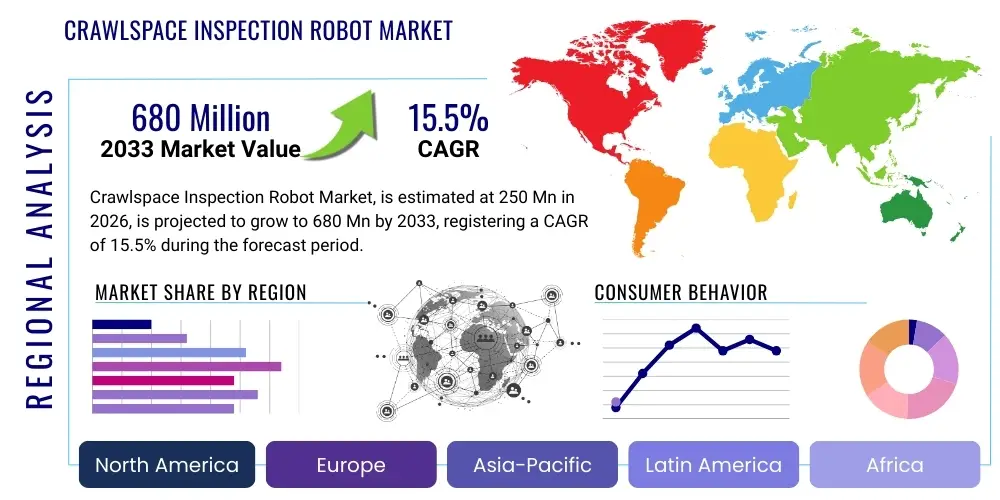

Crawlspace Inspection Robot Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442511 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Crawlspace Inspection Robot Market Size

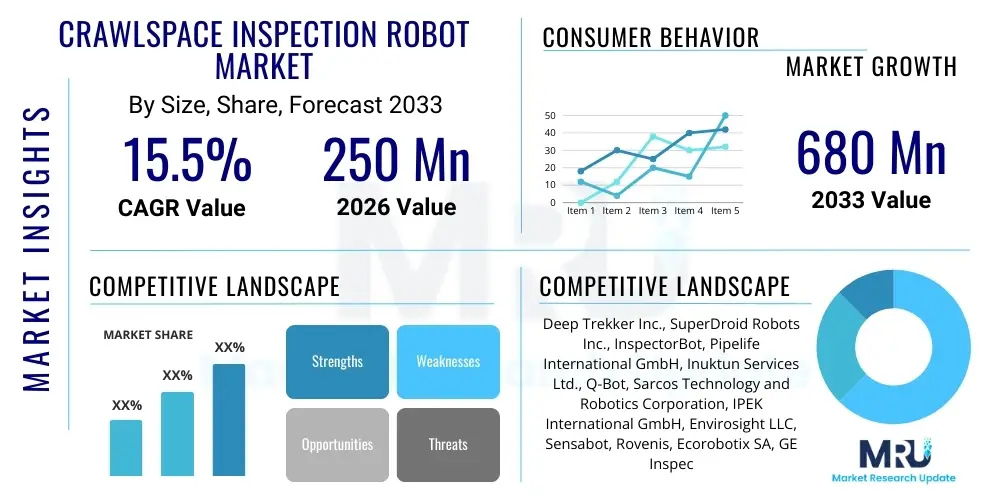

The Crawlspace Inspection Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $680 Million by the end of the forecast period in 2033.

The substantial growth trajectory is underpinned by increasing regulatory mandates for structural safety and energy efficiency in residential and commercial buildings across developed economies. Traditional crawlspace inspections are hazardous, time-consuming, and prone to human error, necessitating autonomous or semi-autonomous robotic solutions. Furthermore, the rapid advancements in sensor technology, including thermal imaging, LiDAR, and gas detection systems integrated into these robots, significantly enhance the quality and granularity of inspection data, driving their adoption among contractors, home inspectors, and insurance firms.

Market expansion is also highly correlated with the rising average age of housing stock in regions like North America and Europe, which necessitates frequent and thorough inspections for aging infrastructure issues such as foundation settling, mold infestations, and pest damage. The integration of high-definition cameras and sophisticated mapping software allows these robots to create accurate 3D models of crawlspaces, facilitating predictive maintenance and proactive repair scheduling. The shift towards non-destructive testing (NDT) methodologies further validates the high return on investment (ROI) offered by automated inspection platforms, consolidating market confidence and accelerating investment in next-generation robotic systems designed for complex, confined spaces.

Crawlspace Inspection Robot Market introduction

The Crawlspace Inspection Robot Market encompasses specialized, remotely operated vehicles (ROVs) designed to navigate and capture critical diagnostic data within confined, hazardous, and typically inaccessible sub-floor areas of structures. These products are compact, durable, and equipped with high-resolution cameras, environmental sensors (such as moisture and temperature probes), and advanced illumination systems. Major applications span residential home inspections, commercial building assessments, energy audits, pest control services, and foundation repair diagnostics. The core benefits include drastically reduced safety risks for human operators, enhanced data accuracy through consistent imaging and sensor deployment, improved efficiency in inspection turnaround times, and the ability to reach zones impractical for manual inspection. The market is primarily driven by escalating labor costs, increasing occupational safety standards, and technological integration, particularly relating to battery longevity and real-time data transmission capabilities, positioning these robots as indispensable tools for modern structural maintenance and assessment industries.

Crawlspace robots are fundamentally transforming the diligence process associated with property transactions and long-term asset management. These devices often feature articulated suspension systems, allowing them to traverse uneven terrain, debris, and tight corners commonly found beneath structures. Beyond basic visual inspection, modern units incorporate features crucial for comprehensive structural health monitoring, such as ultrasonic sensors for material integrity checks and integrated communication modules utilizing mesh networking protocols to ensure reliable data uplink even in signal-obstructing environments. This evolution from simple motorized cameras to sophisticated diagnostic platforms highlights the rapid maturation of the market and its potential to standardize inspection procedures globally.

The primary technological differentiator among competing products lies in their autonomy level and sensor payload capacity. While basic models rely heavily on human teleoperation, advanced systems leverage simultaneous localization and mapping (SLAM) algorithms to navigate autonomously, pre-program inspection paths, and automatically flag anomalies using embedded machine vision software. This autonomy significantly reduces the operator's cognitive load and increases the scalability of inspection services, enabling a single technician to manage multiple inspection tasks concurrently. The growing demand for detailed, defensible evidence for insurance claims and regulatory compliance fuels the continuous advancement and market penetration of these highly specialized robotic solutions.

Crawlspace Inspection Robot Market Executive Summary

The Crawlspace Inspection Robot Market is experiencing robust expansion fueled by critical business trends emphasizing automation, safety compliance, and data-driven maintenance strategies. Key regional trends show North America dominating market share due to stringent building codes and a high adoption rate of sophisticated robotic solutions in residential inspection sectors, while the Asia Pacific region is forecast to exhibit the highest growth rate, driven by rapid urbanization and infrastructure development requiring continuous monitoring. Segment trends indicate that the wheeled robots segment maintains leadership due to cost-effectiveness and versatility, although the tracked robots segment is gaining traction for rougher terrain applications. Furthermore, the commercial end-user segment, comprising large facility managers and engineering firms, is projected to be the fastest-growing sector, demanding higher payload capacity and more integrated NDT features compared to the traditionally dominant residential inspection market. The overall market trajectory indicates a strong shift toward AI-powered data processing and fully autonomous navigation systems.

A significant business trend observed is the consolidation of hardware providers with software analytics platforms, enabling companies to offer end-to-end inspection solutions that move beyond data capture to actionable insights. This integration creates higher barriers to entry for new competitors and strengthens the competitive advantage of established firms offering comprehensive, cloud-integrated services. Furthermore, there is a distinct move toward Robotics-as-a-Service (RaaS) models, particularly appealing to smaller inspection companies that prefer operational expenditure over large capital investment, thereby democratizing access to high-end inspection technology and accelerating market penetration.

Geographically, while North American and European markets focus on replacing traditional labor with automated solutions for existing structures, emerging markets in APAC and Latin America are leveraging these robots primarily for quality assurance during rapid construction phases and pre-emptive disaster mitigation efforts. Segment-wise, the sensor technology sub-segment is witnessing tremendous innovation, specifically the miniaturization of high-fidelity sensors, which allows robots to maintain a smaller profile while maximizing diagnostic capabilities, making them suitable for the most restrictive crawlspaces. The increasing acceptance of remote telepresence solutions by regulatory bodies is also a crucial factor bolstering cross-regional standardization of inspection protocols.

AI Impact Analysis on Crawlspace Inspection Robot Market

Common user questions regarding AI's impact on the Crawlspace Inspection Robot Market typically revolve around the robot's ability to interpret complex damage autonomously, the reliability of AI-driven anomaly detection compared to human judgment, and the feasibility of implementing full autonomous navigation in dynamic, debris-filled environments. Users are highly interested in how AI can expedite report generation, specifically through automated identification and classification of defects such as termite damage, structural cracks, and HVAC leaks, minimizing the need for extensive post-inspection human review. Key themes indicate high expectations for predictive maintenance capabilities, where AI analyzes current conditions against historical structural data to forecast future failure points, and concerns about data security and algorithmic bias in automated assessments.

The implementation of Artificial Intelligence and Machine Learning (AI/ML) algorithms fundamentally shifts the value proposition of inspection robots from mere data collection tools to sophisticated diagnostic assistants. AI enhances image recognition capabilities, enabling the robot to instantly classify various structural defects, including identifying specific mold types, differentiating between active and inactive pest activity, and quantifying the severity of foundation cracks based on predefined industry standards. This automated analysis dramatically reduces the time required for data processing and report generation, transitioning the role of the human inspector from meticulous data reviewer to strategic problem solver.

Furthermore, AI algorithms are crucial for perfecting autonomous navigation in unstructured environments. By processing real-time sensor data from LiDAR and depth cameras, AI can dynamically plan optimal paths, avoid obstacles (like plumbing or electrical conduits), and ensure complete coverage of the crawlspace floor area without repeated passes. This increased efficiency and reliability in autonomous operation is expected to significantly lower operational costs for inspection firms and improve service consistency, making advanced robotic systems an undeniable competitive necessity in the market.

- AI-driven anomaly detection and classification of structural defects (e.g., crack identification, water ingress).

- Enhanced autonomous navigation capabilities (SLAM) in confined and debris-filled crawlspaces.

- Automated report generation, significantly reducing post-inspection data processing time.

- Predictive maintenance analytics based on historical and real-time sensor data analysis.

- Optimization of battery usage and mission planning through machine learning algorithms.

DRO & Impact Forces Of Crawlspace Inspection Robot Market

The Crawlspace Inspection Robot Market is propelled by strong Drivers such as escalating workplace safety regulations, the need for high-precision, documented inspection data for insurance purposes, and the perennial shortage of skilled labor willing to perform hazardous tasks. Restraints primarily involve the high initial capital investment required for sophisticated robotic systems, limited battery life in high-demand operations, and challenges associated with reliable communication links in electromagnetically challenging underground environments. Opportunities are vast, focused on developing fully autonomous systems, integrating advanced environmental sensing (radon, carbon monoxide), and expanding deployment into adjacent industrial inspection markets like utility conduits and storage tanks. The Impact Forces indicate that technological innovation is the strongest influence, constantly pushing capabilities forward, followed closely by stringent regulatory adherence which mandates verifiable inspection quality, collectively shaping a market favoring high-tech, reliable solutions.

Key drivers center around the demonstrable return on investment (ROI) derived from utilizing robots. By reducing inspection time by up to 50% compared to manual methods and eliminating liability associated with human injury in hazardous environments, robotic solutions offer compelling operational advantages. Furthermore, the data fidelity provided by robot-mounted high-definition sensors provides irrefutable evidence for real estate transactions, enhancing trust and transparency in the property assessment process. Regulatory bodies globally are beginning to recognize and accept robot-captured data as the standard, further solidifying the market’s foundation.

Despite these accelerators, the market faces significant restraints. The complexity of manufacturing durable, moisture-resistant, and high-mobility robots contributes to elevated acquisition costs, making them prohibitive for smaller, independent contractors. Moreover, ensuring robust, real-time connectivity (especially video streaming) through thick concrete and soil layers remains a technical hurdle, occasionally necessitating specialized communication repeaters or localized mesh networks which adds complexity. However, the opportunity to standardize data output formats and integrate inspection findings directly into major property management software systems represents a substantial avenue for future growth and value creation across the entire ecosystem.

Segmentation Analysis

The Crawlspace Inspection Robot Market segmentation provides a granular view of diverse product offerings and application landscapes, enabling manufacturers to strategically target specific end-user requirements based on mobility type, component specialization, and required operational capacity. The market is primarily dissected based on the mechanism of mobility, differentiating between wheeled and tracked systems, which directly impacts the robot's terrain capability. Further segmentation occurs across the component stack, separating revenue generated from the robotic hardware itself (chassis, motors) versus the crucial inspection payloads (sensors, cameras) and the associated proprietary software required for data processing and navigation. End-user classification is pivotal, distinguishing the needs of residential inspectors, commercial facilities managers, and specialized service providers such as pest control and environmental assessment firms.

- By Mobility Type:

- Wheeled Robots

- Tracked Robots

- Hybrid/Legged Robots

- By Component:

- Hardware (Chassis, Motors, Actuators)

- Software & Services (Control Systems, Data Analytics, Cloud Integration)

- Payloads (Cameras, Sensors, Illumination Systems)

- By Application:

- Residential Inspection

- Commercial/Industrial Facility Assessment

- Pest Control & Environmental Monitoring

- Foundation Repair & Structural Engineering

- By Sensor Type:

- Visual & Thermal Cameras

- LiDAR and Depth Sensors

- Moisture and Gas Sensors

- By Operational Mode:

- Remote Controlled (Teleoperated)

- Semi-Autonomous

- Fully Autonomous

Value Chain Analysis For Crawlspace Inspection Robot Market

The value chain for the Crawlspace Inspection Robot market begins with the Upstream analysis, focusing on the sourcing of highly specialized components, including custom-designed motor controllers, ruggedized chassis materials (often aerospace-grade composites for light weight and durability), and advanced sensor suites from specialized optics and MEMS suppliers. Raw material procurement is critical, demanding high quality standards for moisture and temperature tolerance. Midstream activities involve the complex integration of these components, including software development for navigation and data processing, manufacturing, assembly, and rigorous testing for reliability in harsh conditions. Downstream activities are dominated by specialized distributors and direct sales channels targeting professional inspection services, engineering firms, and municipal bodies, focusing on specialized technical training and after-sales support.

The distribution channel landscape is bifurcated into direct and indirect routes. Direct sales are preferred by leading manufacturers when dealing with large enterprises, governmental entities, or military contracts, allowing for tighter control over pricing, customization, and deployment support. This ensures high-touch service delivery required for complex robotic integration. Conversely, indirect channels, involving specialized equipment dealers and localized robotics distributors, cater effectively to the fragmented residential inspection market, providing geographical reach and localized technical assistance necessary for small and medium-sized enterprises (SMEs).

The ultimate success within the value chain depends heavily on the robust collaboration between sensor technology innovators and robotics manufacturers, ensuring the integration of cutting-edge diagnostic capabilities into mobile, resilient platforms. The software layer, encompassing everything from user interface design to cloud analytics platforms, adds significant value downstream, transforming raw inspection footage into quantified, actionable reports. Furthermore, the provision of maintenance, repair, and operational (MRO) services forms a crucial post-sale segment, ensuring robot longevity and maximizing the lifetime value of the hardware investment for end-users.

Crawlspace Inspection Robot Market Potential Customers

The primary End-Users/Buyers of Crawlspace Inspection Robots are diverse professional entities requiring detailed subterranean structural assessments. This encompasses home inspection professionals who utilize these tools to enhance report quality and reduce liability during real estate transactions; structural engineering firms that require precise measurements of foundation integrity and movement; and large property management companies needing scalable solutions for maintaining vast portfolios of residential and commercial properties. Additionally, specialized service providers such as pest control companies are significant buyers, leveraging the robots' imaging capabilities to locate and assess infestation activity in hard-to-reach areas. Government and municipal bodies, particularly those involved in historical preservation or infrastructure maintenance, also constitute a niche but growing customer segment demanding high-fidelity, archival-quality inspection data.

A key growth area lies within the insurance and underwriting sector. Insurance adjusters are increasingly adopting robotic inspection tools to gather objective evidence for claims related to water damage, foundation issues, or storm damage, thereby streamlining the claims process and minimizing fraudulent activities. These customers demand highly accurate, geo-referenced data that can withstand legal scrutiny. The adoption rate among independent contractors is rising as rental and RaaS models make the technology more accessible, offering specialized solutions without necessitating the full capital expenditure, broadening the overall customer base beyond large corporations.

Furthermore, the environmental remediation sector represents a developing customer base. These firms use inspection robots equipped with gas and moisture sensors to detect and map hazardous conditions, such as radon gas presence or excessive mold growth zones, before initiating decontamination procedures. The ability of the robot to operate safely in environments potentially contaminated with harmful substances is a critical determinant for adoption in this professional application space, positioning safety and data integrity as paramount purchasing factors for this customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $680 Million |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deep Trekker Inc., SuperDroid Robots Inc., InspectorBot, Pipelife International GmbH, Inuktun Services Ltd., Q-Bot, Sarcos Technology and Robotics Corporation, IPEK International GmbH, Envirosight LLC, Sensabot, Rovenis, Ecorobotix SA, GE Inspection Technologies, Protrusio, Flyability SA, Boston Dynamics, Inspector Gadget Bot, Locus Robotics, RIEGL Laser Measurement Systems GmbH, and ClearSight Inspection Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crawlspace Inspection Robot Market Key Technology Landscape

The technological evolution of the Crawlspace Inspection Robot market is characterized by advancements across three primary domains: mobility, sensing, and connectivity. In mobility, the focus is on developing robust, lightweight materials coupled with high-torque, energy-efficient motors to enhance traverse capability over debris, tight turns, and wet surfaces. Tracked systems incorporating specialized tread patterns and independent suspension are becoming standard for maximizing traction in challenging environments. Furthermore, sophisticated power management systems utilizing high-density lithium-ion batteries and wireless charging capabilities are crucial for extending operational duration, directly addressing a primary restraint within the industry.

The sensing payload represents the core value driver, moving far beyond standard visual cameras. Integration of high-resolution thermal imaging cameras allows inspectors to quickly identify insulation deficiencies, moisture intrusion points, and hidden thermal bridges, which are often invisible to the naked eye. LiDAR (Light Detection and Ranging) technology is increasingly being deployed to create precise, high-density 3D maps of the crawlspace structure, enabling accurate volume measurement for repair estimates and comparison against blueprints. Furthermore, the addition of specialized environmental sensors, such as those detecting methane, carbon monoxide, or humidity levels, provides comprehensive situational awareness necessary for ensuring compliance and safety.

Connectivity and software are pivotal for facilitating real-time decision-making. High-frequency wireless communication protocols, often leveraging mesh networking to maintain signal strength through concrete barriers, ensure uninterrupted video streaming and control feedback. The software ecosystem incorporates sophisticated control interfaces optimized for intuitive teleoperation and increasingly, AI-powered autonomous control systems. These systems utilize SLAM algorithms for self-localization and machine vision for automated defect recognition, significantly enhancing the efficiency of data capture and transforming raw sensor input into structured, diagnostic reports suitable for immediate client delivery and archival purposes. The standardization of Application Programming Interfaces (APIs) also facilitates seamless integration with broader property management and reporting software.

Regional Highlights

The global market exhibits distinct adoption patterns influenced by structural age, climate, and regulatory stringency. North America, encompassing the United States and Canada, remains the largest market due to its mature residential inspection industry, high prevalence of wood-frame homes with crawlspaces, and the high cost of manual labor, accelerating the transition toward automation.

- North America: Market dominance driven by stringent safety standards (OSHA), a highly organized residential inspection sector, and widespread acceptance of robotics-as-a-service models. High investment in sensor technology and autonomous capabilities.

- Europe: Steady growth propelled by regulatory initiatives focused on energy efficiency (e.g., EU Energy Performance of Buildings Directive), requiring detailed thermal and insulation assessments often best achieved robotically in confined areas. Emphasis on R&D for small, specialized robots suitable for older, fragmented building structures.

- Asia Pacific (APAC): Fastest growing region, fueled by rapid urbanization, massive infrastructure projects in China and India, and increasing awareness regarding structural integrity and earthquake preparedness. Adoption is primarily driven by large commercial and industrial facility management requiring scalable inspection solutions.

- Latin America (LATAM): Emerging market characterized by fragmented adoption, primarily concentrated in high-value commercial construction and resource extraction sectors (mining/oil and gas infrastructure inspection), leveraging crawlspace robot technology for difficult industrial access points.

- Middle East and Africa (MEA): Growth focused on high-specification commercial developments and energy sector infrastructure maintenance. Adoption is moderate, concentrated in technologically advanced economies like the UAE and Saudi Arabia, driven by high safety mandates for workers in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crawlspace Inspection Robot Market.- Deep Trekker Inc.

- SuperDroid Robots Inc.

- InspectorBot

- Pipelife International GmbH

- Inuktun Services Ltd.

- Q-Bot

- Sarcos Technology and Robotics Corporation

- IPEK International GmbH

- Envirosight LLC

- Sensabot

- Rovenis

- Ecorobotix SA

- GE Inspection Technologies

- Protrusio

- Flyability SA

- Boston Dynamics

- Inspector Gadget Bot

- Locus Robotics

- RIEGL Laser Measurement Systems GmbH

- ClearSight Inspection Systems

Frequently Asked Questions

Analyze common user questions about the Crawlspace Inspection Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using crawlspace inspection robots over manual inspection?

The primary benefit is significantly improved safety for personnel, as robots eliminate the need for humans to enter hazardous, confined spaces. Additionally, robots provide higher data consistency and resolution (e.g., 4K video, thermal scans) crucial for accurate diagnostics and report documentation.

Which sensor technologies are essential for advanced crawlspace inspection robots?

Essential sensor technologies include high-definition visual cameras, thermal imaging sensors for identifying moisture and insulation gaps, and LiDAR (or structured light) systems necessary for creating accurate 3D maps and measurements of the structural environment.

What are the key differences between wheeled and tracked inspection robots?

Wheeled robots are typically faster and more maneuverable on smooth, debris-free concrete or prepared surfaces. Tracked robots, however, offer superior traction and stability, making them better suited for navigating highly uneven terrain, loose dirt, deep mud, or areas with significant debris and obstacles.

How is Artificial Intelligence (AI) enhancing the functionality of these inspection robots?

AI primarily enhances functionality through automated anomaly detection (identifying cracks, mold, or pests without human intervention) and improving autonomous navigation capabilities (SLAM), allowing the robot to execute pre-programmed inspection routes efficiently and thoroughly.

What is the projected growth rate (CAGR) for the Crawlspace Inspection Robot Market?

The Crawlspace Inspection Robot Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 15.5% between the forecast period of 2026 and 2033, driven by increased safety regulations and technological integration.

The preceding sections detail the complex interplay of technology and market dynamics propelling the growth of robotic solutions in confined space inspection. The high projected CAGR reflects sustained demand from structural engineers, property managers, and home inspection professionals who are increasingly reliant on high-fidelity data and remote operational safety. The continued miniaturization of sensors, coupled with significant strides in AI for data processing, is expected to maintain the market's rapid trajectory, creating substantial value across the entire asset management lifecycle.

Further analysis into the competitive landscape reveals that firms investing heavily in proprietary software for data reporting and cloud-based asset management are establishing significant market leadership. These proprietary platforms integrate seamlessly with the hardware, providing end-users with a unified system for data capture, analysis, and archival, a critical requirement for regulatory compliance and insurance verification. This vertical integration trend is a defining characteristic of the current market structure, favoring companies that offer comprehensive ecosystems rather than stand-alone hardware units.

The demand for specialized robots tailored for niche environments, such as those capable of handling extreme temperatures or operating semi-submerged in water, presents lucrative avenues for specialized manufacturers. As building codes evolve to prioritize resilience and sustainability, the requirement for predictive maintenance facilitated by autonomous monitoring systems will expand the core addressable market beyond traditional residential inspections into critical infrastructure monitoring, including utility tunnels and aging municipal water systems, securing long-term growth prospects for the sector.

In terms of operational modes, the trend towards fully autonomous capabilities is driven by the need for scalability. Autonomous robots can be deployed across vast commercial sites, completing repetitive inspection tasks with minimal human oversight, thereby optimizing labor allocation. Regulatory frameworks are gradually adapting to accommodate these autonomous systems, particularly in markets where clear documentation of inspection scope and methodology can be guaranteed through advanced telemetry and immutable data logging provided by the robotic platforms. This technological acceptance is a critical catalyst for future adoption.

The component segment analysis further underscores the shift in market value capture. While the initial capital outlay is driven by hardware (chassis and motors), the recurring revenue streams and long-term profitability are increasingly tied to the proprietary software, cloud services, and subscription-based maintenance agreements. Manufacturers are prioritizing the development of intuitive user interfaces and integrated data visualization tools, recognizing that the efficiency of data interpretation is as important to the end-user as the capability of the hardware itself. Therefore, software differentiation is paramount in competitive market strategies.

Regional variations in construction materials and climate necessitate customized robotic specifications. For instance, robots deployed in North America must often contend with loose insulation and fiberglass debris, requiring specialized filtering systems and robust sealing, whereas robots in humid tropical regions require superior resistance to moisture ingress and corrosion. Market leaders are addressing these regional demands through modular design principles, allowing for rapid customization of sensor payloads, chassis materials, and environmental shielding based on specific geographic operational challenges. This adaptability enhances global market penetration.

Finally, the evolution of connectivity solutions, moving toward 5G integration and proprietary low-latency mesh networks, is mitigating the historic challenge of signal degradation in confined concrete structures. Reliable, high-speed data transmission is essential for real-time teleoperation and the seamless uploading of high-volume 3D scan data to cloud processing centers. Addressing this connectivity hurdle not only improves operational efficiency but also facilitates remote expert consultation, allowing specialized engineers to oversee inspections conducted by local technicians from any global location, further enhancing service quality and accessibility across the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager