Creatine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441569 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Creatine Market Size

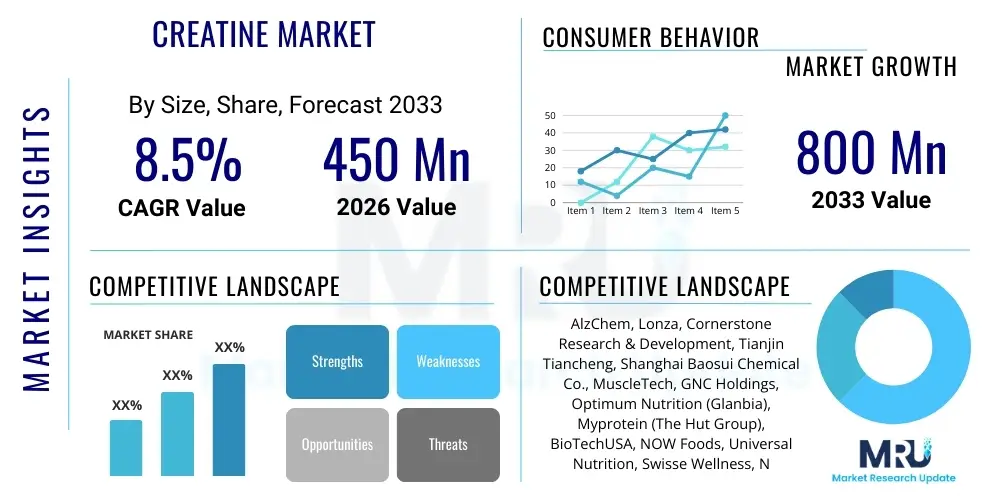

The Creatine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 500 Million in 2026 and is projected to reach USD 900 Million by the end of the forecast period in 2033.

Creatine Market introduction

The Creatine Market encompasses the global trade and consumption of creatine supplements, primarily serving the sports nutrition, health, and medical sectors. Creatine, a naturally occurring compound synthesized from amino acids (arginine, glycine, and methionine), is vital for energy production in muscle cells, supporting high-intensity, short-duration exercise. The core product, Creatine Monohydrate, remains the benchmark, though advanced forms like Creatine Hydrochloride (HCL) and buffered creatine are gaining traction due to perceived benefits in solubility and absorption. This market is highly dynamic, driven by increasing health consciousness, the professionalization of fitness, and expanding consumer acceptance of supplements for performance enhancement and cognitive benefits.

Major applications of creatine extend beyond bodybuilding and competitive sports, penetrating therapeutic and general wellness domains. In clinical settings, creatine is being investigated for its neuroprotective properties, potential in managing muscle wasting diseases (sarcopenia, muscular dystrophy), and applications in cardiovascular health. The key benefits driving consumer adoption include enhanced muscle strength, improved exercise capacity, accelerated muscle recovery post-workout, and emerging cognitive support functions, particularly in high-stress or sleep-deprived individuals. The versatility and established safety profile of creatine contribute significantly to its robust market position compared to other sports supplements.

Driving factors sustaining the market's growth include the global expansion of fitness centers and gym memberships, increased disposable income allocated toward wellness products in emerging economies, and pervasive digital marketing emphasizing evidence-based nutrition. Furthermore, continuous scientific research validating creatine’s efficacy and safety helps solidify its reputation among mainstream consumers and healthcare professionals. Regulatory bodies, especially in North America and Europe, generally recognize creatine as a safe and effective dietary supplement when used appropriately, which further mitigates market hesitation and supports broader commercialization efforts globally.

Creatine Market Executive Summary

The Creatine Market is experiencing robust growth fueled by shifting consumer focus toward preventive healthcare and performance optimization, moving beyond traditional bodybuilding demographics. Business trends highlight strategic emphasis on product diversification, including flavored creatine blends, superior solubility formulations like Creatine HCL, and integration into multi-ingredient pre-workout and post-workout stacks. Key manufacturers are investing heavily in supply chain resilience and quality assurance, particularly concerning sourcing high-purity raw materials, as counterfeiting and quality inconsistencies pose risks to brand reputation. Mergers and acquisitions focusing on vertical integration—from synthesis to direct-to-consumer (DTC) distribution—are reshaping competitive dynamics and enhancing market penetration, especially through e-commerce channels which dominate sales.

Regionally, North America maintains market leadership due to high per capita spending on sports nutrition and a mature regulatory environment supportive of dietary supplements. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by urbanization, rising disposable incomes in countries like China and India, and the burgeoning adoption of Western fitness trends. European markets demonstrate steady demand, characterized by stringent quality standards and a preference for certified, traceable ingredients, prompting suppliers to adhere to rigorous manufacturing practices. Latin America and the Middle East & Africa (MEA) are emerging as significant consumption hubs, with growing awareness about athletic performance enhancement and improved accessibility to global supplement brands through organized retail.

Segmentation trends indicate a sustained dominance of Creatine Monohydrate due to its cost-effectiveness and proven efficacy, though non-monohydrate forms are expanding their share among niche, performance-focused users seeking enhanced convenience or minimized gastrointestinal issues. The application segment sees strong momentum in athletic and sports performance, but the medical and clinical application segment is projected to accelerate rapidly as research validates creatine’s role in sarcopenia treatment and neurological support. Distribution preference continues to heavily favor online platforms, offering convenience, product reviews, and competitive pricing, while brick-and-mortar specialty stores remain crucial for expert advice and immediate consumer access.

AI Impact Analysis on Creatine Market

Common user questions regarding AI's influence on the Creatine Market often revolve around personalized dosing recommendations, the use of AI in optimizing clinical trial outcomes for new creatine forms, and how supply chains can utilize predictive analytics to manage ingredient sourcing volatility. Users frequently ask if AI can accurately predict individual responses to creatine based on genetic profiles or training regimens, minimizing variability in effectiveness. Concerns are often raised about the ethical implications of using AI to filter supplement efficacy claims and the potential for AI-driven recommendation systems to exacerbate market dominance by larger players. Overall, users expect AI to significantly enhance the precision of creatine usage, from manufacturing consistency to highly personalized end-user protocols, shifting the focus from generalized supplementation advice to data-driven, bio-individualized nutrition strategies.

- AI-Driven Personalized Nutrition: Utilizing algorithms to analyze genetic data, physiological markers, and workout intensity to recommend optimal creatine dosage and timing for maximal efficacy, moving beyond standardized recommendations.

- Manufacturing Optimization: Employing machine learning models to monitor real-time production parameters, ensuring precise quality control, purity levels, and batch consistency in creatine synthesis, minimizing waste and contamination risks.

- Supply Chain Prediction and Resilience: Implementing AI and predictive analytics to forecast demand fluctuations and manage sourcing risks for raw materials (like sarcosine and cyanamide), thereby stabilizing costs and improving inventory management for manufacturers.

- Clinical Research Acceleration: Using AI tools to analyze vast datasets from clinical trials, speeding up the identification of creatine's therapeutic applications in neurology or muscle wasting, thus accelerating the launch of medical-grade formulations.

- Enhanced Consumer Engagement: Deploying AI chatbots and virtual assistants on e-commerce platforms to answer complex consumer questions about creatine, its interactions, and optimal use, thereby improving consumer education and driving conversion rates.

- Counterfeit Detection: Leveraging image recognition and blockchain-integrated AI systems to verify product authenticity across the distribution chain, protecting consumers from substandard or fraudulent creatine products.

DRO & Impact Forces Of Creatine Market

The Creatine Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory. Key drivers include the overwhelming body of scientific evidence supporting creatine's safety and efficacy, the rapid global expansion of the organized fitness industry, and the increasing adoption of sports supplements by amateur athletes and lifestyle users. Restraints primarily involve regulatory complexities across disparate international markets, the persistent issue of product quality and adulteration from unregulated sellers, and the misperception among general consumers that creatine is solely an anabolic steroid or harmful substance. Opportunities lie in diversifying creatine applications into clinical nutrition for aging populations (sarcopenia) and capitalizing on emerging cognitive health benefits, alongside technological advancements in delivery systems that enhance bioavailability and reduce potential side effects.

The primary impact forces propelling the market forward are technological advancements in microencapsulation and novel delivery forms, aimed at improving solubility and minimizing gastric distress, making creatine more palatable and effective for a wider user base. Furthermore, the strong influence of social media and fitness influencers acts as a powerful promotional force, rapidly disseminating information and building trust among younger demographics. Conversely, the market faces constraint from high competition and pricing pressure, particularly in the bulk Creatine Monohydrate segment, requiring manufacturers to constantly innovate or pivot toward high-value, differentiated products to maintain margins.

The overall impact of these forces suggests a sustained, upward trajectory for the Creatine Market, provided regulatory frameworks remain supportive of science-backed dietary supplements. The market's stability is reinforced by creatine's position as a staple supplement, unlikely to be fully replaced by alternatives. Strategic focus on exploiting the clinical opportunities—moving beyond the saturated athletic performance niche—will be critical for long-term premium growth. Addressing consumer misinformation through targeted, science-based educational campaigns remains essential for minimizing the negative impact of perceived restraints and maximizing market acceptance in untapped populations.

Segmentation Analysis

The Creatine Market is comprehensively segmented based on product type, application, and form, providing granular insight into consumer preferences and demand patterns across different end-use sectors. Understanding these segments is crucial for manufacturers to tailor their production, marketing, and distribution strategies effectively. The segmentation highlights the maturity of certain product formats, such as Creatine Monohydrate, while also pinpointing emerging areas of high growth, particularly within specialized non-monohydrate variants and clinical applications. Geographic segmentation further dissects consumption patterns based on regional regulatory environments, cultural fitness adoption rates, and economic factors.

- By Product Type:

- Creatine Monohydrate (Dominant due to established efficacy and cost-effectiveness)

- Creatine Hydrochloride (HCL) (Growing due to enhanced solubility)

- Creatine Ethyl Ester

- Buffered Creatine (e.g., Kre-Alkalyn)

- Creatine Nitrate

- Other Creatine Forms (e.g., Magnesium Creatine Chelate)

- By Application:

- Athletic Performance and Sports Nutrition (Largest segment)

- General Health and Wellness

- Clinical and Medical Applications (Neurological support, muscle disorders)

- Cosmetics and Personal Care (Niche and emerging)

- By Form:

- Powder (Most common and economical)

- Capsules/Tablets (Convenience-driven segment)

- Liquid/Ready-to-Drink (RTD) Formulations

- By Distribution Channel:

- Online Retail (E-commerce platforms, brand websites)

- Brick and Mortar (Specialty Stores, Pharmacies, Supermarkets/Hypermarkets)

- Direct Sales (Gyms, Wellness Clinics)

Value Chain Analysis For Creatine Market

The value chain for the Creatine Market begins with the upstream sourcing and synthesis of raw materials, primarily Sarcosine and Cyanamide, which are precursors to creatine. This phase is characterized by high capital intensity and strict quality control requirements, often dominated by a few specialized chemical manufacturers, particularly in Asia. The upstream analysis focuses heavily on supply security and maintaining price stability of these chemical inputs, which directly impact the final product cost. Manufacturers engaged in the core synthesis process must adhere to Good Manufacturing Practices (GMP) and ensure the resulting creatine product, usually in bulk powder form (Creatine Monohydrate), meets purity standards (typically 99.9% pure). Any disruption in the supply of precursors, often due to geopolitical factors or environmental regulations on chemical production, can propagate significant volatility throughout the entire chain.

The midstream involves processing, formulation, and branding. Bulk creatine is acquired by dietary supplement companies who specialize in formulating it into consumer-ready products (powders, capsules, liquids), often blending it with flavorings, electrolytes, or other complementary supplements (e.g., beta-alanine, whey protein). This stage requires significant investment in research and development to create novel, proprietary formulations (e.g., HCL or buffered creatine) and packaging that appeals to specific consumer segments. Quality testing, third-party verification, and achieving certifications (like NSF Sport or Informed Sport) are critical steps in this phase to build brand trust and navigate complex international regulatory landscapes, especially for exports to mature markets like North America and Europe.

Downstream analysis focuses on distribution and sales. Creatine reaches the end-user through both direct and indirect channels. Indirect distribution, dominated by specialized health and nutrition retailers (both online and physical) and large e-commerce platforms (Amazon, Alibaba), benefits from wide reach and inventory efficiency. Direct distribution includes branded websites (DTC model) and sales via gyms or personal trainers, offering higher margins and direct consumer feedback loops. The choice of distribution strategy impacts product visibility and pricing; while specialty supplement stores offer expert advice, online channels often lead in price competitiveness and geographic reach. Effective logistics and cold-chain management (though less critical for stable powder forms) remain important for maintaining product integrity and shelf life.

Creatine Market Potential Customers

The potential customer base for the Creatine Market is broadening significantly, extending beyond the traditionally targeted demographic of professional and dedicated amateur bodybuilders and athletes. The primary current end-users are individuals engaged in high-intensity intermittent training (HIIT), strength training, and sports requiring bursts of explosive power, such as football, track and field, and weightlifting. These consumers prioritize measurable performance improvements, rapid muscle recovery, and increased lean body mass, viewing creatine as a foundational supplement proven by sports science to achieve these goals. This segment is characterized by a high degree of product knowledge and brand loyalty, often influenced by coaching staff, scientific publications, and certified nutritionists.

A rapidly expanding segment of potential customers includes the general health and wellness demographic, specifically aging populations and individuals undergoing physical rehabilitation. For older adults, creatine offers potential benefits in mitigating age-related muscle loss (sarcopenia) and improving functional capacity, making it a critical component of healthy aging protocols. Furthermore, consumers seeking cognitive enhancement, including students, shift workers, and those under chronic sleep deprivation, are emerging buyers, driven by research suggesting creatine's positive effects on brain energy metabolism and cognitive function. Marketing strategies for this segment emphasize wellness and longevity rather than peak athletic performance.

Clinical institutions and research facilities represent a highly valuable, albeit smaller, B2B customer segment. These entities utilize pharmaceutical-grade creatine for clinical trials related to neurodegenerative diseases (like Parkinson’s or Huntington’s), cardiovascular health, and specific metabolic disorders. These customers require the highest purity standards and rigorous documentation, often necessitating specialized sourcing and certification. As therapeutic applications gain traction, this segment offers significant long-term growth potential and high-value contracts for manufacturers specializing in clinical-grade raw materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 500 Million |

| Market Forecast in 2033 | USD 900 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alzchem Group AG, MuscleTech, GNC Holdings Inc., Optimum Nutrition (Glanbia PLC), Myprotein (THG PLC), Dymatize Enterprises LLC, Bio-Engineered Supplements and Nutrition, Inc. (BSN), ALLMAX Nutrition, Inc., Universal Nutrition, Transparent Labs, BulkSupplements.com, Now Foods, JNX Sports, EFX Sports, Amway Corporation, ProMera Sports, NutraBio Labs, Inc., Kaged Muscle, Cellucor (Nutrabolt), Pure Encapsulations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Creatine Market Key Technology Landscape

The technological landscape within the Creatine Market is predominantly focused on enhancing product attributes such as solubility, stability, and bioavailability, while simultaneously optimizing synthesis processes for higher purity and lower production costs. The traditional manufacturing process involves the reaction of sarcosine and cyanamide, but modern techniques emphasize sterile and controlled environments to minimize heavy metal contamination and ensure pharmaceutical-grade output. Key technological innovations center around micronization—reducing particle size to improve dissolution rate and absorption—which is now standard for premium Creatine Monohydrate products. Furthermore, advancements in buffering technology are utilized to create specialized products like Kre-Alkalyn, which aims to protect the creatine from degradation in the acidic stomach environment, potentially reducing gastrointestinal side effects and improving uptake, although the scientific consensus on its superiority over monohydrate remains debated.

Another crucial area of technological advancement involves the development of novel creatine derivatives, such as Creatine Hydrochloride (HCL) and Creatine Nitrate. Creatine HCL is manufactured to be significantly more soluble in water than monohydrate, allowing for smaller effective doses and potentially eliminating the need for a 'loading phase.' Creatine Nitrate involves binding creatine to a nitrate molecule, which may offer dual benefits related to muscle energy and nitric oxide production, appealing to users seeking multi-functional supplements. These chemically engineered forms represent the forefront of product innovation, catering to niche consumer demands for convenience, enhanced efficacy, and reduced side effects, providing manufacturers with opportunities for higher profit margins compared to the heavily commoditized monohydrate segment.

The distribution and consumption technology landscape is equally evolving. Advances in encapsulation and tablet technology are producing stable, delayed-release creatine products designed to optimize absorption windows or integrate creatine into multi-vitamin complexes. Furthermore, the use of blockchain technology is emerging in the supply chain to provide verifiable proof of sourcing and purity, addressing consumer concerns about adulteration and enhancing brand transparency. On the consumer interaction front, mobile applications and integrated wearable technology are increasingly being used to track exercise performance and nutritional intake, potentially leading to the delivery of personalized, real-time dosing suggestions based on an individual's biomechanical and training data, thereby integrating creatine consumption seamlessly into a technology-enabled fitness regimen.

Regional Highlights

- North America (United States, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

North America holds the largest share of the global Creatine Market, driven by high consumer awareness, widespread acceptance of dietary supplements, and a highly structured sports nutrition industry. The United States, in particular, dominates consumption due to its mature fitness culture, extensive network of health and specialty supplement retailers, and significant expenditure on performance-enhancing products. Regulatory standards, largely governed by the FDA (for supplements), provide a predictable framework that supports large-scale manufacturing and diverse product innovation. The region benefits from a robust ecosystem of research institutions and marketing platforms (including influential sports leagues and social media personalities) that consistently drive demand and legitimize the use of creatine among mainstream users and professionals alike. The market trend here involves a strong pivot toward premium, scientifically backed, and transparently sourced products, with Creatine HCL and high-purity Monohydrate leading sales.

The competitive environment in North America is highly saturated, characterized by numerous domestic and international players vying for market share through aggressive marketing, competitive pricing, and constant product reformulation. E-commerce platforms are the primary sales driver, offering consumers unparalleled access to comparative pricing and detailed product information. Challenges include managing the perpetual influx of private-label and low-cost alternatives, forcing established brands to invest heavily in clinical testing and third-party certifications (e.g., Informed Choice) to maintain consumer trust and justify premium pricing. Canada and Mexico show steady growth, mirroring U.S. trends but often constrained by slightly stricter import regulations and lower per capita spending on supplements, although fitness adoption rates are accelerating.

Strategic investments in the region focus on expanding product formats to include ready-to-drink (RTD) options and incorporating creatine into functional foods. Manufacturers are also exploring the geriatric and clinical nutrition spaces, positioning creatine as a tool for muscle preservation and recovery in older populations, thereby tapping into the lucrative preventative health expenditure in the region. Furthermore, stringent quality expectations necessitate continuous technological investment in synthesis and testing methodologies to ensure compliance with cGMP standards and consumer safety expectations.

Europe represents the second-largest market for creatine, distinguished by strong regulatory emphasis on quality, traceability, and ingredient sourcing, often guided by standards set by the European Food Safety Authority (EFSA). Germany and the UK are the dominant contributors, boasting high levels of consumer education and significant participation in athletic and fitness activities. European consumers typically prioritize certification and scientific substantiation, leading to higher demand for pharmaceutical-grade creatine products and certified supply chains. The market exhibits steady, predictable growth, supported by national health initiatives promoting physical activity and an aging population increasingly interested in muscle maintenance supplements.

Market dynamics in Europe are influenced by diverse regional tastes; while Western Europe (UK, Germany, France) focuses on specialized sports nutrition and premium brands, Eastern Europe presents faster growth potential but remains more price-sensitive, often favoring bulk Creatine Monohydrate. The UK shows a particularly strong penetration of online sales and direct-to-consumer models, facilitated by mature digital infrastructure. Innovation in the region centers on formulating low-sugar or naturally sweetened creatine products and integrating them into vegan and specialized diet lines, aligning with broader European health and environmental trends. The strict regulatory environment, particularly regarding health claims, necessitates careful marketing communication strategies.

A key regional focus is leveraging creatine’s potential in medical nutrition. European research institutions are active in investigating creatine for conditions such as chronic fatigue and neurological support, creating opportunities for manufacturers to collaborate with healthcare providers and expand distribution through pharmacies and specialized clinical channels. Navigating the varied language and national regulatory requirements across the EU and non-EU countries remains a critical challenge, requiring localized packaging and compliance strategies for effective market entry and sustained operation across the continent.

The Asia Pacific region is forecast to be the fastest-growing market globally for creatine, fueled by demographic shifts, rapid urbanization, rising middle-class disposable incomes, and the strong influence of Western fitness and lifestyle trends. China and India are the pivotal growth engines. China, in particular, is transitioning from being primarily a manufacturing hub to a massive consumer market, driven by governmental emphasis on national health and widespread adoption of organized sports and fitness facilities. South Korea and Japan represent mature markets with high demand for premium, high-quality, and aesthetically pleasing supplement formats.

Challenges in APAC include fragmented distribution networks, significant variances in regulatory approvals (e.g., strict restrictions on supplement sales in certain countries), and high instances of counterfeit products, particularly in rapidly developing e-commerce environments. To overcome these hurdles, international players are forming strategic joint ventures or focusing on stringent verification technologies like QR codes and blockchain. Consumer behavior in this region is highly influenced by social media influencers and key opinion leaders (KOLs), making digital marketing and localized content adaptation essential for effective market penetration.

The opportunity within APAC is vast, extending beyond traditional sports consumption to encompass massive populations focused on holistic wellness and preventative health. Manufacturers are prioritizing product formulations suitable for Asian dietary preferences, such as lower doses, micro-blends, and integration into traditional health tonics or beverages. Investing in local manufacturing and robust cold chain logistics is becoming essential to meet escalating demand while maintaining quality and reducing tariffs. The region's young population demographic provides a fertile ground for sustained long-term expansion in the sports and wellness segments.

Latin America is characterized by high rates of sports participation, particularly in football (soccer) and weightlifting, establishing a foundational consumer base for creatine. Brazil leads the regional market, supported by strong local manufacturing capacity and a high cultural value placed on physical fitness and appearance. The market is highly price-sensitive, leading to strong demand for bulk, cost-effective Creatine Monohydrate, though premium, branded alternatives are gaining visibility among the affluent urban populations. Economic instability and fluctuating currency values pose significant operational challenges for international suppliers regarding pricing and profit repatriation.

Distribution channels in Latin America are often complex, combining traditional retail stores with informal markets and a quickly developing, though still challenging, e-commerce sector. Successful market entry requires strong local partnerships to navigate complex tariffs and import regulations. Consumer trends are heavily influenced by U.S. sports nutrition marketing, leading to high adoption of globally recognized brands, even if locally manufactured. The emphasis on body image and competitive amateur sports continues to drive sustained demand for performance supplements.

Future growth in this region depends on improving regulatory harmonization and stabilizing economic conditions. Opportunities exist in expanding health education to reduce reliance on informal or unregulated sources of supplements and promoting creatine’s benefits for general health and muscle maintenance, particularly as the middle class expands. Localizing manufacturing operations to mitigate import duties and focusing on efficient, high-volume production are key strategies for maximizing profitability in this highly dynamic regional market.

The MEA region is witnessing accelerated growth in the Creatine Market, largely concentrated in the Gulf Cooperation Council (GCC) countries—Saudi Arabia, UAE, and Qatar—driven by significant government investment in sports infrastructure, a young, health-conscious expatriate population, and high disposable incomes. Fitness and sports participation, traditionally lower than Western averages, are rapidly increasing, leading to heightened demand for performance supplements. South Africa is another key consumer market, with a mature sports culture and established retail chains for supplements.

The market in the MEA is characterized by a strong preference for high-quality, reputable international brands, often imported from the U.S. or Europe, due to perceived quality superiority. Regulatory clearance, particularly in GCC nations, is stringent and often requires Halal certification, posing a specific challenge and opportunity for manufacturers. Distribution relies heavily on organized retail (malls, specialty supplement stores) and rapidly growing localized e-commerce platforms. High summer temperatures necessitate robust climate-controlled logistics for warehousing and transport to maintain product integrity.

Opportunities exist in diversifying product formats, addressing specific dietary needs (e.g., specialized formulations for fasting periods like Ramadan), and expanding reach into underserved sub-Saharan African countries as economic development progresses. The cultural importance of fitness and appearance, supported by massive infrastructure projects like global sporting events, continues to elevate supplement consumption. Strategic focus must be placed on obtaining local certifications and ensuring cultural sensitivity in marketing efforts to effectively capture the rising consumer expenditure on health and wellness across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Creatine Market.- Alzchem Group AG

- MuscleTech

- GNC Holdings Inc.

- Optimum Nutrition (Glanbia PLC)

- Myprotein (THG PLC)

- Dymatize Enterprises LLC

- Bio-Engineered Supplements and Nutrition, Inc. (BSN)

- ALLMAX Nutrition, Inc.

- Universal Nutrition

- Transparent Labs

- BulkSupplements.com

- Now Foods

- JNX Sports

- EFX Sports

- Amway Corporation

- ProMera Sports

- NutraBio Labs, Inc.

- Kaged Muscle

- Cellucor (Nutrabolt)

- Pure Encapsulations

Frequently Asked Questions

Analyze common user questions about the Creatine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Creatine Market?

The market's primary driver is the extensive and consistent scientific validation confirming creatine's efficacy and safety in enhancing athletic performance, strength, and recovery, which continuously boosts consumer trust and mainstream adoption globally.

Which form of creatine currently dominates the market share?

Creatine Monohydrate maintains market dominance due to its exceptional cost-effectiveness, established safety profile, and comprehensive body of research proving its bioavailability and effectiveness as the gold standard supplement.

How is the Asia Pacific region impacting the global Creatine Market?

The Asia Pacific region, particularly China and India, is projected to exhibit the highest CAGR, driven by rapid urbanization, increasing disposable incomes, and the accelerated adoption of Western fitness and health consciousness trends.

Are there significant clinical or medical applications driving future creatine demand?

Yes, significant future demand is expected from clinical and medical applications, focusing on creatine’s potential role in managing age-related muscle wasting (sarcopenia), improving cognitive function, and supporting neurological health.

What technological innovations are emerging in creatine delivery systems?

Key technological innovations include micronization for improved solubility, development of enhanced derivatives like Creatine Hydrochloride (HCL), and the use of specialized encapsulation techniques to optimize stability and bioavailability.

What are the main risks associated with the Creatine Market supply chain?

The main risks include price volatility and supply security challenges related to sourcing key chemical precursors (Sarcosine and Cyanamide), regulatory complexities across different geographies, and persistent issues of product quality control and counterfeiting.

How does the retail distribution landscape differ for creatine products?

The distribution landscape is shifting towards online retail (e-commerce platforms and DTC websites) due to convenience and competitive pricing, although brick-and-mortar specialty nutrition stores remain vital for expert consultation and immediate purchase.

What role does Artificial Intelligence (AI) play in the creatine industry?

AI is increasingly being utilized for personalized nutrition recommendations, optimizing manufacturing processes for purity, enhancing supply chain forecasting, and accelerating clinical research outcomes for novel creatine formulations.

Which segment offers the highest potential for premium pricing in the market?

Non-monohydrate derivatives, such as Creatine HCL and Creatine Nitrate, often command premium pricing due to perceived advantages in solubility, lower dosing requirements, and specific functional benefits appealing to highly discerning users.

What impact do government regulations have on the European Creatine Market?

European regulations, guided by bodies like EFSA, impose stringent requirements for product traceability, quality testing, and permissible health claims, ensuring a high standard of quality but often creating market entry barriers for smaller firms.

Is creatine consumption increasing among non-athletic populations?

Yes, creatine consumption is steadily increasing among general health and wellness consumers, particularly older adults seeking muscle maintenance and individuals looking for non-stimulant cognitive support and overall energy improvement.

What is the current trend regarding creatine product format innovation?

The trend is towards convenient, palatable formats, including flavored powders that mix easily, ready-to-drink (RTD) beverages, and smaller, easy-to-swallow capsules, moving away from large, unflavored bulk powders.

How do manufacturers ensure product purity in the creatine synthesis process?

Manufacturers utilize advanced chemical synthesis techniques under strict Good Manufacturing Practices (GMP), involving multiple purification stages, precise temperature control, and rigorous third-party testing to minimize heavy metal contamination and volatile impurities.

What challenges face global brands entering the Latin American creatine market?

Challenges in Latin America include navigating complex import tariffs, coping with currency volatility, intense price sensitivity among local consumers, and establishing reliable distribution networks across geographically diverse regions.

How critical is the role of digital marketing and social media in the creatine industry?

Digital marketing is highly critical, driving consumer education, brand loyalty, and sales through targeted social media campaigns, influencer partnerships, and the provision of verifiable scientific information to build trust among fitness communities.

What is the significance of the "loading phase" in creatine usage for market sales?

The traditional "loading phase" (higher initial doses) contributes to temporary spikes in initial product sales, although newer creatine forms and evolving scientific consensus suggest that lower, consistent daily doses are equally effective for long-term saturation, influencing purchasing cycles.

How does creatine HCL differ fundamentally from Creatine Monohydrate?

Creatine HCL (Hydrochloride) is chemically bound to hydrochloric acid, making it significantly more soluble in water and potentially reducing the incidence of gastrointestinal discomfort often associated with larger doses of Monohydrate.

What strategies are being used to combat counterfeit creatine products?

Strategies involve leveraging blockchain technology for supply chain transparency, using unique serialization and QR codes on packaging for consumer verification, and collaborating with law enforcement to track and dismantle unauthorized distributors.

What are the growth opportunities in the Middle East and Africa (MEA) region?

Growth opportunities in MEA are concentrated in GCC nations, driven by high disposable incomes and government investment in sports; manufacturers must focus on Halal certification and organized retail penetration to succeed.

How does the Creatine Market relate to the overall sports nutrition sector?

Creatine is a foundational, non-protein supplement within the broader sports nutrition sector, often considered second only to protein powder in terms of scientific evidence and consumer adoption for maximizing training adaptations.

What is the typical shelf life and stability profile of Creatine Monohydrate?

Creatine Monohydrate is highly stable and generally possesses a long shelf life of three to five years when stored correctly in cool, dry conditions, making logistics and inventory management relatively straightforward for distributors.

What factors influence consumer trust in a creatine brand?

Consumer trust is primarily influenced by third-party testing certifications (e.g., NSF, Informed Sport), clinical trial documentation, sourcing transparency, purity guarantees, and consistency in meeting label claims.

Are there any major sustainability concerns impacting creatine production?

Sustainability concerns mainly relate to the energy-intensive nature of chemical synthesis processes and waste management associated with large-scale chemical manufacturing of precursors, prompting shifts towards more environmentally conscious production methods.

How do competitive pricing pressures affect product innovation in the Creatine Market?

Intense pricing pressures, especially in bulk monohydrate, force established companies to focus R&D efforts on high-margin, differentiated products (like HCL or specialized blends) that can justify a premium price point, insulating them from commoditization.

What impact does the aging global population have on creatine consumption?

The aging population is driving increased demand for creatine as a clinical nutrition supplement, recognized for its ability to combat sarcopenia (age-related muscle loss) and improve functional mobility, broadening the consumer base significantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Creatine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Creatine Citrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Creatine Pyruvate Market Statistics 2025 Analysis By Application (.), By Type (Purity:), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Creatine Kinase Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (CK-MM, CK-MB, CK-BB), By Application (Laboratory Testing, Point-of-care Testing), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Dicreatine Malate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Content 99%, Content 99%), By Application (Food, Feed), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager