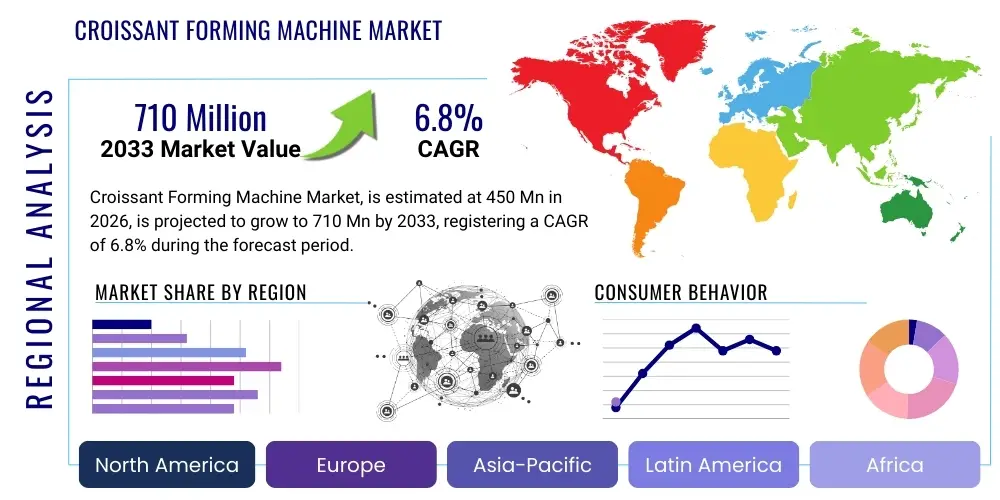

Croissant Forming Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441417 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Croissant Forming Machine Market Size

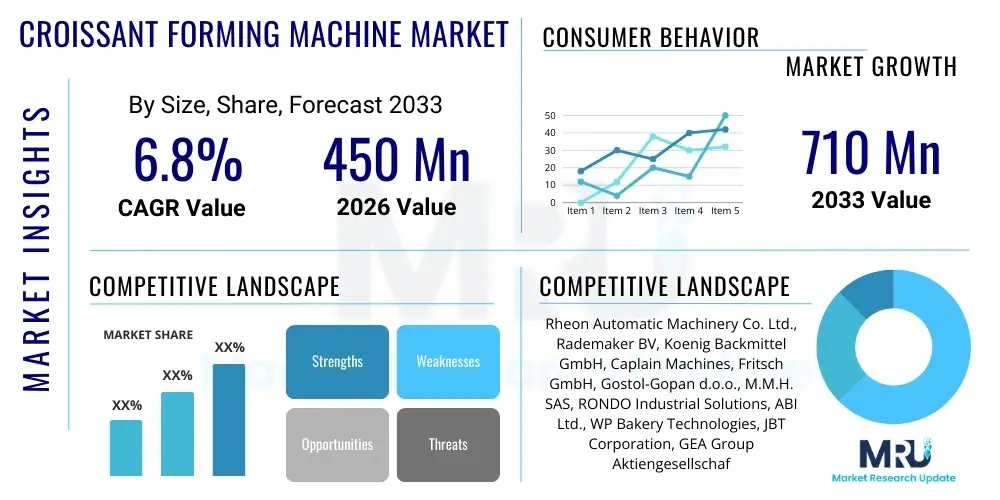

The Croissant Forming Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Croissant Forming Machine Market introduction

The Croissant Forming Machine Market encompasses equipment designed to automate the delicate and complex process of cutting, rolling, and shaping laminated dough into the traditional crescent form required for croissants. These machines are crucial components in modern industrial and commercial bakeries, enabling high-volume production while ensuring consistency in product size, weight, and structure. The primary function of these systems is to handle the dough gently to preserve the intricate layering necessary for the croissant’s flaky texture, translating manual expertise into a repeatable mechanical operation.

Key applications of croissant forming machinery span across large-scale food manufacturing plants, specialized patisserie chains, and quick-service restaurant suppliers who require standardized baked goods in massive quantities. Product description varies significantly, ranging from compact, semi-automatic lines suitable for smaller operations to fully integrated, high-capacity automatic lines capable of processing thousands of pieces per hour. These advanced systems often incorporate features like dough relaxation conveyors, precise cutting mechanisms (including ultrasonic blades), and synchronized rolling modules to handle high-fat, laminated dough effectively.

The market benefits significantly from the increasing global demand for convenience foods and premium baked goods, particularly in emerging economies where western dietary habits are gaining traction. Driving factors include the necessity for labor cost reduction, the imperative for sanitary and consistent food production standards, and the overall industrialization trend within the food processing sector. Furthermore, advancements in automation technology, such as servo motor control and programmable logic controllers (PLCs), are enhancing machine efficiency and reducing downtime, thereby accelerating market adoption among discerning bakery operators globally.

Croissant Forming Machine Market Executive Summary

The Croissant Forming Machine Market is characterized by robust business trends centered on automation, efficiency, and flexibility. Leading manufacturers are focusing heavily on developing modular systems that allow bakeries to quickly switch between different product shapes and sizes, catering to diverse consumer preferences, including miniature and filled croissants. Sustainability and energy efficiency are emerging as critical competitive differentiators, with businesses demanding machines that reduce waste dough and minimize energy consumption per unit produced. Mergers, acquisitions, and strategic partnerships between equipment manufacturers and technology providers are defining the competitive landscape, aiming to offer integrated solutions encompassing mixing, sheeting, forming, proofing, and baking processes.

Regional trends indicate strong growth in Asia Pacific (APAC), driven by the rapid expansion of international food service brands and the rising disposable income fueling demand for premium baked products in countries like China and India. North America and Europe remain mature but vital markets, characterized by demand for sophisticated, high-precision equipment adhering to strict food safety regulations (such as FDA and EFSA standards). Latin America and the Middle East and Africa (MEA) present opportunities primarily driven by urbanization and the establishment of centralized production facilities serving expanding populations.

Segmentation trends highlight the dominance of fully automatic machines due to their unparalleled capacity and reduced dependency on skilled labor, particularly in industrial settings. The high-capacity segment (producing over 8,000 pieces per hour) is witnessing significant technological investment. Regarding end-users, industrial bakeries are the primary revenue generators, although large commercial bakeries focusing on artisanal quality alongside volume production are increasingly adopting advanced, medium-capacity machinery that offers better dough handling characteristics and preservation of product quality attributes.

AI Impact Analysis on Croissant Forming Machine Market

Common user questions regarding AI's influence often revolve around predictive maintenance capabilities, quality control efficiency, and the optimization of dough handling parameters. Users are concerned about how AI can minimize expensive downtime, ensure product consistency across long production runs, and autonomously adjust machine settings based on real-time environmental factors such as temperature and humidity. There is a strong expectation that AI will move these machines beyond mere automation towards intelligent manufacturing, leading to significant reductions in operational waste and improvement in overall yield without human intervention.

The key themes indicate that users seek AI solutions that integrate seamlessly with existing PLC systems to provide prescriptive analytics rather than just descriptive data. Concerns center on the cost of implementing these advanced sensor arrays and AI models, data security, and the necessity of specialized training for maintenance staff. Ultimately, the expectation is that AI-driven forming machines will dramatically enhance reliability and allow for unprecedented levels of customization and recipe management, predicting optimal roller pressure and cutting speeds for different dough hydration levels.

The adoption of machine learning models for visual inspection is rapidly gaining traction, allowing the machines to identify imperfectly rolled or cut croissants with high precision, exceeding human capabilities in speed and consistency. Furthermore, AI algorithms are being used to optimize the scheduling and workflow of integrated baking lines, ensuring that the forming process is perfectly synchronized with proofing and oven cycles, which is critical for maintaining the fragile structure and quality of the final baked product.

- Implementation of predictive maintenance using machine learning algorithms to forecast component failures, minimizing unplanned downtime and optimizing spare parts inventory management.

- Integration of Computer Vision systems utilizing AI for real-time, high-speed defect detection, ensuring uniform size, shape, and lamination quality of every formed croissant.

- Autonomous process control adjustments where AI monitors dough rheology (viscosity and elasticity) and environmental factors, instantly modulating roller speeds and cutting pressure for optimal forming results.

- Enhanced recipe management through AI optimization, suggesting parameter changes based on ingredient variations (e.g., flour moisture, butter temperature) to guarantee consistent output quality.

- Optimization of energy consumption by utilizing deep learning models to manage motor load and operational cycles during different phases of the forming process.

- Development of digital twins of forming lines, allowing bakeries to simulate production changes and optimize throughput virtually before deploying changes physically.

DRO & Impact Forces Of Croissant Forming Machine Market

The Croissant Forming Machine Market is primarily driven by the escalating demand for bakery products globally, coupled with the critical need for automation to counteract rising labor costs and shortages of skilled bakery personnel. Restraints include the substantial initial capital investment required for high-capacity, advanced equipment, making it challenging for small and medium-sized bakeries to adopt modern machinery. Furthermore, the technical complexity associated with maintaining and troubleshooting highly sensitive lamination and forming mechanisms necessitates specialized technical support, which can be costly and difficult to secure in certain regions. The market’s operational performance is also heavily impacted by the variability of raw materials; inconsistent dough quality can significantly reduce machine efficiency and increase maintenance requirements.

Opportunities within the sector are centered on technological advancements, specifically the development of flexible forming machines capable of producing a wider variety of specialized laminated products beyond traditional croissants, such as puff pastry items, Danish pastries, and specialty breads. The growing trend towards clean label ingredients and specialized diets (e.g., gluten-free, vegan) presents a niche opportunity for manufacturers to develop forming technology uniquely suited to handling non-traditional dough compositions, which often have different rheological properties compared to standard wheat dough. Additionally, the expansion of modular and scalable machine designs offers a pathway for smaller businesses to upgrade their capacity incrementally.

The combined impact forces reflect a strong momentum towards efficiency and quality standardization. The necessity of maintaining competitive pricing in the mass market pushes bakeries toward fully automatic, high-throughput systems (Driver). However, the market faces resistance due to the high cost of entry and the steep learning curve associated with sophisticated PLCs and sensor technology (Restraint). The long-term trajectory is positive, supported by global expansion and technological refinement (Opportunity), where automation is not just a preference but a necessity for surviving stringent international food safety and quality standards (Impact Force). Manufacturers who successfully integrate AI-driven diagnostics and remote monitoring capabilities will be best positioned to capitalize on this evolving landscape.

Segmentation Analysis

The Croissant Forming Machine Market segmentation provides a granular view of diverse operational requirements and purchasing behaviors across the global bakery industry. Segmentation is fundamentally categorized by the degree of automation (manual, semi-automatic, automatic), operational capacity (low, medium, high), and the primary end-user application (industrial versus commercial bakeries). This structure helps manufacturers align their product development efforts with specific market needs, focusing on optimizing efficiency for industrial scale-up or prioritizing flexibility and gentle dough handling for artisanal quality production.

The capacity segmentation remains paramount, dictating the machine’s size and complexity. The high-capacity segment, targeting industrial bakeries producing over 8,000 croissants per hour, commands the largest market share in value terms due to the specialized engineering required for continuous, high-speed lamination and precise cutting. In contrast, the low-capacity segment caters to smaller, specialized shops and institutional kitchens, prioritizing footprint and operational simplicity over maximum throughput.

Further analysis of the sales channel segmentation indicates a significant reliance on direct sales channels and specialized distributors who can provide installation, maintenance contracts, and technical training. The complexity of these capital goods necessitates a high degree of technical consultation during the purchasing process, favoring manufacturer-led sales teams or highly specialized engineering distributors capable of providing comprehensive aftermarket support and integration services into existing bakery lines. The rise of integrated equipment packages, where forming machines are bundled with sheeting and packaging solutions, also influences procurement decisions across all segments.

- By Type:

- Fully Automatic Croissant Forming Machines

- Semi-Automatic Croissant Forming Machines

- Manual/Benchtop Croissant Forming Accessories

- By Capacity (Pieces per Hour):

- Low Capacity (Up to 3,000 pcs/hr)

- Medium Capacity (3,001 to 8,000 pcs/hr)

- High Capacity (Above 8,000 pcs/hr)

- By End-User:

- Industrial Bakeries and Food Manufacturers

- Large Commercial Bakeries

- Hotels, Restaurants, and Catering (HORECA)

- In-Store Bakeries (Supermarket Chains)

- By Sales Channel:

- Direct Sales (Manufacturer to End-User)

- Distributors and Value-Added Resellers

- Online Marketplaces (Limited to smaller, specialized accessories)

Value Chain Analysis For Croissant Forming Machine Market

The value chain for the Croissant Forming Machine Market begins with upstream activities involving the sourcing of highly specialized materials and components. This includes precision-engineered stainless steel (for food contact surfaces), sophisticated electronic components (PLCs, sensors, servo motors), and high-durability polymers for conveyor belts. Key upstream challenges involve managing the supply chain volatility for electronic components and ensuring compliance with stringent material safety standards (e.g., food-grade lubricants and metals). Manufacturers focus heavily on optimizing design and modularity in this stage to reduce manufacturing complexity and assembly time.

The core value creation lies in the manufacturing and assembly phase, where high-precision machining and system integration are critical. Successful market players invest heavily in research and development to improve dough handling mechanics, reduce friction, and increase line speed without compromising product integrity. Distribution channels are predominantly indirect through specialized agents or distributors, particularly for international sales, who provide localized sales expertise and installation support. However, high-end, bespoke industrial lines often involve direct sales channels to ensure seamless communication between the client's engineering team and the manufacturer's design department.

Downstream activities include installation, commissioning, training, and, most critically, aftermarket services such as maintenance, spare parts supply, and technical upgrades. The long lifespan of these machines makes service contracts a significant revenue stream. Direct distribution channels are often preferred for maintenance and service, ensuring rapid response times and expert knowledge transfer, which builds long-term customer loyalty. Indirect channels, while useful for initial sales volume, rely on the technical competency of local partners to deliver adequate post-sale support, posing a potential quality control challenge for the original equipment manufacturer (OEM).

Croissant Forming Machine Market Potential Customers

Potential customers for Croissant Forming Machines are entities operating within the industrial food production and large-scale commercial baking sectors who prioritize automation, volume, and consistent quality output. The largest segment of buyers consists of multinational food conglomerates that operate dedicated manufacturing plants for frozen and ready-to-bake products supplied to retail chains globally. These customers demand the highest capacity, fully automated lines with integrated quality assurance systems and full traceability features compliant with international standards like ISO 22000.

Another crucial customer segment involves large regional or national commercial bakeries specializing in supplying fresh goods to supermarkets, independent cafes, and local food service providers. These buyers typically seek flexible, medium-to-high capacity machines that offer versatility in product variation (e.g., filled, straight, curved croissants) and are often more quality-sensitive regarding dough handling to mimic artisanal methods. Their purchasing decisions are highly influenced by the machine’s footprint and energy efficiency, as operational costs are a major concern.

The HORECA sector, specifically major hotel chains, cruise lines, and large institutional catering operations, also represents a growing customer base, generally opting for semi-automatic or lower-capacity automatic machines. For these users, reliability, ease of cleaning, and small batch flexibility are prioritized over sheer volume. Furthermore, specialized end-users like dedicated gluten-free or allergy-friendly bakeries constitute a niche market, requiring machines designed with specialized materials and handling mechanisms suitable for non-traditional, often more fragile, dough mixtures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rheon Automatic Machinery Co. Ltd., Rademaker BV, Koenig Backmittel GmbH, Caplain Machines, Fritsch GmbH, Gostol-Gopan d.o.o., M.M.H. SAS, RONDO Industrial Solutions, ABI Ltd., WP Bakery Technologies, JBT Corporation, GEA Group Aktiengesellschaft, VMI Mixers, AMF Bakery Systems, Kaak Group, Kemper Bakery Systems, Spooner Industries, Shaffer Manufacturing, Comas SpA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Croissant Forming Machine Market Key Technology Landscape

The technology landscape of the Croissant Forming Machine Market is defined by the necessity for precision engineering to handle highly delicate laminated dough structures. Modern machines rely extensively on advanced servo motor technology coupled with sophisticated Programmable Logic Controllers (PLCs). Servo motors allow for exceptionally precise control over roller speeds and indexing movements, minimizing stress on the dough layers and ensuring uniform product size and weight, which is paramount for baking consistency and waste reduction. Furthermore, high-resolution sensors are used extensively to monitor dough thickness and alignment in real-time, often feeding back data to the PLC for instantaneous parameter adjustments.

A major technological trend involves the development and adoption of "stress-free" dough sheeting and relaxation systems preceding the actual forming process. This ensures the gluten network remains relaxed, resulting in a more uniform lift and texture in the final product. Cutting technology has also evolved significantly, with mechanical cutters being supplemented or replaced by ultrasonic cutting systems. Ultrasonic technology minimizes dough sticking and deformation, delivering cleaner, more consistent cuts, especially critical for high-fat, sticky laminated doughs and for reducing machine cleaning time and complexity.

Beyond the physical mechanics, the integration of Industry 4.0 principles, including the Internet of Things (IoT) and cloud connectivity, is transforming machine operation. These connectivity features allow for remote diagnostics, software updates, and performance monitoring, providing bakeries with actionable data insights into operational efficiency (OEE). The technology is shifting towards modular designs, where components like curling stations or filling depositors can be easily swapped out, enhancing machine versatility and future-proofing the investment against changing market demands and product diversification.

Regional Highlights

Regional analysis reveals diverse market dynamics driven by variations in production volumes, labor costs, and consumer preference for baked goods.

- North America: A mature market characterized by the presence of large industrial bakeries and a strong focus on high-speed, fully automated lines. Demand is concentrated on technology offering maximum throughput, advanced sanitation features, and integrated AI for quality control. High labor costs necessitate comprehensive automation, making this region a leader in adopting the latest, most sophisticated machinery.

- Europe: This region exhibits a dual market structure. Western Europe demands high-quality, flexible systems that cater to both industrial producers and highly specialized artisanal bakeries, prioritizing gentle dough handling. Central and Eastern Europe are witnessing rapid industrialization, driving robust demand for medium-to-high capacity, cost-effective automated solutions to modernize existing facilities.

- Asia Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and the adoption of Western dietary patterns. Countries like China, India, and Southeast Asian nations are investing heavily in establishing large centralized bakery production facilities. The market is highly price-sensitive but shows increasing demand for reliable, scalable, and durable automatic machinery.

- Latin America (LATAM): Growth is steady, driven by the expansion of multinational food service franchises and local industrialization efforts. Focus is primarily on reliable, mid-range automation that offers a balance between cost and throughput efficiency. Market penetration is often facilitated through established regional distribution networks.

- Middle East and Africa (MEA): Emerging market opportunities linked to tourism, rapid infrastructure development, and the expansion of packaged food industries. Demand is concentrated in the UAE, Saudi Arabia, and South Africa, focusing on high-volume production to serve regional consumer bases and the significant HORECA sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Croissant Forming Machine Market.- Rheon Automatic Machinery Co. Ltd.

- Rademaker BV

- Koenig Backmittel GmbH

- Caplain Machines

- Fritsch GmbH

- Gostol-Gopan d.o.o.

- M.M.H. SAS

- RONDO Industrial Solutions

- ABI Ltd.

- WP Bakery Technologies

- JBT Corporation

- GEA Group Aktiengesellschaft

- VMI Mixers

- AMF Bakery Systems

- Kaak Group

- Kemper Bakery Systems

- Spooner Industries

- Shaffer Manufacturing

- Comas SpA

- O.N. S.r.l.

Frequently Asked Questions

Analyze common user questions about the Croissant Forming Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fully automatic and semi-automatic croissant forming machines?

Fully automatic machines handle the entire process, from sheeting the dough ribbon to forming and traying the final crescent, requiring minimal operator intervention and achieving high throughput (8,000+ pieces/hour). Semi-automatic machines require manual handling of the dough ribbon into the forming station and often manual placement on trays, suitable for medium capacity and specialized, artisanal applications.

How does AI contribute to reducing operational waste in modern croissant production lines?

AI integrates with computer vision and weight sensors to monitor and adjust cutting and rolling parameters in real-time. By predicting and correcting slight variations in dough thickness or elasticity, AI minimizes scrap dough and ensures every piece meets precise size and weight specifications, significantly boosting overall yield and efficiency.

What are the critical factors determining the ROI for investing in a high-capacity forming machine?

The critical factors include the machine’s efficiency (OEE), labor cost savings achieved through automation, reduction in product variability and waste, and the machine's energy consumption rate per unit. A higher initial investment is often justified by reduced running costs, minimized downtime through predictive maintenance, and consistent product quality over a 5-10 year operational lifecycle.

Which geographical region is expected to demonstrate the highest growth rate (CAGR) for this market during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR due to rapid industrialization, increasing urbanization, rising disposable income leading to higher consumption of convenience baked goods, and substantial investment in modern, centralized food production facilities, particularly in key developing economies like China and India.

What technological advancements are crucial for handling non-traditional doughs, such as gluten-free formulations?

Crucial advancements involve "stress-free" sheeting technology and optimized roller designs that avoid shearing and tearing fragile dough structures. Specialized material coatings and ultrasonic cutting mechanisms are necessary to prevent sticking and deformation, ensuring the non-traditional dough retains its structure throughout the forming process without compromising volume or texture.

Why is gentle dough handling a non-negotiable requirement for high-quality croissant production?

Gentle dough handling preserves the integrity of the laminated structure—the alternating layers of dough and butter/fat. Excessive stress or pressure can rupture these delicate layers, causing the butter to seep out prematurely during proofing or baking, resulting in a dense, chewy product rather than the desired light, flaky texture and optimal volume lift.

How do global supply chain constraints impact the procurement lead times for new forming machines?

Global supply chain issues, particularly related to microchip and specialized electronic components (like PLCs and servo drives) sourced from Asia, have significantly extended procurement lead times. This often requires end-users to place orders 12 to 18 months in advance, prompting manufacturers to increase component stockpiling and diversify their supplier base to mitigate risks.

What role does machine standardization play in the global expansion of multinational bakeries?

Machine standardization ensures product consistency across different manufacturing sites globally. Multinational bakeries rely on identical forming machine models and configurations across various regions to guarantee that a croissant produced in one country tastes and looks identical to one produced in another, maintaining critical brand quality and reputation standards worldwide.

What are the sanitation challenges specific to croissant forming equipment?

Croissant forming machines handle sticky, high-fat dough, making residual build-up of fat and flour challenging. Sanitation demands include design features like cantilevered frames, easily removable components (Quick-Release systems), and Clean-In-Place (CIP) capabilities to ensure compliance with strict food safety standards and prevent cross-contamination.

How are manufacturers addressing the market demand for more energy-efficient forming solutions?

Manufacturers are integrating high-efficiency servo motors and optimizing machine programming to reduce idle power consumption. They also focus on minimizing friction in the dough handling pathway, thereby lowering the required power draw during operation. Lightweight, durable materials further reduce the inertial load, contributing to overall energy savings.

Is there a growing trend toward customized or modular machine configurations?

Yes, modularity is a significant trend. Bakeries increasingly demand modular components that allow them to expand capacity or change product lines (e.g., adding a filling station or switching cutting dies) without purchasing an entirely new machine, offering better adaptability and capital efficiency for the long term.

What certifications are essential for machinery sold in the European and North American markets?

Machines sold in Europe require CE marking, signifying compliance with health, safety, and environmental protection standards. In North America, essential certifications often include UL or CSA approval for electrical safety, and adherence to specific USDA and FDA sanitary design guidelines for food contact surfaces.

How does the volatile price of butter affect the adoption rate of high-precision forming machines?

Volatility in butter price, a key ingredient, incentivizes bakeries to adopt high-precision forming machines. These machines minimize dough trim waste and ensure accurate weight control, preventing the costly overuse of ingredients, thus mitigating the financial risk associated with high commodity costs.

What is the function of the dough relaxation conveyor in a fully automatic line?

The dough relaxation conveyor is positioned before the cutter/former. Its function is to allow the laminated dough sheet time to relax after the mechanical stress of sheeting. This crucial step prevents shrinkage and ensures the dough is pliable for the final forming stage, leading to uniform size and improved final product structure.

Are refurbished or used croissant forming machines a viable alternative for smaller bakeries?

Refurbished machines are a viable, cost-effective alternative for smaller bakeries seeking to automate without the high capital expenditure of new equipment. However, buyers must ensure the machinery has updated control systems (PLCs) and genuine OEM parts to guarantee operational reliability and access to future technical support.

What impact does the growth of frozen baked goods have on the demand for forming machines?

The exponential growth in the frozen, ready-to-bake goods segment significantly boosts demand for high-capacity forming machines. Manufacturers of frozen croissants require automated lines that can consistently produce tens of thousands of pieces per hour, designed for optimal freezing and subsequent transportation, driving investment in industrial-scale automation.

How important is remote monitoring and diagnostics capability for modern forming equipment?

Remote monitoring is highly important, especially for industrial users operating 24/7. It allows manufacturers to proactively monitor machine health, diagnose issues without a physical site visit, optimize operational parameters based on performance data, and implement software updates, thereby maximizing uptime and reducing maintenance costs globally.

What specialized tooling is required for forming filled or savory croissants?

Forming filled croissants requires specialized tooling, including integrated dosing units (depositors) for accurate placement of fillings (sweet or savory) and specific cutting and rolling mechanisms designed to fully encapsulate the filling without rupturing the dough during the subsequent proofing and baking stages.

How does the overall equipment effectiveness (OEE) metric relate to market competition?

OEE, measuring availability, performance, and quality, is a critical competitive metric. Manufacturers whose machines consistently demonstrate higher OEE—indicating minimal downtime, higher speed, and fewer defects—gain a significant competitive advantage, especially when selling to industrial clients focused on maximizing operational throughput and minimizing cost per unit.

What are the limitations of using manual or benchtop croissant forming equipment?

Manual equipment severely limits throughput capacity and relies heavily on skilled labor, leading to inconsistency in product size and weight across batches. While suitable for extremely low volume or artisanal specialty production, it is economically unfeasible for commercial volumes due to high labor input and variability.

Do machine dimensions and footprint significantly influence purchasing decisions?

Yes, particularly for urban commercial bakeries and smaller food service operations where floor space is limited and costly. Manufacturers are increasingly developing compact, vertical, or flexible linear machines to maximize production capacity while minimizing the required operational footprint, especially crucial in crowded European and Asian markets.

How is the concept of "Hygienic Design" implemented in new machine models?

Hygienic Design involves engineering practices that prioritize easy cleaning and sterilization. This includes using slanted surfaces to prevent water pooling, eliminating horizontal ledges where debris can accumulate, minimizing hidden crevices, and utilizing materials (like specific grades of stainless steel) that resist corrosion and bacterial growth.

What are the challenges associated with the integration of third-party filling or packaging equipment?

Integration challenges mainly stem from synchronization issues. The forming machine must precisely time its output rate with the input requirements of the filling machine and the speed of the packaging line. This requires open-protocol communication standards (e.g., OPC UA) and robust PLC programming to ensure seamless, high-speed handoffs between different vendors’ machinery.

In the context of the value chain, why is spare parts availability a critical factor for end-users?

Spare parts availability is critical because unscheduled downtime due to component failure can halt large-scale industrial production, resulting in massive financial losses. End-users prioritize suppliers who maintain extensive local inventory and guarantee rapid delivery of specialized parts, minimizing the Mean Time To Repair (MTTR).

How is intellectual property and patent protection affecting market competition?

Leading manufacturers heavily protect IP related to specialized dough handling kinematics, unique cutter designs (like ultrasonic blades), and proprietary software algorithms for quality control. Patent protection creates high barriers to entry, forcing smaller competitors to invest significantly in novel design alternatives or risk litigation, thereby shaping the competitive landscape.

What is the typical lifespan of a fully automatic croissant forming machine?

With proper maintenance and routine refurbishment of wear parts, a high-quality, industrial-grade fully automatic croissant forming machine typically has an operational lifespan of 15 to 25 years. The longevity is heavily dependent on the quality of the underlying frame, motor systems, and the rigor of the owner's preventative maintenance schedule.

How do varying regional power supply standards affect machine design and sales?

Regional power supply variations (voltage, frequency, and phase configurations) necessitate that manufacturers design highly adaptable electrical systems or build customized control panels and transformers for specific markets (e.g., 480V/60Hz in North America versus 400V/50Hz in Europe). This customization adds complexity and cost to the international sales process.

What measures are taken to ensure operator safety around high-speed machinery?

Safety measures include comprehensive safety guarding (interlocked gates that shut down the machine when opened), Emergency Stop (E-Stop) buttons located strategically, light curtains to detect intrusion into hazardous zones, and low-voltage control systems. Compliance with standards like ISO 13849 is mandatory for machine safety systems.

How does the shift towards shorter production runs for specialty products influence machine technology?

Shorter runs require machines with exceptionally fast and easy changeover capabilities. Technology is shifting towards tool-less exchanges, standardized component mounting, and recipe-driven automation via HMI (Human Machine Interface) screens, allowing operators to rapidly transition between different products with minimal manual adjustments or setup time.

What are the key technical specifications potential customers evaluate when purchasing a new machine?

Key specifications include maximum throughput (pieces/hour), usable dough sheet width, dough weight variance control (precision), minimum required labor force, ease of cleaning/sanitation rating (e.g., IP rating), power consumption (kW), and the machine's overall footprint (length and width).

Does the market favor continuous or intermittent forming processes?

The industrial segment heavily favors continuous forming processes, where the dough ribbon flows uninterruptedly through the system, maximizing speed and minimizing synchronization pauses. Intermittent processes are generally reserved for highly specialized, slower artisanal production lines where delicate handling is prioritized over sheer volume.

What is the competitive advantage gained by offering machines with open-source software interfaces?

Offering open-source or highly flexible proprietary software allows bakeries to integrate the forming machine seamlessly with their existing enterprise resource planning (ERP) systems or manufacturing execution systems (MES). This integration capability is a major competitive advantage, allowing for centralized data collection and streamlined production planning.

How does increasing consumer interest in visible product quality affect machine design requirements?

Consumers prioritize the visual appeal of croissants, specifically the distinct layering and symmetrical crescent shape. This demand necessitates machines with ultra-high precision curling and rolling units that consistently deliver perfectly symmetrical products, often achieved through multi-stage rolling mechanisms and advanced tension control systems.

In the context of APAC, what role do local manufacturing partnerships play?

Due to high import duties and the need for localized support, Western manufacturers increasingly enter joint ventures or licensing agreements with local APAC companies. These partnerships facilitate local assembly, reduce shipping costs, accelerate market penetration, and ensure rapid, culturally appropriate customer service and technical support.

What advancements are being made in noise reduction technology for forming machines?

Noise reduction advancements include the use of acoustic dampening materials within machine housings, optimized gear train designs (helical gears), and the precise control offered by servo motors, which minimize sudden, loud mechanical movements. This is critical for improving the working environment in large bakery facilities.

How is the trend of "miniaturization" in croissants influencing forming technology?

The demand for miniature or "mini" croissants requires extremely precise cutting tools and higher-speed forming capacity, as the sheer number of pieces produced per hour increases dramatically. This trend drives the need for advanced ultrasonic cutting technology and highly optimized indexing conveyor systems to handle the smaller, more numerous dough pieces.

What is the significance of the dough return/rework system in waste reduction?

The dough return or rework system collects the trim/scrap dough left after the cutting process. Efficient systems minimize the amount of stress applied to this trim dough before reintroducing it to the main ribbon. This system is crucial for minimizing waste without negatively affecting the quality of the final product, which requires gentle handling of the laminated structure.

How does a manufacturer’s warranty period reflect the machine’s perceived quality and reliability?

A longer manufacturer's warranty period (e.g., 2-3 years versus the standard 1 year) directly indicates the manufacturer's confidence in the machine's build quality, component reliability, and engineering robustness. It acts as a powerful differentiator in the competitive landscape, assuring the buyer of long-term performance and minimizing early operational risk.

What role does augmented reality (AR) play in machine maintenance and training?

AR is increasingly used to overlay digital instructions onto the physical machine through smart glasses or tablets. This technology aids maintenance staff by providing step-by-step repair guides, troubleshooting assistance, and immersive training simulations, reducing the reliance on highly skilled specialized technicians and speeding up repairs.

How do stringent environmental regulations influence the choice of machine lubricants and materials?

Regulations necessitate the mandatory use of food-grade lubricants (H1 certified) that are safe for incidental food contact. Furthermore, manufacturers must comply with WEEE directives regarding electronic waste disposal and prioritize recyclable materials in the machine construction, aligning with corporate sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager