Crude Oil Assay Testing Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442799 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Crude Oil Assay Testing Service Market Size

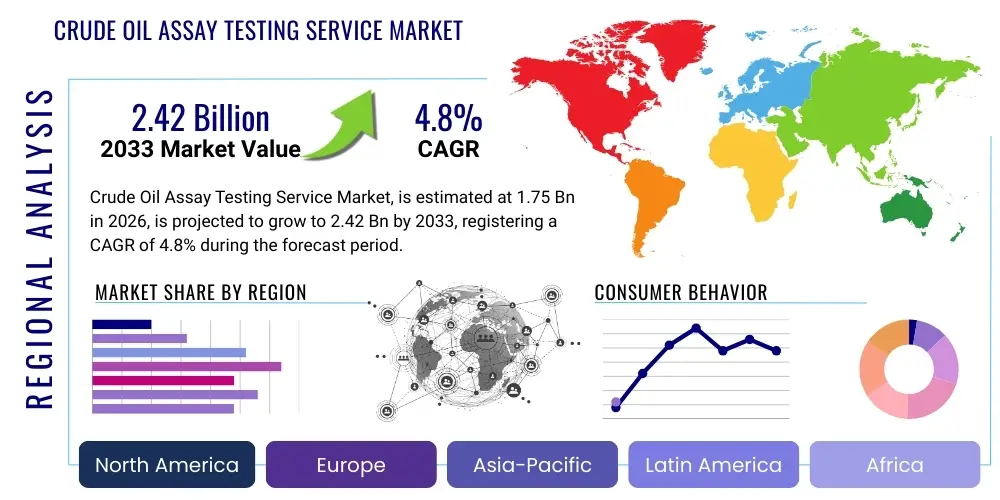

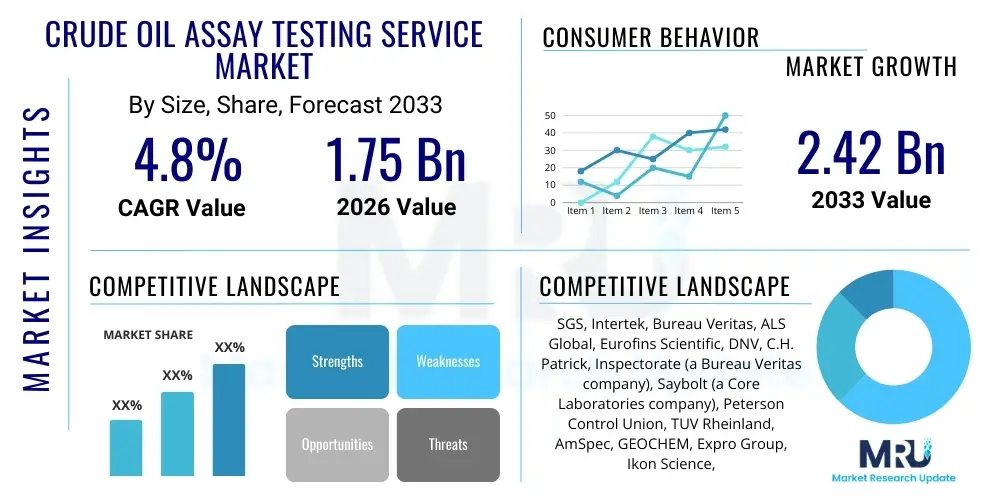

The Crude Oil Assay Testing Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.75 Billion in 2026 and is projected to reach USD 2.42 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global complexity of crude oil sourcing, coupled with stringent regulatory demands concerning refining processes and environmental compliance. The necessity for accurate characterization of unconventional and heavy crude streams mandates specialized assay services, thereby sustaining robust market expansion.

The valuation reflects the critical role these services play in the global petroleum value chain, where precise crude oil quality data is paramount for optimizing refinery operations, minimizing catalyst degradation, and ensuring product specifications meet international standards. Furthermore, volatile crude oil pricing and shifting geopolitical factors necessitate frequent testing for trading and transaction verification, contributing significantly to the service market size. Investments in advanced laboratory instrumentation and digitalization of assay reporting are further supporting this market valuation increase over the forecast horizon.

Crude Oil Assay Testing Service Market introduction

The Crude Oil Assay Testing Service Market encompasses specialized laboratory analysis services designed to determine the physical properties and chemical composition of crude oil samples. These comprehensive tests, known as crude oil assays, are essential for characterizing the yield of refined products, identifying contaminants, and assessing the oil's suitability for specific refining configurations. Major applications span from pre-drilling exploration analysis and production monitoring to commercial trading, transportation logistics, and final refinery intake quality control. Key benefits include maximizing refinery profitability by optimizing processing streams, ensuring compliance with strict environmental and safety regulations, and providing crucial data for pipeline integrity and blending operations. The market is driven primarily by rising global energy demand, increased sourcing of diverse crude types (including shale and ultra-deepwater crudes), and the necessity for accurate valuation in high-volume global trade.

Crude Oil Assay Testing Service Market Executive Summary

The Crude Oil Assay Testing Service Market is currently characterized by strong business trends focusing on digitalization, automation of laboratory processes, and expansion into emerging markets, particularly in Asia Pacific and the Middle East, driven by new refining capacity additions. Regional trends indicate North America maintaining a dominant share due to high production volumes of unconventional oil requiring complex assays, while Asia Pacific exhibits the fastest growth due fueled by massive infrastructure investments in refining and petrochemical sectors. Segment trends highlight the growing importance of Enhanced Assay services, which utilize highly sophisticated analytical techniques such as two-dimensional gas chromatography (GC×GC) and advanced mass spectrometry to analyze complex residue fractions, moving beyond traditional atmospheric and vacuum distillation methods to provide finer detail necessary for modern, integrated refineries. Additionally, the proliferation of global crude trading activities significantly boosts demand for rapid, certified inspection and testing services, compelling major players to expand their global laboratory footprints and enhance rapid turnaround capabilities.

AI Impact Analysis on Crude Oil Assay Testing Service Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Crude Oil Assay Testing Service Market frequently revolve around questions of efficiency gains, data interpretation accuracy, and potential job displacement within traditional laboratory roles. Users are primarily concerned with how AI can rapidly process massive datasets generated by modern analytical instruments (such as GC-MS or ICP-OES), predicting optimal refinery input based on assay data, and automating quality control checks to minimize human error. Expectations center on AI developing predictive modeling for crude blending operations, identifying subtle variations in unconventional crude chemistries that manual analysis might miss, and accelerating the turnaround time for comprehensive reports, moving the industry towards real-time digital assay capabilities that integrate directly with refinery optimization software. A critical theme is the ability of AI to standardize and validate results across disparate global laboratories, addressing current inconsistencies and bolstering the reliability of trade data, while reducing the overhead costs associated with repetitive sample preparation and basic data evaluation.

- AI enables predictive modeling for crude oil stability and compatibility, optimizing blending decisions prior to processing.

- Machine learning algorithms significantly accelerate data interpretation from complex chromatography and spectrometry analyses, reducing reporting lead times.

- AI-driven automation of laboratory information management systems (LIMS) enhances sample tracking, quality assurance, and compliance reporting efficiency.

- Digital twins and simulation platforms utilize historical assay data analyzed by AI to forecast refinery yields under varying crude input scenarios.

- Computer vision systems, integrated with robotic sample handling, standardize preparation and analysis execution, minimizing technician variability.

- AI enhances fraud detection and data verification in trading assays by flagging statistically anomalous compositional shifts indicative of adulteration.

DRO & Impact Forces Of Crude Oil Assay Testing Service Market

The Crude Oil Assay Testing Service Market is propelled by the growing complexity and diversity of global crude supply (Drivers), including heavy, sour, and unconventional grades, which mandate rigorous testing before refining. However, the market faces significant Restraints, notably the high initial capital investment required for state-of-the-art analytical equipment and the scarcity of highly specialized chemists and petroleum engineers trained in complex assay interpretation. Opportunities arise from the global shift towards digitalization in the oil and gas sector, fostering demand for integrated, real-time testing solutions, and the expansion of the petrochemical sector requiring detailed feedstock analysis. The Impact Forces shaping the market include intense competition among major international inspection companies, continuous technological advancements in analytical instrumentation (e.g., automated distillation and advanced spectroscopy), and stringent regulatory pressure focusing on reducing emissions and managing hazardous contaminants like sulfur and heavy metals, which necessitates more detailed and precise assay reporting.

The primary driving force remains the economic necessity for refiners to maintain optimal operational efficiency. Incorrectly characterized crude oil can lead to expensive downtime, catalyst poisoning, and production of off-spec products. Therefore, investment in reliable assay services is viewed not as a cost, but as risk mitigation and profitability optimization tool. Regulatory frameworks, particularly those addressing global fuel specifications (e.g., IMO 2020 requiring low sulfur fuels), place continuous pressure on the industry to verify crude quality meticulously, thereby solidifying the baseline demand for these testing services globally.

Segmentation Analysis

The Crude Oil Assay Testing Service Market is segmented based on the type of test conducted, the technology utilized for analysis, and the specific end-user industry requiring the services. The segmentation reflects the diverse needs across the petroleum value chain, ranging from quick field quality checks to detailed, comprehensive laboratory evaluations required for long-term refinery planning. The comprehensive Full Crude Assay segment commands the largest market share due to its necessity for initial refinery design and feedstock valuation, while the Production Monitoring Assay segment is seeing rapid growth driven by the need for continuous quality control in ongoing exploration and production activities, particularly in regions with multi-source blending operations.

- By Test Type:

- Full Crude Assay

- Production Monitoring Assay

- Enhanced Assay (Advanced Analytical Testing)

- By End-User:

- Refineries (Integrated and Merchant)

- Oil and Gas Exploration & Production (E&P) Companies

- Trading and Inspection Agencies

- Government and Regulatory Bodies

- By Technology:

- Chromatography (GC/GC-MS, GCxGC)

- Spectrometry (AAS, ICP-OES, FTIR)

- Physical Property Testing (Viscosity, Density, Pour Point, Flash Point)

- Distillation Methods (ASTM D2892, D5236, TBP)

Value Chain Analysis For Crude Oil Assay Testing Service Market

The Value Chain for Crude Oil Assay Testing Services begins with the Upstream analysis conducted by E&P companies, where services focus on reservoir fluid characterization to assess crude quality feasibility and potential production strategies. This phase demands specialized Pressure-Volume-Temperature (PVT) and compositional analysis, often performed near the wellhead or in highly specialized remote laboratories. The midstream component involves extensive testing required for custody transfer, pipeline scheduling, and maritime logistics, focusing on density, viscosity, and contaminant levels (e.g., salt content, hydrogen sulfide). Major trading houses and inspection agencies play a crucial role here, commissioning independent testing laboratories to ensure transparency and compliance during high-volume transactions.

The Downstream phase represents the largest demand segment, where refineries utilize comprehensive assays to finalize feedstock selection and optimize processing units. This phase involves deep component analysis and simulated distillation curves to maximize yield and minimize operational risk. The distribution channel is characterized by both Direct relationships, where large oil companies maintain internal, captive laboratories or enter long-term contracts with global providers for standardized services, and Indirect channels, primarily utilizing independent third-party inspection and testing agencies. The trend towards integrated service provision means many major companies offer a full spectrum of services from wellhead to refined product, enhancing efficiency but simultaneously creating significant barriers to entry for smaller, specialized labs.

Crude Oil Assay Testing Service Market Potential Customers

The primary end-users and buyers of Crude Oil Assay Testing Services are multifaceted, spanning the entire hydrocarbon supply chain. Integrated Oil and Gas Companies (IOCs) and National Oil Companies (NOCs) represent substantial customers, utilizing these services both internally for E&P activities and externally for refinery operations. Independent refiners and petrochemical complexes rely heavily on external assay providers to manage the diversity of purchased crude stocks and ensure their process units are optimally configured for the incoming feedstock. Furthermore, significant demand originates from global commodity trading houses (e.g., Vitol, Glencore) and specialized third-party inspection agencies, who mandate independent, certified assays to validate crude quality and volume during transactional custody transfer, particularly at major loading and unloading ports.

Government agencies and environmental regulatory bodies also act as crucial, albeit indirect, customers. They require certified assay data to monitor compliance with domestic and international standards regarding emissions, fuel quality, and transport safety. The burgeoning segment of midstream operators, including pipeline companies and storage terminal owners, also increasingly purchases assay services focused on crude compatibility and corrosion prevention, ensuring the integrity and safe operation of their extensive infrastructure networks. This diversification across the value chain guarantees sustained demand for accurate, rapid, and verifiable crude oil characterization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 2.42 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS, Intertek, Bureau Veritas, ALS Global, Eurofins Scientific, DNV, C.H. Patrick, Inspectorate (a Bureau Veritas company), Saybolt (a Core Laboratories company), Peterson Control Union, TUV Rheinland, AmSpec, GEOCHEM, Expro Group, Ikon Science, Weatherford, Baker Hughes, Schlumberger, LGC Limited, RINA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crude Oil Assay Testing Service Market Key Technology Landscape

The technological landscape within the Crude Oil Assay Testing Service Market is undergoing rapid modernization, moving away from conventional, time-consuming wet chemistry methods towards highly automated, precise instrumental analysis. Distillation methods, traditionally based on manual ASTM procedures (D2892, D5236), are now increasingly automated, leveraging robotic systems to enhance precision and throughput while simulating complex refinery processes accurately. Chromatography, specifically high-resolution gas chromatography (GC) and mass spectrometry (GC-MS), remains foundational, utilized for detailed compositional analysis of light ends and middle distillates. The emergence of two-dimensional gas chromatography (GC×GC) is particularly transformative, offering unparalleled separation capability for the complex mixtures found in heavy crude residues, allowing for more precise characterization of petrochemical feedstocks and difficult-to-analyze contaminants.

Spectrometry technologies, including Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES) and Atomic Absorption Spectroscopy (AAS), are essential for measuring trace metals (e.g., nickel, vanadium, iron) which are critical indicators of crude source and potential catalyst poisons in refineries. Furthermore, digital technologies such as advanced Laboratory Information Management Systems (LIMS) and cloud-based data platforms are crucial for managing the enormous volume of data generated by modern instrumentation, facilitating rapid reporting and secure, real-time data sharing across global client operations. The integration of spectroscopic methods like Fourier-Transform Infrared (FTIR) spectroscopy is also gaining traction for rapid field screening and quality verification, enhancing efficiency at the point of custody transfer and supporting the overall market shift toward faster, more comprehensive data delivery.

Regional Highlights

The Crude Oil Assay Testing Service Market exhibits distinct regional dynamics dictated by production characteristics, refining capacity, and regulatory environments. North America leads the market share, driven primarily by the high volume of complex tight oil (shale) and heavy oil production. These unconventional crudes exhibit highly variable and complex properties, necessitating sophisticated and frequent assay testing to manage volatility in refining processes and transportation logistics. The stringent regulatory focus on environmental compliance, particularly concerning sulfur and benzene content, also compels continuous, accurate testing throughout the region.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive investments in new mega-refineries and expanding petrochemical complexes, particularly in China, India, and Southeast Asia. As these economies rely heavily on imported crude from diverse sources—ranging from the Middle East to Latin America—the demand for unbiased, certified assay services for trade verification and optimization is escalating dramatically. The region's focus on shifting towards higher-value refined products further increases the necessity for detailed feedstock characterization.

The Middle East and Africa (MEA) constitute a significant market, largely due to the sheer volume of globally traded crude originating from this region. While much of the production is standardized, the increasing need for detailed assay services is linked to managing blending operations for export, ensuring contractual compliance, and supporting the region’s own expansion in downstream refining capacity. Europe maintains a mature, stable market, focused heavily on supporting refining activities that comply with the continent's stringent environmental directives, including the analysis of biofuels and complex feedstocks to meet decarbonization goals.

- North America: Dominant market share due to complex shale oil assays, strict regulatory demands, and a highly sophisticated refining infrastructure requiring precise feedstock control.

- Asia Pacific (APAC): Highest growth rate, driven by rapid expansion of refining and petrochemical capacity, increasing reliance on diverse crude imports, and growing energy demand from China and India.

- Middle East & Africa (MEA): Significant market volume tied to major global export volumes, increasing domestic downstream investment, and the necessity for certified international trade assays.

- Europe: Mature market characterized by advanced analytical technologies, high regulatory pressure concerning emissions, and high demand for quality control of renewable and blended feedstocks.

- Latin America: Growth driven by heavy oil production (e.g., Venezuela, Brazil) requiring specialized assay techniques to manage viscosity, metals, and acidity issues for export and domestic processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crude Oil Assay Testing Service Market.- SGS S.A.

- Intertek Group plc

- Bureau Veritas S.A.

- ALS Global

- Eurofins Scientific SE

- DNV GL

- C.H. Patrick & Co., Inc.

- Inspectorate (a Bureau Veritas company)

- Saybolt (a Core Laboratories company)

- Peterson Control Union

- TUV Rheinland AG

- AmSpec, LLC

- GEOCHEM Group

- Expro Group

- Ikon Science (part of Baker Hughes)

- Weatherford International plc

- Baker Hughes Company

- Schlumberger Limited

- LGC Limited

- RINA S.p.A.

Frequently Asked Questions

Analyze common user questions about the Crude Oil Assay Testing Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand for Crude Oil Assay Testing Services?

The primary drivers are the rising global complexity and diversity of crude oil streams (including heavy, sour, and unconventional grades) and the imperative for refineries to maximize profitability while strictly adhering to stringent global environmental regulations, such as those governing sulfur content and volatile organic compounds.

How does the quality of crude oil affect refinery profitability?

Accurate crude oil assay data is crucial because it allows refiners to optimize processing units, select appropriate catalysts, and anticipate yields. Processing incorrectly characterized crude can lead to reduced product output, severe equipment corrosion, expensive catalyst poisoning, and significant unscheduled downtime, thereby drastically reducing profitability.

Which technology segment is experiencing the fastest growth in the crude oil assay market?

The Enhanced Assay segment, utilizing sophisticated analytical techniques such as two-dimensional gas chromatography (GC×GC) and advanced mass spectrometry, is growing fastest. These technologies provide the detailed molecular characterization necessary for analyzing complex residue fractions and optimizing modern petrochemical feedstocks.

What role does digitalization play in the future of crude oil assay services?

Digitalization, including AI-driven data interpretation and cloud-based Laboratory Information Management Systems (LIMS), is enabling the transition toward real-time digital assays. This integration accelerates turnaround times, improves data consistency across global operations, and facilitates direct input of assay results into refinery optimization and blending models.

Which region holds the largest market share for crude oil assay testing services?

North America currently holds the largest market share. This dominance is attributed to the high volume of complex, highly variable unconventional oil production (shale oil) which requires continuous, precise characterization, coupled with a well-established and technologically advanced downstream sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager