Crypto Music and Audio Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441938 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Crypto Music and Audio Market Size

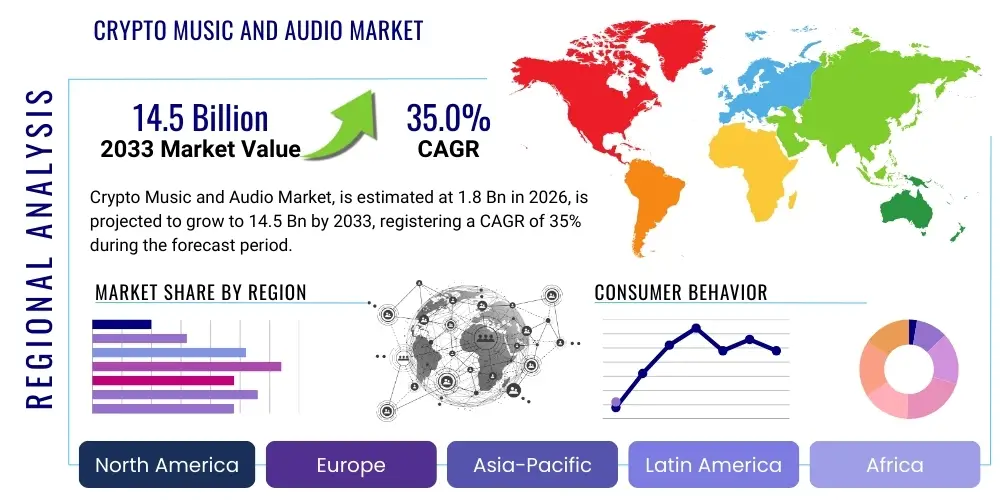

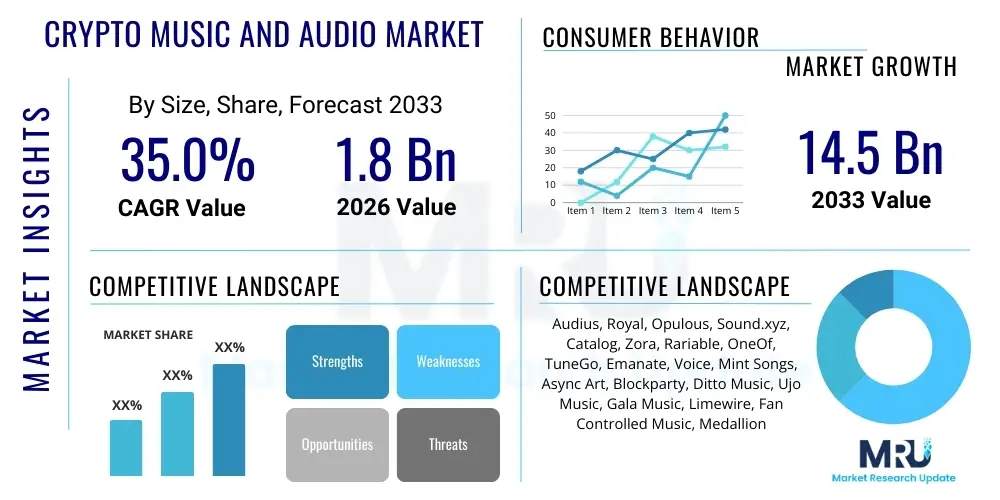

The Crypto Music and Audio Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.0% between 2026 and 2033. This burgeoning sector, leveraging blockchain technology to fundamentally restructure how music is created, distributed, owned, and monetized, is experiencing rapid institutional and consumer adoption. Initial traction is driven by the perceived unfairness of traditional streaming models and the desire for enhanced transparency and direct artist-fan engagement.

The market is estimated at $1.8 Billion in 2026, primarily fueled by early applications in Non-Fungible Tokens (NFTs) for music rights, decentralized streaming platforms, and tokenized royalty mechanisms. The high growth trajectory reflects the shift towards Web3 infrastructure, offering artists greater control over intellectual property and providing fans with verifiable ownership stakes or utility within creator ecosystems. Investment in foundational decentralized autonomous organizations (DAOs) focused on music governance is a major financial contributor in the early forecast years.

The market is projected to reach $14.5 Billion by the end of the forecast period in 2033. This substantial expansion will be supported by widespread adoption of blockchain-integrated digital rights management (DRM) systems, the proliferation of Metaverse concert experiences requiring crypto-native ticketing and virtual goods, and the maturity of legal and regulatory frameworks surrounding tokenized assets. Furthermore, the integration of established music publishers and major record labels into Web3 ecosystems through strategic partnerships or internal blockchain development will stabilize and accelerate market value.

Crypto Music and Audio Market introduction

The Crypto Music and Audio Market encompasses all digital ecosystems, products, and services that utilize blockchain technology, smart contracts, and associated cryptographic assets (such as NFTs and fungible tokens) to manage music creation, distribution, consumption, and ownership. This transformation is driven by the necessity to address critical inefficiencies and inequities within the traditional music industry, particularly concerning royalty payments, transparency, and artist compensation. Key applications include decentralized streaming platforms (DSPs), music NFT marketplaces, and fan engagement tools built on decentralized autonomous organizations (DAOs). The market seeks to establish a fairer economic model by facilitating direct relationships between creators and consumers, eliminating or minimizing the need for conventional intermediaries like record labels and centralized distributors.

Products within this market range significantly, spanning from unique, one-of-a-kind music NFTs representing full ownership or fractional rights to albums or singles, to utility tokens that grant access to exclusive content, voting rights in music DAOs, or premium features on decentralized streaming services. Major applications extend beyond simple digital distribution; they include blockchain-based intellectual property (IP) management systems, transparent royalty accounting via smart contracts, decentralized concert ticketing, and the integration of music assets into virtual worlds (Metaverse). These technologies collectively aim to create auditable, immutable records of ownership and transactional history, fundamentally empowering artists to manage their careers and monetize their work more effectively than existing Web2 structures allow.

The intrinsic benefits of the Crypto Music and Audio Market, which are simultaneously its primary driving factors, revolve around financial transparency, enhanced creator autonomy, and verifiable scarcity. Artists receive royalties instantaneously and directly, reducing payment delays and administrative overheads often associated with collecting societies. For consumers, the shift offers genuine ownership of digital assets, verifiable authenticity, and the opportunity to become proactive financial stakeholders in an artist's career, rather than passive subscribers. Furthermore, technological drivers, such as the increasing efficiency of Layer-2 scaling solutions and decreasing gas fees on prominent blockchains like Ethereum and Polygon, are making these crypto-native solutions more accessible and cost-effective for mass-market deployment.

Crypto Music and Audio Market Executive Summary

The Crypto Music and Audio Market is experiencing exponential growth, underpinned by fundamental shifts in business models favoring decentralization and direct monetization. Business trends show a strong migration of established artists and intellectual property holders toward tokenization strategies, moving beyond simple collectible NFTs to issuing complex securities and fractionalized royalty tokens. A key emerging trend is the convergence of gaming, social media, and music through Metaverse integration, where music NFTs serve dual purposes as digital collectibles and functional assets within virtual environments. Strategic venture capital funding is increasingly focused on infrastructure providers—blockchain protocols optimized for media storage and smart contract platforms designed for complex rights management—indicating a maturation beyond hype-driven collectibles toward sustainable technological foundations.

Regionally, North America and Europe currently dominate the market in terms of transactional volume and foundational development, largely due to high crypto adoption rates, sophisticated legal frameworks for digital assets, and a dense concentration of influential music industry stakeholders and technology startups. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, driven by massive mobile-first populations, high engagement with digital entertainment, and proactive regulatory environments in countries like Singapore and South Korea supporting blockchain innovation. Latin America and the Middle East & Africa (MEA) represent significant opportunities for leapfrogging traditional music infrastructure, with decentralized solutions offering attractive alternatives where conventional financial and distribution systems are underdeveloped or restrictive.

Segmentation analysis highlights the Digital Rights Management (DRM) and Royalty Payout segment as foundational, capturing significant market share by addressing the core issue of industry inefficiency. The NFT Marketplace segment continues to drive public attention and high-value transactions, especially for limited edition or exclusive content. Furthermore, the Decentralized Streaming Platforms segment is expected to see accelerated growth, moving from niche adoption to mainstream viability as user interfaces improve and tokenomics models evolve to reward both listeners and creators more equitably than platforms like Spotify or Apple Music. Technology segmentation emphasizes the dominance of Ethereum (and its Layer 2s) for high-value transactions and utility, while alternatives like Solana, Flow, and specialized music blockchains gain traction for scalability and specific application needs.

AI Impact Analysis on Crypto Music and Audio Market

Common user questions regarding AI's impact on the Crypto Music and Audio Market frequently revolve around ownership rights of AI-generated compositions, the provenance tracing capabilities of blockchain for synthesized content, and the potential for AI tools to democratize music creation further. Users are deeply concerned about the regulatory status of AI-assisted music, specifically asking: "If an AI generates a song, who owns the NFT linked to it—the programmer, the user, or the AI itself?" There is also considerable interest in how blockchain can verify the authenticity of human-created art versus AI-generated art, and how AI can be utilized in conjunction with smart contracts to automate royalty splitting for complex collaborative works. The key themes summarized are: legal clarity on AI ownership, the application of blockchain for authenticity verification (anti-deepfake), and using AI to enhance decentralized royalty management systems.

The primary influence of AI in this domain is twofold: creation and administration. On the creation side, AI tools accelerate the output of music, potentially leading to an explosion of content that necessitates robust blockchain-based IP management to track usage and ownership effectively. Blockchain provides the immutable ledger needed to register the complex, multi-layered intellectual property resulting from AI-human collaboration, detailing contributions from the AI model license, the human editor, and the underlying data used for training. This collaboration mandates the development of sophisticated smart contracts capable of dynamically calculating and distributing micro-royalties based on pre-defined contribution percentages, codified through AI-driven analytical tools.

Administratively, AI is crucial for optimizing the decentralized music ecosystem. AI algorithms can analyze listener behavior on decentralized streaming platforms, ensuring token rewards (Proof-of-Listen) are distributed fairly and preventing fraudulent engagement. Furthermore, AI tools are vital for enhancing the user experience on NFT marketplaces, providing automated valuation assessments for music assets based on historical sales data, artist popularity, and intrinsic asset utility. This synergy between AI's processing power and blockchain's trustless verification mechanism is accelerating the market's efficiency and transparency, addressing concerns about market saturation and fraudulent activity.

- AI-driven automated royalty distribution via smart contracts.

- Blockchain verification of content provenance for AI-generated music.

- Enhanced content moderation and fraud detection on decentralized platforms using machine learning.

- AI assistance in valuation and pricing of music NFTs based on market dynamics.

- Development of legal and technical frameworks defining ownership for human-AI collaborative works.

- Increased market competition due to rapid, low-cost AI music generation.

DRO & Impact Forces Of Crypto Music and Audio Market

The Crypto Music and Audio Market is shaped by powerful Drivers, structural Restraints, and significant Opportunities, which together form the Impact Forces determining its future trajectory. A primary driver is the pervasive dissatisfaction among artists with the centralized, opaque, and low-payout models of traditional streaming platforms, creating a strong pull toward Web3 solutions that offer direct monetization and higher revenue share (often 80-100%). Coupled with this is the escalating consumer demand for experiential and verifiable digital ownership, fueled by the mainstream acceptance of NFTs across culture and art. The intrinsic technological advantages of blockchain, such as immutability, transparency, and the ability to execute fractional ownership via smart contracts, provide the foundational mechanics driving adoption.

However, several significant restraints impede rapid mainstream adoption. Regulatory uncertainty remains a major hurdle globally, particularly concerning the classification of music NFTs as commodities, securities, or utility tokens, which complicates legal compliance and limits large-scale institutional investment. Technical barriers, including the complexity of Web3 wallets, high gas fees on certain protocols during peak network congestion, and poor user interface/user experience (UI/UX) on many decentralized platforms, deter non-crypto-native consumers. Furthermore, the inherent volatility of cryptocurrency markets poses a financial risk to both creators and investors, making sustainable long-term financial planning challenging for artists relying solely on tokenized income.

Opportunities for expansion are abundant. The potential integration of crypto music into the rapidly expanding Metaverse offers new revenue streams through virtual concerts, exclusive in-game music assets, and digital land ownership tied to musical venues. The development of specialized Layer-1 and Layer-2 blockchains optimized specifically for media and low-cost micro-transactions promises to solve scalability issues and reduce transactional friction significantly. Moreover, the opportunity for existing music publishers and collecting societies to adopt blockchain technology for transparent royalty tracking offers a massive enterprise integration market, providing hybrid solutions that bridge the gap between Web2 and Web3 music infrastructure, thus securing significant market growth over the next decade.

Segmentation Analysis

The Crypto Music and Audio Market is segmented based on the type of tokenized asset, the core application platform, the technology deployed, and the specific end-user/monetization model. This detailed segmentation allows stakeholders to analyze specific high-growth niches, understand competitive dynamics within distinct operational areas (e.g., marketplaces versus streaming), and tailor investment strategies. The market structure reflects a transition from early-stage collectible NFTs to sophisticated, infrastructure-heavy platforms focused on solving complex digital rights management and scalable distribution challenges.

The primary segment driving revenue is the NFT Marketplace sector, where transactions are often high-value and reflect premium or exclusive content offerings. However, the future market volume is expected to be dominated by the Decentralized Streaming and Royalty Management segments, as they address the recurring revenue streams and foundational infrastructure of the music industry. Technology-wise, the ecosystem is rapidly evolving away from monolithic chains to multichain architectures, leveraging protocols optimized for media handling and low-latency transactions.

- By Asset Type:

- Full Ownership Music NFTs (Master Rights, Publishing Rights)

- Fractional Ownership Music NFTs (Royalty Shares, Micro-shares)

- Utility Tokens (Access, Voting, Rewards)

- Collectibles and Art NFTs (Visuals paired with audio)

- By Application Platform:

- Decentralized Streaming Platforms (DSPs)

- Music NFT Marketplaces (Primary and Secondary)

- Decentralized Autonomous Organizations (DAOs) for Music Governance

- Blockchain-based Digital Rights Management (DRM) Systems

- Metaverse Music Experiences and Ticketing

- By Technology/Protocol:

- Ethereum and Layer 2 Solutions (e.g., Polygon, Arbitrum)

- Alternative Layer 1s (e.g., Solana, Flow, Tezos)

- Specialized Media Blockchains (e.g., Audius, Arweave for storage)

- By End User/Monetization Model:

- Independent Artists and Labels

- Fan Communities and Collectors

- Music Publishers and Collection Societies

- Enterprise IP Management Solutions

Value Chain Analysis For Crypto Music and Audio Market

The value chain for the Crypto Music and Audio Market significantly deviates from the traditional linear model dominated by centralized gatekeepers. It is fundamentally restructured around decentralization, shifting power and financial rewards closer to the creator and consumer. The upstream activities involve music creation (including human and AI composition) and the initial tokenization process, where smart contracts are drafted to define intellectual property rights, royalty splits, and asset metadata. Crucially, upstream infrastructure involves the selection and deployment on specific blockchain protocols (e.g., Ethereum or Solana) and decentralized storage solutions (e.g., IPFS or Arweave) to ensure immutability and permanence of the music files and associated metadata.

Downstream analysis focuses on consumption, monetization, and secondary market activities. This includes the operation of decentralized streaming platforms (DSPs) where listeners interact directly with smart contract-verified content, and NFT marketplaces facilitate the primary sale and subsequent trading of music assets. Distribution channels are predominantly direct-to-consumer (D2C) via digital marketplaces and social crypto communities, bypassing traditional aggregation channels. The decentralized nature minimizes the complexity and cost associated with traditional distribution agreements and performance rights organizations (PROs), allowing artists to capture a much larger percentage of the revenue generated.

Distribution is categorized into direct and indirect channels. Direct channels involve artists issuing tokens or NFTs directly to their fan base through proprietary or open marketplace smart contracts, ensuring the highest level of transparency and revenue retention. Indirect channels involve platforms such as decentralized exchanges (DEXs) for trading utility tokens, or specialized third-party music DAOs that pool fan investment for collective IP ownership. The efficiency and low friction of these channels, secured by blockchain validation, represent a major competitive advantage over conventional music commerce, driving rapid adoption among digitally native creators.

Crypto Music and Audio Market Potential Customers

The core customer base for the Crypto Music and Audio Market is highly segmented, ranging from individual high-net-worth collectors interested in unique digital artifacts to large institutional investors seeking alternative assets and technology integration solutions. The primary end-users are independent musicians and mid-tier artists who are actively seeking more equitable and transparent monetization mechanisms than currently offered by major streaming giants and traditional labels. These artists leverage the market to conduct initial funding rounds, pre-sell album rights, and build closer, financially engaged communities.

A rapidly expanding customer segment is the crypto-native fan and collector community. These individuals are motivated not only by consumption but by the opportunity for fractional ownership and the utility derived from holding tokens, such as governance voting rights, exclusive access to content or events, and speculative investment potential. These users form the backbone of the decentralized consumer ecosystem, rewarding artists directly through token purchases and active engagement on decentralized platforms, thereby creating a vibrant, circular economy.

In the enterprise sector, potential customers include established music publishers, major record labels, and existing Digital Rights Management (DRM) companies. These entities are increasingly exploring blockchain integration to streamline complex global royalty distribution, enhance transparency for reporting to artists, and prevent piracy or unauthorized use of IP. By adopting crypto music infrastructure, large corporations can drastically reduce administrative overhead and modernize legacy systems, making them crucial, high-value customers for enterprise-grade blockchain solution providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $14.5 Billion |

| Growth Rate | 35.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Audius, Royal, Opulous, Sound.xyz, Catalog, Zora, Rariable, OneOf, TuneGo, Emanate, Voice, Mint Songs, Async Art, Blockparty, Ditto Music, Ujo Music, Gala Music, Limewire, Fan Controlled Music, Medallion |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crypto Music and Audio Market Key Technology Landscape

The technological landscape of the Crypto Music and Audio Market is defined by the interoperability between various blockchain layers, decentralized storage solutions, and robust smart contract platforms. The primary foundational technology is the blockchain ledger itself, which provides the immutable record necessary for proving ownership and tracking transactions. Ethereum, due to its maturity and robust developer community, remains the dominant platform for high-value NFT transactions and complex smart contract logic, particularly for fractionalized ownership and sophisticated royalty mechanisms. However, scalability challenges necessitate reliance on Layer 2 scaling solutions like Polygon and Arbitrum, which offer faster, cheaper transactions, making decentralized streaming and micro-royalty payouts economically viable for mass adoption.

A critical component is decentralized data storage, primarily implemented through systems like the InterPlanetary File System (IPFS) and Arweave. Unlike traditional cloud storage, these systems ensure that the actual music files (the audio payload) and the associated metadata remain permanently linked to the NFT token address, guaranteeing censorship resistance and persistence. This decentralized storage is vital because the value proposition of a music NFT hinges on the perpetual accessibility of the underlying asset. The efficiency and cost-effectiveness of these storage mechanisms directly influence the operational success of decentralized streaming platforms and NFT marketplaces.

Beyond core blockchain protocols and storage, the technology stack includes advanced features such as zero-knowledge proofs (ZKPs), which are being explored to maintain listener privacy on decentralized streaming platforms while still verifying consumption for reward distribution. Furthermore, cross-chain bridge technology is essential for market liquidity and interoperability, allowing music assets tokenized on one chain (e.g., Tezos) to be traded or utilized on another (e.g., Ethereum). This evolving technological sophistication is gradually lowering the barrier to entry, improving UI/UX, and enhancing the overall functionality and economic sustainability of crypto-native music services.

Regional Highlights

The global Crypto Music and Audio Market exhibits distinct regional dynamics driven by local crypto adoption rates, regulatory environments, and the existing structure of the music industry.

- North America: Dominates the market in terms of innovation and capital investment. Home to major blockchain developers, leading NFT platforms, and a highly influential music industry, the region drives trendsetting, particularly in high-value music NFT launches and the integration of crypto elements into major live events. The presence of sophisticated venture capital ensures consistent funding for specialized music Web3 startups.

- Europe: Characterized by strong regulatory scrutiny but high technological readiness. Western European countries are rapidly adopting decentralized solutions, focusing particularly on regulatory compliance for tokenized securities and strong IP protection frameworks. Germany and the UK are emerging as hubs for enterprise blockchain adoption within existing music publishing and rights collection organizations.

- Asia Pacific (APAC): Positioned for the fastest growth, fueled by vast mobile connectivity, a massive population of digital-native consumers, and a culture highly engaged with digital entertainment. Countries like South Korea, Japan, and Singapore are leaders in Metaverse development and regulatory sandbox testing for digital assets, making them ideal markets for scaling decentralized streaming and fan engagement tokens.

- Latin America (LATAM): Exhibits high potential due to significant economic volatility and high inflation, which incentivize local artists and consumers to utilize decentralized finance (DeFi) tools and stablecoin-based transactions for music royalties, bypassing unstable local banking infrastructure. Brazil and Mexico are seeing rapid artist adoption of NFT platforms for direct monetization.

- Middle East and Africa (MEA): Primarily focused on opportunities for leapfrogging traditional distribution infrastructures. The market is driven by young populations and increasing smartphone penetration. Blockchain solutions offer critical transparency and direct payment channels where centralized systems may lack efficiency, particularly in accessing global markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crypto Music and Audio Market.- Audius

- Royal

- Opulous

- Sound.xyz

- Catalog

- Zora

- Rariable

- OneOf

- TuneGo

- Emanate

- Voice

- Mint Songs

- Async Art

- Blockparty

- Ditto Music

- Ujo Music

- Gala Music

- Limewire

- Fan Controlled Music

- Medallion

- Decentraland (Metaverse Music Integration)

- The Sandbox (Virtual Venue Development)

- Arweave (Decentralized Storage Provider)

- Polygon (Scaling Solution Provider)

- Coala Pay (Blockchain Ticketing Solutions)

Frequently Asked Questions

Analyze common user questions about the Crypto Music and Audio market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of the Crypto Music Market for independent artists?

The primary benefit is enhanced autonomy and transparent monetization. Crypto music platforms enable artists to bypass traditional intermediaries, securing higher royalty percentages (often 80-100%) paid instantly via smart contracts, and fostering direct, economically engaged relationships with their fan base through token ownership.

How do Music NFTs differ from standard digital downloads or streaming?

Music NFTs represent verifiable digital ownership, managed on a public blockchain ledger. Unlike a stream (which is a licensed access) or a digital download (which lacks verifiable scarcity), an NFT proves that the owner possesses a unique, immutable token linked to the music asset, which can be resold or utilized for utility.

What role do Decentralized Autonomous Organizations (DAOs) play in the Crypto Music Industry?

Music DAOs allow fan communities and token holders to collectively own and govern intellectual property, decide on funding new projects, or determine platform development features. They facilitate shared ownership and democratic decision-making, shifting control away from centralized corporate structures.

What are the main technical hurdles limiting mainstream adoption of Crypto Music?

The main hurdles include poor user experience (UX) related to setting up and managing Web3 wallets, the complexity associated with understanding tokenomics, and the intermittent high transactional costs (gas fees) on prominent blockchain networks during periods of congestion, which complicate micro-payouts.

Is the Crypto Music Market regulated, and what are the major regulatory concerns?

The market is currently under evolving regulation. The major concern is the classification of fractionalized music NFTs, which often possess characteristics of unregistered securities. Global regulators are actively assessing how to apply existing financial laws to these novel digital assets, creating significant legal uncertainty for investors and platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager