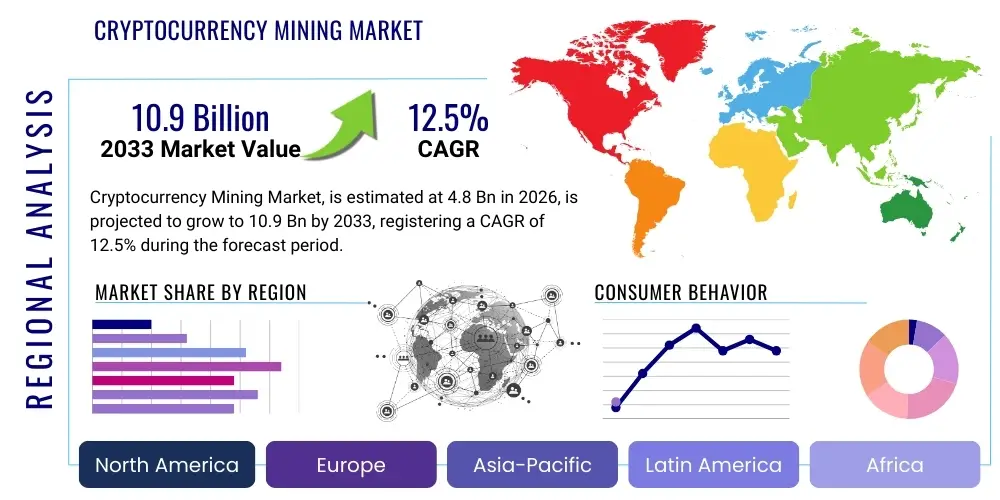

Cryptocurrency Mining Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441974 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Cryptocurrency Mining Market Size

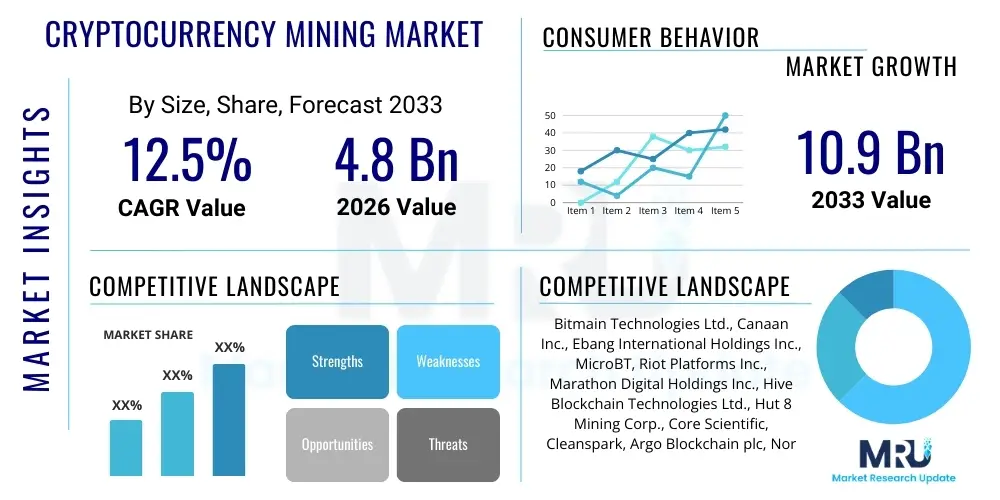

The Cryptocurrency Mining Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033. This robust expansion is predominantly fueled by the sustained institutional adoption of major cryptocurrencies like Bitcoin and Ethereum (prior to the Merge for PoW systems), alongside relentless technological advancements in Application-Specific Integrated Circuits (ASICs) designed for enhanced hashing power and energy efficiency. The cyclical nature of cryptocurrency valuations significantly influences investment decisions in mining infrastructure, yet the long-term trend remains upward, driven by the fundamental role mining plays in securing decentralized networks.

The calculation of this market valuation incorporates several key variables, including capital expenditure on mining hardware (ASICs, GPUs, power supply units), operational expenses related to electricity and cooling infrastructure, and the revenues generated by successful block rewards and transaction fees. Geographical shifts, particularly the migration of large-scale mining operations from regions with regulatory uncertainty to jurisdictions offering stable political environments and abundant low-cost, renewable energy sources, are critical factors supporting the projected CAGR. Furthermore, the increasing complexity of mining difficulties across major Proof-of-Work (PoW) networks necessitates continuous hardware upgrades, ensuring a perpetual demand cycle within the components and equipment segments of the market.

While regulatory headwinds in certain key markets present intermittent challenges, the underlying decentralization ethos of cryptocurrencies continues to attract significant venture capital and private equity investment into mining infrastructure development, particularly focusing on sustainable and carbon-neutral solutions. The ongoing integration of cryptocurrency mining into traditional energy grid management systems, utilizing excess or stranded energy, also opens up novel business models that support market expansion, solidifying the market's long-term growth trajectory beyond mere speculative cryptocurrency price movements. The drive towards institutional-grade security and operational efficiency further bolsters market value.

Cryptocurrency Mining Market introduction

The Cryptocurrency Mining Market encompasses the complex ecosystem involved in validating transactions and securing decentralized ledgers, primarily through resource-intensive computational processes known as Proof-of-Work (PoW). This industry is characterized by the use of specialized, high-performance computing hardware, predominantly ASICs, designed to rapidly solve cryptographic puzzles. The primary product generated is the validation of transaction blocks, for which miners are rewarded with newly issued cryptocurrency (block rewards) and associated transaction fees. Major applications span monetary transaction security, decentralized financial system maintenance, and the creation of new coin supply, underpinning the entire digital asset economy.

The key benefits derived from cryptocurrency mining include achieving network decentralization, ensuring the immutability of recorded data, and providing robust security against malicious attacks, such as 51% attacks. Mining activity serves as the critical security layer for protocols like Bitcoin, preventing fraudulent transactions and ensuring network consensus globally. The market is heavily driven by factors such as the rising market capitalization of cryptocurrencies, which increases the value of block rewards, the ongoing improvements in mining hardware efficiency (measured in joules per terahash), and the competitive search for economical energy sources worldwide to maintain operational profitability against escalating mining difficulty.

The market has evolved from small-scale hobbyist operations utilizing general-purpose CPUs and GPUs to a highly industrialized sector dominated by large, professional data centers managed by publicly traded entities and institutional investors. The shift towards industrialization emphasizes economies of scale, sophisticated cooling techniques like immersion cooling, and strategic geographical placement near renewable energy hubs. The cyclical nature of the Bitcoin Halving events consistently resets the competitive landscape, forcing continuous efficiency improvements and strategic divestment of outdated hardware, thus perpetuating innovation within the entire technological supply chain, from semiconductor fabrication to modular data center construction.

Cryptocurrency Mining Market Executive Summary

The global Cryptocurrency Mining Market is undergoing a rapid transition characterized by significant consolidation and a pervasive shift toward sustainability, driven by stringent environmental, social, and governance (ESG) considerations from institutional investors. Key business trends include the increasing dominance of large, publicly traded mining enterprises capable of raising substantial capital for infrastructure development and securing favorable power purchase agreements (PPAs). These entities leverage sophisticated risk management techniques to hedge against cryptocurrency price volatility and operational risks associated with energy markets, moving the industry beyond traditional garage-based operations into established financial markets.

Regionally, North America, particularly the United States and Canada, has emerged as a powerhouse, offering regulatory clarity, political stability, and access to scalable energy infrastructure, attracting massive investment following previous shifts in geopolitical mining landscapes. The Asia Pacific region remains critical due to its concentration of hardware manufacturing (semiconductors and ASICs), though the mining operations themselves have decentralized globally. Emerging regional trends involve the proliferation of mining activities in energy-rich, underdeveloped regions such as parts of Latin America and Central Asia, where cheap, often stranded, hydro or geothermal power sources can be monetized through PoW computations.

Segment trends highlight the overwhelming supremacy of the ASIC hardware segment due to its superior efficiency for SHA-256 algorithms, although specialized GPU mining remains relevant for niche altcoins utilizing alternative hashing algorithms. Within the service segment, the institutionalization of mining pools offering robust security, transparency, and advanced payout structures is crucial. Furthermore, the shift in energy usage towards renewable sources like solar, wind, and hydroelectric power, often coupled with advanced technologies like battery storage and power grid balancing services, defines the contemporary competitive edge and positions these segments for sustained, compliant growth in the forecast period.

AI Impact Analysis on Cryptocurrency Mining Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cryptocurrency Mining Market frequently revolve around optimizing profitability, managing complex infrastructure, and mitigating operational risks. Common questions center on how AI can predict the most profitable coins to mine given real-time market data and difficulty adjustments, and whether AI can fundamentally improve the energy efficiency of existing mining farms. Users are keenly interested in predictive maintenance capabilities—specifically, using AI to monitor thousands of interconnected machines, detect early signs of hardware failure, and preemptively manage cooling systems to avoid costly downtime. There is also significant user concern regarding whether AI-driven optimization might inadvertently lead to increased centralization of mining power, contradicting the decentralized ethos of cryptocurrencies.

The integration of AI and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and profitability of large-scale mining operations. AI systems are increasingly deployed to analyze vast datasets encompassing power consumption, temperature readings, hashing rates, firmware performance, and real-time electricity pricing. By processing these variables concurrently, AI can dynamically adjust the clock speed and voltage settings of individual ASIC miners—a process known as overclocking or underclocking optimization—to maximize the hash rate per watt, especially crucial in environments with fluctuating electricity costs or complex cooling requirements. This optimization moves far beyond static settings, enabling miners to maintain peak profitability margins even during periods of low cryptocurrency valuation or high energy costs, effectively transforming a rigid infrastructure model into a highly adaptive, intelligent system.

Beyond hardware performance optimization, AI is critically influencing strategic decisions by improving the predictive modeling of cryptocurrency markets. ML models are capable of analyzing macroeconomic indicators, regulatory announcements, social media sentiment, and technical analysis patterns to forecast short-term and medium-term price movements of various minable assets. This predictive capability allows large mining pools and centralized operations to dynamically switch between different Proof-of-Work currencies (where feasible) or optimize their inventory of mined coins for maximum selling prices. Furthermore, AI contributes significantly to cybersecurity by detecting unusual network traffic patterns, identifying potential Distributed Denial of Service (DDoS) attacks targeting mining pools, and securing proprietary firmware, thereby safeguarding valuable operational assets and intellectual property within the highly competitive mining landscape.

- AI optimizes ASIC performance by dynamically adjusting voltage and frequency for peak energy efficiency (Joules/Terahash).

- Predictive maintenance schedules are generated by ML models analyzing hardware telemetry data, minimizing downtime and extending equipment lifespan.

- AI-driven cooling management systems optimize fluid flow and ambient temperature, reducing power consumption dedicated to cooling infrastructure.

- Algorithmic trading and coin switching based on real-time profitability models are enabled by predictive analytics.

- Enhanced security protocols utilizing AI for anomaly detection protect mining pools and infrastructure from cyber threats.

DRO & Impact Forces Of Cryptocurrency Mining Market

The Cryptocurrency Mining Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively representing the Impact Forces shaping its future trajectory. Key drivers include the exponential growth in the global adoption of decentralized finance (DeFi) and associated blockchain technologies, which fundamentally increases the demand for network security provided by miners. Additionally, the periodic halving events in major PoW networks, such as Bitcoin, drastically reduce block rewards, thereby necessitating continuous investment in more efficient, cutting-edge hardware to maintain profitability, stimulating the semiconductor and hardware segments. Institutional investment, particularly from publicly listed companies raising capital for mining expansion, provides necessary stability and credibility, accelerating technological deployment and global operational scaling.

Conversely, the market faces significant restraints, primarily centered around environmental impact and regulatory uncertainty. The substantial energy consumption associated with PoW mining generates considerable environmental scrutiny, prompting demands for strict compliance and often leading to regulatory crackdowns or moratoriums in specific jurisdictions, which disrupts established operational locations. Furthermore, the inherent volatility of cryptocurrency prices poses a major financial risk; sudden downturns can render large-scale operations unprofitable, leading to mass hardware decommissioning and potential market contraction. The rapid depreciation and obsolescence of specialized hardware, driven by increasing network difficulty and relentless innovation, require massive ongoing capital expenditure, acting as a high barrier to entry and sustainability for smaller operators.

Opportunities within the sector are primarily focused on energy innovation and geopolitical diversification. The integration of mining facilities with renewable energy sources—utilizing stranded natural gas, geothermal, solar, and wind power—not only addresses ESG concerns but also offers long-term, predictable, and low-cost energy solutions, fundamentally improving profitability metrics. The development of advanced cooling technologies, such as single-phase and two-phase immersion cooling, significantly improves hardware lifespan and energy efficiency, moving beyond traditional air cooling constraints. Geopolitical diversification into stable regions with favorable energy policies and supportive regulatory frameworks, particularly across North America and select parts of Europe, mitigates regional risk and unlocks new avenues for massive infrastructure scaling, solidifying these areas as future mining hubs.

The cumulative impact forces dictate a clear trajectory toward industrialization, sustainability, and efficiency. The relentless pursuit of lower energy costs and higher hash rates will continue to drive mergers and acquisitions (M&A) activities, leading to further market consolidation. Regulatory pressures will act as a funnel, directing capital toward operators demonstrating robust environmental stewardship and adherence to established financial reporting standards. The overall force compels the market toward a high-capital, high-technology environment where operational excellence and energy strategy are the primary determinants of long-term success.

Segmentation Analysis

The Cryptocurrency Mining Market is structurally segmented based on crucial dimensions including the type of Mining Hardware utilized, the Cryptocurrency (Coin) being mined, the Type of Service offered, and the geographical Region of operation. Analyzing these segments provides nuanced insight into investment flows and technological dominance. Hardware segmentation, notably ASIC versus GPU miners, reflects the efficiency trade-offs and specialization required for different hashing algorithms. The dominance of ASIC miners in the Bitcoin ecosystem dictates major supply chain dynamics, whereas GPU miners retain flexibility for newer or less established PoW protocols.

Service segmentation highlights the evolving commercial models within the industry, distinguishing between self-mining (proprietary operations), cloud mining (renting hashing power), and mining pools (shared resource aggregation). Mining pools represent the most substantial service segment, crucial for small and medium-sized operators seeking stable, predictable payouts. Cloud mining, while historically controversial due to inherent risks, is finding renewed institutional interest with highly vetted, secure contractual arrangements. The segmentation by Cryptocurrency, particularly the focus on Bitcoin (SHA-256) versus Altcoins (Scrypt, Ethash, etc.), determines the specialized hardware demand and operational profitability thresholds based on market volatility.

Furthermore, geographical segmentation is pivotal, reflecting differences in regulatory environments, electricity costs, climate conditions, and access to capital. The shift from Asia to North America has profoundly impacted global distribution and manufacturing strategies, driving demand for modular data centers and localized supply chains. Understanding the interdependence of these segments—for instance, how ASIC hardware availability (a supply-side factor) affects the profitability of Bitcoin self-mining operations in North America (a demand-side factor)—is essential for accurately projecting future market trends and identifying strategic entry points.

- By Component:

- Hardware (ASIC Miners, GPU Miners, Power Supply Units, Cooling Systems)

- Software (Mining Management Software, Firmware Optimization Tools)

- Services (Maintenance, Consulting, Deployment)

- By Cryptocurrency:

- Bitcoin (BTC)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Other Altcoins (Monero, Dogecoin, etc.)

- By Type of Service:

- Self-Mining/Colocation

- Cloud Mining

- Mining Pools

- By Deployment:

- On-Premise/Data Center

- Mobile/Containerized Solutions

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Cryptocurrency Mining Market

The value chain of the Cryptocurrency Mining Market is characterized by highly specialized stages, beginning with upstream activities dominated by semiconductor fabrication and advanced hardware manufacturing. Upstream analysis focuses heavily on the design and production of Application-Specific Integrated Circuits (ASICs), where a few dominant players control the global supply of high-performance mining chips. This stage involves intense research and development to achieve lower nanometer technology (e.g., 5nm or 3nm chips) crucial for maximizing computational efficiency and reducing power draw. Key relationships at this level are between ASIC designers (like Bitmain or Canaan) and major semiconductor foundries (like TSMC or Samsung), whose capacity constraints directly impact the scalability of mining operations globally. The cost and scarcity of these specialized chips form the foundational capital expenditure for the entire industry.

The midstream segment involves the assembly, distribution, and setup of mining equipment. Distribution channels are bifurcated into direct sales from manufacturers to large institutional buyers and indirect channels through authorized resellers, often dealing with smaller-scale operations. Large miners often prefer direct engagement to secure volume discounts and custom configurations, while the indirect channel serves the broader global market, including regions where manufacturers lack direct presence. The logistics of moving thousands of specialized, fragile machines and establishing necessary infrastructure, including modular data centers and advanced cooling systems (e.g., liquid immersion tanks), define this stage, emphasizing robust supply chain management and swift deployment capabilities to capitalize on favorable market conditions.

Downstream analysis encompasses the operational phase and the monetization of mining rewards. This includes the management of mining farms (colocation or self-mining), participation in mining pools, and the subsequent conversion of mined cryptocurrencies into fiat or other digital assets. Mining pools act as critical aggregation points, stabilizing revenue streams for miners by combining hash power and distributing rewards reliably. Direct monetization occurs when large mining companies sell their mined coins directly on exchanges or hold them as treasury assets, linking the mining value chain directly to the financial services sector and cryptocurrency trading platforms. The downstream profitability is highly sensitive to real-time electricity costs, hardware maintenance efficiency, and cryptocurrency market liquidity, completing the cyclical value generation process within the ecosystem.

Cryptocurrency Mining Market Potential Customers

The potential customer base for the Cryptocurrency Mining Market is segmented into three primary groups: large-scale institutional miners, medium-to-large corporate treasury managers, and individual or hobbyist miners, each with distinct capital requirements and operational expectations. Institutional miners, comprising publicly traded mining companies (e.g., Riot Platforms, Marathon Digital Holdings), large private equity groups, and specialized crypto investment funds, represent the most significant customer segment in terms of capital expenditure and demand for advanced services. These customers require end-to-end solutions, including purchasing bulk quantities of the latest ASIC hardware, securing colocation services in high-efficiency data centers, advanced cooling systems (immersion cooling), and highly formalized power purchase agreements (PPAs) that ensure long-term, low-cost electricity access. Their focus is purely on achieving the lowest operating cost per coin (OPEX) and maintaining maximum uptime.

Corporate treasury managers, particularly those of technology companies or financial institutions increasingly holding Bitcoin or other digital assets on their balance sheets, represent a growing segment. These buyers often invest in cloud mining contracts or form strategic partnerships for specialized mining operations to diversify their asset accumulation strategies without incurring the significant operational complexities of running a physical farm. Their primary requirement is reliability, verifiable compliance, and transparent auditing of the mining activities, ensuring that their crypto accrual methods meet regulatory and internal governance standards. This segment drives demand for highly secure and regulated service offerings, differentiating them from pure hash rate purchasers.

Individual and hobbyist miners, although declining in terms of overall network hash power contribution, still constitute a large volume of transactions within the aftermarket hardware and mining pool segments. These customers typically purchase smaller quantities of GPU or older generation ASIC miners and rely heavily on readily accessible mining pools and user-friendly management software. Their purchasing decisions are highly price-sensitive and focused on equipment with lower entry costs and manageable power requirements suitable for residential or small commercial setups. While the trend favors institutional scale, this segment ensures a robust secondary market for hardware and promotes decentralized geographic distribution of hashing power.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bitmain Technologies Ltd., Canaan Inc., Ebang International Holdings Inc., MicroBT, Riot Platforms Inc., Marathon Digital Holdings Inc., Hive Blockchain Technologies Ltd., Hut 8 Mining Corp., Core Scientific, Cleanspark, Argo Blockchain plc, Northern Data AG, Galaxy Digital, SBI Crypto, Stronghold Digital Mining, Genesis Digital Assets, FutureBit, Blockstream, Terawulf Inc., GekkoScience. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cryptocurrency Mining Market Key Technology Landscape

The technology landscape of the Cryptocurrency Mining Market is defined by intense competition in achieving maximal energy efficiency and computational density, primarily driven by advancements in Application-Specific Integrated Circuits (ASICs). The transition from older 16nm and 7nm nodes to leading-edge 5nm and 3nm semiconductor fabrication processes is critical, as smaller transistor sizes allow manufacturers to cram more hash power onto a single chip while dramatically lowering power consumption per unit of hashing capacity (Terahash). This continuous shrinking of the die size is not merely incremental improvement; it fundamentally shifts the economic viability of mining operations, ensuring that firms that can rapidly adopt the latest generation hardware maintain a definitive competitive advantage over those relying on depreciating, less efficient machinery. The complexity and capital investment required for these advanced chips further concentrate market power among major hardware producers.

Alongside chip miniaturization, thermal management technology has become equally crucial, necessitated by the extreme heat generated by dense computational systems. Air cooling, the traditional method, is rapidly being superseded by highly efficient liquid cooling solutions, particularly single-phase and two-phase immersion cooling. Immersion cooling involves submerging the entire ASIC unit into a non-conductive dielectric fluid, which drastically improves heat transfer, reduces fan noise and maintenance, and potentially extends the operational lifespan of the hardware by reducing thermal stress and exposure to dust/humidity. This technology enables higher power density in smaller physical footprints and is vital for large-scale facilities aiming for high energy efficiency ratios (PUEs), especially in regions with high ambient temperatures, thereby transforming the physical design and engineering requirements of modern mining data centers.

Furthermore, software optimization and infrastructure management technologies play a vital role. Specialized firmware and operating systems are continuously developed to fine-tune ASIC performance, allowing operators to dynamically control voltage and frequency settings to match real-time electricity pricing or environmental conditions. This dynamic optimization is often coupled with sophisticated data center infrastructure management (DCIM) systems that integrate AI/ML for predictive maintenance, power load balancing, and automated fault detection across thousands of interconnected machines. The emergence of modular, containerized mining solutions also represents a significant technological leap, allowing for rapid deployment and easy relocation to stranded energy sources (e.g., flare gas capturing sites or remote hydroelectric plants), enhancing the agility and geographical flexibility of large mining operations in response to volatile regulatory or energy market conditions worldwide.

Regional Highlights

The global cryptocurrency mining landscape has undergone a dramatic geopolitical reconfiguration, largely driven by regulatory policy and the search for sustainable, low-cost energy. North America, particularly the United States (Texas, Wyoming, Kentucky) and Canada (Quebec, Alberta), has solidified its position as the world leader for industrial-scale mining operations. This dominance is attributed to a combination of factors: readily available energy resources (both natural gas and renewables), relatively clear regulatory frameworks that support innovation, and robust access to capital markets, allowing mining firms to scale rapidly and operate with institutional financial backing. The regulatory stability and large energy grids facilitate long-term planning, attracting massive foreign direct investment into data center infrastructure and advanced cooling technologies.

The Asia Pacific (APAC) region, while historically dominant, has shifted its focus. Although China remains a significant hub for manufacturing ASIC hardware and related components, large-scale mining operations have largely migrated out due to restrictive governmental policies. However, emerging APAC nations, especially those with developing energy sectors and supportive crypto policies (e.g., certain regions in Central Asia and Southeast Asia), are showing potential for growth, leveraging their proximity to manufacturing supply chains. Europe, particularly Scandinavian countries (Sweden, Norway, Iceland), specializes in green mining, utilizing abundant hydroelectric and geothermal power. European operations emphasize environmental compliance and sustainability, often attracting institutional investment focused on ESG criteria, though they can be constrained by high taxation and slower infrastructure scaling compared to North America.

Latin America and the Middle East & Africa (MEA) represent emerging frontiers driven by opportunities in monetizing stranded or underutilized energy resources. Countries with abundant hydroelectric power (e.g., Paraguay) or cheap natural gas (e.g., parts of the Middle East) are attracting pioneering miners. While political instability and underdeveloped infrastructure pose significant risks in some areas, the sheer potential for cost-effective energy provides a powerful incentive. These regions typically demand containerized, highly resilient, and flexible mining solutions that can be deployed quickly and withstand challenging environmental conditions, highlighting a distinct set of technological requirements for market entry and sustained operation.

- North America (Dominant Market): Characterized by large-scale, publicly listed mining companies; strong capital access; and focus on renewable and stranded energy sources (e.g., Texas, utilizing curtailed wind power).

- Asia Pacific (Manufacturing Hub): Primary region for ASIC chip fabrication and hardware assembly; operational mining shifts toward Central Asia and Southeast Asia after major regulatory changes.

- Europe (Green Mining Focus): High reliance on hydroelectric and geothermal energy in Nordic countries; strong emphasis on ESG compliance and sustainable operations, appealing to environmentally conscious investors.

- Latin America (Emerging Frontier): Attractive due to low energy costs derived from abundant hydro and geothermal resources; growth challenged by political volatility and infrastructure limitations.

- Middle East and Africa (MEA): Potential for energy monetization (e.g., flare gas capture); market development is nascent, requiring specialized, rugged infrastructure solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cryptocurrency Mining Market.- Bitmain Technologies Ltd.

- Canaan Inc.

- Ebang International Holdings Inc.

- MicroBT (Whatsminer)

- Riot Platforms Inc.

- Marathon Digital Holdings Inc.

- Hut 8 Mining Corp.

- Core Scientific

- Cleanspark

- Argo Blockchain plc

- Hive Blockchain Technologies Ltd.

- Northern Data AG

- Stronghold Digital Mining

- Terawulf Inc.

- Genesis Digital Assets

- Galaxy Digital (Mining division)

- SBI Crypto

- F2Pool (Mining Pool Operator)

- Poolin (Mining Pool Operator)

- GekkoScience (Specialized Hardware)

Frequently Asked Questions

Analyze common user questions about the Cryptocurrency Mining market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor behind the projected growth in the Cryptocurrency Mining Market?

The primary driver is the sustained institutional acceptance and rising market capitalization of major Proof-of-Work (PoW) cryptocurrencies, coupled with the relentless technological push for more energy-efficient ASIC hardware required to maintain profitability after events like Bitcoin halvings.

How are environmental concerns impacting the strategic direction of large-scale mining operations?

Environmental concerns are compelling large operators to shift investments toward renewable energy sources (hydro, solar, wind) and advanced cooling techniques like immersion cooling to improve energy efficiency (PUE) and meet strict Environmental, Social, and Governance (ESG) criteria required by institutional funding partners.

Which geographical region currently dominates the global Cryptocurrency Mining market for operations?

North America, particularly the United States, currently dominates the operational market due to political stability, regulatory clarity, and access to scalable, often stranded or low-cost, energy resources suitable for establishing massive, institutional-grade mining data centers.

What technological advancement is most critical for future mining profitability?

The most critical advancement is the continued scaling down of semiconductor technology in ASICs, moving toward 5nm and 3nm chips. This miniaturization drastically increases the hashing power while minimizing power consumption per terahash, directly determining long-term operational profitability.

What role does Artificial Intelligence play in optimizing cryptocurrency mining operations?

AI is essential for dynamic operational optimization, managing energy consumption by adjusting ASIC performance in real time based on electricity costs, implementing predictive maintenance to reduce hardware downtime, and optimizing advanced liquid cooling systems for peak efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cryptocurrency Mining Market Size Report By Type (Self-Mining, Cloud Mining Services, Remote Hosting Services, Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dash), By Application (Trading, E-commerce and Retail, Peer-to-Peer Payment , Remittance), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Cryptocurrency Mining Hardware Market Statistics 2025 Analysis By Application (Enterprise, Personal), By Type (ASIC Miner, GPU Mining Rig, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager