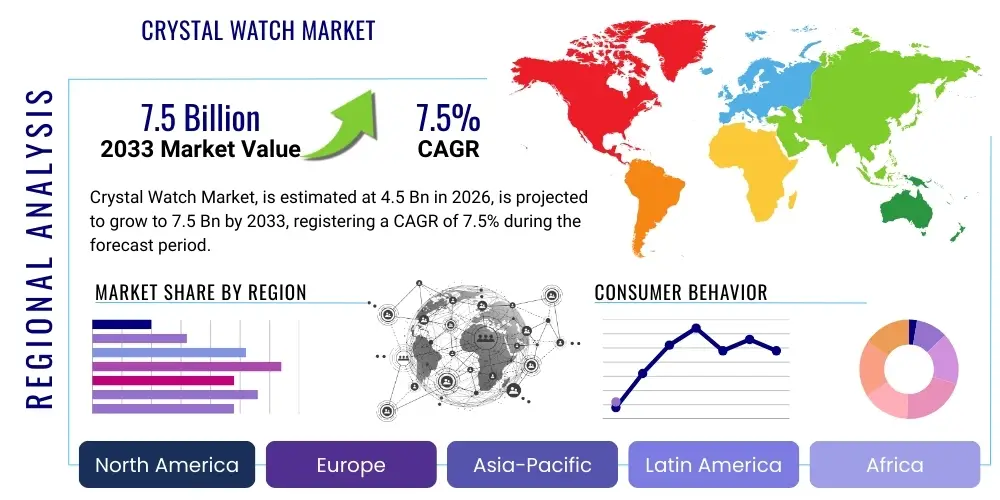

Crystal Watch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443088 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Crystal Watch Market Size

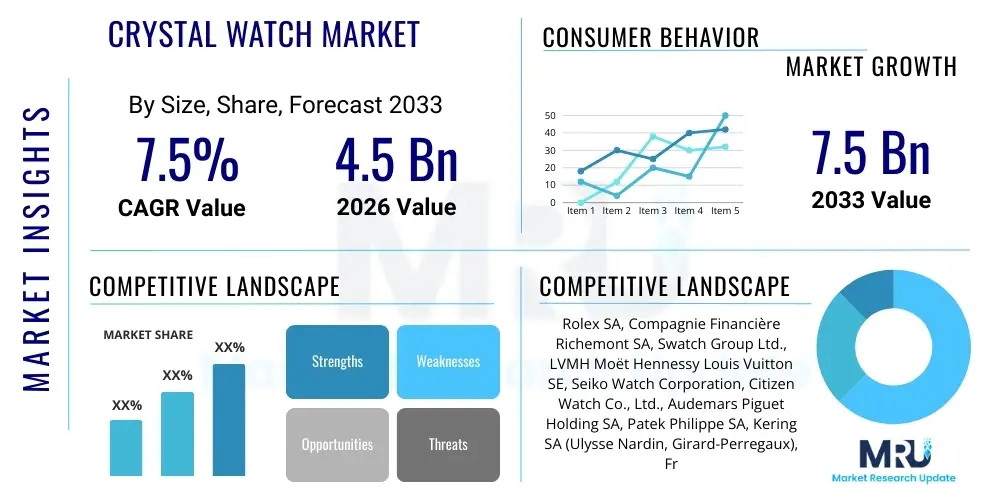

The Crystal Watch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $4.5 billion in 2026 and is projected to reach $7.5 billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing consumer demand for luxury timepieces incorporating superior materials, particularly sapphire crystal, which offers unparalleled scratch resistance and clarity, elevating the durability and aesthetic appeal of high-end watches. The market growth trajectory is further supported by innovations in crystal manufacturing techniques, including advanced anti-reflective coatings and domed designs, catering to sophisticated horological tastes globally. The segment dedicated to vintage and refurbished watches, where original crystal replacement or restoration is crucial, also contributes significantly to this projected valuation.

Crystal Watch Market introduction

The Crystal Watch Market encompasses the sale and manufacturing of timepieces where the watch glass, or crystal, is a defining component influencing both functionality and luxury perception. These crystals primarily include sapphire, mineral glass, and acrylic variants, each offering different levels of durability, clarity, and cost. Sapphire crystal, synthetically manufactured aluminum oxide, dominates the premium segment due to its extreme hardness, ranking 9 on the Mohs scale, making it highly resistant to scratches and impacts, a critical feature for enduring quality in luxury watches. Mineral glass, a treated standard glass, provides a more economical and shock-resistant alternative often utilized in mid-range and sports watches, while acrylic (plastic) crystals retain a niche in vintage or highly affordable timepieces.

Major applications of crystal watches span daily wear, professional diving (where crystal integrity under pressure is vital), aviation, and haute couture fashion accessories. The crystal serves multiple critical functions beyond mere protection; it significantly impacts legibility through anti-reflective treatments and can shape the watch's aesthetic profile, such as through the use of box-shaped or deeply domed crystals characteristic of vintage styles or modern design complexity. The benefits of high-quality crystals, particularly sapphire, include superior optical clarity, longevity, and resistance to environmental degradation, which preserves the intrinsic value and appearance of the timepiece over decades of use, positioning them as heirloom assets.

The market is predominantly driven by the escalating disposable incomes in emerging economies, leading to greater adoption of luxury goods, coupled with a renewed global interest in mechanical and handcrafted watchmaking, where material quality is paramount. Furthermore, successful marketing campaigns emphasizing heritage, precision, and the durability offered by sapphire crystals have solidified consumer perception of these materials as benchmarks for quality. Technological advancements enabling thinner, lighter, and more complex crystal shapes (e.g., asymmetrical or multi-faceted designs) further stimulate product differentiation and market expansion, attracting collectors and discerning buyers seeking unique aesthetic features.

Crystal Watch Market Executive Summary

The Crystal Watch Market is defined by a strong emphasis on material science superiority and consumer preference for durable luxury, heavily favoring sapphire crystal integration across various price points, albeit dominating the high-end sector. Business trends indicate increased vertical integration among major watch manufacturers, controlling the crystal sourcing and finishing processes to ensure quality and supply chain resilience. There is a noticeable shift towards sustainable sourcing and manufacturing practices for crystal materials, responding to growing ethical consumerism. Concurrently, the proliferation of online luxury retailing platforms has broadened geographical access to specialized crystal watches, supporting robust global sales volumes even as traditional brick-and-mortar stores emphasize experiential retail to justify premium pricing.

Regionally, Asia Pacific (APAC), led by strong demand from China and India, represents the fastest-growing market, driven by rising affluence and cultural significance attached to gifting high-quality timepieces. Europe, anchored by Switzerland, remains the epicenter of manufacturing excellence and accounts for the largest revenue share, characterized by established luxury brands maintaining stringent quality standards for crystal materials and finishing. North America shows stable growth, fueled by strong consumer spending on accessible luxury and smartwatches that often incorporate advanced durable crystal technology to protect sensitive screens, thereby blurring traditional segment lines.

Segment trends highlight the dominance of the men's crystal watch segment due to historical preference for complex mechanical watches requiring highly durable crystals, although the women’s segment is accelerating rapidly with increasing demand for smaller, fashion-forward timepieces utilizing specialty crystal cuts. By material, sapphire crystal holds the leading market share in value terms, reflecting its premium positioning and near-universal adoption by luxury brands. Distribution analysis indicates that specialized retail stores and official brand boutiques maintain primacy for high-value transactions, providing authentication and personalized service, while e-commerce channels successfully capture the middle-market volume, emphasizing convenience and competitive pricing for standardized models.

AI Impact Analysis on Crystal Watch Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the manufacturing precision of crystal components, particularly for complex shapes like domed or boxed sapphire crystals, and whether AI can personalize the crystal finishing process for luxury customization. Key concerns revolve around AI's role in optimizing material usage to reduce waste, forecasting demand for specific crystal types (e.g., anti-magnetic shields vs. standard sapphire), and detecting micro-defects invisible to the human eye during quality control. There is a strong expectation that AI will streamline the entire crystal supply chain, from raw material sourcing (aluminum oxide) to the final anti-reflective coating application, ultimately resulting in higher product quality, lower production costs, and shorter lead times for specialized watch models requiring unique crystal geometries.

- AI-driven optimization of crystal cutting and polishing processes, minimizing material waste and achieving nanometer-level precision in complex geometries (e.g., triple-domed crystals).

- Predictive maintenance analytics applied to crystal manufacturing machinery (furnaces, grinding machines) to prevent defects and ensure consistent batch quality.

- Enhanced visual inspection and quality control utilizing machine learning algorithms to rapidly detect microscopic flaws, cracks, or impurities in sapphire and mineral glass components.

- AI-powered demand forecasting and inventory management specific to different crystal types (flat, domed, boxed, exhibition casebacks) to optimize procurement and reduce holding costs.

- Personalization tools utilizing AI to offer customers bespoke crystal customizations, such as unique engravings, tinting, or specialized anti-glare finishes, integrated into the online configuration process.

- Simulation models powered by AI to predict the structural integrity and pressure resistance of crystals for deep-sea diving watches before physical prototyping.

DRO & Impact Forces Of Crystal Watch Market

The Crystal Watch Market is simultaneously propelled by increasing consumer wealth driving luxury purchasing and restrained by the high cost and technical complexity associated with premium materials like sapphire. Opportunities lie in the adoption of novel crystal materials and sustainable manufacturing, while the impact forces necessitate navigating global economic volatility and maintaining technological superiority against alternative screen technologies used in smart devices. Drivers include the status symbol associated with high-quality mechanical watches, the functional benefits of superior scratch resistance, and the sustained growth of the luxury e-commerce segment facilitating access to specialized timepieces globally. The primary constraint is the intensive energy usage and high capital expenditure required for synthetic sapphire production, which limits scalability and maintains high price barriers, coupled with the rising threat of counterfeit crystal components in the grey market.

Opportunities are significant in developing advanced surface treatments, such as ultra-hardened mineral glass alternatives that close the performance gap with sapphire at a lower cost, and exploiting the expanding trend of exhibition casebacks, which necessitates high-clarity crystal usage on both the front and back of the watch. Furthermore, collaborations between traditional horology houses and specialized material science firms present avenues for innovation in shock absorption and optical purity. Impact forces, driven by shifting macroeconomic factors and geopolitical stability, directly influence discretionary spending on luxury goods, creating demand volatility. Moreover, rapid advancements in competing display protection technologies (like Gorilla Glass variants in smart devices) pressure traditional watch crystal manufacturers to continuously innovate and justify the premium associated with their materials, particularly in the sports and casual watch segments.

Successfully navigating these dynamics requires manufacturers to invest heavily in supply chain transparency and quality certification to combat counterfeiting, simultaneously exploring sustainable manufacturing processes to appeal to environmentally conscious luxury buyers. The long-term durability promise of crystal watches remains a powerful differentiating factor against tech obsolescence, yet brands must strategically communicate the material science superiority, focusing not just on hardness but also on optical performance and aesthetic versatility. This intricate balance between material innovation, cost efficiency, and consumer perception defines the competitive landscape and future trajectory of the Crystal Watch Market through the forecast period, emphasizing resilience and continuous product refinement.

Segmentation Analysis

The Crystal Watch Market segmentation provides a granular view of consumer preferences, material science trends, and distribution strategies employed across the industry. This analysis categorizes the market primarily based on the type of crystal material used (Sapphire, Mineral, Acrylic), which directly correlates with the watch's price point and durability profile. Further segmentation includes application (Men's, Women's, Unisex), reflecting design trends and mechanical complexity, and distribution channel (Online, Offline), illustrating the evolving landscape of luxury retail. Understanding these segments is crucial for manufacturers to tailor their production capabilities, marketing messages, and geographical expansion strategies, ensuring optimal resource allocation and maximum market penetration in high-growth areas.

The sapphire crystal segment dominates the market by value, primarily targeting the luxury and high-end niche, benefitting from strong brand identity and consumer willingness to pay a premium for superior scratch resistance and clarity. Conversely, the mineral glass segment caters to the mass-market and sports watch sectors, providing a balance of shock resistance and affordability. The men’s application segment traditionally holds the largest volume, particularly in mechanical and functional watches (diver’s, pilot’s), where large, legible, and highly durable crystals are essential. However, the women’s and unisex segments are witnessing accelerated growth fueled by fashion-forward designs and the integration of smaller, custom-cut crystals.

Geographically, market segmentation reveals differentiated growth speeds and material preferences. Asia Pacific exhibits high demand for prestige and investment-grade watches, boosting the sapphire segment, while mature markets in Europe focus on heritage brands and impeccable finishing, driving demand for specialized crystal treatments like anti-reflective coatings and domed vintage aesthetics. The continuous refinement of segmentation strategies, particularly in e-commerce, allows brands to leverage data analytics to predict regional material preferences, such as a preference for highly domed acrylic in retro designs versus flat sapphire in modern tactical watches, thereby optimizing inventory and campaign execution across diverse consumer bases.

- By Crystal Material:

- Sapphire Crystal

- Mineral Crystal (Hardened/Treated Glass)

- Acrylic/Hesalite Crystal

- By Application/End-User:

- Men's Watches

- Women's Watches

- Unisex/Smart Watches

- By Price Range:

- Luxury (Above $5,000)

- Mid-Range ($500 - $5,000)

- Affordable (Below $500)

- By Distribution Channel:

- Offline Retail (Brand Boutiques, Authorized Dealers, Specialized Jewelry Stores)

- Online Retail (E-commerce Platforms, Official Brand Websites)

- By Caseback Type:

- Solid Caseback

- Exhibition Caseback (Crystal utilized for movement viewing)

Value Chain Analysis For Crystal Watch Market

The value chain for the Crystal Watch Market begins with the upstream sourcing of raw materials, primarily high-purity aluminum oxide powder for synthetic sapphire production or specialized silica compounds for mineral glass. This stage is capital-intensive, requiring specialized high-temperature furnaces and complex growing techniques (like the Verneuil or Kyropoulos methods for sapphire). The next crucial step involves transformation: cutting, grinding, shaping, and polishing the raw crystal boules into the specific watch glass dimensions and geometries (flat, domed, boxed). Precision engineering and advanced CNC machining are vital here, as crystal hardness demands specialized tools and prolonged processing times, contributing significantly to the final cost, especially for complex designs.

The midstream phase involves assembly and integration, where watch manufacturers incorporate the finished crystal into the case, applying gaskets and ensuring water resistance. This requires highly precise measurements and sterile environments to prevent contamination. Downstream activities involve distribution channels, encompassing both direct sales through brand-owned boutiques and indirect sales via authorized third-party retailers, multi-brand luxury stores, and increasingly, specialized e-commerce platforms. Direct channels offer greater control over brand image and pricing, fostering personalized customer experiences essential for high-value sales, while indirect channels provide broader market reach and localized service expertise, particularly in fragmented international markets. The efficiency of the logistics network, ensuring secure and insured global transit of valuable timepieces, is a significant component of downstream effectiveness.

The distribution channel strategy is dichotomous: high-end luxury crystal watches rely heavily on specialized, authorized brick-and-mortar retailers for authenticity verification, expert consultation, and after-sales service, reinforcing the investment aspect of the purchase. Conversely, mid-range and affordable crystal watches are rapidly migrating towards robust online platforms, utilizing sophisticated visual tools (360-degree views, augmented reality features) to showcase the crystal's clarity and durability, thereby minimizing the physical viewing requirement. Effective post-sale service, including crystal replacement and repair facilities, forms the final link in the chain, strongly influencing long-term customer loyalty and repeat purchases. The integration of technology, particularly in tracking authenticity from raw material to final sale (e.g., blockchain for luxury goods), is becoming a critical competitive differentiator across the entire value chain.

Crystal Watch Market Potential Customers

Potential customers for the Crystal Watch Market are highly stratified, ranging from affluent collectors seeking investment-grade timepieces with pristine sapphire crystals to mainstream consumers looking for durable, aesthetically pleasing accessories. The primary end-user segment is the discerning luxury consumer (often high-net-worth individuals) who values longevity, material excellence, and the heritage associated with traditional mechanical watchmaking. These buyers prioritize watches featuring synthetic sapphire crystal, often with multiple anti-reflective coatings and complex geometries, viewing the watch not merely as a time-telling device but as a wearable piece of engineering and art. This segment requires high-touch retail experiences and comprehensive after-sales support.

A second significant customer base comprises the expanding middle-to-upper-middle class in developing nations, particularly Asia, who are purchasing mid-range timepieces utilizing hardened mineral glass or entry-level sapphire crystals. For this demographic, the watch symbolizes upward mobility, achievement, and reliable quality. They are highly responsive to marketing emphasizing durability and brand reputation, often making purchases through accessible online channels or large department stores. They seek value propositions that offer superior scratch resistance compared to standard glass without the extreme price tag of haute horology.

Furthermore, niche markets such as professional athletes, divers, pilots, and military personnel represent critical buyers for specialized crystal watches. These end-users require specific performance features, such as extremely thick, pressure-resistant crystals (for divers) or anti-magnetic, highly legible crystals (for pilots). Their purchasing decisions are primarily driven by functional requirements and certified technical specifications rather than purely aesthetic appeal. Finally, the growing community of smart device users seeking durable screen protection also intersects with the crystal market, as premium smartwatches increasingly adopt sapphire glass to maintain robustness against daily wear and tear, representing a significant volume growth opportunity for crystal suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rolex SA, Compagnie Financière Richemont SA, Swatch Group Ltd., LVMH Moët Hennessy Louis Vuitton SE, Seiko Watch Corporation, Citizen Watch Co., Ltd., Audemars Piguet Holding SA, Patek Philippe SA, Kering SA (Ulysse Nardin, Girard-Perregaux), Frank Muller Watchland, Chopard Group, Hublot SA, Bremont Watch Company, TAG Heuer SA, Rado Watch Co. Ltd., Corning Incorporated (Material Supplier), SCHOTT AG (Material Supplier), Rubicon Technology, Inc. (Material Supplier), Saint-Gobain S.A. (Material Supplier). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crystal Watch Market Key Technology Landscape

The technology landscape in the Crystal Watch Market is dominated by advancements in material science and high-precision manufacturing processes essential for creating durable and optically superior components. The synthesis of sapphire crystal remains a critical technology, with manufacturers constantly refining methods like the Kyropoulos process to grow larger, higher-quality crystal boules with fewer internal defects, thereby reducing waste during the cutting phase. Innovations in surface engineering, including the development of multi-layered anti-reflective (AR) coatings, are paramount. These coatings are chemically applied via vacuum deposition techniques to minimize glare and maximize legibility, a key differentiator in the premium segment, often requiring proprietary formulas to ensure long-term integrity and resistance to peeling or degradation.

Furthermore, the market relies heavily on sophisticated Computer Numerical Control (CNC) machining and laser cutting technologies to achieve the intricate shapes demanded by modern watch designs, such as complex domed, faceted, or highly curved crystals that integrate seamlessly into ergonomic cases. These machining processes must handle the extreme hardness of sapphire without chipping or inducing stress fractures. Beyond shaping, plasma etching and specialized grinding techniques are utilized to achieve smooth, perfect edges and precise fits required for high water resistance ratings. These technological refinements not only enhance the aesthetic appeal but also fundamentally contribute to the functional integrity of performance-oriented watches, such as those used for deep-sea diving.

A burgeoning technological area is the integration of advanced materials beyond traditional sapphire. This includes hybrid materials, such as extremely hardened mineral glass treated with ceramic coatings (e.g., Gorilla Glass variants tailored for horology), which aim to offer sapphire-like durability at a lower production cost. Additionally, technology related to crystal inspection and quality control is evolving rapidly, incorporating ultra-high-resolution microscopy and automated visual systems to detect sub-micron level flaws. Sustainability technologies are also gaining prominence, focusing on minimizing the high energy consumption traditionally associated with sapphire growth and optimizing the recycling processes for crystal components, aligning production methods with contemporary environmental standards sought by luxury consumers.

Regional Highlights

- Europe (The Manufacturing Hub and Largest Value Market): Europe, specifically Switzerland, retains its position as the global nexus for luxury watch manufacturing, driving the highest revenue share in the crystal watch market. The region’s strength lies in its established infrastructure, stringent quality standards, and the presence of world-leading luxury groups (Swatch Group, Richemont, LVMH). Demand here is focused heavily on premium sapphire and unique crystal forms like vintage-style box crystals and highly domed plexiglass replacements for historical pieces. The regulatory environment also emphasizes precision and material provenance, reinforcing the reliance on sophisticated crystal technology.

- Asia Pacific (APAC) (Fastest Growing Consumption Market): APAC is projected to exhibit the highest Compound Annual Growth Rate, fueled by rapidly increasing middle-class affluence in China, India, and Southeast Asia. The region views high-quality crystal watches as essential status symbols and investment assets. Key markets are characterized by strong demand for luxury sapphire watches and a rising trend of purchasing smartwatches with durable crystal protection. Local consumers are highly responsive to brand heritage combined with modern durability claims, often utilizing e-commerce platforms for cross-border luxury purchases, demanding robust supply chain integrity.

- North America (High Adoption of Accessible Luxury and Smart Devices): North America demonstrates stable, mature growth, characterized by strong consumer spending on both traditional mid-to-high-range mechanical watches and technologically advanced crystal-protected smartwatches. The market is highly competitive, emphasizing speed to market and technological features, leading to higher adoption rates of innovative material treatments like specialized mineral glasses and complex anti-glare coatings. E-commerce penetration for watch sales is exceptionally high here, requiring brands to effectively communicate the visual benefits and durability of their crystals online.

- Middle East and Africa (MEA) (Luxury Niche Growth): MEA represents a significant niche market driven by high-net-worth individuals, particularly in the Gulf Cooperation Council (GCC) states. The demand is almost exclusively concentrated in the ultra-luxury segment, favoring high-end diamond-set watches and highly exclusive limited editions, all of which mandate the use of flawless sapphire crystals. Purchases are often made through high-end brand boutiques and flagship stores, focusing on bespoke experiences and limited-run material combinations.

- Latin America (Emerging Market Potential): Latin America presents growth potential, though constrained by currency volatility and economic fluctuations. The demand is concentrated in key urban centers and focuses primarily on accessible luxury and branded mid-range watches utilizing hardened mineral or entry-level sapphire crystals. The market is sensitive to price, meaning crystal manufacturers who can provide a strong balance between cost and perceived durability gain a competitive edge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crystal Watch Market, encompassing major watch conglomerates and critical crystal material suppliers.- Rolex SA

- Compagnie Financière Richemont SA

- Swatch Group Ltd.

- LVMH Moët Hennessy Louis Vuitton SE

- Seiko Watch Corporation

- Citizen Watch Co., Ltd.

- Audemars Piguet Holding SA

- Patek Philippe SA

- Kering SA (Ulysse Nardin, Girard-Perregaux)

- Frank Muller Watchland

- Chopard Group

- Hublot SA

- Bremont Watch Company

- TAG Heuer SA

- Rado Watch Co. Ltd.

- Corning Incorporated

- SCHOTT AG

- Rubicon Technology, Inc.

- Saint-Gobain S.A.

- Monocrystal

Frequently Asked Questions

Analyze common user questions about the Crystal Watch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between sapphire, mineral, and acrylic watch crystals?

Sapphire crystal is highly scratch-resistant (Mohs 9) and used primarily in luxury watches. Mineral crystal is standard glass treated for greater shock resistance and is common in mid-range watches. Acrylic (or Hesalite) is a plastic material, easily scratched but shatter-proof and prevalent in vintage or affordable timepieces.

Is sapphire crystal truly scratch-proof or only highly resistant?

Sapphire crystal is extremely scratch-resistant, ranking second only to diamond in hardness. While highly durable against everyday materials, it can still be scratched by objects of equal or greater hardness, such as industrial diamonds, specialized abrasive tools, or crystallized silicon carbide particles.

How does anti-reflective (AR) coating technology affect crystal watch market value?

AR coating significantly enhances legibility by reducing glare, which is crucial for high-performance and luxury watches. The application of high-quality, multi-layered AR coatings is a premium feature, often increasing the perceived and actual value of the timepiece due to superior optical performance and aesthetic clarity.

Which geographical region leads the global demand for luxury crystal watches?

While Europe, specifically Switzerland, dominates the manufacturing and value creation, the Asia Pacific region, driven by markets in China and India, currently exhibits the fastest growth rate and is leading global demand in terms of volume and increasing value share due to rising consumer affluence.

What role do specialized crystal shapes, like domed or box crystals, play in current market trends?

Specialized crystal shapes are key aesthetic differentiators, especially in the vintage revival and high-design segments. Domed and box crystals evoke nostalgic design elements and require complex, high-precision manufacturing, justifying premium pricing and catering to collectors seeking unique horological aesthetics and historical accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager