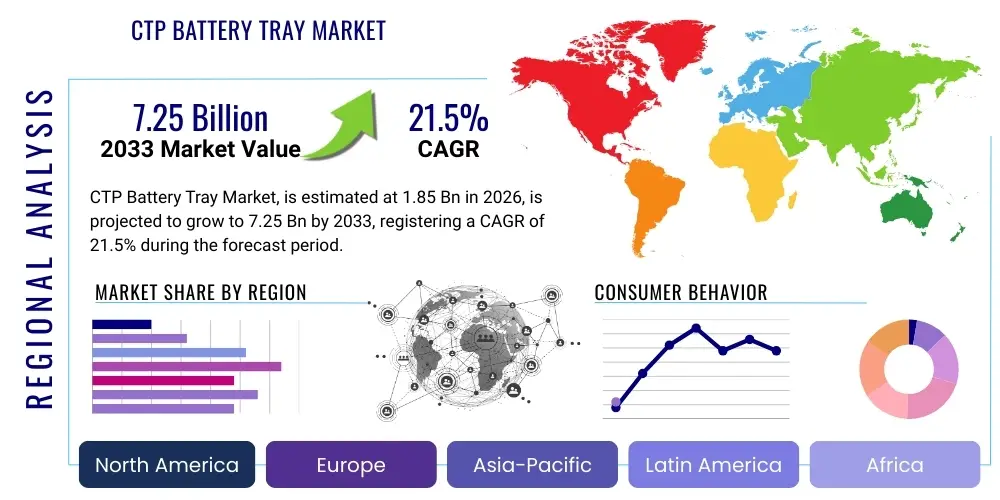

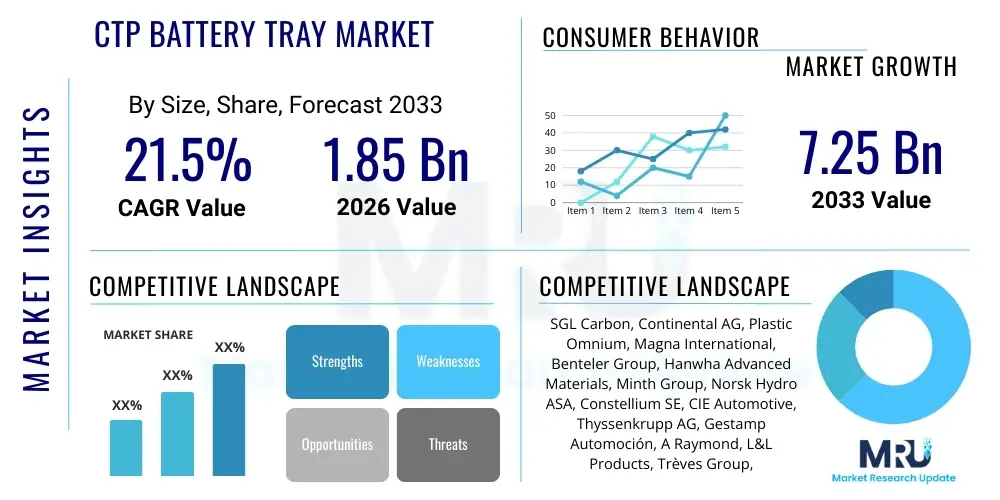

CTP Battery Tray Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441077 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

CTP Battery Tray Market Size

The CTP Battery Tray Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at $1.85 Billion USD in 2026 and is projected to reach $7.25 Billion USD by the end of the forecast period in 2033.

CTP Battery Tray Market introduction

The Cell-to-Pack (CTP) Battery Tray Market represents a critical evolution in electric vehicle (EV) battery architecture, moving away from traditional modules to a simplified system where battery cells are integrated directly into the pack structure, often utilizing the tray itself as a core structural and protective component. This structural shift, primarily driven by leading Asian battery manufacturers, significantly enhances volumetric energy density and reduces manufacturing complexity and cost. The CTP tray, therefore, is not merely a casing but a crucial engineering solution that must satisfy stringent requirements for structural integrity, thermal management, fire resistance, and crash safety, especially concerning new regulatory standards like those focusing on thermal runaway propagation mitigation. The demand for these sophisticated trays is intrinsically linked to the global acceleration of EV adoption across passenger vehicles, commercial fleet segments, and increasingly, high-capacity energy storage systems (ESS), necessitating trays capable of housing larger, more complex battery configurations. The design of these trays is moving rapidly toward lightweight, multi-material solutions, integrating advanced aluminum alloys, structural foams, and fiber-reinforced composites to balance weight savings with enhanced protection against external forces and internal thermal stress, thereby maximizing vehicle range and overall battery lifespan.

A CTP battery tray is designed to maximize the utilization of internal space within the battery pack by eliminating bulky intermediate modules, thereby increasing the effective energy storage capacity per unit volume—a key metric for EV competitiveness. The primary function extends beyond simple containment; it serves as the foundational mounting platform for cells, cooling plates, and the Battery Management System (BMS), forming a robust, unitary structure that interfaces directly with the vehicle chassis. Major applications span the entire spectrum of electric mobility, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and electric buses, alongside large-scale stationary energy storage projects where high energy density and ease of deployment are paramount. The benefits derived from adopting CTP technology are manifold, encompassing reduced component count, streamlined assembly processes, lower total system weight, and improved thermal dissipation pathways, which collectively contribute to reduced vehicle production costs and enhanced operational efficiency. These advanced trays often incorporate features such as integrated cooling channels or internal structural stiffeners engineered through sophisticated simulation models, ensuring durability under dynamic driving conditions and compliance with increasingly stringent global safety certifications related to impact protection and fire containment.

The driving factors for the pervasive growth of the CTP Battery Tray Market are deeply rooted in the macroeconomic shift toward electrification and regulatory pressures emphasizing battery performance and safety. Key drivers include aggressive targets set by global automakers for phasing out internal combustion engine vehicles, which mandates continuous improvement in EV battery metrics, particularly the pursuit of higher cruising range without commensurate increases in vehicle mass. Furthermore, the necessity for cost reduction in EV manufacturing to achieve price parity with conventional vehicles strongly favors the CTP approach due to its simplification of assembly and reduction in material inputs (by eliminating module casings and associated hardware). Regulatory frameworks, particularly those emanating from China (the largest EV market) and Europe, demanding higher levels of safety post-crash and superior thermal management capabilities, push manufacturers toward specialized tray designs that utilize advanced materials and manufacturing techniques. The inherent structural advantages offered by CTP trays—acting as a significant structural element of the EV chassis—further propel their adoption, promising enhanced vehicle stiffness and improved distribution of forces during collision events, thus making them indispensable components in the next generation of electric vehicle architectures aiming for unparalleled safety and efficiency standards.

CTP Battery Tray Market Executive Summary

The CTP Battery Tray market is currently defined by intense innovation and rapid geographic expansion, driven by major business trends centered on vertical integration and material science advancements. Leading battery producers are increasingly forming strategic alliances with material suppliers and specialized manufacturing partners to secure supply chains and co-develop customized tray solutions that perfectly match specific cell chemistries (LFP, NCM) and form factors (prismatic, large format cylindrical). A prominent business trend is the transition from purely aluminum construction, traditionally favored for its light weight and proven corrosion resistance, toward hybrid structures integrating high-performance composites, such as Glass Fiber Reinforced Polymers (GFRP) or Carbon Fiber Reinforced Polymers (CFRP). This multi-material strategy aims to achieve optimum strength-to-weight ratios while effectively managing the critical requirement of dielectric strength and thermal insulation, crucial for maintaining safety within high-voltage battery packs. Furthermore, scalability of production remains a core focus, with major players investing heavily in large-scale stamping, injection molding, and advanced bonding techniques like friction stir welding (FSW) or laser welding to meet the surging demand volumes forecast for the latter half of the decade.

Regionally, the market exhibits a distinct concentration in the Asia Pacific (APAC) region, which serves as the epicenter for both high-volume battery cell production and large-scale electric vehicle manufacturing, particularly dominated by China. China’s substantial governmental support for electrification and the presence of globally dominant battery suppliers like CATL and BYD establish APAC as the primary driver of CTP adoption and technological maturity. Europe is rapidly emerging as the second major growth pole, propelled by stringent emission standards, aggressive national EV mandates, and significant investments in local battery gigafactories, fostering a regional preference for CTP architectures designed to meet Euro NCAP safety standards and specific European OEM requirements. North America, while starting from a lower base in terms of localized battery production, is experiencing accelerated growth fueled by regulatory initiatives such as the Inflation Reduction Act (IRA), which incentivizes domestic manufacturing of EVs and their components, driving demand for localized CTP tray production capabilities and supply chain resilience within the continent. The differing regulatory environments and vehicle size preferences across these regions necessitate regional variations in tray design, impacting material choice and production scale.

Segmentation trends within the CTP Battery Tray market highlight a strong bifurcation based on material type and application. By material, the market is shifting substantially toward the lightweight segment, characterized by high-strength aluminum alloys (e.g., 6000 series) and thermoplastic composites, as OEMs seek continuous weight reduction to boost EV range. The composite segment, while currently smaller, is expected to exhibit the fastest growth due to its superior performance in heat and fire resistance, a critical factor in mitigating thermal runaway events, providing a competitive edge in premium and high-performance vehicle segments. By application, passenger electric vehicles remain the dominant consumer segment, reflecting the mass-market adoption of BEVs and PHEVs. However, the commercial vehicle segment (e-buses, e-trucks) is rapidly gaining momentum, requiring significantly larger, more robust CTP trays designed for heavy-duty cycles and extremely high energy capacities, often leading to specialized, modular designs. These trends underscore a market that is highly responsive to performance demands, safety regulations, and the constant pressure to optimize manufacturing costs across different vehicle categories, driving material innovation and process refinement throughout the forecast period.

AI Impact Analysis on CTP Battery Tray Market

User queries regarding the impact of Artificial Intelligence (AI) on the CTP Battery Tray market frequently revolve around optimization capabilities—specifically, how AI can expedite the design cycle, enhance material performance prediction, and improve manufacturing quality control. Common concerns center on the ability of Generative Design AI to rapidly iterate complex structural geometries that optimize crash absorption and thermal management within the constrained battery pack space, a task too complex for traditional simulation methods. Users are highly interested in AI’s role in predicting material stress and fatigue life under varied operational conditions, allowing engineers to select the optimal combination of composite and metallic components for enhanced durability and safety compliance. Furthermore, significant expectations are placed on AI for real-time monitoring of advanced manufacturing processes, such as complex welding or composite layup, to detect microscopic defects and ensure near-perfect quality control at high volumes. AI-driven simulation and material informatics are thus viewed as transformative tools essential for cutting R&D costs and accelerating the time-to-market for safer, lighter, and more efficient CTP battery tray designs, fundamentally changing how these critical components are engineered and validated.

- AI-driven Generative Design for topology optimization of tray structures, maximizing stiffness and minimizing material usage simultaneously.

- Predictive maintenance analytics applied to manufacturing equipment, reducing downtime and ensuring continuous high-volume production of trays.

- Machine learning algorithms enhancing quality control by analyzing high-resolution imagery and sensor data from welding and bonding processes to detect micro-cracks or flaws instantly.

- Material Informatics using AI to screen and predict the long-term performance (fatigue, thermal stability, corrosion) of novel hybrid materials (e.g., carbon fiber-aluminum matrices) for tray construction.

- Supply chain optimization through AI forecasting, improving logistics and procurement of specialized raw materials like high-grade aluminum and complex resins, mitigating market volatility risks.

DRO & Impact Forces Of CTP Battery Tray Market

The CTP Battery Tray Market is fundamentally propelled by powerful drivers, countered by significant restraints, while simultaneously presenting numerous high-growth opportunities, all shaped by overarching impact forces. The primary drivers include the mandatory shift towards high energy density battery systems, which CTP inherently facilitates by reducing non-cell components, directly translating into longer EV range and improved customer acceptance. However, a major restraint is the lack of universal standardization across CTP architectures; different OEMs and battery manufacturers (e.g., Tesla, BYD, CATL) utilize proprietary cell formats and integration methods, fragmenting the supply chain and increasing the difficulty for tier-one suppliers to achieve true economies of scale. Opportunities abound in the realm of specialized material innovation, particularly the commercialization of lightweight, fire-resistant thermoplastic and thermoset composites that offer superior passive thermal runaway protection compared to metallic solutions, potentially capturing premium market share. Impact forces such as governmental safety regulations (e.g., stricter requirements on 5-minute thermal runaway containment) and fluctuating prices of key raw materials like aluminum and lithium influence investment decisions and product design choices, necessitating flexible and resilient supply chain strategies. The interplay between these forces dictates the pace of technological adoption and market penetration, favoring suppliers capable of delivering highly customized, safety-compliant, and cost-effective structural solutions at immense volumes.

A critical driver is the aggressive cost reduction strategies pursued by automotive OEMs globally, aiming to reduce the total battery pack cost below $100/kWh. CTP architectures inherently support this objective by reducing parts count, simplifying assembly, and cutting labor costs associated with traditional module assembly lines, making the optimized tray design an essential element in achieving cost competitiveness. This financial pressure is intensified by regulatory push for battery longevity and recyclability, promoting tray designs that facilitate easier disassembly at end-of-life—a significant technical challenge that presents a specialized opportunity for innovative designs focusing on reversible joining methods, such as modular bolted assemblies replacing permanent welds. The primary restraint, beyond standardization, involves the highly demanding mechanical performance requirements of the tray; as a direct structural element, it must resist significant torsion, impact forces, and maintain precise cell compression over the vehicle's lifespan, requiring sophisticated and often expensive manufacturing precision. The opportunity to leverage advanced manufacturing techniques, such as giga-casting of large aluminum sections, promises to overcome some precision and cost restraints, further simplifying the tray structure and accelerating production throughput, fundamentally redefining the economics of battery pack casing production.

Impact forces also include the geopolitical landscape surrounding battery material sourcing and manufacturing capacity localization. As North America and Europe push for regional autonomy in the battery supply chain (aided by legislation like the IRA and the European Green Deal), CTP tray suppliers face pressure to establish local production facilities, requiring massive capital investment and rapid knowledge transfer. This localization is an opportunity for regional players but acts as a short-term restraint due to the time required to build and certify large-scale composite and metal fabrication facilities. Furthermore, the accelerating pace of battery chemistry evolution (e.g., sodium-ion cells, solid-state batteries) represents a constant impact force, demanding that CTP tray designs remain adaptable and modular enough to accommodate future cell technologies without complete redesign, thus favoring versatile engineering platforms. The ongoing tension between maximizing energy density (driving CTP adoption) and ensuring uncompromising safety (demanding robust, fire-resistant trays) forms the core dynamic of the market, wherein innovation in materials like specialized aerogel blankets and fire-retardant resins within the tray assembly will be crucial for maintaining regulatory compliance and consumer confidence.

Segmentation Analysis

The CTP Battery Tray Market is segmented based on several crucial dimensions, primarily including Material Type, Battery Chemistry, Vehicle Type, and Manufacturing Process. This segmentation helps to delineate the varied requirements imposed by different vehicle platforms and performance expectations, influencing design and cost structures. The dominant material segment currently relies on high-strength aluminum alloys, valued for their proven lightweight properties, excellent thermal conductivity, and mature recycling infrastructure. However, the fastest-growing segment involves composite materials (specifically polymer matrix composites and hybrid structures), driven by their superior thermal insulation capabilities, which are essential for preventing cell-to-cell thermal runaway propagation, alongside enhanced structural rigidity. Segmentation by vehicle type shows a clear dominance of Passenger Vehicles (BEVs/PHEVs), though Commercial Vehicles (e-buses, heavy-duty trucks) represent a high-value, fast-expanding segment due to their requirement for extremely large and ruggedized trays. Differentiation based on battery chemistry, such as Nickel-Manganese-Cobalt (NMC) versus Lithium Iron Phosphate (LFP), influences the internal tray architecture, particularly the density and placement of cooling channels, to manage the distinct thermal profiles of each chemistry effectively. Understanding these segments is vital for suppliers seeking to align their technological offerings with specific OEM requirements and regional market demands.

The choice of manufacturing process creates a critical segmentation point, reflecting the balance between cost, volume, and geometric complexity. Traditional methods, such as welding stamped aluminum sheets, are highly scalable and cost-effective for simpler tray geometries, but they struggle with complex integration of cooling lines and structural elements. Conversely, advanced processes like aluminum die-casting (including high-pressure and giga-casting) allow for the production of monolithic trays with integrated features, significantly reducing assembly steps, albeit requiring substantial upfront capital investment. The composite segment relies heavily on high-speed methods such as Resin Transfer Molding (RTM) or compression molding, optimized for volume production of complex shapes with embedded structural integrity. Market segmentation based on manufacturing capabilities thus highlights the competitive advantage held by players who have mastered high-precision, high-volume production techniques that minimize weight while maintaining absolute structural integrity. As OEMs continue to push for tighter tolerances and seamless integration of the tray into the chassis, the move toward integrated manufacturing solutions spanning casting and composite forming will dominate the investment landscape, favoring suppliers with multi-process expertise.

The geographical dimension also strongly influences segmentation, particularly concerning regulatory compliance and material sourcing. For instance, the European market often demands trays compliant with stricter recyclability mandates and high-integrity crash standards (Euro NCAP), potentially favoring certain aluminum alloys or standardized bolted designs. The Chinese market, driven by sheer volume and aggressive cost targets, often leads in the rapid adoption of new, simplified CTP designs, frequently utilizing LFP chemistry which has distinct thermal management requirements compared to the NMC-dominated Western markets. Furthermore, the segmentation by integration level—ranging from non-structural trays merely housing the cells to highly structural designs integrated into the vehicle's body-in-white (BIW)—is increasingly relevant. Highly structural trays require deeper collaboration between the tray manufacturer and the OEM vehicle engineering team, demanding precision in areas such as chassis mounting points and force distribution pathways. This functional segmentation underscores the market's trajectory toward the battery pack becoming a structural element of the vehicle, pushing the limits of material science and design engineering in the CTP tray domain.

- Material Type

- Aluminum Alloys (e.g., 5xxx and 6xxx series)

- Composite Materials (e.g., GFRP, CFRP, Thermoplastics)

- Hybrid Structures (Aluminum-Composite Combination)

- Battery Chemistry

- Lithium Iron Phosphate (LFP)

- Nickel Manganese Cobalt (NMC)

- Other Chemistries (e.g., Sodium-ion, Future Solid-State Packs)

- Vehicle Type

- Passenger Electric Vehicles (BEVs and PHEVs)

- Commercial Vehicles (Buses, Trucks, Delivery Vans)

- Other Mobility Solutions (E-bikes, Forklifts, Specialty Vehicles)

- Manufacturing Process

- Stamping and Welding

- Die Casting (High-Pressure and Giga-Casting)

- Composite Molding (RTM, Compression Molding)

Value Chain Analysis For CTP Battery Tray Market

The value chain for the CTP Battery Tray Market is complex, involving specialized material extraction, highly precise manufacturing, sophisticated assembly, and direct interaction with downstream original equipment manufacturers (OEMs) and battery pack integrators. The upstream segment is dominated by raw material suppliers, primarily specialized aluminum producers providing high-purity, lightweight alloys with specific mechanical and corrosion-resistant properties required for structural applications, alongside chemical companies supplying high-performance resins, fibers (glass and carbon), and structural foams used in advanced composite trays. The key upstream dynamic is securing stable supply and managing price volatility, especially for global aluminum markets and specialized polymer inputs, as the volume demand is escalating rapidly. Critical material processing—such as rolling, extruding, or compounding specialized composite materials—adds significant value, determining the final strength and weight of the tray components. Partnerships between tray manufacturers and primary material suppliers are essential to co-develop custom materials that meet the unique thermal, mechanical, and safety standards mandated by the automotive industry, thereby establishing competitive barriers to entry.

The core manufacturing and midstream segment involve the specialized tray producers who transform raw materials into finished structural components through processes such as high-precision stamping, complex die-casting (including investment in giga-casting facilities), or advanced composite molding techniques. This segment adds the highest engineering and manufacturing value, focusing intensely on geometric accuracy, integration of cooling channels, and adherence to tight tolerances necessary for direct cell mounting and seamless chassis integration. Downstream analysis reveals that the primary customers are Tier-1 battery pack integrators (e.g., specialized module/pack builders) and, increasingly, major EV Original Equipment Manufacturers (OEMs) who have vertically integrated battery assembly capabilities. These buyers require trays delivered "just-in-time" (JIT) and often demand a high degree of customization to fit specific vehicle platforms and internal battery layouts. The key challenge downstream is coordinating the high-volume delivery of large, delicate components to geographically dispersed gigafactories, requiring highly optimized logistics networks and robust quality control systems to handle transportation without structural damage.

Distribution channels are predominantly direct, characterized by long-term, highly collaborative relationships between the CTP tray manufacturers and the OEMs or large battery makers (like CATL, LG Energy Solution, or SK Innovation). Due to the high degree of technical customization, the volume requirements, and the necessity of intellectual property exchange regarding battery cell layout and thermal management strategies, indirect distribution channels play a negligible role in core tray supply. The manufacturing process often involves co-location strategies where the tray supplier establishes a facility near the customer's gigafactory or vehicle assembly plant to minimize logistics costs and reduce supply chain risk, reflecting a tight integration between the tray fabrication and the final battery pack assembly process. This direct channel facilitates continuous engineering feedback, allowing for rapid iterations and improvements in tray design based on real-world assembly and performance data. The expertise in direct customer relationship management, technical consultancy, and supply reliability are critical differentiators for leading players in this specialized, high-stakes manufacturing ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $7.25 Billion USD |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon, Continental AG, Plastic Omnium, Magna International, Benteler Group, Hanwha Advanced Materials, Minth Group, Norsk Hydro ASA, Constellium SE, CIE Automotive, Thyssenkrupp AG, Gestamp Automoción, A Raymond, L&L Products, Trèves Group, Sumitomo Riko Co., Ltd., BASF SE, Toray Industries, Inc., Teijin Limited, LG Chem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CTP Battery Tray Market Potential Customers

The primary potential customers for CTP Battery Trays are the global network of Original Equipment Manufacturers (OEMs) specializing in electric vehicles and the leading multinational battery cell and pack manufacturers (Tier 1 suppliers). EV OEMs such as Tesla, Volkswagen Group, General Motors, Ford, BYD, and numerous emerging electric vehicle startups represent the ultimate buyers, as they dictate the specifications, material requirements, and volume forecasts based on their vehicle architecture and battery strategy. These OEMs often engage in deep technical collaborations with tray suppliers, sometimes managing the final pack assembly in-house. A crucial segment of potential customers includes large commercial vehicle manufacturers (e.g., Daimler Truck, Volvo Group, and specialized e-bus makers) who require extremely robust, modular CTP trays capable of withstanding harsh operating environments and accommodating massive battery capacities suitable for long-haul and heavy-duty applications. The procurement process for these high-value customers is highly structured, involving lengthy validation cycles and demanding compliance with rigorous quality management and safety standards, particularly concerning fire mitigation and structural resilience during vehicle impact events, making supply relationship stability a key factor.

Another significant customer segment comprises the major global battery manufacturers (known as cell producers or gigafactory operators) such as CATL, LG Energy Solution, SK Innovation, and Panasonic. These companies often take ownership of the pack integration process, bundling the cells, thermal management systems, and BMS components within the CTP tray before supplying the completed pack to an OEM. For these customers, the CTP tray is viewed as a critical component in maximizing the energy density of their proprietary battery platforms, making rapid prototyping and the ability to scale production swiftly paramount. Their purchasing decisions are heavily influenced by the tray supplier's proven ability to deliver highly precise components that minimize alignment issues during automated pack assembly, thereby reducing production bottlenecks and quality defects. The adoption of CTP architecture is intrinsically linked to the strategies of these battery giants, meaning suppliers must tailor their offerings to match the specific thermal and mechanical demands of different proprietary cell formats (e.g., blade batteries versus standard prismatic cells), which often necessitates continuous, iterative design partnerships ensuring perfect form, fit, and function for automated lines.

In addition to the core automotive and battery industry players, niche segments such as specialized Energy Storage System (ESS) integrators and railway/marine electrification providers also constitute potential customers. While these applications require trays with different regulatory and operational profiles (often favoring longevity and static load resilience over dynamic crash performance), they benefit from the density and structural advantages offered by CTP principles. ESS systems, for instance, utilize large, stationary battery banks that require scalable and thermally managed structural enclosures, presenting a growing market for specialized, large-format CTP tray designs adapted for grid-scale deployment and industrial use. Furthermore, the emerging market for high-performance electric motorsports and aerospace applications, though low volume, represents a high-value customer segment demanding exotic materials (like carbon fiber) and extreme precision for lightweight, structurally critical battery housings. These diverse end-users emphasize that the CTP tray is evolving into a versatile, platform-agnostic structural solution, applicable wherever high energy density and robust structural protection for lithium-ion cells are mandatory, broadening the potential customer base beyond traditional automotive manufacturing streams and requiring suppliers to possess adaptable engineering and certification capabilities tailored to distinct industry requirements.

CTP Battery Tray Market Key Technology Landscape

The CTP Battery Tray market's technological landscape is defined by continuous innovation across material science, advanced manufacturing processes, and integrated thermal management solutions, all aimed at achieving the trifecta of lightweighting, enhanced safety, and cost efficiency. In material technology, the focus has shifted from standard aluminum to high-strength, crash-absorbent 6000-series aluminum alloys and, significantly, to advanced composite materials. Technologies such as high-volume Resin Transfer Molding (RTM) and specialized Sheet Molding Compound (SMC) processes are crucial for producing composite trays that offer superior inherent fire resistance (via flame-retardant resins) and lower thermal conductivity, effectively acting as passive fire breaks between cells and the external environment. The integration of structural foams and strategically placed ceramic materials within the tray structure represents a key safety technology, designed to absorb impact energy and contain thermal runaway propagation for mandated periods, thus allowing occupants crucial time to evacuate the vehicle safely. These material advancements require specialized joining technologies, moving beyond conventional welding to friction stir welding (FSW) for complex aluminum assemblies and advanced adhesive bonding (structural adhesives) for connecting hybrid material structures, ensuring structural integrity under high stress and thermal cycling conditions throughout the vehicle's operational lifetime.

Manufacturing process innovation, particularly the adoption of Giga-Casting techniques for massive aluminum components, is fundamentally changing how trays are produced, leading to simpler, monolithic designs. Giga-casting, pioneered by companies like Tesla, allows for the integration of multiple structural parts into a single, high-precision casting, drastically reducing part count, simplifying assembly, and improving dimensional accuracy, which is critical for CTP packs where cells are mounted directly. This technology demands high-tonnage casting presses and specialized tooling, representing a major barrier to entry but offering significant competitive advantage in terms of scalability and cost per unit for high-volume automotive platforms. Concurrently, the landscape includes sophisticated automation in welding and assembly lines, utilizing robotic systems equipped with advanced sensors for real-time quality assurance, ensuring that the structural welds and adhesive bonds meet exacting safety specifications. The digital twin concept is also integral, where highly detailed simulation models are used to optimize tooling design and predict material behavior under casting or molding stresses before physical production begins, drastically cutting down development cycles for complex tray geometries necessary for CTP systems.

Furthermore, integrated thermal management is a core technological area where CTP trays provide an opportunity for optimization. Since CTP eliminates the intermediate module structure, the tray often serves as the direct housing for the cooling plate, utilizing advanced designs that integrate fluid channels (water-glycol mixture) directly into the tray floor or an attached sub-component to ensure uniform cell temperature regulation. Key technologies here include micro-channel cold plates, advanced fluid dynamics simulation (CFD) to optimize cooling pathways, and highly efficient heat exchangers integrated into the structural design. The trend is moving toward structural cooling, where the aluminum chassis component performs dual functions—structural support and heat dissipation—requiring specialized die-casting techniques to form intricate, leak-proof channels with minimal wall thickness to improve heat transfer efficiency. The continuous drive for higher charging rates (e.g., 800V architectures) necessitates superior thermal management, making the integration technology within the CTP tray a critical performance differentiator. The overall technological landscape emphasizes multi-functional design, where the tray is not just a protective box but a high-performance structural and thermal regulator integral to the battery pack’s safety and efficiency performance, reflecting profound advancements in metallurgical and composite engineering capabilities.

Regional Highlights

- Asia Pacific (APAC): APAC, spearheaded by China, remains the dominant global market for CTP Battery Trays. This dominance is attributed to the region hosting the largest battery cell manufacturers (CATL, BYD) and the highest volume EV production globally. China’s push for high-density LFP chemistry (utilized in CTP "blade" architectures) and aggressive government mandates for electrification ensures sustained high-volume demand. South Korea and Japan are also significant contributors, focusing on high-precision engineering for global OEMs and advanced material development, particularly for NCM-based packs, positioning APAC as the undisputed innovation and manufacturing hub.

- Europe: Europe represents the fastest-growing market in terms of CAGR, driven by the continent's ambitious decarbonization targets and the establishment of numerous gigafactories by both native and Asian battery producers (e.g., Northvolt, ACC). European OEMs require CTP designs that adhere strictly to Euro NCAP safety standards, favoring robust, high-integrity aluminum and hybrid composite trays. Government incentives and localized sourcing requirements are compelling key suppliers to establish manufacturing bases within countries like Germany, Poland, and Hungary, fostering a regional specialization in high-end structural safety components for premium EVs.

- North America: The North American market is rapidly accelerating, primarily due to supportive legislation such as the Inflation Reduction Act (IRA), which strongly incentivizes domestic battery and EV component manufacturing. This has triggered massive investments in localized CTP tray production capacity, often leveraging innovative manufacturing techniques like Giga-Casting, particularly for large-format electric trucks and SUVs which require exceptionally rugged and large trays. The market focus is on optimizing the domestic supply chain and reducing dependency on Asian imports, creating unique opportunities for localized material and process suppliers to capture significant market share.

- Latin America & Middle East/Africa (MEA): While currently smaller in volume, these regions present high long-term growth potential as electrification infrastructure develops. Latin America, specifically Brazil and Mexico, is attracting EV assembly investment, potentially necessitating local CTP supply chains in the medium term. The MEA region, leveraging its position as a major energy producer, is beginning to invest in local renewable energy and EV pilot projects, requiring specialized CTP solutions for localized ESS and commercial fleet applications designed to withstand harsh, high-temperature operating conditions, demanding superior thermal management integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CTP Battery Tray Market.- SGL Carbon

- Continental AG

- Plastic Omnium

- Magna International

- Benteler Group

- Hanwha Advanced Materials

- Minth Group

- Norsk Hydro ASA

- Constellium SE

- CIE Automotive

- Thyssenkrupp AG

- Gestamp Automoción

- A Raymond

- L&L Products

- Trèves Group

- Sumitomo Riko Co., Ltd.

- BASF SE

- Toray Industries, Inc.

- Teijin Limited

- LG Chem

Frequently Asked Questions

Analyze common user questions about the CTP Battery Tray market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of CTP (Cell-to-Pack) architecture in battery trays?

The primary advantage is significantly increased volumetric energy density (up to 20%), achieved by eliminating intermediate modules, which allows for more active cell material within the same battery footprint, leading directly to extended electric vehicle range.

Which materials are predominantly used for manufacturing CTP battery trays?

High-strength Aluminum Alloys (like 6000 series) are dominant due to their light weight and thermal conductivity. However, advanced Composite Materials (e.g., GFRP and Carbon Fiber Reinforced Polymers) are increasingly utilized for superior passive fire resistance and enhanced structural rigidity.

How does CTP technology impact EV manufacturing costs?

CTP technology reduces overall EV manufacturing costs by simplifying the battery pack structure, decreasing the number of components required (e.g., module housings, wiring), and streamlining the assembly process, leading to lower labor input and faster production times.

What is the role of AI in CTP battery tray design and manufacturing?

AI is crucial for design optimization using generative design algorithms to create complex, lightweight structures, and for enhancing manufacturing quality control through real-time defect detection in welding and composite molding processes, accelerating R&D cycles.

Which region currently leads the global CTP Battery Tray Market?

The Asia Pacific (APAC) region, particularly China, leads the market due to its concentration of high-volume battery cell production and the aggressive deployment of CTP architectures by major regional battery suppliers and electric vehicle manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager