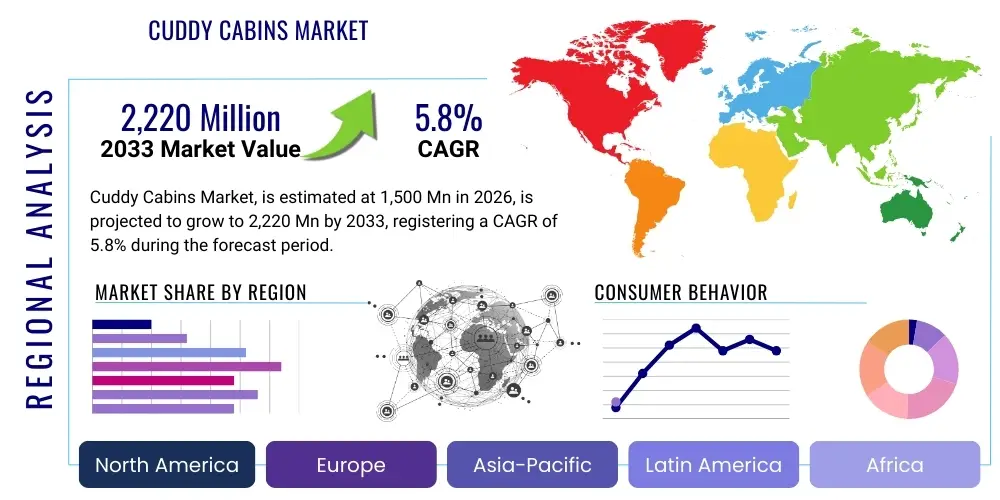

Cuddy Cabins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441440 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Cuddy Cabins Market Size

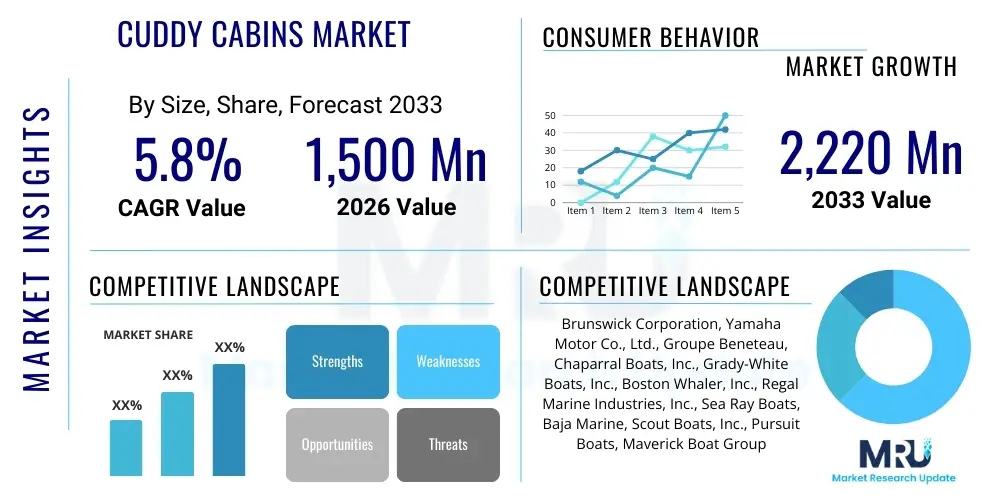

The Cuddy Cabins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,500 Million in 2026 and is projected to reach USD 2,220 Million by the end of the forecast period in 2033. This consistent growth trajectory reflects the increasing consumer interest in recreational boating activities, coupled with technological advancements in marine engineering that enhance the safety, efficiency, and comfort of these vessels. The moderate size and versatility of cuddy cabin boats position them ideally for both novice and experienced boaters seeking a blend of day cruising capability and minimal overnight accommodation, thereby maintaining robust demand across key geographic regions, particularly North America and Europe.

Cuddy Cabins Market introduction

The Cuddy Cabins Market encompasses the manufacturing, distribution, and sales of recreational boats characterized by a small, enclosed cabin (cuddy) located forward of the cockpit, typically used for storage, basic shelter, or a sleeping berth. These vessels bridge the gap between pure day boats and full cabin cruisers, offering enhanced functionality without the complexity or cost associated with larger yachts. The product description emphasizes versatility, ranging generally from 20 to 30 feet in length, and their design caters significantly to family outings, casual fishing, and light water sports. Key benefits include improved protection from weather elements compared to open boats, secure storage for gear, and the critical advantage of providing a quiet, private space on the water. The core driving factors fueling market expansion are rising disposable incomes in developed and emerging economies, the growing cultural prioritization of outdoor leisure activities, and continuous innovations in hull design and propulsion systems, leading to more fuel-efficient and stable boats.

Major applications of cuddy cabin boats are multifaceted, heavily skewed towards leisure cruising and recreational fishing. Families utilize these boats for weekend excursions, coastal exploration, and swimming, capitalizing on the small cabin for naptime or changing clothes. Furthermore, the robust hull construction and flexible cockpit layout often make them suitable for certain specialized activities such as light diving expeditions or tow sports like wakeboarding, provided they are equipped with adequate horsepower. The strategic balance of size and functionality makes cuddy cabins highly attractive to first-time boat owners transitioning from smaller runabouts, offering a practical pathway into the larger marine lifestyle without the substantial maintenance burden of large cruisers.

The evolution of the Cuddy Cabins Market is inextricably linked to advancements in material science, notably the use of lighter and stronger fiberglass composites, which allows manufacturers to create more spacious and fuel-efficient designs. Beyond leisure, these boats often find niche applications in commercial sectors, such as patrol duties in harbors, or as tender boats for larger vessels, leveraging their stability and manageable size. The sustained appeal of cuddy cabins is rooted in their inherent flexibility; they represent a significant investment in a lifestyle product that provides both performance and comfort. Consequently, market growth is bolstered by a strong secondary market and a manufacturing ecosystem focused on customization and integrating contemporary marine technology, including advanced navigation systems and ergonomic cockpit designs, ensuring sustained consumer interest and market vitality.

Cuddy Cabins Market Executive Summary

The Cuddy Cabins Market is characterized by steady business trends dominated by innovation focused on sustainable marine practices and enhanced user experience. Manufacturers are increasingly integrating hybrid or fully electric propulsion systems, although the market remains predominantly reliant on traditional outboard and sterndrive engines. A key business trend involves market consolidation, as larger marine conglomerates acquire niche builders to diversify their product lines and capture specialized segments of the recreational boating market. Furthermore, the shift towards digital integration within the cockpit, offering advanced monitoring, connectivity, and navigational aids, is becoming a standard expectation, driving up the average selling price and simultaneously enhancing safety features, thereby appealing to a broader, more tech-savvy consumer base. This focus on premiumization and digital features dictates competitive strategies among leading industry players, necessitating significant investment in research and development to maintain market relevance and brand differentiation.

Regional trends indicate North America maintaining its position as the largest market, driven by high boating participation rates, expansive coastlines, and well-established marine infrastructure, particularly around the Great Lakes and coastal states. Europe follows closely, with robust demand originating from the Mediterranean region and Northern European countries, where the moderate climate supports extensive coastal cruising. The Asia Pacific (APAC) region, while currently smaller, is projected to exhibit the fastest growth, propelled by rising affluence in coastal cities, particularly in China and Australia, and the burgeoning interest in water-based recreational activities. Regulatory environments concerning emissions and safety standards significantly influence regional dynamics; European regulations often drive earlier adoption of sustainable technologies compared to other regions. Moreover, government incentives supporting tourism and marina development in emerging markets are acting as crucial catalysts for regional market penetration and expansion.

Segmentation trends highlight the enduring popularity of cuddy cabins in the 25-30 ft length category, which strikes an optimal balance between maneuverability, cabin space, and seating capacity, catering primarily to the family cruiser segment. Propulsion segmentation reveals a strong preference shift towards high-horsepower outboard motors, driven by ease of maintenance, improved fuel economy, and reliability compared to traditional inboard installations, especially in smaller and mid-sized models. Application-wise, leisure cruising and general family boating remain the dominant segments, though the crossover appeal with serious sport fishing is substantial, leading to manufacturers designing multi-purpose cuddy cabins equipped with features like live wells, specialized rod storage, and reinforced hulls. The market is also witnessing a demand for highly customizable interior layouts, allowing owners to configure the cuddy space to serve specific needs, whether that is increased sleeping capacity or specialized equipment storage, underscoring the shift towards personalized boating experiences.

AI Impact Analysis on Cuddy Cabins Market

Common user questions regarding AI's influence on the Cuddy Cabins Market primarily center on the feasibility of autonomous navigation systems, predictive maintenance capabilities, and the integration of smart safety features in recreational vessels. Users are keen to understand if AI can reduce the skill ceiling required for docking and navigating complex waterways, thereby making boating more accessible. Concerns often revolve around the cost implications of implementing such advanced technology, the reliability of AI systems in harsh marine environments, and the necessary regulatory framework for semi-autonomous recreational boats. There is also significant interest in how AI could personalize the boating experience, optimizing comfort, energy consumption, and route planning. Consequently, the key themes summarizing user expectations suggest a strong demand for AI tools that enhance safety, simplify operation, and optimize efficiency, rather than full automation, within the immediate forecast period. This emphasis on assistance and optimization reflects the recreational nature of the market, where human involvement remains a core enjoyment factor.

The immediate practical impact of Artificial Intelligence on the Cuddy Cabins market is seen predominantly in advanced diagnostics and operational efficiency. AI algorithms are being employed in engine management systems to monitor performance in real-time, predict component failures before they occur, and schedule necessary maintenance proactively, significantly reducing downtime and maintenance costs for owners. This predictive capability extends the lifespan of critical components and enhances the overall reliability of the boat, which is a major purchasing consideration for consumers. Furthermore, AI-driven systems are optimizing hull trim and performance based on real-time sea conditions and load distribution, ensuring maximum fuel efficiency and a smoother ride, directly addressing consumer demand for lower operational costs and enhanced comfort.

Looking forward, AI integration will fundamentally transform the user interface and navigation experience. Future cuddy cabins are anticipated to feature AI-powered docking assistance systems that utilize sensors and high-precision GPS to automatically execute complex maneuvers, overcoming one of the primary barriers to entry for new boaters. Moreover, onboard AI personal assistants will manage environment controls, entertainment systems, and provide intelligent route suggestions based on real-time weather forecasts and preferred user activities. While full autonomy in recreational boating remains distant due to regulatory and liability hurdles, AI’s role as a sophisticated co-pilot and system manager is poised to revolutionize the operational ease and safety profile of high-end cuddy cabin vessels, distinguishing premium models in the competitive landscape and justifying higher pricing tiers.

- AI-driven predictive maintenance reducing engine downtime and operational costs.

- Integration of advanced docking assistance and maneuvering algorithms for simplified operation.

- AI-optimized fuel consumption based on real-time environmental and load conditions.

- Intelligent navigation systems offering dynamic route planning and hazard avoidance.

- Enhanced sensor fusion and object detection for improved safety protocols, especially at night.

- Personalized onboard experience management, controlling climate and entertainment via voice commands.

DRO & Impact Forces Of Cuddy Cabins Market

The Cuddy Cabins Market is shaped by a complex interplay of drivers, restraints, and opportunities, collectively known as the DRO matrix, which dictates its trajectory and resilience. Primary drivers include the global increase in leisure spending and the rising popularity of marine tourism, especially among the middle-aged and affluent demographics seeking experiential travel and accessible luxury. The consistent innovation in marine engine technology, focusing on power-to-weight ratio and environmental efficiency (such as lower emissions), also drives replacement cycles and new sales. Conversely, key restraints impacting growth involve the high initial purchase price of recreational boats, coupled with significant ongoing costs associated with maintenance, storage, and insurance, which can deter potential first-time buyers. Additionally, regulatory hurdles related to waterway access, licensing requirements, and strict environmental standards (e.g., noise pollution and effluent discharge) present geographical limitations to market expansion and increase manufacturing complexities.

Opportunities within the market are abundant, particularly centered around the growing demand for customization and the strategic adoption of sustainable technologies. The shift towards electrification presents a major opportunity for manufacturers to differentiate their products and appeal to environmentally conscious consumers, especially in regions with strict emission zones. Furthermore, the expansion of modern marinas and improved infrastructure in emerging economies, notably in Southeast Asia and Latin America, opens up untapped markets for cuddy cabins. The integration of advanced digital features, such as remote monitoring and sophisticated connectivity, provides manufacturers with a premium segment to target, transforming the boat from a simple recreational vehicle into a connected lifestyle platform, thereby bolstering market value and offering higher margin potential for specialized builders.

The impact forces influencing the market dynamics are categorized into supply-side and demand-side pressures. Supply-side forces include fluctuations in the cost of raw materials, such as fiberglass, aluminum, and critical electronic components, which directly affect manufacturing profitability and pricing strategies. Labor shortages in skilled marine craftsmanship also pose a constant challenge to production output and quality maintenance. Demand-side forces are heavily influenced by macroeconomic stability, consumer confidence levels, and discretionary income availability. Furthermore, the competitive intensity among global and regional boat builders dictates pricing stability and the pace of technological introduction. The overall net effect of these integrated forces suggests a moderately high-growth market, resilient to minor economic fluctuations but sensitive to sustained inflation and significant changes in consumer borrowing costs, necessitating strategic inventory management and flexible manufacturing processes to mitigate risks and capitalize on dynamic market conditions.

Segmentation Analysis

The Cuddy Cabins Market is strategically segmented based on several key operational and design attributes, allowing for precise targeting of diverse consumer needs across the global boating community. Primary segmentation is observed across criteria such as boat length, propulsion type, and application area, each revealing distinct consumption patterns and price sensitivities. Analyzing these segments provides manufacturers with crucial insights into tailoring production lines and marketing strategies. The length segmentation, typically ranging from under 20 feet to over 30 feet, strongly correlates with the primary use case; smaller vessels often serve as introductory boats or tenders, while larger cuddy cabins cater to extended cruising and offer enhanced amenities, thus commanding significantly higher price points and featuring more complex systems, including full galleys and advanced navigation suites.

Propulsion type segmentation, encompassing Outboard, Inboard, and Sterndrive configurations, reflects ongoing consumer debates regarding efficiency, maintenance ease, and performance characteristics. The recent resurgence and dominance of high-horsepower outboard motors are attributed to their modularity, ease of servicing, and maximized interior space within the hull, as the engine is located externally. Sterndrive systems, while traditionally offering a sleek profile and balanced performance, face challenges regarding maintenance complexity. In contrast, inboard engines are generally reserved for larger, more traditional cruising applications, making them less common in the typical cuddy cabin segment but still relevant for certain luxury or specialized fishing models requiring maximum torque and reliability for heavy loads.

Application-based segmentation clearly delineates the market into core activities: recreational cruising, professional or competitive fishing, and specialized water sports. While most cuddy cabins offer multi-purpose functionality, manufacturers increasingly design features optimized for specific activities—for instance, enhanced rod holders, circulating bait tanks, and reinforced platforms for fishing models, versus comfortable seating arrangements, sun pads, and integrated entertainment systems for cruising-focused models. This bespoke approach to design ensures that the market successfully captures both the casual family buyer and the dedicated marine enthusiast, driving overall market volume and supporting the continuous innovation in cockpit ergonomics and on-deck utility systems necessary to satisfy demanding users in each specialized application segment.

- By Boat Length:

- Under 20 Feet

- 20 to 25 Feet

- 25 to 30 Feet

- Over 30 Feet

- By Propulsion Type:

- Outboard Motor

- Inboard Engine

- Sterndrive (I/O)

- By Application:

- Leisure Cruising and Family Boating

- Sport Fishing and Angling

- Water Sports (Wakeboarding, Tubing)

- Commercial/Utility Use

- By Material:

- Fiberglass/Composite

- Aluminum

Value Chain Analysis For Cuddy Cabins Market

The value chain of the Cuddy Cabins Market begins with upstream activities involving the sourcing and processing of raw materials, primarily fiberglass resins, core materials (like marine-grade plywood and foam), aluminum, and sophisticated engine components and marine electronics. Key upstream suppliers include major chemical companies for resins and composites, and global engine manufacturers (e.g., Mercury Marine, Yamaha) for propulsion systems. The quality and availability of these raw materials directly impact the manufacturing efficiency and the final cost of the vessel. Boat builders must maintain strong, reliable relationships with these suppliers to manage supply chain risks, particularly concerning fluctuations in petroleum-based resin pricing and the global availability of semiconductors crucial for modern electronic navigation and control systems, ensuring production timelines are met and quality standards are consistently maintained across all product lines.

The midstream component is dominated by the manufacturing and assembly phase, where boat builders specialize in hull design, mold construction, lamination, and the integration of highly specialized marine systems (plumbing, electrical, and HVAC). This stage requires skilled labor and significant capital investment in facilities and tooling. Direct distribution channels involve manufacturers selling directly to consumers, which is common among smaller, highly customized builders or in specific regional markets, allowing for greater control over brand image and profit margins. Indirect distribution, however, remains the primary model, relying heavily on an established network of independent marine dealerships. These dealers provide essential local services, including sales consultation, financing options, commissioning, warranty support, and crucial after-sales service, acting as the primary interface between the manufacturer and the end-user, often holding substantial inventory.

Downstream activities focus on the final consumer interaction, including sales, post-sale service, and the thriving aftermarket. Marine dealerships and specialized brokers handle the critical function of marketing and selling the boats, often providing sea trials and necessary documentation. The aftermarket is crucial, encompassing engine maintenance, boat detailing, equipment upgrades (e.g., adding specialized fishing gear or navigation electronics), and winterization services. Success in the downstream segment relies heavily on customer loyalty and the reputation of the dealer network for quality service. Ultimately, the entire value chain is interconnected, where efficiency gains in upstream sourcing must translate into high-quality, reliable products in the midstream, supported by a robust and knowledgeable service network in the downstream, ensuring optimal lifetime customer value and driving positive word-of-mouth referrals necessary for sustained market growth.

Cuddy Cabins Market Potential Customers

The primary potential customers for Cuddy Cabins are affluent, middle-aged families (typically 40–60 years old) residing near coastal regions, large lakes, or established waterways, who prioritize recreational leisure, weekend cruising, and secure, multi-purpose boating experiences. These buyers often represent the second-tier market entry, having previously owned smaller runabouts or desiring an upgrade from simpler, open-cockpit boats, seeking the added convenience of an enclosed space for protection from the elements, temporary shelter, and secure storage for longer outings. This demographic typically possesses significant disposable income and values reliability, safety, and brand reputation highly, often leading to a preference for well-established, premium boat builders. They are seeking a balance between the ease of trailering and maintenance of a smaller boat, combined with the amenities and comfort features of a larger vessel, making the cuddy cabin design an ideal compromise that meets these diverse practical and luxury requirements.

A secondary, yet rapidly expanding, customer segment includes serious recreational anglers and light sport fishing enthusiasts. These buyers require rugged construction, reliable performance in varied sea conditions, and specific fishing-oriented features such as integrated live wells, specialized tackle storage, and substantial cockpit space for fighting fish. For this group, the cuddy cabin provides essential shelter during adverse weather conditions, a safe place for electronic equipment, and often, an integrated head (toilet) facility, extending the duration and comfort of their fishing trips. Their purchasing decisions are heavily influenced by hull performance, stability, and the ability to customize the boat with professional-grade electronics and high-end outboard engine packages, demanding specialized design elements that cater directly to their sport's rigorous needs.

Furthermore, an emerging customer base consists of younger, tech-savvy consumers in high-growth coastal markets who are attracted to the modern, digitally integrated models offering connectivity and advanced safety features. This demographic is often interested in water sports like wakeboarding and tubing, requiring boats with strong towing capacity and specific platform designs for easy water access. For these potential buyers, the cuddy cabin serves as a social hub and a platform for active recreation. Manufacturers are adapting to this trend by offering bold color schemes, advanced stereo systems, and seamless smartphone integration, appealing to a generation that views their vessel as a key component of their integrated lifestyle, thereby diversifying the traditional customer profile and ensuring long-term generational market renewal.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,220 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brunswick Corporation, Yamaha Motor Co., Ltd., Groupe Beneteau, Chaparral Boats, Inc., Grady-White Boats, Inc., Boston Whaler, Inc., Regal Marine Industries, Inc., Sea Ray Boats, Baja Marine, Scout Boats, Inc., Pursuit Boats, Maverick Boat Group, Starcraft Marine, Finnmaster Boats, Jeanneau (part of Groupe Beneteau) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cuddy Cabins Market Key Technology Landscape

The Cuddy Cabins Market's technological landscape is rapidly evolving, driven primarily by the pursuit of enhanced efficiency, operational simplicity, and superior connectivity, mirroring trends seen in automotive and aerospace industries. Key technologies focus on advanced hull design, specifically stepped-hull architecture and vacuum-infused lamination processes. Stepped hulls reduce drag and increase fuel efficiency by introducing air under the running surface, allowing boats to achieve higher speeds with less horsepower, a crucial factor for the mid-sized cuddy segment. Vacuum-infusion technology, a method of building the fiberglass structure, ensures a precise resin-to-glass ratio, resulting in lighter, stronger, and more consistently built hulls compared to traditional hand lay-up methods, significantly enhancing structural integrity and reducing overall boat weight, contributing directly to better performance and decreased fuel consumption over the vessel's lifetime.

Propulsion technology is undergoing a major transition, characterized by the continued dominance and increasing sophistication of four-stroke outboard engines. Manufacturers are pushing the boundaries of horsepower output while simultaneously integrating advanced electronic controls, known as fly-by-wire systems, which replace traditional mechanical cables with precise electronic signals. This not only improves shifting smoothness and throttle response but also facilitates seamless integration with joystick docking systems. These sophisticated maneuvering systems utilize computer algorithms to coordinate multiple outboards independently, enabling novice boaters to dock large vessels easily in tight quarters, drastically improving the accessibility and user experience of larger cuddy cabin models and overcoming a traditional operational hurdle in the marine environment.

Furthermore, connectivity and digital integration define the modern cockpit experience. The adoption of multifunction displays (MFDs) that consolidate radar, GPS chart-plotting, sonar, engine monitoring, and entertainment controls into a single, intuitive interface is now standard across most mid-to-high-end cuddy cabins. These systems often incorporate NMEA 2000 networking protocols, allowing various onboard devices to communicate seamlessly. Remote monitoring technology, often connected via cellular networks, allows owners to check bilge pump status, battery voltage, and security cameras from their smartphones, providing peace of mind when the boat is stored or left unattended. This level of digital integration is critical for maintaining competitiveness and meeting the expectation of today’s tech-native marine consumers who demand robust, interconnected systems that enhance both safety and convenience on the water.

Regional Highlights

North America currently serves as the largest and most mature market for Cuddy Cabins, primarily led by the United States. This dominance is attributed to a deep-rooted boating culture, substantial disposable incomes, vast inland and coastal waterways, and a highly competitive manufacturing base (centered in states like Florida, Michigan, and North Carolina). American consumers favor larger cuddy cabins (25-30 ft) equipped with powerful outboard engines, prioritizing speed, comfort, and advanced fishing amenities. The strong presence of major marine finance institutions and an established dealer network supports high sales volumes and encourages frequent model upgrades. Regulatory stability and consumer confidence in leisure spending solidify North America's continued role as the primary demand center, setting key trends in design, particularly the shift towards maximizing cockpit space and minimizing reliance on the cabin for anything more than basic shelter and storage, reflecting the preference for day boating and short excursions.

Europe represents the second-largest market, characterized by significant regional variation influenced by climate, local traditions, and maritime laws. Countries bordering the Mediterranean Sea (Spain, Italy, France) focus heavily on coastal cruising and family leisure, valuing aesthetic design, high-quality finishes, and fuel efficiency due to higher fuel costs. Nordic countries, such as Norway and Sweden, prefer durable, efficient cuddy cabins, often built with slightly deeper v-hulls to handle choppier conditions, and demanding robust heating systems for year-round use. European demand is increasingly influenced by stringent EU RCD (Recreational Craft Directive) regulations regarding emissions and noise, accelerating the adoption of cleaner engine technologies and prompting manufacturers to invest heavily in hull noise reduction and composite material advancements, often leading global trends in marine sustainability and efficiency focused design.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, albeit from a smaller base, driven largely by emerging economies and increasing urbanization along coastal zones. Countries like Australia, where boating is a well-established pastime, contribute significantly to current market size, favoring rugged, offshore-capable cuddy cabins. However, high-growth potential is centered in developing markets such as China and specific Southeast Asian countries (e.g., Thailand and Vietnam), where rapidly expanding middle and affluent classes are beginning to invest significantly in recreational assets. Market development in APAC requires adaptation to diverse regulatory environments and a greater focus on boats optimized for tropical conditions, featuring enhanced ventilation, UV resistance, and often smaller, more maneuverable sizes suitable for crowded harbor conditions and island hopping, contrasting sharply with the larger models popular in Western markets, necessitating localized product strategy development.

- North America: Dominant market share due to established boating infrastructure, high disposable income, and strong preference for performance and large outboards.

- Europe: High growth in Mediterranean (leisure focus) and Nordic regions (durability focus), stringent environmental regulations driving technology adoption.

- Asia Pacific (APAC): Highest projected CAGR, led by increasing affluence in China and Australia, and growth in marine tourism infrastructure.

- Latin America (LATAM): Emerging market with potential centered on coastal resort areas, sensitive to economic volatility and import tariffs.

- Middle East and Africa (MEA): Niche luxury market demand in the GCC countries; growth tied to coastal development projects and high-end tourism initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cuddy Cabins Market.- Brunswick Corporation (Including Sea Ray Boats, Boston Whaler)

- Yamaha Motor Co., Ltd. (Including Regulator Marine)

- Groupe Beneteau (Including Jeanneau, Beneteau Power)

- Chaparral Boats, Inc.

- Grady-White Boats, Inc.

- Regal Marine Industries, Inc.

- Scout Boats, Inc.

- Pursuit Boats

- Maverick Boat Group (Including Hewes, Maverick)

- Stingray Boats

- Cobia Boats

- Crownline Boats

- MasterCraft Boat Holdings, Inc.

- Finnmaster Boats Oy

- Baja Marine

- Viking Yachts (for specialized custom applications)

- Tiara Yachts

- Stabicraft Marine

- Larson Boat Group

- Formula Boats

Frequently Asked Questions

Analyze common user questions about the Cuddy Cabins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Cuddy Cabin and a Walkaround boat design?

The primary difference lies in deck access and cabin size. A Cuddy Cabin features a smaller, often closed cabin structure with limited side deck access, maximizing internal cabin volume. A Walkaround boat, while also having a forward cabin, features wider, easily navigable side decks surrounding the cabin, prioritizing 360-degree fishability and mobility around the deck over maximum cabin space.

Are Cuddy Cabins suitable for offshore fishing in challenging conditions?

Yes, many premium Cuddy Cabins (especially those 25 feet and above from established builders) are designed with deep-V hulls and robust construction suitable for offshore fishing. Their design offers better protection and a more comfortable ride than open boats, provided they are appropriately powered and equipped with necessary navigation and safety electronics for harsh marine environments.

Which propulsion system is currently dominating the Cuddy Cabins Market and why?

Outboard motor propulsion is dominating the modern Cuddy Cabins Market, particularly in the 20 to 30-foot range. This preference is driven by outboards' superior ease of maintenance, improved fuel efficiency, better power-to-weight ratio, and the advantage of freeing up significant internal space within the hull for storage or customized cabin layouts.

How is sustainability impacting the purchasing decisions for Cuddy Cabin boats?

Sustainability is increasingly impacting purchasing decisions, particularly in Europe and affluent North American markets. Consumers are prioritizing vessels with lighter, fuel-efficient hull designs (like vacuum-infused composites) and manufacturers that offer low-emission or emerging hybrid/electric propulsion options, viewing environmental responsibility as a key differentiator.

What is the typical lifespan and depreciation rate of a fiberglass Cuddy Cabin boat?

A well-maintained fiberglass Cuddy Cabin can have a structural lifespan exceeding 30 years. Depreciation is highly variable, but new models generally lose 20-30% of their value in the first five years. Boats from reputable builders with consistent maintenance records and desirable features often maintain stronger resale values than lesser-known or poorly maintained alternatives, reflecting market demand for quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager