Cultivator Camera Guidance System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442015 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Cultivator Camera Guidance System Market Size

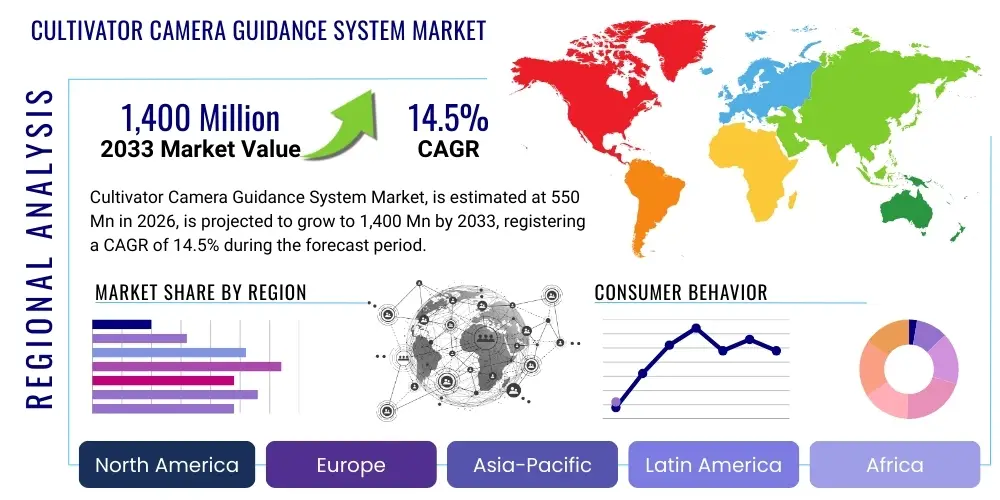

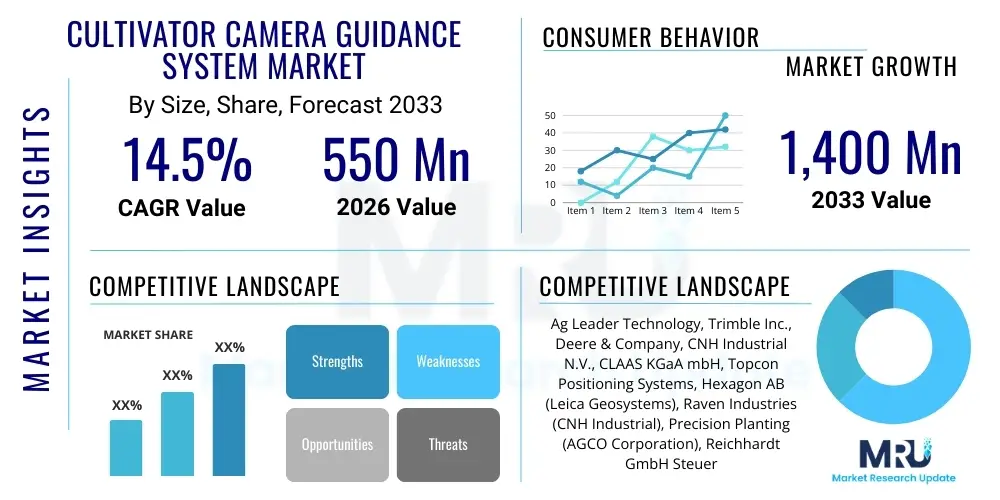

The Cultivator Camera Guidance System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $550 million in 2026 and is projected to reach $1,400 million by the end of the forecast period in 2033.

Cultivator Camera Guidance System Market introduction

The Cultivator Camera Guidance System Market encompasses advanced technological solutions designed to enhance the precision and efficiency of agricultural cultivation practices. These systems utilize high-resolution cameras, sophisticated image processing algorithms, and global navigation satellite systems (GNSS) to accurately detect crop rows and guide cultivation equipment autonomously. This technology ensures that weeding and soil preparation tasks are performed with exceptional accuracy, minimizing crop damage while maximizing weed removal effectiveness. The primary function is to maintain precise implement positioning, often within centimeter-level tolerances, which is critical in modern high-density farming operations. The market is driven by the global imperative to improve farm productivity, reduce reliance on manual labor, and decrease the environmental impact associated with traditional broad-acre herbicide application.

Major applications of these systems span across large-scale row crops, such as corn, soybeans, and cotton, and increasingly into specialty crops, including vegetables and high-value horticultural products, where precision thinning and cultivation are crucial for yield quality. The systems offer substantial benefits, including significant savings in labor costs, optimization of machinery use, and a marked reduction in input waste, particularly herbicides. By enabling mechanical weeding with high accuracy, these systems support the growing trend toward sustainable and organic farming methodologies. Furthermore, the integration with variable rate technology allows for tailored cultivation adjustments based on real-time field conditions, further boosting operational efficiencies across diverse soil types and crop health variations.

Key factors driving market expansion include the increasing global adoption of precision agriculture techniques, substantial advancements in machine vision and sensor technology, and persistent labor shortages in developed agricultural economies. Governments and regional bodies worldwide are also promoting smart farming initiatives through subsidies and regulatory support, encouraging farmers to invest in high-efficiency equipment. Moreover, the necessity for robust food security in the face of climatic challenges necessitates the deployment of technologies that can ensure optimal crop establishment and maintenance, positioning camera guidance systems as essential components of future farming infrastructure.

Cultivator Camera Guidance System Market Executive Summary

The Cultivator Camera Guidance System Market is characterized by robust technological development and rapid commercialization, fueled primarily by the digital transformation of the agricultural sector. Business trends indicate a strong focus on strategic partnerships between traditional agricultural equipment manufacturers (OEMs) and specialized technology firms, aimed at integrating seamless guidance capabilities directly into new machinery. Furthermore, subscription-based models for software updates and data analysis services are gaining traction, shifting revenue streams from pure hardware sales to recurring service income. The competitive landscape is intensely focused on achieving higher operational speeds and improved accuracy in diverse lighting and field conditions, necessitating ongoing research in AI-powered vision systems and sensor fusion techniques to maintain a market edge.

Regionally, North America and Europe currently dominate the market, attributed to high levels of mechanization, favorable government policies supporting precision farming adoption, and the immediate need to address stringent environmental regulations regarding pesticide use. However, the Asia Pacific region, particularly countries like China and India, is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is driven by large agricultural populations seeking efficiency gains and governments actively investing in modernizing farming infrastructure to enhance yields and reduce post-harvest losses. Latin America is also emerging as a significant market, buoyed by the cultivation of large tracts of export-oriented row crops requiring high-precision cultivation methods.

Segment trends highlight the increasing prominence of Vision-Based Guidance Systems over traditional GPS/RTK systems, specifically due to their ability to provide real-time, dynamic steering adjustments based on plant geometry rather than pre-mapped coordinates. In terms of component segments, the demand for high-resolution cameras and advanced processing units capable of running complex deep learning algorithms is experiencing exponential growth. End-user trends show a shift towards small to medium-sized farms beginning to adopt these technologies, spurred by the introduction of more affordable, modular, and easy-to-integrate aftermarket solutions, broadening the overall accessibility and penetration of the market beyond large commercial operations.

AI Impact Analysis on Cultivator Camera Guidance System Market

User queries regarding the impact of Artificial Intelligence (AI) on Cultivator Camera Guidance Systems overwhelmingly center on enhancing real-time decision-making, improving accuracy under adverse conditions, and ensuring system reliability across diverse crop types. Farmers and industry stakeholders are keen to understand how AI, specifically machine learning (ML) and deep learning (DL), will move the technology beyond simple row-following to genuine plant-level intelligence, enabling tasks such as individual plant health assessment during cultivation passes. Key themes emerging from these questions include the required computational power for edge processing, the standardization of training datasets for model generalization, and the economic viability of retrofitting AI-enabled systems onto existing machinery. There is significant expectation that AI will unlock new functionalities, such as automated differential cultivation intensity based on soil variability or weed type identification, drastically reducing human oversight.

- AI enables real-time weed identification and species classification, allowing for tailored, site-specific mechanical or chemical intervention.

- Deep Learning algorithms enhance system robustness, maintaining guidance accuracy in challenging visual conditions like shadow, dust, or high sun glare.

- Machine Learning optimizes the steering control loop, reducing actuator lag and minimizing stress on implement components during high-speed operation.

- AI facilitates predictive maintenance by analyzing sensor data for anomalies, forecasting potential mechanical failures in the cultivator or guidance components.

- Neural networks are used to train complex models capable of recognizing subtle differences between crops and weeds at early growth stages (e.g., differentiating between grass weeds and corn seedlings).

- AI supports data fusion, seamlessly integrating visual data (cameras) with geospatial data (RTK GPS) and spectral data (multispectral sensors) for enhanced situational awareness.

- Autonomous calibration and self-learning capabilities reduce the setup time and operational complexity for farmers handling varied field geometry or planting patterns.

DRO & Impact Forces Of Cultivator Camera Guidance System Market

The market dynamics for Cultivator Camera Guidance Systems are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing market trajectory. The predominant drivers center on the global push for agricultural sustainability and efficiency. Specifically, the necessity to comply with increasingly strict environmental regulations regarding pesticide usage compels farmers to seek non-chemical weed control methods, making high-precision mechanical cultivation indispensable. Simultaneously, persistent demographic shifts, characterized by an aging farming population and chronic labor shortages in key agricultural regions, accelerate the adoption of autonomous and automated solutions like camera guidance systems. Furthermore, the declining cost and miniaturization of sophisticated sensor technology, coupled with enhanced computational power, make these advanced systems economically viable for a broader range of farm sizes.

Conversely, significant restraints hinder widespread adoption. High initial investment costs for integrated systems remain a primary barrier, particularly for small and medium-sized farming enterprises operating on thin margins. The technical complexity associated with system integration, calibration, and ongoing maintenance also poses a challenge, requiring specialized technical expertise that is often scarce in rural areas. Additionally, performance variability in highly challenging field environments—such as uneven terrain, extremely high wind, or excessive mud—can temporarily compromise the reliability of the vision systems, leading to farmer skepticism and reluctance to fully commit to the technology until greater reliability is proven across all conditions. Data ownership and security concerns regarding the voluminous field data generated by these smart systems also represent an emerging institutional restraint.

Opportunities for market growth are vast and largely tied to technological convergence and geographic expansion. The potential for seamless integration with other precision agriculture technologies, such as drone-based scouting, variable rate seeding, and farm management software (FMS), offers enhanced value propositions for holistic farm automation. Moreover, the untapped potential in developing economies, particularly those beginning to modernize their staple crop production, represents a massive latent market. The development of standardized, open-source software interfaces and more affordable, modular, plug-and-play aftermarket kits will be crucial in unlocking these opportunities, allowing farmers to incrementally adopt the technology. The combined impact forces suggest a market poised for exponential growth, provided manufacturers successfully mitigate the issues surrounding cost and technical complexity through product simplification and economies of scale.

Segmentation Analysis

The Cultivator Camera Guidance System Market is comprehensively segmented based on various technical and commercial parameters, allowing for detailed market analysis and strategic planning. The primary segmentation involves Component, Application, Vehicle Type, Guidance Type, and Distribution Channel. This granular breakdown helps in understanding demand patterns and technological maturity across different facets of the agricultural landscape. The Component segmentation, covering hardware like cameras, control units, and actuators, is vital for tracking technological advancements and supply chain resilience. Meanwhile, segmentation by Application, differentiating between high-acreage row crops and labor-intensive specialty crops, reveals where the highest immediate financial returns on investment are being realized by end-users.

The segmentation by Guidance Type, contrasting highly accurate but expensive RTK GPS with the increasingly versatile and plant-aware Vision-Based Systems, is particularly crucial for forecasting future technological dominance. Vision-Based Systems are gaining ground due to their superior capability in handling non-uniform planting and minimizing implement drift, a major concern for mechanical weeding efficiency. Further segmentation by Vehicle Type, distinguishing between traditional tractors and specialized self-propelled cultivators, reflects the evolution of farming equipment design toward greater autonomy and implement-specific optimization. Understanding these segments is paramount for manufacturers tailoring their product portfolios to meet specific functional requirements, whether it is high-speed planting synchronization or ultra-low disturbance cultivation in fragile specialty crops.

- Component:

- Sensors (CMOS/CCD Cameras, Ultrasonic Sensors, Lidar)

- Control Units/Processors

- Actuators (Hydraulic, Electric, Pneumatic)

- Display and Interface Modules

- Application:

- Row Crops (Corn, Wheat, Soybeans, Rice)

- Specialty Crops (Vegetables, Vineyards, Orchards)

- Horticulture and Nurseries

- Vehicle Type:

- Tractors (Standard and Articulated)

- Self-Propelled Cultivators

- Autonomous Agricultural Vehicles/Robots

- Guidance Type:

- Vision-Based Guidance Systems

- RTK GPS-Based Guidance Systems (Combined Vision and GPS)

- Distribution Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket Sales and Service Providers

Value Chain Analysis For Cultivator Camera Guidance System Market

The value chain for the Cultivator Camera Guidance System Market starts with upstream activities focused on the procurement and manufacturing of specialized electronic components. This phase involves sourcing high-performance image sensors (CMOS and CCD), advanced microprocessors suitable for edge computing (GPUs/FPGAs), high-precision GNSS receivers, and robust mechanical and hydraulic actuator systems. Key upstream suppliers include global semiconductor manufacturers, specialized optical component providers, and sophisticated electronics assembly firms. The cost and quality of these foundational components significantly influence the final product price and performance envelope. Establishing reliable partnerships with specialized chip manufacturers capable of producing durable, agriculture-grade electronics is critical for OEMs to ensure the reliability required for harsh outdoor environments, leading to strong reliance on specialized, high-tier component vendors.

The midstream segment involves the core manufacturing, integration, and software development processes. Major OEMs and technology providers focus on developing proprietary machine vision algorithms, deep learning models for accurate crop/weed differentiation, and user-friendly control interfaces. This stage adds the highest intellectual property value, as system accuracy and robustness are determined here. Following manufacturing, the distribution channel plays a pivotal role. Direct distribution through OEMs is dominant for new equipment installations, where the guidance system is factory-fitted. This channel ensures seamless integration and high-quality assurance from the outset. Specialized dealer networks and certified service centers handle system installation, calibration, and ongoing maintenance, offering localized support critical for complex technology adoption.

The downstream analysis focuses on the end-user adoption and aftermarket services. Farmers are the ultimate beneficiaries, utilizing the system to optimize field operations. The aftermarket segment, which includes retrofitting older machinery with guidance systems and providing software updates and calibration services, represents a substantial and growing part of the value chain. Indirect distribution occurs through independent distributors, agricultural cooperatives, and third-party technology integrators who specialize in customizing solutions for specific regional crop requirements. The efficiency and effectiveness of the aftermarket support network—including remote diagnostics and swift component replacement—are crucial for maintaining high customer satisfaction and ensuring minimal field downtime, which significantly influences future purchase decisions and brand loyalty in this technology-intensive market.

Cultivator Camera Guidance System Market Potential Customers

The primary potential customers for Cultivator Camera Guidance Systems are diverse agricultural entities across the globe, ranging from large-scale commercial farming operations focused on staple row crops to specialized, high-value horticultural producers. Large commercial farms represent the core customer base due to their high volume of acreage, which translates directly into significant cost savings from improved efficiency and reduced input waste. These farms often already possess substantial fleets of modern, interconnected machinery and are early adopters of precision agriculture technologies, making the integration of camera guidance systems a logical next step in their automation journey. For these customers, the emphasis is on achieving high operational speed and ensuring robust, 24/7 reliability across thousands of acres, often leveraging combined Vision- and RTK-GPS based solutions.

A rapidly growing segment of potential customers includes organic and specialty crop producers. These farmers face intense market pressure to eliminate or minimize chemical interventions, making high-precision mechanical weeding systems indispensable. For specialty crops like vegetables (carrots, lettuce, cabbage) and high-value permanent crops (grapes, nuts), where crop row spacing is tight and plant damage must be near zero, the accuracy provided by camera guidance is not merely an efficiency measure but a necessity for quality and yield preservation. These customers prioritize the system's ability to handle complex geometries, uneven terrain, and variable plant growth stages, often preferring systems with advanced AI vision capabilities that can differentiate individual plants with high fidelity.

Furthermore, agricultural contractors and farming cooperatives constitute a significant customer base. Contractors, who provide services to multiple smaller farms, rely on camera guidance to maximize machine utilization and minimize the labor required across different client fields. Their requirement is for systems that are highly versatile, easy to calibrate for different implement widths and crop types, and durable under constant field changes. As the technology becomes more modular and affordable, smaller family farms are also becoming target customers, often utilizing aftermarket systems to incrementally upgrade their existing machinery, allowing them to compete more effectively through lower operational costs and enhanced sustainability practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,400 Million |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ag Leader Technology, Trimble Inc., Deere & Company, CNH Industrial N.V., CLAAS KGaA mbH, Topcon Positioning Systems, Hexagon AB (Leica Geosystems), Raven Industries (CNH Industrial), Precision Planting (AGCO Corporation), Reichhardt GmbH Steuerungstechnik, AutoFarm, Steer Command, Guidance Technologies, NovAtel (Hexagon), Hemisphere GNSS, FJDynamics, SST Sensing Ltd, Blue River Technology (Deere & Company), Vicon (Kubota Corporation), Hardi International A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cultivator Camera Guidance System Market Key Technology Landscape

The technology landscape underpinning the Cultivator Camera Guidance System Market is defined by the convergence of high-speed digital imaging, artificial intelligence, and precise geospatial positioning systems. Central to this landscape are machine vision systems that utilize specialized cameras (often stereoscopic or 3D time-of-flight cameras) coupled with powerful embedded processors to capture and interpret real-time field data. These processors must handle complex deep learning inferences at high frame rates—up to 60 frames per second—to accurately track fast-moving implements and identify small, early-stage weeds amidst dense crop rows. The shift from traditional algorithmic image processing to AI/ML models is perhaps the most significant technological evolution, enabling systems to learn and adapt to various crop varieties, soil colors, and diverse environmental lighting conditions with unprecedented accuracy and minimal manual calibration.

Another crucial technological pillar is the integration of sensor fusion capabilities. Modern guidance systems rarely rely solely on camera data; they seamlessly combine visual inputs with Real-Time Kinematic (RTK) GPS data. RTK GPS provides highly stable, centimeter-level global positioning data, which acts as a robust baseline, while the camera system provides the necessary localized correction data, compensating for implement sway, drift, and slight variations in planting straightness. This fusion mitigates the weaknesses of each system—visual systems struggle in dust or fog, and GPS systems cannot account for minor implement mechanical variations—resulting in highly reliable guidance. Furthermore, the adoption of CAN bus communication protocols and ISO-BUS standards ensures interoperability between guidance systems and diverse fleets of tractors and implements, facilitating broader market acceptance.

The technological evolution is also focused heavily on improving component durability and processing efficiency. Cameras and control units are being engineered to withstand extreme temperatures, vibrations, and moisture inherent in farming environments (IP69K ratings are increasingly common). Edge computing capabilities are vital, allowing the AI models to process data locally without constant reliance on cloud connectivity, thereby ensuring real-time responsiveness in remote agricultural settings. Advances in actuator technology, moving towards faster and more precise electric and proportional hydraulic controls, are necessary to translate the guidance system's commands into rapid, accurate implement movements. The continuous development in these areas solidifies the foundation for fully autonomous cultivation and weed management solutions in the near future.

Regional Highlights

The regional market landscape for Cultivator Camera Guidance Systems demonstrates significant heterogeneity based on agricultural maturity, regulatory environments, and economic capacity for technology investment. North America holds a dominant market share, primarily due to large-scale commodity crop production and early, aggressive adoption of precision agriculture technologies. The U.S. and Canada benefit from extensive government support for farm technology and the presence of major agricultural machinery OEMs and specialized guidance system providers. High labor costs and the continuous drive for efficiency further cement the region's leadership in both current market size and technological innovation, particularly concerning high-speed planting and cultivation systems designed for extensive acreage.

Europe represents a highly critical market, driven less by acreage expansion and more by strict environmental and sustainability mandates, such as the European Union’s Farm to Fork strategy, which aims to substantially reduce pesticide use. This regulatory push provides a strong legislative driver for mechanical, camera-guided weeding systems as alternatives to herbicides. Countries like Germany, France, and the Netherlands show high adoption rates, concentrating on high-value crops and demanding exceptional precision to navigate complex, often smaller, and irregularly shaped fields. The focus here is often on modular aftermarket solutions and systems tailored for specialty crops and organic production methodologies, emphasizing flexibility and adaptability across varied farming systems.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment. This growth is fueled by rapidly modernizing agriculture sectors in China, India, and Southeast Asia, driven by the need to feed large populations efficiently and address growing labor scarcity in rural areas. While initial adoption was focused on basic automation, the market is quickly moving towards sophisticated camera guidance as farmers seek to maximize yields from smaller, fragmented land holdings. Government subsidies, particularly in China and South Korea, aimed at upgrading farming equipment, are major catalysts. Latin America, particularly Brazil and Argentina, demonstrates robust demand tied to their vast exports of row crops like soybeans and corn, necessitating large, highly efficient machinery integrated with state-of-the-art guidance technology to manage extensive field operations and improve logistical efficiency.

- North America (U.S., Canada): Market leader; driven by large commercial farming, high precision planting demands, and early technology adoption spurred by high labor costs.

- Europe (Germany, France, UK): High growth potential fueled by stringent environmental regulations requiring reduced chemical inputs and strong focus on organic farming practices.

- Asia Pacific (China, India, Australia): Fastest-growing region; investment driven by agricultural modernization, government subsidies, and the necessity to enhance yields from dense populations.

- Latin America (Brazil, Argentina): Significant growth from major commodity exporters focusing on large-scale row crop cultivation and efficiency improvements across vast territories.

- Middle East & Africa (MEA): Nascent market, primarily focused on controlled environment agriculture and modernization efforts aimed at securing regional food supply through selective technology adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cultivator Camera Guidance System Market.- Deere & Company

- Trimble Inc.

- CNH Industrial N.V.

- Ag Leader Technology

- Topcon Positioning Systems

- Hexagon AB (Leica Geosystems)

- Raven Industries (CNH Industrial)

- CLAAS KGaA mbH

- Precision Planting (AGCO Corporation)

- Reichhardt GmbH Steuerungstechnik

- AutoFarm

- Guidance Technologies

- NovAtel (Hexagon)

- Hemisphere GNSS

- FJDynamics

- SST Sensing Ltd

- Blue River Technology (Deere & Company)

- Vicon (Kubota Corporation)

- Hardi International A/S

- Steer Command

Frequently Asked Questions

Analyze common user questions about the Cultivator Camera Guidance System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a Cultivator Camera Guidance System?

The primary benefit is achieving ultra-precise implement control during cultivation, which minimizes damage to crops, maximizes weed removal effectiveness, and significantly reduces reliance on costly chemical herbicides, thereby lowering operational expenditures and improving sustainability.

How does AI improve the performance of these guidance systems?

AI, specifically deep learning, enhances system robustness by allowing real-time, accurate differentiation between crop seedlings and weeds, even in varied lighting or early growth stages. This enables tailored cultivation decisions and ensures sustained accuracy under challenging environmental conditions where human eyesight or basic algorithms would fail.

Is the initial investment in camera guidance systems justifiable for small farms?

While the initial cost is high, the return on investment (ROI) is increasingly favorable for small and medium farms, especially those engaged in high-value specialty crops or organic production where the cost savings from eliminated herbicide use and reduced labor inputs quickly offset the capital expenditure. Aftermarket and modular solutions further enhance accessibility.

What is the difference between Vision-Based and RTK GPS guidance?

RTK GPS guidance relies on highly accurate satellite positioning for steering based on pre-mapped coordinates. Vision-Based guidance uses cameras to optically "see" and track the actual crop rows in real-time, dynamically adjusting steering based on plant location. Modern systems often fuse both technologies for superior reliability and precision.

Which regions are leading the adoption of this technology?

North America currently holds the largest market share due to its established precision agriculture infrastructure, while Europe shows strong growth driven by strict environmental regulations promoting mechanical weeding. The Asia Pacific region is forecast to exhibit the fastest growth, propelled by rapid agricultural modernization initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager