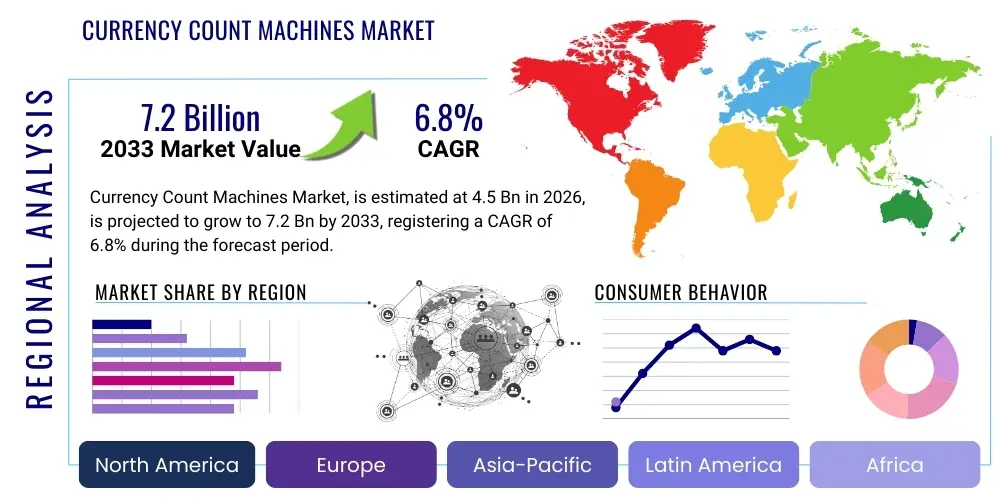

Currency Count Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442195 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Currency Count Machines Market Size

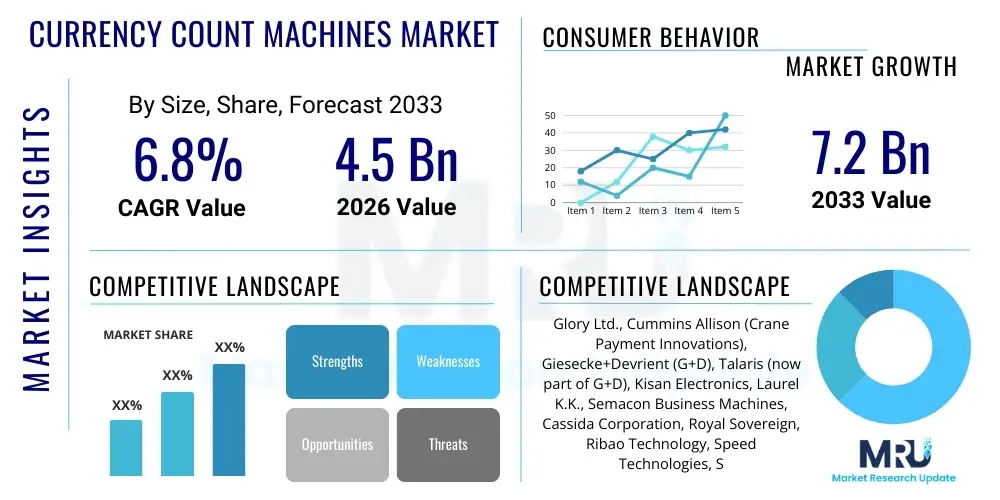

The Currency Count Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Currency Count Machines Market introduction

The Currency Count Machines Market encompasses devices designed to rapidly and accurately count banknotes, significantly improving operational efficiency across various cash-handling sectors. These machines range from simple bill counters to sophisticated currency discriminators and high-speed sorters capable of verifying authenticity, denominating mixed currencies, and fitness sorting based on predefined criteria. The primary product categories include portable devices suitable for small businesses or mobile applications, desktop models dominating the retail and small banking segments, and heavy-duty, multi-pocket sorters essential for central banks and large financial institutions handling vast volumes of cash daily. The fundamental purpose of these machines is to minimize human error, prevent monetary disputes, and accelerate the processing of cash transactions, which remains a cornerstone of global commerce despite the rise of digital payment systems.

Major applications of currency counting machines span financial services, retail, gaming, and government sectors. Financial institutions, including commercial banks, credit unions, and central banks, rely heavily on these devices for teller operations, vault management, and processing cash deposits. In the retail sector, especially large supermarkets, department stores, and quick-service restaurants, currency counters are vital for end-of-day reconciliation and reducing shrinkage. The benefits derived from implementing these technologies are multifaceted, primarily centered on enhanced security through advanced counterfeit detection features utilizing UV, MG, IR, and image recognition technologies. Furthermore, they drastically reduce labor costs associated with manual counting and audit preparation, ensuring regulatory compliance regarding cash management and reporting.

The market is predominantly driven by the persistent global reliance on cash transactions, particularly in developing economies, coupled with stringent anti-counterfeiting regulations mandating accurate verification processes. The increasing sophistication of counterfeit techniques necessitates continuous technological upgrades in detection mechanisms, spurring demand for modern, smart counting and sorting machines. Moreover, the global expansion of the banking infrastructure and the burgeoning volume of cash transactions in high-growth retail environments, such as convenience stores and large format retail chains, contribute significantly to market expansion. The push for operational excellence and minimization of downtime in cash-intensive operations further cements the role of automated currency handling solutions as essential business tools.

Currency Count Machines Market Executive Summary

The Currency Count Machines Market is characterized by robust technological advancements focused on integrated counterfeit detection and high-speed processing capabilities, driving steady business trends, particularly in emerging economies where cash usage remains dominant. Key business trends include the convergence of hardware efficiency with software intelligence, enabling detailed reporting, tracking, and integration with existing enterprise resource planning (ERP) systems and vault management software. Furthermore, there is a distinct trend towards modular designs and specialized machines, such as those optimized for specific foreign currency sorting or enhanced fitness analysis for central bank operations, reflecting the increasing complexity of global cash flows and regulatory requirements. The competitive landscape is intensely focused on patenting advanced sensor technologies and offering comprehensive service contracts that cover maintenance and software updates, ensuring machine longevity and relevance against evolving threats.

Regionally, the market exhibits divergent maturity levels; North America and Europe emphasize replacement cycles driven by the adoption of sophisticated discriminators and sorters required for advanced cash centers, while the Asia Pacific (APAC) and Latin America regions are experiencing rapid expansion fueled by new installations across a fast-growing financial infrastructure and booming retail industries. APAC, propelled by densely populated nations like India and China, shows the highest growth potential due to increasing financial inclusion and the sheer volume of cash in circulation. Conversely, mature markets prioritize features like connectivity (IoT integration for remote diagnostics) and security protocols, ensuring data integrity and operational transparency. Government initiatives focusing on modernization of cash management and reducing illicit financial activities further influence regional procurement patterns, favoring suppliers who can meet high compliance standards.

Segment trends reveal a pronounced shift towards discrimination technology over basic count-only machines, especially in banking and large retail environments, due to the critical requirement for mixed currency handling and authentication in a single pass. The End-User segmentation highlights the financial institutions segment maintaining market dominance, but the retail segment is rapidly gaining traction as operational costs drive mid-sized retailers to automate cash management beyond traditional point-of-sale systems. Technology trends emphasize multi-sensor integration, providing layers of security, including full-image scanning and serial number capture, enabling audit trails and traceability, which are crucial for combating organized crime and adhering to anti-money laundering (AML) regulations. This sophisticated technology integration is driving premium pricing in the high-end sorter segment while maintaining competitive pricing pressure in the standard desktop counter category.

AI Impact Analysis on Currency Count Machines Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Currency Count Machines primarily center on three themes: the potential for AI to enhance counterfeit detection capabilities beyond static sensor analysis, the role of machine learning in predictive maintenance and operational efficiency, and the long-term impact on the workforce handling cash. Users are concerned whether current sensor technologies are reaching their limits against sophisticated counterfeits and expect AI to introduce dynamic pattern recognition to detect novel fraudulent notes. Furthermore, there is significant interest in how AI algorithms can analyze machine performance data to predict component failure, thereby minimizing costly downtime in high-volume operations. Finally, stakeholders seek clarity on how the integration of AI-driven automation will reshape the skillset required for bank tellers and cash center operators, moving them from manual counting to supervisory and technical roles focused on system management and reconciliation anomaly resolution.

The adoption of AI and machine learning (ML) paradigms fundamentally transforms currency counting and sorting from a reactive, rule-based process into a proactive, adaptive system. ML algorithms can be trained on vast datasets of known genuine and counterfeit banknotes, allowing the machine to identify subtle, previously unseen anomalies in texture, printing quality, or alignment that traditional sensor packages might miss. This significantly enhances the precision of authentication, making the system future-proof against evolving counterfeit methods. Beyond detection, AI optimization algorithms are being utilized to improve sorting routes and fitness analysis, ensuring that machines operate at peak efficiency based on real-time operational variables such as note quality and volume, thereby maximizing throughput in centralized cash processing facilities.

The long-term impact of AI integration extends to automating the decision-making process within cash centers. For instance, AI can prioritize notes for shredding versus re-issue based on complex fitness parameters, reducing human subjectivity and ensuring higher quality cash circulation. Moreover, AI-powered predictive maintenance models analyze sensor data, motor cycles, and thermal profiles to schedule preventative service, drastically lowering unscheduled maintenance costs and maximizing uptime. This intelligent operational management transforms the total cost of ownership (TCO) calculation for financial institutions, making advanced currency handling systems more economically viable despite higher initial investment costs. The continuous learning capabilities inherent in AI systems ensure that the machines adapt to new currency series or regional specificities without extensive manual reprogramming.

- AI enables dynamic, real-time pattern recognition for advanced counterfeit note detection, moving beyond static sensor thresholds.

- Machine learning algorithms optimize sorting logic and path planning, maximizing throughput and energy efficiency in high-speed sorters.

- Predictive maintenance driven by AI minimizes downtime by forecasting component failure based on operational data analytics.

- AI facilitates enhanced serial number capture and analysis, streamlining traceability and supporting anti-money laundering (AML) compliance efforts.

- Integration with IoT platforms allows AI systems to analyze fleet-wide performance data, suggesting best practices and optimal deployment strategies across large networks.

DRO & Impact Forces Of Currency Count Machines Market

The dynamics of the Currency Count Machines Market are governed by a complex interplay of positive catalysts (Drivers), constraining factors (Restraints), and future growth avenues (Opportunities), which collectively define the Impact Forces influencing industry trajectory. Primary drivers center on the global necessity for speed, accuracy, and rigorous verification in cash transactions, necessitated by high labor costs and the persistent threat of counterfeiting. This is particularly evident in economies undergoing rapid modernization of their banking infrastructure. Restraints largely stem from the global trend toward digitalization and cashless transactions, which potentially reduces the long-term volume of physical cash handling, and the significant initial capital expenditure required for sophisticated currency sorting and processing systems, which can be prohibitive for smaller institutions or retailers. Opportunities are centered on leveraging advanced technologies like AI, IoT, and high-resolution imaging to create multi-functional devices that offer more than just counting, such as automated deposit services and end-to-end audit trail generation, ensuring market resilience against the digital shift.

The impact forces are predominantly positive and transformative, driven by regulatory pressures and technological innovation. The increasing severity of global anti-money laundering (AML) and know-your-customer (KYC) regulations necessitates the implementation of devices capable of accurate serial number capturing and detailed transaction logging, directly boosting the demand for high-end discriminators. Furthermore, the global push for financial inclusion in developing nations often results in a higher circulation of cash, creating immediate and substantial demand for reliable counting and verification tools at the grassroots level, thereby broadening the market base. Conversely, market growth is moderated by the saturation in developed markets, where replacement cycles are longer and competition is primarily based on features, software integration, and maintenance support rather than sheer unit sales.

The long-term strategic outlook for the market is highly favorable for providers who focus on innovation in detection and integration capabilities. The opportunity to bundle advanced security features, such as biometric access control or secure network connectivity for data transmission, creates premium segments within the market. Moreover, addressing the operational complexity of handling multiple currencies (Euro, USD, Yen, etc.) efficiently within single machines offers a significant competitive advantage, especially in international banking hubs and travel retail environments. The persistent global cash usage, even amidst digitalization, driven by consumer preference for anonymity, financial exclusion from digital systems, and resilience against infrastructure outages, ensures that currency counting machines remain essential capital equipment for foundational economic activities worldwide.

Segmentation Analysis

The Currency Count Machines Market segmentation provides a detailed lens through which market dynamics, consumer preferences, and growth trajectories across various product types, technologies, end-users, and operational speeds can be analyzed. This granular perspective allows manufacturers and service providers to tailor product offerings and marketing strategies to specific industry needs, ranging from the high-accuracy requirements of central banks to the portability needs of small business owners. The market is fundamentally segmented based on the core function—basic counting versus complex discrimination and sorting—which dictates price points, technological complexity, and suitability for different operational environments. Understanding these segment behaviors is critical for forecasting future demand shifts, especially as digitalization influences the low-volume counting segment while simultaneously boosting the need for highly secure, high-volume processing equipment in centralized cash centers.

The key technological segments, namely Bill Counters, Discriminators, and Sorters, highlight the evolution of currency handling. Bill counters offer basic quantity summation, serving smaller cash volumes or basic retail needs. Discriminators represent the mid-range, providing mixed-denomination counting, advanced counterfeit verification, and batching capabilities. High-speed sorters represent the premium segment, utilized primarily by central banks and large commercial banks for fitness sorting (categorizing notes based on quality), serial number tracking, and high-volume processing necessary for recirculation readiness. This stratification reflects the differing security and efficiency requirements across the market spectrum. End-user segmentation further refines this view, with Financial Institutions demanding robust, integrated sorting technology, while the Retail Sector typically opts for reliable, cost-effective discriminators for daily reconciliation.

- By Product Type:

- Desktop Currency Counters

- Portable Currency Counters

- Heavy Duty/High-Speed Currency Sorters

- By Technology:

- Bill Counters (Count-Only Machines)

- Currency Discriminators (Mixed Denomination and Verification)

- Currency Sorters (Fitness, Serial Number, Multi-Pocket)

- By End-User:

- Financial Institutions (Banks, Credit Unions, Central Banks)

- Retail Sector (Supermarkets, Hypermarkets, Department Stores)

- Casinos and Gaming Industry

- Government and Public Sector (Post Offices, Tax Bureaus)

- Transportation and Logistics

- Others (Hotels, Hospitals, Vending Operators)

- By Speed:

- Low Speed (Below 800 Notes/Min)

- Medium Speed (800 – 1200 Notes/Min)

- High Speed (Above 1200 Notes/Min)

Value Chain Analysis For Currency Count Machines Market

The Value Chain for the Currency Count Machines Market begins with the upstream activities centered on the procurement and development of highly specialized components, followed by manufacturing, assembly, distribution, and critical post-sales services. Upstream analysis focuses heavily on the procurement of advanced sensor technologies, including UV, Magnetic (MG), Infrared (IR) readers, and sophisticated Contact Image Sensors (CIS) necessary for high-accuracy counterfeit detection and image capture. Key suppliers include specialized electronics manufacturers providing high-speed motors, precision optics, and customized software development kits (SDKs) for integrating algorithms and firmware. Innovation at this stage is crucial, as the performance and security features of the final product are directly dependent on the quality and fidelity of these core technological components. Effective upstream management requires strong supplier relationships to ensure component reliability and cost efficiency in a globally fragmented supply chain.

The downstream segment of the value chain involves the distribution, sales, installation, and essential maintenance services provided to end-users. Distribution channels are typically bifurcated into direct sales for large institutional clients (e.g., central banks, major commercial banking groups) where complex customization and long-term service contracts are required, and indirect channels relying on regional distributors, value-added resellers (VARs), and office equipment retailers for the retail and small business segments. Direct channels offer greater control over pricing and customer relationship management, vital for high-margin sorters. Indirect channels provide broader market reach and localized support for desktop counters and discriminators. The efficacy of the downstream operations is heavily reliant on a global network of certified technicians capable of providing rapid response maintenance and software updates, which are critical due to the sensitive nature of cash handling operations and regulatory compliance requirements.

The distinction between direct and indirect distribution is primarily driven by product complexity and end-user scale. High-speed, multi-pocket sorters often require bespoke installation, specific training, and ongoing calibration, necessitating a direct sales and service model. This ensures that the manufacturer maintains strict quality control over deployment and adheres to rigorous regulatory standards set by central banks. Conversely, standard currency discriminators and simple bill counters are commodity products best suited for indirect distribution through established dealer networks and e-commerce platforms, offering competitive pricing and accessible purchase options to a broad base of small to mid-sized enterprises. The trend towards software integration and connectivity is increasing the importance of the service component within the value chain, as remote diagnostics and firmware updates become crucial differentiators for maximizing equipment uptime and long-term customer satisfaction.

Currency Count Machines Market Potential Customers

The Currency Count Machines Market targets a broad spectrum of end-users whose operations are inherently cash-intensive and require meticulous accuracy, efficiency, and security in money handling. The most significant segment of potential customers remains Financial Institutions, encompassing not only major commercial banks and credit unions but also specialized institutions like armored car services, money exchanges, and payment processors. These entities handle cash in massive volumes, necessitating high-throughput, multi-functional currency sorters that perform detailed fitness analysis, serial number logging, and multi-currency authentication. Their purchasing decisions are driven by regulatory compliance, the need for centralized cash management, and minimizing reconciliation errors across large branch networks, making them primary consumers of advanced, integrated solutions.

The Retail Sector represents the fastest-growing segment in terms of unit consumption, driven by enterprises ranging from large supermarket chains and hypermarkets to smaller convenience stores and quick-service restaurants. For retailers, the primary value proposition of currency counting machines is loss prevention (reducing internal theft and counterfeit acceptance) and accelerating the cash management process at the point of sale and back office. They typically favor reliable, medium-speed discriminators that can handle daily till reconciliation quickly and accurately, often integrating the counters with centralized cash management software. The expansion of retail infrastructure globally, coupled with the need for immediate deposit preparation, ensures continuous demand from this sector, often opting for equipment through leasing models to manage capital expenditure.

Other substantial segments include the Casinos and Gaming Industry, which operates entirely on large, rapid volumes of cash and chips exchange, demanding the highest levels of accuracy and speed to prevent fraud; the Government and Public Sector, which uses these devices in tax collection offices, post offices, and utilities departments; and various service industries such as large hospitals and transportation hubs. These diverse customers all share a common requirement: automated, verifiable cash processing that surpasses the capabilities and reliability of manual methods. The continued prevalence of cash in sectors like gaming and small-scale business transactions globally reinforces the essential nature of automated counting technology across the economic landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glory Ltd., Cummins Allison (Crane Payment Innovations), Giesecke+Devrient (G+D), Talaris (now part of G+D), Kisan Electronics, Laurel K.K., Semacon Business Machines, Cassida Corporation, Royal Sovereign, Ribao Technology, Speed Technologies, Shenzhen TITO Technology, Julong, Tellermate, AccuBanker, Pingle, Zhejiang Shuyou, Xinda |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Currency Count Machines Market Key Technology Landscape

The technology landscape of the Currency Count Machines Market is undergoing constant evolution, driven primarily by the need to combat increasingly sophisticated counterfeit notes and to integrate cash handling data seamlessly into modern financial ecosystems. Central to this landscape are the various detection methodologies employed, including Ultraviolet (UV) light detection for analyzing paper fluorescence, Magnetic (MG) ink verification to check metallic threads and magnetic strips, and Infrared (IR) pattern analysis to verify distinct printing characteristics visible only in the IR spectrum. The most significant advancement is the widespread adoption of full-width Contact Image Sensors (CIS) or dual-CIS technology, which captures a high-resolution image of both sides of the banknote, enabling precise denomination recognition, physical fitness assessment (rips, tears, soil level), and advanced comparison against stored genuine currency templates. This comprehensive imaging capability forms the foundation for currency discriminators and high-end sorters, moving beyond simple counting to sophisticated validation.

Beyond sensor technology, the mechanical engineering and software integration aspects are crucial differentiators. High-speed sorters utilize multi-pocket designs coupled with complex transport mechanisms and feed systems capable of processing over 1,200 notes per minute without jamming, ensuring minimal interruption in critical cash center operations. These mechanical systems are governed by highly specialized embedded firmware responsible for real-time sensor data processing, anomaly detection, and sorting logic execution. Furthermore, connectivity and communication protocols define the "smart" capabilities of contemporary machines. Modern currency counters are increasingly equipped with Ethernet, Wi-Fi, and USB ports, allowing for integration with enterprise cash management software, remote diagnostics, and standardized data export. This integration capability allows institutions to generate detailed audit reports and maintain a continuous, traceable record of cash flow, satisfying stringent regulatory requirements.

Future technological advancements are heavily focused on the application of Artificial Intelligence and Machine Learning (AI/ML) to detection and operational optimization. AI algorithms are being developed to analyze serial numbers at high speed, not just for capture but for identifying patterns indicative of suspicious activity, aiding in anti-money laundering efforts. Furthermore, modular design is becoming standard, allowing machines to be easily configured for different currencies and updated with new detection standards or fitness criteria via software updates, extending the usable life of the hardware. The adoption of cloud-based monitoring solutions is also gaining traction, enabling fleet management and centralized control over dispersed networks of counting machines, providing real-time performance metrics and preemptive maintenance alerts, thus transforming cash handling from a mechanical task into a managed data process.

Regional Highlights

The regional dynamics of the Currency Count Machines Market reveal varied growth patterns and technological adoption levels, primarily segregated by the economic maturity and cash-usage intensity of the respective regions. North America and Europe represent mature markets characterized by high penetration rates and demand concentrated in replacement cycles and advanced technology adoption. These regions prioritize sophisticated multi-pocket sorters for central banking and large financial institutions, focusing on features such as fitness sorting, serial number tracking, and seamless integration with existing IT infrastructure. The adoption is driven less by unit growth and more by the continuous necessity to upgrade technology to counter new counterfeit threats and adhere to evolving European Central Bank (ECB) or Federal Reserve standards for currency recirculation quality. The high labor costs further incentivize investment in automation to maximize operational efficiency within cash centers, maintaining steady, albeit slower, revenue growth.

Asia Pacific (APAC) stands out as the primary growth engine for the global market, exhibiting the highest Compound Annual Growth Rate (CAGR) projections due to several macro-economic factors. Rapid urbanization, increasing financial inclusion, and the vast populations in countries like India, China, and Indonesia mean that despite the digital push, the absolute volume of cash transactions is enormous and continues to grow substantially. The demand in APAC spans all machine types: high-speed sorters for central banks modernizing infrastructure, and a massive base demand for mid-range discriminators and basic counters for burgeoning commercial banks and the burgeoning retail sector. Government initiatives to control the black economy and ensure accurate tax collection further mandate the use of traceable and reliable counting equipment, creating high volume sales opportunities for regional and global manufacturers focusing on localized currency support and robust build quality to handle poorer quality notes often found in circulation.

Latin America (LATAM), and the Middle East and Africa (MEA) regions present significant untapped potential and complex dynamics. In LATAM, market growth is fueled by the expansion of banking services, the informal economy's reliance on cash, and high levels of financial volatility which often encourage reliance on physical currency. The market demands reliable, cost-effective machines capable of handling varying currency quality and offering robust counterfeit detection due to regional instability. In the MEA region, the rapid development of large financial hubs (e.g., UAE, Saudi Arabia) drives demand for high-end sorting systems compliant with international standards, while the African continent represents a rapidly expanding frontier market where entry-level to mid-range discriminators are being widely adopted across the expanding retail and microfinance sectors. Challenges in these regions include infrastructure limitations and varying regulatory environments, requiring manufacturers to provide flexible and robust service and support models.

- North America: Focus on technology replacement, advanced serial number tracking, and seamless integration of sorters into bank automation systems.

- Europe: Driven by strict European Central Bank (ECB) standards for banknote fitness and recirculation, high demand for multi-currency discriminators and specialized Euro sorters.

- Asia Pacific (APAC): Highest growth market, fueled by financial inclusion, massive cash volumes (especially in China and India), and modernization of banking infrastructure across Southeast Asia.

- Latin America: Characterized by increasing bank expansion, demand for reliable counterfeit detection, and robust equipment to handle cash in potentially volatile economic environments.

- Middle East and Africa (MEA): Varied demand; high-end sorters in financial hubs (Middle East) and high-volume demand for reliable discriminators in expanding African banking and retail sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Currency Count Machines Market.- Glory Ltd.

- Cummins Allison (Crane Payment Innovations)

- Giesecke+Devrient (G+D)

- Talaris (now part of G+D)

- Kisan Electronics

- Laurel K.K.

- Semacon Business Machines

- Cassida Corporation

- Royal Sovereign

- Ribao Technology

- Speed Technologies

- Shenzhen TITO Technology

- Julong

- Tellermate

- AccuBanker

- Pingle

- Zhejiang Shuyou

- Xinda

Frequently Asked Questions

Analyze common user questions about the Currency Count Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a currency discriminator and a currency sorter?

A currency discriminator counts mixed denominations and verifies authenticity in one pass, typically batching notes together. A currency sorter, a higher-end machine, performs all discriminator functions but also physically sorts notes into multiple pockets based on fitness (quality), denomination, or orientation, essential for central bank processing.

How is AI improving the security and accuracy of modern currency counting machines?

AI, specifically machine learning, enhances security by training algorithms on complex datasets to detect subtle, non-standard patterns indicative of new or advanced counterfeit notes that traditional sensor arrays might overlook. This provides adaptive, future-proof authentication capabilities and reduces false rejects.

Which end-user segment is driving the highest growth volume for currency counters globally?

The Asia Pacific (APAC) Financial Institutions and Retail Sector segments are collectively driving the highest volume growth due to rapid infrastructure expansion, increasing financial inclusion, and the sheer magnitude of cash circulating in emerging economies.

What are the primary counterfeit detection technologies used in high-speed currency counters?

High-speed counters employ a combination of technologies, including Ultraviolet (UV) light detection, Magnetic (MG) ink analysis, Infrared (IR) pattern verification, and crucial Contact Image Sensors (CIS) which capture full-image scans for precise authentication and fitness analysis.

How does the shift toward digital payments impact the long-term demand for currency counting machines?

While the digital shift reduces demand for simple, low-volume counters, it increases the need for sophisticated sorters and discriminators in cash centers. Consolidation of cash handling means higher volumes are managed centrally, driving demand for high-throughput, integrated, and regulatory-compliant sorting solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager