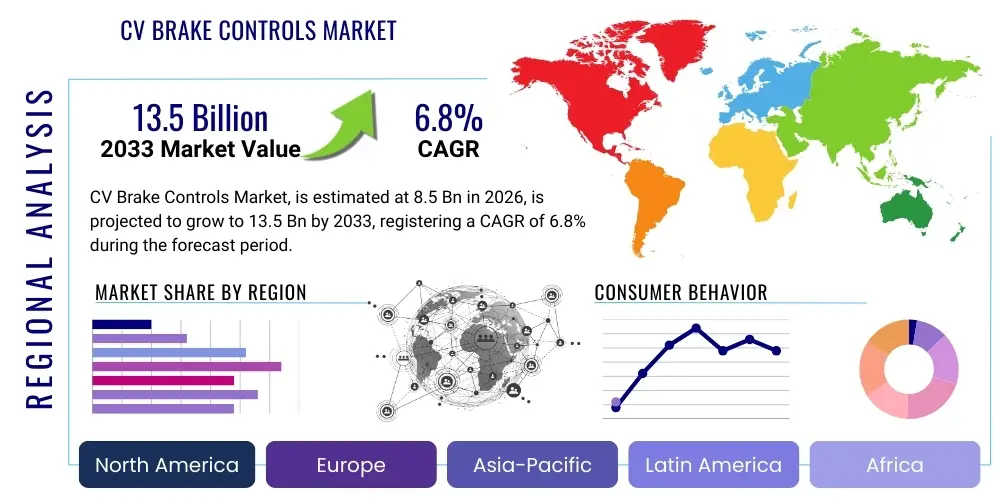

CV Brake Controls Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442528 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

CV Brake Controls Market Size

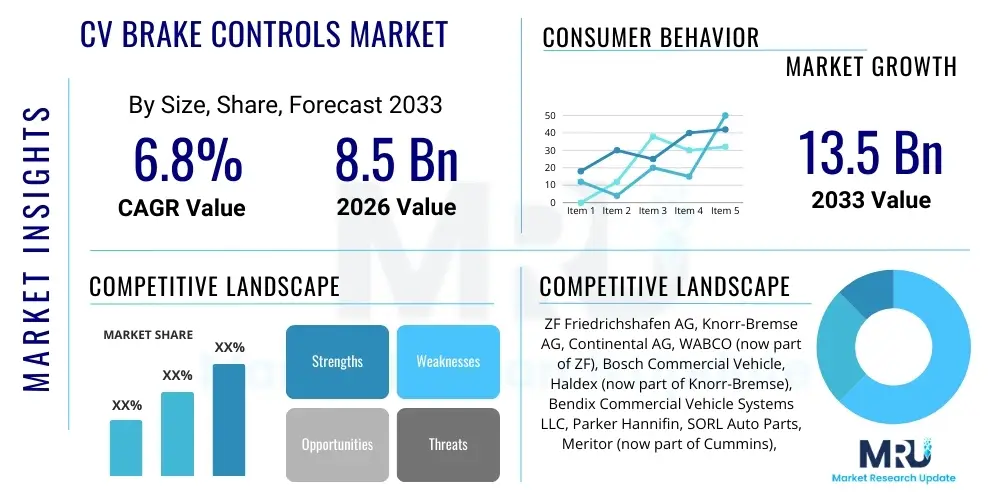

The CV Brake Controls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

CV Brake Controls Market introduction

The Commercial Vehicle (CV) Brake Controls Market encompasses a sophisticated ecosystem of components, systems, and software designed to ensure optimal braking performance, stability, and safety across various heavy-duty and medium-duty vehicles, including trucks, buses, and trailers. These systems are critical for maintaining vehicle control under adverse conditions, significantly reducing stopping distances, and preventing skidding or jackknifing. Modern CV brake controls have evolved far beyond conventional pneumatic systems, incorporating advanced technologies such as Anti-lock Braking Systems (ABS), Electronic Braking Systems (EBS), and Electronic Stability Control (ESC), which function synergistically with powertrain components and steering systems to provide integrated vehicle dynamics management. The primary function of these controls is to modulate braking force at each wheel independently, maximizing tire traction and ensuring directional stability, thereby complying with increasingly stringent global regulatory mandates regarding vehicle safety.

The product description spans across various technological segments, including traditional pneumatic brake valves, foundation brakes, and sophisticated electronic control units (ECUs). Key components involve air compressors, air dryers, brake chambers, master cylinders (for hydraulic systems in medium-duty CVs), and complex software algorithms that interpret sensor data (speed, yaw rate, steering angle) to determine the appropriate braking response. Major applications are predominantly observed in long-haul trucking fleets, municipal transport buses, construction vehicles, and specialized heavy machinery, where safety, reliability, and minimal downtime are paramount operational considerations. The systems are increasingly becoming integrated components of Advanced Driver Assistance Systems (ADAS).

The benefits derived from advanced CV brake controls are substantial, including enhanced vehicle safety profiles, improved fleet operational efficiency due to reduced accident rates, and superior driver comfort and confidence. Driving factors propelling this market include global standardization of vehicle safety features, particularly in emerging economies, the rising production and sales of heavy-duty vehicles, and the continuous push towards autonomous and semi-autonomous driving capabilities which rely heavily on precise and reliable brake-by-wire technologies. Furthermore, technological advancements centered around regenerative braking and energy recuperation in electric commercial vehicles are opening new avenues for brake control system design and integration.

CV Brake Controls Market Executive Summary

The CV Brake Controls Market is poised for robust expansion, driven primarily by tightening global regulatory frameworks mandating the implementation of advanced safety features like ABS, EBS, and ESC across new commercial vehicle registrations, particularly in high-growth regions like Asia Pacific. Current business trends indicate a strong shift toward system integration, where brake controls are no longer standalone units but are deeply networked with ADAS features such such as Adaptive Cruise Control (ACC) and Collision Mitigation Systems (CMS). Key industry stakeholders are focusing research and development efforts on enhancing the cybersecurity of electronic braking systems and developing fail-safe architecture to support Level 3 and Level 4 autonomous driving applications, demanding ultra-reliable, high-speed data processing capabilities within the Electronic Control Units (ECUs).

Regional trends highlight the Asia Pacific region, led by China and India, as the fastest-growing market due to rapid urbanization, expanding logistics sectors, and increased infrastructure spending necessitating large fleets of modern commercial vehicles equipped with standardized safety features. North America and Europe, characterized by highly mature regulatory environments, are witnessing demand centered on advanced aftermarket upgrades and sophisticated brake control systems suitable for electric and hydrogen fuel cell CVs. These mature markets emphasize weight reduction, efficiency gains, and integration with telematics systems for predictive maintenance and diagnostics, optimizing overall fleet management.

Segment trends reveal that the Electronic Braking System (EBS) segment is expected to dominate the market share due to its superior performance capabilities over traditional pneumatic systems, offering quicker response times and better compatibility with stability control features. In terms of vehicle type segmentation, the Heavy-Duty Truck category maintains the largest market share, directly correlating with its extensive use in global freight transportation. Furthermore, the burgeoning demand for electric CVs is fostering growth within the electro-pneumatic and electro-hydraulic braking systems segments, requiring manufacturers to adapt traditional components to handle complex regenerative braking inputs and provide seamless blending of friction and regeneration braking forces.

AI Impact Analysis on CV Brake Controls Market

Users frequently inquire about how Artificial Intelligence will fundamentally reshape the safety and operational efficiency of CV brake controls, specifically focusing on predictive maintenance capabilities, autonomous intervention, and system reliability enhancement. Common questions revolve around the use of machine learning algorithms for identifying minute anomalies in braking performance before catastrophic failure occurs, the role of AI in optimizing regenerative braking efficiency in electric CVs, and the integration challenges associated with training AI models using vast amounts of real-world driving data under diverse conditions. Furthermore, concerns are often raised regarding the ethical implications and liability issues related to autonomous braking decisions made by AI systems in emergency scenarios. The general expectation is that AI will move CV brake controls from reactive safety mechanisms to proactive, predictive vehicle dynamics management systems.

The adoption of AI and machine learning techniques within the CV brake controls market is rapidly transitioning braking systems from deterministic control models to predictive and adaptive frameworks. AI algorithms utilize data streams from various vehicle sensors (accelerometers, pressure sensors, wheel speed sensors, cameras, lidar) to continuously learn driver behavior, road conditions, and vehicle load dynamics. This enables the braking ECU to make real-time, highly optimized decisions regarding braking force distribution, stability control intervention thresholds, and the precise blend between friction braking and energy recuperation in electrified commercial vehicles. This predictive capability drastically improves overall safety by anticipating high-risk scenarios and intervening smoothly and earlier than conventional systems.

Moreover, AI is pivotal in facilitating advanced diagnostics and predictive maintenance for complex pneumatic and hydraulic systems. By analyzing historical performance data and identifying subtle deviations in pressure buildup times or valve response characteristics, AI can forecast component failure with high accuracy. This proactive maintenance approach significantly reduces unexpected vehicle downtime, a crucial metric for fleet operators, leading to substantial cost savings and improved logistical reliability. The seamless integration of these AI-driven decision-making units with the vehicle’s central computational platform is a primary focus for leading brake system suppliers and Tier 1 automotive component manufacturers aiming to support future fully autonomous commercial trucking operations.

- AI optimizes predictive braking and stability control in dynamic conditions.

- Machine learning enhances diagnostic capabilities, predicting component failure (e.g., air dryer issues, valve leaks).

- AI algorithms improve the efficiency and blending of regenerative and friction braking in Electric CVs (ECVs).

- Autonomous driving relies on AI for instantaneous, reliable brake-by-wire decision-making.

- AI systems analyze real-time sensor data for precise load and center-of-gravity detection, optimizing brake force distribution.

DRO & Impact Forces Of CV Brake Controls Market

The CV Brake Controls Market is predominantly driven by stringent governmental safety regulations globally, particularly the mandatory implementation of advanced systems like EBS and ESC across heavy-duty commercial vehicle fleets in major economies. The rapid growth of the logistics and transportation sector, fueled by e-commerce expansion and infrastructure projects, necessitates higher volumes of reliable commercial vehicles, thereby increasing demand for sophisticated control systems. Furthermore, the accelerating transition towards vehicle electrification, requiring complex brake-by-wire and regenerative braking capabilities, acts as a significant long-term driver for technological innovation and market expansion in specialized braking components and control software.

Restraints in the market include the high initial cost associated with integrating advanced electronic control units and sensor arrays into commercial vehicles, which can deter fleet owners, especially in price-sensitive emerging markets, from adopting the latest technologies. Technical complexities related to system integration—specifically ensuring interoperability between braking systems, powertrain control units, and third-party ADAS modules—present significant hurdles. Additionally, the increasing threat of cyberattacks targeting networked electronic braking systems represents a critical restraint, necessitating costly and continuous security updates and robust system architecture design.

Opportunities are abundant in the aftermarket segment for upgrading older CV fleets with modern safety technologies, particularly in developing regions where vehicle replacement cycles are longer. The growing trend toward fully autonomous commercial trucking (platooning and hub-to-hub transport) creates immense opportunities for manufacturers specializing in redundant, fail-operational brake control architectures. Impact forces, driven by technological evolution and regulatory shifts, exert substantial pressure on market players to innovate rapidly, prioritize system reliability, and focus on delivering energy-efficient solutions compatible with future powertrain technologies, ensuring continuous optimization of commercial vehicle total cost of ownership (TCO).

Segmentation Analysis

The CV Brake Controls Market is segmented based on the complexity of the control system, the specific components involved, the type of commercial vehicle, and the sales channel. Detailed segmentation allows manufacturers and market participants to precisely tailor their product offerings to specific regulatory environments and operational demands within distinct vehicle categories. The sophistication of control systems, ranging from purely pneumatic to fully electro-pneumatic and electro-hydraulic setups, reflects the varying safety and performance requirements dictated by payload capacity and operational environment. Understanding these segments is crucial for strategic planning and resource allocation within the competitive landscape.

The segmentation by technology is particularly vital, delineating the market share between conventional systems, which still hold relevance in certain economies, and advanced systems such as ABS, EBS, and ESC. The vehicle type segmentation is essential as brake control complexity and requirements differ significantly between heavy-duty trucks (Class 8), medium-duty trucks, and large transit or coach buses, especially concerning axle load limits and required deceleration rates. Geographically, the market is divided to reflect regional regulatory differences and varying rates of technological adoption, with mature markets focusing on system redundancy and electrification components, while emerging markets prioritize basic mandates like mandatory ABS implementation.

Furthermore, segmentation by component highlights the key revenue streams generated from control modules (ECUs), actuators (brake chambers/calipers), and sensors (wheel speed, pressure), providing a granular view of supply chain dynamics. The increasing demand for replacement components and system retrofits in the aftermarket segment provides a stable revenue source, contrasting with the often volatile nature of OEM sales which are tied directly to vehicle production cycles. This comprehensive segmentation framework aids in accurate forecasting and targeted marketing strategies across the global commercial vehicle industry.

- By Type of Technology:

- Anti-lock Braking System (ABS)

- Electronic Braking System (EBS)

- Electronic Stability Control (ESC)

- Traction Control System (TCS)

- Conventional Pneumatic Systems

- By Component:

- Electronic Control Units (ECU)

- Sensors (Wheel Speed, Pressure, Yaw Rate)

- Actuators (Brake Chambers, Valves)

- Pneumatic Components (Air Compressors, Dryers)

- Hoses and Fittings

- By Vehicle Type:

- Heavy-Duty Trucks (HDCV)

- Medium-Duty Trucks (MDCV)

- Buses and Coaches

- Trailers

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For CV Brake Controls Market

The CV Brake Controls value chain begins with upstream analysis, focusing on the procurement of raw materials and sophisticated electronic components. Key inputs include high-grade plastics, various metals (steel, aluminum) for enclosures and mechanical parts, and highly specialized semiconductors and microprocessors crucial for the Electronic Control Units (ECUs). Suppliers of these critical electronic components, particularly microcontrollers optimized for safety-critical automotive applications (ASIL D certification), hold significant leverage due to supply chain complexities and stringent quality requirements. The efficiency and reliability of these upstream suppliers directly influence the final product quality and manufacturing costs of the entire braking system.

Midstream activities involve the design, manufacturing, and assembly of the brake control systems by Tier 1 and Tier 2 suppliers. Tier 2 suppliers typically produce specialized components like sensors and complex valves, which are then integrated by Tier 1 suppliers (such as ZF, Knorr-Bremse, and Continental) into complete modules (e.g., EBS units, ABS modulators). Manufacturing processes are characterized by high levels of automation, rigorous testing, and compliance with ISO 26262 functional safety standards. Optimization of lean manufacturing principles and localized production near major commercial vehicle assembly hubs are key to maintaining competitive pricing and timely delivery within this stage of the value chain.

The downstream analysis involves the distribution channels, which are segmented into Direct and Indirect sales. Direct channels primarily encompass sales to Original Equipment Manufacturers (OEMs) like Daimler Truck, Volvo, and PACCAR, where systems are delivered directly to assembly lines based on long-term supply agreements. Indirect channels pertain to the aftermarket segment, involving distribution through a network of authorized dealers, independent garages, and specialized parts distributors who provide replacement parts, diagnostic tools, and system upgrades. Establishing a robust global aftermarket network is crucial for long-term profitability, ensuring accessibility of repair parts and specialized training for system maintenance across diverse geographical regions.

CV Brake Controls Market Potential Customers

The primary potential customers and end-users of CV Brake Controls are Commercial Vehicle Original Equipment Manufacturers (OEMs), followed by large fleet operators and independent maintenance facilities that cater to the aftermarket demand. OEMs constitute the largest customer base, purchasing integrated braking systems in high volumes for installation in new trucks, buses, and trailers. These buyers prioritize systems that offer superior safety compliance, reduced weight, seamless integration with vehicle architecture (especially powertrain and steering systems), and favorable lifetime total cost of ownership (TCO) based on reliability and maintenance intervals.

Fleet owners represent a rapidly growing segment of potential customers, particularly in the aftermarket, seeking upgrades or replacement systems that improve vehicle uptime and enhance safety records, which subsequently lowers insurance costs. Large logistics companies, public transport authorities, and construction firms that operate extensive vehicle fleets are sophisticated buyers. They focus not only on the physical components but also on the embedded software features, telematics compatibility for remote diagnostics, and predictive maintenance capabilities offered by the brake control system manufacturers, often preferring globally recognized brands known for reliability and service support.

Other significant end-users include specialized vehicle manufacturers (e.g., fire trucks, concrete mixers), trailer manufacturers, and independent garages and repair shops that purchase components through distributors. The demand from trailer manufacturers is particularly relevant, as trailer braking systems (T-EBS) require synchronization with the tractor unit’s controls, creating specialized demand for connectivity and control modules. Ultimately, the purchasing decision across all customer segments is driven by the imperative to meet stringent government safety regulations and enhance operational efficiency through reliable, high-performance braking technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Knorr-Bremse AG, Continental AG, WABCO (now part of ZF), Bosch Commercial Vehicle, Haldex (now part of Knorr-Bremse), Bendix Commercial Vehicle Systems LLC, Parker Hannifin, SORL Auto Parts, Meritor (now part of Cummins), Minda Corporation, FTE automotive, TSE Brakes, Tectran, MICO Inc., Carlisle Brake & Friction, Autoliv, Eberspächer, Dorman Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CV Brake Controls Market Key Technology Landscape

The technology landscape of the CV Brake Controls Market is defined by a shift from mechanical and pneumatic dependency towards sophisticated electronic and software-driven systems. The core technology centers around Electronic Braking Systems (EBS), which replace the traditional pneumatic signal line with an electronic signal, significantly reducing response time and enabling precise modulation of braking force. This foundation is essential for integrating higher-level safety functions like Electronic Stability Control (ESC) and Roll Stability Control (RSC), which use complex algorithms and rapid actuation capabilities to mitigate potential rollovers or loss of control events. The ongoing miniaturization and increased computational power of Electronic Control Units (ECUs) are facilitating these advanced functionalities.

A critical trend involves the development of brake-by-wire (BBW) systems, particularly relevant for electric and autonomous commercial vehicles. While pure BBW systems still face regulatory and redundancy challenges in CV applications, electro-pneumatic systems are bridging this gap, offering faster response and greater control fidelity while maintaining pneumatic redundancy for safety. Furthermore, the convergence of braking systems with telematics and Internet of Things (IoT) platforms is enabling real-time monitoring and advanced diagnostics. Smart sensors embedded within the brake controls transmit operational data to the cloud, allowing fleet managers to track component wear, temperature anomalies, and system integrity remotely, shifting maintenance practices from reactive to predictive models.

Specific technological focus areas include enhanced cybersecurity protocols for CAN bus and Ethernet-based communication networks within the braking systems, protecting against unauthorized access or manipulation—a necessity for connected CVs. The brake controls for Electric Commercial Vehicles (ECVs) require specialized software to manage the 'brake blending' function, seamlessly combining the vehicle's regenerative braking torque with the friction braking system to maximize energy recovery without compromising safety or driver feel. Innovation is also focused on developing lightweight materials for brake components and improving the efficiency of air management systems to reduce parasitic drag and contribute to overall vehicle fuel efficiency or range extension.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption rate within the CV Brake Controls Market, driven by disparate regulatory timelines, economic growth rates, and geographical operational demands.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily due to large volume CV production in China and India, coupled with rapid infrastructure development and the increasing enforcement of mandatory safety standards, such as India's requirements for ABS on heavy vehicles. This region represents a high-volume, potentially high-growth market, focusing initially on mandatory safety features (ABS, basic EBS) but quickly moving toward advanced stability controls driven by domestic and export demands.

- Europe: Europe represents a technologically mature market characterized by early and widespread adoption of stringent regulations, including mandatory ESC and AEBS (Advanced Emergency Braking Systems) integration. Demand is centered on high-specification, sophisticated systems compatible with autonomous driving features, advanced diagnostics, and solutions for electric/hybrid CVs, emphasizing redundancy and functional safety (ISO 26262 compliance).

- North America: The North American market is highly competitive and regulation-driven, particularly by the Federal Motor Vehicle Safety Standards (FMVSS). Key focus areas include improving stopping distance requirements, maximizing fuel efficiency through optimized air management, and supporting the deployment of large-scale platooning and semi-autonomous trucking operations that require highly robust, interconnected braking controls capable of high-speed synchronization.

- Latin America (LATAM): This region exhibits moderate growth, driven by recovering economies and increased trade activity. While adoption lags behind Europe and North America, regulatory bodies are progressively implementing mandates for basic safety features, creating substantial opportunities for mid-range EBS and pneumatic systems, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is heterogeneous, driven largely by oil and gas logistics and infrastructure investment in the Gulf Cooperation Council (GCC) countries. Demand is often focused on durable, reliable systems capable of functioning effectively in extreme heat and dusty conditions. Market penetration of advanced electronic controls is still lower compared to global averages, offering potential for future market entry as safety awareness and regulations strengthen.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CV Brake Controls Market.- ZF Friedrichshafen AG (including WABCO)

- Knorr-Bremse AG (including Haldex)

- Continental AG

- Robert Bosch GmbH

- Bendix Commercial Vehicle Systems LLC

- Meritor (now part of Cummins)

- TSE Brakes

- SORL Auto Parts

- Minda Corporation

- Wabtec Corporation

- Hengst SE

- Parker Hannifin Corporation

- Aisin Seiki Co., Ltd.

- FTE automotive

- Delphi Technologies (BorgWarner)

- Eaton Corporation plc

- Hella GmbH & Co. KGaA

- Carlisle Brake & Friction

- MICO Inc.

Frequently Asked Questions

Analyze common user questions about the CV Brake Controls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the CV Brake Controls Market?

The primary driver is the stringent enforcement of global safety regulations mandating advanced braking technologies, such as Electronic Stability Control (ESC) and Anti-lock Braking Systems (ABS), across new commercial vehicle fleets worldwide, thereby standardizing high-performance safety features.

How do Electronic Braking Systems (EBS) differ from traditional pneumatic systems?

EBS utilizes electronic signals to control the braking pressure, offering significantly faster response times, more precise force modulation, and seamless integration with complex safety functions like ESC, which is superior to the slower, purely air-driven control of traditional pneumatic systems.

What role does the electrification of commercial vehicles play in this market?

Electrification necessitates specialized brake control units and software to effectively manage 'brake blending,' which is the complex process of seamlessly combining frictional braking with regenerative braking for maximum energy recovery while maintaining consistent stopping performance and vehicle safety.

Which geographical region holds the highest potential for market expansion?

The Asia Pacific region, specifically China and India, holds the highest expansion potential due to robust growth in the logistics sector, high commercial vehicle production volumes, and accelerating governmental mandates for modern brake control technologies.

What are the major challenges facing brake system manufacturers?

Key challenges include managing the high complexity and integration costs of advanced electronic systems (ADAS compatibility), ensuring robust cybersecurity protection against digital threats, and navigating stringent functional safety standards required for autonomous driving readiness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager