Cycling Gloves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441871 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Cycling Gloves Market Size

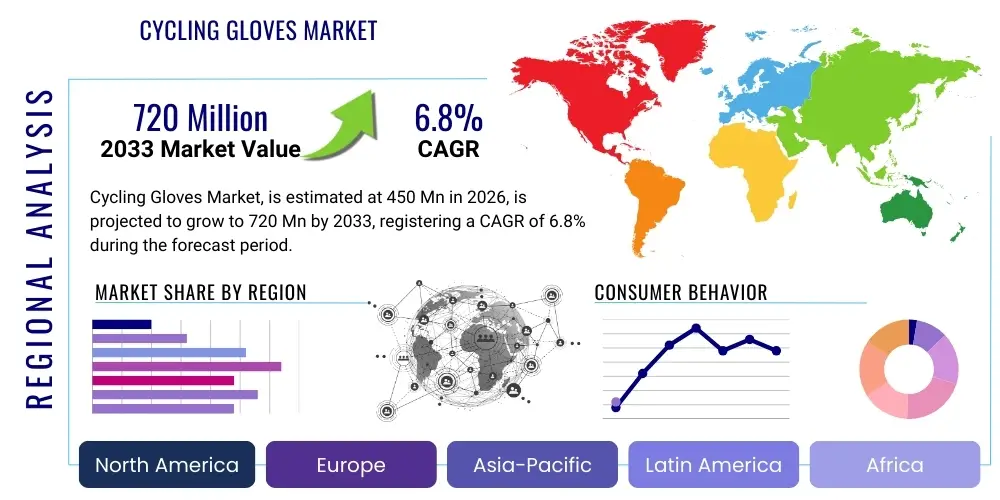

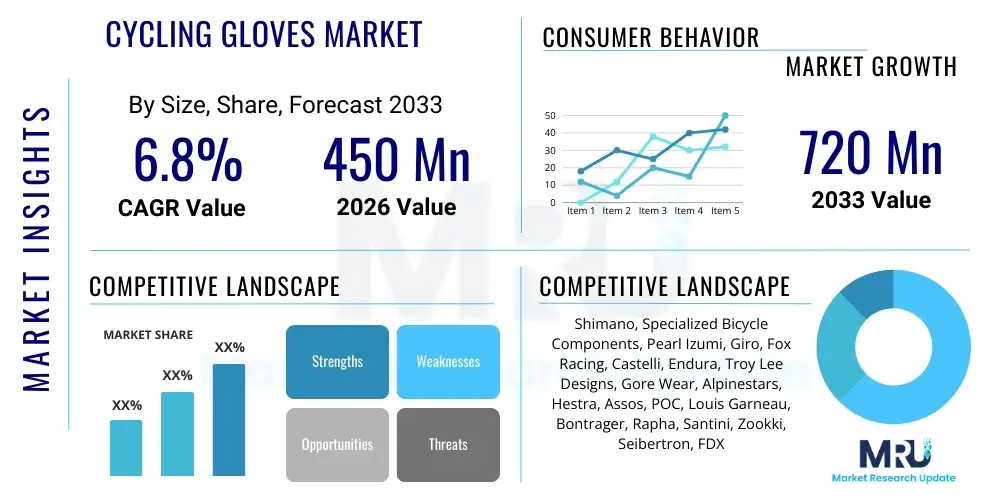

The Cycling Gloves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Cycling Gloves Market introduction

The Cycling Gloves Market is characterized by its essential role in enhancing cyclist safety, performance, and comfort across all cycling disciplines, ranging from high-intensity professional road racing to casual urban commuting and rugged mountain biking. These accessories are fundamentally designed to provide critical vibration dampening, protect hands from abrasions in the event of falls, and significantly improve grip, especially in varied weather conditions. Market growth is structurally underpinned by the increasing global emphasis on health and wellness, leading to a higher rate of participation in cycling as both a sport and a sustainable mode of transport. The complexity of the product lies in balancing protection, breathability, and tactile feedback, necessitating continuous innovation in material science, particularly regarding padding materials like specialized gels and memory foams, and moisture-wicking synthetic fabrics like Lycra and proprietary blends. The market landscape is highly competitive, driven by both established sports apparel giants and specialized cycling gear manufacturers who compete intensely on features such as ergonomic design, durability, and integration of smart technologies. The evolution of specialized cycling disciplines, such as e-bike usage and gravel riding, further necessitates the development of highly specific glove models catering to unique demands for robust protection and enhanced cushioning. The core benefits derived from these gloves—prevention of pressure points leading to nerve damage, minimization of hand fatigue, and superior handlebar control—cement their status as indispensable cycling gear, driving consistent demand growth throughout the forecast period.

Product description analysis reveals that cycling gloves are not homogenous but are segmented based on finger coverage (full-finger gloves offering maximum protection from cold and debris, versus half-finger gloves optimizing ventilation and tactile feel during warmer months). Furthermore, the design incorporates strategic features such as seamless palm construction to minimize friction, wrist closures utilizing Velcro or elastic materials for secure fit, and often, conductive material integration in fingertips for seamless smartphone operation. The specialized application of these gloves dictates material choice and construction methodology; for instance, mountain biking gloves require significantly more durable fabrics and reinforced knuckle protection against trail obstacles, while road racing gloves prioritize lightness, aerodynamic efficiency, and minimal bulk. The proliferation of diverse cycling segments has amplified the complexity of product offerings, ensuring that consumers have access to optimized gear regardless of their specific riding environment or intensity level. The ongoing trend toward customization and personalization, leveraging advanced manufacturing techniques, is also becoming a substantial factor in premium market segments. Manufacturers are increasingly focusing on sustainable and environmentally friendly materials, responding to the growing consumer preference for eco-conscious sporting goods, thereby integrating recycled polyesters and bio-based foams into their production processes to enhance brand appeal and market differentiation.

Major applications span recreational cycling, competitive cycling, off-road cycling (MTB), and specialized touring or endurance events. The driving factors propelling the market include government initiatives promoting cycling infrastructure and adoption in urban centers, increasing health consciousness leading to higher bicycle sales globally, and continuous product innovations focused on enhanced shock absorption and thermal regulation. Specifically, the rise in cycling tourism and the expansion of cycling events globally, such as Gran Fondos and major professional tours, generate significant demand for high-performance and durable cycling apparel, including gloves. Furthermore, the substantial safety benefits, particularly the reduction in road rash injuries and cumulative hand trauma, serve as persuasive purchasing drivers for both novice and experienced cyclists. Economic growth in developing regions, coupled with improved disposable income, is enabling wider consumer access to specialized cycling equipment. The convergence of fashion, technology, and functionality further enhances market attractiveness, positioning cycling gloves not just as utilitarian safety gear but also as a key component of the cycling ensemble. The perpetual cycle of technological refinement ensures that newer models consistently offer demonstrably superior comfort and performance metrics over previous generations, maintaining high engagement in the replacement market.

Cycling Gloves Market Executive Summary

The global Cycling Gloves Market is experiencing robust expansion driven by converging trends in sustainable mobility, health-oriented consumer behavior, and sophisticated material innovation. Key business trends indicate a significant shift towards Direct-to-Consumer (D2C) models, leveraging e-commerce platforms to bypass traditional retail distribution, allowing specialized brands to reach niche audiences globally and control brand messaging more effectively. Furthermore, strategic partnerships between cycling component manufacturers and apparel companies are becoming common, aiming to provide fully integrated ergonomic solutions from the handlebar grip to the glove padding. Investment in R&D is heavily skewed towards developing intelligent textiles that can integrate biofeedback sensors or automatically adjust thermal properties, pushing the average selling price (ASP) upward for premium offerings. Consolidation through mergers and acquisitions is also evident, as larger sporting goods conglomerates seek to acquire specialized cycling apparel brands to quickly gain market share and proprietary textile technology access. Sustainability mandates and circular economy principles are influencing manufacturing processes, favoring suppliers who can demonstrate reduced environmental impact and traceable supply chains for materials like recycled nylon and responsibly sourced leather alternatives, establishing a competitive edge in environmentally sensitive markets.

Regionally, the market demonstrates heterogeneous growth patterns. North America and Europe remain the primary revenue generators, characterized by high consumer spending power, established cycling cultures, and well-developed infrastructure supporting both recreational and competitive cycling. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR, primarily fueled by massive urbanization, increased governmental investment in cycling infrastructure (notably in China, Japan, and South Korea), and a burgeoning middle class adopting cycling for leisure and fitness. Within APAC, the proliferation of electric bicycles (e-bikes) is creating a significant ancillary market demand for specialized gloves that often require enhanced durability and insulation due to higher sustained speeds. The Middle East and Africa (MEA) and Latin America (LATAM) show promising growth potential, contingent on improving economic stability and the successful implementation of public health campaigns promoting physical activity. European countries, particularly the Netherlands, Denmark, and Germany, continue to lead in per capita consumption due to strong policy support for cycling as a primary transport mode. Successfully navigating regional consumer preferences—such as the strong demand for thermal gloves in Northern European winters versus highly ventilated gloves in Southeast Asia—is paramount for strategic market penetration.

Segment trends underscore the enduring popularity of synthetic fabric gloves over traditional leather, primarily due to advancements in synthetic material technology offering superior moisture management, lightweight characteristics, and easier maintenance. Within the type segmentation, full-finger gloves are gaining traction year-round, extending their use beyond cold weather due to increased consumer awareness regarding UV protection and comprehensive abrasion resistance, especially prevalent among mountain bikers and gravel cyclists. The distribution channel analysis highlights the continued dominance of Specialty Cycling Stores, which offer expert fitting and personalized advice, complementing the explosive growth witnessed in the Online Retail segment, valued for convenience, competitive pricing, and extensive product variety. Technological segmentation is evolving rapidly, with gel padding solutions consistently preferred over traditional foam for superior shock absorption and pressure distribution, critical for long-distance riding comfort and reducing the incidence of cycling-related neurological disorders. The competitive landscape is forcing manufacturers to diversify their portfolios rapidly, ensuring they cover the entire spectrum of consumer needs, from entry-level commuter gloves to highly technical, performance-optimized racing gloves, ensuring market dynamism and sustained consumer engagement across all price points.

AI Impact Analysis on Cycling Gloves Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cycling Gloves Market primarily revolve around how AI can enhance product design optimization, personalize fit and material recommendations, and streamline the manufacturing supply chain. Common themes include the potential for AI algorithms to analyze biomechanical data from riders to create truly custom ergonomic patterns, moving beyond standard size charts to mitigate pressure points specific to individual hand geometry and riding posture. Concerns often focus on the required data privacy needed for personalized fitting solutions and the capital expenditure required for integrating AI-driven design software and smart manufacturing equipment into existing production lines, especially for smaller market players. Users also frequently inquire about the role of predictive analytics, particularly concerning forecasting demand variability influenced by regional weather patterns and cycling event schedules, which could optimize inventory management for seasonal products like gloves. Expectations are high for AI to reduce material waste through more efficient pattern cutting (nesting algorithms) and to facilitate rapid prototyping cycles for new fabric technologies and padding configurations, accelerating the time-to-market for innovative products and responding quickly to emerging cycling trends.

AI’s influence is manifesting significantly in the design phase, where Generative Design tools leverage machine learning to iterate thousands of potential padding shapes and placement configurations based on predefined performance constraints (e.g., maximum pressure reduction, minimum weight). This allows designers to achieve optimal ergonomic layouts that were previously unattainable through traditional iterative design methods. Specifically, AI can process vast datasets related to pressure mapping, cyclist anatomy, vibration frequency analysis, and material properties to recommend the perfect balance of stiffness, flexibility, and cushioning required for specific cycling disciplines, such as high-frequency vibration absorption required in road racing versus heavy impact protection needed in downhill mountain biking. Furthermore, computational fluid dynamics (CFD) simulations, increasingly augmented by machine learning, are used to analyze the aerodynamic profile of gloves, crucial in competitive segments where marginal gains are paramount. This systematic, data-driven approach elevates the performance ceiling of cycling gloves, transforming them from simple protective gear into highly technical performance instruments.

In manufacturing and supply chain management, AI plays a pivotal role in optimizing operational efficiency. Machine vision systems powered by AI are employed for quality control, ensuring consistent stitching, uniform padding thickness, and fault detection in complex material assemblies, significantly reducing manufacturing defects and improving overall product reliability. Predictive maintenance using sensor data on machinery minimizes downtime, ensuring continuous production flow. In logistics, AI-driven demand forecasting leverages historical sales data, promotional calendars, macroeconomic indicators, and even real-time weather data feeds to accurately predict localized demand fluctuations. This capability is critical for managing the highly seasonal inventory requirements of cycling gloves, preventing stockouts during peak seasons and minimizing excess inventory during off-peak periods. The integration of AI therefore supports both product innovation (design) and operational excellence (manufacturing and logistics), collectively driving market competitiveness and ensuring a faster, more tailored consumer experience.

- AI optimizes ergonomic design via Generative Design tools analyzing biomechanical data.

- Machine learning algorithms enhance material selection for specific pressure relief and impact absorption.

- Predictive analytics streamline global supply chains by forecasting seasonal and regional demand variations.

- AI-powered machine vision systems improve manufacturing quality control and defect detection.

- Customized fit recommendations utilizing rider data enhance personalization and consumer satisfaction.

DRO & Impact Forces Of Cycling Gloves Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the competitive intensity and growth trajectory of the Cycling Gloves Market. The primary Drivers include the global expansion of cycling as a leisure activity and competitive sport, reinforced by substantial public and private investment in cycling infrastructure globally, such as dedicated bike lanes and public bike-sharing schemes. Furthermore, increasing consumer awareness regarding hand protection, nerve damage prevention (like Cyclist's Palsy), and overall riding comfort serves as a consistent demand stimulant. Continuous material innovation, particularly in gel and synthetic foam padding that offers superior shock absorption and reduced bulk, drives consumers toward product upgrades. Conversely, Restraints primarily involve the seasonal nature of cycling in many temperate climates, leading to unpredictable demand cycles and inventory management complexities. Price sensitivity in emerging markets, where generic or unbranded protective gear often competes heavily with established premium brands, poses a significant challenge to margin maintenance. Moreover, the prevalence of counterfeit products, especially in online marketplaces, undermines brand integrity and legitimate sales revenues, requiring sustained effort in intellectual property protection and authorized distribution management to mitigate impact.

Opportunities within the market center on several key areas. The burgeoning market for electric bicycles (e-bikes) presents a unique opportunity, as e-bike riders often require gloves offering specific attributes, such as enhanced grip for higher speeds and increased vibration dampening due to differing frame geometries and weight distributions. Secondly, market penetration in underserved geographies, particularly in Latin America and Southeast Asia, through localized marketing strategies and regionally tailored product lines focused on climate-appropriate materials, represents substantial untapped potential. The integration of smart technology, such as embedded sensors for tracking hand fatigue, grip force, or even utilizing conductive threads for seamless device interaction, is creating a high-value, niche segment. Furthermore, manufacturers focusing on sustainable production practices, utilizing recycled or bio-based materials, can capitalize on the growing consumer demand for eco-friendly athletic apparel, positioning themselves as leaders in corporate social responsibility (CSR) initiatives. Leveraging advanced 3D printing technologies for customized padding inserts offers a unique opportunity to provide highly personalized ergonomic solutions, moving the industry toward mass customization models that enhance rider performance and comfort significantly.

The Impact Forces shaping this market—derived from Porter's Five Forces analysis—indicate moderate to high competitive rivalry. The market is fragmented, with many specialized and global players vying for consumer attention, leading to aggressive pricing strategies and rapid product introduction cycles. The bargaining power of buyers is moderate to high due to the availability of numerous substitute products and low switching costs; however, this power is slightly mitigated in the premium segment where brand loyalty and specialized features command higher prices. The bargaining power of suppliers is relatively low, especially for common synthetic textiles, but increases significantly for specialized, proprietary materials like certain high-density gels or advanced membrane fabrics used for waterproofing or breathability. The threat of new entrants is moderate, as while capital investment for basic manufacturing is manageable, establishing brand recognition and distribution networks, especially securing placement in key specialty retail channels, presents a substantial barrier. Finally, the threat of substitutes is considerable; while direct substitutes for high-performance cycling gloves are limited, general sports gloves or non-specialized alternatives often capture the lower-end commuter market, necessitating consistent differentiation through performance and ergonomic superiority to maintain market share.

Segmentation Analysis

The Cycling Gloves Market is meticulously segmented across several critical dimensions, enabling manufacturers and marketers to target specific consumer needs and cycling disciplines with tailored product offerings. These primary segmentation axes include glove type, material composition, application, and distribution channel. Segmentation based on application is particularly crucial, distinguishing between the robust, heavily padded gloves required for Mountain Biking (MTB), the lightweight, aerodynamic designs favored by Road Cyclists, and the thermally insulated or weatherproof variants essential for touring and winter riding. This comprehensive approach ensures that product development aligns directly with specific rider requirements, optimizing features such as ventilation, protection, and tactile response. The maturity of the market demands nuanced segmentation to capture high-value niche areas, such as gloves designed specifically for female cyclists, addressing anatomical differences, or products optimized for e-bike commuters who prioritize durability and touch-screen compatibility over absolute minimal weight.

A detailed analysis of the material segment shows a fundamental division between traditional leather, valued for its durability and natural grip, and advanced synthetic fabrics (e.g., polyester, nylon, proprietary moisture-wicking blends), which dominate the volume market due to their superior breathability, lightweight nature, and ease of care. Critical differentiation often occurs within the padding sub-segment, where specialized materials such as silicon gel, viscoelastic foam, and proprietary polymer compounds are utilized to maximize shock absorption and evenly distribute pressure across the ulnar and median nerves, directly influencing long-ride comfort and injury prevention. The choice of closure mechanisms, such as adjustable Velcro straps, elasticized cuffs, or slip-on designs, also contributes significantly to functional segmentation, affecting the glove's security, ease of removal, and overall comfort during intense activities. Manufacturers strategically utilize these material combinations to position their products effectively across different price points, from budget-friendly commuter gloves to highly technical, multi-layered racing apparel that justifies premium pricing.

The distribution channel segmentation highlights the evolving landscape of retail interaction. While brick-and-mortar Specialty Cycling Stores continue to be vital for consumers seeking personalized fitting advice and immediate product evaluation, the Online Retail channel, encompassing both proprietary brand websites and major e-commerce platforms, is exhibiting explosive growth. This channel offers unparalleled accessibility, convenience, and often more competitive pricing, particularly crucial for geographically dispersed customers. Furthermore, the segmentation by end-user—ranging from amateur hobbyists and daily commuters to elite professional athletes—dictates the required performance specifications, durability standards, and price tolerance. Professional segments require uncompromising performance and adherence to strict racing regulations, whereas commuter segments prioritize visibility (reflective elements) and weather protection. Understanding these varied demands across segments allows for precise inventory management and targeted marketing campaigns that resonate effectively with the intended consumer demographic.

- Type: Half-finger Gloves, Full-finger Gloves

- Material: Leather, Synthetic Fabrics (Polyester, Lycra, Nylon), Advanced Padding (Gel, Viscoelastic Foam, Proprietary Polymers)

- Application: Road Cycling (Racing, Endurance), Mountain Biking (Downhill, Trail, Cross-Country), Leisure Cycling (Commuting, Touring), BMX/Dirt Jumping

- Distribution Channel: Specialty Cycling Stores, Online Retail (Brand Websites, E-commerce Platforms), Sporting Goods Stores, Hypermarkets/Supermarkets

- End-User: Amateur Cyclists, Professional Athletes, Commuters, Recreational Riders

Value Chain Analysis For Cycling Gloves Market

The Value Chain for the Cycling Gloves Market begins with Upstream Analysis, which involves the sourcing and processing of core raw materials. This stage is crucial and highly sensitive to global commodity price fluctuations and sustainability concerns. Key raw materials include specialized synthetic textiles (e.g., Lycra, spandex, breathable mesh fabrics, proprietary waterproof membranes like Gore-Tex equivalents), various types of leather (though decreasingly used), and highly engineered padding materials such as specialized silicone gels, high-density polyurethane foams, and viscoelastic inserts. Sourcing complexity arises from the need for high-performance characteristics—such as moisture-wicking abilities, abrasion resistance, and UV protection—requiring relationships with specialized textile mills. Research and development activities, including textile engineering and ergonomic design conceptualization, are integrated into this upstream phase, setting the foundation for product quality and differentiation. Maintaining a robust and ethical supply chain for these specialized components is paramount for ensuring consistent product quality and meeting increasingly strict environmental and labor standards imposed by international markets and conscious consumers.

Midstream activities encompass the manufacturing, assembly, and finishing processes. This stage involves sophisticated pattern cutting (often utilizing computer-aided design and laser cutting for precision), complex stitching and seam sealing (particularly for waterproof models), integration of padding and ergonomic features, and application of branding elements. Quality control is a major value-add here, ensuring the durability and performance integrity of the gloves under stressful cycling conditions. Due to the labor-intensive nature of glove assembly, manufacturing operations are often concentrated in regions offering specialized labor skills and cost efficiencies, predominantly in Asia Pacific countries. Manufacturers must optimize production processes to handle small-batch runs for specialized high-end models while simultaneously achieving economies of scale for mass-market products. Strategic midstream management focuses heavily on lean manufacturing techniques to minimize waste and reduce production lead times, crucial for responding swiftly to seasonal demand shifts and fast-moving fashion cycles within the cycling apparel industry.

Downstream analysis focuses on Distribution Channels and the path to the end consumer. Distribution is segmented into Direct and Indirect channels. Direct channels involve sales through the company's own e-commerce platforms and flagship stores, offering maximum margin control and direct consumer data acquisition, critical for personalized marketing and product feedback. Indirect channels include wholesale distribution to Specialty Cycling Stores (providing expert sales consultation and fitting services), large Sporting Goods Retailers (offering broad market reach), and major third-party E-commerce Platforms (ensuring global availability and convenience). Specialty stores act as crucial touchpoints for premium sales, relying on detailed product knowledge and the ability to educate consumers on the technical benefits of advanced padding and material technologies. Effective downstream logistics management, including optimized warehousing and efficient global shipping, is necessary to ensure product availability during peak cycling seasons, maximizing market penetration and consumer satisfaction across diverse geographical territories.

Cycling Gloves Market Potential Customers

Potential customers for the Cycling Gloves Market are highly diverse and can be broadly categorized based on their commitment level, cycling discipline, and purchasing drivers. The core demographic includes dedicated recreational cyclists and enthusiasts who participate in regular weekend rides, long-distance touring, or fitness cycling. This group prioritizes performance, durability, and comfort, making them prime targets for mid-to-high range products featuring advanced padding technology (gel/foam) and premium moisture-wicking fabrics. Their purchasing decisions are heavily influenced by reviews from specialized cycling media, recommendations from peers, and technical specifications that promise tangible benefits, such as reduced vibration fatigue and enhanced anatomical support. This customer base is often willing to invest significant capital in specialized gear to maximize their riding enjoyment and minimize the risk of injury, representing a stable and profitable segment for premium glove manufacturers.

A secondary, high-volume customer segment comprises urban commuters and casual riders who utilize bicycles for transport, errands, or occasional leisure. This group places a greater emphasis on practicality, visibility (e.g., integrated reflective elements), and protection against minor elements, often favoring durable, multi-purpose gloves at a more accessible price point. While they might not require the hyper-specialized features of racing gloves, they are essential volume drivers, particularly responding well to value propositions that include weather resistance, easy maintenance, and robust construction suitable for daily wear and tear. Retail strategies targeting this segment often utilize large sporting goods stores and general e-commerce platforms, capitalizing on convenience and comparative pricing. The burgeoning popularity of public bike-sharing schemes also contributes to this segment, although these users typically buy their own protective accessories rather than relying on rental provisions, driving consistent demand for entry-level and mid-range functional gloves.

The third crucial segment involves professional athletes and competitive cyclists across road, track, and mountain biking disciplines. These customers demand the absolute highest level of technical performance, prioritizing minimal weight, aerodynamic efficiency, tactile feedback, and regulatory compliance. Their purchase cycles are often tied to race schedules and sponsorship agreements, demanding the latest innovations in materials and design. Manufacturers utilize feedback from these elite athletes for R&D purposes, using the insights gained to trickle down advanced features into mass-market products, leveraging professional endorsements for credibility and market authority. Furthermore, the rising adoption of cycling by women and youth also constitutes rapidly growing sub-segments, requiring anatomically optimized designs and size ranges that cater specifically to their needs, driving product portfolio expansion and generating new opportunities for targeted marketing and specialized product development within the broader market structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shimano, Specialized Bicycle Components, Pearl Izumi, Giro, Fox Racing, Castelli, Endura, Troy Lee Designs, Gore Wear, Alpinestars, Hestra, Assos, POC, Louis Garneau, Bontrager, Rapha, Santini, Zookki, Seibertron, FDX |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cycling Gloves Market Key Technology Landscape

The technology landscape of the Cycling Gloves Market is predominantly defined by advancements in textile engineering, padding materials science, and ergonomic design methodologies. A primary technological focus involves the development of proprietary synthetic fabrics that offer exceptional moisture management, high breathability, and robust abrasion resistance without compromising flexibility or tactile feedback. Manufacturers are increasingly utilizing advanced membrane technologies (similar to high-performance outdoor wear) to create fully waterproof and windproof gloves that remain highly breathable, crucial for maintaining thermal comfort in adverse weather conditions. Furthermore, seamless knitting technology is being adopted to minimize irritation and pressure points, moving away from traditional cut-and-sew methods, thereby enhancing the fit and longevity of the product. The application of highly reflective materials and integrated LED lighting systems represents an evolving safety technology, significantly improving rider visibility during low-light conditions, appealing strongly to the commuter segment and enhancing overall product safety attributes in urban environments.

Padding technology represents the most significant area of material science innovation. The evolution from simple foam to complex viscoelastic polymers and strategically shaped gel inserts has dramatically improved shock absorption capabilities. Key technological developments include targeted pressure relief systems, which map high-pressure zones on the palm corresponding to the ulnar and median nerves, designing padding placement and density specifically to mitigate compression and potential nerve damage (Cyclist's Palsy). Advanced 3D printing and scanning technologies are beginning to be utilized in the premium segment to create highly customized, anatomically specific padding inserts tailored to an individual rider's hand shape and preferred handlebar geometry, marking a significant step towards true mass customization in cycling apparel. These innovations not only improve performance and comfort but also serve as key differentiating factors, allowing brands to justify premium price points by offering scientifically validated ergonomic benefits that enhance long-distance endurance.

Beyond materials, smart textile integration is an emerging technological frontier. Though still nascent, conductive fabrics and embedded micro-sensors are being tested in concept gloves to monitor biomechanical parameters such as grip pressure, hand temperature, and even potential physiological indicators like heart rate, relaying this data wirelessly to cycle computers or smart devices. While full market penetration of smart gloves is yet to materialize due to cost and battery life constraints, the ability to collect and analyze real-time performance data holds immense potential for professional training optimization and injury prevention. Furthermore, the manufacturing process itself benefits from technological advancements such as automated pattern recognition systems (AI-driven) for quality control and sophisticated bonding techniques that replace stitching in critical areas, ensuring lighter weight and better impermeability, collectively solidifying the technological basis for sustained product performance enhancement in the global Cycling Gloves Market.

Regional Highlights

- North America: This region is characterized by high disposable income, strong demand for premium and specialized gear, and robust participation in both road cycling and intense mountain biking. The U.S. and Canada drive market growth, heavily influenced by fitness culture and major cycling events. Manufacturers focus on durable, performance-oriented full-finger gloves for varied terrain and weather. E-commerce dominance is pronounced, although specialized retailers maintain strong influence through professional fitting services.

- Europe: Europe remains a mature and leading market, underpinned by deep-rooted cycling culture, strong government support for sustainable transportation, and high density of competitive cycling organizations. Countries like Germany, the Netherlands, and the UK demonstrate high per capita consumption. The market shows a high demand for technologically advanced products, including thermal, windproof, and waterproof gloves utilizing cutting-edge membrane materials due to diverse climate conditions across the continent.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is driven by rapid urbanization, increasing middle-class income, and governmental promotion of cycling in nations like China, Japan, and South Korea. Demand is shifting from basic protective gear to specialized athletic equipment. The hot and humid climate in Southeast Asia specifically fuels high demand for lightweight, highly ventilated half-finger gloves that emphasize moisture-wicking properties and UV protection.

- Latin America (LATAM): Growth in LATAM is promising, albeit sensitive to macroeconomic instability. Key markets like Brazil and Mexico are developing strong cycling communities, particularly in MTB and competitive road cycling. The demand profile is price-sensitive but shows increasing interest in mid-range durable gloves that offer a balance of performance and longevity, often favoring synthetic materials for cost efficiency.

- Middle East and Africa (MEA): This region is a developing market with growth concentrated in urban centers (e.g., UAE, Saudi Arabia, South Africa). Market expansion is tied to rising awareness of cycling as a fitness activity. The focus is on lightweight, high-UV-protection gloves in the Middle Eastern countries due to intense heat, while South Africa shows a stronger affinity for off-road cycling gear, requiring robust, protective gloves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cycling Gloves Market.- Shimano

- Specialized Bicycle Components

- Pearl Izumi

- Giro

- Fox Racing

- Castelli

- Endura

- Troy Lee Designs

- Gore Wear

- Alpinestars

- Hestra

- Assos

- POC

- Louis Garneau

- Bontrager

- Rapha

- Santini

- Zookki

- Seibertron

- FDX

Frequently Asked Questions

Analyze common user questions about the Cycling Gloves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Cycling Gloves Market?

The primary driver for market growth is the global surge in recreational and competitive cycling participation, directly correlated with increasing consumer focus on health, wellness, and sustainable urban mobility. This trend is amplified by continuous material science innovations offering superior ergonomic comfort and critical hand protection.

Which material segment currently dominates the Cycling Gloves Market?

Synthetic fabrics, including proprietary blends of polyester, Lycra, and Nylon, dominate the market due to their superior performance characteristics such as moisture-wicking capabilities, light weight, and breathability. Advanced padding materials like specialized silicone gel inserts are crucial sub-segments for high-end shock absorption and nerve protection.

How is the rise of e-bikes influencing the demand for cycling gloves?

The increasing adoption of e-bikes creates demand for specialized gloves that offer enhanced durability and increased grip security necessary for sustained higher speeds compared to traditional bicycles. E-bike riders often require gloves with integrated weather protection and robustness suitable for year-round commuting and touring.

What is the most rapidly growing region in the Cycling Gloves Market forecast?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, expanding cycling infrastructure investments, and increasing disposable income leading to greater adoption of cycling as both a sport and transportation method, particularly in dense metropolitan areas across East and Southeast Asia.

What role does Artificial Intelligence (AI) play in the future of cycling glove manufacturing?

AI is strategically employed to optimize the design process through generative design algorithms, creating anatomically perfect padding placements for maximum comfort and pressure mitigation. Additionally, AI enhances supply chain efficiency via predictive demand forecasting and improves manufacturing quality control through advanced machine vision systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager