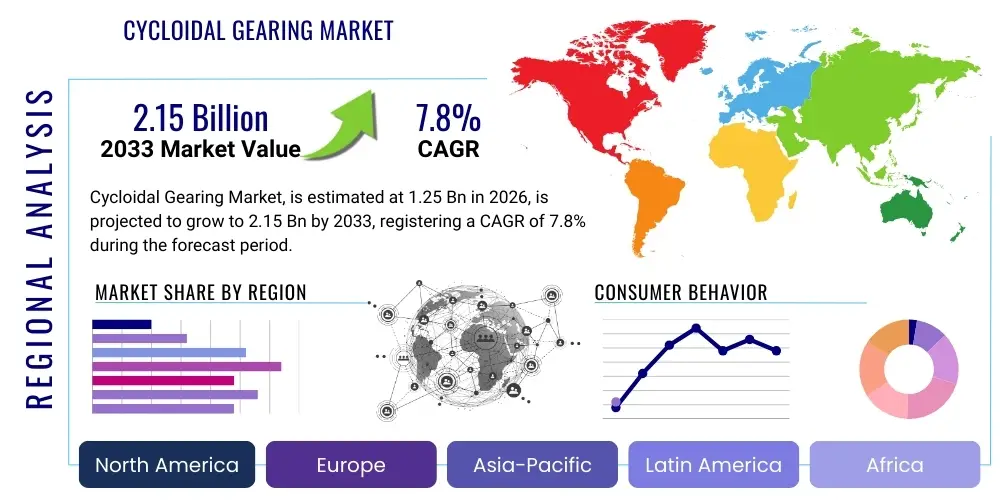

Cycloidal Gearing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443491 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Cycloidal Gearing Market Size

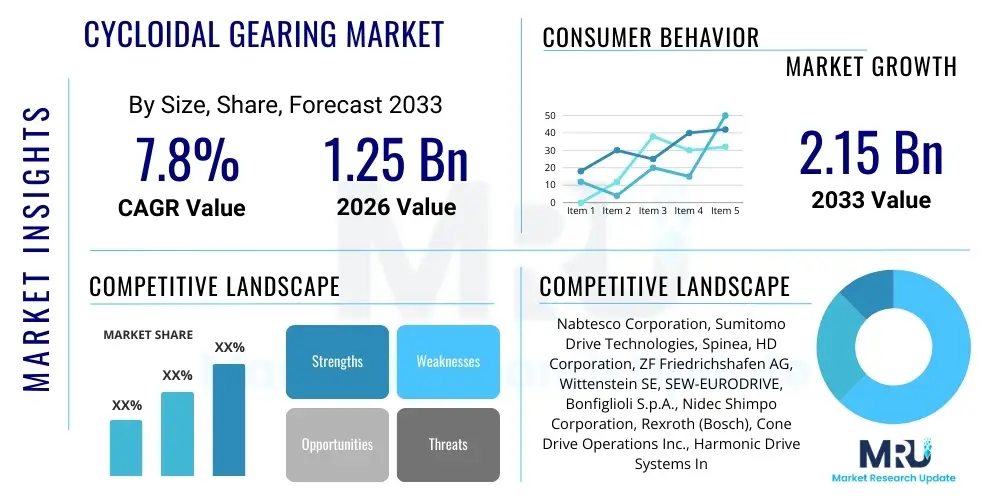

The Cycloidal Gearing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033.

Cycloidal Gearing Market introduction

The cycloidal gearing market is defined by the production and distribution of high-performance speed reduction mechanisms that employ a unique kinematic principle involving cycloidal discs and roller pins, fundamentally differing from traditional involute gearing systems. This distinctive design grants cycloidal reducers superior operational characteristics, including remarkably high reduction ratios within a single stage, extreme resistance to shock loads, and zero or near-zero backlash capability. These attributes are non-negotiable in modern precision motion control applications. The core product, the cycloidal speed reducer, serves as the critical mechanical interface between a motor and the output shaft, enabling precise manipulation of heavy loads or achieving highly accurate positional repeatability in automated systems. Key manufacturers focus intensely on material science and grinding precision to maintain the tight tolerances essential for peak performance and longevity in highly dynamic environments.

The primary applications driving the substantial demand for cycloidal gearing are centered around sophisticated industrial automation, particularly multi-axis robotic arms and high-precision machine tools such as CNC machining centers. In robotics, the stiffness and low backlash of cycloidal drives are crucial for achieving micron-level accuracy and maintaining rigidity when the arm is subjected to dynamic forces or high payloads. Beyond manufacturing, these gearing solutions are increasingly vital in emerging sectors like medical robotics (e.g., surgical assistance platforms) and specialized cleanroom equipment for semiconductor manufacturing, where failure tolerance is virtually zero. The inherent benefits of the design—including a large number of contact points (distributed load sharing) and a compact form factor relative to torque capacity—allow engineers to design smaller, more powerful, and reliable mechanical systems compared to those utilizing conventional gear trains.

Market expansion is powerfully propelled by global macro-trends, including the rapid acceleration of Industry 4.0 adoption, mandating highly reliable mechanical components capable of seamless integration into digital control ecosystems. Furthermore, the persistent growth in global industrial output, coupled with labor cost increases, forces manufacturers across all sectors to invest heavily in automated machinery. This investment cycle directly translates into increased procurement of cycloidal drives. Driving factors also encompass the continuous improvement in manufacturing processes, such as the implementation of advanced grinding techniques and superior surface coatings, which reduce friction losses and increase the efficiency and lifespan of the drives, making the total cost of ownership increasingly attractive to end-users over traditional alternatives.

Cycloidal Gearing Market Executive Summary

The Cycloidal Gearing Market is undergoing rapid technological and commercial evolution, underpinned by several prominent business trends. Strategically, market leaders are focusing on vertically integrating their supply chains to maintain tight control over the high-precision machining of critical components, essential for ensuring consistent zero-backlash performance and mitigating supply risks. There is a marked shift toward offering highly customized, modular drive solutions that integrate seamlessly with various motor technologies (AC servo, stepper motors) and industrial communication protocols. Furthermore, competitive strategy increasingly revolves around expanding service and aftermarket support, providing comprehensive predictive maintenance solutions and faster turnaround times for component replacement, which is critical for end-users operating high-cost, continuous production lines. New business models include leasing or performance-based contracts for integrated robotic actuator units utilizing cycloidal drives, moving beyond simple component sales.

Regional trends continue to be dominated by the Asia Pacific (APAC) region, which commands the largest market share due to substantial capital investments in electronics, automotive, and general manufacturing automation, predominantly centered in China, Japan, and South Korea. However, North America and Europe demonstrate robust growth driven by high-value, niche applications requiring ultra-high precision, such as defense systems, high-speed packaging, and sophisticated medical devices. In these Western markets, the adoption of collaborative robots (cobots), which rely on safe, precise, and compact cycloidal drives, is a particularly strong regional trend. Regulatory pressures regarding environmental sustainability and energy efficiency also favor cycloidal technology in mature markets, as its inherent efficiency often surpasses older gearing systems, supporting regional growth through mandatory efficiency upgrades.

Segmentation analysis underscores the vitality of the industrial robotics application segment, which serves as the primary revenue generator and innovation incubator for the entire market. Trends within segmentation reveal growing demand for hybrid cycloidal-planetary systems that leverage the strengths of both designs, offering a balance of reduction ratio, efficiency, and cost for specific intermediate-load applications. The shift towards higher torque capacity drives (>5,000 Nm) is noticeable, fueled by increased automation in heavy industries like mining, construction, and specialized naval equipment. This necessitates manufacturers to invest heavily in robust housing materials and enhanced cooling mechanisms. Overall, the market remains highly competitive, with established Japanese and European precision engineering firms setting the benchmark for quality, while Chinese manufacturers rapidly gain ground through aggressive pricing and expanding capacity across the medium-torque spectrum.

AI Impact Analysis on Cycloidal Gearing Market

User analyses frequently highlight concerns regarding the life cycle management and manufacturing consistency of cycloidal gearing, prompting numerous questions about AI's role in mitigating these challenges. Key user questions revolve around the feasibility of utilizing AI to detect microscopic defects in cycloidal discs during production, which is a major determinant of final product quality, and how machine learning can be employed to optimize the extremely complex grinding and heat treatment processes. Users also express high interest in AI-enabled condition monitoring, specifically asking if AI can reliably predict the onset of gear tooth wear or bearing fatigue far enough in advance to schedule non-disruptive maintenance. The core expectation is that AI will automate quality assurance, reduce variability in production, and unlock greater operational efficiency by moving maintenance from reactive or time-based models to highly accurate predictive models, directly addressing the high total cost of ownership often associated with precision drives.

The integration of Artificial Intelligence into the manufacturing workflow of cycloidal gearing is transforming quality control from a labor-intensive, probabilistic process into a real-time, deterministic one. AI-powered vision systems, coupled with high-resolution cameras and structured light scanners, are capable of inspecting 100% of manufactured cycloidal discs for surface anomalies, micro-cracks, and dimensional deviations that are invisible or difficult to detect consistently using traditional methods. Furthermore, ML algorithms are being applied to multivariate data streams collected from the CNC grinding machines—such as spindle speed, feed rate, temperature, and acoustic emissions—to dynamically adjust cutting parameters. This results in an unprecedented level of control over the geometry and surface finish, drastically reducing scrap rates and ensuring that every component meets the stringent requirements for zero-backlash assembly, thereby significantly improving overall product yield and performance consistency.

Beyond manufacturing, AI profoundly impacts the operational lifespan and reliability of installed cycloidal drives through advanced diagnostics and prognostics. By installing embedded vibration and temperature sensors, AI systems continuously analyze the data signature of the gearbox. Machine learning models trained on vast datasets of healthy and failing gear units can identify subtle shifts in the spectral signature or temperature profile indicative of incipient failure mechanisms, such as minor bearing pitting or lubrication degradation. This enables true predictive maintenance, where the system provides an actionable warning several weeks before potential failure, allowing the end-user to order spares and schedule replacement during planned downtime, eliminating costly catastrophic failures and maximizing the effective utilization of high-value industrial assets. This capability adds significant commercial value to the cycloidal drive offering, justifying premium pricing and establishing a competitive advantage.

- AI-driven Predictive Maintenance: Utilizing ML for real-time monitoring of vibration and temperature to forecast gear failure, optimizing operational uptime.

- Generative Design Optimization: Employing AI tools to create lighter, stronger, and more thermally efficient cycloidal geometries for specialized applications.

- Enhanced Manufacturing Quality Control: Implementing computer vision and deep learning for automated, precise detection of surface defects and dimensional inconsistencies.

- Dynamic Load Adaptation: Developing smart cycloidal drives that adjust lubrication or operational parameters based on real-time load conditions analyzed by embedded AI systems.

- Supply Chain Efficiency: Using predictive analytics to optimize inventory management of critical components and raw materials needed for high-tolerance gearing production.

- Automated Tolerance Adjustment: Applying ML to CNC machine parameters to minimize dimensional variation during the critical grinding of the cycloidal disc profile.

DRO & Impact Forces Of Cycloidal Gearing Market

The market's trajectory is primarily guided by powerful drivers stemming from global economic shifts and technological necessity. A paramount driver is the inexorable demand for increased payload capacity and speed in industrial robotics, particularly in sectors where production cycles are accelerating, such as battery manufacturing and consumer electronics assembly. The inherent structural resilience and high torque-to-volume ratio of cycloidal drives make them uniquely suited for these demanding applications, often displacing less robust planetary or parallel shaft helical drives. Moreover, the expanding field of collaborative robotics (cobots) requires compact, high-precision drives that operate safely and quietly; cycloidal reducers meet these criteria better than most alternatives. This continuous technological pull from the robotics sector ensures sustained investment and innovation in cycloidal drive technology.

Despite the strong demand, significant restraints impede the market's seamless expansion, centered largely on the complexity and cost of manufacturing. The required precision in machining the cycloidal profile and associated components necessitates substantial capital investment in specialized, high-end grinding equipment and strictly controlled cleanroom environments, making economies of scale difficult for smaller entrants. The lengthy lead times often associated with customized, high-tolerance orders also serve as a restraint, forcing system integrators to manage complex logistics. Furthermore, the market faces robust substitution threats from highly specialized zero-backlash harmonic drives in very low-torque, ultra-compact applications (e.g., aerospace antennae positioning) and from optimized high-efficiency planetary drives, particularly where cost sensitivity outweighs the need for extreme shock load resistance.

Crucial market opportunities arise from diversification into high-growth, non-industrial automation sectors. The transition to Electric Vehicles (EVs) presents a vast opportunity, as cycloidal or cycloidal-derived gear systems are being explored for compact, high-efficiency reduction gearboxes in e-axle designs, offering crucial space and weight savings. Simultaneously, the global focus on sustainable energy production creates significant potential, with cycloidal drives finding application in the precise pitch and yaw control mechanisms of large-scale wind turbines, demanding extreme reliability under intermittent, high-stress conditions. The primary impact forces influencing the market dynamics are the intellectual property landscape surrounding cycloidal profiles (patents often held by key Japanese players) and the increasing global regulatory push toward standardizing industrial machinery safety and efficiency, favoring high-quality, certified cycloidal solutions over cheaper, non-compliant alternatives.

Segmentation Analysis

Market segmentation provides essential clarity into the specialized nature of demand within the cycloidal gearing landscape, differentiating requirements based on technical specifications and end-use environments. The classification by Type, notably between Pin Gear Cycloidal Drives and Differential Cycloid Drives, reflects varying design priorities. Pin Gear types are prevalent in large-scale industrial applications due to their exceptional shock load capability and robustness, whereas Differential Cycloid Drives are often preferred where slightly higher input speeds and specialized gear ratios are required, showcasing the technical depth of product specialization available to industrial customers. This granular division allows manufacturers to tailor R&D spending and production line capabilities effectively.

Segmentation based on Torque Capacity (Low, Medium, High) is highly correlated with the end-user industry and application. The Low Torque segment (<500 Nm) primarily serves medical robotics, semiconductor handling, and light laboratory automation, prioritizing zero backlash and precision over sheer power. Conversely, the High Torque segment (>5,000 Nm) is indispensable for heavy-duty applications such as construction equipment, mining machinery, and large industrial mixers, where the inherent structural strength of the cycloidal design is fully utilized. The Medium Torque segment (500 Nm – 5,000 Nm) represents the largest volume market, dominated by standard industrial robotics and general material handling systems, serving as the backbone of modern factory automation.

Finally, the Segmentation by End-Use Industry illuminates the principal revenue streams and growth vectors. The Automotive and Electronics industries, driven by their sheer scale of automation needs, remain critical consumers. However, the fastest growth is projected in the Medical & Healthcare segment due to the rising adoption of sophisticated robotic surgery and diagnostic platforms requiring flawless motion control. Geographically, segmentation remains highly relevant, with regional manufacturing maturity dictating component adoption rates; highly automated economies rely on cycloidal drives for high-value manufacturing, whereas emerging economies are adopting them as they modernize their foundational industrial infrastructure.

- By Type:

- Pin Gear Cycloidal Drives

- Differential Cycloid Drives

- Cyclo-Planetary Hybrid Systems

- By Torque Capacity:

- Low Torque (< 500 Nm) - Precision assembly, medical devices

- Medium Torque (500 Nm – 5,000 Nm) - Standard industrial robotics, packaging

- High Torque (> 5,000 Nm) - Heavy machinery, wind turbines, construction

- By Application:

- Industrial Robotics (Articulated, SCARA, Delta)

- Machine Tools (CNC, Lathes, Indexing)

- Material Handling & Conveying Systems (AS/RS, AGVs)

- Actuation Systems (Linear, Rotary)

- Packaging Machinery (Fillers, Palletizers)

- Medical and Surgical Robotics

- By End-Use Industry:

- Automotive & Transportation (EV component manufacturing)

- Aerospace & Defense (Actuators, positioning systems)

- Mining & Construction (Heavy equipment drives)

- Semiconductor & Electronics (Cleanroom automation)

- Medical & Healthcare (Surgical robots, imaging)

- Food & Beverage (High-speed, sterile packaging)

Value Chain Analysis For Cycloidal Gearing Market

The cycloidal gearing value chain is characterized by a high degree of technical specialization and stringent quality control beginning at the upstream sourcing phase. Upstream analysis focuses predominantly on securing high-purity, specialized raw materials—primarily high-strength alloy steels (e.g., 4140, 8620) known for excellent machinability and heat-treat response, and precision bearing steel. Procurement efficiency is vital, as material imperfections or inconsistencies can lead to catastrophic failure once subjected to high stress cycles. Furthermore, specialized component suppliers for cross-roller bearings, seals, and housing castings must maintain extremely tight supply protocols. This phase is capital-intensive, requiring robust metallurgical testing and certification processes to validate material integrity before entering the manufacturing stage, highlighting the importance of reliable, certified global supply partners.

The midstream process, involving the core manufacturing and assembly, constitutes the highest value-add activity. This stage includes precision CNC turning, milling, and the extremely critical high-precision grinding of the cycloidal discs and pin gears. Manufacturers utilize proprietary grinding techniques, often involving continuous profile measurements and closed-loop feedback systems, to achieve angular transmission accuracy measured in arcminutes. Assembly requires highly skilled technicians operating in temperature-controlled environments to minimize thermal expansion effects on tolerances. After physical assembly, the products undergo comprehensive testing for backlash, torsional stiffness, and thermal runaway, ensuring compliance with both proprietary and industry standards. This core manufacturing capability often represents the greatest competitive barrier to entry in the market.

Downstream activities center on efficient market penetration and long-term service provision. Direct distribution channels are favored by leading multinational manufacturers, especially when serving large Tier 1 automotive suppliers or global robotics integrators (e.g., ABB, KUKA, Fanuc). Direct sales enable tailored technical support, integration consulting, and comprehensive warranty management, crucial for complex automation projects. Indirect distribution relies on specialized industrial distributors and system integrators who add value through regional stocking, local language support, and integrating the gear drive into broader mechanical systems for smaller OEMs or MRO customers. Post-sale, the availability of technical training, remote diagnostics (often enabled by IoT sensors), and rapid parts supply are essential differentiators, directly influencing the total customer lifetime value and the supplier’s reputation for reliability in continuous operation environments.

Cycloidal Gearing Market Potential Customers

The potential customer base for cycloidal gearing is multifaceted, spanning high-tech manufacturing, heavy industry, and specialized niche markets, all united by the common need for high-precision, reliable motion control under challenging conditions. The largest segment of end-users are original equipment manufacturers (OEMs) specializing in industrial automation systems. This includes global leaders in articulated robot manufacturing, who require these components for all major joints (axis 1-6) to ensure the required repeatability and payload handling capacity. Machine tool builders form another significant group, purchasing cycloidal drives for rotary tables, tool changers, and critical axis feeds where stability and precise indexing are vital for machining complex geometries, such as those found in aerospace components and molds.

In addition to traditional automation, high-growth sectors represent crucial targets. Semiconductor manufacturing equipment providers—who build steppers, lithography machines, and wafer handling systems—are key buyers, demanding ultra-low-backlash components certified for cleanroom environments. Similarly, the aerospace and defense industry relies on cycloidal drives for critical actuation systems in aircraft flaps, landing gear mechanisms, and surveillance equipment, where reliability under extreme temperature and pressure variations is mandatory, making them willing to pay a premium for certified performance and robust material construction. These customers typically require extensive documentation and traceability for every component.

The third major category of potential customers includes large-scale infrastructure operators and systems integrators in heavy industries. This encompasses companies managing automated logistics warehouses, utilizing complex AS/RS racks and sorting machinery that run 24/7, necessitating highly durable gearboxes that can withstand continuous cycling and rapid acceleration/deceleration. Furthermore, operators of renewable energy facilities, specifically wind farms, are critical customers for high-torque cycloidal solutions used in the heavy-duty actuators that adjust the massive turbine blades, where component failure can lead to severe operational losses. Targeting these high-load and continuous operation segments requires manufacturers to emphasize durability, thermal management, and shock absorption capabilities in their marketing and product development efforts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nabtesco Corporation, Sumitomo Drive Technologies, Spinea, HD Corporation, ZF Friedrichshafen AG, Wittenstein SE, SEW-EURODRIVE, Bonfiglioli S.p.A., Nidec Shimpo Corporation, Rexroth (Bosch), Cone Drive Operations Inc., Harmonic Drive Systems Inc. (Direct Competitor/Substitutes Provider), Precima Magnettechnik GmbH, Jiangsu Huazhong Reducer Co., Ltd., Shanghai Tongli Reducer Co., Ltd., Tsubaki Power Transmission LLC, Curtis Machine Company, Inc., Vogel Antriebstechnik GmbH, Stöber Antriebstechnik GmbH + Co. KG, Suzhou Zuoqi Precision Machinery Co., Ltd., Donghua Chain Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cycloidal Gearing Market Key Technology Landscape

The technological sophistication of the Cycloidal Gearing Market is profoundly influenced by breakthroughs in computer-aided engineering (CAE) and metallurgical science. A key technological advancement involves highly sophisticated modeling and simulation tools (FEA - Finite Element Analysis) used to precisely map stress distribution across the cycloidal disc and housing under various load profiles. This allows engineers to optimize the material thickness and weight distribution, leading to lighter yet more robust gearbox designs without compromising the shock resistance characteristic of cycloidal drives. Furthermore, surface engineering technologies, such as Plasma Enhanced Chemical Vapor Deposition (PECVD) and specialized cryogenic treatments, are applied to the discs to enhance surface hardness and reduce the coefficient of friction, thereby significantly boosting the power efficiency and thermal performance of the drive units and reducing the need for external cooling in many applications.

Manufacturing process technology remains a critical determinant of performance. The transition from conventional hobbing and shaving to specialized jig grinding and continuous profile grinding techniques for the cycloidal components has been paramount. These advanced grinding methods, which often involve five-axis CNC machines and continuous thermal stabilization, are essential for maintaining the sub-micron level positional accuracy required to achieve minimal backlash (often measured in less than one arc-minute). Alongside machining, the development of integrated sensor packages—including miniature magnetic encoders and absolute position sensors built directly into the gear unit housing—transforms the cycloidal drive into a complete, intelligent actuator, simplifying the integration process for robotics manufacturers and reducing system complexity.

Looking ahead, the technological frontier is focused on miniaturization and integration for emerging applications like exoskeletons and smaller collaborative robots. This involves leveraging additive manufacturing (3D printing) for prototyping complex internal structures and potentially for producing housing components with optimized heat dissipation pathways. The critical development of specialized lubrication systems, utilizing ferrofluids or high-viscosity synthetic greases designed to minimize viscosity fluctuations across broad operating temperatures, further enhances the drive’s durability. Ultimately, the successful deployment of cycloidal gearing relies on a continuous feedback loop between sophisticated design software, cutting-edge material science, and ultra-precise manufacturing techniques, ensuring the mechanical components remain the leading edge of industrial motion control capability.

Regional Highlights

- Asia Pacific (APAC): APAC represents the epicenter of cycloidal gearing production and consumption. Driven by comprehensive national strategies like "Made in China 2025," the region sees unparalleled investment in smart manufacturing and automation, especially in the automotive electronics sectors. Japan and South Korea, home to key robotics and precision machinery manufacturers, exhibit extremely high component uptake. The regional market benefits from both high-volume standardized production (China) and ultra-high-precision, niche applications (Japan), ensuring its continued leadership in terms of both revenue and volume.

- North America: North America is a high-margin market characterized by demand for specialized, high-performance cycloidal solutions where application complexity justifies premium pricing. Growth is particularly strong in defense contracting (actuators for UAVs and precision tracking systems) and the rapidly expanding domestic semiconductor fabrication industry, necessitating certified, reliable gear drives for cleanroom automation. Market participants emphasize reliability, custom engineering services, and compliance with stringent operational standards (e.g., ATEX, FDA) to capture this sophisticated customer base.

- Europe: The European market, anchored by Germany's robust machine tool sector, is driven by the mandate of Industry 4.0 adoption, emphasizing energy efficiency and long-term asset management. Cycloidal drives are essential for high-end CNC machines and advanced packaging lines. Furthermore, Europe leads in renewable energy deployment, where these drives are integrated into complex systems for wind turbine control, demanding exceptional resistance to fatigue and weather extremes. Sustainability and technical compliance are key purchasing criteria in this mature region.

- Latin America (LATAM): LATAM is an accelerating market primarily focused on modernizing legacy infrastructure across the automotive, mining, and oil & gas sectors. Countries like Brazil and Mexico are increasing automation rates to remain competitive globally, leading to a steady uptake of medium-torque cycloidal drives for material handling and general assembly tasks. Market penetration is generally achieved through strong partnerships with local distributors and system integrators who can provide necessary technical training and localized support.

- Middle East and Africa (MEA): The MEA region’s demand for cycloidal gearing is highly concentrated in large-scale capital projects related to infrastructure development, oil and gas exploration, and specialized heavy lifting equipment. The operational environment often imposes challenges (e.g., extreme heat, dust), requiring drives with enhanced sealing, robust thermal management, and high ingress protection ratings. Saudi Arabia and the UAE are primary growth centers, driven by diversification efforts away from oil and gas and toward logistics and manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cycloidal Gearing Market.- Nabtesco Corporation

- Sumitomo Drive Technologies

- Spinea

- HD Corporation

- ZF Friedrichshafen AG

- Wittenstein SE

- SEW-EURODRIVE

- Bonfiglioli S.p.A.

- Nidec Shimpo Corporation

- Rexroth (Bosch)

- Cone Drive Operations Inc.

- Harmonic Drive Systems Inc. (Key competitor with substitute technology)

- Precima Magnettechnik GmbH

- Jiangsu Huazhong Reducer Co., Ltd.

- Shanghai Tongli Reducer Co., Ltd.

- Tsubaki Power Transmission LLC

- Curtis Machine Company, Inc.

- Vogel Antriebstechnik GmbH

- Stöber Antriebstechnik GmbH + Co. KG

- Suzhou Zuoqi Precision Machinery Co., Ltd.

- Donghua Chain Group Co., Ltd.

- PHT Automationstechnik GmbH & Co. KG

- Varvel SpA

Frequently Asked Questions

Analyze common user questions about the Cycloidal Gearing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of cycloidal gearing over standard planetary gearboxes?

Cycloidal gearing offers significantly higher torque density and superior shock load resistance, often handling intermittent loads up to 500% of the nominal rating. Their unique design minimizes backlash, providing greater precision and stiffness, which is critical for demanding robotics and machine tool applications.

Which end-use industry drives the highest demand for cycloidal drives?

The Industrial Robotics segment is the leading driver of demand. Robotics requires zero-backlash, high-rigidity reducers to ensure precise positional accuracy and smooth motion control, characteristics where cycloidal drives outperform most conventional gear systems.

How is AI influencing the longevity and maintenance of cycloidal drives?

AI is primarily used for predictive maintenance (PdM). By analyzing real-time sensor data (vibration, temperature), AI algorithms accurately predict potential component failures, allowing for proactive servicing, minimizing unplanned downtime, and maximizing the operational lifespan of the gear unit.

Is Asia Pacific the largest market, and why?

Yes, Asia Pacific holds the largest market share due to extensive government investments in advanced automation and smart factories, particularly in China and Japan. The region's high concentration of automotive and electronics manufacturing necessitates high-volume consumption of precision gearing components.

What is the main technical restraint faced by the Cycloidal Gearing Market?

The primary technical restraint is the high initial manufacturing cost associated with the necessary precision machining. The intricate geometry of the cycloidal discs requires specialized, high-tolerance grinding and heat treatment processes, making the components more expensive than standard gearing solutions.

What is the typical operational backlash tolerance for high-precision cycloidal drives?

High-precision cycloidal drives, particularly those used in robotics, are typically rated for minimal backlash, often achieving tolerances of less than 3 arc-minutes, with some premium models reaching below 1 arc-minute, crucial for maintaining high positional repeatability.

How does cycloidal gearing address the needs of the emerging EV market?

In the EV market, cycloidal-derived reduction gears are valued for their compactness, high torque capacity, and ability to handle high input speeds from electric motors, offering an efficient solution for specialized e-axle applications where space and weight savings are crucial design factors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager