Dairy Farm Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443391 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Dairy Farm Management Software Market Size

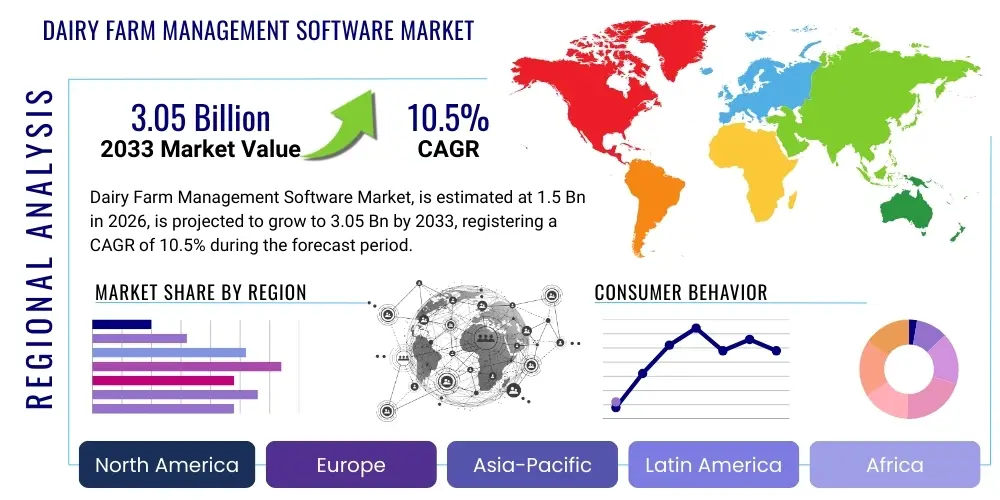

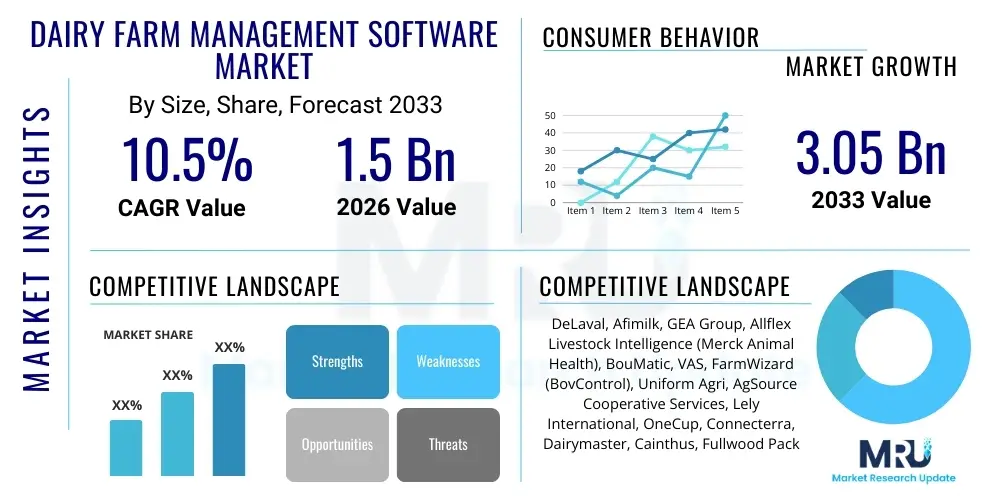

The Dairy Farm Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.05 Billion by the end of the forecast period in 2033.

Dairy Farm Management Software Market introduction

The Dairy Farm Management Software Market encompasses technological solutions designed to optimize operational efficiency, enhance productivity, and improve animal welfare across various dairy farming operations globally. These sophisticated platforms integrate data from sensors, milking systems, feeding machines, and wearable technology to provide real-time insights into herd health, reproduction cycles, and milk quality metrics. The core product offerings include integrated management systems (IMS) covering everything from feed optimization and resource allocation to detailed financial tracking and regulatory compliance reporting, enabling farmers to transition towards data-driven, precision dairy farming models. The adoption is driven by the necessity to manage larger herds efficiently, mitigate rising labor costs, and adhere to increasingly stringent environmental and animal welfare standards imposed by global regulatory bodies and consumer demands.

Major applications of dairy farm management software include precise monitoring of individual animal metrics, automated disease detection through behavioral pattern analysis, optimization of milking parlor routines, and sophisticated genetic selection planning. These systems transform raw farm data into actionable intelligence, allowing proactive decision-making rather than reactive responses to crises. Key benefits derived from implementing these solutions involve substantial reduction in input costs, maximized milk yield per cow, increased longevity of the herd, and streamlined administrative processes. Furthermore, the capability to maintain detailed digital records is critical for traceability and establishing transparency throughout the dairy supply chain, catering directly to consumer preferences for ethically and sustainably produced dairy products.

Driving factors for the market expansion are multifaceted, centered around the rapid global adoption of IoT and sensor technology in agriculture, coupled with the increasing scale and complexity of modern dairy farms. The pressure on farmers to meet high demand while managing limited natural resources accelerates the need for efficiency tools. Government initiatives promoting smart agriculture and providing subsidies for technological upgrades also significantly contribute to market penetration, especially in developing economies aiming to modernize their agricultural sectors. The shift toward Cloud-based solutions and subscription models further lowers the initial investment barrier, making advanced management tools accessible to a broader range of farm sizes, thereby solidifying the market's robust growth trajectory over the forecast period.

Dairy Farm Management Software Market Executive Summary

The global Dairy Farm Management Software Market is undergoing significant evolution, characterized by a rapid shift towards integrated, Cloud-based systems leveraging artificial intelligence (AI) and machine learning (ML) for predictive analytics. Business trends highlight strategic partnerships between traditional agricultural equipment manufacturers and specialized software developers, aiming to offer seamless, end-to-end farm digitization packages. There is a discernible trend of market consolidation, where larger technology firms are acquiring niche providers to integrate advanced capabilities, such as automated image analysis for cow locomotion scoring or sophisticated genomic testing integrations, thus expanding the feature set and competitive advantage of integrated platforms. Furthermore, sustainability reporting features are becoming mandatory components, driven by corporate mandates requiring transparent environmental footprint tracking across the supply chain.

Regionally, North America and Europe currently dominate the market due to high levels of automation maturity, substantial disposable income among commercial farmers, and stringent food safety and traceability regulations that necessitate advanced digital record-keeping. However, the Asia Pacific region, particularly India and China, is projected to exhibit the highest growth rate, fueled by government-led initiatives to modernize small- and medium-sized dairy operations and the rapid scaling of large commercial farms seeking operational efficiencies. Latin America and the Middle East are also emerging as crucial growth hubs, focusing on utilizing software solutions to overcome climatic challenges and optimize resource usage, such as water and feed, for maximizing localized production.

In terms of segment trends, the Cloud-based deployment model is rapidly outpacing the traditional on-premise solutions, primarily due to lower total cost of ownership (TCO), easier scalability, and accessibility of data across multiple devices and locations. Within applications, Herd Management remains the largest segment, crucial for tracking reproduction and health events, yet the Data Analytics and Reporting segment is experiencing explosive growth. This growth is driven by the demand for predictive maintenance schedules and disease outbreak forecasting, moving the industry from descriptive reporting to prescriptive action. Small and Medium Farms (SMEs) represent the fastest-growing customer segment, incentivized by modular, cost-effective subscription offerings tailored to lower herd sizes.

AI Impact Analysis on Dairy Farm Management Software Market

User queries regarding AI in dairy farm management predominantly revolve around how artificial intelligence can move beyond simple data aggregation to truly autonomous decision-making, focusing on improving labor efficiency and predicting complex biological outcomes. Common questions include the feasibility of integrating AI for early mastitis detection, the accuracy of machine learning models in predicting optimal breeding times (heat detection), and concerns about the data privacy and security of sensitive animal health records managed by external AI platforms. Users are keen to understand the return on investment (ROI) associated with AI-driven prescriptive analytics, specifically comparing the performance of traditional methods against AI-optimized strategies for feed formulation, resource distribution, and genetic selection. A key theme is the expectation that AI will deliver substantial reductions in operational variability and enhance the speed and accuracy of critical, time-sensitive interventions, ultimately enabling one-person management of significantly larger herds.

The integration of sophisticated machine learning algorithms and deep learning models into dairy farm management software represents a paradigm shift from reactive record-keeping to proactive, predictive livestock management. AI algorithms analyze massive, continuous data streams generated by IoT sensors, cameras, and robotic milking systems—data points far too complex for manual human analysis. This capability allows the software to accurately identify subtle behavioral changes, such as shifts in feeding patterns, rumination activity, or gait irregularities, often signaling the onset of disease or reproductive readiness days before traditional methods or human observation could detect them, leading to reduced mortality rates and minimized veterinarian costs.

Furthermore, AI significantly enhances optimization processes across the farm. For instance, reinforcement learning can be applied to dynamically adjust feed rations based on individual cow output, body condition score, and milk composition in real-time, minimizing wastage and maximizing nutrient conversion efficiency. In genetic management, AI tools sift through complex genomic data to provide prescriptive recommendations for selective breeding, accelerating the improvement of herd traits like milk production persistence, feed conversion rate, and resilience to specific environmental stressors. This advanced level of analytical capability positions AI as the core driver for future innovations in precision agriculture, ensuring sustainable profitability and superior animal welfare outcomes.

- Enhanced Predictive Health Diagnostics: AI algorithms analyze biosignals and behavior patterns for early detection of lameness, ketosis, and mastitis, significantly reducing treatment costs and antibiotic use.

- Optimized Feed Management: Machine learning models calculate optimal, personalized feed rations based on real-time milk yield, age, and environmental factors, minimizing feed wastage and maximizing yield efficiency.

- Automated Heat Detection: AI-powered computer vision and sensor data provide highly accurate prediction windows for insemination, dramatically improving conception rates and herd reproductive efficiency.

- Prescriptive Maintenance Scheduling: Algorithms analyze equipment performance data (e.g., milking robotics) to predict failures and schedule maintenance proactively, minimizing expensive downtime.

- Labor Efficiency and Autonomy: AI enables higher levels of automation and remote monitoring, allowing farm personnel to manage larger herds with greater precision and focus on high-priority intervention tasks.

- Improved Environmental Compliance: AI tools analyze manure and waste output alongside feed intake to optimize nutrient usage, assisting farms in meeting stringent regulatory requirements for nitrogen and phosphorus runoff.

DRO & Impact Forces Of Dairy Farm Management Software Market

The Dairy Farm Management Software Market is propelled forward by powerful drivers such as the escalating need for operational efficiency amid global food demand increases and severe labor shortages, particularly in developed agricultural economies. Simultaneously, growth is restrained by significant barriers, including the high initial capital investment required for implementing sophisticated integrated systems and the critical lack of digital literacy and technical expertise among older generations of farmers, especially in fragmented agricultural landscapes. Opportunities abound through the development of affordable, modular, and user-friendly Cloud-based solutions tailored specifically for small and mid-sized farmers, coupled with the leveraging of Big Data analytics and AI to offer superior predictive capabilities. These forces collectively shape the competitive dynamics, with the impact forces of technology integration, market fragmentation, and regulatory pressure driving the speed and direction of technology adoption.

Key drivers center on the global imperative to boost per-cow productivity while simultaneously reducing environmental impact, which necessitates precision management tools. The increasing severity of disease outbreaks and the resultant consumer demand for transparency and antibiotic-free milk drive the adoption of sophisticated health monitoring solutions offered by modern software. Conversely, the market faces strong restraints stemming from concerns over data ownership and security, as sensitive operational information is centralized in third-party systems. Furthermore, incompatibility issues between legacy farming equipment and newer integrated software platforms often complicate and delay full-scale digital transformation initiatives, particularly in regions with diverse equipment suppliers.

Opportunities are strongly linked to geographical expansion into emerging markets, where dairy industries are rapidly scaling up and seeking to bypass outdated manual processes entirely by adopting advanced digital solutions from the outset. Strategic opportunities also lie in integrating dairy management software with the broader agricultural ecosystem, including supply chain management (SCM) systems and financial software, creating a holistic data environment for farmers. The impact forces indicate that regulatory shifts, such as mandatory electronic identification (eID) for livestock, will accelerate market adoption, forcing reluctant users to embrace software for compliance, while technological advancements like 5G connectivity enhance data throughput, making real-time sensor integration practical even in remote farming locations.

Segmentation Analysis

The Dairy Farm Management Software market is meticulously segmented across multiple dimensions, including the type of Offering (Software and Services), Farm Size, primary Application, and Deployment Model. This granular segmentation allows vendors to tailor product features and pricing strategies to specific customer needs, ranging from large-scale industrial dairy operations requiring highly customized enterprise resource planning (ERP) integrations to small, family-owned farms benefiting from simple, cost-effective mobile applications for basic herd tracking. The Software segment, comprising integrated management platforms, holds the largest market share, while the Services segment—including consulting, installation, and ongoing technical support—is projected to demonstrate the fastest growth rate, reflecting the complexity of modern technology implementation and the ongoing need for expert guidance and data interpretation services for maximizing software utility.

The Application segmentation highlights the specific functional needs addressed by the software. While Herd Management, encompassing tracking reproductive status, calving, and grouping, remains foundational, segments like Milk Harvesting and Feed Management are seeing increased technological sophistication through real-time sensor data integration. The differentiation based on Farm Size (Small, Medium, Large) is crucial, as large farms demand robust, multi-site network capabilities and integration with sophisticated automation hardware, whereas small and medium farms prioritize ease of use, mobility, and affordability. The shift towards Cloud deployment is notable across all segments, democratizing access to powerful analytical tools previously restricted to large enterprises due to high hardware installation costs.

- Offering: Software (On-Premise, Cloud-Based), Services (Consulting, Integration, Support, Data Analytics as a Service)

- Farm Size: Small Farms (Less than 100 Cows), Medium Farms (100-500 Cows), Large Farms (More than 500 Cows)

- Application: Feed Management, Milk Harvesting, Herd Management (Reproduction, Health, Genetics), Animal Comfort Monitoring, Financial Management, Inventory Management

- Deployment: Cloud, On-Premise

Value Chain Analysis For Dairy Farm Management Software Market

The value chain for the Dairy Farm Management Software Market begins with upstream activities dominated by sensor manufacturers, hardware developers (IoT devices, wearable tags, milking robotics), and core software platform developers who create the fundamental operating systems and application programming interfaces (APIs). Key upstream analysis focuses on securing reliable, high-quality data input hardware that can withstand harsh farm environments and ensuring interoperability standards are met to facilitate seamless integration with diverse software environments. Competitive advantage in the upstream segment is often determined by the accuracy, longevity, and battery life of monitoring devices, alongside the sophistication of the foundational data management architecture.

Midstream activities are characterized by the software providers themselves, who focus on data processing, algorithm development (including AI/ML modules), user interface design, and system integration. This phase involves transforming raw data inputs into actionable insights and intuitive dashboard displays for the end-user. Distribution channels play a crucial role in bringing the product to the farm. Direct channels involve proprietary sales teams deployed by major equipment manufacturers (like DeLaval or GEA), often bundling software subscriptions with hardware purchases. Indirect channels, which are increasingly common, rely on agricultural dealerships, specialized IT consultants, and regional veterinary service providers who act as certified integrators and resellers, offering localized installation and support expertise.

Downstream analysis centers on the end-users—dairy farmers and farm managers—and the ancillary services required for successful implementation, such as training, customized programming, and continuous technical support. The effectiveness of the software hinges on its adoption rate and the farmer's ability to interpret and act upon the generated insights. The value realization occurs downstream through improved farm profitability, enhanced regulatory compliance, and better animal welfare outcomes. The trend towards Software-as-a-Service (SaaS) models emphasizes the crucial role of ongoing support and updates, making long-term customer relationship management and high-quality post-sales service a definitive differentiator in the market.

Dairy Farm Management Software Market Potential Customers

The potential customer base for Dairy Farm Management Software is broadly segmented based on scale, technological readiness, and specific operational needs, encompassing conventional commercial dairy farms, specialized organic dairy operations, and large agribusiness conglomerates managing extensive livestock portfolios. Commercial dairy farms, particularly those with medium to large herd sizes (100+ cows), represent the primary and most immediate consumer base, driven by the urgency to maximize yield and manage high fixed costs associated with land and equipment. These farms require sophisticated, integrated solutions that can handle complex data flows from automated milking parlors and precise feeding systems, focusing heavily on predictive maintenance and genetic optimization.

Emerging potential customers include governmental agricultural research institutions and universities utilizing the software for research into animal behavior, genetic improvement, and sustainable farming practices, often requiring specialized API access for data extraction and analysis. Furthermore, feed suppliers, veterinarians, and animal health consultants are increasingly becoming key buyers or influential decision-makers, utilizing integrated farm data to provide tailored, data-driven services to their client farms. This trend is moving the software beyond simple farm management to an essential component of the entire agricultural consultation ecosystem, enabling third-party experts to deliver prescriptive advice based on real-time operational metrics.

Small dairy farms, while often constrained by budgetary limitations, represent a high-potential future market segment, especially with the proliferation of modular, lower-cost mobile applications and entry-level Cloud subscriptions. These smaller producers are seeking basic, yet reliable, tools for compliance, simple health tracking, and inventory management to maintain competitiveness against larger industrial operations. The core buyer persona across all segments is a farm manager or owner who recognizes the strategic value of data analytics in mitigating risk and ensuring long-term financial viability in an increasingly volatile commodity market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.05 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DeLaval, Afimilk, GEA Group, Allflex Livestock Intelligence (Merck Animal Health), BouMatic, VAS, FarmWizard (BovControl), Uniform Agri, AgSource Cooperative Services, Lely International, OneCup, Connecterra, Dairymaster, Cainthus, Fullwood Packo, DairyComp, Agri-EID, HerdConnect, BoviSync, CowManager |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dairy Farm Management Software Market Key Technology Landscape

The technological landscape of the Dairy Farm Management Software market is characterized by the convergence of several sophisticated technologies, forming an ecosystem centered around real-time data acquisition and analysis. Central to this landscape is the widespread adoption of the Internet of Things (IoT), where wireless sensors, RFID tags, and automated milking systems generate continuous streams of data regarding cow location, activity, milk volume, and composition. This foundational data layer requires robust, scalable Cloud computing infrastructure to store and process petabytes of information efficiently. The integration of 5G and high-speed satellite internet is rapidly improving data transmission capabilities, ensuring reliable, low-latency connectivity crucial for real-time monitoring and control of robotic equipment.

Data analytics and Artificial Intelligence (AI) represent the intellectual core of modern dairy software. Machine Learning (ML) algorithms are employed for predictive modeling, moving beyond simple statistical analysis to forecasting disease risk, optimizing yield curves, and predicting optimal insemination windows. This includes deep learning applications utilizing computer vision to analyze visual cues, such as automated body condition scoring or early lameness detection based on gait analysis captured by installed barn cameras. The development of standardized APIs is also a critical technological requirement, enabling different proprietary systems (e.g., feed mixers, ventilation controls, and milking robots) to communicate seamlessly with the central management software, fostering an open yet secure data environment.

Furthermore, the focus on user experience (UX) and mobility defines the front end of the technology landscape. Modern software relies on highly intuitive, mobile-optimized interfaces, often utilizing augmented reality (AR) features for on-site troubleshooting or livestock identification. Blockchain technology is emerging as a critical tool, not for direct farm management but for establishing secure, tamper-proof records for food traceability and provenance, addressing the growing consumer demand for supply chain transparency. These interconnected technologies collectively enable precision dairy farming, ensuring that every operational decision is backed by high-fidelity data and predictive modeling.

Regional Highlights

- North America (US and Canada): Dominates the market due to the high average size of dairy farms, early adoption of automation technologies, and substantial capital investment capacity. Stringent food safety and animal welfare regulations necessitate advanced record-keeping and traceability features, driving demand for premium, integrated enterprise solutions. The region is a leader in implementing AI and sophisticated Big Data analytics for genetic and nutritional optimization.

- Europe (Germany, Netherlands, France, UK): A highly mature market characterized by advanced technological integration, particularly in countries like the Netherlands and Germany which pioneer robotic milking systems. Growth is supported by strong governmental support for sustainable agriculture and strict environmental mandates, pushing demand for software that tracks methane emissions, nutrient balance, and carbon footprint. Fragmentation exists, leading to strong demand for software interoperability.

- Asia Pacific (APAC) (China, India, Australia, Japan): Anticipated to be the fastest-growing market. This growth is driven by the rapid commercialization and industrialization of the dairy sector in China and India, shifting from traditional, small-scale models to large, technology-intensive operations. Australia and New Zealand, with their established export-focused dairy industries, drive demand for efficient pasture management and quality control software.

- Latin America (Brazil, Argentina): Exhibits significant growth potential, leveraging software to improve resource efficiency and overcome climatic challenges affecting pasture quality. The focus here is on maximizing herd health and productivity in extensive grazing systems, leading to demand for robust mobile monitoring and satellite imagery integration capabilities. Affordability and localized customer support are critical competitive factors.

- Middle East and Africa (MEA): Emerging market where growth is concentrated in large-scale, climate-controlled mega-farms in the Gulf Cooperation Council (GCC) countries. These farms require highly specialized software for managing extreme environmental conditions and optimizing water and cooling systems alongside standard herd management. Adoption is slower in Africa due to infrastructure constraints but shows promise with donor-funded agricultural modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dairy Farm Management Software Market.- DeLaval

- Afimilk

- GEA Group

- Allflex Livestock Intelligence (Merck Animal Health)

- BouMatic

- VAS

- FarmWizard (BovControl)

- Uniform Agri

- AgSource Cooperative Services

- Lely International

- OneCup

- Connecterra

- Dairymaster

- Cainthus

- Fullwood Packo

- DairyComp

- Agri-EID

- HerdConnect

- BoviSync

- CowManager

Frequently Asked Questions

Analyze common user questions about the Dairy Farm Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dairy Farm Management Software and how does it improve profitability?

Dairy Farm Management Software (DFMS) is an integrated digital platform that uses sensor data and analytics to monitor, track, and manage all aspects of a dairy operation, including herd health, feeding, reproduction, and milk yield. It improves profitability by enabling predictive maintenance, optimizing input costs (like feed and veterinary care), reducing labor dependency through automation, and maximizing milk production efficiency per animal.

Is Cloud-based or On-Premise deployment better for DFMS?

Cloud-based deployment is generally considered superior due to lower upfront capital expenditure, simplified maintenance, automatic updates, and enhanced accessibility of data via mobile devices from any location. On-Premise deployment is chosen by large farms with complex security requirements or areas with unreliable internet connectivity, requiring significant dedicated IT infrastructure.

What role does Artificial Intelligence (AI) play in modern dairy management?

AI, primarily through machine learning, analyzes large datasets from farm sensors to provide predictive and prescriptive insights. Key AI applications include early disease detection (e.g., mastitis, lameness) by analyzing behavioral anomalies, optimizing customized feed rations for peak performance, and increasing the accuracy of heat detection, leading to improved reproductive efficiency.

How much does DFMS cost and what is the typical ROI?

The cost varies significantly based on farm size, selected features, and deployment model (SaaS subscription vs. outright license). While initial investment can be substantial for fully integrated systems, the typical Return on Investment (ROI) is realized through reduced operational costs, particularly feed optimization (saving 5-10% of feed costs), improved conception rates, and lower veterinary expenses due to proactive health management.

What are the primary data security concerns associated with DFMS?

The main concerns revolve around data ownership—who owns the proprietary farm data generated—and the security of sensitive operational metrics, including production volumes and financial records. Vendors must provide robust encryption, multi-factor authentication, and clear data usage policies compliant with global data protection regulations to mitigate these risks and build farmer trust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager