DC Isolator Covers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442050 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

DC Isolator Covers Market Size

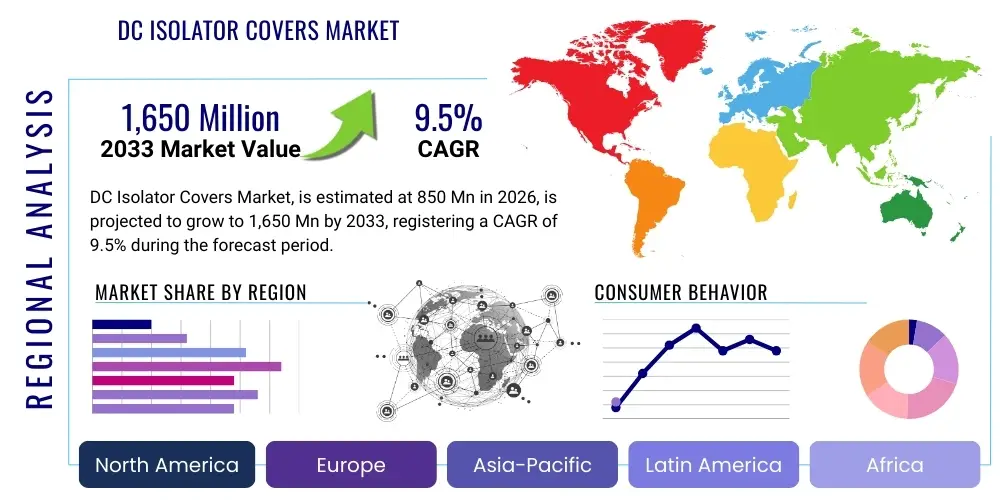

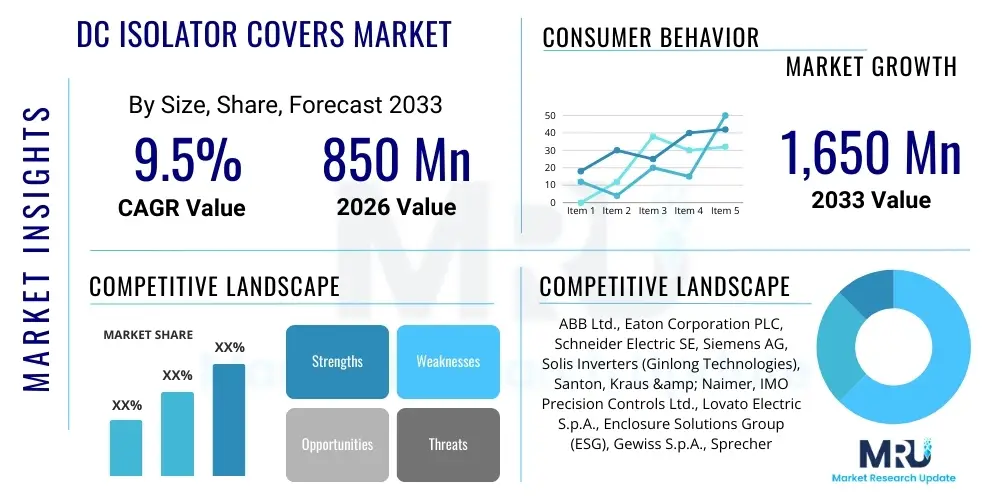

The DC Isolator Covers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,650 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the exponential global growth in solar photovoltaic (PV) installations, coupled with increasingly stringent regulatory requirements mandating enhanced electrical safety features across residential, commercial, and utility-scale solar projects. The necessity of protecting sensitive DC isolation components from environmental degradation, UV exposure, and mechanical damage is a fundamental factor contributing to sustained market valuation increase over the next decade.

Market size determination is inherently linked to the adoption rate of modern solar inverter technologies and the integration of energy storage systems (ESS). As system voltages in PV arrays trend higher (e.g., from 1000V to 1500V DC), the requirements for reliable insulation and protection of the associated switching gear, including DC isolators, become critically important. The material science advancements in polymer and engineering plastics, offering superior fire resistance and durability under extreme weather conditions, further solidify the market's growth trajectory, supporting higher average selling prices for premium protective solutions tailored for specialized applications, such as floating solar farms or desert installations.

Furthermore, the replacement and retrofitting market segment plays a crucial role in maintaining market momentum. DC isolator covers, being essential components subject to constant environmental stress, require periodic inspection and replacement to maintain compliance and system operational integrity. Regulatory bodies in key markets, particularly in Europe and North America, are increasingly focusing on long-term safety and fire hazard mitigation in aging solar infrastructure, creating sustained demand not only from new installations but also from maintenance operations spanning millions of existing PV systems globally. This recurring revenue stream ensures market stability and contributes significantly to the projected valuation of $1,650 Million by 2033.

DC Isolator Covers Market introduction

The DC Isolator Covers Market encompasses the manufacturing, distribution, and utilization of protective enclosures designed specifically to shield Direct Current (DC) isolator switches used primarily in solar photovoltaic (PV) systems. DC isolators are critical safety devices used to manually disconnect solar arrays from inverters, allowing for safe maintenance or emergency shutdown. The protective covers, often made from high-grade, UV-stabilized, flame-retardant polymers or specialized plastics, ensure that the isolator switches are protected against ingress of dust, moisture (IP ratings are critical here), extreme temperatures, and accidental mechanical damage. This protection is paramount to preventing premature system failure, electrical faults, and, most importantly, fire hazards associated with DC arcs.

Major applications of DC isolator covers span the entire solar energy sector, including residential rooftop installations, where visual integration and aesthetics are key; commercial and industrial rooftop projects (C&I), which prioritize durability and fire safety ratings; and utility-scale solar farms, demanding robust, high-voltage compatible solutions capable of enduring harsh environmental conditions over a 25-year lifespan. The principal benefits derived from these covers include enhanced operational safety by preventing unauthorized access or accidental contact, prolonged equipment life due to superior environmental shielding, and adherence to international safety standards (such as IEC and UL), which is mandatory for system commissioning and insurance purposes. The increasing average DC voltage levels in modern PV systems directly amplify the need for highly reliable and certified protective covers.

Driving factors for this specialized market segment are multifaceted, rooted deeply in the global energy transition toward renewables. Governments worldwide are implementing ambitious renewable energy targets and offering incentives for solar deployment, directly increasing the underlying demand for PV components, including isolators and their covers. Technological advancements in cover materials, such as the integration of advanced heat dissipation features or smart monitoring capabilities within the enclosure, further boost market traction. Crucially, the evolving landscape of electrical safety standards, often catalyzed by documented fire incidents in solar installations, compels developers and installers to utilize certified, high-quality protective gear, overriding cost considerations in favor of long-term reliability and safety compliance.

DC Isolator Covers Market Executive Summary

The DC Isolator Covers Market is characterized by vigorous growth, underpinned by fundamental shifts in global energy policy and a hyper-focus on electrical safety within the booming solar photovoltaic (PV) industry. Business trends indicate a strong move toward customization and integration, where manufacturers are developing application-specific covers—for instance, those designed exclusively for extreme desert climates or high-humidity coastal regions—rather than generalized protective enclosures. Strategic collaborations between polymer producers, switchgear manufacturers, and solar inverter companies are becoming essential to ensure seamless product compatibility and certified performance. Furthermore, the emphasis on sustainability is driving the adoption of recyclable and eco-friendly polymer materials for cover fabrication, appealing to environmentally conscious large-scale project developers and investors seeking verifiable ESG compliance in their supply chains.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, maintains dominance in terms of volume due to unparalleled new PV installation rates, particularly in utility-scale projects. However, North America and Europe demonstrate superior growth in terms of value, driven by stricter adherence to premium safety standards (e.g., rapid shutdown requirements) and a higher willingness to invest in certified, branded protective solutions. The European market, particularly Germany and the UK, shows significant activity in the retrofitting segment, focusing on upgrading existing solar infrastructure to meet contemporary safety codes. Emerging markets in Latin America and the Middle East and Africa (MEA) are poised for acceleration as large-scale governmental and private solar initiatives begin to materialize, necessitating robust, locally sourced or regionally specified isolator covers.

Segment trends highlight the critical importance of material type and application voltage. Covers made from high-performance engineering plastics (such as PC/ABS blends or specialized polyamides) are commanding premium pricing due to superior UV and fire resistance compared to standard PVC or polyethylene enclosures. The segmentation by installation type reveals robust growth in the C&I sector, driven by increasing regulatory scrutiny on fire prevention in commercial buildings. Furthermore, the market is seeing a subtle shift towards covers offering higher ingress protection (IP66 and above) and greater thermal stability, addressing performance degradation issues observed in high-temperature operating environments. This segmentation focus confirms that safety features and durability remain the primary consumer priorities, influencing purchasing decisions significantly more than marginal cost savings.

AI Impact Analysis on DC Isolator Covers Market

User inquiries regarding AI's influence on the DC Isolator Covers Market center predominantly on how artificial intelligence can enhance predictive maintenance, optimize manufacturing processes, and potentially integrate smart features into the covers themselves. Key themes identified include the expectation of AI-driven quality control during high-volume production, ensuring zero-defect rates in critical safety components, and the use of machine learning to analyze environmental sensor data collected from systems housed within these covers. Users are keenly concerned about whether AI can help predict material degradation (like UV damage or thermal stress) before catastrophic failure occurs, thereby moving the industry from reactive replacement to proactive, scheduled maintenance. The consensus expectation is that while AI won't change the physical design of the cover overnight, it will revolutionize the lifecycle management and quality assurance of these components, making them part of a broader, interconnected smart PV ecosystem.

The secondary area of user focus is logistics and inventory management. Given the vast global supply chain for solar components, users expect AI to optimize the distribution and stocking of specific DC isolator cover models, matching regional demand, project timelines, and local regulatory requirements. AI algorithms can accurately forecast demand based on regional solar policy changes, weather patterns, and construction schedules, leading to significant reductions in lead times and inventory holding costs for both manufacturers and installers. This optimization indirectly impacts the market by ensuring the correct, certified cover is available precisely when needed, preventing project delays and promoting compliance.

Finally, there is emerging interest in using AI for structural integrity analysis. Finite Element Analysis (FEA) combined with AI optimization techniques can be used during the design phase of the cover to simulate extreme thermal and mechanical loads, fine-tuning the geometry and material usage to maximize protection while minimizing material waste and cost. This allows manufacturers to quickly iterate on designs that meet stringent new safety standards (e.g., arc fault containment), accelerating time-to-market for next-generation protective solutions. This deep integration of AI into the R&D cycle assures consumers of enhanced product quality and verified reliability under challenging operating conditions.

- AI-driven Quality Control: Utilizing computer vision and machine learning models for defect detection during the high-speed injection molding process, ensuring compliance with IP ratings and flame resistance standards.

- Predictive Maintenance Integration: AI algorithms analyze embedded sensor data (temperature, humidity, vibration) within the enclosure environment to predict the remaining useful life of the isolator switch and the cover material, scheduling preemptive replacements.

- Optimized Supply Chain Management: ML models forecast regional demand for specific cover types based on solar installation trends and regulatory deadlines, optimizing inventory and reducing logistical bottlenecks.

- Generative Design for Durability: AI assists in simulating complex environmental stresses (e.g., cyclical thermal expansion, extreme UV exposure) to optimize the structural design and material composition of new covers for enhanced longevity and fire safety.

- Enhanced Manufacturing Efficiency: Implementation of AI in factory automation to optimize machine parameters (e.g., temperature, pressure, cycle time) for energy efficiency and consistent part geometry.

DRO & Impact Forces Of DC Isolator Covers Market

The DC Isolator Covers Market is shaped by a robust set of driving factors (D), inherent limitations (R), and significant future opportunities (O), which collectively define the overarching impact forces influencing market dynamics. The primary driver is the unprecedented growth in global renewable energy capacity, specifically solar PV, creating a foundational need for all auxiliary safety components. This is coupled with evolving, strict regulatory mandates, especially concerning fire safety in high-voltage DC systems, compelling mandatory adoption of certified protective covers. However, the market faces restraints such as the commoditization pressure from low-cost manufacturers, often leading to compromises in material quality and certification rigor. Furthermore, the complex certification process required for new materials and designs acts as a temporary barrier to rapid innovation and market entry for smaller players. These competing forces create a market environment where quality and compliance are rewarded, but cost pressures remain significant.

Opportunities in this sector are vast, centering on material science and smart integration. The development of advanced composite materials offering superior thermal performance, lighter weight, and improved sustainability profiles presents a strong growth avenue. Integration with smart monitoring systems, such as covers equipped with non-invasive temperature or arc detection sensors, represents a premium market segment poised for rapid expansion. Geographically, untapped potential exists in emerging solar markets across Africa and Southeast Asia, where future utility-scale projects will necessitate high volumes of durable, climate-specific isolator covers. Manufacturers who can leverage these opportunities by combining high-grade material solutions with digital integration will secure a leading competitive position.

The overarching impact forces result in a market landscape dominated by safety compliance and technological differentiation. The direct impact force is the regulatory environment: failure to comply with standards like IEC 60947-3 or UL 508 results in project cancellation, making certification the absolute minimum barrier to entry. Another critical force is the cost of raw materials, which significantly impacts pricing strategies, especially for fire-rated engineering plastics. The continuous innovation in inverter technology, leading to higher system voltages (up to 1500V DC), forces cover manufacturers to perpetually update their designs and materials, making R&D a sustained and high-impact investment area. Successfully navigating these forces requires manufacturers to balance cost-effectiveness with unwavering adherence to increasingly stringent global safety specifications.

Segmentation Analysis

The DC Isolator Covers Market is intricately segmented based on material type, protection class, application voltage, and end-user segment. This granular segmentation allows market participants to tailor their product offerings to specific operational demands and regulatory environments worldwide. Material type is arguably the most crucial delineation, reflecting the cover’s ability to withstand UV radiation, thermal cycling, and achieve required flammability ratings (e.g., UL94 V-0). The protection class segment, primarily defined by IP (Ingress Protection) ratings, dictates suitability for indoor vs. outdoor installations, with IP65 and IP66 being standard requirements for harsh outdoor environments.

Segmentation by application voltage is critical, distinguishing between covers designed for lower voltage residential systems (e.g., up to 600V or 1000V DC) and specialized covers necessary for utility-scale projects operating at 1500V DC. Higher voltage applications demand thicker walls, superior dielectric strength, and advanced thermal management features. The market is further segregated by end-user: Residential, Commercial & Industrial (C&I), and Utility-Scale. Each end-user group exhibits unique purchasing criteria, ranging from aesthetic design and ease of installation (Residential) to extreme durability and large volume capacity (Utility-Scale).

Analyzing these segments reveals a trend toward premiumization within the C&I and Utility sectors, where lifetime cost and reliability significantly outweigh initial purchase price. Manufacturers focusing on certified, high-performance materials and advanced features like integrated venting systems or tamper-proof mechanisms are capturing higher market share in these segments. Conversely, the residential segment remains highly price-sensitive but is increasingly being influenced by regional fire safety codes, pushing even budget installations toward minimum certified quality standards, thereby elevating the overall quality floor of the market.

- By Material Type:

- UV Stabilized Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- PC/ABS Blends (for enhanced heat resistance)

- Polyester (GRP/FRP Composites)

- Others (e.g., Specialized Halogen-Free Materials)

- By Protection Class (IP Rating):

- IP65

- IP66

- IP67 and above

- By Application Voltage:

- Low Voltage (Up to 1000V DC)

- High Voltage (1000V DC to 1500V DC)

- By End-User:

- Residential

- Commercial & Industrial (C&I)

- Utility-Scale Solar Farms

Value Chain Analysis For DC Isolator Covers Market

The value chain for the DC Isolator Covers Market begins with the upstream segment, dominated by raw material suppliers, primarily specialized chemical and polymer manufacturers. These suppliers provide critical engineering plastics—such as high-grade UV-resistant polycarbonates, specialized flame-retardant ABS, and composite resins—that determine the final product's performance characteristics, including fire rating (UL 94 V-0), durability, and weather resistance. Procurement involves selecting materials that meet strict international safety standards while managing significant volatility in petrochemical prices. The manufacturing stage, where these polymers are processed using injection molding or vacuum forming into the finished cover products, is highly capital-intensive, requiring specialized tooling and stringent quality control protocols to maintain dimensional accuracy and sealing integrity for IP ratings.

The downstream segment encompasses the integration of the DC isolator covers into the broader solar ecosystem. This involves collaboration with DC isolator switch manufacturers, solar inverter companies, and solar panel original equipment manufacturers (OEMs). Direct distribution often occurs through specialized electrical wholesalers and distributors focused specifically on the renewable energy sector, who bundle the covers with the isolator switches and necessary mounting hardware. Indirect channels involve large engineering, procurement, and construction (EPC) firms, who purchase covers in massive volumes based on their specific project requirements and safety specifications, often bypassing smaller distributors. Effective marketing in the downstream segment focuses heavily on certification, compliance documentation, and demonstrable long-term reliability.

The distribution channel is crucial for market penetration and efficiency. Direct sales are common for customized or high-volume contracts with major EPCs or inverter manufacturers, allowing for tighter quality control and direct feedback loops. Indirect distribution, leveraging established electrical supply houses and solar-specific distributors, provides necessary reach to small and medium-sized installers. Furthermore, the rise of e-commerce platforms specializing in electrical components offers a growing channel, particularly for standardized, replacement, or residential-grade covers. The successful optimization of the value chain relies on efficient material procurement, maintaining robust manufacturing quality (zero-defect output for IP sealing), and establishing strong, trustworthy relationships with major players in the PV installation community to ensure product adoption during critical project phases.

DC Isolator Covers Market Potential Customers

The primary end-users and buyers of DC Isolator Covers are highly defined within the solar photovoltaic industry ecosystem, spanning from large corporate entities responsible for utility infrastructure to individual homeowners and local electrical contractors. The largest volume consumers are Engineering, Procurement, and Construction (EPC) companies specializing in solar farm development. These firms require certified, high-durability covers in bulk quantities for large-scale, multi-megawatt projects. Their purchasing decisions are driven by compliance, proven longevity, and large-scale supply capabilities, often preferring products that integrate seamlessly with specific inverter and racking systems used on site. Secondly, DC isolator switch manufacturers and solar inverter OEMs represent significant customers, often integrating the cover as part of their complete certified product assembly before it reaches the end installer. This B2B relationship focuses on technical compatibility, custom branding, and consistent quality.

The secondary customer group includes electrical wholesalers and specialized solar distributors. These entities serve as the crucial intermediary, stocking various cover types and brands to supply independent solar installation companies (ICs) and regional maintenance contractors. Their purchasing decisions are influenced by product range, inventory management efficiency, and pricing structure. Finally, the end installers, particularly those focused on the residential and small commercial sectors, are the ultimate decision-makers on the ground. While they may purchase through distribution, their preferences—driven by ease of installation, local code adherence, and warranty provisions—dictate which specific models are ultimately used in thousands of daily installations worldwide. In essence, the potential customer base spans the entire supply chain, from component integrators to the final contractor responsible for system commissioning.

Specifically, municipal and government agencies, through their infrastructure development arms, also constitute a growing segment of potential customers when they commission public solar projects (e.g., covering municipal buildings, schools, or public land). These projects typically demand the highest level of certification and often include sustainability requirements regarding the cover material itself. As the global installed base of solar PV ages, a significant emerging customer base includes maintenance and operations (O&M) providers. These providers continuously purchase replacement covers due to maintenance cycles, damage from severe weather, or degradation over time, forming a reliable, recurring aftermarket demand that sustains the market beyond new construction alone. Addressing the unique procurement processes and quality demands of each of these customer segments is key to maximizing market share and long-term revenue streams in the DC isolator covers sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,650 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Eaton Corporation PLC, Schneider Electric SE, Siemens AG, Solis Inverters (Ginlong Technologies), Santon, Kraus & Naimer, IMO Precision Controls Ltd., Lovato Electric S.p.A., Enclosure Solutions Group (ESG), Gewiss S.p.A., Sprecher + Schuh, Palazzoli S.p.A., Hylec Controls, Noark Electric, Terasaki Electric, Gacia, L&T Electrical & Automation, ETI Elektroelement. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DC Isolator Covers Market Key Technology Landscape

The technological landscape of the DC Isolator Covers Market is predominantly focused on advancements in material science, thermal management, and rapid manufacturing techniques. The core technology involves highly specialized polymer injection molding, which must achieve tight tolerances to guarantee high ingress protection ratings (IP66/IP67) essential for preventing moisture and dust penetration. Key materials being utilized are often fire-retardant, halogen-free engineering plastics such as UV-stabilized polycarbonate and advanced thermoplastic polyesters (TPEs) or glass-reinforced polyester (GRP) composites. These materials are selected not only for their superior mechanical strength and UV resistance but, critically, for their ability to meet stringent international fire safety standards, particularly concerning self-extinguishing properties and resistance to tracking under high voltage, minimizing the risk of DC arc fault propagation.

A significant technological shift is the integration of advanced thermal management features directly into the cover design. Given that DC isolators generate heat during operation, especially when carrying large currents, and are often exposed to direct sunlight, preventing excessive internal temperature buildup is paramount to prolonging the switch's lifespan and preventing material deformation. This involves designing specialized internal geometry, incorporating heat sinks, or utilizing pressure equalization valves (PEVs) to manage internal humidity and thermal cycles effectively without compromising the IP rating. Furthermore, manufacturers are increasingly using advanced numerical simulation tools, such as Computational Fluid Dynamics (CFD) analysis, during the design phase to optimize ventilation pathways and ensure efficient passive cooling within the enclosed space, especially for 1500V systems.

Emerging technologies also involve integrating smart features and connectivity into the covers, transitioning them from passive protective shells to active components within the solar monitoring system. Although still niche, some high-end covers are incorporating non-invasive sensors—such as infrared sensors or subtle vibration detectors—to monitor the operational status of the isolator switch or detect early signs of overheating or arcing, transmitting data wirelessly to the central monitoring platform. This integration is crucial for meeting the demands of modern grid management and insurance mandates that require continuous performance monitoring and immediate fault identification. The continuous drive for smaller, lighter, yet more robust covers also necessitates ongoing research into lightweight composite materials and nano-fillers that enhance mechanical and thermal properties without increasing the product's footprint or cost significantly.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market by volume, driven by massive governmental investments in solar energy, particularly in China, India, and Southeast Asia. China dominates both production and consumption, characterized by high-volume, cost-competitive manufacturing and rapid deployment of utility-scale solar farms. The demand here is centered on scalable, robust covers suitable for extreme monsoon and high-temperature environments. India’s burgeoning solar sector is contributing significantly, focusing on both ground-mounted and decentralized PV applications. The region’s rapid urbanization and energy needs ensure continued market expansion, although compliance standards can vary significantly between countries.

- Europe: Europe is a high-value market defined by stringent regulatory environments (e.g., adherence to IEC standards and local fire codes) and a strong emphasis on product longevity and sustainability. Germany, the UK, and Italy are key contributors, characterized by a substantial existing installed base and a strong retrofit market focused on upgrading components to meet modern safety requirements, especially concerning arc fault containment and fire safety. European consumers prioritize certified, premium-brand products, driving demand for covers utilizing advanced, halogen-free, and recyclable engineering plastics. The focus on residential self-consumption and battery storage integration further boosts demand for high-quality protective components.

- North America: North America, led by the United States, is a rapidly growing market segment distinguished by the absolute requirement for UL certification and adherence to strict local electrical codes, such as the National Electrical Code (NEC). The market exhibits a strong demand for covers that facilitate rapid shutdown capabilities, a critical safety mandate for rooftop solar installations. Canada also shows steady growth, prioritizing products designed to withstand extreme cold and heavy snow loads. The high safety and legal liability standards in this region necessitate the use of highly reliable, thoroughly tested, and certified covers, often resulting in premium pricing compared to global averages.

- Latin America: This region represents a significant growth opportunity, with Brazil, Chile, and Mexico spearheading solar development. Market requirements are diverse, ranging from high-humidity coastal zones to arid, high-UV deserts. The demand is currently scaling rapidly, with a focus on both utility-scale projects and emerging decentralized generation. Market maturity is increasing, pushing local installations toward greater use of internationally compliant, durable covers to mitigate risks associated with long-term infrastructure investment.

- Middle East and Africa (MEA): MEA is an emerging but fast-accelerating market, characterized by large-scale, ambitious solar programs (e.g., in Saudi Arabia and the UAE). The primary technical challenge and driver here are extreme heat, dust, and intense UV radiation, necessitating covers with exceptional thermal stability, robust sealing (IP67 or higher), and superior resistance to environmental stress cracking. Project viability in this region is critically dependent on the long-term resilience of components exposed to desert conditions. South Africa leads the African market, driven by power generation shortages and burgeoning private installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DC Isolator Covers Market.- ABB Ltd.

- Eaton Corporation PLC

- Schneider Electric SE

- Siemens AG

- Solis Inverters (Ginlong Technologies)

- Santon

- Kraus & Naimer

- IMO Precision Controls Ltd.

- Lovato Electric S.p.A.

- Enclosure Solutions Group (ESG)

- Gewiss S.p.A.

- Sprecher + Schuh

- Palazzoli S.p.A.

- Hylec Controls

- Noark Electric

- Terasaki Electric

- Gacia

- L&T Electrical & Automation

- ETI Elektroelement

- Fuji Electric Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the DC Isolator Covers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and necessity of a DC Isolator Cover in a solar system?

The primary function of a DC Isolator Cover is to provide robust environmental protection (against dust, moisture, and UV degradation) and mechanical integrity for the DC isolator switch, a critical safety device used to shut down the solar array. The cover is essential for ensuring the isolator maintains its intended ingress protection (IP) rating and, critically, prevents fire hazards by containing potential DC arcs and ensuring compliance with stringent electrical safety codes.

Which international standards are mandatory for DC Isolator Covers?

The covers themselves must comply with material safety standards such as UL 94 (flammability ratings) and relevant IP ratings (e.g., IP66 or IP67) for environmental protection. Critically, the covers must be compatible with isolator switches certified under major international electrical standards, including IEC 60947-3 (for switchgear) and relevant regional standards like UL 508 (North America) and the specific fire codes mandated by regulatory bodies in key geographical markets.

How does the shift to 1500V DC systems impact the design requirements for isolator covers?

The transition to 1500V DC systems necessitates covers with significantly enhanced dielectric strength, thicker wall sections, and materials with higher Comparative Tracking Index (CTI) values to prevent surface tracking and breakdown under higher voltage stress. Furthermore, these covers must incorporate superior thermal management features to dissipate heat effectively, ensuring the safe operation and longevity of the isolator components in high-voltage environments, often requiring specialized, high-performance engineering plastics.

What are the key differences between Polycarbonate (PC) and ABS covers?

Polycarbonate (PC) covers generally offer superior impact strength, excellent dimensional stability, and better performance under extreme temperatures, often preferred for heavy-duty or critical applications. ABS is typically more cost-effective and easier to mold but offers less resistance to UV radiation and lower impact resistance. Many premium covers utilize PC/ABS blends to balance cost, moldability, and critical performance requirements like flame retardancy and UV stability.

Is the aftermarket (replacement) segment a significant growth driver for DC Isolator Covers?

Yes, the aftermarket replacement segment is increasingly significant. As the global installed solar base ages (20+ years), environmental degradation, maintenance damage, and updated safety regulations necessitate the periodic replacement of exposed components like isolator covers. This recurring demand, driven by O&M providers and system owners ensuring continued system safety and compliance, provides a stable, long-term revenue stream alongside the continuous growth from new installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager